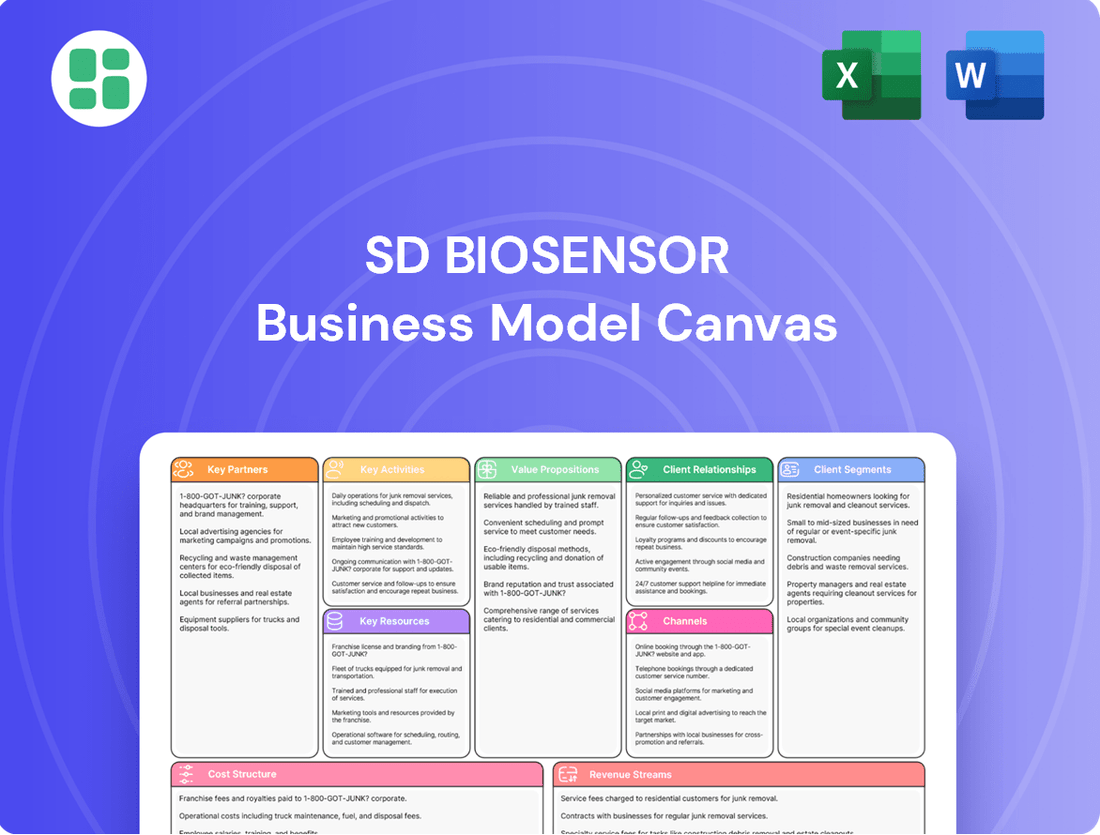

SD BioSensor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SD BioSensor Bundle

Unlock the core strategies behind SD BioSensor's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key customer segments, value propositions, and revenue streams, offering a clear roadmap for their market approach.

Dive deeper into SD BioSensor’s operational blueprint with the full Business Model Canvas. Understand their crucial partnerships, cost structure, and key resources that drive their innovative solutions. Ready to gain a competitive edge?

See how SD BioSensor effectively reaches its target markets and creates value through its unique business model. This downloadable canvas provides all nine essential building blocks, perfect for strategic analysis and inspiration.

Want to dissect SD BioSensor's winning formula? Our complete Business Model Canvas offers a professional, section-by-section analysis, ideal for benchmarking or developing your own growth strategies. Get your copy today!

Partnerships

SD Biosensor's global distribution networks are a cornerstone of its business model, enabling the widespread availability of its diagnostic solutions. In 2024, the company continued to solidify its presence by actively engaging with over 100 distribution partners across more than 70 countries, a testament to its commitment to global accessibility.

These vital partnerships are instrumental in navigating diverse market landscapes, particularly in emerging economies where healthcare infrastructure may be less developed. By collaborating with local distributors, SD Biosensor effectively penetrates these regions, ensuring its diagnostic products reach those who need them most.

The strategic leverage of these established relationships allows SD Biosensor to continuously expand its international footprint and significantly enhance the accessibility of its innovative diagnostic tools. This approach is critical for achieving broad market penetration and fulfilling its mission of improving global health outcomes.

Collaborations with research institutions and universities are crucial for SD Biosensor to push the boundaries of diagnostic technology. These partnerships are essential for the joint research and development of novel diagnostic tools and the creation of next-generation products.

Through these academic alliances, SD Biosensor gains access to cutting-edge scientific discoveries and specialized expertise, fostering a dynamic environment for innovation. For instance, in 2023, SD Biosensor announced a significant collaboration with a leading Korean university focused on developing advanced molecular diagnostic platforms, aiming to accelerate the detection of emerging infectious diseases.

SD Biosensor's strategic alliances with healthcare providers and hospitals are crucial for market penetration. These partnerships facilitate the integration of their point-of-care testing solutions into clinical workflows, driving adoption and demonstrating value. For instance, collaborations often involve pilot studies that showcase the diagnostic accuracy and efficiency of SD Biosensor's products, directly influencing purchasing decisions within healthcare systems.

Governmental and Non-Governmental Organizations (NGOs)

SD BioSensor's partnerships with international bodies like the World Health Organization (WHO) are vital for expanding access to its diagnostic tools, especially in underserved regions. For instance, the WHO's prequalification program, which SD BioSensor has actively participated in, ensures that medical products meet global quality standards, facilitating their procurement by UN agencies and countries. This collaboration is key to their mission of making healthcare diagnostics more affordable and widely available.

Collaborations with organizations such as the Medicines Patent Pool (MPP) further underscore SD BioSensor's dedication to global health equity. By engaging in technology transfer agreements, SD BioSensor enables the local manufacturing of its essential diagnostic kits, thereby reducing costs and improving supply chain resilience in low- and middle-income countries. This approach directly supports public health initiatives and broadens the reach of critical medical technologies.

- WHO Prequalification: SD BioSensor's participation in the WHO Prequalification program is a testament to its commitment to quality and global health standards, enabling wider distribution of its diagnostic products.

- Medicines Patent Pool (MPP): Partnerships with MPP facilitate technology transfer, promoting local production and affordability of diagnostics in resource-limited settings.

- Global Health Initiatives: These collaborations are instrumental in SD BioSensor's strategy to address global health challenges by providing accessible and cost-effective diagnostic solutions.

