SD BioSensor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SD BioSensor Bundle

Unlock the critical external factors shaping SD BioSensor's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces driving the diagnostics industry. This in-depth report provides actionable intelligence to inform your strategic decisions and secure a competitive advantage. Download the full version now and gain the foresight you need to thrive.

Political factors

Government healthcare spending is a critical driver for diagnostic companies like SD Biosensor. For instance, in 2024, many nations are focusing on strengthening public health infrastructure, which often translates to increased budgets for diagnostic tools and services. This directly impacts the demand for SD Biosensor's product portfolio, especially in areas like infectious disease testing and chronic condition management.

Policies that champion early detection and preventative healthcare measures significantly boost the market for diagnostic solutions. In 2024 and looking into 2025, we see a trend of governments incentivizing or mandating regular health screenings. This creates substantial opportunities for companies offering rapid and accurate diagnostic tests, aligning with SD Biosensor's market position.

Conversely, any reduction in government healthcare expenditure or a pivot in policy priorities can pose challenges. For example, if a government decides to reallocate funds from public health initiatives to other sectors, it could lead to decreased purchasing of diagnostic equipment and reagents. This potential shift necessitates careful market monitoring and strategic adaptation by SD Biosensor.

Global health initiatives, like those championed by the World Health Organization (WHO), are pivotal for the rapid diagnostic test market. Increased funding for pandemic preparedness, a trend amplified by recent global health events, directly benefits companies like SD Biosensor that specialize in infectious disease diagnostics. For instance, investments in national health security and international collaborations for disease surveillance create a more robust demand for rapid testing solutions.

Trade policies significantly shape SD Biosensor's operational landscape. For instance, the US imposing tariffs on goods from China, a major manufacturing hub, could directly increase the cost of components or finished products for SD Biosensor if sourcing or sales are impacted. Conversely, trade agreements like the EU's single market facilitate smoother import and export, potentially lowering logistical costs for the company within that bloc.

Political Stability in Key Markets

Political stability in key markets is a critical consideration for SD Biosensor's global operations. Unforeseen political shifts or instability in regions where the company has significant sales or manufacturing presence, such as its recent expansion into India with a new plant, can directly impact business continuity. Geopolitical tensions or domestic unrest can disrupt vital supply chains, affect consumer demand for diagnostic products, and generally create a more unpredictable operating environment.

For instance, the ongoing geopolitical landscape in various regions can influence trade agreements and regulatory frameworks, potentially affecting SD Biosensor's market access and pricing strategies.

- Impact of Geopolitical Tensions: Events like trade disputes or regional conflicts can disrupt the import/export of raw materials and finished goods, affecting SD Biosensor's production and distribution efficiency.

- Regulatory Environment: Changes in government policies, particularly concerning healthcare and diagnostic testing, can significantly alter market dynamics and compliance requirements for SD Biosensor.

- Investment Climate: Political stability influences foreign direct investment, which is crucial for SD Biosensor's expansion plans, such as its new facility in India, aiming to bolster its manufacturing capacity.

- Market Access: Political relationships between countries can facilitate or hinder market entry and growth for SD Biosensor's diagnostic solutions.

Government Support for Local Manufacturing

Governments worldwide are increasingly focusing on bolstering domestic manufacturing capabilities, particularly in critical sectors like medical devices. This trend can manifest through various policy levers, including direct subsidies, attractive tax incentives, and preferential procurement programs designed to favor locally produced goods. For a company like SD Biosensor, this means government support for local manufacturing could significantly influence its production strategies and competitive positioning in markets that actively champion domestic output. For instance, SD Biosensor's own experience relocating a factory in South Korea resulted in substantial tax refunds, illustrating the tangible benefits of such government initiatives.

These supportive policies can create a more favorable operating environment for domestic players, potentially impacting SD Biosensor's market share and pricing power in regions where local production is prioritized. As of 2024, many nations are actively reviewing and expanding their industrial policies to enhance supply chain resilience, with a notable emphasis on healthcare manufacturing. This strategic shift by governments aims to reduce reliance on foreign suppliers and stimulate local economies.

The implications for SD Biosensor are multifaceted:

- Manufacturing Location Decisions: Government incentives might encourage the establishment or expansion of manufacturing facilities within specific countries to leverage these benefits.

- Competitive Landscape: Local manufacturers receiving government backing could gain a cost advantage or preferential market access, altering the competitive dynamics for SD Biosensor.

- Supply Chain Strategy: SD Biosensor may need to adapt its global supply chain to align with national manufacturing priorities and potentially integrate more local sourcing or production.

- Regulatory Environment: Government support often comes with specific regulatory requirements or compliance standards that SD Biosensor must navigate.

Government healthcare spending remains a significant driver for SD Biosensor, with many nations in 2024 and 2025 prioritizing public health infrastructure. This translates to increased demand for diagnostic tools, especially for infectious diseases and chronic conditions. Policies promoting early detection and preventative care, often incentivized or mandated by governments, create substantial opportunities for rapid diagnostic test providers like SD Biosensor.

