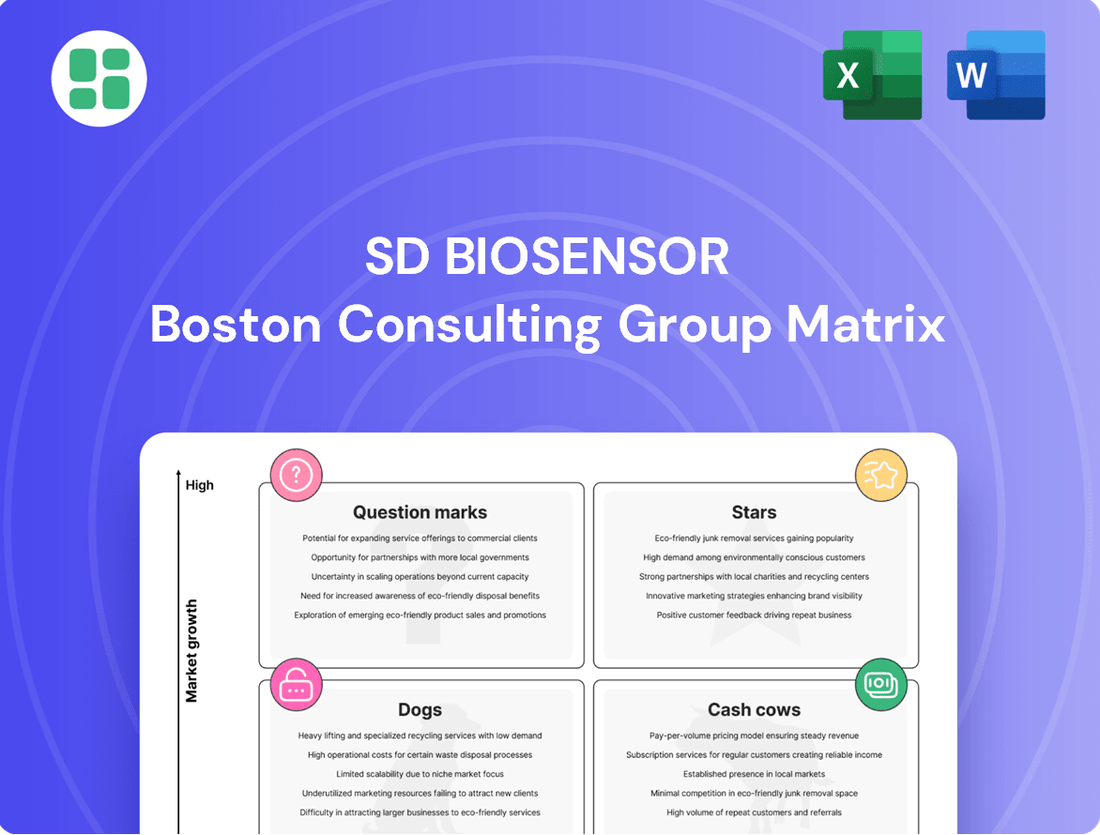

SD BioSensor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SD BioSensor Bundle

Curious about SD BioSensor's product portfolio performance? This preview offers a glimpse into their BCG Matrix, highlighting key areas of growth and potential challenges.

Ready to unlock the full strategic potential? Purchase the complete SD BioSensor BCG Matrix report for detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments.

Stars

SD Biosensor's STANDARD M10 Molecular Diagnostic System is positioned as a star within its product portfolio, reflecting its high market growth potential and strong competitive performance. This point-of-care system streamlines molecular diagnostics, offering rapid and accurate results for infectious diseases, drug resistance, and genetic testing, directly addressing the growing demand for decentralized healthcare solutions.

The recent CE-IVDR certification for its v2.0 in 2024 underscores its advanced capabilities and market readiness, particularly in Europe. Global promotion efforts, including participation in major scientific congresses like ESCMID Global 2024, highlight SD Biosensor's commitment to expanding the M10's reach and solidifying its star status in the dynamic molecular diagnostics market.

SD Biosensor's blood glucose monitoring systems (BGMS) are showing robust sales, especially in the Americas and Africa, indicating a strong market presence. The company secured CE-IVDR certification for five personal blood glucose meters in April 2025. This achievement is crucial for expanding their reach within the expanding global diabetes care market, where demand for user-friendly and precise self-monitoring tools is high.