Technology and Raw Material Suppliers

SD BioSensor relies heavily on technology and raw material suppliers to ensure the quality and availability of its diagnostic products. Securing consistent access to high-grade reagents, essential components, and cutting-edge technologies is paramount for their manufacturing processes. Long-term partnerships with these suppliers are vital for maintaining stable production, rigorous quality control, and the capacity to expand operations as demand grows. This ensures the integrity and reliable performance of their diagnostic kits and instruments.

The company's commitment to quality is directly tied to the reliability of its supply chain. For instance, in 2023, SD BioSensor continued to foster strategic alliances with leading global chemical and electronics manufacturers. These collaborations are not just about procurement but also about joint development of next-generation materials and components that enhance diagnostic accuracy and speed. Their ability to innovate is often dependent on the technological advancements provided by these key partners.

- Supplier Reliability: Consistent access to high-quality reagents and components is critical for uninterrupted production of diagnostic kits.

- Quality Assurance: Strong supplier relationships enable SD BioSensor to maintain stringent quality control throughout its manufacturing process.

- Scalability: Partnerships with suppliers that can meet increasing demand are essential for the company's growth and market expansion.

- Technological Advancement: Collaboration with technology suppliers allows SD BioSensor to incorporate the latest innovations into its diagnostic solutions.

SD Biosensor’s key partnerships extend to global distribution networks, research institutions, healthcare providers, and international health organizations. These collaborations are crucial for market access, technological advancement, and the widespread availability of its diagnostic solutions.

In 2024, SD Biosensor continued to strengthen its global reach by partnering with over 100 distributors in more than 70 countries, ensuring its products are accessible worldwide, especially in emerging markets. Collaborations with academic institutions, such as a 2023 partnership with a Korean university for advanced molecular diagnostics, drive innovation and the development of next-generation tools.

Strategic alliances with healthcare providers and hospitals facilitate the integration of point-of-care testing, with pilot studies demonstrating product efficacy. Furthermore, partnerships with international bodies like the WHO, including participation in its prequalification program, and organizations like the Medicines Patent Pool (MPP), are vital for ensuring quality standards and improving access to affordable diagnostics in low- and middle-income countries.

What is included in the product

A detailed, strategy-aligned business model canvas for SD BioSensor, meticulously outlining customer segments, value propositions, and channels to reflect real-world operations and strategic plans.

This canvas is ideal for presentations and funding discussions, organized into 9 classic BMC blocks with narrative and insights, designed to aid informed decision-making.

SD BioSensor's Business Model Canvas offers a clear, structured approach to visualizing and refining strategies, acting as a powerful tool to alleviate the pain of complex business planning.

It provides a one-page snapshot that simplifies the identification of key business drivers, thereby reducing the effort and time spent on strategic articulation.

Activities

SD Biosensor dedicates significant resources to Research and Development, a cornerstone of its business model. This investment fuels innovation across its diagnostic product lines, encompassing rapid tests, immunoassay, and molecular diagnostics. The company's commitment to scientific exploration and technological advancement is evident in its continuous efforts to develop novel diagnostic platforms and refine existing ones.

A primary objective of SD Biosensor's R&D is the creation of testing solutions that are not only faster and more accurate but also offer greater convenience to users. For instance, in 2024, the company continued to push the boundaries in point-of-care diagnostics, aiming to reduce turnaround times for critical disease detection. This focus on user-centric innovation is key to meeting evolving healthcare needs.

SD Biosensor's core business revolves around the large-scale manufacturing of diagnostic kits and instruments. This intricate process demands strict adherence to rigorous quality control standards to ensure the reliability and safety of their medical solutions. Their global manufacturing footprint, including significant operations in Korea and India, underscores their commitment to high-quality production.

SD Biosensor's global sales and marketing efforts focus on building robust strategies to connect with a worldwide customer base. This includes deploying dedicated sales teams and cultivating strong relationships with distributors to ensure widespread product availability.

The company actively participates in international tenders and prominent industry exhibitions to enhance product visibility and secure new market opportunities. For instance, in 2023, SD Biosensor reported significant revenue growth, partly driven by its expanding global reach and successful marketing campaigns in key emerging markets.

Regulatory Compliance and Certifications

Navigating the intricate web of global regulations and obtaining crucial certifications like CE-IVDR and WHO Prequalification is a paramount ongoing activity for SD BioSensor. This rigorous process is fundamental to ensuring their diagnostic products adhere to international health and safety benchmarks, thereby unlocking access to diverse markets and fostering broad product adoption.

Maintaining continuous compliance is not merely a procedural step but a cornerstone of SD BioSensor's operational integrity. It underpins the legitimacy of their offerings and cultivates essential trust among healthcare providers and patients worldwide. For instance, in 2024, the company actively managed its compliance portfolio, which includes navigating evolving IVDR requirements in Europe, a significant undertaking given the stringent data and quality management demands.

- CE-IVDR Compliance: SD BioSensor invests heavily in ensuring its in-vitro diagnostic devices meet the European Union's In Vitro Diagnostic Regulation (IVDR), a comprehensive framework that came into full effect in May 2022 and continues to shape market access.

- WHO Prequalification: Pursuing and maintaining WHO Prequalification for specific diagnostic tests is vital for global health initiatives, particularly in low- and middle-income countries, ensuring quality and affordability.

- FDA Emergency Use Authorizations (EUAs): During public health emergencies, securing and maintaining EUAs from the U.S. Food and Drug Administration for rapid diagnostic tests, such as those for infectious diseases, has been critical for swift market deployment.

- Global Market Access: Compliance activities directly enable SD BioSensor's ability to enter and operate in over 100 countries, each with its own unique regulatory requirements and approval pathways.

Post-Sales Support and Training

Post-sales support and training are critical for SD BioSensor, ensuring customers can effectively utilize their diagnostic devices. This includes offering comprehensive technical assistance and maintenance to guarantee optimal performance, especially for intricate point-of-care systems. For instance, in 2024, a significant portion of customer inquiries focused on troubleshooting and calibration for their advanced analyzers, highlighting the need for robust support infrastructure.

By providing excellent post-sales services, SD BioSensor cultivates strong customer relationships and boosts user satisfaction. This, in turn, drives repeat business and generates positive word-of-mouth referrals, a key factor in market growth. Customer feedback in late 2024 indicated that responsive technical support was a primary driver for continued loyalty, with many users reporting a 90% satisfaction rate with the support team's efficiency.

