RXO Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RXO Bundle

Unlock the strategic core of RXO's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, customer relationships, and revenue streams, offering a clear view of their market advantage.

Dive deeper into RXO’s innovative approach to logistics and transportation. Our full Business Model Canvas provides an in-depth look at their value propositions and cost structure, essential for anyone studying industry leaders.

Want to understand what drives RXO's success? Purchase the full Business Model Canvas for a complete, actionable blueprint of their business strategy, perfect for strategic planning and competitive analysis.

Partnerships

RXO's asset-light strategy hinges on a vast network of independent motor carriers. These crucial partnerships provide the immense truckload capacity needed for efficient freight movement throughout North America.

The integration of Coyote Logistics into RXO Connect in early 2024 significantly bolsters this carrier network. This move offers carriers enhanced access to freight opportunities, thereby minimizing empty miles and improving overall network efficiency.

RXO's digital freight marketplace, RXO Connect, relies heavily on partnerships with technology and platform providers. These collaborations are crucial for integrating advanced functionalities like real-time shipment visibility and predictive analytics, directly impacting operational efficiency. For instance, the ongoing integration of Coyote's advanced technology into RXO Connect underscores the strategic importance of these tech alliances.

RXO's strategic alliance with Triumph marks a significant step in bolstering its financial service offerings for carriers. This collaboration underpins the launch of RXO Extra | Factoring, a crucial component designed to provide essential financial tools.

Through this partnership, RXO is extending access to vital services such as factoring and advanced digital payment solutions. These offerings directly address the working capital needs of carriers, ensuring they have immediate access to funds and streamlined payment processes.

This initiative not only expands RXO's footprint within the broader freight industry but also cultivates deeper relationships with its carrier network. By providing these financial conveniences, RXO aims to enhance carrier satisfaction and retention, solidifying its position as a supportive partner.

Large Shippers and Enterprise Clients

RXO’s key partnerships with large shippers and enterprise clients form the bedrock of its business model, providing stability and growth opportunities. These relationships span various industries, from retail and e-commerce to food and beverage and automotive. For instance, RXO serves major retailers, ensuring their supply chains are efficient and responsive to consumer demand.

These partnerships are not just transactional; they often involve long-term contracts for freight services. This creates predictable revenue streams for RXO, allowing for better financial planning and investment in infrastructure and technology. In 2024, RXO continued to solidify these relationships, with a significant portion of its revenue derived from these contracted services, highlighting their importance to the company's financial health.

- Diverse Client Base: RXO partners with companies of all sizes, including Fortune 100 clients, across critical sectors like retail, e-commerce, and automotive.

- Contractual Stability: Long-term freight contracts with these large shippers provide consistent and predictable revenue streams, crucial for operational stability.

- Managed Transportation Services: These partnerships allow RXO to leverage its expertise in managed transportation, offering comprehensive solutions beyond basic freight.

- Industry Impact: By serving major players in sectors like food and beverage, RXO plays a vital role in the efficient movement of essential goods.

Strategic Acquisition Targets

RXO's strategic acquisition of Coyote Logistics in September 2024 is a prime example of a key partnership, dramatically bolstering its scale and market presence. This move, which added approximately $3 billion in annual revenue, significantly expands RXO's customer base and service capabilities within the freight brokerage sector.

This inorganic growth strategy is designed to achieve several objectives:

- Enhanced Service Offerings: Integrating Coyote's network and technology allows RXO to offer a more comprehensive suite of transportation solutions.

- Revenue Diversification: The acquisition broadens RXO's revenue streams by adding a substantial freight brokerage operation.

- Cost Synergies: RXO anticipates significant cost savings through operational efficiencies and combined purchasing power.

- Market Share Expansion: The combined entity solidifies RXO's position as a major player in the North American transportation and logistics market.

RXO's asset-light model relies on a robust network of independent carriers, with Coyote Logistics' integration in 2024 significantly expanding this capacity. Partnerships with technology providers are vital for RXO Connect, enhancing visibility and analytics, as seen with Coyote's tech integration. Strategic alliances, like the one with Triumph, bolster financial services for carriers, offering factoring and digital payments to improve working capital. Finally, strong relationships with large shippers, including Fortune 100 companies, provide stable, long-term contracts and drive revenue growth across diverse sectors.

| Partnership Type | Key Contribution | Impact |

|---|---|---|

| Independent Motor Carriers | Vast truckload capacity | Enables efficient North American freight movement |

| Technology Providers | Platform integration, analytics | Enhances RXO Connect's functionality and efficiency |

| Financial Service Partners (e.g., Triumph) | Factoring, digital payments | Supports carrier working capital and retention |

| Large Shippers/Enterprise Clients | Long-term freight contracts | Provides stable revenue and growth opportunities |

What is included in the product

A detailed breakdown of RXO's logistics and transportation services, highlighting key customer segments like shippers and carriers, and their value propositions of efficiency and reliability.

This model outlines RXO's operational strategy, including their asset-light approach and technology-driven solutions, for optimizing freight movement and supply chain management.

RXO's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their complex logistics operations, enabling stakeholders to quickly grasp and address inefficiencies.

It simplifies the understanding of RXO's multifaceted business by isolating key elements, allowing for targeted solutions to common industry challenges.

Activities

RXO's core business revolves around freight brokerage operations, acting as the crucial link between companies needing to ship goods and the trucking companies that can transport them. This involves managing full-truckload (FTL), less-than-truckload (LTL), and intermodal shipments, ensuring goods move efficiently across various transportation modes.

The company heavily relies on its proprietary digital platform to streamline these operations. This technology is key to quickly and accurately matching available freight loads with qualified carriers, optimizing routes, and managing the entire transportation process from pickup to delivery.

