RXO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RXO Bundle

RXO's strategic positioning in the logistics sector is bolstered by its strong operational network and experienced management team, but also faces challenges from intense market competition and evolving customer demands.

Want the full story behind RXO's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

RXO's asset-light business model is a significant strength, allowing it to operate with lower capital expenditures compared to asset-heavy competitors. This approach means less money tied up in owning and maintaining a large fleet, offering greater flexibility.

This operational flexibility is crucial for adapting to market shifts and scaling operations efficiently. By not bearing the full cost of fleet ownership, RXO can reduce fixed costs and improve its financial agility, a key advantage in the often-volatile transportation and logistics sector.

In 2024, RXO focused its capital expenditures on strategic areas like technology and equipment upgrades, rather than fleet expansion. This strategic allocation of capital underscores the benefits of its asset-light strategy, enabling investments that enhance service capabilities without the burden of extensive physical asset ownership.

RXO's proprietary technology platform, exemplified by RXO Connect®, is a significant strength. This digital brokerage platform is designed to streamline freight movement, boosting efficiency and reliability. It's a key differentiator in the logistics space.

The company's investment in advanced technology is paying off, with AI and machine learning driving substantial productivity improvements. In fact, brokerage productivity saw a notable 17% increase over the past year, directly attributable to these technological advancements.

Furthermore, the seamless integration of Coyote's operations onto this unified technological backbone reinforces RXO's competitive edge. This consolidation enhances the platform's capabilities and broadens its impact across the organization.

RXO's diverse service portfolio is a significant strength, encompassing freight brokerage, managed transportation, and last-mile delivery. This broad offering allows them to serve a wide array of customer requirements and tap into multiple revenue channels. For example, in the first quarter of 2024, RXO reported that its managed transportation segment saw revenue increase by 3% year-over-year, demonstrating the stability provided by this diversified approach.

Scalability and Adaptability

RXO's asset-light business model, when paired with its sophisticated integrated technology, provides a significant advantage in swiftly adjusting to evolving market needs and expanding its operational reach. This inherent flexibility allows the company to scale up or down its services efficiently without the heavy capital investment typically associated with owning a large fleet of assets.

The successful integration of Coyote's operations onto the RXO Connect platform is a prime example of this scalability in action. This migration showcases the robustness of their existing technological infrastructure, proving its capacity to manage higher freight volumes and a broader network of carriers effectively. For instance, in Q1 2024, RXO reported a 16% increase in freight volume handled through its digital platforms, underscoring this capability.

- Asset-Light Model: Reduces capital expenditure and increases operational flexibility.

- Integrated Technology: RXO Connect® enables efficient scaling of operations and carrier management.

- Digital Freight Volume Growth: Demonstrated ability to handle increased loads through technology, as seen in Q1 2024 performance.

Strong Market Position and Integration Synergies

RXO solidified its market standing significantly after acquiring Coyote Logistics, now ranking as the third-largest full-truckload freight broker across North America. This strategic move not only expanded its operational footprint but also endowed the company with a substantial dataset, crucial for advanced analytics and informed decision-making.

The integration of Coyote Logistics is progressing ahead of its initial timeline, with carrier and coverage operations now fully unified. This seamless integration is a key strength, enabling RXO to leverage its combined resources more effectively and efficiently.

RXO anticipates realizing over $70 million in annualized cost synergies stemming from the Coyote Logistics acquisition. These synergies are expected to enhance profitability and operational efficiency, bolstering RXO's competitive advantage in the freight brokerage sector.

- Market Leadership: RXO is now the third-largest full-truckload freight broker in North America post-Coyote acquisition.

- Data Advantage: The company possesses an immense dataset for sophisticated market analysis.

- Integration Progress: Carrier and coverage operations are unified, with integration ahead of schedule.

- Synergy Realization: RXO projects over $70 million in annualized cost synergies from the acquisition.

RXO's robust technological infrastructure, particularly its proprietary RXO Connect platform, is a significant strength. This digital brokerage solution enhances efficiency and reliability in freight movement, acting as a key differentiator. Productivity improvements driven by AI and machine learning have been substantial, with brokerage productivity increasing by 17% over the past year, showcasing the tangible benefits of their tech investments.

The company's asset-light model provides substantial operational flexibility and reduces capital expenditure requirements. This allows for efficient scaling of operations and adaptation to market changes without the burden of extensive fleet ownership. For instance, RXO strategically allocated capital in 2024 towards technology and equipment upgrades rather than fleet expansion, highlighting this advantage.