Global health initiatives and pandemic preparedness funding, amplified by recent events, directly benefit SD Biosensor's infectious disease diagnostics. Investments in national health security and international disease surveillance collaborations bolster demand for rapid testing solutions. Conversely, shifts in government spending priorities or reductions in healthcare budgets could pose challenges, necessitating careful market monitoring and strategic adaptation.

Political stability in key markets is crucial for SD Biosensor's global operations and expansion, such as its new facility in India. Geopolitical tensions and domestic unrest can disrupt supply chains and affect consumer demand, creating an unpredictable operating environment. Trade policies also significantly shape market access and pricing strategies, with tariffs or trade agreements directly impacting operational costs and efficiency.

Governments are increasingly focused on bolstering domestic manufacturing, offering subsidies and incentives for local production in critical sectors like medical devices. This trend, evident in 2024 industrial policy reviews, aims to enhance supply chain resilience and reduce reliance on foreign suppliers. SD Biosensor's relocation of a factory in South Korea, which resulted in substantial tax refunds, exemplifies the tangible benefits of such government initiatives.

What is included in the product

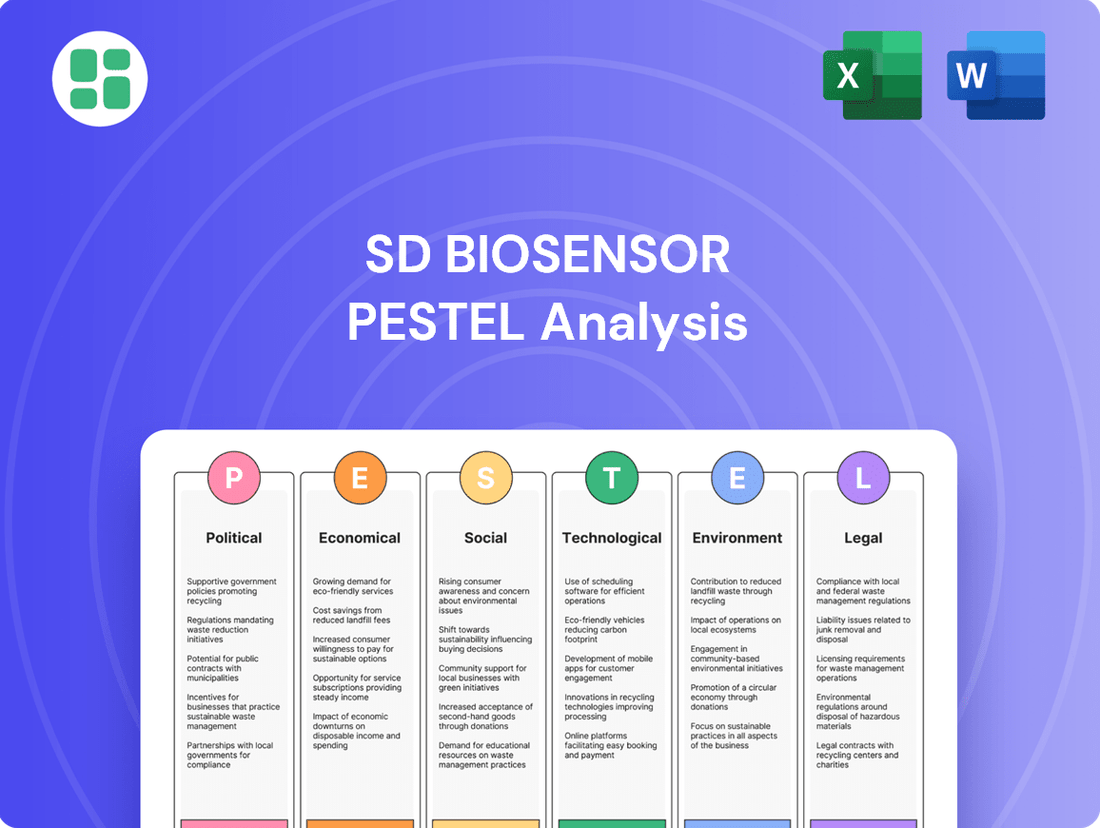

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing SD BioSensor, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the dynamic global market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear, actionable overview of external factors impacting SD BioSensor's market strategy.

Economic factors

Global economic growth significantly shapes healthcare budgets, directly impacting the market for diagnostic solutions like those offered by SD BioSensor. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from 3.5% in 2023, indicating a potentially more constrained environment for increased healthcare spending.

Economic downturns can squeeze public and private healthcare finances, potentially reducing demand for advanced diagnostic tools and slowing adoption of new technologies. If economic conditions worsen, as some forecasts suggest for certain regions in late 2024 or early 2025, this could translate to tighter budgets for hospitals and clinics, affecting their purchasing power.

