RXO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RXO Bundle

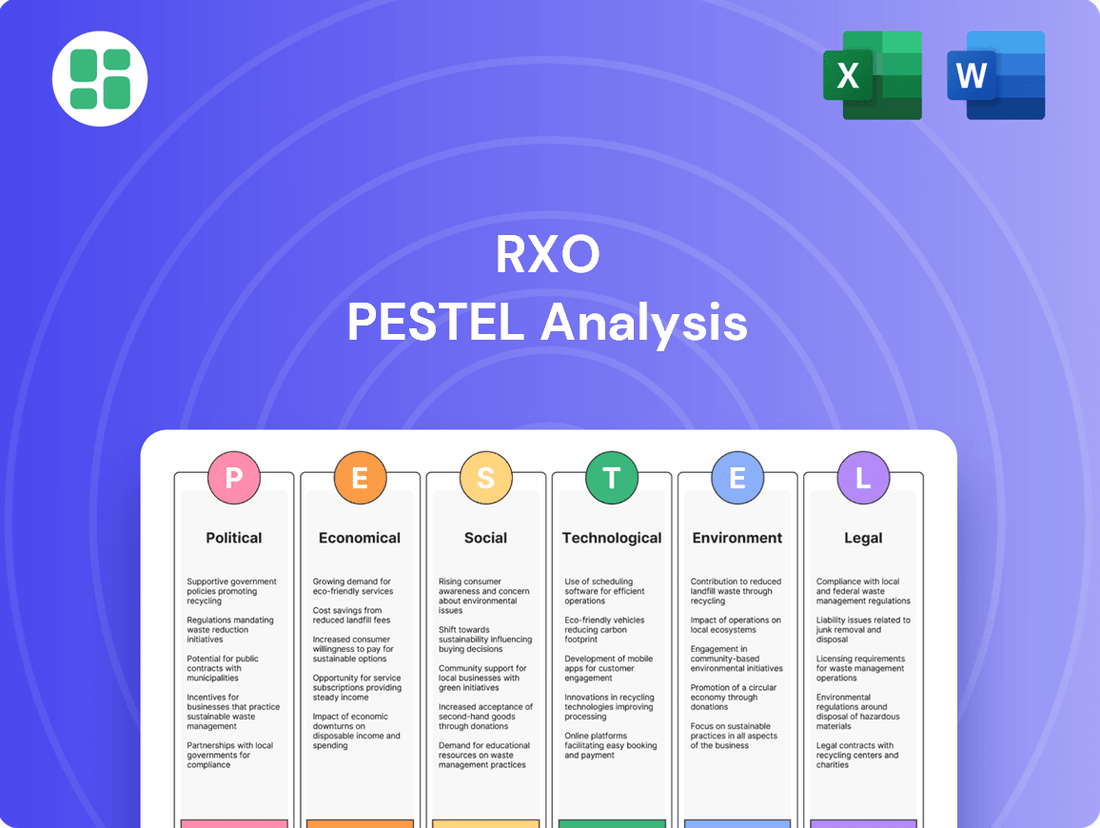

Unlock the critical external factors shaping RXO's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces impacting the logistics giant. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategic approach. Download the full PESTLE analysis for RXO now and gain a decisive competitive advantage.

Political factors

Government infrastructure spending, particularly on roads, bridges, and ports, directly influences RXO's operational efficiency. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, aims to modernize transportation networks. This significant investment is expected to improve freight movement by reducing transit times and enhancing capacity, which directly benefits logistics providers like RXO by potentially lowering fuel costs and increasing delivery speed.

Changes in international trade policies and tariffs directly impact RXO's operations by altering freight volumes and shipping patterns. For instance, the imposition of new tariffs on goods moving between major trading blocs can disrupt established supply chains, leading to shifts in demand for cross-border freight services. This uncertainty can also affect domestic shipping as companies adjust their sourcing and distribution strategies in response to global trade dynamics.

In 2024, ongoing discussions around trade agreements and potential tariff adjustments, particularly concerning major economies like China and the European Union, create a volatile environment for logistics providers. RXO, heavily reliant on the flow of goods, must navigate these policy shifts, which can influence the overall demand for truckload services. For example, a 10% tariff on imported goods could reduce shipment volumes if businesses opt for domestic alternatives or reduce overall consumption.

The trucking sector operates under a complex web of regulations covering driver work hours, vehicle upkeep, and licensing. RXO and its carrier partners must navigate these rules, which are evolving. For instance, the Federal Motor Carrier Safety Administration (FMCSA) is phasing out Motor Carrier (MC) numbers, requiring a transition to U.S. Department of Transportation (USDOT) numbers by December 2024, a significant administrative shift for compliance.

Further regulatory developments, such as potential mandates for speed limiters and automatic emergency braking systems, will necessitate technological and operational adjustments across RXO's network. These changes aim to enhance safety, but they also introduce compliance costs and require proactive adaptation from all parties involved in freight transportation.

