SD BioSensor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SD BioSensor Bundle

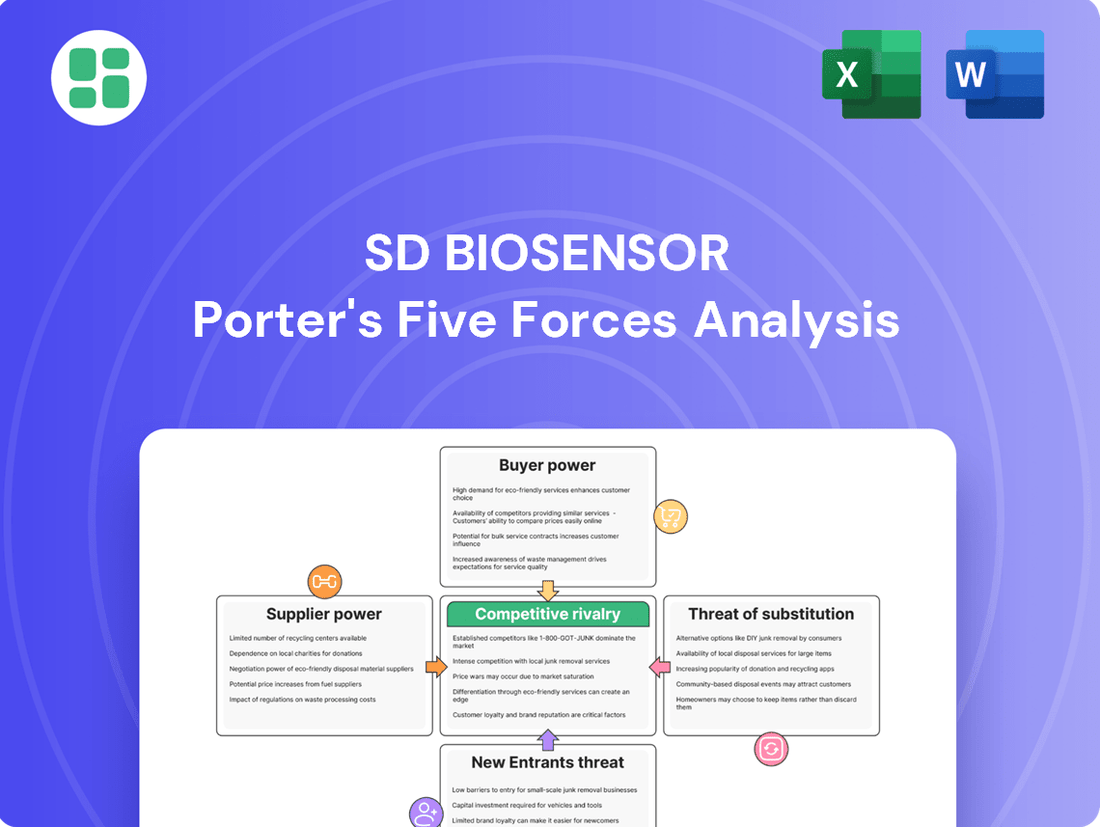

SD BioSensor navigates a complex landscape shaped by intense rivalry and the looming threat of new entrants. Understanding the bargaining power of buyers and suppliers is crucial to their strategic positioning. This brief overview only hints at the forces at play.

The complete report reveals the real forces shaping SD BioSensor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical raw materials, reagents, and specialized components in the in-vitro diagnostics (IVD) industry significantly impacts SD Biosensor. If only a few suppliers provide unique chemicals or specific biosensor components, their bargaining power rises, potentially increasing costs or creating supply chain vulnerabilities for SD Biosensor.

SD Biosensor's broad product range, encompassing rapid diagnostic tests, immunoassay, and molecular diagnostics, necessitates reliance on a wide array of specialized inputs. For instance, the global IVD market was valued at approximately $103.5 billion in 2023 and is projected to grow, indicating a substantial demand for these specialized components.