Conversely, periods of strong economic expansion typically correlate with higher healthcare expenditure. Robust growth, if sustained into 2025, could see governments and private payers allocating more resources to healthcare, boosting demand for innovative diagnostic products and services.

Reimbursement policies from both government and private insurance providers are crucial in shaping the profitability and market acceptance of diagnostic tests like those offered by SD Biosensor. These policies directly influence how much healthcare providers and patients are willing to pay, impacting SD Biosensor's revenue streams and overall business strategy.

SD Biosensor is continually navigating pricing pressures, particularly as it aims to expand its reach in emerging markets where affordability is a key consideration. Fluctuations in reimbursement rates, whether from Medicare in the US or national health services elsewhere, can have a direct and significant impact on the company's financial performance and its ability to compete effectively.

For instance, changes in reimbursement for COVID-19 testing, a significant area for diagnostic companies in 2023 and early 2024, have already demonstrated the sensitivity of the market to payer decisions. As of late 2024, many countries are still recalibrating their healthcare budgets, which will continue to put pressure on diagnostic pricing and reimbursement levels for a wide range of tests.

As a global player, SD Biosensor's financial performance is directly influenced by currency exchange rate volatility. For instance, if the South Korean Won strengthens against major currencies like the US Dollar or Euro, SD Biosensor's reported revenues from overseas sales would translate into fewer Won, potentially impacting profitability. Conversely, a weaker Won could make their products more competitive internationally, boosting sales volume.

In 2024, the South Korean Won experienced fluctuations against major trading partners. For example, the average USD/KRW exchange rate saw shifts throughout the year, impacting the cost of imported raw materials and the value of repatriated earnings. This dynamic requires SD Biosensor to actively manage currency exposure through hedging strategies to mitigate potential losses and capitalize on favorable movements.

Inflation and Supply Chain Costs

Inflationary pressures significantly impact SD Biosensor by driving up the costs of essential raw materials, manufacturing processes, and global logistics. This directly affects the company's ability to produce its diagnostic products affordably. For instance, a 2024 report indicated a 5% increase in global shipping costs, a key component for SD Biosensor's international distribution.

Managing these escalating supply chain expenses is paramount for SD Biosensor to safeguard its profit margins. This is particularly true for their high-volume, cost-sensitive diagnostic kits, where even small cost increases can erode profitability. The company's strategy in 2025 will likely focus on optimizing sourcing and logistics to mitigate these effects.

- Rising Material Costs: Increased prices for chemicals, plastics, and electronic components used in diagnostic kits.

- Logistical Challenges: Higher freight and transportation expenses impacting the delivery of finished goods globally.

- Impact on Affordability: Pressure to maintain competitive pricing for essential diagnostic tools despite rising input costs.

- Profit Margin Management: Strategic cost control measures are crucial to ensure sustained profitability in a fluctuating economic environment.

Investment in Healthcare Infrastructure

Government and private sector investment in healthcare infrastructure, especially in emerging economies, is a significant driver for companies like SD Biosensor. As more resources are channeled into building and upgrading healthcare facilities, the demand for diagnostic tools, including point-of-care testing solutions, naturally increases. This trend is particularly visible in regions striving to enhance public health access.

For instance, global healthcare infrastructure spending is projected to reach substantial figures, with a notable portion allocated to diagnostic services and equipment. In 2024, the global healthcare market was valued at over $12 trillion, and infrastructure development forms a crucial part of its expansion. This growth directly benefits companies offering innovative diagnostic technologies.

Key economic factors influencing this investment include:

- Increased Public Health Spending: Many nations are prioritizing healthcare as a critical sector, leading to higher government budgets for infrastructure and equipment. For example, India's Union Budget 2024-25 allocated a significant portion to healthcare, aiming to strengthen its infrastructure.

- Growth in Developing Markets: The expansion of healthcare access in countries across Asia, Africa, and Latin America creates fertile ground for diagnostic solutions. These regions are witnessing a rise in disposable incomes and a greater awareness of health, boosting demand.

- Technological Advancements: Investment often focuses on adopting advanced diagnostic technologies that offer faster and more accurate results, aligning with SD Biosensor's product portfolio. The point-of-care diagnostics market alone is expected to grow considerably, with projections indicating a CAGR of around 8-10% from 2024 to 2030.

- Public-Private Partnerships: Collaborations between governments and private entities are accelerating infrastructure development, creating a more robust ecosystem for healthcare product deployment and sales.

Economic conditions significantly impact healthcare spending, with global growth forecasts influencing the demand for diagnostic solutions. For instance, the IMF projected global growth at 3.2% for 2024, a slight slowdown from 3.5% in 2023, suggesting potentially tighter healthcare budgets.