Labor Laws and Workforce Policies

Government policies directly influence RXO's operational costs and workforce availability. For instance, changes in regulations concerning driver compensation, such as minimum wage adjustments or per-mile rate mandates, can significantly impact expenses. In 2024, the ongoing discussion around driver shortages, a critical issue for the logistics sector, means that new government initiatives aimed at increasing the trucking workforce, like expanded apprenticeship programs, could reshape RXO's carrier network and associated costs.

Workforce policies, including those related to working conditions and hours of service, also play a crucial role. Stricter regulations could necessitate increased driver pay or reduced operational hours, potentially affecting delivery times and overall efficiency. Furthermore, immigration policies can impact the supply of labor, a factor particularly relevant given the persistent driver shortage. For example, the trucking industry faced an estimated shortage of over 78,000 drivers in 2023, a figure that government policy adjustments could either alleviate or exacerbate.

- Driver Shortage Impact: The persistent driver shortage, estimated at over 78,000 in 2023, directly affects RXO's ability to secure and retain qualified personnel.

- Compensation Regulations: Evolving government mandates on driver pay, whether hourly or per-mile, can lead to increased operational expenses for RXO.

- Working Condition Standards: Stricter regulations on driver hours and working conditions may require RXO to invest more in driver welfare and potentially adjust service offerings.

- Immigration Policy Influence: Changes in immigration laws could impact the availability of foreign-born drivers, a segment that contributes to the overall labor pool in logistics.

Geopolitical Stability and Global Events

Geopolitical tensions, such as ongoing conflicts or trade disputes, can significantly disrupt global supply chains. This disruption directly impacts freight demand and the operational stability of logistics providers like RXO, even those primarily focused on North America. For instance, disruptions in key manufacturing regions can alter shipping volumes and routes for RXO's clients, creating more fluid and unpredictable market conditions.

While RXO operates primarily in the asset-light segment within North America, broader international instability can still indirectly affect its business. Economic slowdowns or shifts in global trade patterns stemming from geopolitical events can reduce the overall shipping needs of multinational corporations that are RXO's clients. This creates a ripple effect, influencing freight volumes and pricing dynamics across the industry.

- Supply Chain Vulnerability: Geopolitical instability can lead to port congestion, border delays, and increased shipping costs, directly impacting the efficiency of freight movement.

- Client Demand Fluctuations: International conflicts or sanctions can alter manufacturing output and consumer demand in various sectors, leading to unpredictable changes in freight volumes for RXO's customers.

- Economic Uncertainty: Global events contribute to broader economic uncertainty, which can dampen business investment and consumer spending, ultimately affecting the demand for logistics services.

- Market Volatility: The logistics market, including asset-light solutions, becomes more volatile during periods of geopolitical stress, making forecasting and operational planning more challenging.

Government infrastructure spending, particularly on roads and ports, directly impacts RXO's operational efficiency and potential for growth. The U.S. Bipartisan Infrastructure Law, with over $1.2 trillion allocated, aims to modernize transportation networks, which is expected to improve freight movement by reducing transit times and enhancing capacity.

Regulatory changes concerning driver hours, vehicle safety, and administrative compliance present ongoing challenges. For instance, the FMCSA's transition from Motor Carrier (MC) to U.S. Department of Transportation (USDOT) numbers by December 2024 requires significant administrative adaptation for RXO and its partners.

Government policies on driver compensation and working conditions directly affect RXO's operational costs and labor availability. The persistent driver shortage, estimated at over 78,000 in 2023, means government initiatives to boost the trucking workforce could reshape RXO's network and expenses.

Trade policies and geopolitical tensions can create market volatility, influencing freight volumes and shipping patterns. For example, ongoing discussions around tariffs in 2024, particularly concerning major economies, create an unpredictable environment for logistics providers like RXO.

What is included in the product

This RXO PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to identify strategic opportunities and mitigate potential threats for RXO.

A clear, actionable summary of external factors, enabling swift identification and mitigation of potential business disruptions.

Economic factors

The overall health of the economy is a major driver for freight demand. When the economy is growing and consumers are spending more, especially online, the need for transportation services like those offered by RXO naturally increases. This robust economic activity directly fuels RXO's freight brokerage and last-mile delivery segments.

For instance, in the first quarter of 2024, U.S. real GDP grew at an annualized rate of 1.3%, reflecting continued, albeit moderated, economic expansion. This growth, coupled with persistent consumer spending, supported freight volumes. However, a significant economic downturn or a sharp drop in consumer confidence could lead to a noticeable decline in freight volumes, impacting RXO's business.

Fluctuations in fuel prices, especially diesel, are a major cost driver for the carriers that make up RXO's network. Even though RXO operates an asset-light model, these fuel costs directly impact the rates carriers charge, which then influences RXO's gross margins and its ability to remain competitive on pricing. For instance, if diesel prices were to jump by, say, 10% in a given quarter, this could translate to higher operating expenses for RXO's partners.