In 2024, RXO reported that its brokerage segment generated significant revenue, highlighting the scale of its operations. The company's ability to handle a vast volume of freight, facilitated by its digital tools, underscores its position as a major player in the logistics industry.

RXO's managed transportation services offer clients comprehensive, end-to-end oversight of their logistics. This includes everything from initial strategic planning and network design to the day-to-day execution of freight movements, ensuring optimized supply chain operations. This integrated approach leverages RXO's robust digital platform, providing visibility and control throughout the entire process.

In 2024, RXO's managed transportation segment continued to be a significant driver of their business. The company reported strong performance in this area, reflecting increased client demand for outsourced logistics solutions. Their ability to manage complex freight networks efficiently, often handling millions of shipments annually, underscores the value proposition of these services.

RXO's key activity in last-mile delivery focuses on the crucial final leg of product distribution, particularly for bulky, heavy, or complex items requiring specialized handling. This includes services like white-glove delivery, assembly, and installation, differentiating them from standard parcel carriers.

This specialized segment has been a significant growth driver for RXO. In 2024, RXO continued to expand its last-mile capabilities, investing in technology and infrastructure to support increasing e-commerce demand for larger goods, contributing to their robust revenue streams.

Technology Development and Integration

RXO's key activities heavily focus on technology development and integration, particularly with its digital brokerage platform, RXO Connect. This involves ongoing investment to enhance its capabilities and ensure it remains at the forefront of logistics technology. The company is committed to optimizing this platform for greater efficiency and user experience.

A significant part of this involves integrating advanced technologies like artificial intelligence and machine learning. These tools are being leveraged to streamline operations, improve decision-making, and provide predictive analytics for customers. This technological advancement is crucial for maintaining a competitive edge in the rapidly evolving logistics landscape.

Furthermore, RXO is actively engaged in the successful migration of acquired platforms into its unified RXO Connect system. A prime example is the integration of Coyote's technology, a move that expands RXO's digital footprint and service offerings. This strategic integration aims to create a seamless experience for all users on the consolidated platform.

- Continuous Investment in RXO Connect: RXO consistently allocates resources to the development and optimization of its proprietary digital brokerage platform, RXO Connect, ensuring it offers cutting-edge features and a user-friendly interface.

- AI and Machine Learning Integration: The company actively incorporates AI and machine learning to enhance operational efficiency, improve load matching, and provide advanced analytics, thereby driving better outcomes for shippers and carriers.

- Platform Migration Success: A critical activity is the seamless integration of acquired technologies, such as Coyote's platform, into the unified RXO Connect ecosystem, creating a single, powerful digital solution.

Carrier Relationship Management and Recruitment

RXO actively manages and grows its extensive network of independent carriers, a cornerstone of its asset-light strategy. This includes offering attractive rates and user-friendly digital platforms to attract and retain drivers.

Fostering carrier loyalty is key, with programs like RXO Extra | Factoring designed to ensure consistent capacity. This proactive approach helps maintain a robust and reliable transportation network.

- Carrier Network Growth: RXO's focus on strong carrier relationships is vital for securing the capacity needed to meet customer demand, especially during peak seasons.

- Digital Tools and Efficiency: Providing carriers with advanced digital tools streamlines operations, improving efficiency and the overall experience for independent contractors.

- Loyalty Programs: Initiatives like RXO Extra | Factoring offer financial benefits and support, encouraging carriers to prioritize RXO shipments and maintain long-term partnerships.

RXO's key activities are centered on managing its freight brokerage operations, which involves connecting shippers with carriers across various modes like FTL, LTL, and intermodal. They also focus on providing comprehensive managed transportation services, overseeing entire logistics networks for clients.

A significant effort is dedicated to enhancing its proprietary digital platform, RXO Connect, through AI and machine learning integration to optimize load matching and provide predictive analytics. Furthermore, RXO actively works on integrating acquired technologies into this unified platform to expand its digital reach and service offerings.

The company also prioritizes cultivating and maintaining a robust network of independent carriers, offering them digital tools and loyalty programs to ensure consistent transportation capacity and foster strong partnerships.