Inflationary pressures, such as the 5% increase in global shipping costs noted in 2024, directly affect SD BioSensor's production costs for raw materials and logistics, necessitating strategic cost control to maintain profit margins.

Currency exchange rate volatility, as seen with the South Korean Won in 2024, impacts SD BioSensor's international revenue and the cost of imported components, requiring active management of currency exposure.

Government and private sector investment in healthcare infrastructure, projected to be a substantial part of the over $12 trillion global healthcare market in 2024, creates opportunities for diagnostic companies like SD BioSensor, especially in developing regions.

| Economic Factor | Impact on SD BioSensor | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Influences healthcare budgets and demand for diagnostics. | IMF projected 3.2% global growth for 2024, down from 3.5% in 2023. |

| Inflation | Increases raw material, manufacturing, and logistics costs. | Global shipping costs rose by 5% in 2024; continued inflationary pressures expected into 2025. |

| Currency Exchange Rates | Affects international revenue and import costs. | USD/KRW fluctuations in 2024 impacted South Korean companies; ongoing volatility anticipated. |

| Healthcare Infrastructure Investment | Drives demand for diagnostic tools, particularly in emerging markets. | Global healthcare market valued over $12 trillion in 2024; point-of-care diagnostics market CAGR projected at 8-10% (2024-2030). |

Preview Before You Purchase

SD BioSensor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your SD BioSensor PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown for SD BioSensor.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis for SD BioSensor.

Sociological factors

The world's population is getting older, and this demographic shift is a major boost for companies like SD Biosensor. As people age, they're more likely to develop chronic illnesses such as diabetes and heart disease. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, according to the UN. This means a growing need for diagnostic tools to manage these conditions.

This increasing prevalence of chronic diseases directly translates into higher demand for the diagnostic products SD Biosensor provides. Their offerings, particularly for diabetes management, are well-positioned to capitalize on this trend. The global diabetes care market, for example, was valued at over $60 billion in 2023 and is expected to grow significantly in the coming years, driven by an aging population and lifestyle changes.

Public awareness of health conditions is surging, fueled by easily accessible information and robust public health initiatives. This heightened awareness directly translates into a greater demand for early detection and proactive health management, including diagnostic testing. For instance, in 2024, global spending on preventive healthcare services was projected to reach over $800 billion, indicating a significant societal investment in well-being.

This societal shift empowers individuals to take a more active role in their health. People are increasingly seeking out diagnostic services, embracing self-monitoring tools, and adopting point-of-care testing solutions. The market for at-home diagnostic kits alone saw a substantial growth of 15% in 2023, demonstrating this trend.

Global lifestyles are shifting, leading to a rise in chronic conditions like obesity and diabetes, alongside the resurgence of infectious diseases. For instance, the World Health Organization reported in 2023 that non-communicable diseases, largely lifestyle-driven, accounted for an estimated 74% of all deaths globally. This evolving health landscape directly influences demand for diagnostic solutions.

SD Biosensor's product lines, particularly those focused on infectious disease detection and blood glucose monitoring, are intrinsically linked to these changing disease patterns. The increasing burden of diabetes, with the International Diabetes Federation estimating over 537 million adults living with diabetes in 2023, underscores the market need for effective glucose management tools.

Access to Healthcare and Health Equity

Societal pressure for fair healthcare access, especially in less-served areas and developing nations, directly impacts how affordable diagnostic tools are created and distributed. SD Biosensor's focus on improving global health access, demonstrated by its collaborations for technology sharing, directly addresses these societal expectations.

The increasing demand for health equity means that companies like SD Biosensor must consider affordability and accessibility in their product development. For instance, the World Health Organization's push for universal health coverage by 2030 highlights the critical role of accessible diagnostics in achieving this goal.

- Global Health Initiatives: Organizations like the WHO and Gavi, the Vaccine Alliance, are channeling significant resources into improving healthcare infrastructure in LMICs, creating opportunities for diagnostic providers.

- Affordability Benchmarks: In 2024, the average cost for a rapid diagnostic test in many African nations remained a key barrier, underscoring the need for cost-effective solutions from companies like SD Biosensor.

- Partnership Models: SD Biosensor's engagement in technology transfer agreements, such as those seen in 2023 with local manufacturers in Southeast Asia, directly supports local capacity building and wider product availability.

Cultural Acceptance of Diagnostic Testing

Cultural norms significantly influence the acceptance of diagnostic testing. In many regions, ingrained beliefs about health, illness, and medical treatments can create barriers to adopting new technologies like advanced diagnostic tools. For instance, a study in Southeast Asia in 2024 revealed that while awareness of diagnostic testing is growing, a notable percentage of the population still relies on traditional remedies or expresses skepticism towards laboratory-based diagnostics due to cultural or religious reasons.