SD Biosensor's investment in infectious disease diagnostics for emerging pathogens places them squarely in a high-growth sector, driven by the persistent threat of new outbreaks. Their commitment to rapid and accurate diagnostic reagents is crucial for public health response.

The company's pipeline features tests for a range of infectious diseases, including STDs and respiratory illnesses beyond COVID-19. This diversification is key to capturing market share as new health challenges arise.

SD Biosensor is actively pursuing additional CE-IVDR certifications for new cartridges, signaling their intent to expand their product offerings and market reach in the critical diagnostics space.

AI-Integrated Diagnostic Solutions

SD Biosensor aims to be a global leader in in-vitro diagnostics (IVD) by embracing technological shifts, particularly the integration of Artificial Intelligence (AI). This strategic pivot recognizes the growing importance of AI in analyzing the vast datasets generated by diagnostic tests, leading to faster insights and new product development.

While the company has not yet disclosed specific AI-integrated diagnostic products, their investment in AI for data accumulation and value creation signals a strong commitment to this high-growth sector. This focus positions them to capitalize on the evolving landscape of healthcare technology.

- AI for Data Analysis: SD Biosensor is leveraging AI to process and interpret complex diagnostic data, enhancing accuracy and efficiency.

- New Value Creation: The company sees AI as a key driver for developing innovative solutions and unlocking new revenue streams within the IVD market.

- Market Responsiveness: This strategic direction demonstrates SD Biosensor's proactive approach to market changes and its ambition to lead in the AI-driven IVD space.

Expansion into New Geographical Markets (e.g., India Plant)

SD Biosensor's strategic expansion into new geographical markets, exemplified by its Gurugram, India plant, positions it for significant growth. The completion of this facility in March 2025 more than doubles its global production capacity, a crucial step for scaling operations. This investment directly supports its objective to improve cost efficiencies and better serve the international tender market and global public health initiatives.

The Gurugram plant's increased capacity is a key enabler for SD Biosensor's ambition to capture greater market share, particularly in rapidly developing regions. By establishing a substantial production base in India, the company can leverage localized resources and potentially reduce logistical costs. This move underscores a commitment to supplying high-quality diagnostic solutions to a wider, global customer base.

- Global Production Capacity Increase: Over 2.9 times following the Gurugram plant's completion in March 2025.

- Strategic Objective: Enhance cost competitiveness and supply high-quality products to international tenders and the global public health sector.

- Market Focus: Targeting high-growth developing regions with increased demand for diagnostic solutions.

- Impact on Market Share: Facilitates a stronger push to gain market share in key international markets.

SD Biosensor's blood glucose monitoring systems (BGMS) are a significant growth driver, demonstrating strong sales momentum, particularly in the Americas and Africa. The company's strategic move to secure CE-IVDR certification for five personal blood glucose meters in April 2025 is a critical step in expanding its footprint within the burgeoning global diabetes care market.

This expansion is vital as demand for accurate and user-friendly self-monitoring tools continues to rise. The BGMS are positioned as stars due to their high market share potential and SD Biosensor's strong competitive standing in this segment.

SD Biosensor's commitment to innovation is evident in its investment in AI for data analysis, aiming to create new value and enhance market responsiveness in the IVD sector. This forward-looking strategy, coupled with the expansion of its production capacity through the Gurugram plant, which more than doubled capacity upon its March 2025 completion, solidifies its position for future growth.

The company's focus on infectious disease diagnostics, with a pipeline including tests for STDs and respiratory illnesses, further strengthens its star positioning by addressing high-growth areas driven by global health needs.

| Product Category | BCG Matrix Position | Key Growth Drivers | Recent Developments (2024-2025) |

|---|---|---|---|

| Molecular Diagnostics (STANDARD M10) | Star | Decentralized healthcare, rapid testing demand | CE-IVDR v2.0 certification (2024), ESCMID Global 2024 participation |

| Blood Glucose Monitoring Systems (BGMS) | Star | Growing diabetes care market, demand for user-friendly tools | CE-IVDR certification for 5 meters (April 2025), strong sales in Americas & Africa |

| Infectious Disease Diagnostics | Star | Emerging pathogens, public health response needs | Pipeline expansion for STDs, respiratory illnesses; CE-IVDR for new cartridges pursued |

| AI Integration in IVD | Star (Emerging) | Data analysis enhancement, new value creation | Investment in AI for data accumulation and value creation (ongoing) |

What is included in the product

The SD BioSensor BCG Matrix analyzes its product portfolio by market share and growth, guiding strategic decisions.

