Saudi Investment Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Saudi Investment Bank Bundle

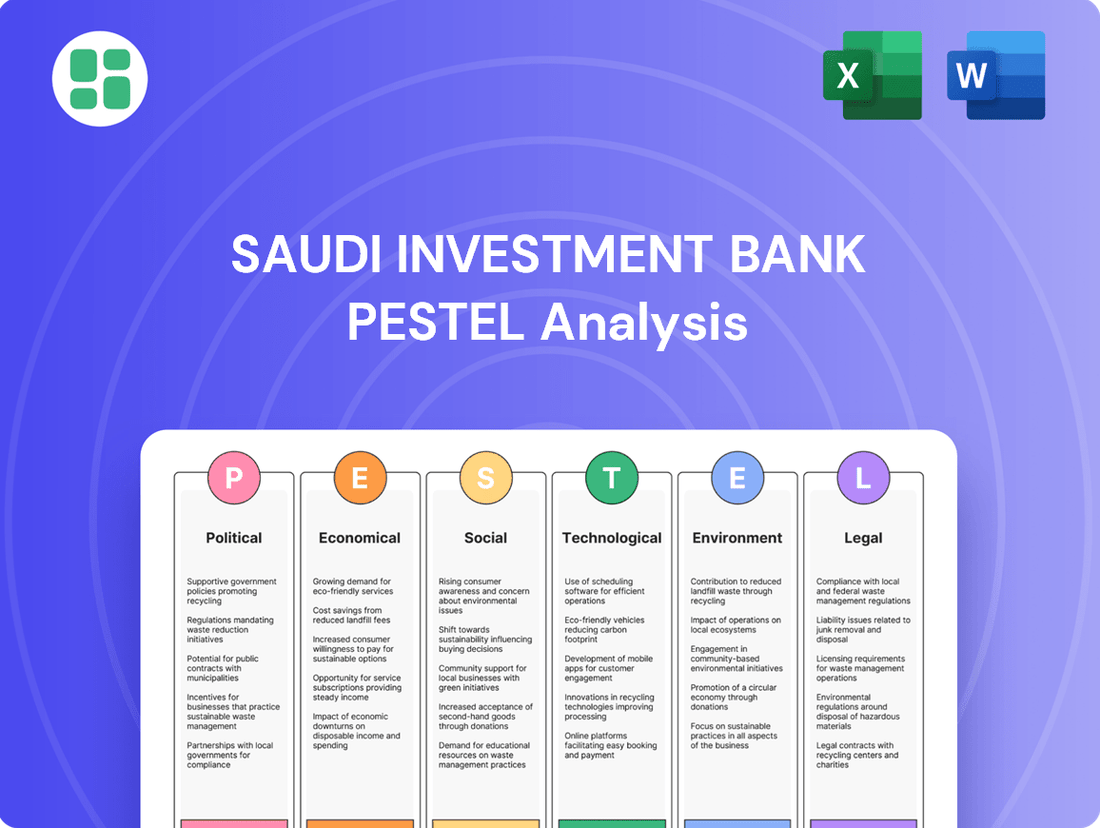

Navigate the dynamic landscape impacting Saudi Investment Bank with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors shaping its trajectory. Gain a strategic advantage by understanding these external forces. Download the full PESTLE analysis for actionable intelligence and informed decision-making.

Political factors

The Saudi government's Vision 2030 is a major political driver for the Saudi Investment Bank (SAIB). This ambitious plan aims to diversify the economy away from oil, spurring massive investments in sectors like tourism, entertainment, and technology. These initiatives create substantial new lending and investment opportunities for banks like SAIB, pushing them to align their strategies with national development priorities.

Specifically, the Financial Sector Development Program (FSDP), a key component of Vision 2030, is designed to foster a more robust and varied financial landscape. By 2025, the FSDP aims to increase the financial sector's contribution to GDP by 10%, directly impacting SAIB's operating environment and growth prospects. This program encourages innovation and competition, supporting SAIB's efforts to expand its services and market reach.

The Saudi Central Bank (SAMA) is pivotal in ensuring Saudi Arabia's financial stability and overseeing its banking sector. Saudi Investment Bank (SAIB) operates under SAMA's watchful eye, meaning SAMA's decisions on interest rates, liquidity, and capital requirements directly influence SAIB's financial performance and how it manages risks.

SAMA's recent initiatives, such as the Open Banking Framework and updated regulations for credit cards and digital payments, are significantly reshaping the operational environment and competitive dynamics for SAIB. For instance, SAMA's push for digital transformation through these frameworks encourages banks like SAIB to invest in new technologies and adapt their service offerings.

Saudi Arabia's commitment to Vision 2030 underscores its focus on geopolitical stability, a key driver for attracting foreign direct investment. This stability directly bolsters business confidence, creating a favorable environment for the Saudi Investment Bank (SAIB) and its expansion plans. For instance, the Kingdom's proactive role in regional diplomacy aims to mitigate potential conflicts that could disrupt economic flows.

