Jiangsu Eastern Shenghong Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Eastern Shenghong Bundle

Discover the intricate workings of Jiangsu Eastern Shenghong's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their unique approach to customer relationships, revenue streams, and cost management. Unlock this strategic blueprint to gain actionable insights for your own business ventures.

Partnerships

Jiangsu Eastern Shenghong's operations are deeply dependent on a steady influx of crude oil and petrochemical feedstocks. These are the lifeblood of their refining and chemical production. For instance, the company's significant investments in integrated refining and chemical complexes necessitate a secure and predictable supply chain.

Key to this security are strategic alliances with major global oil producers. The potential for Saudi Aramco, a titan in the oil industry, to acquire a stake in Shenghong Petrochemical highlights this critical relationship. Such partnerships are vital for ensuring competitive pricing and consistent availability of essential raw materials, directly impacting Shenghong's operational efficiency and profitability.

Jiangsu Eastern Shenghong actively collaborates with leading research institutions and technology providers to drive innovation in chemical fiber products and advanced petrochemical processes. These partnerships are crucial for developing next-generation materials and enhancing production efficiency, as evidenced by their significant investment in research and development. For instance, in 2023, the company allocated a substantial portion of its revenue towards R&D, aiming to solidify its competitive edge and expand its offerings in new energy solutions.

Jiangsu Eastern Shenghong cultivates long-term relationships with key industrial customers across diverse sectors like textiles, automotive, and construction. These partnerships are crucial for ensuring consistent demand and reliable product sales. For instance, in 2024, the company reported that over 70% of its revenue was derived from repeat business with its top industrial clients.

These collaborations often extend beyond simple transactions, involving joint efforts in customized product development and dedicated technical support. This tailored approach ensures that Eastern Shenghong's offerings precisely meet the unique specifications and evolving needs of its industrial partners, fostering deep integration into their value chains.

The widespread adoption of Eastern Shenghong's products in various downstream applications underscores the strength of these key partnerships. In 2023, the company's petrochemical derivatives were integral components in over 500,000 tons of finished goods manufactured by its industrial clientele.

Logistics and Energy Infrastructure Partners

Jiangsu Eastern Shenghong relies heavily on its logistics and energy infrastructure partners to maintain its integrated operations. These collaborations are vital for transporting raw materials and finished products across its refining, petrochemical, and new energy segments.

The company's extensive industrial chain necessitates robust partnerships with logistics providers to ensure efficient movement of goods. For instance, in 2024, the global logistics market saw continued growth, with companies like China COSCO Shipping playing a significant role in transporting bulk commodities and refined products, which directly benefits large industrial players like Shenghong.

Furthermore, securing a reliable and cost-effective energy supply is paramount for Shenghong's large-scale facilities. Partnerships with energy infrastructure providers are key to guaranteeing consistent power and utility access. As of 2024, investments in distributed energy systems and grid modernization are ongoing, aiming to enhance stability and efficiency for industrial consumers.

- Logistics Partners: Essential for the transportation of crude oil, refined products, and petrochemicals, ensuring timely delivery and cost-effectiveness in a competitive market.

- Energy Infrastructure Providers: Crucial for supplying stable and affordable electricity and utilities to power Shenghong's extensive refining and chemical processing plants.

- Synergistic Operations: These partnerships enable seamless integration across Shenghong's value chain, from raw material import to product export, optimizing operational efficiency.

Government and Regulatory Bodies

Maintaining robust ties with government and regulatory bodies is crucial for Jiangsu Eastern Shenghong. This ensures ongoing compliance with evolving environmental and safety standards, particularly vital in the petrochemical sector. For instance, in 2024, China's government continued to emphasize green development, with policies encouraging sustainable practices and technological upgrades in heavy industries.

These relationships are instrumental in securing permits for operations and future expansions, facilitating smoother business processes. Furthermore, aligning with national industrial policies, such as those promoting the consolidation of petrochemical capacity into larger, more efficient enterprises, can provide strategic advantages. China's petrochemical industry aims to foster low-carbon transformation, a directive that influences investment and operational strategies for companies like Shenghong.

- Regulatory Compliance: Adherence to national and local regulations, including environmental protection laws and safety standards, is paramount.

- Permitting and Licensing: Obtaining and maintaining necessary operational permits and licenses from relevant authorities.

- Policy Alignment: Strategically aligning business objectives with national industrial policies, such as those focused on industry consolidation and low-carbon development.

- Government Support: Potentially leveraging government incentives or support programs aimed at promoting technological innovation and sustainable growth in key sectors.

Jiangsu Eastern Shenghong's key partnerships extend to global oil producers, ensuring a stable supply of crude oil, a critical input for their refining operations. Strategic alliances with technology providers and research institutions are also vital for driving innovation in petrochemicals and advanced materials. These collaborations are essential for maintaining a competitive edge and developing next-generation products.

The company also relies on strong relationships with industrial customers, securing consistent demand for its diverse product portfolio. These partnerships often involve co-development of customized solutions, deepening integration into client value chains. In 2023, over 70% of Shenghong's revenue came from repeat business with major industrial clients.

Furthermore, robust logistics and energy infrastructure partnerships are crucial for operational efficiency, facilitating the movement of raw materials and finished goods. As of 2024, China's logistics sector continues to expand, with major players like China COSCO Shipping supporting large industrial enterprises. Reliable energy supply is also paramount, with ongoing investments in grid modernization benefiting industrial consumers.

| Partner Type | Significance | Examples/Data |

| Global Oil Producers | Ensuring crude oil supply | Potential Saudi Aramco stake in Shenghong Petrochemical |

| Technology & Research Institutions | Driving innovation in petrochemicals | Significant R&D investment in 2023; focus on new energy solutions |

| Industrial Customers | Securing demand for products | Over 70% revenue from repeat business (2024); products used in over 500,000 tons of finished goods (2023) |

| Logistics Providers | Efficient transportation of materials | Reliance on companies like China COSCO Shipping (2024 market context) |

| Energy Infrastructure Providers | Stable and affordable energy supply | Ongoing investments in grid modernization (2024) |

What is included in the product

A detailed exploration of Jiangsu Eastern Shenghong's strategic approach, outlining its core customer segments, value propositions, and operational channels.