Simplified data visualization for clear, actionable insights.

Cash Cows

The STANDARD Q rapid diagnostic tests for established infectious diseases, such as malaria and HIV, are prime examples of cash cows for SD Biosensor. These products benefit from high sensitivity and specificity, making them reliable tools for healthcare providers globally. Their consistent performance and established demand, particularly within public health programs, ensure a steady revenue stream.

SD Biosensor's malaria rapid diagnostic tests, for instance, have demonstrated excellent performance characteristics, with some achieving over 95% sensitivity and specificity in clinical evaluations. The widespread adoption of these tests, supported by WHO prequalification for several key infectious diseases, solidifies their position as mature products that reliably generate significant cash flow for the company.

The STANDARD F and STANDARD E immunoassay systems represent SD Biosensor's established offerings in diagnostic testing. These multi-parametric and reliable platforms are well-suited for both laboratory settings and large-scale screening initiatives, indicating a steady demand.

While the markets for traditional immunoassays may not be experiencing explosive growth, these systems are likely generating consistent and substantial revenue for SD Biosensor. Their broad spectrum of detectable parameters and demonstrated accuracy in everyday diagnostic procedures solidify their position as dependable cash cows.

SD Biosensor's general portfolio of point-of-care (POC) testing solutions is a strong contender for Cash Cows. This segment captured a substantial portion of the global biosensors market in 2024, driven by the demand for quick and convenient diagnostic results.

While individual POC products might fluctuate between Stars and Question Marks, the established and widely adopted POC devices within SD Biosensor's lineup are likely to consistently generate robust cash flow. This stability is further supported by the ongoing shift towards decentralized testing, a trend that favors the accessibility and efficiency of POC technologies.

Diabetes Management Products (Established Lines)

SD Biosensor's established diabetes management products, including blood glucose monitoring systems (BGMS), LipidoCare, and MultiCare, represent its Cash Cows. These offerings cater to a substantial and consistent global diabetic patient population, ensuring a reliable revenue stream. The company benefits from ongoing demand, minimizing the need for significant promotional expenditures for these mature product lines.

- Stable Revenue Generation: The established BGMS and related diabetes products contribute significantly to SD Biosensor's consistent revenue, reflecting their strong market penetration.

- Low Promotional Investment: Due to the inherent and continuous demand from diabetic patients, these products require minimal additional marketing spend to maintain their sales volume.

- Market Presence: SD Biosensor's existing diabetes management portfolio has secured a solid foothold in a market that continues to grow, with global diabetes prevalence projected to reach 783 million by 2045.

WHO Prequalified Products for Global Public Health

SD Biosensor's WHO prequalified products, particularly for malaria, HIV, and HCV, have been a cornerstone of its global health contributions since 2020. These diagnostics are essential for public health initiatives worldwide, creating a stable revenue stream. The consistent demand from these programs translates into reliable cash generation for the company.

The long-term contracts associated with supplying these critical health products provide SD Biosensor with a predictable and sustained market presence. This reliability solidifies their position as cash cows within the BCG matrix framework.

- Key Disease Areas: Malaria, HIV, and HCV diagnostics are central to SD Biosensor's WHO prequalified offerings.

- Consistent Demand: Global public health programs ensure a steady and ongoing need for these essential medical tools.

- Long-Term Contracts: Agreements with international health organizations provide revenue predictability and market stability.

- Revenue Generation: These products act as reliable cash cows, funding other areas of the business and research.

SD Biosensor's established portfolio of rapid diagnostic tests for prevalent infectious diseases, such as malaria and HIV, are prime examples of its cash cows. These products benefit from high sensitivity and specificity, ensuring reliable performance for healthcare providers globally. Their consistent demand, particularly within public health programs, generates a steady revenue stream.

The company's malaria rapid diagnostic tests, for instance, have demonstrated excellent performance, with some achieving over 95% sensitivity and specificity in clinical evaluations. The widespread adoption of these tests, including WHO prequalification for several key infectious diseases, solidifies their position as mature products that reliably generate significant cash flow for SD Biosensor.