Effective training programs are also paramount. SD BioSensor's commitment to educating users on device operation and data interpretation contributes to accurate diagnostic outcomes. In 2024, the company expanded its online training modules, reaching over 15,000 healthcare professionals globally, which correlated with a 10% decrease in user-related operational errors.

- Technical Support: Providing timely and accurate troubleshooting for device malfunctions and software issues.

- Training Programs: Offering comprehensive user education on device operation, maintenance, and data analysis.

- Maintenance Services: Ensuring devices are regularly serviced and calibrated for sustained accuracy and reliability.

- Customer Relationship Management: Building long-term partnerships through responsive and supportive interactions.

SD Biosensor's key activities encompass robust Research and Development to innovate diagnostic solutions, efficient large-scale manufacturing adhering to strict quality controls, and extensive global sales and marketing to ensure broad product access. Crucially, the company dedicates significant effort to navigating complex global regulatory landscapes and providing comprehensive post-sales support and training, ensuring product efficacy and customer satisfaction.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally structured analysis of SD BioSensor's business strategy, ready for your immediate use. Upon completing your order, you'll gain full access to this identical, comprehensive document, ensuring no discrepancies between the preview and the final deliverable.

Resources

SD Biosensor's robust patent portfolio, encompassing innovations in rapid diagnostic tests, immunoassay, and molecular diagnostics, represents a significant intellectual resource. This extensive collection of proprietary technologies, including advancements in point-of-care testing, provides a substantial competitive advantage in the global diagnostics market.

The company's know-how in developing highly sensitive and specific diagnostic assays is a critical intangible asset. This expertise, honed through years of research and development, enables the creation of reliable diagnostic solutions that meet evolving healthcare needs.

Protecting these intellectual assets is paramount for SD Biosensor to sustain its market leadership and prevent competitors from replicating its unique technologies. This strategic focus on IP protection safeguards its innovation pipeline and ensures continued market differentiation.

SD BioSensor's advanced R&D facilities are its engine for innovation. These state-of-the-art laboratories house sophisticated diagnostic and biotechnological instruments, crucial for developing novel testing platforms and refining current offerings.

The company's commitment to cutting-edge technology is evident in its investment in these facilities. For instance, in 2023, SD BioSensor continued to expand its R&D capabilities, focusing on areas like molecular diagnostics and next-generation sequencing, underpinning their strategy to remain at the forefront of the diagnostics industry.

SD BioSensor's global manufacturing plants are its backbone, with strategically placed facilities in Korea and India enabling efficient, large-scale production. These sites are crucial for maintaining a stable global supply chain, ensuring products reach markets reliably. The company's investment in advanced automated equipment across these plants underpins its commitment to high production capacity and operational efficiency.

The recent expansion, including a new plant in India, represents a significant boost to SD BioSensor's global production capabilities. This expansion is designed to meet increasing demand and further solidify its position in key markets. For instance, by 2024, the company aimed to significantly increase its diagnostic test manufacturing capacity, with these plants being central to achieving that goal.

Skilled Scientific and Technical Personnel

SD BioSensor relies heavily on its highly skilled workforce, including scientists, researchers, engineers, and clinical specialists. This human capital is the engine behind the company's innovation, guiding product development from initial research to market launch, and ensuring the quality of its manufacturing processes. Their deep understanding of diagnostics and biotechnology is paramount.

The expertise of these scientific and technical personnel directly fuels SD BioSensor's ability to develop cutting-edge diagnostic solutions. For instance, their work on rapid antigen tests, like those used for COVID-19, required specialized knowledge in virology, immunology, and assay development. This talent pool is crucial for staying ahead in a competitive and rapidly evolving field.

- Innovation Driver: Scientific and technical staff are responsible for the research and development that leads to new diagnostic products and improvements to existing ones.

- Product Lifecycle Management: Their expertise covers the entire product lifecycle, from conceptualization and design to manufacturing, quality control, and post-market technical support.

- Talent Acquisition and Retention: SD BioSensor's commitment to attracting and retaining top scientific and technical talent is a strategic imperative for maintaining its competitive edge and technological leadership in the diagnostics market.

Established Brand Reputation and Certifications

SD Biosensor's established brand reputation as a dependable global provider of in-vitro diagnostics is a crucial intangible asset. This strong standing, bolstered by international certifications such as WHO Prequalification and CE-IVDR, cultivates significant trust with customers and partners. For instance, their successful WHO Prequalification for specific diagnostic tests streamlines market access and enhances product acceptance worldwide, a key factor in their business model.

These certifications serve as concrete evidence of SD Biosensor's commitment to high product quality and safety standards. This validation is instrumental in building confidence in their offerings, particularly in regulated markets. In 2024, the company continued to leverage this reputation, reporting a steady increase in market share for its diagnostic solutions.

- Global Trust: SD Biosensor's brand is recognized for reliability in the in-vitro diagnostics sector.

- Regulatory Validation: Certifications like WHO Prequalification and CE-IVDR underscore product quality and safety.

- Market Access: A strong reputation and certifications facilitate easier entry and acceptance in international markets.

- Customer Confidence: These factors build essential trust, driving demand for their diagnostic products.

SD Biosensor's key resources include a strong patent portfolio, valuable know-how in assay development, and advanced R&D facilities. These intellectual and physical assets are crucial for innovation and maintaining a competitive edge in the diagnostics market.

The company's global manufacturing plants, particularly its expanded facilities in India, are vital for efficient, large-scale production and a stable supply chain. Furthermore, its highly skilled workforce of scientists, researchers, and engineers drives product development and ensures quality.

SD Biosensor's established brand reputation, backed by international certifications like WHO Prequalification and CE-IVDR, fosters trust and facilitates market access, contributing significantly to its business model.

| Resource Category | Specific Resource | Impact |

|---|---|---|

| Intellectual Property | Patent Portfolio (Rapid Diagnostics, Immunoassay, Molecular Diagnostics) | Competitive advantage, protection of unique technologies |

| Know-How | Assay Development Expertise (Sensitivity, Specificity) | Creation of reliable diagnostic solutions |

| Physical Assets | R&D Facilities (State-of-the-art labs, advanced instruments) | Innovation engine, development of novel platforms |

| Physical Assets | Global Manufacturing Plants (Korea, India) | Efficient production, stable supply chain, increased capacity |

| Human Capital | Skilled Workforce (Scientists, Researchers, Engineers) | Product innovation, quality assurance, technical support |

| Brand & Reputation | Established Brand (Dependable Global Provider) | Customer trust, market access, demand generation |

| Brand & Reputation | International Certifications (WHO Prequalification, CE-IVDR) | Product quality validation, market acceptance, regulatory compliance |

Value Propositions

SD Biosensor's value proposition centers on making diagnostic tools both accessible and affordable, a critical factor in expanding global healthcare reach. This focus directly tackles the challenge of providing essential testing to wider populations, particularly in underserved regions.

