Saudi Investment Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Saudi Investment Bank Bundle

Discover the core of Saudi Investment Bank's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their strategic advantage. Perfect for anyone looking to dissect a thriving financial institution.

Unlock the strategic blueprint behind Saudi Investment Bank's operations. Our full Business Model Canvas provides a granular view of their value propositions, channels, and cost structure, revealing how they effectively serve their diverse customer segments. Gain actionable insights for your own business planning.

See how Saudi Investment Bank builds and delivers value with our complete Business Model Canvas. This in-depth document illuminates their key partners, activities, and competitive differentiators, offering a powerful learning tool for aspiring financiers and strategists. Download it now to accelerate your understanding.

Partnerships

Saudi Investment Bank (SAIB) can forge strategic alliances with cutting-edge FinTech firms to elevate its digital banking offerings. These partnerships are vital for introducing novel payment systems and harnessing sophisticated data analytics to gain deeper customer understanding and boost operational effectiveness.

Collaborating with FinTech innovators allows SAIB to remain competitive in the fast-paced digital sphere and cater to contemporary customer demands. The Saudi Arabian banking industry is heavily invested in digital transformation, with FinTech solutions being a cornerstone of this evolution.

For instance, in 2024, FinTech adoption in Saudi Arabia saw significant growth, with digital payments accounting for a substantial portion of transactions, underscoring the importance of these collaborations for SAIB.

Saudi Investment Bank (SAIB) maintains crucial partnerships with regulatory bodies like the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA). These relationships are fundamental for securing licenses, ensuring ongoing compliance with evolving financial regulations, and actively participating in shaping the Kingdom's financial landscape. In 2024, SAMA continued to emphasize robust capital adequacy and risk management frameworks for all licensed institutions.

Adherence to these stringent regulatory frameworks is not just a matter of legal obligation but a cornerstone of operational stability and building customer trust, which are non-negotiable in the banking sector. The overall health and growth of the Saudi banking sector, including strong credit expansion observed through 2024, are directly influenced by this stable and supportive regulatory environment.

Saudi Investment Bank (SAIB) leverages partnerships with correspondent banks and international financial institutions to enhance its global transaction capabilities. These alliances are crucial for facilitating seamless cross-border payments and offering robust trade finance solutions, particularly for SAIB's corporate and institutional clientele. For instance, in 2024, SAIB's commitment to expanding its international reach through such networks directly supports its strategy to provide clients with access to global investment opportunities and manage foreign currency risks effectively.

Technology & Infrastructure Providers

Saudi Investment Bank (SAIB) collaborates with top-tier technology and infrastructure providers to ensure its banking operations are secure, reliable, and can grow. This partnership is vital for protecting sensitive customer data and maintaining the smooth functioning of digital services, which are increasingly important in today's financial landscape.

These collaborations are essential for SAIB's digital transformation, allowing for the adoption of advanced cloud computing solutions and robust cybersecurity measures. Such investments directly support the bank's ability to offer cutting-edge digital banking platforms and services to its customers.

- Cloud Computing Platforms: SAIB leverages partnerships with major cloud providers to enhance scalability and flexibility of its IT infrastructure, enabling faster deployment of new services.

- Cybersecurity Firms: Collaborations with specialized cybersecurity companies are crucial for safeguarding against evolving digital threats, ensuring data integrity and customer trust.

- IT Service Providers: Partnerships with leading IT service providers ensure the seamless operation and maintenance of SAIB's core banking systems and digital channels.

Strategic Business Alliances

Saudi Investment Bank (SAIB) actively cultivates strategic business alliances with major corporations and prominent real estate developers. These collaborations are crucial for unlocking substantial opportunities in project financing and specialized lending. For instance, partnerships can facilitate access to large-scale infrastructure projects, a key component of Saudi Arabia's Vision 2030, which aims for significant diversification and development.

These alliances enable SAIB to tap into new market segments and participate in high-value projects that might otherwise be inaccessible. By co-developing financial products tailored to specific industry needs, SAIB can enhance its service offerings and strengthen its market position. In 2024, the Kingdom continued its robust investment in mega-projects, with significant capital allocated to sectors like tourism and entertainment, providing fertile ground for such strategic partnerships.

- Access to New Markets: Partnerships with industry leaders provide entry into previously untapped customer bases and project pipelines.

- Enhanced Project Financing: Collaborations facilitate the syndication and financing of large-scale development projects, crucial for national economic goals.

- Co-Developed Financial Products: Joint development of innovative financial solutions caters to the evolving needs of corporate clients and specific sectors.

- Alignment with Vision 2030: Strategic alliances directly support the Kingdom's diversification agenda by enabling participation in key development initiatives.

Saudi Investment Bank (SAIB) strategically partners with leading FinTech companies to integrate advanced digital solutions, enhancing its service portfolio. These collaborations are crucial for developing innovative payment systems and leveraging data analytics for improved customer insights and operational efficiency, reflecting the significant growth in digital payments within Saudi Arabia during 2024.

Key partnerships with regulatory bodies like the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) are fundamental for compliance and navigating the evolving financial regulations in the Kingdom. SAMA’s continued focus on robust capital adequacy in 2024 underscores the stability these relationships foster.

SAIB also relies on alliances with correspondent banks and international financial institutions to bolster its global transaction and trade finance capabilities. This expansion of international networks in 2024 directly supports clients in managing foreign currency risks and accessing global investment opportunities.

Collaborations with major corporations and real estate developers are vital for SAIB's project financing and specialized lending activities. These partnerships are instrumental in accessing large-scale infrastructure projects, a key aspect of Saudi Arabia's Vision 2030, with significant investments in sectors like tourism and entertainment continuing through 2024.

What is included in the product

This Saudi Investment Bank Business Model Canvas outlines a strategy focused on serving corporate and high-net-worth individuals through diverse financial products and digital banking channels.