Anti-Corruption and Governance Reforms

Saudi Arabia's Vision 2030 heavily emphasizes anti-corruption and governance improvements, creating a more transparent and accountable business landscape. This focus directly impacts financial institutions like SAIB, requiring robust compliance frameworks and a commitment to ethical operations. For instance, the Public Investment Fund (PIF) has been actively divesting from or restructuring entities with governance concerns, signaling a clear governmental directive for improved standards across the economy. This drive fosters greater investor confidence, as demonstrated by the continued inflow of foreign direct investment into the Kingdom, which reached SAR 32.2 billion in Q1 2024, up from SAR 11.4 billion in Q1 2023, according to the General Authority for Statistics.

These reforms translate into stricter regulatory oversight for SAIB, necessitating enhanced internal controls and a proactive approach to risk management. The Saudi Central Bank (SAMA) has consistently updated its prudential regulations and guidelines throughout 2024, reinforcing capital adequacy and operational resilience requirements for all banks. This commitment to good governance not only mitigates operational risks but also strengthens SAIB's reputation, making it a more attractive proposition for both local and international capital.

- Enhanced Transparency: Government initiatives are pushing for greater disclosure and accountability in financial dealings.

- Stricter Compliance: SAIB must adhere to evolving regulations and robust anti-corruption measures.

- Improved Investor Confidence: Reforms are designed to create a more stable and trustworthy environment, attracting foreign investment.

Public-Private Partnerships and Investment Funds

Saudi Arabia's strategic focus on public-private partnerships (PPPs) presents a significant growth avenue for the Saudi Investment Bank (SAIB). The government's commitment to these collaborations, particularly in major infrastructure and development projects, directly translates into increased demand for banking services. For instance, the Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is a key driver of these mega-projects, with its assets under management reaching an estimated $925 billion by the end of 2023, signaling substantial capital deployment opportunities.

SAIB is well-positioned to capitalize on this trend by providing crucial financing for these large-scale initiatives. This will likely boost corporate lending and project finance portfolios. The bank's involvement in funding projects aligned with Vision 2030, such as NEOM and the Red Sea Project, underscores its role in national economic development and offers a clear path for revenue expansion through these strategic partnerships.

- Government Drive for PPPs: Saudi Arabia actively promotes PPPs to leverage private sector expertise and capital for national development.

- PIF's Investment Power: The Public Investment Fund, with over $925 billion in assets as of late 2023, is a primary financier of mega-projects, creating significant opportunities for banks.

- Increased Corporate Lending: SAIB can expect a surge in demand for corporate lending and project finance as these large-scale projects progress.

- Vision 2030 Alignment: The bank's participation in these projects directly supports Saudi Arabia's Vision 2030 goals, fostering a symbiotic relationship between financial institutions and national objectives.

The Saudi government's commitment to Vision 2030 continues to shape the regulatory landscape, emphasizing economic diversification and financial sector development. This creates a dynamic environment for SAIB, requiring constant adaptation to new policies and strategic alignment with national goals. Recent governmental directives in 2024 have focused on enhancing digital infrastructure and promoting fintech innovation, directly impacting how SAIB operates and competes.

The Saudi Central Bank (SAMA) plays a crucial role in implementing these Vision 2030 objectives, with ongoing updates to banking regulations and capital requirements throughout 2024. These adjustments ensure SAIB maintains robust financial health and operational resilience, fostering a stable environment for both domestic and international investment. For example, SAMA's continued focus on cybersecurity and data protection frameworks in 2024 necessitates significant investment in IT infrastructure for SAIB.

Governmental support for public-private partnerships (PPPs) is a significant political factor, driving large-scale infrastructure and development projects. SAIB is positioned to finance these initiatives, with the Public Investment Fund (PIF) actively deploying capital, estimated to reach $1 trillion by 2025, creating substantial opportunities for corporate lending and project finance. This aligns SAIB's growth with Saudi Arabia's national development agenda.

| Political Factor | Impact on SAIB | Supporting Data/Initiative |

| Vision 2030 Diversification | New lending and investment opportunities in non-oil sectors. | Government investment in tourism, entertainment, and technology. |

| Financial Sector Development Program (FSDP) | Increased competition and need for innovation. | Aim to increase financial sector's contribution to GDP by 10% by 2025. |

| Saudi Central Bank (SAMA) Regulation | Direct influence on interest rates, liquidity, and capital requirements. | Ongoing updates to prudential regulations and digital payment frameworks in 2024. |

| Public-Private Partnerships (PPPs) | Growth opportunities in project finance and corporate lending. | PIF assets projected to reach $1 trillion by 2025, funding mega-projects. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Saudi Investment Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential impacts on the bank's operations and future growth.