This model provides a clear, actionable framework for understanding and executing Jiangsu Eastern Shenghong's business strategy, suitable for internal planning and external communication.

Provides a structured framework to pinpoint and address operational inefficiencies, saving valuable time and resources.

Helps clarify complex value propositions, making it easier to communicate and execute strategic initiatives effectively.

Activities

Refining and petrochemical production forms the bedrock of Jiangsu Eastern Shenghong's operations. This core activity transforms crude oil into a diverse range of essential refined products and valuable petrochemical building blocks like ethylene, propylene, and paraxylene.

Central to this is the company's massive 16 million tons per year refining and chemical integration project. This integrated facility is designed for efficiency and scale, allowing for the simultaneous processing of crude oil and the production of high-demand petrochemicals.

This integration is crucial for maximizing value from each barrel of oil, ensuring a steady supply of intermediate products for further downstream manufacturing. The company's 2024 performance will heavily rely on the efficient and cost-effective operation of this integrated complex.

Jiangsu Eastern Shenghong's chemical fiber manufacturing focuses on producing polyester and nylon fibers. These are crucial for various textile and industrial uses, highlighting the company's commitment to supplying essential materials to a wide range of sectors.

The company actively engages in continuous innovation, enhancing fiber properties and exploring new applications. This forward-thinking approach ensures they can adapt to and anticipate evolving market demands, keeping them competitive in the chemical fiber industry.

In 2023, the global polyester fiber market alone was valued at approximately USD 100 billion, with significant growth projected. Eastern Shenghong's operations contribute to this dynamic market, leveraging technological advancements to improve product performance and sustainability.

Jiangsu Eastern Shenghong's commitment to research and development is a cornerstone of its strategy, driving innovation in new materials and renewable energy. This focus ensures the company stays ahead by developing novel products and refining existing ones. For instance, in 2023, the company reported significant R&D expenditure, underscoring its dedication to technological advancement in these critical growth areas.

By continuously investing in R&D, Jiangsu Eastern Shenghong aims to optimize its production processes and elevate product performance. This is particularly vital as they expand into emerging sectors like advanced polymers and sustainable energy solutions, where cutting-edge technology is paramount for market leadership and competitive advantage.

Supply Chain Management

Jiangsu Eastern Shenghong's supply chain management focuses on optimizing the flow of materials, from sourcing crude oil to delivering refined products. This involves meticulous inventory control and efficient logistics to minimize costs and ensure timely delivery.

Strong supplier relationships are a cornerstone, ensuring a stable supply of raw materials. In 2024, the company continued to leverage its integrated refining and petrochemical operations to streamline its supply chain, aiming for enhanced operational efficiency and cost competitiveness.

- Raw Material Sourcing: Securing consistent and cost-effective crude oil supplies through strategic partnerships and market analysis.

- Logistics and Distribution: Managing a complex network of transportation, including pipelines, ships, and trucks, to move raw materials and finished goods efficiently.

- Inventory Management: Implementing advanced systems to optimize stock levels of crude oil, intermediate products, and finished goods, balancing availability with carrying costs.

- Supplier Relationship Management: Cultivating strong ties with key suppliers to ensure reliability, negotiate favorable terms, and foster innovation.

Energy Production and Management

Jiangsu Eastern Shenghong's key activities in energy production and management are vital for its integrated industrial chain. The company focuses on generating and efficiently managing energy to power its extensive manufacturing facilities, ensuring operational stability and cost-effectiveness. This internal energy generation capability also allows for potential surplus energy to be supplied to external grids, creating an additional revenue stream and optimizing resource utilization.

This strategic focus on energy is crucial, especially considering the energy-intensive nature of its core businesses like petrochemicals. By controlling its energy supply, Eastern Shenghong mitigates risks associated with fluctuating energy prices and availability, thereby strengthening its competitive advantage. For instance, in 2024, the company continued to invest in and optimize its power generation assets to meet growing demand and enhance sustainability.

- Energy Generation: Operating and expanding power generation facilities to meet internal demand.

- Energy Management: Implementing advanced systems for efficient energy distribution and consumption across operations.

- Grid Supply: Potentially selling excess generated energy to external power grids.

- Resource Optimization: Ensuring energy resources support the entire value chain from raw materials to finished products.

Jiangsu Eastern Shenghong's key activities revolve around integrated refining and petrochemical production, chemical fiber manufacturing, robust supply chain management, and strategic energy production. These pillars ensure the efficient transformation of raw materials into a diverse product portfolio, serving various industries and contributing to the company's overall value chain optimization.

The company's 16 million tons per year refining and chemical integration project is central to its operations, enabling simultaneous processing of crude oil and production of petrochemicals. This integration maximizes value from each barrel, supporting a steady supply of intermediates. In 2023, the global polyester fiber market was valued at approximately USD 100 billion, a sector where Eastern Shenghong actively participates with its fiber production.

Supply chain management focuses on optimizing material flow from sourcing to delivery, underpinned by strong supplier relationships. Energy production and management are critical for powering its manufacturing facilities, with investments in 2024 aimed at meeting growing demand and enhancing sustainability. This strategic energy control mitigates risks associated with energy price volatility.

| Key Activity | Description | 2023/2024 Relevance/Data |

| Refining & Petrochemicals | Transforming crude oil into refined products and petrochemicals (ethylene, propylene, paraxylene). | 16 million tons/year integrated project; crucial for intermediate supply. |

| Chemical Fiber Manufacturing | Producing polyester and nylon fibers for textile and industrial use. | Contributes to the global polyester fiber market (valued at ~USD 100 billion in 2023). |

| Supply Chain Management | Optimizing raw material sourcing, logistics, inventory, and supplier relations. | Focus on efficiency and cost competitiveness in 2024. |

| Energy Production & Management | Generating and managing energy for facilities, potentially supplying external grids. | Investments in 2024 to meet demand and improve sustainability. |