Preview Before You Purchase

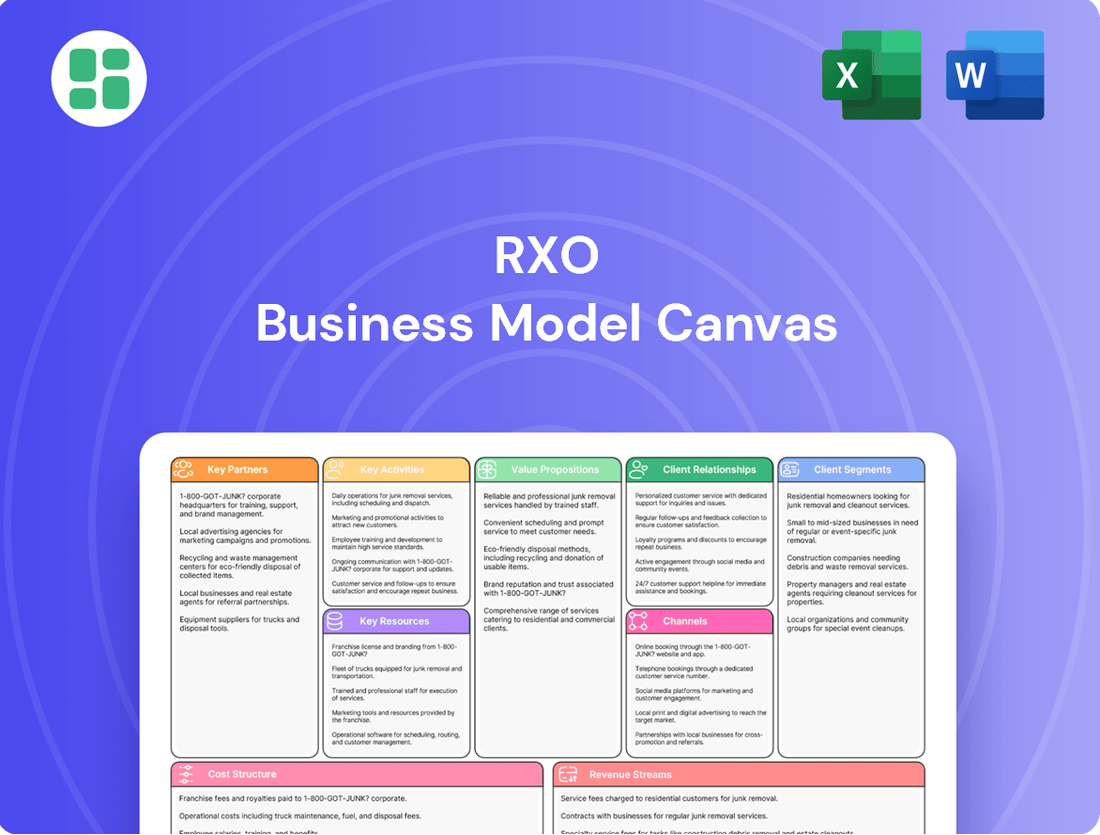

Business Model Canvas

The RXO Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, ready-to-use file, ensuring no surprises in content or formatting. Once your order is complete, you'll gain full access to this exact Business Model Canvas, allowing you to immediately begin leveraging its insights for your strategic planning.

Resources

RXO Connect, their proprietary digital freight marketplace, is central to RXO's business model. This platform utilizes advanced data analytics, artificial intelligence, and machine learning to streamline the process of matching freight with carriers, improving shipment tracking, and automating various operational tasks. This technological backbone is designed to create significant efficiencies and bolster reliability for everyone involved in the shipping process.

RXO's extensive carrier network, comprising a vast pool of independent motor carriers, is the bedrock of its asset-light strategy. This network provides the crucial flexibility and scalability needed to meet diverse customer demands efficiently. For instance, in 2024, RXO continued to leverage this expansive network to manage a significant volume of freight, ensuring capacity availability even during peak seasons.

Cultivating and nurturing these carrier relationships is a continuous priority for RXO. By offering competitive rates, reliable payment, and supportive services, RXO incentivizes carriers to remain loyal and engaged. This focus on partnership is vital for maintaining the high service levels that RXO's customers expect, ensuring that capacity is consistently available and responsive.

RXO's brokerage leaders, technologists, and employees are the backbone of its operations, possessing deep industry expertise crucial for tackling intricate transportation issues. This skilled workforce, particularly those with specialized knowledge in managed transportation, enables RXO to deliver superior service and pioneer innovative solutions.

In 2024, RXO continued to invest in its human capital, recognizing that specialized talent is a key differentiator in the competitive logistics landscape. The company’s focus on attracting and retaining individuals with expertise in areas like freight brokerage and supply chain management directly fuels its ability to offer customized and efficient transportation services.

Customer Relationships and Brand Reputation

RXO's customer relationships are a cornerstone, built on trust and consistent performance. These long-standing connections with a broad spectrum of clients, from small enterprises to major Fortune 100 corporations, are a vital resource. This diversity in clientele underscores the company's adaptability and broad market appeal.

The brand reputation RXO has cultivated is a significant asset, signaling reliability and innovation in logistics. This positive perception, particularly around its tech-enabled solutions, is key to not only attracting new business but also ensuring the retention of its existing, valuable customer base. For instance, RXO reported a customer retention rate of approximately 95% in late 2023, highlighting the strength of these relationships.

- Customer Base Diversity: Serving businesses of all sizes, from local operations to global giants.

- Brand Trust: Reputation for dependable and technologically advanced logistics services.

- Client Retention: High rates of keeping existing customers satisfied and engaged.

- Relationship Value: Long-term partnerships contribute significantly to stable revenue streams.

Financial Capital and Liquidity

RXO's financial capital is a bedrock for its operations and expansion. This includes cash generated from its core business activities, which provides a steady inflow. For instance, in Q1 2024, RXO reported cash flow from operations of $178 million, demonstrating its ability to generate internal funding.

Beyond operational cash, RXO leverages revolving credit facilities, offering flexibility for short-term needs and working capital management. These facilities act as a vital safety net, ensuring liquidity even during periods of fluctuating demand or investment.

Strategic financing is also key, as seen with the private placement of $300 million in June 2024, specifically to fund the Coyote Logistics acquisition. This move highlights RXO's proactive approach to securing capital for significant growth opportunities and technological advancements.

- Cash Flow from Operations: $178 million in Q1 2024.

- Strategic Financing: $300 million private placement in June 2024 for Coyote acquisition.

- Liquidity Management: Utilization of revolving credit facilities for operational flexibility.

RXO's key resources are its proprietary digital freight marketplace, RXO Connect, and its extensive, asset-light carrier network. These are supported by a skilled workforce adept at managing complex logistics and strong, diverse customer relationships built on trust and performance. The company also maintains robust financial capital, including operational cash flow and strategic financing capabilities, to fuel growth and acquisitions.

| Key Resource | Description | 2024 Data/Insight |

| RXO Connect | Proprietary digital freight marketplace | Utilizes AI/ML for efficient freight matching and tracking. |

| Carrier Network | Vast pool of independent motor carriers | Provides flexibility and scalability for meeting diverse customer demands. |

| Human Capital | Skilled workforce with deep industry expertise | Focus on attracting and retaining talent in freight brokerage and supply chain management. |

| Customer Relationships | Long-standing partnerships with diverse clientele | High customer retention rates, signaling trust and consistent performance. |

| Financial Capital | Operational cash flow and strategic financing | Q1 2024 cash flow from operations: $178 million; $300 million private placement in June 2024 for Coyote acquisition. |

Value Propositions

RXO leverages its proprietary digital platform, RXO Connect, to significantly boost efficiency and reliability for both shippers and carriers. This technology provides real-time shipment tracking, advanced predictive analytics for better planning, and automated processes that reduce manual effort and potential errors. For instance, by the end of 2023, RXO reported a substantial increase in digital engagement, with a significant portion of its freight transactions managed through its platform, underscoring the operational improvements.