RXO's market position has been significantly bolstered by the acquisition of Coyote Logistics, establishing it as the third-largest full-truckload freight broker in North America. This integration is ahead of schedule, with carrier and coverage operations now fully unified. The company anticipates over $70 million in annualized cost synergies from this acquisition, further strengthening its financial standing and competitive edge.

| Key Strength | Description | Supporting Data/Fact |

| Asset-Light Model | Reduces capital expenditure and increases operational flexibility. | Strategic capital allocation in 2024 focused on technology, not fleet expansion. |

| Integrated Technology (RXO Connect) | Enhances efficiency, reliability, and enables effective scaling. | Brokerage productivity increased by 17% due to AI/ML advancements. |

| Market Leadership & Integration | Third-largest full-truckload freight broker in North America post-Coyote acquisition. | Integration ahead of schedule; projected over $70 million in annualized cost synergies. |

What is included in the product

Delivers a strategic overview of RXO’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

RXO's SWOT analysis offers a structured framework to identify and address operational inefficiencies, acting as a proactive pain point reliever by highlighting areas for improvement.

Weaknesses

RXO's position as an asset-light freight broker means it depends heavily on its network of third-party carriers. This reliance can create vulnerabilities if carrier availability fluctuates or if pricing becomes unfavorable. For instance, disruptions in the broader trucking market, such as driver shortages or increased fuel costs, directly affect RXO's ability to secure capacity and maintain competitive pricing for its clients.

The quality and reliability of these external carriers are also critical. Any issues with carrier performance, such as late deliveries or damaged goods, can negatively impact RXO's reputation and customer satisfaction. In the first quarter of 2024, RXO reported a revenue of $938 million, highlighting the scale of operations where even minor service inconsistencies from carriers could have a significant financial impact.

RXO's reliance on the broader economy makes it vulnerable to economic downturns. Soft freight market conditions, a persistent challenge, directly impact demand for their services. For instance, the company reported a decline in full truckload volume in Q1 2025, illustrating this sensitivity.

The logistics sector is incredibly crowded, with many companies vying for business. This means RXO faces constant pressure on pricing, which can squeeze profit margins. For instance, in the competitive freight brokerage landscape, companies often have to offer lower rates to secure loads, impacting overall profitability, particularly when dealing with smaller clients.

Integration Challenges and Associated Costs

While the acquisition of Coyote Logistics by RXO promised significant synergies, the integration process has presented notable short-term hurdles. These challenges have manifested as increased expenses, impacting recent financial performance. Specifically, transaction, integration, and restructuring costs weighed on RXO's earnings in the fourth quarter of 2024 and the first quarter of 2025.

The integration efforts have also led to a noticeable impact on RXO's core brokerage operations. This has resulted in a deterioration of earnings within this segment, contributing to a more cautious outlook for the company's financial performance throughout 2025. The company has consequently lowered its earnings projections for the year.

- Integration Costs: Transaction, integration, and restructuring expenses negatively affected Q4 2024 and Q1 2025 results.

- Earnings Deterioration: Core brokerage earnings experienced a decline due to integration complexities.

- Lowered 2025 Outlook: The integration challenges prompted a reduction in RXO's earnings guidance for 2025.

Profitability and EPS Declines

Despite revenue growth, RXO experienced significant financial challenges, reporting a net loss of $290 million for the full year 2024. This trend continued into early 2025, with adjusted net losses reported in both the fourth quarter of 2024 and the first quarter of 2025, highlighting ongoing profitability concerns.

The company's earnings per share (EPS) saw a substantial decline, dropping by 71.2% annually over the past two years. This sharp decrease indicates that while RXO managed to expand its top line, its ability to translate that revenue into profit on a per-share basis weakened considerably, raising questions about its operational efficiency and cost management strategies.

- Net Loss: RXO reported a net loss of $290 million in 2024.

- Adjusted Net Losses: The company also posted adjusted net losses in Q4 2024 and Q1 2025.

- EPS Decline: Annual EPS decreased by 71.2% over the last two years.

RXO's reliance on third-party carriers makes it susceptible to fluctuations in carrier availability and pricing, directly impacting its ability to secure capacity and maintain competitive rates. Any disruptions in the broader trucking market, such as driver shortages or increased fuel costs, can significantly affect RXO's operational efficiency and profitability. For example, in Q1 2025, RXO experienced a decline in full truckload volume, underscoring its sensitivity to market conditions.

