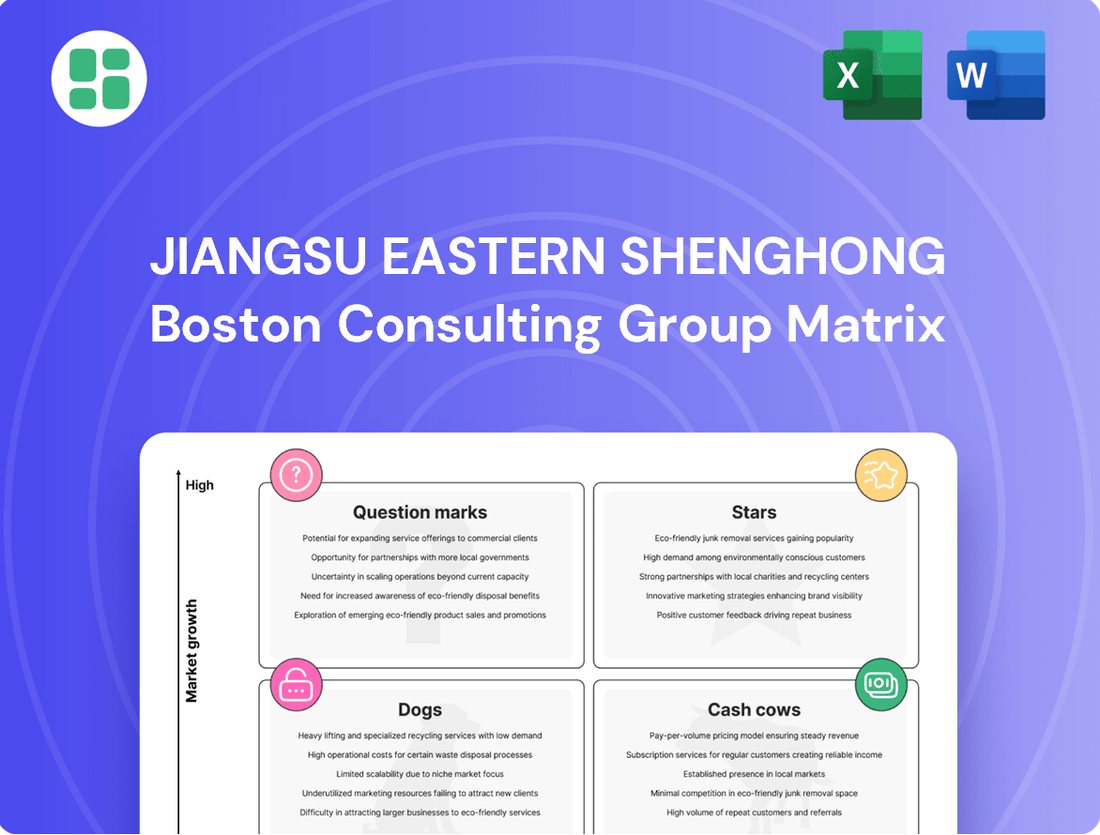

Jiangsu Eastern Shenghong Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Eastern Shenghong Bundle

Uncover the strategic potential of Jiangsu Eastern Shenghong with our comprehensive BCG Matrix analysis. See which of their products are Stars, Cash Cows, Dogs, or Question Marks, and gain a clear picture of their market standing. Purchase the full report for detailed insights and actionable recommendations to optimize your investment and product strategy.

Stars

Jiangsu Eastern Shenghong is making significant strides in the new energy materials sector, particularly with photovoltaic grade EVA and the development of POE. The company aims to be a premier global supplier in these critical areas.

These materials are essential for the booming solar energy industry, a market experiencing rapid expansion. Eastern Shenghong's strategic focus here places them in a high-growth segment where they are actively building a leading market position.

The company's substantial million-ton EVA project is advancing as planned. Furthermore, a 100,000 tons/year POE industrialization unit is currently under construction, solidifying their capacity and commitment to future growth in these vital new energy components.

Jiangsu Eastern Shenghong is strategically shifting its chemical fiber business towards high-performance specialized fibers. This means moving beyond standard offerings to create products with significant added value and advanced technical specifications. For instance, in 2024, the company is focusing on fibers tailored for demanding industrial uses and technical textiles, tapping into markets known for rapid expansion and specialized demand.