RXO offers unparalleled access to a vast and varied capacity by tapping into its extensive network of independent carriers. This allows shippers to move freight efficiently, even for large or specialized loads, across North America.

In 2024, RXO's commitment to providing diverse capacity was evident in its robust carrier network, which facilitated millions of loads. This broad reach ensures that shippers can find the right trucks, at the right time, regardless of shipment size or complexity.

RXO's managed transportation services are designed to streamline a client's entire logistics network, leading to significant cost reductions and enhanced service performance. This holistic approach offers strategic advantages that extend far beyond basic freight matching, providing true operational optimization.

By integrating and managing all aspects of the supply chain, RXO ensures greater efficiency and reliability. For example, in 2024, RXO reported that its managed transportation solutions helped clients achieve an average of 15% reduction in transportation spend.

Specialized Last-Mile Delivery Expertise

RXO's specialized last-mile delivery expertise addresses the intricate demands of goods requiring precise handling and final-mile accuracy. This capability is crucial for sectors like healthcare and high-value retail, where standard delivery methods are insufficient. By focusing on these niche requirements, RXO differentiates itself in a competitive market.

This specialized service is vital for ensuring product integrity and customer satisfaction during the critical final stage of the supply chain. For instance, RXO’s capabilities are instrumental in delivering temperature-sensitive pharmaceuticals or fragile electronics, where a single mishandling can lead to significant financial loss and reputational damage. Their commitment to specialized handling provides a clear value proposition for businesses with complex logistical needs.

- Specialized Handling: RXO provides tailored solutions for goods needing specific care, such as temperature control or secure transport.

- Precision Delivery: The company focuses on accurate and timely delivery to the final destination, minimizing errors and delays.

- Differentiated Service: This expertise allows RXO to serve clients with unique shipping requirements that standard carriers cannot meet.

- Market Reach: RXO's network supports these specialized deliveries across various industries, enhancing its competitive edge.

Financial Support and Loyalty Programs for Carriers

RXO's commitment to its carrier network is evident through its robust financial support and loyalty programs. The RXO Extra | Factoring program is a prime example, offering carriers immediate access to working capital and digital payment solutions. This initiative is designed to alleviate cash flow pressures, a common challenge in the transportation industry, by providing options like same-day payments.

These financial services are crucial for attracting and retaining a high-quality carrier base. By offering tangible benefits that directly impact a carrier's bottom line and operational efficiency, RXO cultivates stronger, more reliable partnerships. This focus on carrier well-being translates into a more stable and responsive supply chain for RXO's customers.

The effectiveness of such programs can be seen in industry trends. For instance, in 2024, many logistics companies are prioritizing carrier retention, recognizing that a consistent and dedicated carrier fleet is a significant competitive advantage. RXO's factoring program directly addresses this need by providing:

- On-demand working capital: Ensuring carriers have the cash flow needed for fuel, maintenance, and other operational expenses.

- Digital payment solutions: Streamlining the payment process for greater efficiency.

- Same-day payment options: Providing immediate liquidity and reducing financial uncertainty.

RXO's value proposition centers on its advanced digital platform, RXO Connect, which enhances efficiency and reliability for shippers and carriers through real-time tracking and predictive analytics. The company also boasts extensive access to diverse freight capacity via its large independent carrier network, ensuring even complex or large shipments are handled efficiently across North America. Furthermore, RXO provides comprehensive managed transportation services that optimize logistics networks, leading to cost reductions and improved performance, with clients seeing an average of 15% reduction in transportation spend in 2024.

RXO differentiates itself with specialized last-mile delivery expertise, crucial for goods requiring precise handling and accuracy, thereby ensuring product integrity and customer satisfaction during the final delivery stage. Crucially, RXO supports its carrier network with robust financial services, such as the RXO Extra | Factoring program, offering immediate working capital and digital payment solutions to alleviate cash flow pressures and foster stronger partnerships.

| Value Proposition | Key Features | Benefit to Customer | 2024 Data/Example |

|---|---|---|---|

| Digital Efficiency & Reliability | RXO Connect Platform | Streamlined operations, reduced errors, improved planning | Significant increase in digital freight transactions by end of 2023 |

| Extensive Capacity Access | Vast Independent Carrier Network | Efficient movement of all freight types, including specialized loads | Facilitated millions of loads in 2024 |

| Managed Transportation Services | End-to-end logistics optimization | Cost reduction, enhanced service performance | Average 15% reduction in transportation spend for clients |

| Specialized Last-Mile Delivery | Precision handling for niche goods | Ensured product integrity and customer satisfaction | Critical for sectors like healthcare and high-value retail |

| Carrier Financial Support | RXO Extra | Factoring Program | Improved carrier cash flow, stronger network loyalty | Offers same-day payment options to carriers |

Customer Relationships

RXO prioritizes cultivating enduring customer connections, often assigning dedicated account managers. These professionals develop a deep understanding of individual client requirements, enabling them to deliver customized solutions. This personalized strategy is particularly vital for large enterprise clients and those utilizing managed transportation services, fostering loyalty and repeat business.