A PESTLE analysis for Saudi Investment Bank acts as a pain point reliever by clearly identifying and categorizing external factors like political stability, economic trends, and technological advancements that could impact operations, allowing for proactive strategy development and risk mitigation.

Economic factors

Despite Saudi Arabia's Vision 2030 efforts to diversify, oil prices remain a critical factor for government revenue and economic expansion. In 2024, Brent crude oil prices have shown fluctuations, impacting the predictability of government spending on major infrastructure initiatives and consumer sentiment. These shifts can indirectly influence the Saudi Investment Bank's (SAIB) loan origination and the health of its loan portfolio.

The ongoing economic diversification is a significant tailwind for SAIB. Projections for 2024-2025 indicate robust growth in non-oil sectors like tourism, technology, and manufacturing. This expansion is expected to create new lending opportunities and improve asset quality for SAIB as the economy becomes less reliant on hydrocarbon revenues.

The Saudi Central Bank (SAMA) plays a crucial role in shaping the interest rate environment, often mirroring global monetary policy shifts. For Saudi Investment Bank (SAIB), these policies directly influence its net interest margin and overall profitability. As of early 2025, expectations lean towards potential interest rate adjustments, which could stimulate lending activity.

Should interest rates decline in 2025, SAIB might see an uplift in business loan demand as borrowing costs decrease. This could also ease the debt burden for households, potentially leading to increased consumer spending and further lending opportunities. However, a lower rate environment necessitates careful management of deposit strategies to maintain funding costs.

Saudi Arabia's economy is poised for robust GDP growth, with projections indicating a significant expansion driven by the ambitious Vision 2030 initiatives. This economic surge is particularly notable in the non-oil sectors, creating a highly favorable landscape for institutions like Saudi Investment Bank (SAIB).

The Kingdom's strategic push towards diversification is fueling substantial activity in construction, tourism, and various service industries. For SAIB, this translates into increased demand for a wide array of banking services, from corporate lending to support large-scale projects and consumer finance for a growing population. This diversification also inherently lessens the banking sector's vulnerability to fluctuations in global oil prices.

For instance, Saudi Arabia's non-oil GDP growth was estimated to be around 4.5% in 2024, a strong indicator of the success of economic diversification efforts. This expansion directly benefits banks by creating new avenues for lending, investment, and fee-based income, supporting SAIB's strategic objectives.

Consumer Spending and Household Debt

Consumer spending in Saudi Arabia has shown robust growth, largely supported by a young and expanding population, alongside increasing disposable incomes. This trend directly benefits Saudi Investment Bank (SAIB) by boosting demand for its retail banking products, including personal loans, auto financing, and credit cards. For instance, Saudi Arabia's GDP per capita reached approximately $30,000 in 2024, a significant increase that translates to greater purchasing power for households.

While this rising consumer demand is a positive driver for SAIB's growth in consumer finance, it also necessitates careful management of escalating household debt levels. The Saudi Central Bank (SAMA) has been monitoring these trends, with household debt as a percentage of GDP remaining a key indicator. SAIB must balance offering accessible credit with prudent risk management to navigate potential economic headwinds.

The Kingdom's strategic push towards digital transformation and financial inclusion is also profoundly reshaping consumer banking. SAIB is actively investing in digital platforms and mobile banking solutions to cater to evolving consumer preferences for seamless, online financial services. This focus aligns with national objectives to increase the proportion of digital transactions, with e-commerce sales in Saudi Arabia projected to grow by over 15% annually through 2025, creating new avenues for customer engagement and product delivery.

- Rising Consumer Demand: Saudi Arabia's expanding workforce and increasing disposable income, evidenced by a rising GDP per capita, fuel demand for retail banking products.

- Household Debt Management: SAIB must proactively manage the growth in household debt, a key metric monitored by the Saudi Central Bank, while capitalizing on consumer finance opportunities.

- Digital Transformation: The shift towards digital payments and financial inclusion, supported by strong e-commerce growth projections, presents significant opportunities for SAIB to enhance its digital offerings and customer reach.

Inflationary Pressures and Cost of Living

Inflationary pressures directly impact consumer purchasing power, potentially reducing demand for loans from Saudi Investment Bank (SAIB). Simultaneously, rising costs can increase operational expenses for businesses, affecting their ability to repay existing loans and increasing default risk for SAIB.

While inflation in Saudi Arabia was projected to remain relatively contained, persistent global supply chain issues and energy price volatility could exert upward pressure. For instance, Saudi Arabia's inflation rate was 1.6% in 2023, and projections for 2024 and 2025 generally hover around the 2-3% mark, though these figures are subject to change based on global economic conditions.

These persistent pressures could influence the Saudi Central Bank's (SAMA) monetary policy, potentially leading to interest rate hikes. Such hikes would increase the cost of borrowing for consumers and businesses, further challenging their capacity to service debt and impacting SAIB's loan portfolio quality.