These specialized fibers are key to Shenghong’s strategy of capturing leadership in niche, high-growth segments. By investing in research and development and advanced manufacturing for these products, the company aims to secure premium pricing and achieve higher profit margins. This proactive approach positions them to benefit from the increasing demand for advanced materials in sectors like automotive, aerospace, and protective wear.

Shenghong is strategically positioning itself in advanced petrochemical derivatives, specifically targeting high-growth sectors such as new energy vehicles and advanced materials. This focus is crucial as these industries are experiencing significant expansion and innovation.

The company's integrated refining and chemical project is designed to boost the output of high value-added and scarce chemical products. For instance, in 2024, the global market for advanced materials, crucial for EV batteries and lightweight components, was projected to reach over $100 billion, highlighting the demand for specialized petrochemicals.

This strategic pivot directly addresses emerging market demands, signaling substantial growth potential and opportunities for Shenghong to establish market leadership in these specialized chemical segments.

Propane Dehydrogenation (PDH) and Olefin Production

Jiangsu Eastern Shenghong's Propane Dehydrogenation (PDH) unit, with a capacity of 700,000 tons per year, signifies a significant step in its olefin production strategy. This expansion allows the company to fully cover three key olefin production process routes, including the 'gas head' method. This comprehensive approach to olefin generation is crucial as olefins are foundational components for a wide array of high-demand polymers and their derivatives.

The strategic advantage of having diversified and efficient production routes for olefins cannot be overstated. In a market that continues to see robust growth for these essential chemical intermediates, Jiangsu Eastern Shenghong is well-positioned. This diversified capability ensures a stable supply chain and enhances the company's competitiveness, allowing it to meet evolving market demands effectively.

- Diversified Olefin Production: Jiangsu Eastern Shenghong operates a 700,000 tons/year PDH unit, achieving full coverage of three olefin production process routes, including 'gas head' production.

- Market Advantage: This multi-route strategy provides a significant competitive edge in the growing market for fundamental polymer building blocks.

- Strategic Importance: Olefins are critical intermediates for numerous high-demand polymers and derivatives, making efficient and diverse production vital.

Carbon Dioxide Comprehensive Utilization Technologies

Jiangsu Eastern Shenghong is actively investing in carbon dioxide comprehensive utilization technologies, a move that aligns perfectly with the global push for sustainability and a circular economy. This focus on innovative solutions for CO2 demonstrates a forward-thinking strategy, positioning the company for potential leadership in a rapidly evolving market.

While these initiatives might be in their nascent stages, the long-term outlook for carbon capture and utilization (CCU) is exceptionally strong. As industries worldwide face increasing pressure to decarbonize, the demand for effective CO2 utilization methods is set to surge. For instance, the global carbon capture, utilization, and storage (CCUS) market was valued at approximately USD 30.5 billion in 2023 and is projected to reach USD 84.5 billion by 2030, growing at a CAGR of 15.7%. This indicates a significant growth trajectory for companies developing these technologies.

- Market Growth: The CCUS market is experiencing substantial expansion, driven by climate change mitigation efforts and regulatory incentives.

- Technological Advancement: Innovations in CO2 utilization, such as conversion into valuable chemicals or materials, offer new revenue streams and environmental benefits.

- Strategic Positioning: Early investment in these areas allows Eastern Shenghong to build expertise and secure a competitive advantage in future decarbonized industries.

- Circular Economy Integration: These technologies are central to developing a circular economy, transforming waste CO2 into resources.

Jiangsu Eastern Shenghong's ventures into new energy materials, specifically photovoltaic grade EVA and POE, position them as a key player in a high-growth sector. The company's significant investment in a million-ton EVA project and a 100,000 tons/year POE industrialization unit underscores their commitment to becoming a leading global supplier in these essential solar energy components.

The company's strategic focus on high-performance specialized fibers, particularly for industrial uses and technical textiles in 2024, aims to capture leadership in niche, high-growth markets. This move towards advanced materials, including those for electric vehicles and aerospace, taps into sectors with substantial demand and premium pricing potential.

Eastern Shenghong's integrated refining and chemical project enhances its output of high value-added petrochemical derivatives, crucial for industries like new energy vehicles. The global advanced materials market, vital for EV batteries, was projected to exceed $100 billion in 2024, highlighting the significant opportunity for specialized petrochemicals.

The company's 700,000 tons/year PDH unit diversifies its olefin production, covering three key process routes. This comprehensive approach to producing foundational chemical intermediates strengthens its supply chain and market competitiveness in a sector with robust demand for polymers and derivatives.