The RXO Connect platform is central to RXO's self-service digital strategy, enabling customers and carriers to manage their logistics needs entirely online. This digital hub allows for seamless interaction, from booking and tracking shipments to accessing crucial real-time data, offering unparalleled convenience for users who prefer to operate independently.

This digital-first approach empowers users with significant control over their operations. For instance, in 2024, RXO reported a substantial increase in digital transactions, demonstrating a growing preference for self-service solutions among its clientele. This trend highlights the platform's success in catering to a modern, digitally-savvy customer base seeking efficiency and transparency.

RXO actively shares market forecasts and insights, like its Curve Index, showcasing deep industry knowledge and guiding clients through fluctuating freight conditions. This transparency fosters trust and establishes RXO as a valuable, informed partner.

In 2023, RXO's commitment to providing actionable market intelligence, such as detailed freight cost analysis, helped customers optimize their supply chains. For instance, their insights into the trucking spot market, which saw significant volatility throughout the year, enabled clients to make more strategic routing and pricing decisions, ultimately improving cost efficiency.

Problem-Solving and Solution-Oriented Approach

RXO's customer relationships are built on a problem-solving foundation, where their teams leverage deep industry knowledge to craft tailored transportation solutions. This approach moves beyond simple freight movement, focusing instead on resolving specific client challenges and delivering tangible value.

This solution-oriented mindset is crucial in a dynamic logistics landscape. For instance, in 2024, RXO reported significant success in optimizing supply chains for a major retailer, reducing transit times by 15% through a combination of dedicated fleets and advanced network planning. This directly addressed the retailer's pain point of late deliveries impacting customer satisfaction.

- Expertise in Complex Challenges RXO's teams are adept at dissecting intricate logistics puzzles.

- Customized Solution Delivery They design and implement unique strategies for each client's needs.

- Value Beyond Transactions The focus is on resolving specific customer pain points, not just moving freight.

- Data-Driven Optimization Utilizing analytics to improve efficiency and reduce costs for clients.

Loyalty Programs and Carrier Support

RXO cultivates strong relationships with its carrier partners through initiatives like RXO Extra. This program offers crucial financial tools, including factoring services and expedited digital payment options, designed to enhance carrier financial stability and operational efficiency. As of 2024, RXO Extra aims to onboard a significant portion of its carrier base, underscoring the company's commitment to carrier success.

This robust carrier support network is a cornerstone of RXO's business model. By empowering carriers with financial resources and streamlined payment processes, RXO ensures a reliable and motivated fleet. This, in turn, translates to greater capacity and service dependability for shippers, a key element in maintaining strong customer relationships across the platform.

- Carrier Loyalty Programs: RXO Extra provides financial tools like factoring and digital payments to its carrier partners.

- Network Strength: This support enhances the carrier network, ensuring greater capacity availability.

- Shipper Benefit: A strong carrier network indirectly leads to improved service and reliability for shippers.

- Financial Empowerment: Offering financial tools helps carriers manage cash flow and invest in their businesses.

RXO fosters deep customer ties through dedicated account managers who understand unique needs, especially for enterprise clients and managed transportation. The RXO Connect platform offers a seamless self-service digital experience for managing all logistics, with digital transactions seeing substantial growth in 2024.

RXO actively shares market intelligence, like its Curve Index, and in 2023 provided detailed freight cost analysis to help clients navigate a volatile trucking spot market, improving their cost efficiency.

RXO's customer relationships are fundamentally about solving problems, with teams crafting tailored solutions that go beyond basic freight movement. This solution-oriented approach was evident in 2024 when RXO reduced transit times by 15% for a major retailer.

RXO also strengthens relationships with carriers through programs like RXO Extra, offering financial tools and expedited payments, which as of 2024, aims to onboard a significant portion of its carrier base to ensure network reliability.

Channels

RXO's primary channel for connecting shippers and carriers is its advanced digital platform, RXO Connect. This online portal facilitates load matching, bidding, tracking, and communication, serving as a central hub for its brokerage operations.

RXO Connect is instrumental in streamlining the freight matching process, offering shippers access to a vast network of carriers and enabling carriers to find profitable loads efficiently. This digital marketplace is key to RXO's strategy of providing seamless and transparent logistics solutions.

In 2024, RXO reported that its digital solutions, including RXO Connect, were driving significant efficiency gains for its customers. The platform's ability to automate and optimize freight movements directly contributes to RXO's value proposition of speed and reliability in the transportation sector.

RXO leverages direct sales teams and account managers to cultivate relationships with major enterprise clients, particularly for managed transportation services. These dedicated professionals are crucial for negotiating complex contracts and ensuring a high level of personalized service, fostering long-term partnerships.

In 2024, RXO's focus on these direct relationships is a key driver for securing substantial, recurring revenue streams. For instance, the company's ability to offer tailored solutions for large-scale logistics needs, often involving multi-year agreements, directly translates into predictable income and strengthens its market position.

RXO's last-mile delivery network is built upon a specialized group of carriers and strategically positioned hubs. This infrastructure is key for handling deliveries that demand extra care, like white-glove service or temperature-sensitive goods.

In 2024, RXO's focus on specialized last-mile solutions is a significant differentiator. The company's network is designed to meet the growing demand for complex deliveries, which often command higher margins compared to standard freight. This specialized approach allows RXO to capture a premium in the market.

Strategic Partnerships (e.g., with Triumph)

Strategic partnerships, like the one with Triumph for financial services, act as crucial channels for RXO. These collaborations allow RXO to offer more value to its carrier network, going beyond just transportation services and fostering deeper relationships.

These alliances expand RXO's market presence and service portfolio, demonstrating a commitment to providing comprehensive solutions for its partners. For instance, in 2023, RXO reported that its brokerage segment, which benefits from such partnerships, generated approximately $4.7 billion in revenue.