Monitoring these economic factors is therefore critical for SAIB's risk management framework and its strategic planning processes to navigate potential shifts in market conditions and consumer financial health.

Saudi Arabia's economic growth is a primary driver for the banking sector. Projections for 2024 and 2025 indicate continued expansion, particularly in non-oil sectors, creating a favorable environment for lending and investment. This diversification strategy, central to Vision 2030, is expected to bolster GDP growth and enhance financial stability.

The Kingdom's commitment to economic diversification is evident in its non-oil GDP growth, which was estimated at approximately 4.5% in 2024. This expansion directly translates to increased demand for banking services, supporting Saudi Investment Bank's (SAIB) strategic growth objectives and reducing its reliance on oil price volatility.

Consumer spending, bolstered by a young population and rising disposable incomes, presents significant opportunities for SAIB's retail banking operations. With GDP per capita reaching around $30,000 in 2024, increased purchasing power fuels demand for personal loans, auto financing, and other consumer credit products.

| Economic Factor | 2024 Projection/Estimate | Impact on SAIB |

| Non-Oil GDP Growth | ~4.5% | Increased lending opportunities, improved asset quality |

| GDP Per Capita | ~$30,000 | Higher demand for retail banking products |

| E-commerce Growth | >15% annually | Enhanced digital banking engagement and customer reach |

Full Version Awaits

Saudi Investment Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Saudi Investment Bank covers political, economic, social, technological, legal, and environmental factors impacting its operations and strategic outlook. Gain actionable insights into the forces shaping the Saudi financial sector.

Sociological factors

Saudi Arabia boasts a substantial and expanding youth demographic, with approximately 60% of its population under the age of 30 as of early 2024. This tech-native generation is a prime target for digital banking and tailored consumer finance offerings. Saudi Investment Bank (SAIB) must adapt its digital channels and product suite to cater to the preferences of these younger customers, emphasizing mobile-first solutions and personalized financial advice.

The increasing youth population directly fuels a growing labor force and drives up consumer demand across various sectors. This demographic shift presents a significant opportunity for SAIB to expand its customer base and product penetration, particularly in areas like digital payments, investment products for young professionals, and accessible lending solutions.

Saudi Arabia boasts remarkable digital connectivity, with internet penetration reaching approximately 97% by early 2024, and smartphone ownership exceeding 90%. This high adoption fuels a swift transition in consumer behavior, with a growing preference for digital banking services.

Customers are increasingly utilizing online and mobile platforms for a wide array of banking needs, from routine transactions and account management to more complex processes like loan applications. This trend underscores the necessity for financial institutions like SAIB to prioritize and continuously innovate their digital offerings.

To remain competitive and capture market share, SAIB must focus on enhancing its digital platforms, ensuring a seamless and intuitive user experience. This includes investing in user-friendly interfaces, robust security measures, and a comprehensive suite of digital services that cater to evolving customer expectations.

Saudi Arabia is actively promoting financial literacy and inclusion, with initiatives like the National Financial Literacy Strategy aiming to boost the financial knowledge of citizens. This creates a fertile ground for SAIB to engage new customers, especially in regions previously underserved by financial services. By simplifying product offerings and digital access, SAIB can tap into this growing demand.

The Saudi Central Bank (SAMA) has been a key driver in these efforts, encouraging banks to develop programs that reach broader segments of the population. For instance, SAMA’s Financial Sector Development Program supports fintech solutions that enhance accessibility. SAIB's participation in these ecosystem developments can lead to significant customer acquisition and loyalty.

Workforce Localization (Saudization)

Saudi Arabia's Saudization policy, a key sociological driver, mandates increasing the proportion of Saudi nationals employed in the private sector. This directly influences the Saudi Investment Bank's (SAIB) human capital strategy, requiring significant investment in training and development programs for local talent to meet regulatory requirements and cultivate a skilled domestic workforce.

The implementation of Saudization impacts SAIB's operational costs, potentially increasing them due to the need for competitive local compensation and extensive training initiatives. Furthermore, it affects the availability of specialized skills within the financial sector, as the bank must actively develop these capabilities domestically rather than relying solely on expatriate expertise.

- Saudization targets: The Saudi government has set ambitious targets for national employment across various sectors, including banking. For instance, by the end of 2024, the banking sector aims to achieve a nationalization rate of 78% for mid-level positions.

- Training investment: SAIB, like other financial institutions, is expected to allocate substantial resources towards upskilling Saudi employees, covering areas like digital banking, risk management, and compliance.

- Talent pool development: The policy encourages SAIB to partner with local educational institutions and vocational training centers to build a sustainable pipeline of qualified Saudi professionals.

- Impact on operational costs: While boosting local employment, Saudization can lead to increased salary expenses and training costs for SAIB as it adapts its workforce composition.