The integration of Coyote Logistics has introduced significant challenges, including increased expenses and a deterioration of earnings within its core brokerage operations. These integration complexities led RXO to lower its earnings projections for 2025, reflecting a more cautious financial outlook. The company reported a net loss of $290 million for the full year 2024, with adjusted net losses also noted in Q4 2024 and Q1 2025, highlighting ongoing profitability concerns.

| Financial Metric | 2024 (Full Year) | Q4 2024 | Q1 2025 |

| Net Loss | $290 million | N/A | N/A |

| Adjusted Net Loss | N/A | Reported | Reported |

| EPS Change (Annual) | -71.2% (over 2 years) | N/A | N/A |

Preview Before You Purchase

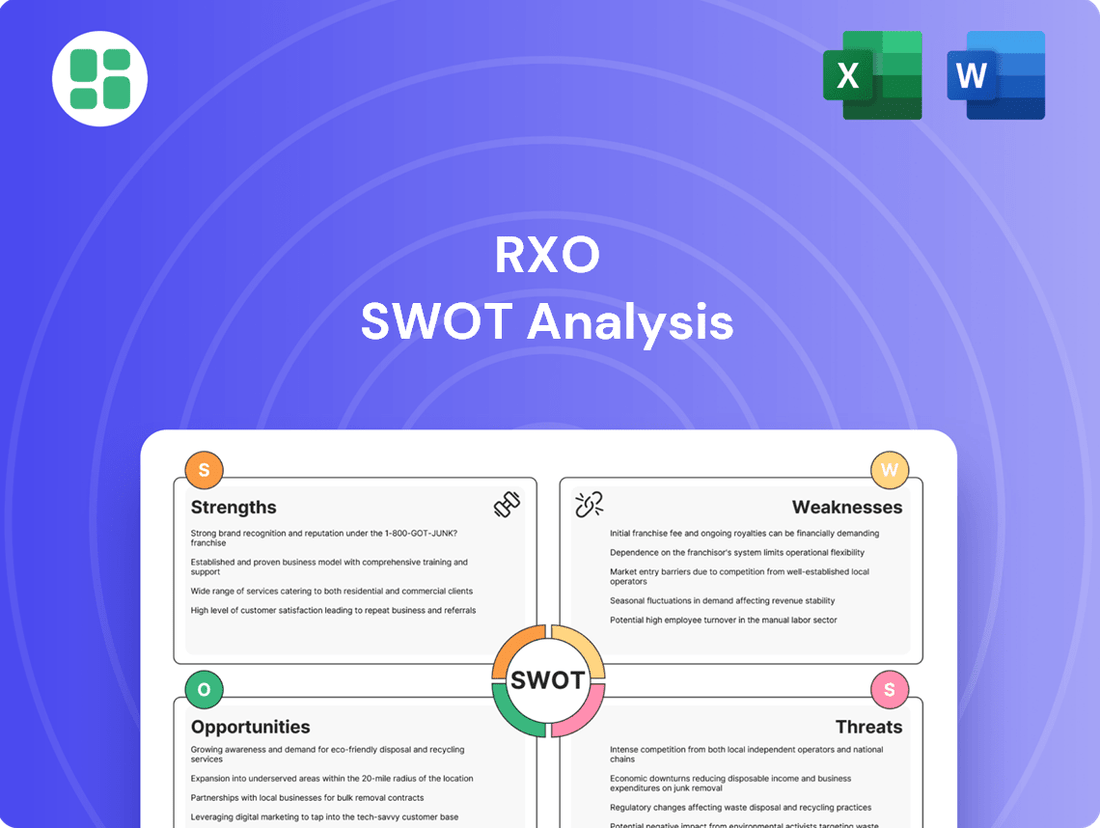

RXO SWOT Analysis

This is the actual RXO SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive insights that will be yours.

The preview below is taken directly from the full RXO SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

This is a real excerpt from the complete RXO SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The relentless growth of e-commerce is a significant tailwind, creating a surging demand for sophisticated and dependable last-mile delivery services, as well as overall freight movement. RXO is strategically positioned to leverage this expanding market. In fact, RXO's Last Mile stops saw an impressive 24% increase year-over-year during the first quarter of 2025, underscoring their capacity to meet this escalating need.

RXO can unlock substantial gains by deepening its commitment to advanced analytics, AI, and machine learning. These technologies are pivotal for refining operational efficiency, bolstering predictive accuracy, and optimizing delivery routes, directly impacting cost savings and service speed.

The company has already witnessed a tangible 17% boost in productivity thanks to AI and machine learning integration. This demonstrates the immediate value of these investments, with expectations for even greater enhancements as RXO continues to feed more data into its advanced systems throughout 2024 and into 2025.

