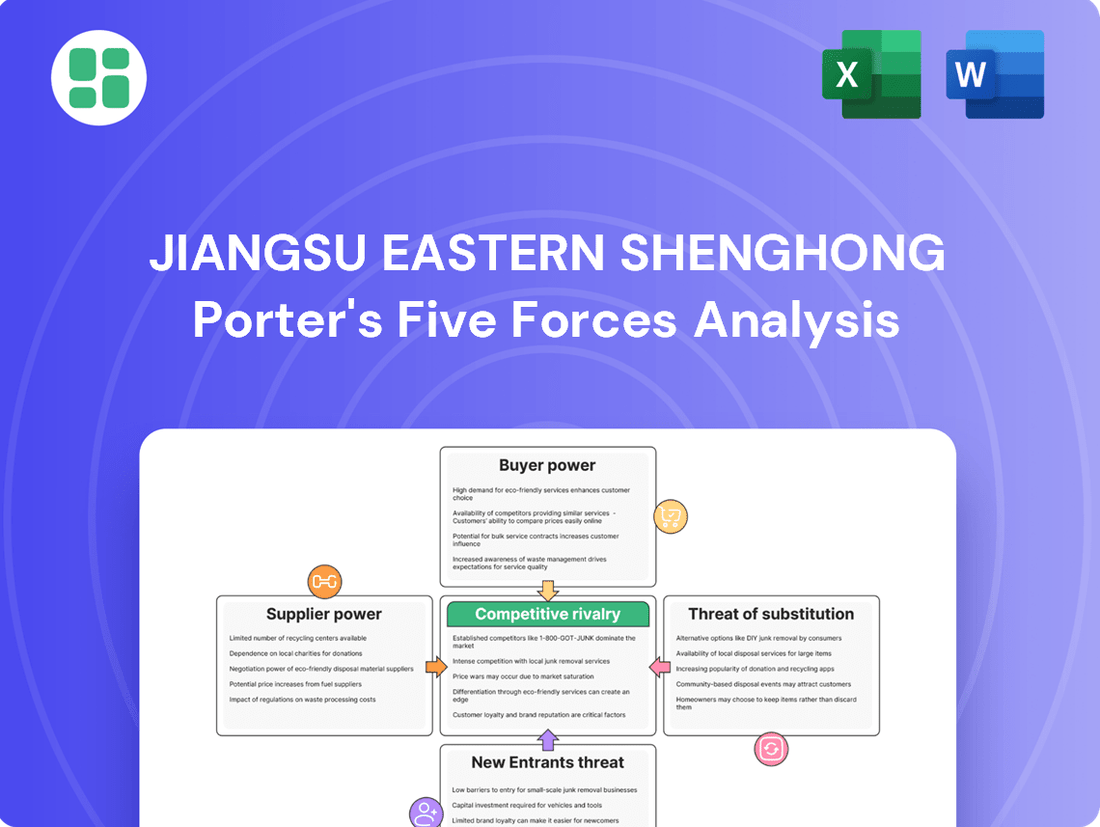

Jiangsu Eastern Shenghong Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangsu Eastern Shenghong Bundle

Jiangsu Eastern Shenghong faces a dynamic competitive landscape, shaped by the bargaining power of its buyers and the intensity of rivalry within its sector. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Jiangsu Eastern Shenghong’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Jiangsu Eastern Shenghong's reliance on crude oil and chemical intermediates for its vast petrochemical and fiber operations means its input costs are highly sensitive to global commodity markets. For instance, fluctuations in crude oil prices, which saw significant volatility in 2024 due to ongoing geopolitical tensions and OPEC+ production adjustments, directly impact the company's raw material expenses.

The supply stability of these essential commodities, often controlled by a few major global producers, can grant them considerable bargaining power. This is particularly true for specialized chemical intermediates where the supplier base is more concentrated, allowing these suppliers to potentially dictate terms and pricing to Shenghong.

