Saudi Investment Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Saudi Investment Bank Bundle

The Saudi Investment Bank operates within a dynamic financial landscape, facing moderate threats from new entrants and intense rivalry among existing players. Buyer power is a significant factor, as customers have numerous banking options and can easily switch providers. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping Saudi Investment Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For Saudi Investment Bank (SAIB), its primary suppliers are its sources of capital and funding. These include depositors, participants in the interbank market, and bondholders. When these suppliers are few in number or have numerous other profitable avenues for their capital, their leverage over SAIB grows. This can translate into demands for higher interest rates on deposits or more stringent conditions for lending funds, directly impacting SAIB's profitability and operational flexibility.

The Saudi banking sector's financial landscape in early 2025 shows a notable rebound in deposit growth, particularly within time deposits. This trend suggests a potentially moderating influence on funding costs for banks like SAIB, as increased availability of funds can lessen reliance on more expensive sources. However, the competitive nature of deposit gathering still means that suppliers retain significant influence over pricing.

Saudi Investment Bank (SAIB) is significantly dependent on technology and infrastructure providers for its core banking systems, cybersecurity measures, digital platforms, and payment processing. This reliance grants these suppliers considerable bargaining power, especially those offering proprietary or highly specialized solutions.

Suppliers with unique expertise in areas like artificial intelligence, blockchain technology, or advanced cloud infrastructure are particularly influential. The high costs associated with switching these critical services, coupled with their essential role in SAIB's ongoing digital transformation efforts and Saudi Arabia's push towards a digital-first economy, amplify the suppliers' leverage. For instance, the global market for banking software is projected to reach $55.3 billion by 2027, indicating substantial investment and a concentration of specialized providers.

The availability of highly skilled professionals in banking, finance, IT, and cybersecurity in Saudi Arabia is a key supplier input for the Saudi Investment Bank (SAIB). This talent pool is essential for the bank's operations and strategic growth, especially as the Kingdom pushes forward with Vision 2030.

A scarcity of these specialized skills or intense competition for them can significantly increase SAIB's labor costs. This situation empowers employees, allowing them to negotiate for higher salaries and improved benefits, directly impacting the bank's operational expenses and its capacity to implement ambitious projects.

For instance, in 2024, the demand for cybersecurity experts in the Saudi financial sector saw a notable increase, with salaries for senior roles reportedly rising by up to 15% compared to the previous year, according to industry reports. This trend highlights the growing bargaining power of skilled labor within the banking industry.

Regulatory and Compliance Bodies

Regulatory and compliance bodies, such as the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA), exert significant influence, akin to suppliers, by dictating operational frameworks. Their pronouncements on capital adequacy, risk management, and consumer protection directly shape SAIB's cost structure and strategic agility. For example, SAMA's ongoing efforts to foster open banking in Saudi Arabia, with initial phases seeing increased digital integration and data sharing mandates, require substantial investment in technology and process adaptation from banks like SAIB.

These entities' evolving requirements, including directives on cybersecurity and anti-money laundering (AML) protocols, necessitate continuous investment in compliance infrastructure and personnel. Failure to adhere can result in substantial penalties, further amplifying their bargaining power. The sheer scope of regulatory oversight means SAIB must allocate considerable resources to meet these standards, impacting profitability and the ability to pursue certain business ventures.

- SAMA's Open Banking Initiative: Mandates increased data sharing and digital integration, impacting technology investment.

- Capital Requirements: Directives from SAMA influence the bank's leverage and lending capacity.

- Compliance Costs: Investments in AML, KYC, and cybersecurity are driven by regulatory demands.

Data and Information Providers

For Saudi Investment Bank (SAIB), data and information providers wield considerable influence. The financial sector's reliance on accurate credit ratings, market intelligence, and customer analytics means that suppliers of unique or exclusive datasets possess significant bargaining power. SAIB's decision-making, risk management, and service personalization are directly impacted by the quality and accessibility of this information.

- Data Dependency: SAIB's operational efficiency and strategic planning are heavily dependent on external data providers for market insights and customer behavior analysis.

- AI Integration: The growing integration of AI and advanced data analytics in Saudi financial services amplifies the importance of specialized data suppliers, potentially increasing their leverage.