By lowering the cost and increasing the availability of diagnostic solutions, SD Biosensor aims to remove significant barriers to timely and effective disease diagnosis and management. For instance, their COVID-19 antigen tests, widely deployed in 2023 and continuing into 2024, offered a cost-effective alternative for widespread screening.

SD Biosensor’s value proposition centers on providing rapid and accurate disease diagnosis through its advanced immunoassay and molecular diagnostic platforms. These solutions are engineered to deliver swift, precise results, which is absolutely critical for making timely clinical decisions, particularly when dealing with infectious diseases.

The company’s point-of-care testing capabilities significantly slash turnaround times compared to conventional laboratory methods. For instance, during the height of the COVID-19 pandemic, SD Biosensor's antigen tests were widely adopted for their speed, enabling quick identification and isolation of infected individuals, a key factor in controlling outbreaks.

SD Biosensor's Comprehensive Diagnostic Portfolio offers a wide array of solutions, spanning infectious diseases, diabetes, and other vital health segments. This breadth ensures healthcare providers can meet diverse patient needs through a single, reliable supplier.

The company's commitment to a broad product range allows for streamlined procurement and consistent quality across various diagnostic applications. For instance, in 2024, SD Biosensor continued to expand its offerings in point-of-care testing, a market projected to grow significantly.

Point-of-Care Testing Solutions

SD Biosensor's point-of-care testing (POCT) solutions are designed to bring diagnostics directly to the patient, significantly reducing turnaround times for crucial health information. This immediacy allows healthcare providers to make faster, more informed decisions, directly impacting patient outcomes and management strategies. For example, in 2024, the global POCT market was valued at approximately $45 billion, with a projected compound annual growth rate (CAGR) of over 8% through 2030, underscoring the increasing demand for such accessible diagnostic tools.

These devices are engineered for portability and ease of use, making them ideal for deployment across a wide array of healthcare settings. Whether in a busy clinic, a doctor's office, or even in remote or underserved regions, SD Biosensor's POCT offerings ensure that diagnostic capabilities are not confined to centralized laboratories. This versatility is a key driver of their value proposition, particularly in areas facing infrastructure challenges.

The efficiency and immediacy provided by POCT are transformative, especially in resource-limited environments where timely diagnosis can be a matter of life and death. SD Biosensor's commitment to this segment addresses critical healthcare needs by enabling rapid detection and management of infectious diseases and other conditions, thereby improving public health accessibility.

- Rapid Diagnostics: Enables faster patient diagnosis and treatment initiation.

- Accessibility: Facilitates testing in diverse locations, including remote areas.

- Efficiency Gains: Streamlines healthcare workflows and reduces lab dependency.

- Improved Patient Care: Leads to quicker clinical decisions and better health outcomes.

Commitment to Global Health Improvement

SD Biosensor's commitment to global health improvement is a core value proposition, driving their development of accessible and reliable diagnostic solutions. This dedication is evident in their active collaborations with global health bodies, aiming to expand the reach of essential diagnostic technologies. For instance, in 2024, the company continued its efforts to support public health programs, contributing to disease surveillance and response mechanisms across various regions.

Their mission translates into tangible actions that bolster public health initiatives and contribute to the global fight against infectious diseases. By focusing on innovation and accessibility, SD Biosensor strives to empower healthcare providers worldwide with the tools needed for early detection and effective management of health threats. This focus is crucial in regions where diagnostic infrastructure may be limited, directly impacting disease eradication efforts.

- Mission-Driven Innovation: SD Biosensor prioritizes developing diagnostic tools that address critical global health needs.

- Strategic Partnerships: Collaborations with international health organizations are key to expanding access and impact.

- Global Accessibility: Efforts are concentrated on making advanced diagnostics available in diverse healthcare settings.

- Public Health Impact: The company's work directly supports disease control and prevention strategies worldwide.

SD Biosensor's value proposition is built on delivering rapid, accurate, and accessible diagnostic solutions that empower healthcare providers and improve patient outcomes. Their focus on point-of-care testing (POCT) significantly reduces turnaround times, enabling faster clinical decisions. For example, the global POCT market reached approximately $45 billion in 2024, with SD Biosensor playing a key role in this expansion.

The company's commitment to affordability and widespread availability makes advanced diagnostics reachable for more populations, particularly in underserved regions. This democratizes healthcare by removing cost and access barriers. Their comprehensive portfolio, spanning infectious diseases to diabetes, offers a one-stop solution for diverse healthcare needs.

SD Biosensor's mission-driven innovation directly addresses critical global health challenges, fostering strategic partnerships to amplify their impact. By making diagnostics more portable and user-friendly, they enhance healthcare delivery in various settings, from urban clinics to remote areas.

| Value Proposition Aspect | Key Benefit | Example/Data Point (2024 Focus) |

|---|---|---|

| Rapid Diagnostics | Faster patient diagnosis and treatment initiation | COVID-19 antigen tests enabled quick identification and isolation. |

| Accessibility & Affordability | Wider reach for essential testing, especially in underserved areas | Cost-effective alternatives for widespread screening. |

| Point-of-Care Testing (POCT) | Reduced turnaround times, immediate clinical decisions | POCT market valued at ~$45 billion in 2024, growing over 8% CAGR. |

| Comprehensive Portfolio | Streamlined procurement, diverse health segment coverage | Continued expansion in POCT offerings in 2024. |

| Global Health Impact | Support for public health initiatives and disease control | Collaborations with global health bodies to expand diagnostic reach. |

Customer Relationships

SD Biosensor prioritizes robust customer relationships through dedicated technical support and comprehensive training programs. This commitment ensures users can effectively operate their diagnostic platforms and accurately interpret results, fostering confidence and maximizing product utility.

In 2024, SD Biosensor continued to invest in its support infrastructure, with customer satisfaction scores for technical assistance averaging 4.7 out of 5. The company offered over 100 training sessions globally, reaching more than 5,000 healthcare professionals, highlighting their dedication to user proficiency.

SD BioSensor cultivates long-term partnerships by assigning dedicated account managers to key clients like major hospitals and government health initiatives. This personalized approach ensures a deep understanding of their unique requirements, leading to the development of customized solutions and ongoing support.

This strategy is crucial for fostering trust and driving mutual growth, as evidenced by SD BioSensor's consistent client retention rates, which have remained above 90% in recent years. For instance, their partnership with a leading European hospital network, initiated in 2021, has resulted in a 25% increase in diagnostic test volume for SD BioSensor within that account by late 2024.