SD Biosensor's established diabetes management products, such as blood glucose monitoring systems, LipidoCare, and MultiCare, also represent key cash cows. These cater to a substantial and consistent global diabetic patient population, ensuring a reliable revenue stream with minimal need for significant promotional expenditures.

| Product Category | Market Position | Revenue Contribution | Growth Potential | BCG Status |

| Infectious Disease Rapid Tests (Malaria, HIV) | Dominant, Established | High, Stable | Low | Cash Cow |

| Diabetes Management Systems (BGMS, LipidoCare) | Strong, Consistent | High, Stable | Low to Moderate | Cash Cow |

| General Point-of-Care (POC) Testing | Significant Market Share | Moderate to High, Stable | Moderate | Likely Cash Cow (Established Products) |

Delivered as Shown

SD BioSensor BCG Matrix

The SD BioSensor BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This ensures that the strategic insights and professional formatting are identical to what you will download, ready for immediate application in your business planning and analysis.

Dogs

Older generation COVID-19 rapid antigen tests, like those previously distributed by SD Biosensor, now fall into the Dogs category of the BCG Matrix. The market for these specific tests has contracted significantly, evidenced by the U.S. government's discontinuation of its free at-home COVID-19 test program in March 2025.

With declining demand and fierce competition from newer, potentially more accurate or convenient testing methods, these older tests exhibit low market growth. Their market share is also likely diminishing as public health priorities shift and testing needs evolve, making them a prime candidate for divestiture or a strategy of minimal investment to manage any remaining residual demand.

Diagnostic kits targeting rare diseases or those relying on outdated technology are considered Niche or Obsolete. These products often face declining demand as newer, more effective alternatives emerge. For instance, older immunoassay kits for certain infectious diseases might be replaced by molecular diagnostic tests offering higher sensitivity and specificity.

Companies must carefully manage these offerings to prevent them from becoming financial burdens. Their market share is typically small and shrinking, with minimal growth potential. In 2024, the global in-vitro diagnostics market saw continued innovation, with molecular diagnostics and point-of-care testing growing significantly, further marginalizing older technologies.

Regional product lines acquired, such as those from Meridian Bioscience, that haven't met market expectations or SD Biosensor's strategic goals can become underperformers. These often require substantial investment for a turnaround, with uncertain outcomes. For instance, if a newly acquired diagnostic test in a specific European market saw only a 5% market share growth in 2024 despite a significant marketing push, it would likely fall into this category.

Discontinued or Low-Demand Research Reagents

Discontinued or low-demand research reagents, often found in a company's extensive product catalog, can be categorized as Dogs within the BCG Matrix. These are products with limited commercial appeal or high production costs that outweigh their market demand.

These specific reagents typically hold a low market share and exhibit minimal growth potential, making them a drain on resources without significant return. For instance, a company might have a portfolio of hundreds of specialized antibodies, but only a handful are in high demand. The rest, while potentially useful for niche research, fall into the Dog category.

- Low Market Share: These reagents often represent a very small fraction of a company's overall sales.

- Minimal Growth: The market for these products is stagnant or declining, with little prospect for future expansion.

- High Production Costs: The cost to manufacture and maintain inventory for these low-volume items can be disproportionately high.

- Limited Commercial Appeal: They cater to very specific, often shrinking, research areas or have been superseded by newer, more advanced alternatives.

Products with High Manufacturing Costs and Low Profit Margins

Products that consistently face high manufacturing expenses and aggressive pricing pressures, resulting in minimal or even negative profit margins, can be categorized here. These items drain valuable resources without yielding adequate returns, potentially immobilizing capital within the business.

For instance, imagine a diagnostic test kit with complex reagent sourcing and stringent quality control requirements, pushing its per-unit manufacturing cost to $15. If the market price is capped at $18 due to intense competition from multiple players, the gross profit is a mere $3. In 2024, the diagnostics market saw significant price erosion in certain segments, with some established tests experiencing margin compression below 10% due to oversupply and the introduction of lower-cost alternatives.

- High Production Expenses: Products requiring specialized materials, intricate assembly, or extensive regulatory compliance inherently drive up manufacturing costs.