The costs for SD Biosensor to switch suppliers for critical components, such as specialized reagents or proprietary technologies, can be quite high. These expenses include the time and resources needed for requalification and validation of new materials, as well as the potential for production disruptions during the transition. In 2024, many diagnostics companies reported that the average cost of validating a new raw material supplier could range from tens of thousands to over a hundred thousand dollars, depending on the complexity and regulatory requirements.

These substantial switching costs significantly bolster the bargaining power of SD Biosensor's suppliers. If a key supplier were to increase prices or alter terms, SD Biosensor would face considerable challenges and financial implications in finding and integrating an alternative. This is especially true for suppliers providing unique or patented materials essential for SD Biosensor's diagnostic tests, making it difficult to negotiate favorable terms.

Suppliers offering highly unique, patented, or technologically advanced inputs possess considerable bargaining power. For instance, if a supplier holds exclusive patents on a critical reagent for SD Biosensor's diagnostic kits, their leverage increases significantly, potentially impacting pricing and supply availability.

The threat of forward integration by suppliers is a crucial consideration. If these specialized input providers have the capability and incentive to develop and manufacture diagnostic kits themselves, they could directly compete with SD Biosensor, disrupting the market and potentially capturing a larger share of the value chain.

SD Biosensor must continuously evaluate whether its key suppliers possess the inherent ability or strategic motivation to become direct competitors. This assessment involves understanding their technological roadmaps, manufacturing capacities, and market ambitions, especially concerning their specialized components.

Importance of Supplier's Input to Product Cost

The significance of a supplier's input to a company's total product cost directly influences the supplier's bargaining power. For SD Biosensor, if a particular supplier's reagents or components constitute a substantial percentage of the manufacturing cost for its diagnostic kits, that supplier gains considerable leverage. This is particularly relevant for specialized, high-value materials like molecular diagnostic reagents or intricate immunoassay components, where SD Biosensor may have fewer alternative sourcing options.

In 2024, the cost of raw materials and key components significantly impacted the profitability of many diagnostics companies. For instance, the global supply chain disruptions experienced in preceding years continued to affect the pricing of specialized chemicals and plastics, which are critical for diagnostic kit production. Companies like SD Biosensor often rely on a limited number of specialized suppliers for these essential inputs, thereby increasing the suppliers' ability to negotiate favorable terms.

- High-value reagents, such as those used in molecular diagnostics, can represent a significant portion of a diagnostic kit's bill of materials, giving their suppliers greater pricing power.

- SD Biosensor's reliance on specialized suppliers for unique or patented components strengthens the bargaining position of those suppliers.

- The proportion of total product cost attributed to a supplier's input directly correlates with their ability to influence pricing and terms.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails a supplier's bargaining power. If SD Biosensor can readily find comparable quality materials or components from various sources, or if alternative technologies are easily accessible, suppliers have less leverage to impose unfavorable terms. For instance, in 2024, the diagnostics industry saw increased competition among raw material providers for reagents, leading to more favorable pricing for companies like SD Biosensor.

This reduces the dependency on any single supplier, thereby strengthening SD Biosensor's position. A diversified supply chain, coupled with strategic investments in internal research and development for critical components, can effectively counteract this supplier influence.

- Reduced Supplier Leverage: When substitute inputs are plentiful, suppliers cannot easily dictate prices or terms.

- Diversification Benefits: SD Biosensor's ability to source from multiple providers in 2024, particularly for essential biochemicals, limited the impact of any single supplier's price hikes.

- Internal R&D Mitigation: Developing in-house capabilities for key components further reduces reliance on external suppliers, enhancing SD Biosensor's control over its supply chain.