Cultural Values and Islamic Finance

Cultural values in Saudi Arabia are intrinsically linked to Islamic finance principles, making Shariah-compliant offerings a cornerstone of the banking sector. The Saudi Investment Bank (SAIB) actively provides a range of products and services that adhere to these ethical and interest-free guidelines, resonating with a significant portion of the Saudi populace.

This deep integration means that for SAIB and its competitors, aligning with these cultural and religious tenets is not just a matter of compliance but a fundamental requirement for building market acceptance and fostering customer trust. For instance, as of early 2024, the Islamic finance sector in Saudi Arabia continues its robust growth, with assets managed under Shariah-compliant principles representing a substantial share of the overall financial system.

- Market Share: Islamic banks and windows in Saudi Arabia held approximately 25% of the total banking sector assets in 2023, demonstrating the significant demand for Shariah-compliant financial solutions.

- Consumer Preference: Surveys consistently show a strong preference among Saudi consumers for banking products that strictly follow Islamic law, underscoring the importance of cultural alignment for financial institutions.

- Product Development: SAIB's strategic focus includes expanding its Shariah-compliant product portfolio, such as Murabaha and Ijarah financing, to meet evolving customer needs and capitalize on cultural preferences.

The significant youth demographic, representing about 60% of Saudi Arabia's population under 30 as of early 2024, presents a key sociological factor. This tech-savvy generation drives demand for digital banking and personalized finance, requiring SAIB to enhance its mobile-first offerings and digital engagement strategies.

Saudi Arabia's strong emphasis on Islamic finance principles, deeply embedded in cultural values, necessitates Shariah-compliant products. SAIB's alignment with these tenets is crucial for market acceptance, with Islamic finance assets comprising roughly 25% of total banking sector assets in 2023.

The Saudization policy, aiming to increase national employment, directly impacts SAIB's human capital strategy. By the end of 2024, the banking sector targets a 78% nationalization rate for mid-level positions, requiring SAIB to invest in local talent development and training.

| Sociological Factor | Description | Implication for SAIB | Relevant Data (2023-2024) |

|---|---|---|---|

| Youth Demographic | ~60% of population under 30 (early 2024) | Demand for digital, mobile-first financial services. | High smartphone penetration (>90%). |

| Cultural Values (Islamic Finance) | Deep integration of Shariah principles. | Need for Shariah-compliant products is paramount for trust. | Islamic finance assets ~25% of total banking assets (2023). |

| Saudization Policy | Mandate to increase Saudi national employment. | Requires investment in local talent, training, and workforce development. | Target of 78% nationalization for mid-level banking roles by end of 2024. |

Technological factors

The Saudi banking sector is rapidly embracing digital transformation, with FinTech innovation at its core. Saudi Investment Bank (SAIB) needs to prioritize investments in cutting-edge digital infrastructure, including robust mobile banking applications and intuitive online platforms, to stay ahead of evolving customer demands and maintain its competitive edge. The emergence of digital-only banks and streamlined payment solutions across the region, including Saudi Arabia, underscores the imperative for SAIB to continuously innovate its service offerings and enhance the overall customer experience to capture market share.

As Saudi Arabia's banking sector, including the Saudi Investment Bank (SAIB), increasingly embraces digital transformation, cybersecurity and data protection have become critical. The Kingdom's Vision 2030 emphasizes digital government and smart city initiatives, driving a surge in online financial activities. This digital expansion necessitates substantial investments in advanced cybersecurity infrastructure to safeguard sensitive customer information and financial transactions against growing threats.

SAIB, like other financial institutions, must prioritize robust data protection measures to comply with evolving Saudi data privacy regulations, such as those stemming from the Personal Data Protection Law. Failure to protect customer data can lead to significant reputational damage and financial penalties. For instance, global cybercrime costs are projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk associated with inadequate security.

Saudi banks, including Saudi Investment Bank (SAIB), are actively integrating Artificial Intelligence (AI) to personalize customer interactions, bolster cybersecurity, and automate back-office functions. This push for AI adoption is a significant trend across the Kingdom's financial sector.

Furthermore, blockchain technology is gaining traction for its potential to revolutionize operational efficiency, particularly in areas such as cross-border payments and remittances, which are vital to the Saudi economy.

SAIB's strategic embrace of these advanced technologies, such as AI-driven fraud detection or blockchain-based transaction processing, is crucial for maintaining a competitive advantage and unlocking innovative service opportunities in the evolving financial landscape.

Open Banking Framework Implementation

Saudi Arabia's Monetary Authority (SAMA) is actively implementing its Open Banking Framework, a significant technological shift that permits authorized third-party providers to access customer financial data, provided explicit consent is given. This initiative is fundamentally reshaping the financial services sector by encouraging greater competition and innovation.