This cultural predisposition can directly impact market penetration for companies like SD BioSensor. Where there's a strong preference for holistic or traditional healing, or a general distrust of scientific interventions, the uptake of sophisticated diagnostic tests may be slower. For example, in parts of Africa, while the need for rapid diagnostics for infectious diseases is high, cultural beliefs sometimes lead to delayed presentation for testing, affecting the effectiveness of public health interventions.

- Cultural Hesitancy: Some cultures may view certain diagnostic tests as invasive or disrespectful of the body, leading to resistance.

- Traditional Medicine Preference: In many societies, traditional healers and remedies are deeply respected, sometimes overshadowing the adoption of modern medical diagnostics.

- Trust in Technology: The level of trust placed in scientific and technological advancements varies globally, impacting the willingness to undergo and rely on diagnostic testing.

- Health Literacy and Beliefs: Cultural understanding of disease causation and the role of diagnostics plays a crucial role in acceptance rates.

Societal trends like aging populations and rising chronic diseases are a boon for SD Biosensor, driving demand for their diagnostic tools. For instance, the global population aged 65 and over is projected to hit 1.6 billion by 2050, increasing the need for conditions like diabetes management. This growing health consciousness also fuels demand for early detection, with global spending on preventive healthcare services expected to exceed $800 billion in 2024.

The increasing prevalence of non-communicable diseases, which accounted for an estimated 74% of global deaths in 2023 according to the WHO, directly boosts the market for SD Biosensor's offerings, particularly in areas like glucose monitoring. Furthermore, a global push for health equity, exemplified by the WHO's universal health coverage goals by 2030, emphasizes the need for affordable and accessible diagnostics, a key area for SD Biosensor's strategic focus.

Cultural acceptance of diagnostic testing varies, with some regions showing a preference for traditional remedies or skepticism towards modern diagnostics, potentially slowing market penetration. For example, a 2024 study in Southeast Asia indicated that cultural beliefs can still lead to reliance on traditional healing over scientific interventions.

| Sociological Factor | Impact on SD Biosensor | Relevant Data/Example |

|---|---|---|

| Aging Population & Chronic Diseases | Increased demand for diagnostic solutions | Global population aged 65+ to reach 1.6 billion by 2050 (UN); Diabetes care market valued over $60 billion in 2023. |

| Health Awareness & Proactive Health | Higher demand for early detection and self-monitoring | Global preventive healthcare spending projected over $800 billion in 2024; At-home diagnostic kits market grew 15% in 2023. |

| Lifestyle Changes & Disease Patterns | Growing need for infectious disease and metabolic disorder diagnostics | Non-communicable diseases caused 74% of global deaths in 2023 (WHO); 537 million adults lived with diabetes in 2023 (IDF). |

| Health Equity & Access | Emphasis on affordable and accessible diagnostics | WHO's universal health coverage goal by 2030; Average cost of rapid diagnostic tests a barrier in some African nations (2024). |

| Cultural Beliefs & Trust | Potential barrier to adoption in certain markets | Southeast Asian study (2024) noted reliance on traditional remedies; Cultural hesitancy towards invasive tests exists globally. |

Technological factors

Continuous innovation in point-of-care testing (POCT) is a significant technological factor for SD Biosensor. Miniaturization, enhanced accuracy, and quicker turnaround times are at the forefront of these advancements, directly impacting the utility and adoption of their diagnostic solutions.

The integration of connectivity, microfluidics, and artificial intelligence (AI) into POCT devices is fundamentally reshaping healthcare. This allows for rapid, decentralized diagnostics directly at the patient's bedside, improving efficiency and patient outcomes. For instance, the global POCT market was valued at approximately USD 36.7 billion in 2023 and is projected to reach USD 64.8 billion by 2030, demonstrating substantial growth driven by these technological leaps.

The increasing integration of AI and ML within diagnostic platforms is a significant technological driver. These advancements enhance data analysis capabilities, leading to improved diagnostic accuracy and the potential for personalized treatment recommendations. For instance, AI algorithms can process vast datasets from diagnostic tests much faster than traditional methods, identifying subtle patterns that might be missed by human observation.

SD Biosensor's strategic focus on AI convergence within the In Vitro Diagnostics (IVD) market is therefore critical for its future growth and competitiveness. Companies investing in AI-driven solutions are better positioned to offer more sophisticated and efficient diagnostic tools. The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow substantially, indicating strong market demand for such innovations.

The molecular diagnostics market, driven by technologies like PCR and next-generation sequencing, is experiencing significant growth, projected to reach approximately $75 billion by 2027, according to recent market analyses. SD Biosensor's STANDARD M10 platform is designed to capitalize on this trend, offering enhanced capabilities for rapid and accurate disease detection and genetic analysis, thereby supporting more informed clinical decisions.

Digital Health and Connectivity Solutions

The healthcare landscape is rapidly evolving with a significant push towards digital health solutions. This includes the widespread adoption of telemedicine, remote patient monitoring, and increasingly, connected diagnostic devices that can transmit data in real-time. This shift is fundamentally changing how healthcare is delivered, making it more accessible and efficient.