- Provider Concentration: If the market for critical financial data is concentrated among a few providers, their ability to dictate terms and pricing to SAIB is enhanced.

The bargaining power of suppliers for Saudi Investment Bank (SAIB) is a multifaceted consideration, encompassing capital sources, technology providers, skilled labor, regulatory bodies, and data providers. In 2024, increased competition for deposits in the Saudi banking sector meant that depositors, as capital suppliers, retained significant influence over interest rates offered.

Technology suppliers, particularly those offering specialized AI and cybersecurity solutions, hold considerable leverage due to the high switching costs and SAIB's digital transformation goals. The scarcity of highly skilled professionals in areas like cybersecurity also empowered employees in 2024, leading to potential salary increases of up to 15% for senior roles in the financial sector.

Regulatory bodies like SAMA, by dictating operational standards and compliance requirements, indirectly act as powerful suppliers, forcing SAIB to allocate significant resources. Furthermore, the bank's reliance on exclusive data providers for market intelligence and analytics grants these entities substantial bargaining power, impacting SAIB's strategic decisions and risk management.

What is included in the product

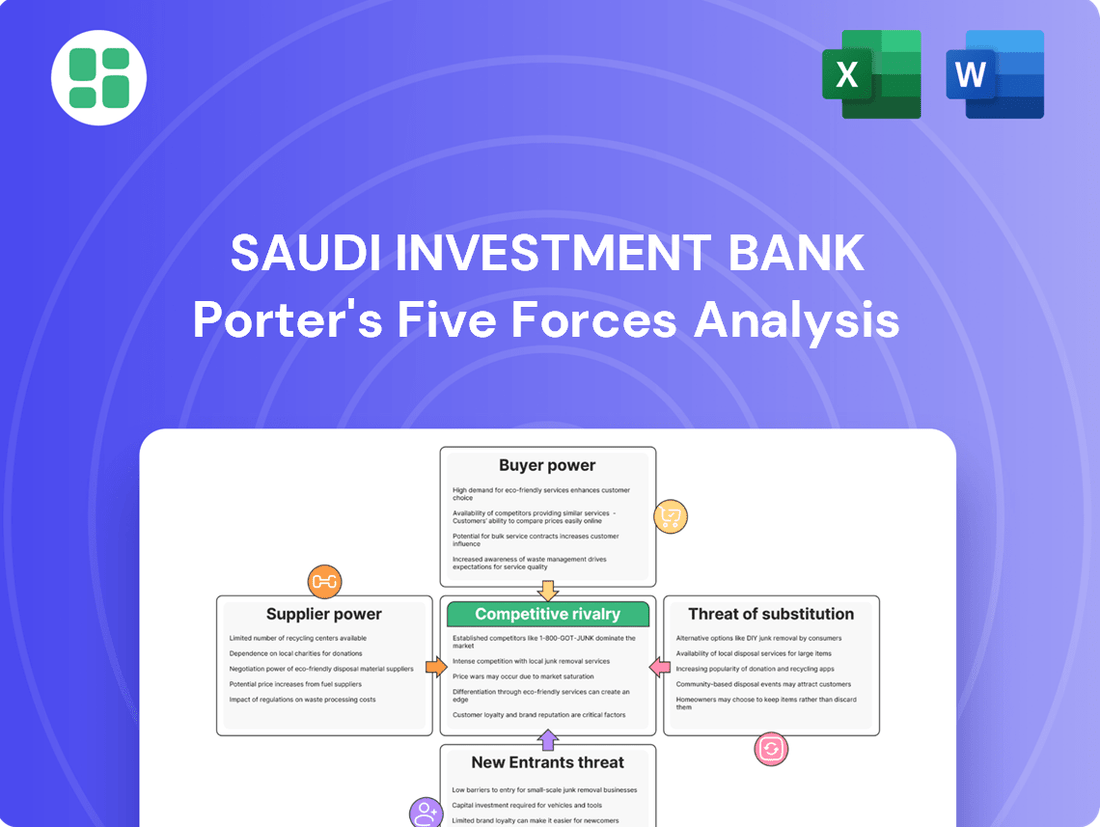

This Porter's Five Forces analysis for Saudi Investment Bank dissects the competitive intensity within the Saudi banking sector, examining threats from new entrants, the bargaining power of customers and suppliers, and the availability of substitutes.