- Expanded Service Offerings: Partnerships enable RXO to bundle services, such as financial solutions, which can attract and retain carriers.

- Deeper Carrier Relationships: Offering integrated services strengthens loyalty and creates a more sticky ecosystem for carriers.

- Increased Revenue Streams: Collaborations can open up new avenues for revenue generation beyond core logistics.

- Market Reach: These alliances effectively extend RXO's reach into new segments of the transportation industry.

Industry Events and Digital Marketing

RXO actively engages in key industry events, such as the annual Transportation Intermediaries Association (TIA) conference, to connect with potential customers and carriers. This direct interaction allows them to showcase their services and build crucial relationships within the logistics ecosystem.

Digital marketing forms a significant part of RXO's outreach strategy. Through targeted social media campaigns and valuable content marketing, including the publication of market forecasts, they aim to attract new business and reinforce their position as an industry leader.

- Industry Conferences: RXO's presence at events like the TIA conference provides direct access to a concentrated audience of logistics professionals.

- Digital Reach: Social media platforms and content marketing, such as market forecast reports, expand RXO's brand awareness and lead generation efforts.

- Showcasing Technology: Both in-person and digital channels are used to highlight RXO's technological advancements and operational efficiencies to potential clients and partners.

- Customer and Carrier Acquisition: These channels are instrumental in attracting new customers and expanding their network of carriers, a critical component of their business model.

RXO's primary channel is its digital platform, RXO Connect, which facilitates load matching, bidding, and tracking, acting as a central hub for brokerage. In 2024, RXO highlighted that these digital solutions are driving significant efficiency for customers, underscoring their role in the company's value proposition of speed and reliability.

Direct sales teams and account managers are crucial for engaging enterprise clients, especially for managed transportation services. These relationships are key to securing recurring revenue, with tailored solutions for large-scale logistics often involving multi-year agreements, as seen in their 2024 strategic focus.

RXO's last-mile delivery network relies on specialized carriers and hubs for complex deliveries like white-glove service. This focus on specialized solutions in 2024 allows RXO to capture premium margins in a growing market segment.

Strategic partnerships, such as the one with Triumph for financial services, enhance RXO's offerings to its carrier network, fostering deeper relationships and expanding market reach. In 2023, RXO's brokerage segment, benefiting from such collaborations, generated approximately $4.7 billion in revenue.

| Channel Type | Description | 2024 Focus/Impact | Key Benefit |

|---|---|---|---|

| Digital Platform (RXO Connect) | Online portal for load matching, bidding, tracking, and communication. | Driving customer efficiency and reliability. | Streamlined freight matching, transparency. |

| Direct Sales & Account Management | Personalized engagement with enterprise clients. | Securing recurring revenue via long-term agreements. | Tailored solutions, high-touch service. |

| Specialized Carrier Network | Infrastructure for complex last-mile deliveries. | Capturing premium margins in specialized segments. | Meeting demand for high-care logistics. |

| Strategic Partnerships | Collaborations for expanded service offerings. | Enhancing value for carrier network, market reach. | Integrated services, deeper relationships. |

Customer Segments

Large enterprise shippers, including Fortune 100 and Fortune 500 companies, represent a key customer segment for RXO. These businesses operate across a wide array of industries such as retail, e-commerce, food and beverage, industrial manufacturing, and automotive.

These clients typically possess substantial and intricate transportation requirements, often necessitating sophisticated managed transportation solutions. For instance, in 2024, the retail and e-commerce sectors continued to drive significant demand for logistics services, with e-commerce sales projected to grow by approximately 8-10% globally.

RXO's ability to handle high-volume, complex freight networks makes it an attractive partner for these large enterprises. Their needs often involve multi-modal transportation, dedicated fleets, and advanced visibility tools, all of which RXO is equipped to provide.

Mid-market shippers represent a crucial customer segment for RXO, as these businesses need dependable freight solutions but often lack the extensive in-house logistics expertise found in larger corporations. RXO aims to fill this gap by offering streamlined, efficient, and scalable transportation services tailored to their operational needs.

The strategic acquisition of Coyote Logistics in 2023 significantly bolsters RXO's presence within the mid-market. This move, which added approximately $3 billion in annual revenue and a robust network, directly enhances RXO's ability to serve a broader range of mid-sized businesses seeking reliable and cost-effective freight management.

Small and medium-sized businesses (SMBs) are a key customer segment for RXO, looking for straightforward and dependable freight brokerage. RXO's digital platform is designed to make managing their shipping needs much simpler and more efficient.

These businesses often don't have large internal logistics teams, so they value RXO's ability to provide access to a wide network of carriers and manage the complexities of transportation. In 2024, the freight brokerage market continued to see strong demand from SMBs seeking cost-effective and reliable shipping solutions.

Independent Motor Carriers

Independent Motor Carriers are the backbone of RXO's asset-light strategy, representing a diverse group from single-owner operators to larger fleets. These businesses are the essential capacity providers, ensuring RXO can meet its customers' freight needs without owning a vast fleet.

RXO focuses on fostering strong relationships with this segment by offering reliable freight opportunities and timely, competitive compensation. This approach is critical for retaining their services and ensuring a consistent supply of transportation capacity.

- Consistent Load Availability: RXO aims to provide a steady stream of loads to keep these carriers' trucks moving and profitable.

- Competitive Payments: Offering attractive rates and prompt payment terms is key to attracting and retaining independent carriers.

- Supportive Financial Tools: Providing resources like fuel advances or factoring services can significantly ease cash flow challenges for smaller carriers.

- Market Dynamics: In 2024, the trucking industry continued to navigate fluctuating fuel costs and evolving freight demand, making reliable partners like RXO even more valuable to independent carriers.