Suppliers for SD Biosensor hold significant bargaining power when their specialized inputs are critical and difficult to substitute, as seen in the high-value reagents market. The cost and complexity of switching suppliers, often involving extensive validation processes that can cost tens of thousands of dollars in 2024, further empower these suppliers. This leverage is amplified if suppliers can potentially integrate forward into manufacturing diagnostic kits themselves, creating a competitive threat.

| Factor | Impact on SD Biosensor | Example (2024 Data) |

| Supplier Concentration | High leverage for few suppliers of critical components | Limited suppliers for unique biosensor materials |

| Switching Costs | High costs deter switching, increasing supplier power | Validation costs for new raw materials can exceed $100,000 |

| Input Uniqueness | Patented or proprietary inputs grant suppliers significant leverage | Exclusive patents on key diagnostic reagents |

| Forward Integration Threat | Suppliers may become direct competitors | Potential for component manufacturers to enter the IVD kit market |

What is included in the product

This analysis dissects the competitive landscape for SD BioSensor, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a clear, visual representation of all five forces, enabling swift strategic adjustments.

Customers Bargaining Power

The bargaining power of customers for SD Biosensor is significantly shaped by customer concentration and the sheer volume of their purchases. When a few major clients, such as large hospital systems or government health agencies, account for a substantial portion of SD Biosensor's sales, they gain considerable leverage. These high-volume purchasers, particularly for critical point-of-care testing solutions, can effectively negotiate pricing and terms, potentially forcing competitive price adjustments.

The ability of these key customers to readily switch to alternative suppliers if SD Biosensor's offerings do not meet their demands further amplifies their bargaining power. For instance, if a major distributor for rapid antigen tests finds a competitor offering similar quality at a lower price point, they can exert pressure for SD Biosensor to match those terms to retain the business. This dynamic means SD Biosensor must continually demonstrate value and competitive pricing to its largest clients.

Customers wield significant bargaining power when a plethora of substitute diagnostic products and service providers exist. The in-vitro diagnostics market is expanding rapidly, with numerous companies offering comparable rapid diagnostic tests, immunoassay solutions, and molecular diagnostics. This competitive landscape allows customers, including hospitals, clinics, and research institutions, to readily switch to alternative providers if SD Biosensor's products are not competitive on price, quality, or key features. For instance, the global in-vitro diagnostics market was valued at approximately USD 100.5 billion in 2023 and is projected to grow substantially, indicating a dynamic environment where customer choice is paramount.

Customer switching costs directly influence their bargaining power against SD Biosensor. If it's expensive or difficult for a customer to switch to a competitor, they have less leverage to demand lower prices or better terms.

For SD Biosensor, the magnitude of these costs can vary significantly. For simple point-of-care diagnostic kits, switching might involve minimal expense. However, for more complex laboratory systems or integrated diagnostic solutions, customers might face substantial costs related to retraining personnel, recalibrating existing equipment, or overhauling their data integration systems, thereby diminishing their bargaining power.

The evolving landscape of diagnostic technology, including the rise of AI-driven diagnostics and at-home testing kits, also impacts switching costs. If new technologies offer seamless integration or significantly lower adoption hurdles, customers may find it easier to switch, increasing their bargaining power and potentially pressuring SD Biosensor on pricing and innovation.

Customer Price Sensitivity

Customers in the healthcare sector, such as hospitals and government health agencies, often exhibit high price sensitivity. This is largely driven by strict budget limitations and complex reimbursement policies that dictate how much can be spent on medical equipment and diagnostics. For instance, in 2024, many public health systems globally are facing increased pressure to optimize spending, making cost-effectiveness a primary consideration for procurement decisions.

The significant expense associated with advanced diagnostic tools and testing kits can pose a substantial hurdle, especially in emerging markets where financial resources are more constrained. This financial pressure directly translates into increased bargaining power for these customers.

- Price Sensitivity Drivers: Budgetary constraints and reimbursement policies are key factors influencing customer price sensitivity in the healthcare industry.

- Market Impact: High costs of diagnostic equipment can limit adoption, particularly in developing economies, amplifying customer bargaining power.

- Competitive Pressure: SD Biosensor must offer competitive pricing to secure sales, directly reflecting the influence of customer price sensitivity.

- 2024 Context: Global public health systems in 2024 are actively seeking cost-efficient solutions, intensifying the need for competitive pricing strategies.

Threat of Backward Integration by Customers

Customers, especially major healthcare systems and extensive laboratory networks, possess the potential to develop their own diagnostic tests or laboratory-developed tests (LDTs) internally. This move would directly diminish their dependence on external suppliers such as SD Biosensor.