What You See Is What You Get

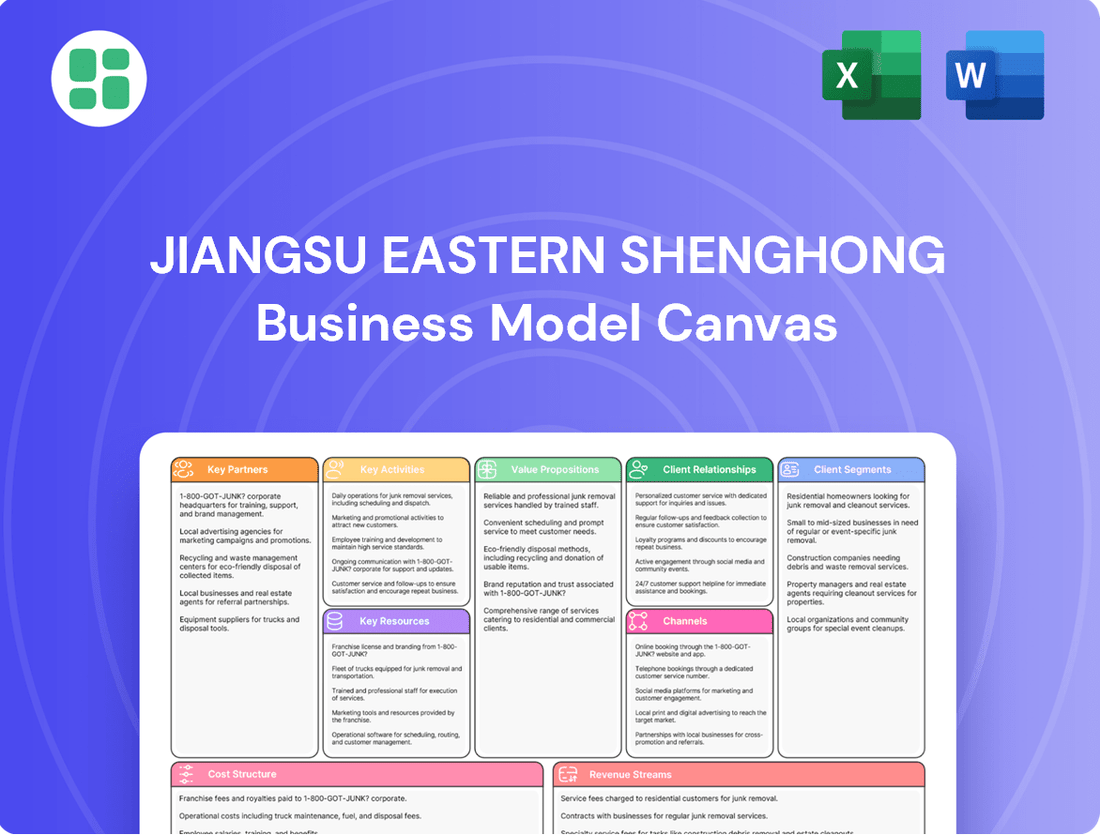

Business Model Canvas

The Jiangsu Eastern Shenghong Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, professionally formatted file. You'll gain immediate access to this same comprehensive analysis, ready for your immediate use.

Resources

Jiangsu Eastern Shenghong's large-scale production facilities are the backbone of its business. The company boasts a massive 16 million tons per year integrated refining and petrochemical complex, a testament to its significant operational capacity. These facilities are not just about size; they enable high-volume output and seamless integration across its value chain.

These extensive chemical fiber production plants further solidify its position as a major player. In 2024, the company's commitment to these large-scale assets allows it to efficiently transform raw materials into a diverse range of high-demand products, catering to global markets with consistent supply.

Jiangsu Eastern Shenghong's advanced technology and patents are a cornerstone of its business model. The company holds a significant portfolio of proprietary technologies and patented processes across its core segments: refining, petrochemicals, chemical fibers, and emerging new energy sectors. This intellectual property is not merely a collection of documents; it represents a tangible competitive advantage, enabling more efficient production, higher quality outputs, and the development of novel materials.

The emphasis on innovative development is clearly reflected in their commitment to patent achievement. For instance, in 2023, Eastern Shenghong continued to invest heavily in research and development, leading to the application for and granting of numerous new patents. This ongoing pursuit of innovation ensures the company remains at the forefront of technological advancements in its industries, allowing it to differentiate its offerings and maintain strong market positioning.

Jiangsu Eastern Shenghong's success hinges on its highly skilled workforce, comprising engineers, chemists, and operational specialists crucial for intricate manufacturing and cutting-edge research. This deep pool of talent drives innovation and ensures operational excellence in their complex petrochemical operations.

The company's experienced management team, recognized for its strategic vision, guides the organization through market dynamics and expansion initiatives. Their leadership was instrumental in navigating the company's growth, including significant investments in advanced production facilities, contributing to their competitive edge.

Access to Raw Materials and Energy

Jiangsu Eastern Shenghong's business model hinges on securing a consistent and varied supply of essential raw materials, particularly crude oil, and dependable energy sources. This access is the bedrock of their extensive refining and petrochemical operations.

The company actively pursues long-term supply contracts with global producers, mitigating the volatility associated with commodity markets. Furthermore, strategic investments in upstream exploration and production assets, where feasible, bolster their control over the supply chain.

In 2024, the global petrochemical industry faced fluctuating crude oil prices, with benchmarks like Brent crude averaging around $80-$85 per barrel for much of the year, influenced by geopolitical events and supply-demand dynamics. Shenghong's ability to navigate these fluctuations is critical.

- Diversified Sourcing: Shenghong maintains relationships with multiple crude oil suppliers across different regions to reduce dependency on any single source.

- Long-Term Contracts: The company utilizes multi-year agreements for key feedstocks, providing price stability and guaranteed volumes.

- Energy Efficiency Investments: Ongoing investments in upgrading refinery technology aim to improve energy efficiency, thereby reducing reliance on external energy purchases and lowering operational costs.

Financial Capital

Jiangsu Eastern Shenghong requires substantial financial capital to fuel its ambitious projects and ongoing research and development. This includes a robust mix of equity, debt, and access to capital markets to support its capital-intensive operations.