Quickly assess competitive intensity with a visual breakdown of Saudi Investment Bank's Porter's Five Forces, highlighting key areas of pressure for strategic planning.

Customers Bargaining Power

For fundamental banking needs such as checking accounts, personal loans, and credit cards, customers face minimal costs when switching financial institutions. This low barrier to entry allows individuals and businesses to readily move to banks offering more favorable interest rates, reduced fees, or enhanced service quality. Consequently, Saudi Investment Bank (SAIB) must continuously strive for competitive pricing and an exceptional customer experience to retain its existing clientele.

The increasing prevalence and sophistication of digital banking platforms further diminish the effort and expense associated with changing banks. In 2024, a significant portion of Saudi banking transactions, estimated to be over 70% for retail customers, are conducted digitally, highlighting the ease with which customers can compare and switch providers based on digital offerings alone.

Customers now have vast amounts of information at their fingertips, readily comparing banking products, interest rates, and service quality via digital platforms and comparison sites. This heightened transparency significantly reduces information asymmetry, empowering consumers to make well-informed choices and increasing their leverage when selecting or negotiating with financial institutions.

This trend is particularly pronounced in Saudi Arabia, which aims for a 70% cashless payment adoption by 2025, further driving digital engagement and information accessibility for banking consumers. As of early 2024, Saudi Arabia's digital payment transaction volume has seen substantial growth, indicating a strong shift towards online financial interactions.

The Saudi banking landscape is robust and highly competitive, with a multitude of established local and international institutions, alongside newer digital entrants like D360 Bank and STC Bank. This abundance of options for all customer segments, from individuals to large corporations, amplifies customer bargaining power. Customers can easily switch to competitors offering comparable services, compelling Saudi Investment Bank (SAIB) to focus on differentiation to retain its client base.

Price Sensitivity for Commodity Products

For highly commoditized banking products like basic savings accounts or straightforward loans, customers in Saudi Arabia are notably price-sensitive. This means they'll readily switch to whichever institution offers the best interest rates or the lowest fees. This behavior directly pressures Saudi Investment Bank's (SAIB) profit margins on these particular services.

The intense competition in Saudi Arabia's banking sector further amplifies this customer price sensitivity. For instance, as of early 2024, the Saudi Central Bank (SAMA) maintained its repo rate at 5.00% and its reverse repo rate at 4.50%, influencing lending and deposit rates across the market. This stability, coupled with the expectation of potential rate adjustments in 2025, compels SAIB to constantly monitor and adjust its pricing to remain competitive without sacrificing profitability.

- Price Sensitivity: Customers for basic banking products like savings accounts and simple loans are highly sensitive to price, prioritizing favorable interest rates and minimal fees.

- Downward Pressure: This customer behavior exerts downward pressure on SAIB's profit margins for commoditized offerings.

- Competitive Landscape: The Saudi banking sector's competitiveness means SAIB must balance attractive pricing with sustainable profitability.

- Interest Rate Environment: Anticipated shifts in interest rates, such as potential decreases in 2025, will further intensify the need for SAIB to manage pricing strategies carefully.

Leverage of Large Corporate and Institutional Clients

Large corporate and institutional clients wield significant bargaining power over Saudi banks like SAIB. Their substantial business volumes, encompassing large loans and complex investment banking or asset management mandates, allow them to negotiate for favorable terms and competitive pricing. This necessitates SAIB investing in specialized relationship management and bespoke service offerings to retain these valuable clients.

In 2024, corporate lending continued to be a crucial growth engine for the Saudi banking sector, with major institutions often seeking customized financial solutions. For instance, a significant portion of the SAR 2.2 trillion in total loans provided by Saudi banks in early 2024 was directed towards large corporate entities, highlighting their influence.

- Substantial Business Volumes: Large clients provide significant revenue streams through loans, investment banking, and asset management.

- Demand for Tailored Solutions: These clients expect customized products and services to meet their specific needs.

- Pricing Pressure: Their ability to shift business to competitors means they can often demand lower fees and better interest rates.