Looking ahead, projections for late 2025 suggest a potential increase in diesel prices. This anticipated rise could put upward pressure on freight rates across the industry. Such a scenario might force RXO to adjust its own pricing strategies to maintain profitability, potentially impacting its market share if competitors absorb costs differently.

High inflation, reaching 3.4% year-over-year in April 2024 according to the latest Consumer Price Index (CPI) data, directly impacts RXO's operational costs by increasing fuel, labor, and equipment expenses for its carriers. This also erodes consumer purchasing power, potentially leading to reduced demand for goods and, consequently, less freight movement.

The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes, with the federal funds rate currently in the 5.25%-5.50% range as of mid-2024, raise the cost of borrowing for logistics companies like RXO. Higher financing costs can hinder capital expenditures on fleet upgrades or technology investments, thereby influencing RXO's long-term growth and financial strategy.

Supply Chain Dynamics and Inventory Levels

Shifting supply chain strategies, particularly concerning inventory management, significantly impact freight demand. For instance, a trend towards just-in-time inventory, as seen in many industries aiming to reduce holding costs, can lead to more frequent, smaller shipments, increasing the overall volume and urgency of freight movements. Conversely, companies building up buffer stock to mitigate potential disruptions, a strategy gaining traction in 2024 and projected to continue into 2025, can temporarily reduce immediate freight needs.

The pursuit of supply chain resilience and diversification is creating new avenues for growth. As businesses move away from single-source dependencies, there's an increased demand for regional and localized logistics solutions. This shift can benefit companies like RXO by opening up opportunities for shorter, more frequent hauls and specialized regional transportation services, potentially boosting their market share in these evolving networks.

- Inventory Optimization: Many companies are reassessing their inventory levels. For example, by mid-2024, some manufacturers were holding 10-15% more inventory than pre-pandemic levels to buffer against disruptions, impacting freight volumes.

- Resilience Investments: Global supply chain resilience investments were projected to reach over $100 billion by the end of 2024, signaling a commitment to more robust, albeit potentially less lean, supply networks.

- Regionalization Trends: The reshoring and nearshoring movement, which gained momentum in 2023 and is expected to accelerate through 2025, is fostering growth in domestic and regional freight markets.

- Freight Demand Sensitivity: Fluctuations in consumer demand, as seen in the retail sector, directly influence inventory levels and, consequently, freight volumes. A slowdown in consumer spending in late 2024 led to increased inventory for some retailers, temporarily softening demand for certain freight services.

Freight Market Capacity and Rates

The freight market's capacity, essentially the number of available trucks and drivers, directly influences freight rates. When demand for shipping outstrips the available capacity, rates tend to climb. RXO's core business model relies on skillfully navigating this supply and demand dynamic.

Looking ahead to 2025, projections suggest a tightening of freight capacity. This scarcity, coupled with an anticipated rise in spot rates, means that companies like RXO may face increased costs for purchasing transportation. Conversely, this environment also presents an opportunity for freight brokers to potentially generate higher revenues by capitalizing on these elevated rates.

Recent data highlights this trend. For instance, the Cass Freight Index reported a 2.4% increase in freight shipments in April 2024 compared to the previous year, signaling robust demand. Simultaneously, trucking spot rates, while volatile, have shown upward pressure in certain lanes, with some analysts predicting an average increase of 3-5% for contract rates in late 2024 and into 2025 due to persistent driver shortages and increased operating costs.

- Driver Shortage Impact: The American Trucking Associations (ATA) estimated a shortage of over 78,000 drivers in 2023, a figure expected to persist and potentially worsen through 2025, directly limiting available capacity.

- Fuel Cost Volatility: Fluctuations in diesel prices, a major operating expense for carriers, can significantly impact trucking costs and, consequently, freight rates.

- Economic Growth Influence: Continued economic expansion, particularly in manufacturing and retail sectors, fuels higher freight demand, further straining available capacity.

- Regulatory Environment: Evolving regulations concerning driver hours, emissions, and vehicle safety can also affect carrier operating costs and capacity availability.

The overall economic climate significantly influences freight demand, with robust GDP growth and consumer spending, like the 1.3% annualized growth in Q1 2024, boosting transportation needs. However, rising inflation, at 3.4% year-over-year in April 2024, increases operational costs for carriers and can dampen consumer spending, impacting freight volumes. Furthermore, the Federal Reserve's interest rate hikes, keeping the federal funds rate between 5.25%-5.50% as of mid-2024, raise borrowing costs for logistics firms, potentially slowing investment in crucial upgrades.

Shifting supply chain strategies, such as increased inventory holding by 10-15% for some manufacturers by mid-2024 to build resilience, can alter freight patterns. The ongoing trend towards regionalization, driven by reshoring efforts expected to accelerate through 2025, is also reshaping domestic freight markets. These strategic adjustments directly affect the volume and type of shipments, influencing demand for RXO's services.