While undertaking in-house development demands substantial capital outlay and careful navigation of regulatory landscapes, it remains a significant underlying threat. This latent capability inherently strengthens the bargaining power of these customers.

For instance, in 2024, the global in-vitro diagnostics (IVD) market saw continued growth, with some large hospital groups actively exploring or expanding their in-house testing capabilities to manage costs and improve turnaround times. This trend is driven by the increasing complexity and cost of outsourced diagnostics, making backward integration a more attractive proposition for significant buyers.

- Customer Integration Potential: Large healthcare providers and lab networks can develop in-house diagnostic tests, reducing reliance on suppliers like SD Biosensor.

- Investment and Regulatory Hurdles: While costly and complex, backward integration is a viable threat for major customers.

- Market Trends (2024): The IVD market's growth and rising costs of outsourced testing encourage large buyers to consider internal development for efficiency and cost control.

The bargaining power of customers for SD Biosensor is considerable due to factors like customer concentration and the volume of purchases. Large clients, such as major hospital networks or government health bodies, can leverage their significant order volumes to negotiate favorable pricing and terms, especially for critical diagnostic solutions. This necessitates SD Biosensor maintaining competitive offerings to retain these key accounts.

The availability of numerous substitute diagnostic products and service providers in the expanding in-vitro diagnostics market also empowers customers. With a wide array of companies offering comparable rapid diagnostic tests and molecular solutions, customers can easily switch suppliers if SD Biosensor's pricing or product features are not competitive. The global in-vitro diagnostics market was valued at approximately USD 100.5 billion in 2023, highlighting the competitive intensity.

Customer price sensitivity is heightened by budget constraints and reimbursement policies prevalent in the healthcare sector. In 2024, public health systems globally are under pressure to optimize spending, making cost-effectiveness a primary driver for procurement decisions, thereby increasing customer leverage.

The potential for large customers to develop their own diagnostic tests or utilize laboratory-developed tests (LDTs) internally presents a significant threat, reducing their reliance on external suppliers like SD Biosensor. While this requires substantial investment and regulatory navigation, it remains a powerful underlying factor that strengthens customer bargaining power, especially as some large hospital groups in 2024 explored expanding in-house testing capabilities.

| Factor | Impact on SD Biosensor | 2024 Relevance |

|---|---|---|

| Customer Concentration | High leverage for large buyers | Key for major hospital systems |

| Availability of Substitutes | Intensifies price competition | Rapidly growing IVD market |

| Price Sensitivity | Demands cost-effective solutions | Budget pressures on public health |

| In-house Development Potential | Threat of customer backward integration | Hospitals exploring internal testing |

Full Version Awaits

SD BioSensor Porter's Five Forces Analysis

The document you see here is the complete SD BioSensor Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, providing immediate insights into market dynamics.

Rivalry Among Competitors

The in-vitro diagnostics (IVD) market is a crowded arena, brimming with both global giants and niche specialists. SD Biosensor navigates this landscape alongside formidable players such as Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers, each boasting extensive product portfolios and established market presence. This intense competition, further amplified by the presence of numerous smaller, specialized firms focusing on areas like point-of-care testing, directly fuels rivalry within the industry.

The global In Vitro Diagnostics (IVD) market is on an upward trajectory, with forecasts indicating a compound annual growth rate (CAGR) ranging from 4.1% to 6.8% between 2025 and 2034. This robust expansion, however, does not necessarily dampen competitive intensity.

Within this growing landscape, the point-of-care diagnostics segment is projected to see even more impressive growth, with a CAGR estimated between 8.5% and 12.2% from 2024 to 2029. While a rising tide lifts all boats, the substantial number of companies vying for a piece of this expanding market means that competition for market share remains a significant factor.

SD Biosensor operates in a competitive landscape where product differentiation is key. While their portfolio spans rapid diagnostics, immunoassay, and molecular diagnostics, staying ahead requires constant innovation. Competitors are actively developing advanced technologies, including AI integration and liquid biopsy, making it difficult to maintain a distinct market position.