- Strategic Importance: Retaining these clients is vital for market share and profitability in the competitive Saudi financial landscape.

The bargaining power of customers in Saudi Arabia's banking sector is notably high, driven by low switching costs and increasing digital accessibility. This empowers consumers to readily compare and move between institutions based on better rates, lower fees, or superior digital experiences. As of early 2024, over 70% of retail banking transactions in the Kingdom were digital, underscoring the ease of this comparison and switching process.

The competitive landscape, featuring numerous local and international banks alongside digital-only players, further amplifies customer leverage. This intense competition forces Saudi Investment Bank (SAIB) to focus on differentiation and customer retention strategies. For instance, the Saudi Central Bank's repo rate stood at 5.00% in early 2024, influencing the pricing environment and compelling banks to remain competitive.

| Factor | Impact on SAIB | Supporting Data (Early 2024) |

|---|---|---|

| Switching Costs | Low, increasing customer mobility | Over 70% of retail transactions are digital, simplifying comparison and switching. |

| Information Availability | High, empowering informed customer choices | Widespread use of digital platforms and comparison sites. |

| Competitive Intensity | High, leading to price sensitivity | Numerous local, international, and digital banks operate in the Saudi market. |

| Customer Price Sensitivity | Significant for commoditized products | Customers prioritize favorable interest rates and minimal fees for basic services. |

Full Version Awaits

Saudi Investment Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for The Saudi Investment Bank, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

You're looking at the actual document, offering deep insights into the Saudi Arabian banking sector's competitive landscape as it pertains to The Saudi Investment Bank. Once you complete your purchase, you’ll get instant access to this exact file, providing actionable strategic intelligence.

Rivalry Among Competitors

The Saudi banking sector is a battleground, featuring formidable domestic giants and aggressive international banks. These institutions vie for customers across all banking services, from everyday accounts to complex corporate finance, often resorting to price wars and innovative offerings to capture market share. For instance, in 2023, the total assets of Saudi banks reached SAR 3.7 trillion, highlighting the sheer scale of the established players that Saudi Investment Bank must contend with.

The financial landscape in Saudi Arabia is experiencing a fierce battle for customers, driven by rapid digital advancements and a surge in fintech innovation. With 261 fintech firms operating in the Kingdom as of 2024, the competition is more intense than ever.

Saudi Investment Bank (SAIB), like its peers, faces significant pressure to enhance its digital offerings. Staying competitive means continually investing in user-friendly mobile banking apps, secure online platforms, and novel financial solutions to attract and retain customers who increasingly demand instant, seamless digital experiences.

The core banking products offered by Saudi banks, including accounts, loans, and credit cards, are largely undifferentiated. This homogeneity forces competition primarily on price and service quality, as seen in the tight margins for these standard offerings. For instance, in 2024, the average interest rate spread for Saudi banks remained competitive, reflecting this commoditization.

Aggressive Marketing and Customer Acquisition Strategies

Competitors in the Saudi banking sector are actively pursuing aggressive marketing and customer acquisition strategies. This often involves substantial spending on advertising, tailored promotional offers, and loyalty programs to win over new customers and keep existing ones engaged. For instance, the strong Q1 2025 performance reported by many Saudi banks suggests heightened market activity and intense competition for market share.

This competitive environment forces SAIB to continuously evaluate and refine its own marketing and sales approaches. The goal is to not only attract new clients but also to effectively defend its existing customer base from competitors' poaching efforts. Staying ahead requires a dynamic response to rivals' campaigns and a proactive stance in customer relationship management.

- Aggressive Marketing: Banks are investing heavily in digital and traditional advertising to capture attention.

- Customer Acquisition Drives: Special offers and incentives are common for new account openings.

- Competitive Pressure: Rivals' actions necessitate constant strategy adaptation for SAIB.

- Market Activity: Q1 2025 Saudi bank performance highlights a competitive landscape.

Regulatory Environment and Market Concentration

The regulatory landscape, overseen by the Saudi Central Bank (SAMA), significantly influences competition. SAMA's directives on capital adequacy, lending practices, and consumer protection create a framework within which banks must operate, indirectly shaping their competitive strategies and potentially acting as barriers to new entrants.