Freight capacity, particularly the availability of trucks and drivers, is a critical factor affecting rates. Projections for 2025 indicate a tightening capacity, exacerbated by a persistent driver shortage, estimated at over 78,000 in 2023 by the ATA. This scarcity, combined with rising operating costs including fuel, is expected to drive up spot rates and potentially contract rates by 3-5% in late 2024 and into 2025, creating both cost challenges and revenue opportunities for RXO.

| Economic Factor | 2024 Data/Projections | Impact on RXO |

|---|---|---|

| Real GDP Growth (US) | 1.3% (Q1 2024 annualized) | Supports freight demand; slower growth can reduce volumes. |

| Inflation (CPI) | 3.4% (April 2024 YoY) | Increases carrier costs; can reduce consumer spending and freight demand. |

| Federal Funds Rate | 5.25%-5.50% (Mid-2024) | Raises borrowing costs, potentially impacting investment in growth. |

| Diesel Prices | Projected increase late 2025 | Increases carrier operating costs, influencing freight rates. |

| Driver Shortage | >78,000 (2023 estimate), persisting into 2025 | Limits capacity, driving up rates and potentially increasing revenue opportunities. |

Full Version Awaits

RXO PESTLE Analysis

The preview shown here is the exact RXO PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of RXO's operational landscape.

Sociological factors

The relentless expansion of e-commerce, projected to reach $2.0 trillion in the US by 2024, directly fuels the demand for efficient last-mile delivery. Consumers now anticipate delivery within 2-3 days, with a growing preference for same-day or next-day options.

This evolving consumer behavior means companies like RXO must prioritize speed and convenience. In 2024, 65% of online shoppers consider delivery speed a crucial factor in their purchasing decisions, pushing RXO to invest in technologies that enable real-time tracking and adaptive routing for its delivery fleet.

The logistics sector, especially trucking, continues to grapple with significant labor shortages. This is largely due to an aging driver population, with the average age of a truck driver in the U.S. hovering around 46 years old, and difficulties in recruiting younger talent. These demographic trends directly affect carrier capacity and drive up operational costs.

RXO must actively support its carrier partners to navigate these labor challenges. This includes exploring ways to bolster the existing workforce and potentially investing in technology solutions that can automate or reduce the reliance on labor for certain processes, thereby mitigating the impact of these persistent shortages.

Increasing urbanization is a significant sociological trend, leading to denser populations in metropolitan areas. This growth directly translates to heightened traffic congestion, making last-mile delivery operations considerably more complex and time-consuming for companies like RXO. For instance, cities like Los Angeles experienced an average of 119 hours lost in traffic per driver in 2023, a stark reminder of these logistical hurdles.

RXO's success in this environment hinges on its capacity to adapt. Strategies such as advanced, dynamic routing software are essential to navigate congested urban landscapes efficiently. Furthermore, the adoption of micro-fulfillment centers located closer to end consumers can significantly reduce the distance and time required for final delivery legs, thereby mitigating the impact of urban sprawl and traffic.

Exploring alternative delivery methods, such as electric vehicles or even drone technology for specific urban routes, could also be a key differentiator. As of early 2024, several major logistics players are piloting drone delivery in select urban areas, indicating a shift towards more innovative solutions to combat congestion and improve delivery speed and sustainability.

Demand for Transparency and Visibility

Customers throughout the supply chain, from businesses shipping goods to the final consumers, are consistently asking for more openness about where their shipments are. This means they want to know the exact location and status of their freight in real-time. This growing expectation is a significant sociological shift influencing how logistics companies operate.

RXO's investment in its proprietary technology directly responds to this demand for transparency. By offering enhanced tracking and communication capabilities, RXO aims to build stronger relationships with its clients. This focus on visibility not only meets customer expectations but also fosters greater trust and ultimately boosts customer satisfaction levels.

- Increased Customer Expectations: A 2024 survey indicated that over 70% of shippers consider real-time tracking a critical factor when selecting a logistics partner.

- RXO's Technology Advantage: RXO's platform provides granular visibility, allowing customers to monitor shipments at every stage, from pickup to final delivery.

- Building Trust: By proactively sharing information, RXO strengthens its reputation as a reliable and transparent service provider in the competitive logistics market.

Societal Focus on Convenience and Speed

Modern consumers increasingly prioritize speed and ease in their transactions, directly impacting the logistics sector. This societal shift means companies like RXO must constantly enhance their services to meet demands for rapid delivery, often within hours.

This focus drives innovation in areas such as:

- Hyperlocal Fulfillment: Establishing smaller, strategically located warehouses to reduce transit times and enable quicker deliveries.

- Advanced Routing Software: Utilizing AI and real-time data to optimize delivery routes, minimizing delays and maximizing efficiency.

- On-Demand Delivery Models: Developing capabilities for same-day or even faster delivery windows, catering to immediate consumer needs.