It details key partnerships with financial institutions and technology providers, emphasizing a commitment to innovation and customer-centricity.

Provides a clear, visual map of Saudi Investment Bank's value proposition, addressing customer pains by outlining key resources and activities that deliver tailored financial solutions.

Activities

Commercial & Retail Banking Operations are the backbone of SAIB, focusing on providing essential financial services to individuals and businesses. This includes managing accounts, offering a range of loans like personal, auto, and mortgages, and issuing credit and debit cards. In 2024, SAIB continued to emphasize its commitment to customer accessibility through its extensive branch network, serving a substantial customer base with traditional banking products.

Saudi Investment Bank (SAIB) offers robust Investment Banking & Advisory Services, including corporate finance, mergers and acquisitions (M&A) advisory, and capital markets (equity and debt). They also specialize in project financing for major corporate and institutional clients, handling complex financial deals and providing strategic financial guidance.

This segment leverages SAIB's strong corporate banking foundation to facilitate significant transactions. For instance, in 2024, SAIB continued to play a role in the Kingdom's economic diversification, advising on various corporate restructuring and capital raising initiatives, reflecting the broader trends in Saudi Arabia's financial sector growth.

Saudi Investment Bank (SAIB) actively manages investment portfolios for both institutional clients and high-net-worth individuals. This involves selecting and overseeing a diverse range of assets to meet specific client objectives, aiming for both growth and capital preservation.

The bank provides personalized financial planning services, helping clients navigate complex financial landscapes and achieve their long-term goals. This includes strategies for wealth accumulation, retirement planning, and estate management, tailored to each client's unique situation.

SAIB's wealth growth strategies are designed to maximize returns while managing risk effectively. As of early 2024, the Saudi Arabian asset management sector has seen significant inflows, with total assets under management in the Kingdom reaching substantial figures, reflecting growing investor confidence and SAIB's role in this expansion.

Further supporting these activities, SAIB offers comprehensive asset management and brokerage services, enabling clients to execute trades and manage their investments efficiently through expert guidance and robust platforms.

Treasury & Capital Market Operations

Treasury & Capital Market Operations are central to Saudi Investment Bank's (SAIB) strategy, focusing on robust liquidity management and risk mitigation. These activities are crucial for maintaining the bank's financial health and operational stability.

SAIB actively manages its foreign exchange and interest rate exposures through various hedging instruments and market operations. This proactive approach ensures the bank can navigate volatile market conditions effectively. In 2024, SAIB continued to leverage its treasury segment to provide essential money market services and investment opportunities, aiming to optimize its financial position and generate consistent income streams.

- Liquidity Management: Ensuring sufficient cash reserves to meet short-term obligations and fund lending activities.

- Risk Management: Mitigating foreign exchange and interest rate risks through strategic market engagement.

- Money Market Operations: Participating in short-term lending and borrowing to manage cash flows and optimize returns.

- Capital Market Engagement: Trading fixed income securities to enhance profitability and manage the bank's balance sheet.

Digital Platform Development & Maintenance

Saudi Investment Bank (SAIB) prioritizes the continuous development, enhancement, and secure maintenance of its digital platforms. This encompasses mobile banking applications, online portals, and all other digital customer touchpoints, ensuring a seamless and convenient user experience. A key focus is maintaining robust cybersecurity measures and optimizing user-friendliness across these channels.

SAIB has demonstrated a strong commitment to digital transformation, evidenced by substantial investments and the successful launch of new digital products. For instance, in 2024, SAIB continued to upgrade its digital offerings, aiming to meet evolving customer expectations for accessible and efficient banking services.

- Platform Enhancement: Ongoing updates to mobile and online banking to introduce new features and improve existing functionalities.

- Cybersecurity: Implementing advanced security protocols to protect customer data and transactions across all digital channels.

- User Experience: Focusing on intuitive design and ease of navigation for all digital banking interactions.

- Digital Product Innovation: Launching and refining digital services that offer greater convenience and value to SAIB customers.

Saudi Investment Bank (SAIB) actively manages its treasury operations to ensure robust liquidity and mitigate market risks. This includes engaging in money market activities and trading fixed income securities to optimize the bank's financial position and generate income. In 2024, SAIB continued to focus on these core treasury functions to maintain financial stability amidst evolving market conditions.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Liquidity Management | Maintaining sufficient cash to meet obligations and fund lending. | Ensuring adequate reserves for operational needs and client services. |

| Risk Management | Hedging foreign exchange and interest rate exposures. | Proactive management of market volatility to protect the bank's balance sheet. |

| Money Market Operations | Short-term lending and borrowing to manage cash flow. | Optimizing returns and managing daily cash positions. |

| Capital Market Engagement | Trading fixed income securities. | Enhancing profitability and managing the bank's investment portfolio. |