Jiangsu Eastern Shenghong's bargaining power of suppliers is significantly influenced by supplier concentration, particularly for specialized petrochemical derivatives. If only a few global or regional entities can provide essential catalysts or high-purity chemicals critical for Shenghong's advanced manufacturing processes, these suppliers gain considerable leverage. This limited supply base allows them to dictate terms, pricing, and delivery schedules, thereby reducing Shenghong's sourcing flexibility and potentially increasing input costs.

Switching suppliers for a major industrial player like Jiangsu Eastern Shenghong involves significant costs. These can include expenses related to re-testing raw materials, recalibrating specialized machinery, and the administrative burden of renegotiating contracts. For instance, in the petrochemical industry, a sector Shenghong operates in, the cost of qualifying a new supplier for critical feedstocks can run into hundreds of thousands of dollars, impacting production schedules and increasing operational risk.

Forward Integration Threat

The threat of forward integration by suppliers is a significant concern for Jiangsu Eastern Shenghong. If a supplier, particularly one providing essential raw materials like crude oil or ethylene, were to move into producing finished chemical fibers or petrochemical products, it would directly compete with Shenghong's core business. This could lead to reduced demand for Shenghong's products or force the company to compete on price with its former suppliers.

For instance, in 2024, the petrochemical industry saw continued investment in downstream integration by major oil and gas producers. Companies that historically supplied basic feedstocks are increasingly exploring opportunities in higher-value chemical derivatives. This trend highlights the real risk that suppliers could become direct competitors, impacting Shenghong's market position and profitability.

- Forward Integration Risk: Suppliers moving into Shenghong's product markets directly increases competition.

- Market Share Erosion: Competitors from the supply side can capture Shenghong's customers.

- Strategic Response: Maintaining strong supplier ties and exploring alternative sourcing are crucial to mitigate this threat.

Uniqueness of Inputs

The bargaining power of suppliers for Jiangsu Eastern Shenghong is significantly influenced by the uniqueness of the inputs they provide. If suppliers offer patented, proprietary, or highly specialized materials crucial for Shenghong's production, their leverage increases. For instance, a supplier of unique catalysts essential for Shenghong's advanced petrochemical processes or specialized synthetic fibers could command higher prices due to limited alternatives.

This reliance on unique inputs can restrict Shenghong's ability to switch suppliers without incurring substantial costs or compromising product quality. For example, in the chemical industry, the development and patenting of novel catalysts can create a strong dependency on a single or few suppliers. In 2024, the global specialty chemicals market saw significant price volatility, with some niche inputs experiencing up to a 15% increase due to supply chain constraints and innovation costs.

- Proprietary Catalysts: Suppliers of patented catalysts for specific refining or chemical synthesis processes hold considerable power, as these are often critical for efficiency and output quality.

- Advanced Polymers: For Shenghong's high-performance fiber production, access to unique or advanced polymer formulations from a limited number of manufacturers can create supplier leverage.

- Specialized Equipment: Highly specialized manufacturing equipment or critical components with long lead times and few alternative providers also contribute to supplier bargaining power.

The bargaining power of suppliers for Jiangsu Eastern Shenghong is moderate, primarily due to the commodity nature of some key inputs like crude oil, though specialized chemical intermediates present a higher threat. In 2024, crude oil prices remained a significant factor, with Brent crude averaging around $83 per barrel for the year, directly impacting Shenghong's feedstock costs. While Shenghong can leverage its scale to negotiate with large oil suppliers, the concentration of global refining capacity limits its options for certain specialized inputs, potentially increasing costs and reducing flexibility.

| Input Category | Supplier Concentration | Bargaining Power Level | 2024 Price Impact Example |

|---|---|---|---|

| Crude Oil | Moderate to High (OPEC+ influence) | Moderate | Brent Crude ~$83/barrel average |

| Specialized Chemical Intermediates | High (few global producers) | High | Niche catalysts saw up to 15% price increases |

| Synthetic Fibers Feedstock (e.g., PTA, MEG) | Moderate to High (regional producers) | Moderate | Price fluctuations tied to petrochemical cycles |

What is included in the product

This analysis uncovers the competitive landscape for Jiangsu Eastern Shenghong, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Easily identify and mitigate competitive threats with a dynamic Porter's Five Forces model that visualizes Jiangsu Eastern Shenghong's market pressures.