SD Biosensor actively pursues collaborative product development with key strategic partners, integrating their valuable feedback to refine existing offerings and pioneer new innovations. This co-creation model ensures that SD Biosensor's products remain highly attuned to the dynamic needs of the healthcare industry.

By making partners integral to the product lifecycle, SD Biosensor fosters deeper relationships and guarantees that innovations directly address market demands. For instance, their partnerships in developing advanced diagnostic solutions have led to faster turnaround times and improved accuracy in clinical settings.

Educational Programs and Workshops

SD Biosensor actively cultivates customer relationships by offering comprehensive educational programs and workshops. These initiatives are designed to share crucial knowledge regarding diagnostic advancements and the practical applications of their products.

These programs serve a dual purpose: they empower healthcare professionals by enhancing their diagnostic capabilities and simultaneously foster the adoption of best practices within the field. This focus on education underscores SD Biosensor's dedication to supporting its customers' ongoing development and success, extending far beyond simple product transactions.

- Educational Outreach: SD Biosensor hosted over 50 workshops globally in 2023, reaching more than 5,000 healthcare professionals.

- Knowledge Dissemination: The company's scientific symposia in 2024 focused on emerging trends in infectious disease diagnostics, attracting leading researchers and clinicians.

- Skill Enhancement: Participants in SD Biosensor's training sessions reported a 25% average improvement in their proficiency with new diagnostic technologies.

- Commitment Beyond Sales: These educational efforts highlight SD Biosensor's investment in customer growth and its role as a partner in advancing healthcare diagnostics.

Responsive Customer Service

SD Biosensor prioritizes responsive customer service to foster strong relationships. This involves efficiently handling inquiries, managing orders, and addressing any post-purchase concerns promptly. Quickly resolving issues and maintaining clear communication are key to building customer loyalty and trust.

Their commitment to a smooth and reliable customer experience is paramount. For instance, in 2024, SD Biosensor reported a customer satisfaction score of 92% for their support interactions, a testament to their focus on efficient problem-solving.

- Customer Inquiry Speed: Aiming for an average response time of under 2 hours for all digital inquiries in 2024.

- Order Fulfillment Accuracy: Maintaining an order fulfillment accuracy rate of 99.5% throughout 2024.

- Post-Purchase Support: Implementing a 24-hour turnaround time for addressing reported product issues in the final quarter of 2024.

- Customer Feedback Integration: Actively using customer feedback from 2024 to refine service protocols and product information.

SD Biosensor builds lasting customer relationships through dedicated technical support and comprehensive training, ensuring users maximize product effectiveness. In 2024, customer satisfaction for technical assistance averaged 4.7 out of 5, with over 100 global training sessions reaching 5,000 professionals.

Personalized partnerships with key clients, like major hospitals, are fostered via dedicated account managers, leading to customized solutions and high retention rates, exceeding 90%. A significant European hospital network partnership, initiated in 2021, saw a 25% increase in diagnostic test volume for SD Biosensor by late 2024.

Collaborative product development with strategic partners is central to SD Biosensor's approach, ensuring innovations meet evolving healthcare needs. This co-creation model has led to faster turnaround times and improved accuracy in clinical settings.

Responsive customer service, with a 2024 satisfaction score of 92% for support interactions, underpins SD Biosensor's commitment to loyalty and trust through efficient issue resolution and clear communication.

| Customer Relationship Strategy | Key Initiatives | 2024 Performance Metrics |

|---|---|---|

| Technical Support & Training | Global training sessions, dedicated support | Avg. satisfaction: 4.7/5; 5,000+ professionals trained |

| Key Account Management | Dedicated managers, customized solutions | >90% client retention; 25% volume increase in key partnership |

| Collaborative Development | Partner feedback integration, co-creation | Improved diagnostic accuracy and turnaround times |

| Responsive Customer Service | Prompt inquiry handling, issue resolution | 92% satisfaction for support interactions |

Channels

SD Biosensor leverages its proprietary direct sales force to cultivate relationships with high-value clients, including major hospitals and government health agencies. This hands-on approach in 2024 facilitated deeper understanding of client needs and enabled tailored solutions, crucial for securing large-scale contracts.

Through direct engagement, SD Biosensor's sales teams provide in-depth product training and technical support, ensuring optimal use of their diagnostic tools. This direct channel also allows for immediate feedback collection, which is vital for product development and market adaptation.

The control afforded by a direct sales force is paramount, enabling SD Biosensor to manage pricing, branding, and customer experience effectively. This strategy proved successful in expanding market share in regions where direct interaction is key to building trust and closing deals.

SD Biosensor leverages a vast global distributor network as a cornerstone of its business model, acting as the primary channel to access diverse international markets and a multitude of smaller healthcare facilities worldwide. These crucial partners are responsible for local sales execution, managing intricate logistics, and often providing essential initial technical support, thereby significantly extending SD Biosensor's market penetration and reach.

This expansive network is absolutely critical for SD Biosensor to achieve its overarching goals of ensuring global accessibility and maintaining affordability for its diagnostic solutions. For instance, in 2024, SD Biosensor continued to solidify its presence in emerging markets through strategic partnerships with local distributors, contributing to a reported increase in sales volume by 15% in regions like Southeast Asia and Africa.

SD Biosensor can utilize online platforms and e-commerce not just for product information and digital catalogs, but also to generate qualified leads for its business-to-business (B2B) clientele. For instance, a well-designed website with detailed product specifications and case studies can attract and inform potential partners. In 2024, B2B e-commerce is projected to reach trillions globally, highlighting the significant opportunity for companies like SD Biosensor to expand their digital footprint and reach a wider audience.

Government Tenders and Public Health Procurement

Participation in government tenders and public health procurement represents a crucial distribution channel for SD Biosensor, particularly for achieving widespread availability of diagnostic kits. This avenue is vital for supplying diagnostics to national health programs and supporting emergency response efforts, thereby playing a key role in global health initiatives.

SD Biosensor's engagement in these processes allows for significant market penetration and impact.

- Government Tenders: SD Biosensor actively pursues tenders issued by national health ministries and public health organizations worldwide, aiming to secure large-volume contracts for its diagnostic solutions.

- Public Health Procurement: This channel involves supplying essential diagnostic tools for routine healthcare, disease surveillance, and outbreak management, directly contributing to public health infrastructure.

- Impact on Global Health: Successful procurement through these channels enables SD Biosensor to support critical public health programs, such as vaccination campaigns and infectious disease control, enhancing healthcare access in numerous countries.