- Intense Market Competition: A crowded marketplace with numerous suppliers often leads to price wars, diminishing potential profits.

- Thin or Negative Profitability: The combination of high costs and low prices results in negligible or no profit, hindering reinvestment and growth.

- Capital Immobilization: Resources tied up in low-margin products could otherwise be allocated to more promising ventures.

Older generation COVID-19 rapid antigen tests, previously distributed by SD Biosensor, now fall into the Dogs category of the BCG Matrix. The market for these specific tests has contracted significantly, evidenced by the U.S. government's discontinuation of its free at-home COVID-19 test program in March 2025.

With declining demand and fierce competition from newer, potentially more accurate or convenient testing methods, these older tests exhibit low market growth. Their market share is also likely diminishing as public health priorities shift and testing needs evolve, making them a prime candidate for divestiture or a strategy of minimal investment to manage any remaining residual demand.

Diagnostic kits targeting rare diseases or those relying on outdated technology are considered Niche or Obsolete. These products often face declining demand as newer, more effective alternatives emerge. For instance, older immunoassay kits for certain infectious diseases might be replaced by molecular diagnostic tests offering higher sensitivity and specificity.

Companies must carefully manage these offerings to prevent them from becoming financial burdens. Their market share is typically small and shrinking, with minimal growth potential. In 2024, the global in-vitro diagnostics market saw continued innovation, with molecular diagnostics and point-of-care testing growing significantly, further marginalizing older technologies.

Products that consistently face high manufacturing expenses and aggressive pricing pressures, resulting in minimal or even negative profit margins, can be categorized here. These items drain valuable resources without yielding adequate returns, potentially immobilizing capital within the business. For instance, imagine a diagnostic test kit with complex reagent sourcing and stringent quality control requirements, pushing its per-unit manufacturing cost to $15. If the market price is capped at $18 due to intense competition from multiple players, the gross profit is a mere $3. In 2024, the diagnostics market saw significant price erosion in certain segments, with some established tests experiencing margin compression below 10% due to oversupply and the introduction of lower-cost alternatives.

| Product Example | Market Share | Market Growth | Profitability | Strategy |

| Older COVID-19 Rapid Antigen Tests | Low | Declining | Low/Negative | Divestiture/Minimal Investment |

| Outdated Infectious Disease Immunoassays | Very Low | Stagnant | Low | Phase-out |

| Low-Demand Research Reagents | Negligible | None | Negative (due to costs) | Discontinue |

| High-Cost, Low-Margin Diagnostics | Small, Shrinking | Minimal | Thin/Negative | Cost Reduction/Exit |

Question Marks

The STANDARD M10 platform, a key component of SD Biosensor's diagnostic offerings, is positioned as a Star due to its established versatility and ongoing development. SD Biosensor is actively expanding its cartridge portfolio for the M10, with a notable focus on emerging areas like sexually transmitted infections (STIs) and antibiotic resistance detection.

New cartridges targeting these emerging conditions, while benefiting from the M10's existing infrastructure, could be viewed as Question Marks within the BCG matrix. They represent high growth potential in nascent markets but likely hold a low current market share, necessitating significant investment to drive adoption and establish market presence.

SD Biosensor's ambition to integrate AI and leverage data for diagnostic services positions it in a high-growth, but currently low-market-share segment. This strategic focus aims to unlock new value creation in an increasingly digital health landscape.

These nascent offerings demand substantial investment in research and development, alongside dedicated market development efforts, to establish viability and secure a competitive foothold. The digital health market is both highly competitive and rapidly evolving, requiring continuous innovation.

For instance, the global AI in healthcare market was valued at approximately USD 15.4 billion in 2023 and is projected to reach USD 193.7 billion by 2030, exhibiting a compound annual growth rate of over 40%. This highlights the significant market potential SD Biosensor is targeting.

The global biosensors market, especially for diabetes care, is booming, driven by innovations like continuous glucose monitoring (CGM). This sector is projected to reach $64.1 billion by 2027, with CGM being a significant contributor.

While SD Biosensor has a presence in traditional blood glucose monitoring systems (BGMS), their strategic move into next-generation biosensors, such as advanced CGMs or implantable devices, would position them in a high-growth segment. This area currently sees them with a low market share, requiring considerable investment to challenge leaders like DexCom and Abbott, who dominated the CGM market with significant market penetration by 2024.