The growth in e-commerce, projected to reach $8.1 trillion globally by 2026, underscores this demand for swift and convenient shipping solutions, with last-mile delivery being a critical component. RXO's investment in technology and network optimization directly addresses this societal expectation.

Societal expectations for rapid and convenient delivery are reshaping the logistics landscape. Consumers, driven by the convenience of e-commerce, now anticipate near-instantaneous fulfillment, pushing companies like RXO to innovate in last-mile solutions. This trend is further amplified by increasing urbanization, which complicates delivery routes and necessitates smarter logistical approaches.

The demand for transparency in the supply chain is also a significant sociological factor. Customers want real-time visibility into their shipments, driving RXO's investment in technology that provides granular tracking and communication. Meeting these evolving demands is crucial for maintaining customer loyalty and competitiveness in the logistics sector.

Labor shortages, particularly among truck drivers, present a persistent challenge. With the average age of U.S. truck drivers around 46, recruiting younger talent is vital. RXO must support its carrier partners in addressing these workforce challenges and explore technological solutions to mitigate labor dependency.

| Sociological Factor | Impact on Logistics | RXO's Response/Data Point |

|---|---|---|

| E-commerce Growth & Consumer Expectations | Increased demand for fast, convenient delivery. | US e-commerce projected at $2.0 trillion in 2024; 65% of shoppers prioritize delivery speed (2024). |

| Urbanization & Congestion | More complex and time-consuming last-mile deliveries. | Los Angeles drivers lost 119 hours in traffic per driver (2023); RXO uses dynamic routing and micro-fulfillment centers. |

| Demand for Transparency | Need for real-time shipment tracking. | Over 70% of shippers consider real-time tracking critical (2024 survey); RXO's proprietary technology offers enhanced visibility. |

| Labor Shortages (Trucking) | Reduced carrier capacity and increased costs. | Average U.S. truck driver age ~46; RXO supports carriers in workforce solutions. |

Technological factors

RXO's proprietary technology, particularly its Freight Optimizer platform, is a key driver of its operational efficiency and competitive edge. This system integrates carrier and coverage operations, creating a substantial dataset that fuels data-driven decision-making and boosts productivity within its brokerage services.

The effectiveness of Freight Optimizer is underscored by its ability to process vast amounts of information, leading to improved load matching and route optimization. This technological infrastructure is crucial for RXO to maintain its position in the logistics market, especially as the industry increasingly relies on digital solutions for streamlined operations.

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing logistics, enabling RXO to enhance efficiency through predictive analytics, dynamic route optimization, and automated decision-making. These technologies are key to improving demand forecasting accuracy and streamlining operations.

RXO's strategic investments in AI and ML have already yielded substantial productivity improvements. For instance, the company reported significant gains in cost-to-serve efficiencies across its brokerage operations, directly attributable to the implementation of these advanced analytical tools in 2023 and continuing into 2024.

Advanced telematics and IoT devices are revolutionizing supply chain visibility. RXO leverages these technologies, allowing for real-time tracking of shipments, which is crucial for meeting customer demands for transparency. This capability directly addresses the growing expectation for immediate updates on order status.

Digital Freight Matching Platforms

The digital freight matching platform market is booming, acting as a crucial bridge between companies needing to ship goods and the carriers who transport them. This growth is driven by the demand for greater efficiency and transparency in the logistics sector.

RXO's strategy heavily leans into these tech-enabled solutions. By using sophisticated digital tools and algorithms, RXO aims to optimize how loads are matched with available trucks. This not only helps reduce instances of trucks traveling empty, which is a significant cost saver, but also makes the entire process of booking and managing freight much smoother for everyone involved.

Consider these points regarding digital freight matching:

- Market Expansion: The global digital freight forwarding market was valued at approximately $21.7 billion in 2023 and is projected to reach over $50 billion by 2030, demonstrating substantial growth.

- Efficiency Gains: Platforms can reduce empty miles by an estimated 10-15% through better load consolidation and route optimization.

- Operational Streamlining: Digital tools shorten the time it takes to book a load, often from days to mere hours or even minutes.

- Data-Driven Decisions: These platforms provide valuable data analytics, allowing companies like RXO to make more informed decisions about pricing, carrier selection, and network efficiency.

Automation and Robotics in Logistics

Automation is significantly reshaping the logistics landscape, boosting efficiency and cutting costs in crucial areas like inventory management and order processing. For instance, warehouse automation solutions are projected to grow substantially, with the global warehouse automation market expected to reach an estimated USD 60.5 billion by 2026, up from USD 22.1 billion in 2021, demonstrating a compound annual growth rate of 22.4%.

While RXO operates with an asset-light model, this widespread automation trend, encompassing robotic process automation (RPA) and the development of autonomous vehicles, indirectly impacts RXO's operational environment. The efficiency gains and cost structures of the carriers and warehouses RXO partners with are directly influenced by their adoption of these technologies.