Gain actionable insights into supplier power and customer bargaining by clearly mapping out negotiation leverage points.

Customers Bargaining Power

Jiangsu Eastern Shenghong caters to a wide array of customers, encompassing major textile producers, industrial enterprises, and even direct consumers in the burgeoning new energy market. This diversity means no single customer segment holds overwhelming sway.

While substantial industrial clients can exert some influence due to their purchase volumes, the sheer fragmentation across these varied end-use sectors generally diminishes the bargaining power of any individual customer. For instance, in 2023, the company's revenue streams were spread across multiple industries, preventing significant dependence on any one buyer group.

For basic chemical fibers and petrochemicals, product standardization can indeed empower customers. If Shenghong's offerings are easily comparable to competitors, buyers can switch suppliers with minimal friction, especially if prices or quality vary. This was evident in 2024, where global petrochemical prices saw significant fluctuations, leading to increased customer price sensitivity across the board.

Customer switching costs for Jiangsu Eastern Shenghong can vary. While changing chemical fiber or petrochemical suppliers might involve expenses like re-tooling machinery or re-validating materials, these costs are often manageable, particularly for more standardized products. This can empower customers with greater bargaining leverage.

For instance, in the broader chemical industry, the average cost to switch suppliers can range from a few thousand dollars for simpler material changes to hundreds of thousands for complex process reconfigurations. This variability directly impacts a customer's willingness to move to a competitor, influencing their overall power.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Jiangsu Eastern Shenghong, especially within the textile and industrial sectors. Many of Shenghong's clients face intense competition, which directly translates into a strong focus on cost. This pressure compels Shenghong to offer competitive pricing, particularly for its more commoditized offerings.

The ease with which customers can compare prices from a multitude of global suppliers further strengthens their bargaining power. This global price transparency means Shenghong must remain vigilant about its cost structure to avoid losing business to lower-cost alternatives.

- Price Sensitivity in Textiles: The global textile market, a key sector for Shenghong, is characterized by high volume and often thin margins, making customers acutely aware of price differences.

- Industrial Sector Demands: In industrial applications, where raw materials are a significant input cost, buyers frequently negotiate based on price per unit.

- Global Benchmarking: Customers can readily access pricing information from manufacturers in countries with lower production costs, increasing their leverage.

Backward Integration Threat

Large customers, especially major textile groups and industrial conglomerates, often have the financial muscle and technical know-how to start producing their own chemical fibers or petrochemical intermediates. This possibility acts as a strong bargaining chip for them during price and supply negotiations. For instance, if a key customer in the automotive sector, a major buyer of Shenghong's petrochemicals, were to consider in-house production, it would significantly shift the power balance.

This backward integration threat means Shenghong needs to consistently offer attractive value, not just on price but also on innovation and service, to keep these influential clients loyal. Failing to do so could see these customers walk away and become direct rivals, potentially impacting Shenghong's market share.

- Customer Leverage: The potential for major buyers to produce their own inputs grants them considerable power in negotiations.

- Competitive Threat: If customers integrate backward, they transform from buyers into direct competitors.

- Shenghong's Strategy: Maintaining customer loyalty requires offering superior value and innovative solutions to deter backward integration.

Jiangsu Eastern Shenghong faces moderate bargaining power from its customers. While the company serves diverse sectors like textiles and industrial manufacturing, the sheer number of buyers across these segments limits the influence of any single customer. However, for commoditized products, price sensitivity and the ease of switching suppliers can empower buyers.