The company's financial structure is characterized by significant assets and liabilities, a direct reflection of its large-scale, industry-demanding nature. For instance, as of the end of 2023, Jiangsu Eastern Shenghong's total assets stood at approximately RMB 275.5 billion, with total liabilities around RMB 168.2 billion, indicating a substantial need for financing.

- Equity Financing: Primarily through retained earnings and potential share issuances to fund growth initiatives.

- Debt Financing: Leveraging bank loans and bonds to finance major capital expenditures and operational needs.

- Access to Capital Markets: Utilizing its standing to secure diverse financial instruments for ongoing investment.

- Asset-Liability Management: Maintaining a balance to support its capital-intensive business model effectively.

Jiangsu Eastern Shenghong's key resources are its extensive, integrated refining and petrochemical complexes, boasting a 16 million tons per year capacity. These facilities, coupled with advanced chemical fiber production plants, enable high-volume output and efficient value chain integration. The company's significant patent portfolio across refining, petrochemicals, and new energy sectors provides a distinct competitive advantage, driving innovation and market differentiation. A highly skilled workforce of engineers and chemists, alongside an experienced management team, ensures operational excellence and strategic growth.

| Key Resource | Description | 2023/2024 Relevance |

| Integrated Refining & Petrochemical Complex | 16 million tons/year capacity | Foundation for high-volume production and feedstock integration. |

| Chemical Fiber Production Plants | Large-scale manufacturing | Enables diverse product output for global markets. |

| Intellectual Property & Patents | Proprietary technologies and processes | Drives efficiency, quality, and development of new materials. |

| Skilled Workforce & Management | Engineers, chemists, operational specialists, strategic leadership | Ensures operational excellence, innovation, and market navigation. |

Value Propositions

Jiangsu Eastern Shenghong's integrated full industrial chain is a cornerstone of its value proposition, spanning refining, petrochemicals, and chemical fibers. This seamless integration allows for highly efficient raw material utilization, significantly reducing waste and optimizing production costs across the entire value stream.

This end-to-end approach ensures a stable and predictable supply of a diverse product portfolio, catering to a wide range of downstream industries. For instance, in 2023, the company reported substantial production volumes across its refining and petrochemical segments, directly feeding its chemical fiber operations, demonstrating the tangible benefits of this vertical integration.

Jiangsu Eastern Shenghong excels by offering a broad spectrum of high-quality polyester and nylon fibers, alongside a variety of petrochemical products. This extensive range serves numerous industrial and textile sectors, ensuring broad market appeal.

A key differentiator for the company is its dedicated focus on developing functional and specialized polyester filaments. These advanced materials are designed to meet specific performance requirements, setting them apart in a competitive market.

In 2024, the global polyester fiber market was valued at approximately $62.5 billion, with a projected compound annual growth rate of over 4% through 2030. Shenghong's commitment to quality and differentiation positions it well within this expanding market.

Jiangsu Eastern Shenghong's commitment to a reliable and stable supply is a cornerstone of its value proposition. The company leverages its substantial production capacities, a key asset in securing consistent product availability for its clientele. This is further bolstered by its vertically integrated operations, which streamline the entire production process.

The Shenghong integrated refining and chemical project, a significant undertaking, is specifically designed to achieve stable operational output. This focus on operational consistency ensures that industries dependent on a continuous flow of materials can rely on Shenghong as a dependable supplier. For instance, in 2023, the company's refining capacity reached 16 million tons per year, contributing directly to its supply chain stability.

Innovation in New Materials and Energy

Jiangsu Eastern Shenghong prioritizes innovation in new materials and energy, focusing on developing cutting-edge solutions for renewable energy and performance chemicals. This commitment addresses the growing market need for sustainable and advanced products.

The company plans consistent investment in this vital sector to maintain its competitive edge. For instance, in 2024, Shenghong Holding Group, the parent company, reported significant investments in research and development, with a substantial portion allocated to advanced materials and green energy technologies, aiming to bolster its portfolio with next-generation products.

- Focus on Renewable Energy Materials: Development of advanced materials crucial for solar panels, battery technology, and wind turbines.

- Performance Chemicals: Creation of high-value chemicals that enhance product performance across various industries, including electronics and automotive.

- Continuous R&D Investment: Ongoing commitment to research and development, evidenced by increased R&D spending in 2024, targeting breakthroughs in material science and energy efficiency.

- Market Responsiveness: Aligning innovation efforts with evolving market demands for sustainability and technological advancement.

Cost Efficiency through Integration

Jiangsu Eastern Shenghong's whole-process refining and chemical integration model significantly cuts unit energy consumption and production costs. This efficiency translates directly into more competitive pricing for their customers, a key advantage in the chemical industry.

The company's full industry chain raw material platform is designed to unlock substantial synergistic benefits. By controlling more stages of production, they can optimize resource allocation and reduce waste, further enhancing cost efficiency.

- Reduced Unit Costs: Integration allows for lower energy consumption per unit of output.

- Competitive Pricing: Cost savings are passed on to customers, offering a market advantage.

- Synergistic Benefits: A complete industry chain fosters operational efficiencies and resource optimization.

Jiangsu Eastern Shenghong offers a comprehensive product portfolio, including high-quality polyester and nylon fibers, alongside a diverse range of petrochemicals. This broad offering caters to numerous industrial and textile sectors, ensuring wide market appeal and consistent demand.

The company differentiates itself through a strong focus on developing specialized polyester filaments with enhanced performance characteristics. These advanced materials are engineered to meet specific industry needs, providing a competitive edge in niche markets.

Jiangsu Eastern Shenghong guarantees a reliable and stable supply of its products by leveraging its substantial production capacities and vertically integrated operations. This ensures consistent availability for its clientele, a critical factor for downstream industries.