The fragmented logistics landscape offers RXO significant opportunities to grow through strategic alliances and acquisitions. By partnering with or acquiring smaller, specialized players, RXO can quickly enhance its service portfolio, enter new geographic markets, and bolster niche capabilities.

RXO's acquisition of Coyote Logistics in late 2023 for approximately $1.025 billion exemplifies this strategy. This move significantly expanded RXO's freight brokerage capacity and market presence, demonstrating a clear intent to capitalize on industry consolidation to gain scale and competitive advantage.

Demand for Supply Chain Resiliency and Managed Services

Recent global disruptions have underscored the imperative for businesses to build more resilient supply chains, driving increased demand for specialized logistics partners. Companies are actively seeking external expertise to navigate complexities and optimize their transportation networks.

RXO is well-positioned to capitalize on this trend, with its managed transportation services showing significant traction. The company reported nearly $2 billion in new freight under management within its sales pipeline as of early 2024, a clear indicator of the market's appetite for outsourced logistics solutions.

This heightened focus on supply chain resilience presents a substantial opportunity for RXO to expand its market share. Key aspects of this opportunity include:

- Increased adoption of managed logistics: Businesses are increasingly outsourcing complex transportation management to third-party providers to enhance efficiency and reduce risk.

- Demand for visibility and control: The need for real-time tracking and data analytics in supply chains is growing, a core offering of managed services.

- Strategic partnerships: Companies are looking for long-term partners that can offer end-to-end supply chain solutions, not just transactional freight movement.

Sustainability and Green Logistics Initiatives

The growing market for sustainable logistics presents a significant opportunity for RXO. As more businesses prioritize environmental responsibility, RXO can leverage its services to appeal to this expanding customer base. For instance, in 2024, the global green logistics market was valued at approximately $29.5 billion and is projected to reach $70.3 billion by 2030, demonstrating a clear demand for eco-friendly solutions.

RXO can further capitalize on this trend by investing in and promoting greener operational practices. This includes adopting technologies like electric or alternative fuel vehicles and developing robust carbon offset programs. Companies are increasingly seeking partners who align with their sustainability goals; by enhancing its green initiatives, RXO can differentiate itself and attract environmentally conscious clients, potentially boosting market share.

- Growing Market Demand: The global green logistics market is expanding rapidly, offering RXO a chance to capture a larger share by meeting client sustainability requirements.

- Customer Attraction: Implementing and promoting eco-friendly practices, such as electric fleets and carbon offsetting, can attract environmentally conscious clients.

- Competitive Advantage: Early adoption and visible commitment to green logistics can provide RXO with a significant competitive edge in the evolving industry landscape.

RXO is poised to benefit from the ongoing expansion of e-commerce, which fuels demand for efficient last-mile delivery and overall freight services. The company's strategic investments in AI and machine learning are already yielding productivity gains, with further enhancements expected as data integration deepens through 2025.

The company can also grow by acquiring or partnering with other logistics firms, as demonstrated by its acquisition of Coyote Logistics. Furthermore, the increasing need for resilient supply chains means businesses are outsourcing more logistics, a trend RXO's managed transportation services are well-positioned to capture.

RXO can also tap into the growing demand for sustainable logistics by investing in eco-friendly practices, which can attract environmentally conscious clients and provide a competitive edge.

| Opportunity Area | Key Driver | RXO's Position/Action | 2024/2025 Impact |

|---|---|---|---|

| E-commerce Growth | Surging demand for last-mile delivery | Strategic positioning, 24% YoY increase in Last Mile stops (Q1 2025) | Increased revenue from high-volume, time-sensitive deliveries |

| Technology Integration | AI/ML for efficiency and optimization | 17% productivity boost achieved, ongoing data integration | Enhanced operational margins, improved service speed and reliability |

| Industry Consolidation | Fragmented logistics market | Acquisition of Coyote Logistics ($1.025B) | Expanded market share, broader service capabilities, increased scale |

| Supply Chain Resilience | Outsourcing complex transportation needs | Managed transportation services pipeline growth (nearly $2B in early 2024) | Secured new contracts, diversified revenue streams |

| Sustainable Logistics | Client demand for eco-friendly solutions | Focus on greener practices, potential for electric fleets | Attraction of new clients, enhanced brand reputation, competitive differentiation |

Threats

An economic downturn poses a significant threat to RXO. A substantial recession could drastically reduce manufacturing output and consumer spending, directly impacting freight volumes. This would translate to lower demand for RXO's transportation and logistics services.