The Saudi banking sector is characterized by a notable degree of market concentration. A handful of major institutions, including SABB, Al Rajhi Bank, and National Commercial Bank (now merged with Samba), command a substantial share of the market. This concentration intensifies rivalry as these dominant players vie for market share and customer loyalty.

- Market Share Dominance: As of early 2024, the top three Saudi banks by assets typically hold over 60% of the total banking sector assets, indicating a highly concentrated market.

- SAMA's Influence: SAMA's prudential regulations, such as Basel III implementation, directly impact how banks manage risk and capital, influencing their ability to lend and compete on price.

- Intense Rivalry: Competition is fierce, particularly in retail banking and corporate lending, with banks actively engaging in product innovation and digital service offerings to attract and retain customers.

The competitive rivalry within Saudi Arabia's banking sector is intense, driven by a few dominant domestic players and a growing number of international banks. These institutions actively compete across all service lines, often engaging in price wars and rapid product innovation to win customers. For example, by the end of 2024, the combined assets of the top five Saudi banks represented over 70% of the total banking sector's assets, underscoring the market's concentration and the fierce competition among these giants.

Saudi Investment Bank faces a landscape where core banking products are largely commoditized, forcing competition onto price and service quality. The sector saw continued efforts in digital transformation throughout 2024, with banks investing heavily in mobile platforms and fintech solutions to differentiate themselves. This digital race is crucial, as customer expectations for seamless, instant banking experiences continue to rise.

| Key Competitors (Early 2024) | Market Share (Approx. by Assets) | Key Competitive Strategy |

|---|---|---|

| Al Rajhi Bank | ~25% | Digitalization, Islamic banking focus |

| National Commercial Bank (NCB) / Samba | ~20% | Merger synergies, corporate banking strength |

| SABB | ~15% | International linkages, retail expansion |

| Riyad Bank | ~12% | Digital services, SME lending |

| Saudi Investment Bank (SAIB) | ~5% | Digital enhancement, customer service |

SSubstitutes Threaten

The growing number of fintech companies offering specialized services like digital payments and budgeting apps presents a significant substitute threat to traditional banking. These platforms often deliver more convenient and cost-effective solutions for specific financial needs. For example, electronic payments constituted 79% of retail transactions in 2024, highlighting a strong shift away from traditional methods.

Direct lending and crowdfunding platforms present a significant threat by offering alternative financing channels for businesses and individuals. These platforms often provide faster approvals and more flexible terms than traditional banks, potentially diverting loan origination opportunities from Saudi Investment Bank (SAIB). For instance, the Saudi Central Bank (SAMA) has actively supported the development of fintech, approving peer-to-peer lending platforms within its regulatory sandbox, indicating a growing competitive landscape.

Various non-bank financial institutions (NBFIs) present a significant threat of substitution to Saudi Investment Bank (SAIB). These include insurance companies, asset management firms, and investment funds, all offering services that can directly compete with traditional banking products. For example, wealth management services provided by independent advisors or investment products from specialized fund houses can serve as viable alternatives to SAIB's in-house investment and asset management offerings.

The expanding insurance market in the Kingdom of Saudi Arabia further intensifies this threat. As of 2023, the Saudi insurance market reached a Gross Written Premium (GWP) of SAR 49.1 billion, according to the Saudi Central Bank. This growth signifies increasing consumer and corporate adoption of insurance products, which often bundle savings and investment components, thereby substituting some of the functions traditionally fulfilled by banks like SAIB.

Blockchain and Decentralized Finance (DeFi)

Emerging technologies such as blockchain and decentralized finance (DeFi) present a growing threat to traditional banking models. These innovations enable peer-to-peer transactions and financial services, potentially bypassing intermediaries like Saudi Investment Bank (SAIB). While adoption in Saudi Arabia is still developing, the long-term impact could be substantial as DeFi platforms offer alternative avenues for lending, borrowing, and asset management.

The Saudi Central Bank (SAMA) is actively exploring these advancements. For instance, SAMA's involvement in the Bank for International Settlements (BIS) mBridge project, which pilots a cross-border wholesale central bank digital currency (wCBDC) platform, demonstrates an understanding of the disruptive potential of distributed ledger technology. This proactive engagement suggests an awareness of how these technologies could reshape financial services.