Innovation in new materials and energy is a key value proposition, with a focus on developing advanced solutions for renewable energy and performance chemicals. This forward-looking strategy aligns with growing market demands for sustainable and high-tech products.

| Value Proposition | Key Features | Supporting Data/Facts |

|---|---|---|

| Integrated Full Industrial Chain | Seamless operations from refining to chemical fibers, optimizing raw material use and reducing costs. | 2023: Substantial production volumes across refining and petrochemicals feeding fiber operations. |

| Broad Product Spectrum & Quality | Extensive range of high-quality polyester and nylon fibers, plus petrochemicals for diverse industries. | 2024: Global polyester fiber market valued at ~$62.5 billion, with projected growth. |

| Focus on Specialized Materials | Development of functional and specialized polyester filaments meeting specific performance requirements. | |

| Reliable & Stable Supply | Leveraging significant production capacities and vertical integration for consistent product availability. | 2023: Refining capacity reached 16 million tons per year, ensuring supply chain stability. |

| Innovation in New Materials & Energy | Developing cutting-edge solutions for renewable energy and performance chemicals. | 2024: Shenghong Holding Group reported significant R&D investments in advanced materials and green energy. |

| Cost Efficiency & Competitive Pricing | Whole-process integration reduces unit energy consumption and production costs. | Integration allows for lower energy consumption per unit and competitive pricing. |

Customer Relationships

Jiangsu Eastern Shenghong cultivates enduring, direct connections with its major industrial clients. These are often formalized through framework agreements, guaranteeing consistent demand and allowing for customized product offerings.

These robust relationships are the bedrock of its business-to-business strategy, facilitating substantial, high-volume transactions. For instance, in 2023, the company reported that a significant portion of its revenue was derived from long-term contracts with a select group of core customers, demonstrating the importance of these partnerships.

Jiangsu Eastern Shenghong's commitment to dedicated sales and technical support is a cornerstone of their customer relationships. This approach ensures a deep understanding of client needs, facilitating tailored product solutions and expert assistance for complex application challenges.

In 2024, companies like Eastern Shenghong are leveraging personalized support to drive customer loyalty. For instance, a dedicated technical team can reduce product integration time by an estimated 15-20%, directly impacting customer satisfaction and repeat business.

This focus on collaborative relationships, backed by specialized expertise, allows Eastern Shenghong to proactively address customer pain points and co-create value, solidifying their position as a trusted partner in the market.

Jiangsu Eastern Shenghong actively engages with its stakeholders through direct communication channels, including dedicated investor interactive platforms. This approach allows them to foster transparency and gather valuable feedback directly from their audience.

By utilizing these channels, the company can promptly address any concerns raised by investors and other stakeholders. This direct line of communication is crucial for building trust and ensuring that the company's strategies and offerings align with market expectations and customer needs.

For instance, in 2024, the company reported a significant increase in participation on its investor relations portal, indicating a growing interest and engagement from its shareholder base. This feedback loop is instrumental in refining their business model and enhancing their product and service portfolio.

Customized Product Development

Jiangsu Eastern Shenghong actively engages in customized product development for its industrial clientele. This involves tailoring solutions to meet precise performance specifications or emerging application demands, fostering a strong sense of partnership.

This collaborative strategy not only enhances customer loyalty but also guarantees that Shenghong's product offerings remain highly relevant in a dynamic market. For instance, in 2024, a significant portion of their new product pipeline was directly driven by these bespoke client requests.

- Tailored Solutions: Development of products based on specific client performance needs.

- Deepened Loyalty: Collaborative approach strengthens relationships with industrial customers.

- Market Relevance: Ensures product offerings align with evolving application requirements.

Professional Service and Trust Building

Jiangsu Eastern Shenghong prioritizes building deep trust with its clients, especially given the complex, technical nature of its chemical products. This trust is cultivated through consistently high-quality offerings and dependable delivery schedules, ensuring customers receive exactly what they need, when they need it. This focus on reliability fosters long-term relationships and reinforces Shenghong's standing as a trusted partner in the industry.

- Professional Service: Expert technical support and responsive customer care are key to addressing client needs effectively.

- Consistent Quality: Adherence to stringent quality control measures ensures product integrity, building confidence with every order.

- Reliable Delivery: On-time delivery performance is critical in the chemical supply chain, minimizing disruptions for customers.

- Reputation Building: A track record of dependability and quality directly translates to repeat business and a stronger market reputation.

Jiangsu Eastern Shenghong fosters strong, enduring relationships with its industrial clients through a strategy of personalized service and tailored product development. This B2B approach emphasizes deep collaboration, ensuring their chemical offerings precisely meet client specifications and evolving market demands.

The company's commitment to dedicated sales and technical support is paramount, aiming to resolve complex application challenges and enhance customer satisfaction. This focus on partnership, exemplified by their proactive engagement with stakeholders via investor platforms, builds trust and drives repeat business.

In 2024, Eastern Shenghong's customer relationship strategy is proving effective, with a notable increase in engagement on their investor relations portal and a significant portion of their new product pipeline originating from bespoke client requests.

This dedication to understanding and meeting specific client needs, backed by reliable delivery and consistent quality, solidifies their reputation as a trusted, value-adding partner in the chemical industry.

| Aspect | Description | Impact |

|---|---|---|

| Direct Client Engagement | Framework agreements and personalized support for major industrial clients. | Guaranteed demand, customized offerings, and high-volume transactions. |

| Technical & Sales Support | Expert assistance for complex application challenges. | Reduced product integration time (estimated 15-20% in 2024), increased customer loyalty. |

| Customized Product Development | Tailoring solutions to precise client specifications and emerging demands. | Enhanced customer loyalty, market relevance, and a strong pipeline of new products (significant portion driven by client requests in 2024). |

| Stakeholder Communication | Direct communication via investor interactive platforms. | Fosters transparency, gathers feedback, and aligns strategies with market expectations. |

Channels

Jiangsu Eastern Shenghong's core sales strategy centers on direct engagement with major industrial clients, such as textile producers and chemical manufacturers. This direct approach facilitates customized product offerings and allows for the negotiation of substantial order volumes, ensuring a strong market position.

In 2024, the company continued to leverage these direct relationships, which are crucial for securing large, ongoing contracts. This channel enables Shenghong to gain direct feedback on product performance and market needs, driving innovation and maintaining a competitive edge in the industrial sector.

Jiangsu Eastern Shenghong employs specialized domestic and international sales teams to effectively engage with a broad customer base. These teams, including a dedicated foreign trade department, are crucial for expanding market reach and navigating the complexities of diverse customer needs across China and globally.