In 2024, global petrochemical price volatility heightened customer focus on cost, impacting Shenghong's pricing strategies. The potential for large clients to pursue backward integration also serves as a significant leverage point, forcing Shenghong to maintain competitive value propositions beyond just price.

| Factor | Impact on Shenghong | Data/Observation |

|---|---|---|

| Customer Segmentation | Moderate | Diverse customer base across textiles, industrial, and new energy sectors. |

| Price Sensitivity | High for commoditized products | 2024 saw increased price sensitivity due to global petrochemical market fluctuations. |

| Switching Costs | Variable, generally manageable | Costs can range from minor to significant depending on product complexity and re-tooling needs. |

| Backward Integration Threat | Significant for large clients | Major textile groups and industrial conglomerates have the potential to produce inputs internally. |

Preview the Actual Deliverable

Jiangsu Eastern Shenghong Porter's Five Forces Analysis

This preview showcases the comprehensive Jiangsu Eastern Shenghong Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring complete transparency. You can trust that this detailed report will equip you with the strategic insights needed to understand and navigate the market effectively.

Rivalry Among Competitors

The chemical fiber and petrochemical sectors in China are crowded, featuring a substantial number of domestic and international companies. This includes formidable state-owned enterprises and major global corporations, creating a highly fragmented yet intensely competitive environment for Jiangsu Eastern Shenghong.

This dense competitive landscape, populated by many players of diverse sizes, directly challenges Jiangsu Eastern Shenghong's ability to gain market share and exert pricing power. For instance, in 2023, China's petrochemical output reached approximately 330 million tons, with numerous companies contributing to this vast production capacity.

The industry growth rate for Jiangsu Eastern Shenghong's operating segments presents a mixed picture. While advanced materials and new energy sectors are poised for robust expansion, traditional chemical fibers and basic petrochemicals exhibit more moderate growth. For instance, the global petrochemical market, a significant area for Shenghong, was projected to grow at a compound annual growth rate (CAGR) of around 3.5% to 4.5% in the years leading up to 2025, indicating a mature but steady market.

This moderate growth in core areas means competition is often fierce. Companies like Jiangsu Eastern Shenghong must actively vie for market share rather than simply benefiting from a rapidly expanding overall market. This dynamic can translate into intense price competition and pressure on profit margins as players battle for existing demand.

The chemical, petrochemical, and refining sectors, where Jiangsu Eastern Shenghong operates, are inherently capital-intensive. This means companies require enormous upfront investments in sophisticated plants, advanced machinery, and ongoing research and development. For instance, building a new petrochemical complex can easily run into billions of dollars, creating a significant barrier to entry and a substantial fixed cost base for existing players.

These substantial fixed costs create immense pressure on companies like Shenghong to maintain high levels of operational capacity. Running plants at near-full utilization is crucial to spread these fixed expenses over a larger output, thereby reducing the per-unit cost. This necessity drives an aggressive competitive environment where securing sales volume becomes paramount, often leading to price wars.

The consequence of not achieving high capacity utilization is a rapid decline in profitability. Idle capacity means fixed costs continue to accrue without generating corresponding revenue, quickly eating into margins. This economic reality compels companies to compete fiercely on price to keep their production lines running, even if it means accepting lower profit margins in the short term.

Product Differentiation

While basic chemical fibers and petrochemicals are largely commoditized, Jiangsu Eastern Shenghong is actively differentiating itself. Its strategic expansion into specialized products, high-performance fibers, and new energy materials provides avenues to move beyond price-based competition. For instance, in 2024, the company continued to invest in advanced materials, aiming to capture higher margins in niche markets.

However, this pursuit of differentiation is not unique to Shenghong. Competitors are also heavily engaged in innovation and product development to set themselves apart. This dynamic environment necessitates continuous investment in research and development to maintain a competitive edge. Companies that successfully build strong brand recognition and leverage proprietary technologies can significantly reduce the pressure of direct price wars.

- Shenghong's focus on specialized products and new energy materials offers a clear differentiation strategy.

- Competitors are also investing in innovation, intensifying the need for continuous R&D.

- Strong brand recognition and proprietary technologies are key to mitigating direct price competition in the sector.

