RXO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RXO Bundle

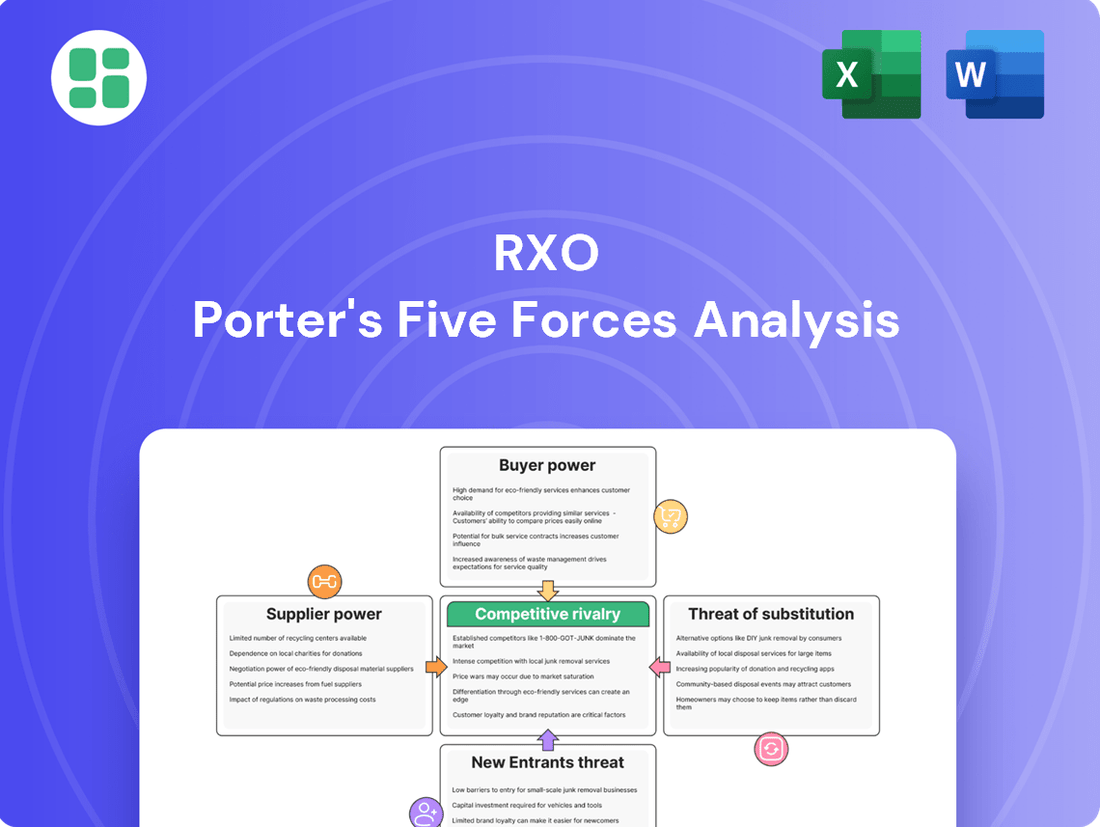

Understanding RXO's competitive landscape is crucial, and Porter's Five Forces provides a powerful framework. We've analyzed the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the logistics sector, specifically for RXO. This brief overview only scratches the surface of these complex dynamics.

Unlock the full Porter's Five Forces Analysis to explore RXO’s competitive dynamics, market pressures, and strategic advantages in detail. Gain actionable insights to drive smarter decision-making and stay ahead of the curve.

Suppliers Bargaining Power

The availability of trucking capacity is a key factor in determining the bargaining power of carriers, who act as suppliers to companies like RXO. In 2024, the trucking market experienced a noticeable tightening of capacity. This shift from a buyer's market to a more balanced one means carriers are regaining some leverage.

Industry analyses for 2024 pointed to a decline in available trucking capacity, a significant change from the previous period of oversupply. This contraction is attributed to various factors, including fleet adjustments and driver availability. Looking ahead to 2025, projections suggest a continued rebalancing and potential growth in capacity, which could moderate carrier power.