In such a scenario, the freight market is likely to remain soft, intensifying competition for the available loads. This increased competition, coupled with reduced demand, would inevitably lead to lower revenues for RXO.

Fluctuations in fuel prices present a significant threat to RXO. As an asset-light company, RXO relies on carriers whose operating costs are directly tied to fuel expenses. When fuel prices surge, these costs are often passed on to RXO in the form of higher freight rates.

Sustained periods of elevated fuel prices, such as those seen in early 2024 where diesel prices averaged around $4.00 per gallon nationally, can put pressure on RXO's profit margins. This volatility can also make it more challenging for RXO to offer competitive pricing to its shipper clients, potentially impacting its market position.

The transportation and logistics sector faces a growing web of regulations covering everything from driver hours and vehicle emissions to data security and environmental impact. For RXO, this means a constant need to adapt and invest in compliance measures. Failure to adhere to these evolving rules can lead to significant fines and operational disruptions.

In 2024, the logistics industry continued to grapple with increased scrutiny, particularly around labor practices and emissions standards. For instance, ongoing discussions regarding independent contractor versus employee classification for drivers could necessitate substantial changes to RXO's operating model, potentially increasing labor costs. Furthermore, stricter environmental regulations, such as those targeting fleet emissions, require ongoing investment in newer, cleaner vehicles, adding to capital expenditure and operational expenses.

Intensifying Competition and Pricing Pressure

The logistics sector is seeing a surge in new players, while established companies are continuously rolling out innovative services. This dynamic environment fuels aggressive pricing tactics across the board, directly impacting RXO’s ability to protect its profit margins, particularly in the highly commoditized freight brokerage segment.

For instance, the freight brokerage market, a core area for RXO, experienced significant rate volatility in 2024. Spot rates for dry van loads, a key indicator of pricing pressure, saw a year-over-year decline of approximately 15% in early 2024, according to industry data from FreightWaves SONAR. This downward pressure on rates makes it difficult for companies like RXO to maintain healthy margins without significant operational efficiencies.

- Increased Market Entrants: The barrier to entry for digital freight matching platforms remains relatively low, leading to a proliferation of competitors.

- Technological Innovation: Competitors are investing heavily in technology to improve efficiency and customer experience, forcing others to keep pace or risk falling behind.

- Margin Erosion: Aggressive pricing strategies, especially for standard services, directly challenge RXO's profitability and market share.

Cybersecurity Risks and Data Breaches

Cybersecurity risks are a major concern for RXO, given its heavy reliance on technology and the sensitive logistics data it manages. A significant cyberattack could severely disrupt operations, leading to delays and increased costs. For instance, the global cost of data breaches reached an average of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

A data breach at RXO could compromise proprietary information, including customer details and operational strategies, potentially giving competitors an advantage. This exposure not only impacts business intelligence but can also lead to substantial financial penalties and legal liabilities, especially with evolving data privacy regulations.

- Reputational Damage: A breach erodes customer trust, impacting RXO's brand image and future business opportunities.

- Operational Disruption: Ransomware attacks or system failures can halt critical logistics processes, affecting supply chains.

- Financial Penalties: Fines from regulatory bodies like GDPR or CCPA can be significant, adding to the cost of a breach.

Increased competition, particularly from digital freight platforms, puts pressure on RXO's pricing power and market share, especially in the commoditized brokerage segment. Aggressive pricing tactics by rivals, evidenced by a roughly 15% year-over-year decline in spot rates for dry van loads in early 2024, directly challenge RXO's profitability.

Cybersecurity risks are a significant threat, with the average cost of a data breach reaching $4.45 million in 2024. A breach at RXO could lead to operational disruptions, loss of sensitive data, and substantial financial penalties, impacting customer trust and competitive advantage.

Evolving regulations in the transportation sector, covering emissions, labor practices, and data security, necessitate ongoing investment and adaptation. For instance, potential reclassification of drivers as employees could increase labor costs, while stricter environmental standards require capital expenditure on cleaner fleets.

Economic downturns and fluctuations in fuel prices directly impact freight volumes and operating costs. A recession would reduce demand for logistics services, while rising fuel prices, which averaged around $4.00 per gallon nationally in early 2024, can squeeze RXO's margins if not effectively passed on to clients.

SWOT Analysis Data Sources

This RXO SWOT analysis is built upon a robust foundation of data, incorporating financial statements, comprehensive market research, and expert industry commentary to provide a well-rounded and actionable assessment.