SD Biosensor is well-positioned to capitalize on this trend. Their product portfolio, especially those incorporating connectivity features, directly supports the move towards decentralized diagnostics. By enabling seamless data flow, these solutions empower healthcare providers with actionable insights for more informed and timely decision-making, crucial for managing chronic conditions and improving patient outcomes.

The global digital health market is projected for substantial growth. For instance, the telehealth market alone was valued at over $100 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 15-20% through 2030. Similarly, the market for connected medical devices is expanding rapidly, with projections indicating it could reach hundreds of billions of dollars in the coming years. SD Biosensor's strategic focus on integrating digital health capabilities, such as cloud connectivity and data analytics for their diagnostic tools, aligns perfectly with these market dynamics.

- Digital Health Adoption: Telemedicine and remote monitoring are becoming standard practices, enhancing patient access and care continuity.

- Connected Diagnostics: Devices that transmit data directly to healthcare systems or patients are crucial for real-time health management.

- Market Growth: The digital health sector is experiencing robust expansion, with significant investments and increasing consumer demand for connected health solutions.

- SD Biosensor's Role: The company's emphasis on connectivity and digital integration supports the decentralized and data-driven healthcare paradigm.

New Diagnostic Principles and Platform Development

SD Biosensor is heavily investing in R&D for new diagnostic principles and platforms, a crucial move to stay ahead in the market. This focus on innovation is key to their strategy for growth and market expansion.

The company plans to introduce novel platforms with groundbreaking diagnostic approaches. For instance, in 2023, SD Biosensor allocated a significant portion of its revenue, approximately 15%, to research and development activities, a figure projected to increase in 2024.

These advancements are designed to unlock new market opportunities and solidify SD Biosensor's reputation as a provider of complete diagnostic solutions. Their pipeline includes platforms leveraging advanced molecular diagnostics and AI-driven analysis, aiming to capture a larger share of the global diagnostics market, which was valued at over $100 billion in 2023.

- R&D Investment: SD Biosensor's R&D spending reached approximately 15% of its revenue in 2023, with plans for continued investment in 2024 to fuel platform development.

- Platform Innovation: The company is developing new diagnostic platforms incorporating novel approaches, including molecular diagnostics and AI integration.

- Market Expansion: These technological advancements are critical for entering new market segments and enhancing SD Biosensor's competitive position.

- Comprehensive Solutions: The aim is to strengthen SD Biosensor's offering as a provider of end-to-end diagnostic solutions.

The increasing sophistication of diagnostic technologies, such as microfluidics and biosensors, is a key technological factor enabling more precise and rapid disease detection. These advancements are driving the growth of the point-of-care testing market, which was valued at approximately USD 36.7 billion in 2023 and is expected to reach USD 64.8 billion by 2030.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into diagnostic platforms is significantly enhancing analytical capabilities, leading to improved accuracy and personalized treatment insights. The global AI in healthcare market, valued at around $15.4 billion in 2023, highlights the demand for these intelligent solutions.

SD Biosensor's commitment to R&D, with approximately 15% of its 2023 revenue reinvested, is crucial for developing next-generation diagnostic platforms. This investment fuels innovation in areas like molecular diagnostics, aiming to capture a larger share of the global diagnostics market, which exceeded $100 billion in 2023.

Legal factors

The European Union's In Vitro Diagnostic Regulation (IVDR) significantly impacts companies like SD Biosensor by introducing more rigorous standards for product approval, quality management, and ongoing market surveillance. This means that for SD Biosensor to continue selling its diagnostic products within the EU, it must demonstrate adherence to these enhanced requirements, which are designed to improve patient safety and product reliability.

SD Biosensor has already achieved CE-IVDR certification for several of its products, signaling a proactive approach to navigating these new regulations. This compliance is crucial for maintaining and expanding market access in the EU, a key region for the diagnostics industry, especially as the IVDR's full implementation continues to shape market dynamics.

SD BioSensor must navigate the U.S. Food and Drug Administration's (FDA) stringent regulatory landscape for market access. This involves rigorous premarket review processes, such as 510(k) clearances or Premarket Approval (PMA) applications, depending on the device's risk classification. For example, in 2024, the FDA continued to emphasize robust data requirements for diagnostic devices.

Post-market surveillance is equally crucial, requiring ongoing monitoring of product performance and adverse events. Compliance with quality management systems, including the recently implemented Quality Management System Regulation (QMSR) which aligns with ISO 13485 standards, is non-negotiable. This QMSR, effective February 2026, mandates a unified approach to quality for medical devices, impacting all manufacturers selling into the US market.

Protecting its innovations through patents and trademarks is crucial for SD Biosensor to maintain its edge in the fast-paced diagnostics sector. For instance, in 2023, the global diagnostics market was valued at approximately $100 billion, highlighting the intense competition and the need for strong intellectual property (IP) protection to secure market share and recoup research and development investments.