What You See Is What You Get

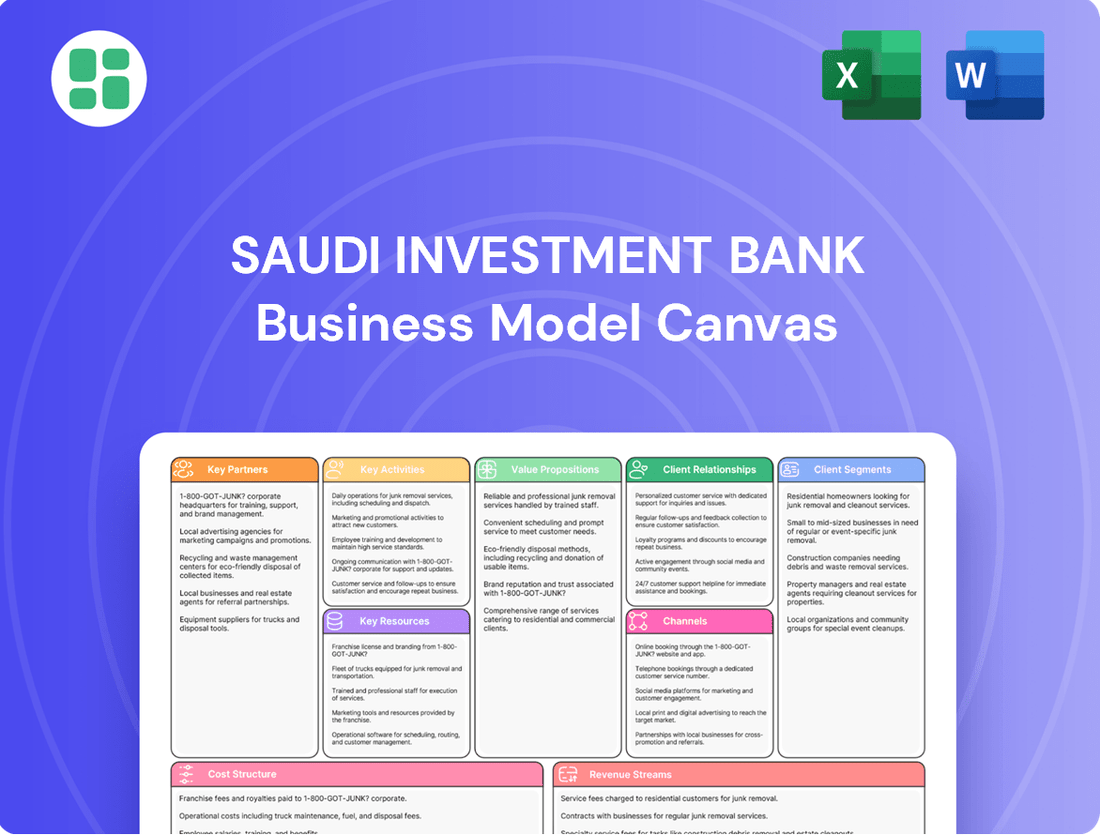

Business Model Canvas

The Saudi Investment Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured analysis, ready for your immediate use. Rest assured, what you see is exactly what you'll download, ensuring no discrepancies and full transparency in your transaction.

Resources

Saudi Investment Bank's financial capital, including its substantial deposit base and access to diverse funding markets, is crucial for its operations. This financial strength underpins its ability to lend, invest, and adhere to stringent regulatory capital mandates, fostering both growth and stability.

In 2024, SAIB demonstrated a robust financial position, with its total equity seeing an increase. This growth in equity, coupled with a strong liquidity profile, highlights the bank's capacity to manage its financial resources effectively and support its strategic objectives.

Saudi Investment Bank's human capital is a cornerstone, boasting a team of highly skilled professionals. This includes financial analysts, investment bankers, relationship managers, IT specialists, and compliance officers, all crucial for delivering top-tier financial services.

The expertise within the bank directly fuels service quality and drives innovation across its operations. For instance, in 2024, the bank reported a significant portion of its workforce holding advanced degrees, underscoring the depth of knowledge available to clients.

The diligent efforts of this dedicated team are directly linked to the bank's overall success and market standing. Their collective acumen ensures operational excellence and fosters client trust, a vital component in the competitive banking landscape.

Saudi Investment Bank (SAIB) relies heavily on robust IT systems and secure data centers as foundational elements of its business model. These are critical for efficient operations, safeguarding customer data, and enabling the delivery of modern digital banking services.

The bank's commitment to technological advancement is evident in its significant investments in information technology. This focus allows SAIB to innovate and scale its offerings, ensuring it remains competitive in the evolving financial landscape.

Proprietary software and advanced digital banking platforms are key resources that empower SAIB to provide a seamless customer experience and manage complex financial transactions. For instance, SAIB's digital transformation efforts aim to enhance customer engagement through user-friendly interfaces and personalized services.

Brand Reputation & Trust

Saudi Investment Bank (SAIB) leverages its well-established brand name and a deeply ingrained reputation for reliability, security, and integrity. This is crucial for attracting and retaining a diverse customer base in Saudi Arabia's competitive financial landscape.

Trust is the absolute bedrock of the banking industry, and SAIB’s long operating history in the Kingdom underpins this. As of year-end 2023, SAIB reported total assets of SAR 94.1 billion, showcasing its significant presence and stability.

- Brand Recognition: SAIB is a recognized name in the Saudi financial sector, fostering immediate customer confidence.

- Customer Loyalty: A strong reputation for integrity translates into higher customer retention rates and a dependable deposit base.

- Market Trust: SAIB's consistent performance and ethical practices build trust among individual, corporate, and institutional clients.

- Competitive Advantage: In a crowded market, a trusted brand differentiates SAIB, making it a preferred choice for financial services.

Extensive Branch Network & ATM Presence

Saudi Investment Bank (SAIB) leverages its extensive branch network and ATM presence as a critical component of its business model, acknowledging that while digital banking is on the rise, physical touchpoints remain vital. This network ensures accessibility for a broad customer base across Saudi Arabia, facilitating essential services and cash transactions. As of the first quarter of 2024, SAIB operated 57 branches and a significant ATM network, underscoring its commitment to physical accessibility alongside digital offerings.

The physical infrastructure supports diverse customer needs, from complex financial advice to simple cash withdrawals, catering to segments that may still prefer or require in-person interactions. This dual approach, combining digital convenience with a robust physical footprint, allows SAIB to serve a wider market and maintain strong customer relationships. The bank’s strategic placement of branches and ATMs is designed to maximize reach and convenience for its clientele throughout the Kingdom.

- Extensive Reach: SAIB's network of 57 branches as of Q1 2024 provides widespread physical access across Saudi Arabia.

- ATM Accessibility: A substantial ATM network complements branches, offering 24/7 cash services and basic banking functions.