Suppliers, particularly trucking companies and independent owner-operators, are experiencing a significant increase in operational costs. Diesel fuel prices, a major component of their expenses, have seen volatility. For instance, average US on-highway diesel prices fluctuated throughout 2024, impacting their bottom line.

These rising input costs, coupled with increasing insurance premiums, directly translate into higher demands for freight rates from brokers like RXO. This scenario amplifies the bargaining power of these suppliers, as their increased expenses necessitate higher compensation to maintain profitability.

The freight brokerage landscape is bustling, with over 25,000 active brokerages as of January 2025. However, the actual carrier market is deeply fragmented, largely composed of numerous small businesses and independent owner-operators. This widespread distribution of carriers generally weakens the individual negotiating leverage of any single carrier.

Despite this fragmentation, market conditions can still shift bargaining power. When the freight market tightens, meaning demand for shipping outstrips available capacity, carriers can more effectively push for rate increases, even with their dispersed nature.

Technological Adoption by Carriers

Carriers are increasingly adopting digital freight matching platforms and AI-powered tools. This technological shift enhances their operational efficiency and provides direct access to shippers. For instance, platforms like Truckstop.com and DAT Solutions are seeing increased carrier engagement, facilitating more direct connections and potentially bypassing traditional broker relationships.

This empowerment through technology can bolster carriers' negotiating leverage. By having greater visibility into market rates and direct access to freight opportunities, carriers can more effectively negotiate for better pricing and terms. This reduces their dependence on intermediaries, thereby increasing their bargaining power within the logistics ecosystem.

- Increased Carrier Efficiency: Digital platforms streamline load matching and route optimization, allowing carriers to operate more profitably.

- Direct Shipper Access: Technology enables carriers to bypass brokers and connect directly with shippers, improving margins.

- Enhanced Negotiation Power: Greater market transparency and direct relationships empower carriers to demand better rates.

Specialized Services and Equipment

When RXO needs specialized freight services or specific equipment for certain routes, the carriers that can provide these niche capabilities gain significant bargaining power. This is particularly true if there are only a limited number of suppliers with the necessary expertise or specialized assets.

RXO's diverse service offerings, such as last-mile delivery, often necessitate partnerships with carriers possessing unique skill sets or specialized fleets. For instance, handling temperature-controlled goods or oversized cargo requires specific equipment and carrier certifications, thereby concentrating power among those few providers.

In 2024, the freight brokerage market continued to see demand for specialized services outpace supply in certain segments. Reports from industry analysts indicated that carriers with advanced technology, such as real-time tracking and temperature monitoring for sensitive shipments, commanded higher rates due to their limited availability and the critical nature of these services for shippers like RXO.

- Limited Availability of Specialized Equipment: Carriers owning unique or highly specialized trailers (e.g., flatbeds with specific load securement features, temperature-controlled units with advanced monitoring) have increased leverage.

- Niche Route Expertise: For routes requiring specialized permits, handling hazardous materials, or navigating complex urban environments, carriers with proven track records and necessary licenses hold more power.

- Impact on RXO's Costs: Dependence on a small pool of specialized carriers can lead to higher operational costs for RXO if these suppliers can dictate terms due to limited alternatives.

- Strategic Partnerships: RXO's ability to secure long-term contracts or build strong relationships with these specialized suppliers can mitigate some of the supplier bargaining power.

The bargaining power of suppliers, primarily trucking companies and independent owner-operators, is influenced by market conditions and operational costs. In 2024, rising diesel prices and increased insurance premiums directly impacted carriers' expenses, leading them to demand higher freight rates from brokers like RXO. While the market features many brokerages, the carrier base is fragmented, which can dilute individual carrier power.