Key impacts include:

- Increased Throughput: Automated systems can process shipments and orders much faster than manual methods, leading to quicker turnaround times.

- Reduced Labor Costs: Robotics and automation can handle repetitive tasks, potentially lowering labor expenses for RXO's partners.

- Enhanced Accuracy: Automated inventory tracking and order picking minimize errors, improving overall service reliability.

- Supply Chain Resilience: Automation can help mitigate disruptions caused by labor shortages or other operational challenges within the broader logistics network.

RXO's technological edge is powered by its proprietary Freight Optimizer platform, a key driver of efficiency and data-driven decision-making in its brokerage services. This platform's ability to optimize load matching and route planning is crucial in an industry increasingly reliant on digital solutions, with the global digital freight forwarding market projected to exceed $50 billion by 2030.

The company's strategic investment in AI and ML has already delivered significant productivity gains, improving cost-to-serve efficiencies in 2023 and continuing into 2024. These advancements, coupled with telematics and IoT for real-time shipment tracking, enhance transparency and meet growing customer demands for immediate updates.

Automation, including warehouse robotics and the potential for autonomous vehicles, indirectly impacts RXO by influencing the operational efficiency and cost structures of its partners. This trend is evident in the projected growth of the warehouse automation market, expected to reach USD 60.5 billion by 2026, indicating a significant shift towards automated logistics.

RXO's digital freight matching capabilities are central to its strategy, aiming to reduce empty miles by an estimated 10-15% and streamline the booking process from days to hours. This data-driven approach allows for more informed decisions regarding pricing and carrier selection.

| Technology Area | RXO's Application/Benefit | Market Context/Data |

| Proprietary Platforms (Freight Optimizer) | Enhanced operational efficiency, data-driven decisions, improved load matching and route optimization. | Digital freight forwarding market valued at ~$21.7 billion in 2023, projected to reach over $50 billion by 2030. |

| AI & Machine Learning | Predictive analytics, dynamic route optimization, automated decision-making, improved demand forecasting. | Significant productivity improvements and cost-to-serve efficiencies reported by RXO in 2023-2024. |

| Telematics & IoT | Real-time shipment tracking, enhanced supply chain visibility, improved transparency. | Essential for meeting customer demands for immediate order status updates. |

| Automation (Indirect Impact) | Influences partner efficiency, potentially reducing labor costs and increasing accuracy for RXO's network. | Warehouse automation market projected to reach USD 60.5 billion by 2026 (CAGR of 22.4%). |

Legal factors

The transportation sector, including trucking, operates under a stringent regulatory framework. These laws cover critical areas such as vehicle safety standards and driver qualifications, including Commercial Driver's License (CDL) requirements and English language proficiency, which are vital for safe operations. RXO must diligently ensure that its own fleet and its extensive network of independent carriers adhere to all federal and state mandates.

Anticipated regulatory shifts in 2025 will likely introduce new compliance obligations. For instance, the Federal Motor Carrier Safety Administration (FMCSA) continually updates its safety regulations, impacting everything from hours-of-service rules to vehicle maintenance protocols. Failure to adapt to these evolving legal landscapes can lead to significant penalties, operational disruptions, and damage to RXO's reputation.

Labor and employment laws significantly influence RXO's operations, particularly concerning driver compensation and hours of service (HOS) regulations. For instance, the Federal Motor Carrier Safety Administration's (FMCSA) HOS rules, updated periodically, dictate how long drivers can operate, impacting delivery schedules and overall efficiency. Failure to comply can lead to hefty fines and operational disruptions, underscoring the need for rigorous adherence.

Evolving overtime regulations and minimum wage laws also directly affect carrier costs, which can be passed on to logistics providers like RXO. As of early 2025, the debate around increasing the federal minimum wage continues, potentially raising operational expenses for carriers in RXO's network. Maintaining a stable and compliant carrier base is therefore paramount for ensuring service reliability and managing costs effectively.

Stricter environmental regulations, such as the U.S. EPA's proposed greenhouse gas emissions standards for heavy-duty vehicles, are pushing for reduced carbon footprints. These evolving standards, including potential mandates for zero-emission vehicles (ZEVs) by 2032, directly impact the trucking industry. While RXO operates an asset-light model, these regulations influence the vehicle types available and operational costs for its carrier network, potentially increasing indirect expenses that could affect pricing and service availability.

Data Privacy and Cybersecurity Laws

RXO, as a company heavily reliant on technology and processing significant volumes of data, faces stringent legal obligations concerning data privacy and cybersecurity. Compliance with regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States is critical. These laws dictate how RXO must collect, store, process, and protect personal information of its customers and partners. Failure to adhere can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher. For instance, in 2023, various companies faced significant penalties for data breaches, underscoring the financial and reputational risks involved.