Shippers with Specialized Last-Mile Needs

Shippers with specialized last-mile needs, particularly those dealing with oversized items like appliances and furniture, represent a critical customer segment for RXO. These clients demand more than just basic transport; they require careful handling, assembly, and in-home placement, often referred to as white-glove service. RXO's dedicated last-mile solutions are tailored to meet these exacting requirements, ensuring customer satisfaction and brand protection for the shipper.

This segment values reliability and precision, prioritizing specific delivery windows and the assurance that their valuable or delicate goods will arrive in perfect condition. For instance, the demand for appliance delivery and installation services continues to grow, with the U.S. appliance market valued at over $40 billion annually. Companies in this space rely on logistics partners like RXO to manage the complexities of these deliveries, including scheduling, notification, and the physical execution of the final mile.

- Specialized Handling: Customers require expertise in moving and installing large, often fragile, items such as refrigerators, washing machines, and sofas.

- White-Glove Service: This includes unpacking, assembly, debris removal, and ensuring the product is correctly placed and operational within the customer's home.

- Precise Delivery Windows: Shippers need assurance of timely deliveries within pre-arranged appointment slots to manage customer expectations and operational efficiency.

- Brand Reputation: The last-mile experience directly impacts the shipper's brand image, making a reliable and professional delivery partner essential.

RXO serves a diverse customer base, from massive Fortune 100 companies with complex global supply chains to growing mid-market businesses needing dependable freight management. They also cater to smaller businesses seeking efficient brokerage services and independent carriers who form the operational core of their asset-light model.

The company's strategy is to provide tailored solutions, whether it's sophisticated managed transportation for large enterprises or simplified digital tools for SMBs. This broad reach is further strengthened by acquisitions like Coyote Logistics, expanding their capacity to serve the mid-market effectively.

A significant focus is also placed on specialized sectors, particularly last-mile delivery for bulky items like appliances and furniture, where white-glove service is paramount. This requires meticulous handling and assembly, directly impacting the shipper's brand reputation.

RXO's customer segments are united by a need for reliable, efficient, and often specialized transportation and logistics solutions, supported by a robust network of carriers and technology. In 2024, the logistics industry continued to see strong demand across these segments, driven by e-commerce growth and the need for efficient supply chain operations.

Cost Structure

Purchased transportation costs represent RXO's most significant expenditure, primarily covering payments to independent motor carriers for freight movement. This expense is inherently variable, directly influenced by fluctuating freight rates, overall market conditions, and shifts in the types of freight handled.

In 2024, RXO's commitment to efficient logistics means this cost category is substantial, reflecting the dynamic nature of the transportation market. For instance, during periods of high demand or driver shortages, these rates can increase, impacting RXO's bottom line.

RXO dedicates substantial resources to the ongoing development and upkeep of its digital logistics platform. This includes significant investments in research and development, particularly for its proprietary AI and machine learning capabilities, which are crucial for optimizing operations and customer experience.

These technology costs also encompass essential maintenance and integration expenses, such as the integration of acquired platforms like Coyote. For instance, in 2023, RXO reported technology and systems expenses of $260 million, reflecting these critical investments in its digital infrastructure and future growth.

RXO's cost structure heavily relies on personnel expenses, encompassing salaries and benefits for brokerage representatives, managed transportation specialists, and administrative staff. In 2024, the company continued to manage these significant labor costs while optimizing operational efficiency. Facility costs, including warehousing and office spaces, along with other direct operating expenses like technology and utilities, also form a substantial part of their expenditures.

RXO has been actively pursuing cost reduction initiatives, particularly within personnel and operational areas, to improve profitability. For instance, the company has implemented strategies to streamline operations and leverage technology, aiming to reduce the overhead associated with its workforce and physical infrastructure. This focus on cost management is crucial for maintaining competitiveness in the transportation and logistics sector.

Sales, Marketing, and Customer Acquisition Costs

RXO incurs significant expenses to onboard new shippers and carriers, crucial for expanding its network and service offerings. These costs encompass sales team salaries and commissions, digital marketing campaigns aimed at lead generation, and various promotional efforts designed to attract and retain customers in a competitive logistics landscape.

In 2024, RXO continued to invest heavily in sales and marketing to drive growth. For instance, the company's selling, general, and administrative (SG&A) expenses, which include these acquisition costs, are a key component of its operational expenditure. While specific figures for customer acquisition alone are not always broken out, understanding the overall SG&A provides insight into this investment area.

- Sales Force Compensation: Salaries, bonuses, and commissions paid to the sales teams responsible for signing up new shippers and carriers.

- Marketing Campaigns: Investment in advertising, digital marketing, content creation, and public relations to build brand awareness and generate leads.

- Promotional Activities: Costs associated with special offers, discounts, and loyalty programs to incentivize new customer acquisition and retention.

- Technology & Tools: Expenditure on CRM systems and marketing automation software that support sales and customer acquisition efforts.

Integration and Restructuring Costs

Following major acquisitions, such as Coyote Logistics, RXO faces substantial integration and restructuring costs. These are typically one-time or short-term expenses incurred to merge systems, operations, and employee bases. For instance, in 2023, RXO reported $162 million in acquisition-related costs, largely driven by the integration of Coyote Logistics.

- System Integration: Costs associated with merging IT infrastructure, software platforms, and data management systems.

- Operational Alignment: Expenses for standardizing processes, consolidating facilities, and optimizing supply chains post-acquisition.

- Personnel Restructuring: Expenditures related to workforce adjustments, severance packages, and retraining programs to align with the new organizational structure.

- Brand Harmonization: Investments in rebranding efforts and marketing to unify the company's image and market presence.