Navigating the complexities of varying international IP laws is a significant challenge. SD Biosensor must develop a comprehensive global strategy to ensure its patents and trademarks are effectively registered and enforced across key markets, which can involve significant legal and administrative costs.

Data Privacy and Cybersecurity Regulations

Strict global data privacy regulations, like the EU's General Data Protection Regulation (GDPR), and evolving cybersecurity rules significantly influence how SD Biosensor manages sensitive patient data and secures its connected diagnostic devices. Failure to comply can lead to substantial legal penalties and erode customer trust, particularly as digital health solutions become more prevalent. For instance, data breaches in the healthcare sector can result in fines reaching millions of dollars, as seen in various GDPR enforcement actions. This necessitates robust data protection measures and continuous vigilance against cyber threats.

SD Biosensor must navigate a complex web of international data privacy laws. The increasing sophistication of cyberattacks targeting the healthcare industry, with ransomware attacks on hospitals and diagnostic labs becoming more common, underscores the critical need for advanced cybersecurity protocols. For example, reports from 2024 indicated a significant rise in healthcare data breaches, highlighting the ongoing risks. Ensuring compliance is not just a legal imperative but also crucial for maintaining the integrity and reliability of their diagnostic offerings and safeguarding patient confidentiality.

- GDPR Fines: Penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher.

- Cybersecurity Investment: Companies in the digital health sector are projected to increase cybersecurity spending significantly through 2025 to combat rising threats.

- Patient Data Sensitivity: Health data is considered particularly sensitive under most privacy regulations, demanding heightened security measures.

- Connected Device Security: The interconnected nature of modern diagnostic devices creates new vulnerabilities that require dedicated security strategies.

Product Liability and Consumer Protection Laws

SD Biosensor operates under product liability laws, meaning the company can be held accountable for any harm or defects stemming from its diagnostic products. This necessitates rigorous quality control and thorough testing throughout the manufacturing process to minimize legal exposure and safeguard consumers. For instance, in 2024, the global medical device market faced increased scrutiny, with regulatory bodies like the FDA issuing more warnings related to product safety, underscoring the importance of compliance for companies like SD Biosensor.

Ensuring comprehensive consumer protection is paramount. This involves providing clear, accurate labeling and instructions for use, which is crucial for the safe and effective deployment of diagnostic kits. Failure to comply can lead to significant penalties and damage to brand reputation. A 2024 report indicated that product recalls in the healthcare sector often stem from inadequate labeling or instructions, highlighting this critical area for SD Biosensor.

- Product Liability: SD Biosensor must adhere to regulations holding manufacturers responsible for product defects causing harm.

- Quality Control: Stringent quality assurance and testing are vital to mitigate legal risks associated with product performance.

- Consumer Protection: Clear labeling and user instructions are essential for consumer safety and regulatory compliance.

- Regulatory Scrutiny: Increased oversight in 2024 by health authorities emphasizes the need for robust product safety protocols.

SD Biosensor must navigate stringent regulatory frameworks globally, including the EU's IVDR and the FDA's evolving requirements, impacting product approval and market access. Compliance with quality management systems, such as the upcoming QMSR aligning with ISO 13485, is critical for 2024/2025 operations. Intellectual property protection is vital in the competitive diagnostics market, valued at approximately $100 billion in 2023, necessitating robust patent strategies across key regions.

Data privacy and cybersecurity are paramount due to sensitive patient information, with regulations like GDPR imposing significant penalties for breaches, potentially up to 4% of global annual turnover. The rise in healthcare cyberattacks in 2024 demands substantial cybersecurity investments. Product liability laws hold SD Biosensor accountable for defects, requiring rigorous quality control and clear consumer information to mitigate legal risks and maintain brand trust, especially with increased regulatory scrutiny in 2024.

| Regulatory Framework | Impact on SD Biosensor | Key Considerations (2024/2025) |

| EU IVDR | Stricter product approval, quality management, and market surveillance. | Continued CE-IVDR certification efforts for market access. |

| US FDA | Rigorous premarket review (510(k), PMA) and post-market surveillance. | Adherence to robust data requirements and upcoming QMSR (effective Feb 2026). |

| Intellectual Property (IP) | Protection of innovations against competitors in a $100B market. | Developing comprehensive global IP strategies for registration and enforcement. |

| Data Privacy & Cybersecurity | Compliance with GDPR, cybersecurity rules for patient data and connected devices. | Significant cybersecurity investment to combat rising threats; robust data protection measures. |

| Product Liability & Consumer Protection | Accountability for product defects; need for clear labeling and instructions. | Enhanced quality control; adherence to consumer safety regulations amidst increased oversight. |

Environmental factors

The environmental footprint of producing diagnostic tools, encompassing energy, water, and waste, is under growing examination. SD Biosensor's strategic investment in eco-conscious facilities, exemplified by its new plant in India featuring energy-efficient systems, underscores a dedication to minimizing its ecological impact.