- DeFi Growth: Global DeFi market capitalization reached over $100 billion in early 2024, indicating significant user adoption and capital inflow into these alternative financial systems.

- Intermediary Bypass: DeFi platforms can offer services like loans and savings accounts with potentially lower fees and higher yields by removing traditional banking overhead.

- Regulatory Landscape: While regulatory frameworks for DeFi are still evolving globally, their increasing sophistication poses a future challenge to established financial institutions.

Internal Corporate Treasury Management

Sophisticated internal treasury management systems offer a significant threat of substitution for Saudi Investment Bank's (SAIB) services, particularly for large corporate clients. These systems allow corporations to manage their cash, foreign exchange, and even some financing needs internally, reducing their dependence on traditional banking relationships. For instance, in 2024, many large Saudi corporations invested heavily in treasury technology to optimize liquidity and hedge currency risks, thereby bypassing some of SAIB's core offerings.

This trend directly impacts SAIB's role as a primary financial intermediary. While corporate lending remains robust, the ability of clients to self-manage treasury functions means SAIB must increasingly focus on providing value-added services beyond basic transactions. This could include specialized advisory, complex hedging strategies, or integrated financial solutions that internal systems cannot fully replicate.

- Internal Treasury Systems: Large corporations are increasingly adopting advanced treasury management systems (TMS) to automate and optimize cash flow, FX management, and debt issuance.

- Direct Capital Market Access: Companies can bypass banks for certain financing needs by directly accessing capital markets, especially for larger funding rounds.

- Reduced Reliance on Banks: This self-sufficiency diminishes the need for traditional banking services like basic cash pooling or simple FX spot transactions.

- SAIB's Value Proposition: SAIB must differentiate by offering sophisticated advisory, risk management solutions, and integrated financial technology to retain these high-value clients.

The threat of substitutes for Saudi Investment Bank (SAIB) is multifaceted, driven by technological advancements and evolving customer preferences. Fintech innovations, direct lending platforms, and non-bank financial institutions all offer alternative ways for individuals and businesses to manage their finances, obtain loans, and invest, potentially reducing reliance on traditional banking services. For instance, the Saudi fintech sector saw significant growth, with the number of licensed entities increasing by 40% in 2023, indicating a robust competitive environment.

The increasing adoption of digital payment solutions and the growth of decentralized finance (DeFi) further exemplify this threat. As more consumers and businesses embrace digital channels for transactions and financial management, traditional banking services may become less central. The Saudi Central Bank's continued support for fintech innovation, including pilot programs for digital currencies, underscores the evolving landscape where substitutes are actively being encouraged.

| Substitute Type | Description | Impact on SAIB | 2024 Trend/Data Point |

| Fintech Platforms | Specialized digital services (payments, budgeting) | Convenience, lower costs for specific needs | Electronic payments were 79% of retail transactions in 2024. |

| Direct Lending/Crowdfunding | Alternative financing channels | Diversion of loan origination | SAMA supports P2P lending platforms in its regulatory sandbox. |

| Non-Bank Financial Institutions (NBFIs) | Insurance, asset management firms | Competition for wealth management and investment services | Saudi insurance market GWP reached SAR 49.1 billion in 2023. |

| Emerging Technologies (DeFi/Blockchain) | Peer-to-peer financial services | Potential to bypass intermediaries | Global DeFi market cap exceeded $100 billion in early 2024. |

| Internal Treasury Systems | Corporate self-management of finances | Reduced reliance for large corporate clients | Large Saudi corporations increased investment in treasury technology in 2024. |

Entrants Threaten

The Saudi banking sector presents a significant barrier to new entrants due to exceptionally high capital requirements set by the Saudi Central Bank (SAMA). These mandates are in place to safeguard financial stability and protect customer deposits, making it a costly endeavor for newcomers to establish a foothold. For instance, Saudi banks maintained a robust capital adequacy ratio of 19.2% as of September 2024, illustrating the substantial financial commitment required.