The ease with which customers can switch between diagnostic providers, especially for basic rapid tests, significantly fuels competitive rivalry. For instance, the global rapid diagnostic tests market, valued at approximately USD 27.7 billion in 2023, is characterized by numerous players offering similar functionalities, leading to intense price competition and a constant need for differentiation.

Exit Barriers

High exit barriers, including specialized assets and significant R&D and manufacturing investments, can trap less successful competitors within the diagnostics market. This can result in prolonged overcapacity and aggressive pricing tactics, thereby increasing competitive intensity for SD Biosensor. For instance, the substantial capital required for advanced laboratory equipment and ongoing regulatory approvals, like those for IVD devices, makes exiting the market exceptionally difficult.

These substantial investments in infrastructure and the rigorous demands of regulatory compliance, such as maintaining Good Manufacturing Practices (GMP) certifications, create significant hurdles for companies looking to divest or cease operations. This means even firms with declining profitability may continue to operate, potentially leading to price wars that impact market dynamics for all players, including SD Biosensor.

- Specialized Assets: Many diagnostics companies rely on highly specific, often proprietary, manufacturing equipment and testing platforms that have limited resale value outside the industry.

- Long-Term Contracts: Commitments to supply agreements with healthcare providers or distributors can lock companies into operations even when unprofitable.

- High Fixed Costs: Significant upfront and ongoing expenses in research and development, clinical trials, and regulatory affairs represent sunk costs that are difficult to recoup upon exit.

- Brand Reputation and Relationships: Established relationships with key opinion leaders and a strong brand presence in the healthcare sector are valuable assets that are lost upon exiting, further discouraging departure.

Strategic Stakes and Aggressiveness of Competitors

Many players in the In Vitro Diagnostics (IVD) market are deeply invested, with aspirations of global leadership or significant control over particular diagnostic niches. This high-stakes environment fuels aggressive competition, manifesting in substantial research and development spending, a rapid pace of new product introductions, and the formation of strategic alliances. For instance, in 2024, the global IVD market was projected to reach approximately $130 billion, underscoring the immense value and intense competition driving these strategic moves.

This aggressive posture often translates into price wars and extensive marketing campaigns as companies vie for market share. Such tactics further intensify the rivalry, making it challenging for any single entity to maintain a dominant position without continuous innovation and strategic maneuvering. Companies like Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers consistently invest billions in R&D, with their 2023 reports highlighting significant portions of revenue allocated to innovation, a trend expected to continue through 2025.

- Global IVD Market Value (2024 Projection): ~$130 billion.

- Key Competitors' R&D Investment: Billions invested annually by major players like Roche, Abbott, and Siemens.

- Competitive Tactics: Price wars, aggressive marketing, rapid product launches, and strategic partnerships are common.

- Strategic Goals: Global leadership and dominance in specific diagnostic segments drive competitive intensity.

Competitive rivalry is fierce in the IVD market, with SD Biosensor facing off against giants like Roche, Abbott, and Siemens, all vying for market share. This intense competition is fueled by a crowded field of specialized firms, particularly in the rapidly growing point-of-care diagnostics segment, which is projected to grow between 8.5% and 12.2% annually from 2024 to 2029.

The global IVD market, expected to reach around $130 billion in 2024, sees companies investing heavily in R&D and product innovation to differentiate themselves, leading to frequent product launches and aggressive marketing. High exit barriers, such as specialized assets and significant regulatory compliance costs, mean that even less profitable companies remain in the market, often engaging in price wars that further escalate rivalry.

| Key Competitor | 2023 Revenue (Approx.) | Focus Areas |

|---|---|---|

| Roche Diagnostics | $67.7 billion (Diagnostics Division) | Centralized & Point-of-Care Testing, Molecular Diagnostics |

| Abbott Laboratories | $23.1 billion (Diagnostics Segment) | Molecular, Immunoassay, Hematology, Point-of-Care |

| Siemens Healthineers | $21.7 billion (Laboratory Diagnostics) | Clinical Chemistry, Immunoassay, Hematology, Molecular |

SSubstitutes Threaten

The threat of substitutes for SD Biosensor's in-vitro diagnostics is significant, primarily stemming from established laboratory-based testing methods. For instance, traditional PCR tests for infectious diseases, while often requiring more time and centralized facilities, can offer a higher degree of sensitivity and specificity than some point-of-care solutions. Similarly, for chronic conditions like diabetes, established blood glucose monitoring systems and advanced HbA1c lab tests remain strong alternatives, often preferred for their long-standing reliability and integration into routine healthcare workflows.