Global regulations on chemicals like PFAS in medical devices are tightening. For instance, the European Union's REACH regulation continues to restrict substances of very high concern, and updates are expected in 2024 and 2025 regarding PFAS. SD Biosensor must ensure its diagnostic kits and manufacturing materials align with these evolving environmental and safety standards to maintain market access and consumer trust.

The growing emphasis on circular economy principles, aiming to minimize waste and maximize resource utilization, significantly impacts product design and supply chain strategies. SD Biosensor must integrate these concepts, focusing on reducing, reusing, and recycling materials across its product lifecycles, from sourcing to disposal.

This shift necessitates a thorough assessment of the environmental footprint associated with raw material procurement and end-of-life product management. For instance, the global waste management market is projected to reach $67.04 billion by 2030, highlighting the increasing economic and regulatory pressure to adopt sustainable practices.

Climate Change and Supply Chain Resilience

Climate change poses significant threats to global supply chains, impacting everything from raw material sourcing to product delivery. Extreme weather events, like the increased frequency of hurricanes and floods, can cripple manufacturing facilities and transportation networks. For instance, a major flood in Southeast Asia in 2022 disrupted the production of essential electronic components, highlighting the vulnerability of even well-established supply routes.

SD Biosensor must proactively build resilience into its supply chain to navigate these environmental challenges. This involves diversifying suppliers, exploring alternative transportation methods, and investing in technologies that can predict and mitigate the impact of climate-related disruptions. The company's ability to maintain consistent product availability, especially for critical diagnostic tools, hinges on its preparedness for these environmental shifts. The global supply chain is estimated to face billions in losses annually due to climate change impacts.

- Increased frequency of extreme weather events globally.

- Disruptions to raw material availability and distribution networks.

- Need for diversified suppliers and alternative logistics.

- Investment in climate risk assessment and mitigation strategies.

Environmental, Social, and Governance (ESG) Standards

The increasing scrutiny from investors and stakeholders on Environmental, Social, and Governance (ESG) criteria is compelling companies like SD Biosensor to embed environmental considerations deeply within their operational strategies. This shift is not just about compliance; it's about building long-term value and resilience.

SD Biosensor's proactive publication of a sustainability report and its stated commitment to ESG management underscore the critical role these factors play in shaping corporate performance and public perception. For instance, a 2024 report by Morningstar indicated that sustainable funds attracted a net inflow of $15.8 billion in the US, highlighting investor appetite for ESG-aligned companies.

- Growing Investor Demand: A significant portion of global assets under management, estimated to be over $37 trillion by the end of 2024, is now influenced by ESG considerations, pushing companies to demonstrate tangible environmental progress.

- Reputational Impact: Strong ESG performance, including robust environmental policies, can enhance brand image and customer loyalty, which is crucial in competitive markets.

- Regulatory Tailwinds: Evolving environmental regulations globally are creating a more stringent operating landscape, rewarding companies that are ahead of the curve in sustainability.

Environmental regulations are becoming more stringent, particularly concerning chemical usage and waste management. SD Biosensor must adapt to evolving standards, such as those related to PFAS, to ensure product compliance and market access. The company's investment in eco-friendly facilities demonstrates a commitment to minimizing its ecological footprint.

Climate change presents tangible risks to supply chains, necessitating robust resilience strategies. SD Biosensor needs to diversify suppliers and explore alternative logistics to mitigate disruptions from extreme weather events. The global economic impact of climate change on supply chains is substantial, with billions in losses projected annually.

Investor and stakeholder focus on ESG factors is intensifying, driving demand for sustainable practices. SD Biosensor's commitment to ESG management, evidenced by its sustainability reports, aligns with this trend. Over $37 trillion in global assets were influenced by ESG considerations by the end of 2024.

| Environmental Factor | Impact on SD Biosensor | Data/Trend |

|---|---|---|

| Chemical Regulations (e.g., PFAS) | Need for product reformulation and material sourcing adjustments. | EU REACH updates expected 2024-2025; increasing global restrictions. |

| Climate Change & Supply Chain Disruptions | Risk to raw material availability and product distribution. | Billions in annual losses globally due to climate impacts on supply chains. |

| Circular Economy Principles | Requirement for waste reduction and resource optimization in product design. | Global waste management market projected to reach $67.04 billion by 2030. |

| ESG Investing | Pressure to demonstrate environmental performance and sustainability. | Over $37 trillion in global AUM influenced by ESG by end of 2024. |

PESTLE Analysis Data Sources

Our SD BioSensor PESTLE Analysis is meticulously constructed using data from leading scientific journals, regulatory body publications, and international health organizations. This ensures a comprehensive understanding of the technological advancements, political landscapes, and societal trends impacting biosensor development.