Jiangsu Eastern Shenghong's investment in carbon dioxide comprehensive utilization technologies aligns with global sustainability trends. The CCUS market, valued at approximately USD 30.5 billion in 2023, is projected for significant growth, offering Eastern Shenghong a strategic advantage in future decarbonized industries.

| Business Segment | Key Products/Initiatives | Strategic Focus | Market Relevance (2024 Data/Projections) |

|---|---|---|---|

| New Energy Materials | Photovoltaic grade EVA, POE | Global leadership in solar energy components | Solar industry expansion; 100,000 tons/year POE unit under construction |

| Specialized Fibers | High-performance industrial and technical textiles | Leadership in niche, high-growth segments | Demand for advanced materials in automotive, aerospace |

| Advanced Petrochemicals | Derivatives for new energy vehicles, advanced materials | Capturing growth in emerging markets | Global advanced materials market >$100 billion |

| Olefins Production | PDH unit (700,000 tons/year), diversified routes | Strengthening supply chain and competitiveness | Robust growth in demand for polymers and derivatives |

| Sustainability Initiatives | CO2 comprehensive utilization | Leadership in decarbonized industries, circular economy | CCUS market projected to reach $84.5 billion by 2030 |

What is included in the product

Highlights which Jiangsu Eastern Shenghong units to invest in, hold, or divest based on market share and growth.

The Jiangsu Eastern Shenghong BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of unclear strategic direction.

Cash Cows

The 16 million tons/year Shenghong integrated refining and chemical project is a cornerstone of the company's strategy, establishing a comprehensive value chain from crude oil to advanced materials. This massive facility is designed to be a significant generator of cash flow.

Despite industry-wide volatility and recent pressures on petrochemical profit margins, the sheer scale and integration of this operation ensure a consistent and substantial revenue stream, positioning it as a key cash cow for Shenghong.

Jiangsu Eastern Shenghong's commodity polyester and nylon fiber production serves as a classic cash cow. This segment, a cornerstone of their operations, benefits from a mature market and the company's substantial, established market share. These fibers are essential for both the textile and industrial sectors, ensuring a steady demand.

The consistent cash flow from polyester and nylon is a direct result of their high production volumes and strong market positioning. Crucially, these mature products require less aggressive marketing and promotional spending compared to newer ventures, allowing for efficient capital generation. For instance, in 2023, the global polyester fiber market was valued at approximately $60 billion, with nylon fiber markets also representing significant revenue streams.

Jiangsu Eastern Shenghong's established acrylonitrile production stands as a formidable cash cow. With a staggering 1.04 million tons/year capacity, it holds the title of the world's largest producer.

Acrylonitrile is a vital building block for numerous polymers and fibers, serving a market that, while mature, remains indispensable. This significant market dominance translates into a consistent and substantial cash flow for the company.

This reliable revenue stream is crucial, providing the financial muscle to invest in and nurture other, potentially high-growth, business units within the Shenghong portfolio.

MMA (Methyl Methacrylate) Production

Jiangsu Eastern Shenghong's Methyl Methacrylate (MMA) production, boasting a significant 340,000 tons/year capacity, positions it as the top producer in China. This leadership in a well-established market signifies consistent profitability and a dependable source of cash flow for the company.

MMA's widespread application across diverse industries, from automotive to construction and electronics, underpins its status as a cash cow. The company's dominant market share in this mature segment ensures stable demand and robust profit margins, contributing significantly to its overall financial strength.

- Leading Market Position: Jiangsu Eastern Shenghong is China's largest MMA producer with 340,000 tons/year capacity.

- Mature Market Stability: MMA is a versatile chemical with established demand, ensuring reliable cash generation.

- Profitability Driver: The company's leading position translates into strong profit margins in the MMA segment.

Core Logistics and Energy Infrastructure

Jiangsu Eastern Shenghong's core logistics and energy infrastructure segments function as its cash cows. These operations, vital for supporting its manufacturing base, are characterized by their stability and consistent cash generation. The company's strategic integration of these services ensures operational efficiency and provides a reliable revenue stream, even in a mature market.

These segments are crucial for the company's overall operational backbone. They provide essential services that underpin its manufacturing activities, ensuring a smooth and cost-effective production process. In 2024, the energy infrastructure segment, for instance, continued to benefit from stable demand, contributing significantly to the company's predictable earnings. The logistics arm also saw steady utilization, supporting both internal needs and offering services externally, further solidifying its cash-generating status.