For Saudi Investment Bank (SAIB), adapting to this framework is crucial. SAIB can leverage this by partnering with FinTech companies to develop and offer novel, integrated financial services, thereby boosting customer value and experience. This move is expected to drive significant growth in digital financial services within the Kingdom.

The Open Banking initiative is projected to unlock substantial economic opportunities. For instance, by 2025, the global open banking market is anticipated to reach over $40 billion, with Saudi Arabia poised to capture a significant share of this growth. SAIB's proactive engagement with this framework will be key to capitalizing on these trends.

- Regulatory Mandate: SAMA's Open Banking Framework is a key driver for technological adoption in Saudi banking.

- FinTech Collaboration: Opportunities exist for SAIB to partner with FinTechs to create new, customer-centric digital offerings.

- Market Growth: The global open banking market is expanding rapidly, with Saudi Arabia expected to see substantial growth by 2025.

- Enhanced Competition: The framework fosters a more competitive landscape, pushing banks to innovate and improve services.

Cloud Computing and Infrastructure Modernization

The Saudi banking sector is increasingly adopting cloud computing to enhance its digital capabilities. For Saudi Investment Bank (SAIB), this technological shift is crucial for scaling its digital services and advanced data analytics. By leveraging cloud infrastructure, SAIB can achieve greater flexibility and cost efficiencies, which are vital for competing in a rapidly evolving digital landscape.

Modernizing IT infrastructure through cloud adoption directly supports SAIB's strategic goals. It allows for quicker development and deployment of new banking products and services, directly impacting customer experience and operational agility. This move is essential for staying competitive and meeting the growing demand for digital banking solutions.

- Cloud Adoption Growth: The Middle East cloud computing market is projected to reach over $13 billion by 2026, with Saudi Arabia being a key driver of this growth.

- Digital Banking Investments: Banks in Saudi Arabia are significantly increasing their IT spending, with a substantial portion allocated to cloud services and infrastructure modernization to support digital transformation initiatives.

- Efficiency Gains: Cloud solutions can reduce IT operational costs by up to 30% for financial institutions, enabling reinvestment in innovation and customer-centric services.

Technological advancements are reshaping the Saudi banking landscape, with Saudi Investment Bank (SAIB) needing to adapt swiftly. The Kingdom's push towards a digital economy, exemplified by Vision 2030, necessitates significant investment in FinTech and robust digital infrastructure. SAIB's strategic adoption of AI and blockchain is key to enhancing customer experience and operational efficiency.

The implementation of SAMA's Open Banking Framework by 2024 is a major technological catalyst, encouraging FinTech partnerships and driving market growth, with the global open banking market projected to exceed $40 billion by 2025. Furthermore, cloud computing adoption is critical for SAIB to scale digital services and achieve cost efficiencies, with the Middle East cloud market expected to surpass $13 billion by 2026.

| Technology Area | Impact on SAIB | Key Data/Projections |

|---|---|---|

| FinTech & Digital Transformation | Enhance customer experience, streamline operations | Global FinTech market growth projected to be robust through 2025. |

| Cybersecurity & Data Protection | Safeguard sensitive data, maintain trust | Global cybercrime costs projected to reach $10.5 trillion annually by 2025. |

| Artificial Intelligence (AI) | Personalize services, automate functions, improve fraud detection | AI adoption is a significant trend across Saudi financial sector. |

| Blockchain Technology | Improve efficiency in payments and remittances | Potential to revolutionize operational efficiency in cross-border transactions. |

| Open Banking | Foster competition, enable FinTech partnerships, drive innovation | Global open banking market to exceed $40 billion by 2025; Saudi Arabia to see significant growth. |

| Cloud Computing | Enhance scalability, data analytics, cost efficiency | Middle East cloud market to exceed $13 billion by 2026; potential cost reduction of up to 30% for IT operations. |

Legal factors

The Saudi Investment Bank (SAIB) operates under the robust Banking Control Law and the comprehensive regulations issued by the Saudi Central Bank (SAMA). These frameworks are foundational, dictating everything from initial licensing and capital adequacy to lending standards and customer safeguards. For instance, SAMA's prudential regulations, updated in 2024, emphasize strong capital buffers, with SAIB maintaining a capital adequacy ratio well above the regulatory minimums, demonstrating its commitment to financial stability.

Compliance with these SAMA directives is not merely a legal obligation but a cornerstone of SAIB's operational integrity and market trust. In 2024, SAMA continued its focus on digital banking security and anti-money laundering (AML) protocols, requiring all financial institutions, including SAIB, to implement advanced cybersecurity measures and robust transaction monitoring systems. SAIB's adherence ensures its continued license to operate and reinforces its reputation as a secure and reliable financial partner within the Kingdom.