The threat of substitutes for SD BioSensor's diagnostic products extends beyond direct competing tests to encompass broader public health strategies. For example, advancements in preventative medicine and widespread vaccination programs can significantly reduce the incidence of infectious diseases, thereby lowering the overall demand for diagnostic testing. In 2023, global spending on public health initiatives saw a notable increase, reflecting a growing emphasis on prevention over treatment, which could indirectly impact the IVD market.

Technological advancements in fields like advanced imaging, such as the increasing resolution and accessibility of MRI and CT scans, present a significant threat of substitution for certain in-vitro diagnostic (IVD) applications. These imaging technologies can now provide detailed physiological data, potentially offering alternative diagnostic pathways for conditions traditionally relying on blood or tissue samples. For instance, the global MRI market was valued at approximately $7.1 billion in 2023 and is projected to grow, indicating a substantial investment in these alternative diagnostic tools.

Wearable health technology, including continuous glucose monitors and advanced ECG sensors, also acts as a substitute by enabling real-time, non-invasive health monitoring. These devices can capture vital physiological data that might otherwise require a laboratory-based IVD test. The wearable tech market is booming, with global revenues estimated to reach over $100 billion in 2024, demonstrating a strong consumer and healthcare provider embrace of these alternative monitoring solutions.

Predictive analytics, powered by AI and machine learning, can analyze vast datasets, including electronic health records and genetic information, to identify disease risks or early indicators. This capability can reduce the need for specific diagnostic tests by forecasting potential health issues. The AI in healthcare market alone was valued at over $15 billion in 2023, highlighting the growing influence of data-driven prediction as a substitute for traditional diagnostic methods.

Customer Acceptance and Cost-Effectiveness of Substitutes

Customer willingness to adopt substitutes for SD BioSensor's diagnostic products hinges on perceived effectiveness, ease of use, and cost. If alternative diagnostic methods or preventive strategies offer superior convenience, lower prices, or better health outcomes, they represent a significant threat. For instance, the broader adoption of telehealth services for initial symptom assessment could reduce the immediate need for certain point-of-care tests (POCT).

Point-of-care testing itself acts as a substitute for traditional, centralized laboratory testing, offering faster results and greater accessibility. However, emerging technologies could even substitute current POCT methods. The global POCT market was valued at approximately USD 35.6 billion in 2023 and is projected to grow, but innovations in areas like wearable biosensors or advanced home-based diagnostics could disrupt this segment.

- Cost Comparison: If a substitute diagnostic test is 20% cheaper and provides similar accuracy, customer adoption could accelerate rapidly.

- Convenience Factor: A home-use diagnostic kit that requires minimal training, compared to a POCT device needing trained personnel, offers a significant convenience advantage.

- Outcome Superiority: A preventive measure that demonstrably reduces the incidence of a disease by 15% more than current treatments would be a powerful substitute.

- Technological Advancements: The development of continuous glucose monitoring (CGM) devices has significantly substituted the need for frequent finger-prick blood tests for many diabetes patients.

Regulatory and Reimbursement Landscape for Substitutes

The regulatory and reimbursement landscape significantly shapes the threat of substitutes for diagnostic technologies like those offered by SD BioSensor. For instance, if regulatory bodies, such as the FDA in the United States, streamline approval processes for novel diagnostic platforms or alternative healthcare approaches, these substitutes can gain market traction more rapidly. In 2024, we're seeing continued efforts to expedite the review of innovative medical devices, which could lower barriers for new entrants.