- Stable Demand: The energy infrastructure segment benefits from consistent demand, ensuring predictable revenue.

- Operational Efficiency: Integrated logistics and energy infrastructure reduce costs and improve the efficiency of core manufacturing.

- Consistent Cash Flow: These mature segments generate reliable, low-risk cash flows, supporting other business units.

- Market Stability: Operating in stable, mature markets minimizes volatility and enhances the cash cow characteristics.

Jiangsu Eastern Shenghong's commodity polyester and nylon fiber production represents a significant cash cow. With established market positions and consistent demand from the textile and industrial sectors, these segments generate substantial and reliable revenue. The company's substantial production volumes and strong market share in these mature product lines contribute directly to its financial stability.

The world polyester fiber market was valued at approximately $60 billion in 2023, highlighting the scale of this segment. Shenghong's dominance in this area, coupled with its nylon fiber operations, ensures a steady inflow of cash, requiring less aggressive investment compared to growth-oriented ventures.

Jiangsu Eastern Shenghong's acrylonitrile production, with a capacity of 1.04 million tons/year, makes it the world's largest producer. This leadership in a vital chemical building block ensures consistent cash flow, providing the financial foundation to support other business areas.

The company's Methyl Methacrylate (MMA) production, holding the top spot in China with a 340,000 tons/year capacity, also functions as a key cash cow. MMA's diverse applications across industries like automotive and electronics create stable demand and robust profit margins for Shenghong.

Shenghong's logistics and energy infrastructure are critical cash cows, providing stable and consistent revenue streams. These integrated operations support manufacturing efficiency and generate reliable earnings, even within mature market conditions.

| Product Segment | Capacity/Scale | Market Position | Cash Flow Characteristic |

| Polyester & Nylon Fibers | High Volume Production | Established Market Share | Consistent, Reliable |

| Acrylonitrile | 1.04 Million Tons/Year (World's Largest) | Global Leader | Substantial, Predictable |

| Methyl Methacrylate (MMA) | 340,000 Tons/Year (China's Largest) | Domestic Leader | Strong, Stable |

| Logistics & Energy Infrastructure | Integrated Operations | Essential Support Services | Steady, Low-Risk |

Full Transparency, Always

Jiangsu Eastern Shenghong BCG Matrix

The Jiangsu Eastern Shenghong BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means you get the full, unwatermarked analysis, ready for immediate integration into your strategic planning processes. No additional editing or formatting will be required, ensuring you have a professional and actionable report from the moment of acquisition.

Dogs

Older chemical fiber production lines at Jiangsu Eastern Shenghong, particularly those focused on conventional products, are likely experiencing significant competitive pressures. This segment might see declining demand and shrinking profit margins, as newer, more efficient technologies emerge in the market.

These legacy units often operate with lower efficiency, necessitating continuous maintenance that yields minimal returns. The risk of these lines becoming cash traps, draining resources without substantial future growth potential, is a key concern for the company's portfolio.

In 2024, the global textile industry, a major consumer of chemical fibers, faced headwinds including oversupply in certain categories and evolving consumer preferences towards sustainable materials. This context exacerbates the challenges for older production facilities.

Certain commodity petrochemical products within Jiangsu Eastern Shenghong's portfolio are exhibiting narrowed price differentials. This trend, driven by volatile crude oil prices and subdued consumer demand, suggests these products are struggling to achieve significant profit margins.

In 2024, the global petrochemical market has seen increased price compression for many basic chemicals. For instance, ethylene, a key building block, experienced a significant drop in its price spread over naphtha feedstock in early 2024 compared to previous years, reflecting oversupply in certain regions and weaker demand from sectors like automotive and construction.

These narrowed differentials place these products in the 'dog' category of the BCG matrix. They operate in highly competitive markets where differentiation is difficult, leading to low profitability and potentially a low market share, barely covering their costs.

Within Jiangsu Eastern Shenghong's diverse holdings, ventures that don't align with their primary chemical and new materials operations could be classified as dogs. These are often older assets or smaller business units that drain capital without contributing meaningfully to overall growth or strategy.

For instance, if Shenghong still operates legacy textile divisions, as some reports from earlier years suggested, these might represent underperforming segments. Such businesses, if not strategically repositioned, can become drains on resources, impacting the company's ability to invest in its core, high-growth areas.