Saudi Arabia maintains strong Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) legislation, compelling institutions like the Saudi Investment Bank (SAIB) to adopt rigorous reporting and oversight procedures. These measures are essential for thwarting illicit financial operations and ensuring adherence to global regulatory benchmarks.

Compliance with these national and international AML/CTF mandates is paramount for SAIB to avert significant financial penalties and safeguard its institutional standing. For instance, failure to comply can result in substantial fines, impacting profitability and investor confidence. The Saudi Central Bank (SAMA) actively enforces these regulations, with banks expected to invest continuously in advanced compliance technologies and training.

Saudi Arabia's Personal Data Protection Law (PDPL) places significant responsibilities on financial institutions like SAIB regarding customer data. SAIB must adhere to stringent rules for collecting, processing, and storing personal information to maintain customer trust and avoid penalties.

Compliance with PDPL is crucial for SAIB to safeguard customer privacy and prevent legal issues. This necessitates the implementation of strong data governance policies and advanced cybersecurity measures to protect sensitive financial data from breaches.

Consumer Protection Regulations

Saudi Arabia's financial sector, including The Saudi Investment Bank (SAIB), operates under robust consumer protection regulations overseen by the Saudi Central Bank (SAMA) and other relevant authorities. These laws are designed to shield banking clients, addressing critical aspects like the clarity of credit card terms, fairness in loan agreements, and efficient dispute resolution mechanisms. For instance, SAMA's Consumer Protection Principles, updated in 2023, emphasize transparency and fair treatment.

SAIB's commitment to compliance means ensuring all interactions with both retail and corporate customers are characterized by transparency, fairness, and unambiguous communication. This adherence is vital for maintaining customer trust and avoiding regulatory penalties. The bank's efforts in 2024 focus on enhancing digital channels to provide clearer product disclosures and more accessible complaint handling, aligning with SAMA’s ongoing digital transformation initiatives for consumer protection.

- SAMA's Consumer Protection Principles: Emphasizing transparency, fairness, and clear communication in all banking services.

- Dispute Resolution: SAIB must provide accessible and efficient channels for resolving customer grievances.

- Transparency in Products: Ensuring clear and understandable terms for loans, credit cards, and other financial products.

- Digital Compliance: Adapting to new regulations governing digital banking and customer data protection in 2024.

Corporate Governance and Shariah Compliance

As a publicly traded company on the Saudi Exchange, The Saudi Investment Bank (SAIB) must adhere to rigorous corporate governance standards set by the Capital Market Authority (CMA). These regulations ensure transparency and accountability in its operations. For instance, the CMA's Corporate Governance Code outlines requirements for board composition, audit committees, and disclosure practices, all critical for investor confidence.

Furthermore, SAIB's commitment to Islamic finance necessitates strict compliance with Shariah principles. This is managed through an independent Shariah Board, which reviews and approves all banking products and operations to ensure they align with Islamic law. This dual layer of governance, encompassing both secular and religious compliance, is fundamental to SAIB's operational integrity and market positioning.

The effectiveness of these governance structures is crucial. For example, strong corporate governance can lead to better risk management, as highlighted by studies showing a positive correlation between good governance and financial performance. SAIB's adherence to these frameworks, including the CMA's recent updates to disclosure requirements effective from early 2024, directly impacts its reputation and ability to attract both domestic and international capital.

The Saudi Investment Bank (SAIB) operates under a comprehensive legal framework, primarily governed by the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA). These bodies enforce strict regulations on banking operations, consumer protection, and corporate governance, ensuring financial stability and investor confidence. SAIB's adherence to these rules, including updated consumer protection principles from 2023 and enhanced disclosure requirements from early 2024, is critical for its legitimacy and market standing.

Environmental factors

Saudi Arabia's commitment to sustainability, exemplified by Vision 2030, is driving significant ESG integration within its financial sector. The Kingdom's Public Investment Fund (PIF) has actively pursued sustainable investments, setting a precedent for other institutions. This growing emphasis means SAIB will likely bolster its green financing efforts, potentially including a greater allocation towards renewable energy projects and environmentally conscious businesses.

Saudi Arabia's commitment to climate change mitigation, exemplified by the ambitious Saudi Green Initiative, significantly influences its financial sector. This national push encourages banks to actively support environmental targets, such as reducing carbon emissions and fostering renewable energy development.

The Saudi Investment Bank's (SAIB) engagement in sustainable financing, including green bonds and loans for eco-friendly projects, directly aligns with these broader national environmental objectives. In 2023, Saudi Arabia announced plans to invest over $100 billion in renewable energy projects, creating substantial opportunities for financial institutions like SAIB to participate in the green transition.

Saudi Investment Bank (SAIB) is increasingly focused on its operational environmental footprint, particularly energy consumption, water usage, and waste generation across its network of branches and data centers. By adopting energy-efficient technologies and sustainable operational practices, SAIB can not only reduce its overhead costs but also bolster its commitment to environmental stewardship.