Exit Barriers

The chemical and petrochemical sectors, where Jiangsu Eastern Shenghong operates, are characterized by very high exit barriers. Significant capital outlays for plants and specialized equipment mean that shutting down operations involves massive sunk costs. For instance, the construction of a new ethylene cracker can easily cost billions of dollars, making it difficult for companies to simply walk away from such investments even if they are not performing well.

These substantial sunk costs, coupled with the potential for significant social repercussions like widespread job losses, make companies hesitant to cease operations. This reluctance means that even firms experiencing financial difficulties may continue to operate, contributing to overcapacity within the industry. This dynamic intensifies competition as all players fight harder for market share, even in a downturn.

- High Capital Investment: Petrochemical plants require billions in upfront capital, creating a significant financial hurdle for exiting the market.

- Specialized Assets: The machinery and infrastructure are highly specific to chemical production, with limited alternative uses, increasing the cost of disposal or sale.

- Social and Employment Concerns: The large workforce in these industries often leads to reluctance to close facilities due to the impact on local communities and employment.

- Continued Operation of Unprofitable Firms: High exit barriers can force even unprofitable players to remain in the market, exacerbating overcapacity and competitive pressures.

The competitive rivalry within Jiangsu Eastern Shenghong's operating sectors is intense, driven by a large number of players and significant capacity. This dynamic is further fueled by high fixed costs and exit barriers, compelling companies to compete aggressively on price to maintain operational utilization.

While basic products face commoditization and price wars, Shenghong's strategy of focusing on specialized materials and new energy products aims to differentiate itself. However, competitors are also pursuing innovation, necessitating continuous R&D investment for Shenghong to sustain its competitive edge and avoid direct price battles.

| Key Competitive Factors | Impact on Shenghong | Industry Data/Trends (2023-2024) |

| Number of Competitors | High fragmentation, intense competition | China's petrochemical output ~330 million tons (2023) |

| Industry Growth Rate | Moderate in traditional segments, high in advanced materials | Global petrochemical market CAGR ~3.5%-4.5% (pre-2025) |

| Fixed Costs & Capacity Utilization | Pressure for high utilization, driving price competition | Capital investment for new petrochemical plants in billions USD |

| Product Differentiation | Opportunity to move beyond price wars via specialization | Shenghong's 2024 investment in advanced materials |

| Exit Barriers | Keeps unprofitable firms in market, increasing rivalry | High sunk costs in specialized, capital-intensive assets |

SSubstitutes Threaten

Natural fibers such as cotton, wool, silk, and linen are direct substitutes for synthetics like polyester and nylon in textile manufacturing. While synthetics boast durability and wrinkle resistance, a growing consumer demand for natural, sustainable, and luxury materials can divert market share. For instance, the global organic cotton market was valued at approximately $2.6 billion in 2023 and is projected to grow, indicating a strong consumer preference for natural alternatives.

The increasing global focus on sustainability and the circular economy is a significant driver for bio-based and recycled polymers. These materials are emerging as direct substitutes for traditional petrochemical-derived plastics and fibers, potentially impacting Jiangsu Eastern Shenghong's market share.

As the cost-effectiveness of these alternatives improves and regulatory frameworks favor greener options, they could increasingly displace Shenghong's offerings. For instance, the global bioplastics market is projected to reach over $13.5 billion by 2024, indicating substantial growth and a growing competitive landscape.

Alternative energy sources pose a significant threat to Shenghong's new energy segment. Technologies like solar and wind power are rapidly improving in efficiency and cost-effectiveness, with global solar PV capacity projected to reach over 2,000 GW by 2025, according to the International Energy Agency.

The increasing affordability and performance of battery storage solutions further enhance the attractiveness of these renewable alternatives, potentially diverting market share from Shenghong's offerings if they are not competitive. Policy incentives and government mandates favoring specific renewable energy types can also accelerate the adoption of substitutes, impacting Shenghong's market position.