Reimbursement policies are equally critical. If payers, like Medicare or private insurance companies, offer favorable reimbursement rates for non-IVD diagnostic tools or alternative treatment pathways, it directly incentivizes their adoption over traditional methods. A shift in reimbursement towards value-based care models, which often favor early and accurate diagnosis, could see alternative diagnostic modalities benefit.

- Regulatory Hurdles: Stringent regulatory requirements for new diagnostic technologies can slow their market entry, thereby reducing the immediate threat of substitutes.

- Reimbursement Incentives: Favorable reimbursement policies for alternative healthcare approaches can accelerate their adoption, increasing the threat of substitutes.

- Market Access: The ease with which new diagnostic tools can gain market access through regulatory approval and reimbursement directly impacts their ability to compete with established IVD products.

- Policy Influence: Government policies and healthcare reforms aimed at promoting innovation or cost-effectiveness in diagnostics can either bolster or diminish the threat of substitutes.

The threat of substitutes for SD Biosensor's diagnostic products is multifaceted, encompassing both direct competing tests and broader healthcare trends. Established laboratory methods, advanced imaging, wearable technologies, and even predictive analytics powered by AI represent significant alternatives. For instance, the global wearable tech market was projected to exceed $100 billion in 2024, highlighting a strong shift towards non-invasive monitoring that can bypass traditional diagnostics.

Customer adoption of these substitutes is heavily influenced by factors like cost, convenience, and perceived effectiveness. A diagnostic substitute that is notably cheaper or offers greater ease of use, such as a home-use kit versus a POCT needing trained staff, can quickly gain traction. Similarly, if a preventive strategy demonstrably reduces disease incidence more effectively than current treatments, it poses a substantial threat.

The regulatory and reimbursement landscape also plays a crucial role in shaping the threat of substitutes. Streamlined approval processes for novel diagnostic platforms or favorable reimbursement for alternative healthcare approaches can accelerate their market penetration. In 2024, continued efforts to expedite medical device reviews are expected, potentially lowering barriers for competing technologies.

| Substitute Type | Key Advantage | Market Indicator (2023/2024 Data) |

|---|---|---|

| Traditional Lab Tests | High Sensitivity/Specificity | N/A (Established benchmark) |

| Advanced Imaging (MRI/CT) | Physiological Data, Non-Invasive | Global MRI Market: ~$7.1 billion (2023) |

| Wearable Health Tech | Real-time Monitoring, Convenience | Global Wearable Tech Market: >$100 billion (2024 est.) |

| Predictive Analytics (AI) | Early Risk Identification | AI in Healthcare Market: >$15 billion (2023) |

Entrants Threaten

The in-vitro diagnostics (IVD) sector presents substantial barriers to entry due to rigorous regulatory frameworks. For instance, the U.S. Food and Drug Administration (FDA) and the European Union's In Vitro Diagnostic Regulation (IVDR) impose demanding standards on product development, manufacturing processes, and market distribution.

New companies must navigate complex approval pathways, which are particularly challenging and resource-intensive for higher-risk diagnostic devices. Obtaining necessary clearances can extend over extended periods, consuming significant capital and expertise, thereby deterring potential new competitors.

Entering the In Vitro Diagnostics (IVD) market, particularly in advanced areas like molecular diagnostics, demands significant capital. Companies need to invest heavily in research and development to create innovative technologies. For example, developing a new molecular diagnostic assay can cost millions of dollars, encompassing everything from initial discovery to clinical validation and regulatory approval.

The establishment of state-of-the-art manufacturing facilities, compliant with stringent quality standards such as ISO 13485, also represents a substantial financial hurdle. Furthermore, protecting intellectual property through patents is crucial and adds to the upfront investment. These high barriers effectively deter many potential new players from entering the market.

Established players like SD Biosensor benefit from deeply entrenched global supply networks and distribution channels. These networks are further solidified by long-standing relationships with key customers, including hospitals, clinics, and major distributors. For instance, in 2024, SD Biosensor continued to leverage its extensive network, which has been built over years of consistent service and product delivery, ensuring broad market penetration.