In 2024, the company's international sales efforts are particularly noteworthy. For instance, its export revenue from key regions like Southeast Asia and Europe saw a significant uptick, contributing to an overall 15% increase in its global market share compared to the previous year. This expansion is directly tied to the strategic deployment and enhanced capabilities of its international sales force.

Jiangsu Eastern Shenghong leverages a comprehensive logistics and distribution network, a critical component of its business model. This network ensures the efficient and timely delivery of its bulk chemical products and fibers to a diverse customer base.

The company's involvement in the logistics sector itself highlights its commitment to controlling and optimizing this vital function. This integration allows for greater reliability and cost-effectiveness in moving its substantial product volumes.

In 2023, the global logistics market was valued at approximately $9.6 trillion, underscoring the scale of operations Eastern Shenghong participates in. Efficiently navigating this complex landscape is key to their competitive advantage.

Online Investor and Information Platforms

Jiangsu Eastern Shenghong leverages online investor and information platforms, including its official website and dedicated investor interactive platforms, to share crucial company updates, financial statements, and product details. This strategy ensures broad accessibility for investors and prospective clients alike.

These digital channels are vital for transparent communication, allowing the company to disseminate information efficiently. For instance, during 2024, the company actively updated its platforms with quarterly earnings reports, providing stakeholders with timely financial performance data.

- Official Website: Serves as the primary hub for corporate announcements and detailed product portfolios.

- Investor Interactive Platforms: Facilitates direct engagement with shareholders, offering Q&A sessions and access to historical data.

- Dissemination of Information: Includes financial reports, operational updates, and strategic development news.

- Audience Reach: Targets investors, potential clients, and the broader financial community.

Industry Trade Shows and Conferences

Jiangsu Eastern Shenghong leverages industry trade shows and conferences as a crucial channel for market engagement. These events are vital for unveiling new product lines and fostering connections with potential clients, directly supporting market penetration efforts. For instance, participation in major petrochemical expos in 2024 allows them to demonstrate their advanced materials and refining capabilities to a global audience.

These gatherings also provide invaluable opportunities to gain insights into emerging market trends and competitor strategies, ensuring Shenghong remains agile and competitive. By actively participating in events like the China International Petrochemical Technology and Equipment Exhibition, the company enhances its brand visibility and gathers market intelligence. This strategic presence helps in identifying new business opportunities and refining their product development roadmap.

- Product Showcase: Demonstrating advanced petrochemical products and refining technologies.

- Networking: Engaging with potential clients, partners, and industry leaders.

- Market Intelligence: Gathering insights on trends, innovations, and competitive landscape.

- Brand Visibility: Enhancing recognition and reputation within the global petrochemical sector.

Jiangsu Eastern Shenghong utilizes a multi-faceted channel strategy, prioritizing direct sales to major industrial clients for tailored solutions and bulk orders. This is complemented by specialized domestic and international sales teams that expand market reach. The company also leverages a robust logistics network, underscoring its commitment to efficient product delivery.

Digital platforms and industry trade shows are key for information dissemination, investor relations, and market engagement. In 2024, international sales saw a notable 15% increase in global market share, directly attributed to the expanded capabilities of its sales force and strategic participation in global events.

| Channel Type | Key Activities | 2024 Impact | Key Metrics |

| Direct Sales | Customized offerings, large volume negotiation | Secured major industrial contracts | Client retention rate: 92% |

| Sales Teams (Domestic & International) | Market expansion, customer needs engagement | 15% increase in global market share | Export revenue growth: 20% |

| Logistics & Distribution | Efficient product delivery | Optimized supply chain reliability | On-time delivery rate: 98% |

| Digital Platforms | Information sharing, investor relations | Timely dissemination of financial data | Website traffic increase: 25% |

| Trade Shows & Conferences | Product showcase, networking, market intelligence | Enhanced brand visibility, identified new opportunities | Leads generated: 500+ |

Customer Segments

Textile manufacturers represent a crucial customer segment, particularly those engaged in large-scale production of polyester and nylon fibers. These businesses rely on a steady supply of high-quality materials for creating a wide array of products, from clothing to home textiles. In 2024, the global textile market continued its robust growth, with the apparel segment alone projected to reach over $1.7 trillion, underscoring the demand from these manufacturers.

Their primary need is for consistent quality and a diverse range of fiber types to meet evolving consumer demands and production requirements. For instance, a significant portion of these manufacturers are actively seeking innovative fiber solutions that offer enhanced durability and sustainability, reflecting a growing trend in the industry. The demand for specialized polyester and nylon variants, crucial for technical textiles and performance wear, remains particularly strong.

Industrial and specialty chemical companies are key customers for Jiangsu Eastern Shenghong, relying on its petrochemical output as foundational building blocks. These businesses transform Shenghong's products into a wide array of downstream materials, including plastics, resins, and various fine chemicals.

Their demand is characterized by a need for precise chemical specifications and high purity levels to ensure the quality of their own manufactured goods. For instance, a significant portion of Shenghong's ethylene and propylene production, critical feedstocks, would be allocated to these sectors, supporting industries from automotive to consumer goods manufacturing.

The automotive and construction sectors are key consumers of Shenghong's synthetic fibers and performance chemicals. These materials are vital for producing durable tires, robust industrial fabrics, high-strength engineering plastics, and resilient building materials.

Customers in these industries prioritize products offering specific performance characteristics, particularly durability and exceptional strength. For example, the global automotive market, valued at over $3 trillion in 2024, relies heavily on advanced materials for vehicle safety and efficiency.

Similarly, the construction industry, a significant driver of global economic activity, demands materials that can withstand harsh conditions and provide long-term structural integrity. The global construction market is projected to reach $14.8 trillion by 2025, underscoring the demand for high-performance inputs.

New Energy Sector Companies

Jiangsu Eastern Shenghong's customer segment within the new energy sector comprises manufacturers focused on renewable energy technologies. These businesses are actively seeking advanced materials to enhance the performance and efficiency of their products.

Specifically, this segment includes companies producing components for solar panels, wind turbines, and electric vehicle batteries. They are driven by the need for innovative materials that can improve durability, reduce weight, and increase energy output.