Recycled Materials

The growing adoption of recycled materials in industries like textiles and plastics poses a considerable threat of substitution for Jiangsu Eastern Shenghong. Manufacturers are increasingly choosing recycled PET and recycled nylon over virgin polyester and nylon, directly impacting Shenghong's core product markets.

This shift is largely fueled by ambitious corporate sustainability targets and a strong consumer preference for eco-friendly products. For instance, by 2024, many major apparel brands have committed to increasing their use of recycled polyester, with some aiming for over 50% recycled content in their collections. This growing demand for recycled alternatives could significantly diminish the market share for newly produced synthetic fibers.

- Growing Demand for Recycled Content: Brands are setting aggressive targets for recycled material usage, impacting virgin fiber demand.

- Consumer Preference Shift: Consumers are actively seeking out products made with recycled materials, driving manufacturer choices.

- Technological Advancements: Improvements in recycling technologies are making recycled materials more viable and cost-competitive.

Process Innovation by Customers

Customers can innovate their own processes, reducing the need for Jiangsu Eastern Shenghong's products. For instance, the growing adoption of advanced manufacturing techniques like 3D printing might lessen demand for traditional materials Shenghong supplies. This shift, while not a direct product-for-product swap, effectively lowers the overall market pull for Shenghong's offerings by changing how downstream industries operate.

Consider the impact on the textiles sector. If apparel manufacturers increasingly utilize on-demand, localized production enabled by new technologies, their need for bulk fiber purchases from companies like Shenghong could diminish. This indirect substitution through process innovation is a significant threat.

By 2024, the global additive manufacturing market was projected to reach over $20 billion, indicating a substantial shift towards new production methods that could bypass traditional material suppliers. This trend directly impacts companies like Shenghong whose core business relies on established material supply chains.

- Process Innovation Threat: Customers developing alternative production methods reduces reliance on Shenghong's materials.

- Example: 3D printing and additive manufacturing can bypass the need for traditional fibers and plastics.

- Market Impact: This indirect substitution lowers overall demand for Shenghong's core product categories.

- 2024 Data Point: The global additive manufacturing market's significant growth highlights the increasing viability of these customer-driven process innovations.

The threat of substitutes for Jiangsu Eastern Shenghong is multifaceted, encompassing both direct material replacements and shifts in customer production processes. The increasing demand for sustainable and recycled materials, such as organic cotton and recycled polyester, directly challenges Shenghong's offerings in synthetic fibers. For instance, by 2024, many major apparel brands aim for over 50% recycled polyester content, impacting virgin fiber demand.

Furthermore, advancements in alternative energy technologies like solar and wind power, supported by improving battery storage, present a substitute threat to Shenghong's new energy segment. Global solar PV capacity is projected to exceed 2,000 GW by 2025, highlighting the growing viability of these alternatives.

Customer-driven process innovations, such as the rise of 3D printing and additive manufacturing, also pose an indirect substitution threat. The global additive manufacturing market was expected to surpass $20 billion by 2024, indicating a trend that could reduce the overall need for traditional materials supplied by companies like Shenghong.

Entrants Threaten

The chemical fiber, petrochemical, and refining sectors demand substantial upfront capital for plant construction, advanced machinery, and ongoing research and development. These considerable financial outlays serve as a significant deterrent for many aspiring new entrants. For instance, building a world-scale petrochemical complex can easily cost billions of dollars.

Jiangsu Eastern Shenghong benefits from its existing, extensive infrastructure and a highly integrated value chain. This established operational framework presents a formidable cost barrier for any new competitor looking to match its scale and efficiency, effectively limiting the threat of new entrants.

Established players like Shenghong leverage substantial economies of scale across production, procurement, and distribution. For instance, in 2024, Shenghong Petrochemical's integrated refining and chemical complex in Lianyungang, with a crude oil processing capacity of 16 million tons per year, allows for significant cost reductions per unit.

Newcomers face immense difficulty matching these cost efficiencies without substantial upfront investment and massive initial output. This inherent scale advantage provides Shenghong with a crucial cost advantage, enabling competitive pricing and greater resilience against market volatility.