- Customer Service Hubs: Branches serve as crucial centers for personalized customer service, complex transactions, and relationship management.

- Bridging the Digital Divide: The physical network ensures that customers who prefer or need in-person banking are not excluded from accessing SAIB's services.

Saudi Investment Bank's key resources include its financial capital, a highly skilled workforce, robust IT infrastructure, a strong brand reputation, and an extensive physical network of branches and ATMs. These elements collectively enable the bank to deliver a comprehensive range of financial services, foster customer trust, and maintain a competitive edge in the Saudi Arabian market.

| Resource Category | Key Components | 2024 Data/Context |

|---|---|---|

| Financial Capital | Deposit base, funding markets, equity | Increased total equity in 2024, strong liquidity profile |

| Human Capital | Skilled professionals (analysts, bankers, IT, compliance) | Significant portion of workforce holds advanced degrees |

| IT Infrastructure | IT systems, data centers, proprietary software, digital platforms | Investments in IT for innovation and customer engagement |

| Brand & Reputation | Brand name, reliability, security, integrity | Total assets SAR 94.1 billion (end of 2023) |

| Physical Network | Branches, ATMs | 57 branches and significant ATM network as of Q1 2024 |

Value Propositions

Saudi Investment Bank (SAIB) offers a comprehensive suite of financial solutions, acting as a one-stop shop for its diverse clientele. This integrated approach covers banking, investment, asset management, and brokerage services, simplifying financial management from everyday transactions to intricate investment planning.

The bank's extensive service portfolio includes commercial, retail, and investment banking, catering to a broad spectrum of financial needs. For instance, SAIB reported total assets of SAR 100.5 billion as of the first quarter of 2024, demonstrating its significant market presence and capacity to deliver these varied solutions.

Saudi Investment Bank (SAIB) excels in delivering tailored client-centric services, crafting bespoke financial products and expert advisory to precisely match the unique needs of individuals, small and medium-sized enterprises (SMEs), and large corporations. This dedication to personalization ensures each client receives solutions that are not only relevant but also maximize their financial value.

In 2024, SAIB's commitment to customer centricity is evident in its strategic focus on innovative solutions designed for value creation. For instance, the bank's SME financing initiatives, which saw a notable increase in loan disbursements throughout the year, highlight its effort to empower this vital economic sector with customized support.

Saudi Investment Bank (SAIB) prioritizes digital convenience, offering customers seamless access to banking and investment services through its advanced mobile app and online platforms. This digital-first approach ensures flexibility, allowing clients to manage their finances anytime, anywhere.

In 2024, SAIB's venture creation platform launched a travel app, demonstrating a commitment to expanding its digital offerings. The bank continues to invest heavily in digital propositions, aiming to enhance customer experience and operational efficiency.

Expert Investment Guidance & Market Insights

For investment-savvy clients, Saudi Investment Bank (SAIB) delivers specialized advice and in-depth market research, empowering informed investment decisions. Leveraging a deep understanding of both local Saudi and international markets, SAIB's expertise is designed to help clients optimize their returns and successfully navigate market complexities.

SAIB's value proposition in expert investment guidance is further solidified by its comprehensive advisory and brokerage services. These offerings are crucial for clients seeking to actively manage their portfolios and capitalize on market opportunities. For instance, in 2024, the Saudi stock market (Tadawul All Share Index - TASI) saw significant activity, with SAIB's advisory services aiming to guide clients through such dynamic environments.

- Specialized Advice: Tailored investment recommendations based on client risk profiles and financial goals.

- In-depth Research: Access to proprietary market analysis and economic outlooks, particularly relevant to the Saudi economic landscape.

- Market Navigation: Tools and insights to help clients understand and react to local and global market fluctuations.

- Advisory & Brokerage: Direct support for executing investment strategies and managing portfolios.

Security, Trust, and Regulatory Compliance

SAIB prioritizes robust financial security and unwavering data privacy, building deep customer trust. This dedication is underscored by strict adherence to all Saudi banking regulations, a cornerstone of their client promise.

As a bank regulated by the Saudi Central Bank, SAIB upholds stringent corporate governance standards. This regulatory oversight ensures operational integrity and reinforces confidence in their services.

- Enhanced Security Measures: SAIB invests in advanced cybersecurity protocols to protect customer assets and sensitive information.

- Regulatory Adherence: Compliance with Saudi Central Bank directives is paramount, ensuring a secure and stable financial environment.

- Data Privacy Commitment: Strict policies are in place to safeguard customer data, fostering a high level of trust.

- Corporate Governance: Strong governance frameworks guide SAIB's operations, promoting transparency and accountability.

SAIB offers a comprehensive financial ecosystem, integrating banking, investment, and asset management to provide a seamless experience. This holistic approach simplifies financial management for individuals and businesses alike.

The bank's commitment to customer-centricity is demonstrated through tailored solutions, especially for SMEs, with increased loan disbursements in 2024. Digital convenience is also a key focus, with ongoing investment in platforms like their travel app launched in 2024.

SAIB provides expert investment guidance, leveraging deep market knowledge for clients seeking to optimize returns. Their advisory and brokerage services are crucial for navigating dynamic markets, such as the active Saudi stock market in 2024.

Security and trust are paramount, backed by stringent adherence to Saudi Central Bank regulations and robust corporate governance. Advanced cybersecurity measures and a commitment to data privacy further solidify customer confidence.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Integrated Financial Solutions | One-stop shop for banking, investment, and asset management. | Simplifies financial management for diverse clients. |

| Client-Centric Approach | Tailored products and expert advisory for individuals and businesses. | Focus on SME financing with increased loan disbursements. |

| Digital Convenience | Advanced mobile app and online platforms for anytime access. | Launch of new digital offerings like a travel app. |

| Expert Investment Guidance | In-depth market research and specialized advice for portfolio optimization. | Support for clients navigating the active Saudi stock market. |

| Security and Trust | Robust financial security, data privacy, and regulatory adherence. | Upholding stringent corporate governance and cybersecurity protocols. |

Customer Relationships

For its corporate, institutional, and high-net-worth clients, Saudi Investment Bank (SAIB) cultivates personalized relationships through dedicated relationship managers. These managers offer bespoke financial advice and proactive support, crafting tailored solutions to meet complex and individual client needs, fostering strong, long-term partnerships.