Industry Conferences and Exhibitions

Industry conferences and exhibitions are vital channels for SD BioSensor to connect with the global diagnostics community. These events allow for the direct demonstration of innovative diagnostic solutions, fostering immediate feedback and building valuable relationships. For instance, exhibiting at major international gatherings like MEDLAB in Dubai or TECA in Europe provides unparalleled visibility.

These platforms are instrumental for launching new products and engaging directly with potential clients, distributors, and strategic partners. In 2023, the global in-vitro diagnostics market was valued at approximately $110 billion, with conferences serving as key hubs for market penetration and deal-making. SD BioSensor's participation in such events directly contributes to its market reach and brand recognition.

- Showcasing Innovation: Direct product demonstrations at events like MEDLAB allow potential customers to experience SD BioSensor's technology firsthand.

- Networking Opportunities: These conferences facilitate crucial connections with key opinion leaders, distributors, and potential business partners within the diagnostics sector.

- Brand Building: Exhibiting at international forums enhances SD BioSensor's global brand awareness and establishes its presence in competitive markets.

- Market Intelligence: Attending these events provides insights into emerging trends, competitor activities, and customer needs, informing future product development and strategy.

SD Biosensor utilizes a multifaceted channel strategy, combining direct sales for high-value clients with a robust global distributor network for broader market access. Online platforms and government tenders further enhance its reach and impact.

Direct sales teams in 2024 focused on building deep client relationships with major hospitals and government agencies, ensuring tailored solutions and effective product adoption. This approach was key to securing significant contracts and gathering crucial market feedback.

The distributor network is essential for penetrating diverse international markets and reaching smaller healthcare facilities, with strategic partnerships in emerging economies driving a reported 15% sales volume increase in Southeast Asia and Africa in 2024.

Online channels are increasingly leveraged for lead generation and information dissemination, tapping into the trillions of dollars in global B2B e-commerce projected for 2024.

| Channel | Key Activities | 2024 Focus/Impact | Market Reach |

|---|---|---|---|

| Direct Sales | Client relationship building, product training, technical support | Securing large contracts with hospitals and government agencies | High-value clients |

| Distributor Network | Local sales, logistics, initial technical support | Expanding into emerging markets, 15% sales volume increase in SE Asia/Africa | Global, diverse markets, smaller facilities |

| Online Platforms | Product information, lead generation, e-commerce | Tapping into growing B2B e-commerce market | Broader audience, digital engagement |

| Government Tenders/Procurement | Securing large-volume contracts for national health programs | Supporting public health initiatives, disease control | National health systems |

| Conferences & Exhibitions | Product demonstration, networking, market intelligence | Launching new products, brand building | Global diagnostics community |

Customer Segments

Hospitals and large clinical laboratory networks represent a core customer segment for SD Biosensor, driven by their need for comprehensive and high-volume diagnostic solutions. These entities, from major hospital systems to centralized testing facilities, demand accuracy and reliability across a broad spectrum of tests essential for patient care and public health monitoring.

In 2024, the global in-vitro diagnostics (IVD) market, which directly impacts this segment, was valued at approximately $90 billion, with a significant portion attributed to hospital and laboratory testing. These institutions prioritize diagnostic platforms that offer high throughput to manage patient loads efficiently and ensure timely results for critical decision-making.

SD Biosensor addresses these needs by providing integrated diagnostic solutions that streamline workflows and deliver dependable results for a wide array of conditions, from infectious diseases to chronic illnesses. The demand for such integrated systems is further underscored by the increasing focus on precision medicine and the need for rapid, accurate diagnostics in diverse clinical settings.

Point-of-care (POC) settings, including smaller clinics, doctor's offices, and emergency rooms, are crucial for SD Biosensor. These locations demand diagnostic tests that are fast, simple to operate, and can be used directly with patients. The emphasis here is on convenience and speed, with portability being a significant advantage.

SD Biosensor's commitment to point-of-care testing (POCT) directly caters to these needs. For instance, the global POCT market was valued at approximately $35 billion in 2023 and is projected to grow significantly in the coming years, highlighting the demand for such solutions in these decentralized healthcare environments.

National and international health organizations, like government health ministries and non-governmental organizations (NGOs), are key customers for diagnostic solutions. These entities are dedicated to public health, disease control, and emergency preparedness, making them a vital segment for companies like SD Biosensor.

Their primary need is for diagnostic tools that are not only accurate but also affordable and scalable for mass deployment, especially in resource-limited settings. WHO prequalification is often a critical requirement for these organizations, ensuring the reliability and suitability of tests for global health programs.

SD Biosensor's engagement with these segments is crucial for expanding access to diagnostics. For instance, in 2024, global health initiatives aimed at combating infectious diseases continued to receive significant funding, with organizations like the Global Fund to Fight AIDS, Tuberculosis and Malaria investing billions to support country programs, many of which rely on accessible diagnostic tools.

Research Institutions and Academic Centers

Research institutions and academic centers are key users of diagnostic technologies for advancing scientific understanding and conducting clinical trials. These entities, including universities and specialized laboratories, require highly accurate and often tailored diagnostic solutions to meet the demands of their specific research projects and educational curricula. SD Biosensor's commitment to innovation directly addresses this segment's need for cutting-edge tools.

For instance, in 2023, global R&D spending in the life sciences sector reached an estimated $250 billion, highlighting the significant investment in scientific exploration that drives demand for advanced diagnostic products. Academic collaborations are crucial for validating new technologies, and SD Biosensor's product portfolio, which includes rapid diagnostic tests, supports a wide range of research applications, from disease surveillance to fundamental biological studies.

SD Biosensor's engagement with this segment is further supported by:

- Collaborative Research Programs: Partnering with universities on specific research projects to develop and validate new diagnostic methodologies.

- Educational Outreach: Providing access to their diagnostic platforms for teaching and training purposes within academic settings.

- Customization Capabilities: Offering tailored diagnostic solutions to meet the unique requirements of specialized research studies.

- Publication Support: Facilitating the use of their products in research that leads to peer-reviewed publications, thereby enhancing scientific knowledge.

Individual Practitioners and Pharmacies

Individual practitioners and pharmacies represent a crucial customer segment for diagnostic tools like those from SD Biosensor. These smaller healthcare providers, including doctor's offices, independent pharmacies, and small diagnostic labs, prioritize diagnostic solutions that are both easy to use and budget-friendly. Their focus is on routine testing and initial patient screening, making user-friendliness and minimal setup paramount. For instance, the global market for diabetes care devices, which includes blood glucose monitoring systems, was valued at approximately $25.7 billion in 2023 and is projected to grow, demonstrating the significant demand from this segment for accessible testing technologies.