RXO's cost structure is dominated by purchased transportation, representing payments to independent carriers, which fluctuates with market rates. Technology investments, including AI and machine learning for platform optimization, are also substantial, with $260 million spent on technology and systems in 2023. Personnel expenses for brokerage representatives and administrative staff, alongside facility and other operating costs, are significant ongoing expenditures.

Customer acquisition costs, including sales compensation and marketing, are vital for growth, reflected in SG&A expenses. Following acquisitions like Coyote Logistics, integration and restructuring costs, totaling $162 million in 2023, impact the overall cost base.

| Cost Category | Key Components | 2023 Impact (Millions) |

|---|---|---|

| Purchased Transportation | Carrier payments, freight rates | Variable, significant |

| Technology & Systems | R&D, platform development, integration | $260 |

| Personnel Expenses | Salaries, benefits (brokerage, admin) | Significant |

| Customer Acquisition | Sales, marketing, promotions | Part of SG&A |

| Integration & Restructuring | System merging, operational alignment | $162 (acquisition-related) |

Revenue Streams

RXO's primary revenue generation stems from the margins captured in its freight brokerage services. This involves the difference between the rates charged to shippers for transportation and the amounts paid to carriers for their services. In 2024, RXO reported strong performance in its brokerage segment, highlighting its ability to secure favorable rates for its clients while managing carrier costs effectively.

RXO generates revenue through managed transportation service fees, which are essentially contract-based charges for overseeing and optimizing clients' entire logistics operations. This covers everything from planning and execution to tracking and reporting, offering a complete end-to-end supply chain solution.

For instance, in the first quarter of 2024, RXO reported that its Brokerage segment, which encompasses managed transportation services, saw a revenue of $553 million. This highlights the significant contribution of these service fees to the company's overall financial performance.

RXO generates income from specialized last-mile delivery services, with fees typically structured per stop or influenced by delivery complexity and item type. This revenue stream has demonstrated steady expansion, reflecting increasing demand for efficient final-leg logistics.

Ancillary Services and Data Insights

RXO can generate significant revenue by offering ancillary services. For instance, financial tools like factoring and digital payment solutions for carriers through RXO Extra | Factoring provide a direct income stream while supporting their network. This creates a sticky ecosystem where carriers are incentivized to use RXO's broader platform.

Furthermore, RXO's proprietary market data and insights, exemplified by the Curve Index, represent a valuable, scalable revenue opportunity. By packaging and selling this data, RXO can tap into a market hungry for actionable intelligence in the logistics sector. In 2023, the logistics market saw continued growth, with data analytics becoming increasingly crucial for operational efficiency and strategic decision-making.

- Factoring and Digital Payments: RXO Extra | Factoring offers financial solutions to carriers, creating a new revenue stream and enhancing carrier loyalty.

- Proprietary Data Insights: The Curve Index and other market data analytics provide valuable information that can be monetized, catering to the growing demand for data-driven logistics strategies.

- Market Demand for Data: The logistics industry's increasing reliance on data for optimization and forecasting underscores the revenue potential of RXO's insight offerings.

Synergies from Acquisitions

Synergies from acquisitions, while not a direct revenue stream, are crucial for RXO's business model. The integration of companies like Coyote Logistics, acquired in 2022 for $1.7 billion, unlocks substantial cost savings and revenue enhancement opportunities. These synergies contribute directly to improved profitability and accelerated growth by leveraging combined operational efficiencies and expanding market reach.

These integrations allow RXO to realize benefits such as:

- Cost Synergies: Streamlining operations, consolidating back-office functions, and optimizing network infrastructure lead to significant cost reductions. For instance, by integrating Coyote's brokerage operations, RXO can achieve greater economies of scale in technology and administrative overhead.

- Cross-Selling Opportunities: The combined customer base and service offerings enable RXO to cross-sell its various logistics solutions, such as managed transportation and freight brokerage, to a wider audience. This expands revenue potential by offering a more comprehensive suite of services.

- Enhanced Market Position: Successful acquisitions bolster RXO's competitive standing by increasing its capacity, expanding its geographic footprint, and diversifying its service portfolio. This strengthens its ability to attract and retain a larger share of the logistics market.

- Improved Profitability: The combined effect of cost savings and increased revenue generation through cross-selling directly contributes to higher profit margins and overall financial performance for RXO.

RXO's revenue streams are diverse, primarily driven by its freight brokerage operations where it profits from the spread between shipper and carrier rates.

Managed transportation services, offering end-to-end logistics solutions, and specialized last-mile deliveries also contribute significantly, with fees often structured per stop or based on delivery complexity.

Additional income is generated through financial services for carriers, such as factoring, and the monetization of proprietary market data like the Curve Index, reflecting the industry's growing need for data analytics.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Freight Brokerage | Margin on transportation services (Shipper Rate - Carrier Rate) | Strong performance reported in brokerage segment, indicating effective rate management. |

| Managed Transportation | Contract fees for overseeing and optimizing client logistics operations | Q1 2024 revenue for Brokerage segment (including managed services) was $553 million. |

| Last-Mile Delivery | Fees per stop or based on delivery complexity/item type | Demonstrated steady expansion due to increasing demand for final-leg logistics. |

| Ancillary Services (e.g., Factoring) | Financial solutions and digital payments for carriers | RXO Extra | Factoring provides direct income and enhances carrier loyalty. |

| Proprietary Data Insights | Monetization of market data and analytics (e.g., Curve Index) | Logistics market growth in 2023 highlighted the crucial role of data analytics. |

Business Model Canvas Data Sources

The RXO Business Model Canvas is informed by a blend of internal operational data, customer feedback, and extensive market research. This comprehensive approach ensures all aspects of the business model are grounded in real-world performance and industry insights.