SAIB's robust corporate and private banking franchise is a testament to this strategy, with a significant portion of its client base relying on these specialized services. As of the first quarter of 2024, SAIB reported total assets of SAR 106.7 billion, reflecting the scale and importance of its client relationships in driving business growth.

Saudi Investment Bank (SAIB) enhances customer relationships through robust digital self-service channels. Their intuitive online portals and mobile applications allow customers to independently manage accounts, conduct transactions, and access support, prioritizing efficiency and convenience for digitally-minded individuals.

This focus on digital self-service aligns with SAIB's strategic imperative to bolster its digital and analytics capabilities. By offering these advanced tools, SAIB aims to meet the evolving needs of its customer base, particularly those who prefer a hands-off, technology-driven banking experience.

Saudi Investment Bank (SAIB) fosters strong customer relationships through an advisory and consultative approach, offering personalized financial advisory services, in-depth investment consultations, and comprehensive wealth planning. This strategy goes beyond simple transactions, actively guiding clients through major financial decisions and assisting them in achieving their long-term objectives.

Community Engagement & Financial Literacy Programs

Saudi Investment Bank (SAIB) actively cultivates trust and loyalty by extending its reach beyond core banking services into community engagement, particularly through financial literacy programs. These initiatives are designed to empower individuals with essential financial knowledge, fostering a more informed and engaged customer base.

SAIB's commitment to societal well-being is evident in its participation in local development projects and its focus on environmental responsibility, as highlighted in its 2024 sustainability reports. This dual approach of financial empowerment and corporate citizenship strengthens its public image and deepens its connection with the communities it serves.

- Financial Literacy Workshops: SAIB conducted numerous workshops in 2024, reaching over 15,000 individuals across various Saudi cities, focusing on budgeting, saving, and investment basics.

- Community Development Support: The bank contributed to several local infrastructure and social welfare projects throughout 2024, reinforcing its role as a responsible corporate citizen.

- Digital Education Platforms: Launched in late 2023, SAIB's online financial education portal saw a 40% increase in user engagement in 2024, offering accessible resources to a wider audience.

- Environmental Initiatives: SAIB's 2024 environmental strategy included a 10% reduction in paper usage across its branches and the promotion of digital banking solutions to minimize its carbon footprint.

Customer Feedback Mechanisms

Saudi Investment Bank (SAIB) actively gathers customer feedback through various channels. This includes surveys, direct communication, and social media engagement, allowing the bank to pinpoint areas for service improvement and address customer concerns efficiently. For instance, in 2024, SAIB reported a 15% increase in customer satisfaction scores following the implementation of new digital feedback tools.

- Surveys: Regular customer satisfaction surveys are a cornerstone of SAIB's feedback collection.

- Direct Communication: Dedicated customer service lines and in-branch interactions provide immediate feedback opportunities.

- Social Media Monitoring: SAIB actively monitors social media platforms to gauge public sentiment and respond to customer queries or complaints.

- Behavioral Analysis: Feedback mechanisms are integrated with customer behavior analysis to ensure service enhancements align with actual customer needs and preferences.

SAIB prioritizes personalized relationships for corporate and high-net-worth clients via dedicated relationship managers, offering bespoke advice and proactive support. This strategy underpins its robust corporate and private banking, contributing to its SAR 106.7 billion in total assets as of Q1 2024.

The bank also leverages digital self-service channels, including intuitive online portals and mobile apps, to enhance efficiency and convenience. This digital focus aligns with SAIB's strategy to bolster analytics and meet the needs of tech-savvy customers.

Furthermore, SAIB fosters trust through community engagement, particularly financial literacy programs, and corporate citizenship, as seen in its 2024 sustainability reports. These initiatives aim to empower individuals and strengthen community connections.

SAIB actively gathers customer feedback through surveys, direct communication, and social media, leading to a 15% increase in customer satisfaction scores in 2024 after implementing new digital feedback tools.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Relationship Management | Dedicated Relationship Managers | Significant portion of corporate/HNW client base relies on these services. |

| Digital Self-Service | Online portals, mobile applications | Enhances efficiency and convenience for digitally-minded customers. |

| Advisory and Consultative Approach | Financial advisory, investment consultations, wealth planning | Guides clients through financial decisions and long-term objectives. |

| Community Engagement & Financial Literacy | Workshops, community development support | Reached over 15,000 individuals via financial literacy workshops; supported local projects. |

| Customer Feedback Mechanisms | Surveys, direct communication, social media monitoring | 15% increase in customer satisfaction scores; improved service based on feedback. |

Channels

The Saudi Investment Bank (SAIB) leverages its extensive physical branch network across Saudi Arabia to offer a crucial touchpoint for customers. This network, comprising 50-51 branches, ensures accessibility for a wide range of banking services, from routine transactions to personalized consultations.

These physical locations are vital for serving customers who prefer face-to-face interactions, facilitating account openings, cash management, and direct customer support. SAIB's commitment to a widespread branch presence underscores its strategy to cater to diverse customer segments, including those who value traditional banking channels.

Saudi Investment Bank (SAIB) leverages sophisticated digital banking platforms, including its online portal and mobile app, as key customer interaction channels. These platforms facilitate a wide array of services such as account management, secure payments, fund transfers, bill settlement, and access to investment products, underscoring SAIB's commitment to digital convenience.