The chemical and petrochemical sectors face significant regulatory hurdles, acting as a strong deterrent for potential new entrants. These industries are inherently complex due to environmental, safety, and health considerations, necessitating rigorous compliance. For instance, China's tightening environmental regulations, as seen with increased enforcement and stricter emission standards in 2023 and early 2024, mean new players must invest heavily in compliance technology and processes from the outset. Obtaining the myriad of permits and licenses required for operations, from initial construction to ongoing chemical handling and waste disposal, is a protracted and expensive undertaking. This substantial upfront investment and the sheer complexity of navigating these frameworks, particularly in a market like China with evolving environmental policies, significantly raise the barrier to entry.

Access to Distribution Channels

Established players, including giants like Jiangsu Eastern Shenghong, possess robust and deeply entrenched distribution networks, cultivated over years of operation and strong customer loyalty. Newcomers would struggle immensely to replicate this, needing significant investment to build their own channels and gain market traction.

Securing reliable access to essential raw materials and establishing efficient logistics for product delivery are significant barriers. Without pre-existing infrastructure and supplier relationships, new entrants face considerable hurdles in managing these critical supply chain components, impacting their cost structure and operational viability.

- Established Distribution Networks: Jiangsu Eastern Shenghong benefits from extensive, long-standing relationships with distributors and end-customers, making it difficult for new entrants to penetrate the market.

- Logistical Hurdles: New companies must invest heavily in creating their own supply chain and logistics infrastructure to compete with the efficiency of established players.

- Market Access Costs: The cost associated with building brand recognition and securing shelf space or digital presence is substantial for any new entrant aiming to reach consumers effectively.

Proprietary Technology and Expertise

Jiangsu Eastern Shenghong's extensive industrial chain and diverse operations, particularly in specialized fibers and new energy sectors, highlight substantial investment in research and development and proprietary technologies. For instance, their advancements in high-performance polyester fibers require specialized knowledge and significant capital for production setup.

New entrants face a considerable hurdle in replicating this technological edge. Acquiring or developing comparable cutting-edge technology and the necessary expertise is both time-consuming and financially demanding, acting as a significant barrier to entry and effective competition.

- Proprietary Technology: Jiangsu Eastern Shenghong's commitment to R&D has resulted in patented processes and unique product formulations, particularly in advanced materials.

- High Capital Investment: Establishing production facilities for specialized fibers or new energy components demands upfront capital expenditures that can run into hundreds of millions of dollars, deterring smaller players.

- Expertise Gap: The specialized knowledge required for operating advanced chemical processes and developing next-generation materials is not easily transferable or acquirable, creating a talent and skill barrier.

- Economies of Scale: Existing players like Jiangsu Eastern Shenghong benefit from economies of scale, which further increases the cost disadvantage for new entrants trying to achieve competitive pricing.

The threat of new entrants in the chemical fiber and petrochemical sectors where Jiangsu Eastern Shenghong operates is significantly mitigated by extremely high capital requirements. Building a modern, integrated petrochemical complex, like Shenghong Petrochemical's Lianyungang facility with its 16 million tons per year crude oil capacity, demands billions of dollars in upfront investment for plants, machinery, and technology. This financial barrier alone deters many potential competitors. Furthermore, stringent environmental regulations and the need for extensive permits, particularly in China where compliance standards tightened in 2023-2024, add considerable cost and complexity for any new player entering the market.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Construction of world-scale petrochemical plants costs billions. | Prohibitive for most potential entrants. |

| Regulatory Compliance | Navigating environmental, safety, and health permits is complex and costly. | Increases initial investment and time-to-market. |

| Economies of Scale | Established players achieve lower per-unit costs. | New entrants face a significant cost disadvantage. |

| Proprietary Technology | Specialized knowledge and R&D are crucial for advanced materials. | Replication is time-consuming and expensive. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Jiangsu Eastern Shenghong draws from a comprehensive blend of sources, including company annual reports, petrochemical industry trade publications, and official government statistics on chemical production and trade.