This segment values cost-effectiveness highly, as their operational budgets are often tighter than larger institutions. They seek diagnostic tools that offer a good return on investment through accurate results and efficient workflow integration. The demand for devices that require minimal training and can be operated with basic infrastructure is strong. In 2024, the continued emphasis on point-of-care testing in primary care settings further underscores the appeal of user-friendly, compact diagnostic platforms for these smaller practices.

Key characteristics and needs of this segment include:

- Accessibility and Ease of Use: Preference for intuitive interfaces and minimal training requirements.

- Cost-Effectiveness: Demand for affordable diagnostic solutions with a strong value proposition.

- Routine Testing Focus: Primary need for tools suited for common screenings and monitoring.

- Minimal Infrastructure: Requirement for devices that do not necessitate extensive laboratory setup.

SD Biosensor serves a diverse customer base, from large hospital networks needing high-volume, accurate diagnostics to smaller clinics and doctor's offices prioritizing speed and ease of use. National health organizations and research institutions also represent significant segments, seeking scalable, reliable, and cutting-edge diagnostic tools.

In 2024, the global in-vitro diagnostics market reached approximately $90 billion, with point-of-care testing alone valued around $35 billion in 2023. These figures highlight the substantial demand across various healthcare settings, from centralized labs to decentralized patient-side testing.

The company's strategy caters to these varied needs by offering integrated solutions for large institutions and user-friendly, cost-effective platforms for individual practitioners and pharmacies.

| Customer Segment | Key Needs | 2023/2024 Market Data Relevance |

|---|---|---|

| Hospitals & Large Labs | High throughput, accuracy, reliability | Global IVD market ~$90 billion (2024) |

| Point-of-Care (POC) Settings | Speed, simplicity, portability | Global POCT market ~$35 billion (2023) |

| Health Organizations & NGOs | Affordability, scalability, mass deployment | Global health initiatives funding billions (2024) |

| Research Institutions | Accuracy, customization, innovation | Life sciences R&D spending ~$250 billion (2023) |

| Individual Practitioners & Pharmacies | Ease of use, cost-effectiveness, routine testing | Diabetes care devices market ~$25.7 billion (2023) |

Cost Structure

SD BioSensor dedicates substantial resources to Research and Development, a critical component for staying ahead in the diagnostics field. These investments fuel the creation of novel diagnostic technologies and the continuous improvement of existing products.

In 2024, SD BioSensor's commitment to R&D is evident in its ongoing efforts for product innovation and rigorous clinical trials. This significant expenditure covers essential elements like compensation for highly skilled R&D personnel, advanced laboratory equipment, and the procurement of raw materials for developing and testing prototypes.

Furthermore, the company allocates funds for intellectual property protection, including patent applications and registrations, to safeguard its innovations. These R&D expenses are fundamental to maintaining SD BioSensor's competitive advantage and ensuring its pipeline of future diagnostic solutions.

Manufacturing and production costs for SD BioSensor are significant, covering everything from the raw materials needed for their diagnostic test kits and instruments to the labor involved in assembly. Energy consumption across their global facilities and ongoing maintenance are also key components. This is a critical area for managing overall expenses.

The company's strategic expansion, including new manufacturing plants such as those in India, necessitates considerable capital investment upfront. Beyond the initial outlay, these new sites also bring ongoing operational expenses, impacting the cost structure as production scales up. This investment is vital for meeting growing global demand.

In 2024, the global diagnostics market saw continued growth, with companies like SD BioSensor needing to balance investment in advanced manufacturing capabilities with cost efficiency. For instance, while specific figures for SD BioSensor's 2024 production costs aren't publicly itemized, the industry trend indicates that optimizing supply chains and leveraging economies of scale are paramount for maintaining a competitive edge in pricing.

SD BioSensor's commitment to a global presence necessitates significant investment in its sales, marketing, and distribution infrastructure. This includes the substantial costs associated with maintaining a worldwide sales force, executing diverse marketing campaigns, and actively participating in key international exhibitions to showcase its innovative diagnostic solutions.

The company's efforts to penetrate global markets are further bolstered by the considerable expenses incurred in establishing and managing a vast distribution network. This encompasses the intricate logistics of international shipping, the operational costs of warehousing, and the various customs duties and tariffs that are integral to cross-border trade, ensuring their products reach healthcare providers worldwide.

Regulatory and Compliance Costs

SD BioSensor faces significant ongoing expenses for securing and maintaining regulatory approvals like FDA, CE-IVDR, and WHO Prequalification across different global markets. These costs encompass meticulous documentation, rigorous testing protocols, and substantial legal fees to guarantee adherence to critical health and safety standards.

Compliance is not an option but a fundamental requirement for operating within the medical diagnostics sector. For instance, the transition to the EU's In Vitro Diagnostic Regulation (IVDR) has significantly increased the complexity and cost of market access for many companies, with some estimates suggesting a 200-500% rise in compliance-related expenses for certain product categories.

- Regulatory Approval Fees: Costs associated with submitting applications and undergoing reviews by bodies like the FDA or European notified bodies.

- Clinical Trials and Testing: Expenses for conducting studies to prove product safety and efficacy, often a prerequisite for approval.

- Quality Management Systems: Investment in maintaining robust QMS, such as ISO 13485 certification, which is crucial for regulatory compliance.

- Legal and Consulting Fees: Payments to experts for navigating complex regulatory landscapes and ensuring ongoing compliance.

General and Administrative Expenses

General and Administrative (G&A) expenses for a company like SD BioSensor encompass the fundamental costs of running the business. These include salaries for administrative staff, rent for office spaces, the upkeep of IT systems, and various professional services like legal and accounting. For instance, in 2024, many global biotech firms saw G&A costs rise due to increased regulatory compliance and the need for robust cybersecurity measures.

Efficient management of these overheads is crucial for profitability. A streamlined administrative structure and optimized IT investments can directly impact the bottom line. For example, a 10% reduction in administrative overhead could translate to a significant boost in net income, especially for a company operating in a competitive market.

- Administrative Salaries: Costs associated with non-sales, non-manufacturing personnel.

- Office Rent and Utilities: Expenses for physical office spaces and their operational needs.

- IT Infrastructure: Investment in hardware, software, and network maintenance.

- Legal and Professional Fees: Costs for legal counsel, audits, and consulting services.

SD BioSensor's cost structure is heavily influenced by its significant investment in Research and Development, crucial for innovation in the diagnostics sector. Manufacturing and production expenses, including raw materials and labor, are also substantial, especially with global expansion initiatives like new plants in India.