Legacy Energy Contracts with Unfavorable Terms

Jiangsu Eastern Shenghong's legacy energy contracts, particularly those with unfavorable terms, could be a drag on performance. If these contracts involve minor energy production assets operating in saturated local markets, they might yield negligible profits or even incur losses. For instance, in 2024, the company might be facing challenges with older, fixed-price energy supply agreements that are now outpaced by market volatility, leading to reduced margins.

These underperforming segments offer little to the company's overall growth trajectory. Consequently, they become prime candidates for divestiture unless significant improvements in operational efficiency can be achieved. Consider the scenario where a specific regional energy supply contract, locked in at a low rate for years, is now costing more to fulfill than it generates, impacting overall profitability.

- Low Profitability: Legacy contracts with unfavorable terms may generate minimal profit or even losses due to outdated pricing or high operational costs in saturated markets.

- Limited Growth Contribution: These segments contribute little to the company's overall growth and can be a drain on resources.

- Divestiture Potential: If efficiency improvements are not feasible, these underperforming assets or contracts are candidates for divestiture to streamline operations.

- Market Saturation Impact: Operating in saturated local energy markets exacerbates the issue, making it harder to renegotiate terms or find new buyers at favorable prices.

Products Facing Significant Asset Impairment Losses

Jiangsu Eastern Shenghong's 2024 financial report highlighted substantial asset impairment losses, primarily driven by inventory devaluation and a downturn in market demand that depressed product prices. These persistent losses are indicative of specific product lines or business segments that are underperforming, tying up valuable capital with minimal prospect of generating returns.

Within the BCG framework, these underperforming assets are classified as Dogs. For Jiangsu Eastern Shenghong, this classification points to products that are not only experiencing declining market share but are also generating insufficient revenue to cover their costs, let alone contribute to the company's growth. The company's 2024 disclosures reveal that these impairments significantly impacted profitability, underscoring the need for strategic divestment or restructuring of these "dog" assets.

- Inventory Write-downs: Significant portions of the 2024 impairment losses were attributed to inventory write-downs, reflecting a substantial oversupply or obsolescence of certain product lines.

- Weak Demand Impact: The persistent weakness in demand for specific products directly led to price erosion, making existing inventory less valuable and triggering impairment charges.

- Capital Tie-up: These underperforming products, classified as Dogs, represent capital that could be better allocated to more promising Stars or Cash Cows within the company's portfolio.

- Profitability Drain: The ongoing losses associated with these products directly drag down the company's overall profitability, necessitating a decisive strategic response.

Jiangsu Eastern Shenghong's legacy chemical fiber production lines, particularly those focused on conventional products, are categorized as Dogs. These segments face intense competition and declining demand, leading to shrinking profit margins and operational inefficiencies. In 2024, the global textile industry's challenges, including oversupply and a shift towards sustainable materials, further pressured these older units, making them potential cash traps.

These underperforming assets, including certain commodity petrochemical products with narrowed price differentials, are characterized by low profitability and difficulty in differentiation. The company's 2024 financial disclosures indicated substantial asset impairment losses, largely due to inventory devaluation and weak market demand for specific products, directly impacting overall profitability.

The company's strategy likely involves divesting or restructuring these "dog" assets to reallocate capital to more promising growth areas. For instance, legacy energy contracts with unfavorable terms in saturated markets also fall into this category, yielding negligible profits or losses.

The identification of these "dog" segments is crucial for strategic resource allocation, ensuring that capital is not tied up in ventures with minimal prospect of generating returns.

Question Marks

Jiangsu Eastern Shenghong's foray into specialized new energy products positions them within a high-growth sector, but these particular offerings may still be in their nascent stages of market adoption. For instance, their recent advancements in solid-state battery materials, a key area of new energy investment, are likely experiencing low initial market penetration as the technology matures and scales.

The company's strategic allocation of capital towards these innovative new energy materials, such as advanced cathode materials for lithium-ion batteries, underscores a commitment to future market leadership. However, these specific product launches are expected to carry a relatively low current market share, necessitating significant ongoing investment to build brand recognition and secure a competitive foothold in the rapidly evolving new energy landscape.

Jiangsu Eastern Shenghong is heavily investing in advanced materials, aligning with the concept of 'new quality productive forces'. This includes pioneering work in carbon dioxide comprehensive utilization, a critical area for sustainable development.

These R&D efforts are focused on high-growth, emerging sectors. However, as these technologies are still in their nascent stages of development or early commercialization, they represent significant cash outlays with currently low market penetration and uncertain future returns.