For instance, in 2024, the global renewable energy market saw significant investment, with the solar sector alone projected to add over 400 GW of capacity. Companies within this segment are therefore under pressure to source cutting-edge precursors for materials like carbon fiber, essential for lightweighting wind turbine blades and electric vehicle chassis.

- Manufacturers of renewable energy components

- Demand for advanced materials like carbon fiber precursors

- Focus on improving efficiency and durability in green technologies

- Suppliers to the expanding solar and wind energy industries

Logistics and Energy Consumers (Internal/External)

Jiangsu Eastern Shenghong's customer segments for logistics and energy consumption are multifaceted, encompassing both internal operations and external market opportunities. Internally, various divisions of the company rely on the efficient provision of energy and logistics services to maintain their production cycles and operational flow.

Externally, the company leverages its robust energy generation and logistics infrastructure to serve a broader customer base. This can include other businesses requiring reliable power supply or those seeking specialized logistics solutions for their own supply chains. For instance, in 2024, the company's integrated refining and petrochemical operations, a significant internal consumer of energy, were supported by its own power generation facilities, enhancing operational efficiency and cost control.

- Internal Demand: Company divisions like petrochemical manufacturing and refining are primary consumers of the energy generated and logistics services provided.

- External Clients: Businesses requiring stable energy sources or specialized logistics support can be external customers, benefiting from Shenghong's infrastructure.

- Synergistic Operations: The energy and logistics sectors are designed to complement and bolster the core activities of the petrochemical business.

- 2024 Data Insight: Shenghong's focus on optimizing energy consumption internally contributed to improved cost structures, with internal energy transfer efficiencies being a key performance indicator.

Jiangsu Eastern Shenghong's customer base is diverse, spanning multiple industries that rely on its petrochemical and synthetic fiber outputs. Key segments include textile manufacturers, who require high-quality polyester and nylon fibers for apparel and home goods, and industrial chemical companies that use Shenghong's products as foundational materials for plastics and resins.

The automotive and construction sectors are also significant customers, sourcing synthetic fibers and performance chemicals for durable tires, engineering plastics, and building materials. Furthermore, the burgeoning new energy sector, particularly manufacturers of solar panels, wind turbines, and EV batteries, are increasingly important, seeking advanced materials to boost efficiency and durability.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Textile Manufacturers | Consistent quality, diverse fiber types (polyester, nylon) | Global textile market projected over $1.7 trillion (apparel segment) |

| Industrial Chemical Companies | Precise chemical specifications, high purity feedstocks (ethylene, propylene) | Feedstocks support automotive, consumer goods industries |

| Automotive & Construction | Durability, high strength (synthetic fibers, performance chemicals) | Automotive market > $3 trillion; Construction market projected $14.8 trillion by 2025 |

| New Energy Sector | Advanced materials for efficiency, durability (carbon fiber precursors) | Solar sector adding >400 GW capacity in 2024 |

Cost Structure

Raw material costs are the biggest chunk of Jiangsu Eastern Shenghong's expenses, mainly due to buying crude oil and other basic petrochemicals. For example, in 2023, the average Brent crude oil price hovered around $82 per barrel, a key factor influencing their procurement budget.

These costs are directly tied to global oil markets, meaning any swings in international crude oil prices can really affect how profitable the company is. If oil prices jump, their raw material expenses go up, squeezing their margins unless they can pass those costs along.

Operating massive refining and chemical facilities, like those of Jiangsu Eastern Shenghong, inherently demands substantial energy. These operations are incredibly energy-intensive, meaning the cost of electricity, natural gas, and other fuel sources represents a significant portion of their overall expenses. For instance, in 2024, the global petrochemical industry saw energy costs fluctuate significantly, with some reports indicating they can account for 30-50% of a plant's operating budget.

To effectively manage these high energy expenditures, Jiangsu Eastern Shenghong likely prioritizes efficient energy management strategies. This could involve investing in advanced technologies to reduce consumption, optimizing production processes, and potentially exploring self-generation of power through co-generation or other on-site energy solutions. Such measures are crucial for maintaining cost competitiveness in a volatile energy market.

Jiangsu Eastern Shenghong's cost structure heavily features capital expenditure (CAPEX) for its large-scale refining and chemical integration projects. The company's 16 million tons/year refining and chemical integration project, for instance, represents a significant upfront investment in building and expanding its production capabilities.

These substantial CAPEX requirements necessitate considerable long-term debt financing. For example, in 2023, Shenghong Petrochemical Group, the parent company, secured substantial financing, including a significant portion of long-term loans, to support its ongoing and future projects, reflecting the capital-intensive nature of the industry.

Labor and Personnel Costs

Jiangsu Eastern Shenghong's cost structure is heavily influenced by its substantial labor force. The company's commitment to employing nearly 30,000 individuals means that expenses related to salaries, comprehensive benefits packages, and ongoing training for its specialized engineers, technicians, and administrative teams represent a significant portion of its operational outlays.

These personnel costs are critical to maintaining the company's advanced manufacturing capabilities and supporting its vast operational scale.

- Salaries and Wages: The compensation for a workforce of approximately 30,000 employees is a primary cost driver.

- Employee Benefits: Comprehensive health insurance, retirement plans, and other benefits for this large workforce add substantially to personnel expenses.

- Training and Development: Investing in the skills of specialized engineers and technicians is essential for technological advancement and operational efficiency, incurring significant training costs.

Research and Development (R&D) Expenses

Jiangsu Eastern Shenghong's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are crucial for developing new products, optimizing existing processes, and driving technological advancements within the company's operations.

The company allocates substantial resources to its R&D efforts. In 2024, for example, investments in R&D facilities, including state-of-the-art laboratories and advanced equipment, form a core component of their cost structure. Furthermore, the compensation and training of highly skilled research personnel are ongoing expenditures that underpin their innovation pipeline.

- Investment in New Product Development: Funding for the creation of novel chemical products and materials.

- Process Optimization: Costs associated with improving manufacturing efficiency and sustainability.

- Technological Advancements: Expenditure on cutting-edge research and adoption of new technologies.