However, when freight capacity tightens, as it did in 2024, carriers gain leverage. Technological adoption by carriers, such as digital freight matching platforms, also enhances their efficiency and direct access to shippers, potentially increasing their negotiating strength. Furthermore, carriers providing specialized services or equipment for niche routes hold significant power due to limited availability.

| Factor | Impact on Supplier Bargaining Power | 2024/2025 Relevance |

|---|---|---|

| Diesel Fuel Prices | Increased costs for carriers | Fluctuated significantly in 2024, driving up carrier rate demands. |

| Trucking Capacity | Tightening capacity favors carriers | Market shifted towards balance in 2024, increasing carrier leverage. Projections for 2025 suggest continued rebalancing. |

| Carrier Fragmentation | Weakens individual carrier power | Over 25,000 active brokerages in Jan 2025, but a fragmented carrier base generally limits individual negotiation strength. |

| Technological Adoption | Enhances carrier efficiency and direct access | Increased use of digital platforms by carriers strengthens their market position and negotiation ability. |

| Specialized Services/Equipment | Increases power of niche providers | Demand for specialized freight services often outpaced supply in 2024, empowering carriers with unique capabilities. |

What is included in the product

Assesses the competitive intensity and profitability potential for RXO by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a dynamic visualization of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Large shippers, especially those with substantial freight volumes, wield considerable bargaining power over RXO. These major clients often possess advanced logistics capabilities, enabling them to negotiate better pricing and contract terms for RXO's brokerage and managed transportation services. For instance, in 2023, RXO reported that its largest customers accounted for a significant portion of its revenue, highlighting the influence these high-volume shippers have on the company's operations and profitability.

The availability of alternative logistics solutions significantly empowers customers, reducing their reliance on any single provider like RXO. Shippers can readily engage with other freight brokers, establish direct relationships with trucking companies, or even invest in their own private fleets to handle transportation needs. This array of choices directly translates into increased bargaining power for customers, as they can easily compare offerings and negotiate more favorable rates.

In 2024, the freight brokerage market continued to see robust competition. For instance, the U.S. trucking industry, a key component of logistics, faced ongoing capacity adjustments, with thousands of carriers operating nationwide. This competitive landscape allows shippers to switch providers or integrate in-house solutions if pricing or service levels become unfavorable, further pressuring logistics companies to offer competitive pricing and efficient service.

Freight transportation represents a significant portion of operating expenses for many companies, directly impacting their bottom line. This inherent cost structure means shippers are naturally inclined to scrutinize and compare pricing, making them highly sensitive to the rates offered by logistics providers like RXO.

In today's intensely competitive market, businesses are constantly on the lookout for ways to optimize their supply chains and reduce overall logistics expenditure. This drives a demand for cost-effective solutions, pushing RXO to not only offer competitive pricing but also to clearly articulate the value proposition of its technological advancements and service quality.

For instance, in 2024, the average cost of freight transportation as a percentage of revenue for U.S. manufacturers remained a critical consideration, with many actively seeking providers who can demonstrate tangible savings. RXO's ability to leverage its digital platform, which aims to improve efficiency and reduce empty miles, directly addresses this customer need for cost optimization.

Transparency and Information Availability

The increasing transparency in the freight market, driven by digital platforms and advanced analytics, significantly amplifies the bargaining power of customers. Shippers can now readily access real-time market rates and capacity information, allowing for more informed comparisons of service providers. This empowers them to negotiate better terms, as they have a clearer understanding of what constitutes a competitive price and service level.

For instance, platforms like FreightWaves' SONAR provide shippers with granular data on trucking spot rates, which in 2024 continued to be a key negotiation point. RXO, like its competitors, faces pressure from shippers who leverage this data to secure more favorable pricing. This heightened visibility means that companies such as RXO must offer competitive rates and demonstrate clear value to retain business.

- Enhanced Rate Visibility: Digital freight marketplaces offer shippers unprecedented access to current market pricing, enabling direct comparisons.

- Capacity Information: Shippers can easily view available trucking capacity, reducing information asymmetry and strengthening their negotiation position.

- Data-Driven Negotiations: The availability of analytics allows customers to approach contract discussions armed with concrete data, increasing their leverage against carriers.