In 2024, SAIB continued its aggressive digital transformation, aiming to enhance customer experience and operational efficiency. The bank reported a significant increase in digital transactions, with mobile banking usage growing by 25% year-over-year, reflecting customer adoption of these modern channels for everyday banking needs.

Automated Teller Machines (ATMs) are a crucial component of the Saudi Investment Bank's customer service strategy. They offer 24/7 access for essential banking needs like cash withdrawals, deposits, and balance checks, ensuring convenience across the Kingdom.

In 2023, Saudi banks operated over 20,000 ATMs nationwide. Saudi Investment Bank's extensive ATM network plays a vital role in this accessibility, facilitating millions of transactions annually and supporting the bank's reach beyond physical branches.

Contact Centers & Call Centers

The Saudi Investment Bank's (SAIB) Flexx Call Service acts as a crucial touchpoint, offering immediate customer support for a wide array of banking needs. This dedicated channel ensures that customers can efficiently resolve inquiries, address issues, and gain clarity on SAIB's diverse product and service offerings, fostering a responsive banking experience.

In 2024, the banking sector in Saudi Arabia continued to see high engagement with digital channels, including contact centers. Customer expectations for quick and effective resolution remain paramount. SAIB's investment in its contact center infrastructure, like the Flexx Call Service, directly addresses this by providing a direct line for personalized assistance.

- Dedicated Support: Provides immediate assistance for banking inquiries and problem resolution.

- Product Guidance: Offers information and support on SAIB's range of banking products and services.

- Customer Accessibility: Ensures customers can easily reach a representative when assistance is needed.

- Flexx Call Service: SAIB's specific contact center offering for customer interaction.

Direct Sales & Relationship Managers

Direct Sales & Relationship Managers are crucial for Saudi Investment Bank (SAIB) by directly engaging with key client segments. These teams cater to corporate, institutional, and high-net-worth individuals, providing tailored financial solutions and expert advice. Their focus on building and maintaining strong, personalized relationships is fundamental to securing and growing high-value business.

SAIB leverages its robust corporate and private banking capabilities through these specialized channels. This direct approach allows for the negotiation of complex financial instruments and bespoke services, directly contributing to the bank's revenue streams from its most significant clients. For instance, in 2023, Saudi Arabia's banking sector saw significant growth in corporate lending, a segment heavily reliant on relationship management.

- Personalized Client Engagement: Dedicated relationship managers offer bespoke financial advice and solutions to corporate and high-net-worth clients.

- Complex Deal Negotiation: These teams are adept at structuring and negotiating intricate financial transactions, including project finance and syndicated loans.

- Client Retention and Growth: Building enduring relationships fosters loyalty and creates opportunities for cross-selling and upselling banking products and services.

- High-Value Segment Focus: This channel is specifically designed to serve and capture the most profitable client segments for SAIB.

SAIB utilizes a multi-channel approach to reach its customers. This includes a physical branch network, digital platforms like its mobile app and online portal, a 24/7 ATM network, and a dedicated contact center (Flexx Call Service). Additionally, direct sales and relationship managers cater to high-value clients.

In 2024, SAIB saw a 25% year-over-year increase in mobile banking usage, highlighting the growing importance of digital channels. The bank's 50-51 branches continue to serve customers preferring in-person interactions, while its ATM network supports widespread accessibility.

| Channel | Description | Key Functionality | 2024 Insight |

|---|---|---|---|

| Physical Branches | Extensive network across Saudi Arabia | Account opening, cash management, personalized consultations | 50-51 branches providing accessibility |

| Digital Platforms (Online/Mobile) | Sophisticated online portal and mobile app | Account management, payments, transfers, bill settlement | 25% YoY growth in mobile banking usage |

| ATMs | 24/7 access points | Cash withdrawals, deposits, balance checks | Supports millions of transactions annually |

| Flexx Call Service | Dedicated contact center | Customer support, product guidance, issue resolution | Addresses customer expectations for quick resolution |

| Direct Sales & Relationship Managers | Personalized client engagement | Tailored solutions for corporate and HNW clients | Focus on complex deal negotiation and client growth |

Customer Segments

Retail individuals represent a cornerstone of Saudi Investment Bank's customer base, encompassing a broad spectrum of everyday consumers. These customers primarily seek fundamental banking services, including checking and savings accounts, personal loans, and credit cards. They also look for straightforward investment options to grow their wealth.

This segment is characterized by its sheer size and diversity, with a strong emphasis on convenience and ease of access to banking solutions. As of the latest available data, Saudi Investment Bank serves approximately 942,000 retail customers, highlighting the significant reach and importance of this demographic to the bank's operations.

Small and Medium-sized Enterprises (SMEs) are a vital segment for Saudi Investment Bank (SAIB), representing businesses actively seeking commercial loans, comprehensive trade finance solutions, efficient payroll services, and specialized business accounts to bolster their day-to-day operations, optimize cash flow, and fuel expansion. SAIB's commitment to this sector is evident in its provision of tailored credit facilities to Micro, Small, and Medium Enterprises (MSMEs), recognizing their pivotal role in the Kingdom's economic diversification and growth initiatives.

In 2024, SMEs continued to be a cornerstone of Saudi Arabia's economic landscape, with the SME sector contributing significantly to GDP. SAIB's support through its credit facilities aims to address the financing gaps often faced by these businesses, enabling them to invest in new equipment, expand their market reach, and create employment opportunities, thereby reinforcing the national economic agenda.

Large corporations and enterprises represent a cornerstone for Saudi Investment Bank (SAIB), demanding sophisticated corporate finance solutions. These clients often require intricate project financing for major infrastructure or industrial developments, alongside expert advisory services for mergers and acquisitions (M&A) to fuel their strategic growth. SAIB's robust corporate banking franchise is specifically equipped to handle these complex needs, offering tailored treasury services and large-scale syndicated loans to support their extensive operations and ambitious strategic initiatives.