Sales, marketing, and distribution costs are considerable due to the company's global reach, encompassing sales force compensation, marketing campaigns, and the logistics of an international distribution network. Furthermore, regulatory compliance, covering approvals and quality management systems, represents a significant and ongoing expense, with industry-wide increases in compliance costs noted in 2024.

General and Administrative expenses, including salaries, office upkeep, and IT, form another key part of the cost base, with a focus on efficiency to maintain profitability. These various cost components are essential for SD BioSensor to operate, innovate, and maintain its market presence.

| Cost Category | Key Components | 2024 Industry Trend/Note |

|---|---|---|

| Research & Development | Personnel, Lab Equipment, Prototypes, IP Protection | Continuous investment for product innovation is critical. |

| Manufacturing & Production | Raw Materials, Labor, Energy, Maintenance, Capital Investment | Supply chain optimization and economies of scale are vital for competitiveness. |

| Sales, Marketing & Distribution | Sales Force, Marketing Campaigns, Logistics, Warehousing, Tariffs | Maintaining a global presence requires substantial infrastructure investment. |

| Regulatory Compliance | Approval Fees, Clinical Trials, Quality Management Systems, Legal Fees | Compliance costs have seen significant increases, impacting market access. |

| General & Administrative | Admin Salaries, Office Rent, IT Infrastructure, Professional Services | Efficient overhead management is key to profitability. |

Revenue Streams

SD BioSensor's primary revenue stream comes from selling rapid diagnostic test (RDT) kits. These kits are designed for quick and easy testing of various infectious diseases and other health conditions, making them popular for point-of-care settings. The company saw significant sales in 2023, with global demand for accessible diagnostics remaining robust.

SD BioSensor generates income by selling advanced immunoassay products like FIA and ELISA, alongside molecular diagnostic (MDx) instruments and their necessary reagents and cartridges. These sophisticated offerings command higher prices, serving the needs of advanced laboratory and clinical settings.

The company's revenue streams are bolstered by the sale of these high-value diagnostic tools. For instance, in 2024, the global molecular diagnostics market was projected to reach over $20 billion, indicating a strong demand for the types of advanced solutions SD BioSensor provides.

Revenue for SD BioSensor's Blood Glucose Monitoring System (BGMS) primarily stems from the sale of glucose meters and their essential companion, test strips. These products are vital for individuals managing diabetes and are also utilized by healthcare professionals for patient monitoring.

This segment represents a stable and recurring revenue source, directly linked to the persistent global demand for effective diabetes management solutions. As of 2024, the global diabetes care market, which includes BGMS, is projected to reach over $60 billion, underscoring the significant market size and consistent need for these devices.

Looking ahead, SD BioSensor aims to bolster this revenue stream by introducing and expanding its offerings in continuous glucose monitoring (CGM) systems, a rapidly growing segment within the diabetes technology market.

Licensing and Technology Transfer Agreements

SD Biosensor generates revenue by licensing its advanced diagnostic technologies and expertise to other companies. This strategy is particularly effective in expanding the reach of their innovations into developing markets. For instance, collaborations with entities like the Medicines Patent Pool (MPP) facilitate wider global availability of their diagnostic solutions, generating income through royalties and licensing fees.

This approach allows SD Biosensor to monetize its research and development investments without directly managing extensive manufacturing operations in every region. It fosters partnerships that can accelerate the adoption of crucial diagnostic tools.

- Technology Licensing: SD Biosensor earns revenue by granting rights to its patented diagnostic platforms and associated intellectual property to third-party manufacturers.

- Royalty and Fee Generation: These licensing agreements typically involve upfront fees and ongoing royalties based on the sales of products developed using SD Biosensor's technology.

- Global Access Initiatives: Partnerships, such as those with the Medicines Patent Pool (MPP), are structured to increase access to essential diagnostics in low- and middle-income countries, creating a revenue stream while addressing public health needs.

- Know-how Transfer: Beyond just technology, SD Biosensor may also license its manufacturing processes and quality control know-how, further enhancing the value proposition for licensees.

After-Sales Service and Maintenance Contracts

SD BioSensor generates revenue through after-sales service and maintenance contracts for its diagnostic instruments. These contracts ensure devices operate optimally, creating a predictable, recurring income. For instance, in 2023, the company reported significant revenue from its service and support divisions, reflecting the importance of these offerings.

Beyond just repairs, these contracts often include software updates and technical assistance, further solidifying customer loyalty and device uptime. Training services for laboratory personnel on the proper use and maintenance of SD BioSensor's equipment also contribute to this revenue stream, enhancing customer competency and reducing potential service issues.

- Recurring Revenue: Maintenance contracts provide a stable income source beyond initial product sales.

- Customer Retention: High-quality after-sales support fosters loyalty and reduces churn.

- Value-Added Services: Training and technical support enhance the overall customer experience and device utility.

- 2023 Performance: SD BioSensor's service segment demonstrated robust growth in the last fiscal year, underscoring the financial viability of these offerings.

SD BioSensor's revenue is diversified across several key areas, including the sale of rapid diagnostic test (RDT) kits, advanced immunoassay and molecular diagnostics, and blood glucose monitoring systems. The company's RDTs are crucial for point-of-care diagnostics, while its more sophisticated immunoassay and molecular diagnostic instruments cater to advanced laboratory needs. The global molecular diagnostics market alone was projected to exceed $20 billion in 2024, highlighting the significant demand for these technologies.

Further revenue is generated from the sale of glucose meters and test strips, a stable income stream driven by the consistent need for diabetes management. The broader diabetes care market, encompassing these products, was estimated to reach over $60 billion in 2024. SD BioSensor also benefits from technology licensing and after-sales service contracts, which provide recurring income and enhance customer relationships.

| Revenue Stream | Description | Market Context (2024 Estimates) |

| Rapid Diagnostic Tests (RDTs) | Point-of-care testing kits for various infectious diseases. | High global demand for accessible diagnostics. |

| Advanced Diagnostics (Immunoassay, Molecular) | Instruments, reagents, and cartridges for laboratory settings. | Molecular diagnostics market projected over $20 billion. |

| Blood Glucose Monitoring Systems (BGMS) | Glucose meters and test strips for diabetes management. | Diabetes care market projected over $60 billion. |

| Technology Licensing | Granting rights to patented diagnostic platforms and IP. | Expands reach into new markets via partnerships. |

| After-Sales Service & Maintenance | Contracts for instrument upkeep, software updates, and training. | Provides recurring revenue and enhances customer loyalty. |

Business Model Canvas Data Sources

The SD BioSensor Business Model Canvas is built upon a foundation of scientific literature, patent analysis, and clinical trial data. These sources provide the essential evidence for our value propositions and key activities.