Demand for Integrated and Value-Added Services

Customers are increasingly looking beyond just cost, seeking integrated services that streamline their operations. This includes demand for advanced technology like real-time shipment tracking and route optimization, which RXO provides through its proprietary platform. For instance, in 2024, logistics technology adoption continued to rise, with many shippers prioritizing visibility and efficiency gains.

RXO's focus on managed transportation services, which bundle various logistics functions, directly addresses this growing customer need for comprehensive solutions. By offering these value-added services, RXO can potentially mitigate the bargaining power of customers if these integrated offerings become indispensable and difficult for competitors to match.

- Integrated Solutions: Customers are shifting from single-service providers to those offering end-to-end logistics management.

- Technology Demand: Real-time tracking, predictive analytics, and supply chain visibility are key differentiators in 2024.

- RXO's Offering: Proprietary technology and managed transportation services are designed to meet these evolving customer expectations.

- Mitigating Power: Highly valued and unique integrated services can reduce customer leverage by creating switching costs.

Customers, especially large shippers, hold significant bargaining power over RXO due to their substantial freight volumes and ability to seek alternative logistics solutions. In 2023, RXO's largest customers represented a considerable portion of its revenue, illustrating their influence. The competitive freight brokerage market in 2024, with numerous carriers and alternative options, further empowers shippers to negotiate better rates and terms.

Increased market transparency, driven by digital platforms providing real-time rate data, amplifies customer leverage. Shippers in 2024 actively used this information, such as FreightWaves' SONAR data, to secure more favorable pricing from providers like RXO. This data-driven negotiation capability means RXO must continuously offer competitive rates and demonstrate superior value to retain its client base.

Customers are increasingly demanding integrated services and advanced technology, such as real-time tracking and route optimization, to streamline operations. RXO's managed transportation services and proprietary platform aim to meet these evolving needs, potentially mitigating customer bargaining power by offering indispensable, value-added solutions that are difficult for competitors to replicate.

| Factor | Impact on RXO | 2024 Market Trend |

|---|---|---|

| Shipper Concentration | High reliance on large clients | Largest customers continue to drive significant revenue |

| Availability of Alternatives | Pressure to offer competitive pricing | Thousands of U.S. carriers provide capacity options |

| Market Transparency | Need for data-driven value proposition | Digital platforms provide real-time rate visibility |

| Demand for Integrated Services | Opportunity to reduce customer leverage | Increased adoption of logistics technology |

Same Document Delivered

RXO Porter's Five Forces Analysis

This preview offers a comprehensive look at our RXO Porter's Five Forces Analysis, showcasing the exact document you'll receive immediately after purchase. You're not seeing a sample; this is the fully formatted, ready-to-use report, providing detailed insights into the competitive landscape of RXO. Rest assured, there are no surprises or placeholders—what you see is precisely what you get, enabling you to leverage this strategic analysis without delay.

Rivalry Among Competitors

The freight brokerage sector is incredibly fragmented, with a vast number of companies competing for business. This includes major players like RXO, alongside many smaller, niche providers and innovative tech startups. This wide array of competitors means that market share is often divided, leading to intense price competition and a constant need for differentiation.

This fragmentation is further fueled by ongoing industry consolidation and the rapid integration of new technologies. For instance, in 2024, the logistics technology market saw significant investment, with companies leveraging digital platforms to streamline operations and attract customers. This dynamic environment intensifies rivalry as firms vie for efficiency and market presence.

The logistics sector's competitive intensity is significantly fueled by rapid technological advancements. Companies are pouring substantial resources into artificial intelligence, machine learning, and automation. These investments aim to boost operational efficiency, refine delivery routes, and elevate the overall customer experience, creating a dynamic and innovation-driven landscape.

RXO actively employs its proprietary technology, RXO Connect, as a key differentiator in this competitive arena. This platform is designed to provide clients with enhanced visibility, control, and optimization across their supply chains. By offering advanced technological solutions, RXO seeks to carve out a distinct market position and attract customers looking for more sophisticated logistics management.