The bank's push towards digital banking services is a key strategy in minimizing its environmental impact, notably by significantly reducing paper consumption. For instance, a continued shift to digital transactions and statements directly translates to fewer trees being felled and less waste generated, aligning with broader sustainability goals.

Green Lending and Investment Opportunities

Saudi Arabia's Vision 2030 places a significant emphasis on sustainable development, creating a fertile ground for green lending and investment opportunities for Saudi Investment Bank (SAIB). This strategic pivot encourages financing for projects that support renewable energy, such as solar and wind power initiatives, and sustainable infrastructure development, including eco-friendly transportation and water management systems.

SAIB can tap into this growing market by offering specialized financial products and services tailored to environmentally conscious businesses and projects. For instance, the bank could develop green bonds or sustainability-linked loans to attract capital for projects aligned with environmental goals. By actively participating in this sector, SAIB can not only contribute to the Kingdom's sustainability targets but also enhance its reputation among ESG-focused investors.

- Renewable Energy Financing: Saudi Arabia aims for 50% of its electricity generation from renewables by 2030, presenting substantial lending opportunities for solar and wind projects, which SAIB can support.

- Sustainable Infrastructure Projects: The Kingdom's investment in smart cities and green transportation aligns with opportunities for SAIB to finance projects with environmental benefits.

- ESG Investor Attraction: By focusing on green finance, SAIB can attract a growing pool of global investors prioritizing environmental, social, and governance (ESG) criteria, potentially lowering its cost of capital.

- Green Bonds Market Growth: The global green bond market reached an estimated $1 trillion in issuance by late 2023, indicating a strong demand for such instruments that SAIB can leverage.

Environmental Risk Management in Lending Portfolios

Saudi Investment Bank (SAIB), like other financial institutions, faces growing pressure to integrate environmental risk management into its lending practices. This involves scrutinizing portfolios for exposure to sectors with significant carbon emissions or those susceptible to climate-related disruptions, such as extreme weather events impacting real estate or agriculture.

Developing comprehensive frameworks to assess these environmental risks is crucial for SAIB. Such assessments can directly influence asset quality and the bank's long-term financial resilience. For instance, a 2024 report by the Saudi Central Bank highlighted the increasing need for financial institutions to consider climate-related financial risks in their strategic planning and risk management processes.

- Climate Risk Assessment: SAIB should implement methodologies to quantify exposure to industries with high greenhouse gas emissions, aligning with Saudi Arabia's Vision 2030 goals for sustainability.

- Portfolio Diversification: Strategies to diversify lending away from environmentally sensitive sectors or towards green initiatives can mitigate potential losses.

- Regulatory Compliance: Adherence to evolving environmental regulations and disclosure requirements from bodies like the Saudi Central Bank is paramount.

- Green Financing: Exploring opportunities in green bonds and sustainable project financing can not only manage risk but also create new revenue streams.

Saudi Arabia's commitment to environmental sustainability, driven by Vision 2030 and initiatives like the Saudi Green Initiative, directly impacts SAIB's operations and strategic direction. The Kingdom's ambitious goal to reach net-zero emissions by 2060 necessitates a shift towards green financing and sustainable practices across all sectors, including banking.

SAIB is actively participating in this transition by increasing its focus on financing renewable energy projects and eco-friendly infrastructure. The bank's digital transformation also plays a crucial role in reducing its environmental footprint, particularly by minimizing paper consumption. This aligns with national efforts to promote a circular economy and reduce waste.

The growing emphasis on ESG factors means SAIB must integrate environmental risk management into its lending decisions. This includes assessing the impact of climate change on its portfolio and ensuring compliance with evolving environmental regulations. By embracing green finance, SAIB can attract ESG-focused investors and contribute to Saudi Arabia's sustainability targets.

| Environmental Factor | Impact on SAIB | Key Initiatives/Data |

|---|---|---|

| Climate Change & Sustainability Goals | Drives demand for green financing and sustainable investments. | Saudi Green Initiative aims for significant emissions reduction; Vision 2030 emphasizes sustainable development. |

| Renewable Energy Transition | Creates opportunities for financing solar, wind, and other green energy projects. | Saudi Arabia targets 50% of electricity from renewables by 2030; over $100 billion planned investment in renewables (as of 2023). |

| Operational Footprint Reduction | Requires SAIB to minimize energy, water, and waste across its operations. | Digital banking initiatives reduce paper consumption; focus on energy-efficient technologies in branches and data centers. |

| Environmental Risk Management | Necessitates assessment of climate-related risks in lending portfolios. | Saudi Central Bank guidance emphasizes climate risk in financial planning; SAIB needs robust risk assessment frameworks. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Saudi Investment Bank is built on a comprehensive review of official Saudi government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. We also incorporate data from reputable news outlets and economic forecasting agencies.