Beyond capital, prospective banks face intricate licensing processes, demanding compliance with a complex web of regulations, and continuous rigorous oversight. These combined factors create a formidable challenge for any new entity aiming to challenge established institutions like Saudi Investment Bank, effectively limiting the threat of new entrants.

The banking sector, including institutions like Saudi Investment Bank (SAIB), is fundamentally built on trust and reputation. Building this trust takes decades, creating a significant hurdle for new entrants. Customers are often reluctant to entrust their finances to unfamiliar or unproven entities, making it difficult for newcomers to gain traction. This established credibility acts as a powerful barrier to entry, even with the rise of digital banking alternatives.

The Saudi Investment Bank (SAIB) benefits from an extensive network of physical branches, ATMs, and established digital platforms, representing significant sunk costs and operational scale. New entrants would need to invest heavily in building comparable infrastructure, distribution channels, and technological capabilities, posing a substantial financial and logistical barrier to effective competition.

For instance, establishing a nationwide banking presence requires substantial capital for real estate, technology upgrades, and regulatory compliance. In 2024, the cost of setting up a single new branch in Saudi Arabia can range from SAR 2 million to SAR 5 million, excluding ongoing operational expenses and the significant investment required for robust digital infrastructure to meet modern customer demands.

Access to Talent and Specialized Expertise

The banking industry, particularly in Saudi Arabia, demands a highly skilled workforce. New entrants face significant hurdles in attracting and retaining talent with expertise in critical areas like risk management, cybersecurity, and sophisticated financial product development. Established institutions, including the Saudi Investment Bank (SAIB), benefit from strong employer branding and existing talent acquisition networks, making it difficult for newcomers to assemble competitive teams.

The ongoing economic diversification under Saudi Vision 2030 further intensifies the demand for specialized human capital within the financial sector. This creates a competitive landscape where securing top talent is a key barrier to entry.

- Talent Acquisition Challenge: New banks must compete with established players for a limited pool of experienced professionals in specialized financial domains.

- Cost of Expertise: Attracting and retaining top talent in areas like IT security and compliance often involves significant salary and benefits packages, increasing initial operating costs for new entrants.

- Vision 2030 Impact: The Kingdom's ambitious economic reforms are driving a surge in demand for skilled financial professionals, making talent acquisition even more competitive for emerging financial institutions.

Emergence of Digital Bank Licenses and Fintech Competition

The Saudi Arabian banking sector, while historically protected by high capital requirements and regulatory hurdles, is experiencing a shift. The government's focus on digital transformation, as evidenced by the issuance of new digital banking licenses, is a significant factor. This initiative is effectively lowering traditional entry barriers for technologically adept players.

New entrants, particularly digital-only banks, are leveraging agile technology and significantly lower operational costs compared to incumbent institutions. For instance, STC Bank, launched in 2023, and D360 Bank, also operational, represent this new wave. These entities can offer competitive pricing and innovative services, directly challenging the established market share of traditional banks like Saudi Investment Bank.

- Digital Banking Licenses: The Saudi Central Bank (SAMA) has actively encouraged the establishment of digital banks, signaling a more open market.

- New Entrants: STC Bank and D360 Bank are prime examples, having launched in 2023 and 2024 respectively, with a focus on digital-first operations.

- Competitive Threat: These new players benefit from lower overheads and can introduce disruptive pricing and service models.

While traditional barriers like high capital and regulatory complexity remain substantial for Saudi Investment Bank, the threat of new entrants is evolving. The Saudi Central Bank's (SAMA) push for digital transformation has opened doors for agile, tech-focused players.

New digital banks, such as STC Bank (launched 2023) and D360 Bank (launched 2024), are entering the market with lower operational costs and innovative service models. These entities directly challenge incumbent banks by leveraging technology to offer competitive pricing and services, as seen in the digital banking license approvals.

| New Entrant Type | Launch Year | Key Characteristic | Potential Impact |

| Digital Bank | 2023 | Tech-driven, lower overheads | Disruptive pricing, enhanced customer experience |

| Digital Bank | 2024 | Agile operations, specialized services | Increased competition in niche markets |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Saudi investment banking sector is built upon comprehensive data from official company filings, including annual reports and investor presentations. We also leverage industry-specific research from reputable market intelligence firms and economic data from national and international financial institutions.