Maintaining robust cybersecurity measures is not merely a legal requirement but a fundamental aspect of RXO's operational integrity and customer trust. Protecting sensitive data, including customer details and carrier information, from breaches and cyber threats is paramount. The increasing sophistication of cyberattacks means RXO must continually invest in advanced security protocols and employee training. Cybersecurity incidents can lead to significant financial losses through remediation costs, legal fees, and lost business, in addition to severe reputational damage. The global average cost of a data breach reached $4.45 million in 2023, according to IBM's Cost of a Data Breach Report, highlighting the immense financial implications of security failures.

- GDPR fines can reach up to 4% of global annual revenue.

- CCPA grants consumers rights over their personal data.

- Cybersecurity investments are crucial to prevent costly data breaches.

- The global average cost of a data breach was $4.45 million in 2023.

Broker Transparency and Financial Responsibility Regulations

Proposed regulations are set to significantly boost broker transparency in the freight industry, mandating the disclosure of transaction records and all associated charges. This initiative is designed to safeguard carriers, ensuring they receive fair compensation for their services. For RXO, this means a heightened need for meticulous record-keeping and clear communication regarding all fees and pricing structures.

Furthermore, the landscape of financial responsibility for brokers and freight forwarders is evolving, with potential changes to existing regulations. RXO must proactively adapt its compliance strategies to meet these new requirements, which could include updated surety bond levels or stricter financial oversight. For example, the Federal Motor Carrier Safety Administration (FMCSA) continuously reviews its regulations, and any updates to financial responsibility requirements for transportation intermediaries would directly impact RXO's operational framework.

- Enhanced Disclosure: New rules will require brokers to provide detailed transaction records and itemized charges to carriers.

- Fair Compensation Focus: These regulations aim to prevent unfair practices and ensure carriers are paid appropriately.

- Evolving Financial Responsibility: Regulations concerning the financial solvency and liability of brokers and freight forwarders are subject to change.

- Compliance Adaptation: RXO needs to adjust its compliance strategies to meet any new financial responsibility mandates.

Legal factors significantly shape RXO's operations, from stringent vehicle safety and driver qualification mandates to evolving labor laws impacting driver compensation and hours of service. Anticipated regulatory shifts in 2025, such as updated FMCSA safety regulations, will necessitate continuous compliance adaptation to avoid penalties. Furthermore, RXO must navigate complex data privacy and cybersecurity laws, with GDPR fines potentially reaching 4% of global annual revenue, underscoring the critical need for robust data protection measures.

| Legal Area | Key Regulations/Considerations | Impact on RXO | Data/Facts (2024/2025) |

|---|---|---|---|

| Safety & Driver Qualifications | FMCSA Regulations, CDL Requirements, English Proficiency | Ensuring fleet and carrier compliance with federal and state mandates. | Ongoing enforcement of hours-of-service rules; potential for increased scrutiny on carrier safety ratings. |

| Labor & Employment | Hours of Service (HOS), Overtime Regulations, Minimum Wage | Managing carrier costs influenced by driver compensation and work hour limits. | Federal minimum wage discussions continue; potential for increased operational expenses for carriers. |

| Environmental Regulations | EPA Greenhouse Gas Standards, Zero-Emission Vehicle (ZEV) Mandates | Influences vehicle availability and operational costs for RXO's carrier network. | Proposed standards pushing for reduced carbon footprints; potential impact on fleet modernization costs. |

| Data Privacy & Cybersecurity | GDPR, CCPA, Cybersecurity Best Practices | Protecting customer and partner data, avoiding substantial fines and reputational damage. | Global average cost of a data breach was $4.45 million in 2023; GDPR fines up to 4% of global annual revenue. |

| Broker Transparency & Financial Responsibility | Disclosure of Transaction Records, Financial Oversight | Requires meticulous record-keeping and clear fee structures; adaptation to potential changes in financial responsibility. | Initiatives to increase transparency and ensure fair carrier compensation are gaining momentum. |

Environmental factors

The logistics sector faces mounting pressure to reduce its carbon footprint, a significant concern given its role in global emissions. For instance, transportation accounts for roughly a quarter of direct CO2 emissions globally, a figure that underscores the urgency for change.

RXO, though operating an asset-light model, plays a crucial role in driving decarbonization. By focusing on route optimization and efficient freight consolidation, the company can directly reduce miles driven and fuel consumption within its extensive network. This focus is critical as the industry navigates evolving environmental regulations and investor expectations for sustainable operations.

The increasing global emphasis on environmental responsibility is driving logistics companies like RXO to adopt sustainable practices. This includes investing in electric vehicles and exploring alternative fuel sources to minimize carbon emissions. For instance, by 2025, many companies aim to have a significant portion of their fleets powered by cleaner energy, reflecting a broader industry trend towards reducing environmental impact.

RXO's technological capabilities play a crucial role in facilitating these green initiatives. By optimizing routes and improving load efficiency, their platforms can directly contribute to lower fuel consumption and reduced greenhouse gas emissions. The company's commitment to innovation in this area is key to supporting clients in achieving their sustainability targets and navigating evolving environmental regulations.