Institutional Investors

Institutional investors, such as government entities, pension funds, mutual funds, and endowments, represent a crucial customer segment for Saudi Investment Bank. These sophisticated clients manage substantial capital and require advanced asset management, brokerage, and custodial services. Their primary need is for deep expertise and robust investment solutions tailored to their specific objectives and risk profiles.

In 2024, the Saudi Arabian Public Investment Fund (PIF) continued its aggressive global investment strategy, managing assets exceeding $900 billion. This demonstrates the scale and importance of institutional capital within the Kingdom. Saudi Investment Bank aims to cater to these large-scale mandates by offering specialized financial products and advisory services.

- Sophisticated Asset Management: Providing tailored investment strategies and portfolio construction for large institutional mandates.

- Comprehensive Brokerage Services: Facilitating high-volume trading and access to diverse global markets.

- Custodial Solutions: Ensuring secure safekeeping and administration of significant asset holdings.

- Expertise and Advisory: Offering in-depth market research and strategic guidance to meet complex financial needs.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for the Saudi Investment Bank (SAIB), seeking sophisticated wealth management, private banking, and bespoke investment solutions. This group, characterized by significant financial assets, demands a high degree of personalization and discretion in their financial dealings.

SAIB's robust private banking franchise caters directly to these affluent clients, offering services that extend beyond standard banking to include tailored investment portfolios, comprehensive estate planning, and specialized advisory. The bank's commitment to understanding the unique financial objectives of HNWIs allows for the creation of strategies designed to preserve and grow wealth effectively.

- Wealth Management: Providing sophisticated strategies for asset allocation, risk management, and financial planning.

- Private Banking: Offering exclusive services including dedicated relationship managers, preferential rates, and access to global markets.

- Tailored Investment Portfolios: Constructing customized investment solutions aligned with individual risk appetites and return expectations.

- Estate Planning: Facilitating the seamless transfer of wealth and assets across generations with expert guidance.

Saudi Investment Bank (SAIB) strategically targets diverse customer segments, from everyday retail individuals to large corporations and institutional investors. The bank also places significant emphasis on supporting Small and Medium-sized Enterprises (SMEs) and High-Net-Worth Individuals (HNWIs) with tailored financial solutions.

| Customer Segment | Key Needs | SAIB's Offerings |

|---|---|---|

| Retail Individuals | Basic banking, personal loans, credit cards, simple investments | Checking/savings accounts, loans, credit cards, investment products |

| SMEs | Commercial loans, trade finance, payroll, business accounts | Tailored credit facilities, trade finance, business banking solutions |

| Large Corporations | Project finance, M&A advisory, treasury services, syndicated loans | Corporate finance, project financing, M&A advisory, treasury services |

| Institutional Investors | Asset management, brokerage, custodial services | Advanced asset management, global brokerage, custodial solutions |

| HNWIs | Wealth management, private banking, estate planning | Bespoke wealth management, private banking, estate planning services |

Cost Structure

Personnel costs represent a substantial expenditure for Saudi Investment Bank (SAIB), encompassing salaries, benefits, training, and recruitment for its diverse workforce. These costs are fundamental to operating across all banking functions, from customer-facing roles to specialized investment and technology departments.

For SAIB, salaries and employee-related expenses saw an increase in 2024, reflecting the ongoing investment in human capital. This rise is typical for large financial institutions aiming to attract and retain talent in a competitive market, ensuring the bank has the skilled personnel necessary for its operations and strategic growth.

Saudi Investment Bank (SAIB) allocates substantial resources to its technology and infrastructure. This includes significant investments in robust IT systems, essential software licenses, and advanced cybersecurity measures to protect sensitive customer data. These expenditures are critical for maintaining efficient and secure modern banking operations.

The bank's commitment to digital transformation means ongoing development and maintenance of its digital platforms. In 2024, SAIB continued its focus on enhancing its technological capabilities, with IT spending being a key component of its operational budget, reflecting the industry-wide trend of prioritizing digital infrastructure for competitive advantage and customer service.

Saudi Investment Bank (SAIB) incurs significant expenses maintaining its physical branch network and ATM infrastructure. These costs encompass rent, utilities, security, and general administrative overheads across its 50-51 branches. Even with increasing digital adoption, this physical presence remains a substantial cost driver for SAIB.

Marketing & Sales Expenses

Marketing and sales expenses for Saudi Investment Bank are crucial for customer acquisition and retention in a dynamic financial landscape. These costs encompass a range of activities designed to build brand awareness and drive business growth.

Key components include significant investments in advertising campaigns across various media, from digital platforms to traditional channels, to reach a broad customer base. Promotional activities, such as special offers and financial product launches, also contribute to these expenses, aiming to attract new clients and encourage existing ones to deepen their engagement with the bank.

Brand building initiatives are essential for establishing trust and a strong market presence, requiring ongoing resources. Furthermore, sales force incentives, including commissions and performance-based bonuses, are vital for motivating the sales team to meet and exceed targets. For instance, in 2024, Saudi banks collectively saw marketing budgets increase to support digital transformation and customer-centric strategies.

- Advertising Campaigns: Significant allocation towards digital and traditional media to enhance visibility.

- Promotional Activities: Costs associated with new product launches and customer incentives.

- Brand Building: Investments in maintaining and strengthening the bank's reputation and market perception.

- Sales Force Incentives: Performance-based rewards to drive sales team productivity and customer acquisition.

Regulatory & Compliance Costs

The Saudi Investment Bank (SAIB) incurs significant expenses to comply with the strict regulatory environment governing the banking sector. These costs are essential for maintaining operational integrity and trust. In 2024, SAIB, like other financial institutions in the Kingdom, navigates a landscape shaped by the Saudi Central Bank's directives, necessitating ongoing investment in compliance functions.