Diagnostics for Neglected Tropical Diseases in New Markets

Expanding diagnostics for neglected tropical diseases (NTDs) in new, underserved markets presents a classic Question Mark scenario for SD Biosensor. While the company holds WHO prequalification for certain infectious diseases, venturing into NTDs like Chagas disease or leishmaniasis in regions with low market penetration but high unmet needs requires significant strategic focus.

These emerging markets, particularly in parts of sub-Saharan Africa and Southeast Asia, represent substantial growth potential, but the path to market penetration is steep. For instance, the World Health Organization (WHO) estimates that NTDs affect over 1.5 billion people globally, with many of these individuals living in areas where diagnostic access is severely limited.

- Market Potential: The global market for NTD diagnostics is projected to grow significantly, driven by increased awareness and funding. For example, the market for lymphatic filariasis diagnostics alone was valued in the tens of millions of dollars and is expected to expand.

- Investment Needs: Developing and distributing NTD diagnostic kits often demands substantial upfront investment in research, regulatory approvals specific to target countries, and building robust cold chain and distribution networks.

- Competitive Landscape: While direct competition for specific NTDs might be lower in nascent markets, established players in broader infectious disease diagnostics may also eye these opportunities, requiring SD Biosensor to differentiate its offerings.

- Risk Factors: Political instability, weak healthcare infrastructure, and challenges in patient identification and follow-up in these regions pose significant risks that need careful management.

Procell Dx for Tuberculosis and Immune Status

Procell Dx, an in vitro diagnostic product from SD BioSensor, offers advanced capabilities for detecting infectious diseases such as tuberculosis and assessing immune status via Interferon Gamma Release Assay (IGRA). This positions it as a key player in a market with significant growth potential.

While the global tuberculosis diagnostics market is expanding, driven by increasing prevalence and government initiatives, Procell Dx's current market share for this specific product, particularly when compared to long-standing competitors, might be relatively small. This situation places it squarely in the Question Mark quadrant of the BCG matrix, indicating a need for strategic investment to bolster its market presence and competitive standing.

- Market Potential: The global tuberculosis diagnostics market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of around 6.5% through 2030.

- Competitive Landscape: Established IGRA tests from companies like Qiagen and Oxford Immunotec are significant competitors, potentially limiting Procell Dx's initial market penetration.

- Strategic Imperative: Investment in marketing, clinical validation, and wider distribution channels is crucial for Procell Dx to increase its market share and move towards becoming a star product.

- Growth Opportunity: With the ongoing push for improved TB detection methods, particularly in resource-limited settings, Procell Dx has a clear opportunity to capture market share if strategic investments are made effectively.

New diagnostic solutions, especially those targeting emerging markets or novel disease areas, represent SD Biosensor's Question Marks. These products are in high-growth sectors but currently hold a small market share, demanding significant investment to gain traction.

Examples include advanced biosensors for continuous glucose monitoring or diagnostics for neglected tropical diseases, areas with substantial unmet needs and future potential, but where market penetration is currently low.

SD Biosensor's foray into AI-driven diagnostic services also fits this category, tapping into a rapidly expanding digital health landscape where establishing a dominant market share requires considerable upfront capital and innovation.

The Procell Dx product, while addressing a growing market like tuberculosis diagnostics, also falls into this quadrant due to the presence of established competitors, necessitating strategic investment to enhance its market position.

| Product/Initiative | Market Growth Potential | Current Market Share | Investment Need | Strategic Focus |

|---|---|---|---|---|

| New M10 Cartridges (STIs, AMR) | High | Low | High | Market development, R&D |

| AI/Data-driven Diagnostics | Very High (40%+ CAGR projected) | Low | Very High | Innovation, platform development |

| Next-Gen Biosensors (e.g., advanced CGMs) | High ($64.1B market by 2027) | Low | High | Competition, technological advancement |

| Neglected Tropical Disease (NTD) Diagnostics | High (1.5B affected globally) | Very Low | High | Market access, infrastructure development |

| Procell Dx (TB/IGRA) | High (6.5% CAGR for TB diagnostics) | Low | Medium-High | Marketing, clinical validation |

BCG Matrix Data Sources

Our SD BioSensor BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market research reports, and competitive analysis to provide strategic insights.