Environmental concerns are increasingly driving companies to focus on waste reduction and resource efficiency across their operations. This trend directly impacts logistics providers like RXO, pushing for more sustainable supply chain practices.

While RXO operates an asset-light model, its digital platforms play a crucial role in enhancing resource efficiency. For instance, by optimizing load capacity and minimizing empty miles, RXO helps reduce fuel consumption and associated emissions within the broader transportation network.

In 2024, the transportation sector is under significant pressure to decarbonize, with initiatives aimed at cutting greenhouse gas emissions by 30% by 2030. RXO's ability to facilitate more efficient freight movement directly supports these environmental goals and contributes to a more sustainable logistics ecosystem.

Climate Change Impact on Supply Chains

Climate change poses significant risks to supply chain operations, with extreme weather events directly impacting transportation infrastructure and reliability. For a company like RXO, this translates to potential disruptions in freight movement, affecting delivery schedules and overall service consistency for clients.

The increasing frequency and intensity of events such as hurricanes, floods, and droughts can render key transportation routes impassable or severely delayed. For instance, in 2024, several major ports experienced significant slowdowns due to severe weather, impacting global shipping volumes. RXO must proactively assess these environmental shifts and integrate resilience strategies into its network planning and service offerings to mitigate these risks and ensure dependable deliveries.

Building resilience involves diversifying transportation modes, optimizing routes to avoid at-risk areas, and potentially investing in more robust infrastructure.

- Increased frequency of extreme weather events: impacting road, rail, and port operations.

- Supply chain disruptions: leading to delays and increased costs for freight movement.

- Need for resilient logistics: requiring adaptation and investment in flexible transportation solutions.

Consumer and Investor Demand for ESG (Environmental, Social, Governance)

Consumers and investors are increasingly prioritizing companies with strong Environmental, Social, and Governance (ESG) practices. This trend is driving demand for businesses to showcase genuine commitment to environmental stewardship. For RXO, highlighting its sustainability initiatives and transparently reporting its environmental footprint can significantly boost its brand image and attract stakeholders who value social responsibility.

The market for ESG-focused investments is expanding rapidly. For instance, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, a notable increase from previous years. This growth underscores the financial imperative for companies like RXO to integrate ESG principles into their core operations and reporting to remain competitive and appealing to a broader investor base.

- Growing ESG Investment: Sustainable investment assets are projected to continue their upward trajectory, with many analysts expecting them to surpass $50 trillion by 2025.

- Brand Enhancement: Companies demonstrating robust environmental practices often see improved brand loyalty and a stronger appeal to younger demographics.

- Risk Mitigation: Proactive environmental management can reduce regulatory risks and operational disruptions, contributing to long-term financial stability.

- Stakeholder Attraction: A clear commitment to ESG principles helps RXO attract not only investors but also top talent and environmentally conscious business partners.

The logistics industry faces increasing pressure to adopt sustainable practices, driven by both regulatory changes and growing consumer demand for eco-friendly services. This push for decarbonization is a significant factor for companies like RXO, impacting operational strategies and investment decisions.

RXO's asset-light model allows it to influence environmental outcomes through technology and network optimization, rather than direct fleet ownership. By focusing on efficient freight consolidation and route planning, RXO directly contributes to reducing fuel consumption and associated emissions across the supply chains it manages.

The financial sector's embrace of Environmental, Social, and Governance (ESG) criteria means companies with strong sustainability performance are more attractive to investors. For instance, global sustainable investment assets reached approximately $37.8 trillion in early 2024, highlighting the financial incentive for RXO to prioritize and demonstrate its environmental commitments.

Climate change also presents tangible risks, with extreme weather events increasingly disrupting transportation networks. For example, severe weather in 2024 caused significant delays at major ports, underscoring the need for resilient logistics solutions that RXO can facilitate through adaptive route planning and mode diversification.

| Environmental Factor | Impact on Logistics | RXO's Role/Opportunity | Relevant Data (2024/2025) |

|---|---|---|---|

| Decarbonization Pressure | Increased operational costs for emissions-intensive activities; demand for greener solutions. | Facilitate emissions reduction through route and load optimization; promote cleaner transport options. | Global transportation accounts for ~25% of direct CO2 emissions. |

| Extreme Weather Events | Supply chain disruptions, infrastructure damage, increased transit times and costs. | Develop resilient network strategies; offer flexible transportation solutions to mitigate delays. | Increased frequency and intensity of events like hurricanes and floods impacting key routes. |

| ESG Investment Growth | Greater access to capital for sustainable companies; pressure to report on environmental performance. | Attract investment and build brand loyalty by demonstrating strong ESG practices. | Sustainable investment assets projected to exceed $50 trillion by 2025. |

PESTLE Analysis Data Sources

Our RXO PESTLE Analysis is built on a robust foundation of data from official government agencies, reputable financial institutions, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.