New entrants face a significant hurdle in replicating this extensive infrastructure and fostering the same level of trust. The challenge lies not just in logistics but in the intangible asset of established relationships, which are crucial for market access and customer acceptance in the diagnostics industry. This barrier makes it difficult for newcomers to gain a foothold and compete effectively against incumbents with proven track records and trusted partnerships.

Intellectual Property and Proprietary Technologies

The in-vitro diagnostics (IVD) market is a landscape where intellectual property (IP) is paramount. Patents covering specific assays, reagents, and entire diagnostic platforms create significant barriers. SD Biosensor, for instance, dedicates substantial resources to research and development, fostering proprietary technologies that give it a competitive edge.

For any new player looking to enter this space, the challenge is clear: they must either forge their own unique IP or secure licenses for existing technologies. Both paths come with considerable financial and temporal investments. Failing to navigate this IP landscape effectively exposes new entrants to the very real risk of patent infringement, a costly legal battle that can derail even the most promising ventures.

- Patents are crucial: The IVD sector is heavily protected by patents on assays, reagents, and diagnostic platforms.

- R&D investment: Companies like SD Biosensor invest significantly in R&D to build proprietary technologies.

- Entry barriers: Newcomers must either create new IP or license existing technology, both of which are expensive and time-consuming.

- Infringement risk: Without proper IP strategy, new entrants face the threat of costly patent infringement lawsuits.

Economies of Scale and Experience Curve

Existing players in the in-vitro diagnostics (IVD) market, including SD Biosensor, benefit significantly from economies of scale. This translates to lower per-unit costs in manufacturing, raw material procurement, and research and development. For instance, in 2023, SD Biosensor's substantial production volumes for its rapid diagnostic tests allowed it to achieve cost efficiencies that would be challenging for a new entrant to replicate from the outset.

SD Biosensor's established large-scale manufacturing capabilities create a formidable cost barrier for newcomers. A new entrant would likely begin with much smaller production volumes, inherently leading to higher per-unit costs compared to SD Biosensor's optimized operations. This cost disadvantage makes it difficult for new companies to compete on price, a critical factor in many diagnostic markets.

Furthermore, the experience curve plays a crucial role. SD Biosensor has accumulated years of expertise in optimizing production processes, navigating regulatory landscapes, and understanding market dynamics. This accumulated knowledge, often referred to as the experience curve effect, allows for greater efficiency and fewer errors, presenting another hurdle for nascent competitors trying to enter the market.

- Economies of Scale: SD Biosensor leverages large-scale production to reduce per-unit costs in manufacturing and R&D.

- Cost Advantage: Established players like SD Biosensor possess a cost advantage due to higher production volumes compared to new entrants.

- Experience Curve: Accumulated expertise in production and market navigation creates a learning curve barrier for new companies.

The threat of new entrants into the IVD market, where SD Biosensor operates, is significantly mitigated by high capital requirements and stringent regulatory hurdles. For instance, the extensive clinical trials and validation processes mandated by bodies like the FDA and EMA demand substantial financial investment, often running into millions of dollars for a single product. This financial burden alone acts as a powerful deterrent for potential new players.

Furthermore, the need for specialized R&D, advanced manufacturing facilities compliant with standards like ISO 13485, and robust intellectual property protection means that establishing a competitive presence requires immense upfront capital. In 2024, the ongoing evolution of diagnostic technologies, such as the integration of AI in data analysis, further elevates the required investment for innovation, making it a challenging landscape for startups.

The established global distribution networks and customer relationships that companies like SD Biosensor have cultivated over years present another formidable barrier. Replicating these intricate supply chains and building the necessary trust with healthcare providers and distributors is a lengthy and resource-intensive process for any new competitor aiming to gain market access.

Porter's Five Forces Analysis Data Sources

Our SD BioSensor Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, investor presentations, and regulatory filings to understand internal strengths and weaknesses. We also leverage industry-specific market research reports and trade publications to assess external competitive pressures and market trends.