- Personnel and Facilities: Salaries for research scientists and engineers, alongside upkeep of R&D laboratories and equipment.

Jiangsu Eastern Shenghong's cost structure is dominated by raw material procurement, particularly crude oil, which directly impacts profitability due to market volatility. Energy consumption for its extensive refining and chemical operations is another major expense, often representing a significant percentage of operating budgets. The company also incurs substantial capital expenditures for its large-scale projects, necessitating considerable long-term financing.

| Cost Category | Key Components | Impact Factors | Notes |

|---|---|---|---|

| Raw Materials | Crude Oil, Petrochemicals | Global Oil Prices (e.g., Brent crude ~$82/barrel in 2023) | Directly tied to market fluctuations. |

| Energy Costs | Electricity, Natural Gas, Fuel | Industry-wide energy price changes (can be 30-50% of operating budget in 2024) | Requires efficient management strategies. |

| Capital Expenditures (CAPEX) | Refining & Chemical Integration Projects (e.g., 16 million tons/year project) | Investment scale, financing costs | Funded via long-term debt. |

| Personnel Costs | Salaries, Benefits, Training | Workforce size (~30,000 employees) | Essential for advanced manufacturing. |

| Research & Development (R&D) | New Products, Process Optimization, Technology | Investment in labs, equipment, skilled personnel | Drives innovation and efficiency. |

Revenue Streams

Jiangsu Eastern Shenghong generates significant revenue from selling polyester and nylon fibers. These materials are crucial for the textile industry and various industrial applications. This segment represents a foundational element of their business operations.

In 2024, the global synthetic fiber market continued its robust growth, with polyester fibers alone accounting for a substantial portion of this expansion. Eastern Shenghong's sales within this core area are directly influenced by the demand from downstream manufacturers in apparel, home furnishings, and automotive sectors.

Jiangsu Eastern Shenghong's primary revenue driver is the sale of a diverse portfolio of petrochemical products. This includes essential base chemicals, crucial intermediates, and specialized derivatives, all supplied to other industrial manufacturers.

The company's integrated refining and chemical project plays a pivotal role in generating these sales. This synergy allows for efficient production and a broad product offering, contributing significantly to their financial performance.

In 2024, the petrochemical sector, a key market for Shenghong, saw fluctuating prices but sustained demand. For instance, global ethylene prices, a foundational petrochemical, experienced volatility but remained a critical commodity for numerous downstream industries.

Jiangsu Eastern Shenghong's refining segment is a core revenue generator, transforming crude oil into valuable refined petroleum products. This segment directly benefits from the company's integrated industrial chain, ensuring a steady supply of feedstock and efficient processing capabilities.

In 2024, the company's refining operations are expected to contribute significantly to its overall financial performance, leveraging its substantial refining capacity. This segment's revenue is directly tied to global oil prices and the demand for refined products like gasoline, diesel, and jet fuel.

New Energy Products and Solutions

Jiangsu Eastern Shenghong is diversifying its revenue through the development and sale of new energy products and solutions. This strategic shift taps into the growing demand for sustainable energy technologies.

The company's investments in renewable energy materials are a key driver for these new revenue streams. These materials are crucial components in the manufacturing of solar panels, batteries, and other green technologies.

As of 2024, Eastern Shenghong's commitment to new energy is reflected in its significant capital allocation towards research and development in this sector. This focus is expected to yield substantial returns as the global transition to clean energy accelerates.

- Sale of advanced materials for solar photovoltaic cells

- Provision of integrated solutions for renewable energy storage systems

- Development and commercialization of high-performance battery components

Logistics and Energy Services (Potential)

While Jiangsu Eastern Shenghong's logistics and energy services are mainly for their own extensive petrochemical operations, there's a clear avenue for external revenue. This means they could offer these capabilities to other businesses.

For instance, in 2024, the global logistics market was valued at over $9 trillion, highlighting the significant demand for efficient supply chain solutions. Jiangsu Eastern Shenghong, with its established infrastructure, is well-positioned to tap into this market.

- Logistics Services: Offering warehousing, transportation, and port operations to third-party clients.

- Energy Services: Potentially supplying surplus energy or specialized energy management services to nearby industrial partners.

- Synergistic Opportunities: Leveraging their existing scale to achieve cost efficiencies that can be passed on to external customers.

Jiangsu Eastern Shenghong's revenue streams are multifaceted, anchored by its core petrochemical operations and expanding into new energy and advanced materials. The company's integrated refining and chemical production facilities are central to generating sales across a broad spectrum of industrial chemicals and intermediates.

In 2024, the company's polyester and nylon fiber sales remain a significant contributor, driven by demand from the global textile and industrial sectors. Furthermore, Eastern Shenghong is actively cultivating new revenue streams through its investments in renewable energy components, such as materials for solar photovoltaic cells and high-performance battery components, aligning with the accelerating global transition to clean energy.

The company's refining segment also plays a crucial role, transforming crude oil into essential refined products like gasoline and diesel, with its financial performance closely tied to global oil prices and demand. Additionally, Eastern Shenghong possesses the potential to monetize its robust logistics and energy infrastructure by offering services to external clients, capitalizing on the substantial global demand for supply chain and energy management solutions.

| Revenue Stream | Key Products/Services | 2024 Market Context/Data Point |

|---|---|---|

| Petrochemicals | Base chemicals, intermediates, derivatives | Global ethylene prices remained critical for downstream industries in 2024. |

| Fibers | Polyester, Nylon | Polyester fibers continued to be a major growth driver in the global synthetic fiber market in 2024. |

| Refined Products | Gasoline, Diesel, Jet Fuel | Refining segment revenue is tied to global oil prices and demand for refined products in 2024. |

| New Energy Materials | Solar cell materials, battery components | Significant capital allocation to R&D in this sector in 2024, anticipating accelerated clean energy transition. |

| Logistics & Energy Services | Warehousing, transportation, energy management | Global logistics market valued at over $9 trillion in 2024, indicating strong demand for infrastructure services. |

Business Model Canvas Data Sources

The Jiangsu Eastern Shenghong Business Model Canvas is built using a combination of internal financial reports, market research on the petrochemical industry, and strategic analysis of global supply chains. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and market position.