Key components of these regulatory and compliance costs include expenses related to regular compliance audits, which are critical for verifying adherence to financial laws. Furthermore, managing legal fees associated with regulatory interpretation and dispute resolution forms a substantial part of this cost structure. SAIB also invests heavily in implementing and maintaining robust risk management systems, a non-negotiable requirement in today's financial markets.

- Compliance Audits: Expenses for internal and external audits to ensure adherence to Saudi Central Bank regulations.

- Legal Fees: Costs associated with legal counsel for regulatory interpretation and compliance matters.

- Risk Management Systems: Investment in technology and personnel for robust risk identification, assessment, and mitigation.

- Training and Development: Ongoing costs for staff training to stay updated on evolving regulatory requirements.

Saudi Investment Bank's cost structure is significantly influenced by its operational scale and strategic priorities. Personnel costs, technology investments, maintaining its physical presence, marketing efforts, and regulatory compliance are key expenditures. These elements collectively ensure the bank's functionality, growth, and adherence to industry standards.

Revenue Streams

Net interest income is the core engine driving Saudi Investment Bank's profitability. This income is essentially the spread earned from its lending and investment activities versus the cost of its funding. In 2024, SAIB saw a positive trend, with its net financing and investment income experiencing an increase, reflecting a healthy performance in its core banking operations.

Saudi Investment Bank (SAIB) generates significant revenue through its fee and commission income, a crucial element in its business model. This income arises from a wide array of banking services, encompassing everything from account maintenance and transaction processing to credit card charges and trade finance operations. The bank also earns advisory fees, reflecting its role in guiding clients through complex financial matters.

This diversified approach to revenue generation is a strategic advantage for SAIB, as it lessens the bank's dependence solely on interest income, which can be more volatile. For instance, in 2024, SAIB reported a notable increase in its fee income from banking services, demonstrating the growing contribution of these non-interest revenue streams to its overall financial performance.

Investment banking fees represent a significant revenue stream for Saudi Investment Bank, generated by offering specialized advisory and execution services. These include assisting clients with mergers and acquisitions (M&A), underwriting new stock and bond issuances, and structuring project finance deals.

For instance, in 2024, Saudi banks, including Saudi Investment Bank, continued to see robust activity in capital markets. The Saudi IPO market remained active, with several companies listing on Tadawul, generating underwriting fees. Furthermore, advisory services for cross-border and domestic M&A transactions contributed to this revenue segment.

Asset Management Fees

Asset management fees represent a core revenue stream for Saudi Investment Bank (SAIB), generated by managing investment portfolios for a diverse clientele, including institutional investors and high-net-worth individuals. These fees are typically structured as a percentage of the total assets SAIB manages, meaning the revenue directly scales with the growth of its managed assets.

SAIB's commitment to expanding its asset management services directly fuels this revenue. For instance, in 2023, the Saudi asset management industry saw significant growth, with total assets under management reaching approximately SAR 2.4 trillion by the end of the year, according to the Saudi Capital Market Authority (CMA). This broader market expansion provides a fertile ground for SAIB to increase its AUM and, consequently, its fee-based income.

- Fee Structure: Typically a percentage of Assets Under Management (AUM).

- Clientele: Institutional investors and high-net-worth individuals.

- Growth Driver: Expansion of managed assets directly increases revenue.

- Market Context: Saudi asset management industry saw substantial growth in 2023, reaching SAR 2.4 trillion in AUM.

Treasury & Trading Income

Treasury & Trading Income for Saudi Investment Bank (SAIB) encompasses profits derived from its active participation in foreign exchange, money markets, and the trading of fixed income securities and other financial instruments. This revenue stream is a direct reflection of the bank's market engagement and its proficiency in risk management.

SAIB's treasury operations are crucial for its overall financial health, generating income through various market-based activities. These include:

- Foreign Exchange Profits: Gains realized from buying and selling currencies, capitalizing on fluctuations in exchange rates.

- Money Market Operations: Income generated from short-term lending and borrowing activities, as well as investments in short-term debt instruments.

- Fixed Income Trading: Profits earned from the buying and selling of bonds and other fixed-income securities.

In 2024, the Saudi banking sector, including institutions like SAIB, continued to benefit from a stable economic environment and robust liquidity. While specific figures for SAIB's treasury income are typically disclosed in their annual reports, the broader market trends indicate a healthy performance in these areas. For instance, the Saudi Arabian Monetary Authority (SAMA) reported strong liquidity in the banking system throughout 2024, supporting active treasury operations.

Saudi Investment Bank (SAIB) diversifies its income beyond traditional interest by leveraging its investment banking capabilities. This segment captures revenue from advisory services for mergers and acquisitions, underwriting new debt and equity issuances, and structuring complex project finance deals. The Saudi market in 2024 continued to show strong activity in capital markets, with ongoing IPOs and M&A transactions providing ample opportunities for SAIB to earn significant fees.

| Revenue Stream | Description | 2024 Context |

| Investment Banking Fees | Advisory and execution services for M&A, underwriting, project finance. | Continued robust activity in Saudi IPO and M&A markets. |

| Asset Management Fees | Percentage of Assets Under Management (AUM) for institutional and HNW clients. | Saudi AUM reached SAR 2.4 trillion in 2023, supporting growth. |

| Treasury & Trading Income | Profits from FX, money markets, and fixed income trading. | Benefited from stable economic environment and strong banking liquidity in 2024. |

Business Model Canvas Data Sources

The Saudi Investment Bank Business Model Canvas is built using a combination of internal financial data, extensive market research on the Saudi banking sector, and strategic insights derived from industry best practices and competitor analysis. These diverse data sources ensure that each component of the canvas is grounded in factual information and reflects the current operational and strategic landscape.