Shenghong's commitment to a green, low-carbon industrial chain is evident in its pilot projects for sustainable chemical production. These initiatives, focusing on areas like green hydrogen-based chemicals and advanced recycling, are positioned as future growth engines.

While these pilot projects hold significant high-growth potential, their current market share is minimal. For instance, the emerging green hydrogen sector, while promising, is still in its nascent stages globally, with Shenghong's contribution being a small fraction of the overall market.

These ventures necessitate substantial capital investment for scaling up operations and achieving commercial viability. The capital expenditure required for green hydrogen infrastructure, for example, can run into billions, reflecting the early-stage, resource-intensive nature of these sustainable technologies.

Emerging International Market Entries for Niche Products

Jiangsu Eastern Shenghong's pursuit of becoming a world-class enterprise involves exploring new international markets for its niche products. These ventures represent potential high-growth areas, but initial market share will likely be low, necessitating substantial investment in marketing and distribution. For example, in 2024, the global market for specialty chemicals, a potential niche for Shenghong, was projected to reach over $300 billion, indicating significant untapped potential in various regions.

To effectively enter these markets, Shenghong could adopt a focused strategy. This would involve identifying specific countries with a strong demand for their specialized offerings and tailoring their market entry approach to local conditions.

- Targeted Market Research: Conducting in-depth analysis of consumer preferences and competitive landscapes in emerging economies like Vietnam or Colombia, where demand for specialized industrial inputs is rising.

- Strategic Partnerships: Collaborating with local distributors or joint venture partners to leverage existing networks and reduce initial operational costs and market entry barriers.

- Product Customization: Adapting niche product formulations or packaging to meet the specific regulatory requirements and consumer tastes of the new international markets.

- Digital Marketing Initiatives: Utilizing online platforms and social media to build brand awareness and reach potential customers efficiently in regions with developing traditional marketing infrastructure.

Diversification into Niche, High-Tech Chemical Applications

Jiangsu Eastern Shenghong is strategically diversifying into niche, high-tech chemical applications to capture higher value segments. This involves developing products with significant technical content, targeting emerging industries that demand specialized chemical solutions.

These new ventures, while positioned in growth markets, necessitate considerable investment in research and development, alongside dedicated market development efforts. For instance, the company's focus on advanced materials for electric vehicles (EVs) and renewable energy sectors requires substantial capital outlays. In 2024, the global specialty chemicals market was projected to reach over $700 billion, with high-tech applications forming a rapidly expanding subset.

- Focus on High Value: Expansion into products with high added value and technical complexity.

- Emerging Industry Targets: Diversification into specialized, high-tech chemicals for sectors like EVs and renewables.

- Investment Needs: Significant R&D and market development capital required to build market share.

- Market Potential: Tapping into growing markets where specialized chemical solutions are increasingly in demand.

Jiangsu Eastern Shenghong's investments in new energy materials and green chemical production represent potential future growth drivers. However, these ventures are characterized by significant upfront capital requirements and currently low market penetration, typical of Question Marks in the BCG Matrix. For example, the company's advancements in solid-state battery materials, while promising, are still in early commercialization phases, contributing minimally to current revenues.

These initiatives, including work in green hydrogen and carbon dioxide utilization, require substantial R&D and infrastructure investment. While the global market for green hydrogen is projected for significant growth, Shenghong's current market share in this nascent sector is negligible, demanding sustained financial commitment to scale operations and achieve market traction.

The company's strategic diversification into niche, high-tech chemical applications, such as advanced materials for electric vehicles, also falls into this category. These areas offer high value but demand considerable R&D and market development capital, with initial market share expected to be low. The global specialty chemicals market, projected to exceed $700 billion in 2024, highlights the potential, but Shenghong's specific high-tech segments are still building their presence.

These Question Mark initiatives, while aligned with long-term growth strategies and sustainability goals, represent cash drains with uncertain future returns. Effective management will involve careful monitoring of market adoption rates and strategic capital allocation to foster growth and eventual transition to Stars or Dogs.

| Initiative Area | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

| New Energy Materials (e.g., Solid-State Batteries) | High | Low | High (R&D, Scaling) | Develop into Star |

| Green Chemical Production (e.g., Green Hydrogen) | Very High | Negligible | Very High (Infrastructure) | Develop into Star |

| Niche High-Tech Chemicals (e.g., EV Materials) | High | Low | High (R&D, Market Dev.) | Develop into Star |

BCG Matrix Data Sources

Our Jiangsu Eastern Shenghong BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.