The asset-light model common in freight brokerage fuels aggressive price competition, particularly when freight demand softens. This dynamic puts significant pressure on profit margins for companies like RXO, forcing them to prioritize operational efficiency and achieving economies of scale to remain profitable.

In 2024, the transportation sector experienced fluctuations, with freight rates showing volatility. For instance, the Cass Freight Index indicated shifts in shipping volumes and costs throughout the year, directly impacting the pricing power of brokers. RXO's ability to manage its brokerage costs and leverage its network scale is crucial for navigating these price-sensitive market conditions and maintaining healthy margins.

Service Diversification and Specialization

Competitive rivalry in the logistics sector intensifies as firms move beyond basic brokerage to offer a broader range of services. This includes managed transportation, where companies oversee an entire supply chain, and specialized last-mile delivery, crucial for e-commerce fulfillment. For instance, in 2024, the demand for integrated logistics solutions continued to grow, pushing companies to expand their offerings to remain competitive.

Companies are strategically choosing between two main paths to gain market share: either by building diverse service portfolios to become a one-stop shop for clients, or by deeply specializing in niche segments, such as cold chain logistics or hazardous materials transport. This dual approach allows them to cater to different market needs and capture specific customer bases.

- Diversification Strategy: Companies like XPO Logistics (which spun off its logistics business as RXO) have historically aimed to offer a comprehensive suite of services, from freight brokerage to dedicated fleets and last-mile solutions, to capture a larger share of customer spending.

- Specialization Strategy: Niche players focus on specific industries or service types, often achieving higher margins and customer loyalty within their chosen segments.

- Market Impact: In 2024, the trend towards more complex supply chains meant that clients increasingly favored providers who could offer integrated, end-to-end solutions, driving further diversification or strategic partnerships.

Market Growth and Economic Conditions

The freight brokerage market is experiencing robust expansion, with projections indicating significant growth through 2032. This overall market growth directly impacts competitive rivalry.

While a growing market generally offers ample opportunities for all players, periods of economic slowdown or when there's more available trucking capacity than demand can significantly ramp up competition. During these times, companies fight harder for the available freight, potentially leading to price wars and reduced profit margins.

For instance, in 2024, the logistics sector, including freight brokerage, is navigating a dynamic economic landscape. Factors such as inflation rates and consumer spending patterns directly influence freight volumes. Companies that can effectively manage capacity and offer competitive pricing during these economic shifts are better positioned to thrive.

- Market Growth: The freight brokerage market is expected to see substantial growth by 2032.

- Economic Impact: Economic moderation or excess capacity intensifies competition for freight.

- 2024 Dynamics: Inflation and consumer spending in 2024 are key drivers affecting freight volumes and competitive intensity.

The competitive rivalry within the freight brokerage sector is fierce, driven by a highly fragmented market with numerous players, from large entities like RXO to smaller, specialized firms and technology startups. This intense competition forces companies to constantly differentiate themselves, often through technological innovation and expanded service offerings, as seen with the significant investments in AI and automation throughout 2024.

Price competition is a major factor, especially with the asset-light model prevalent in freight brokerage. Fluctuations in freight rates, as observed in 2024 with indices like the Cass Freight Index, directly impact pricing power and profit margins, compelling companies like RXO to focus on operational efficiency and network scale to remain competitive.

Companies are strategically diversifying their service portfolios to become comprehensive logistics providers or specializing in niche markets to gain an edge. This trend was particularly evident in 2024, where clients increasingly sought integrated, end-to-end supply chain solutions, pushing providers to adapt their offerings.

The overall growth projected for the freight brokerage market through 2032 presents opportunities, but economic slowdowns or periods of excess trucking capacity can significantly intensify competition, leading to price wars and margin compression.

| Metric | 2023 (Approx.) | 2024 (Projection/Early Data) | Key Trend |

|---|---|---|---|

| Freight Brokerage Market Size (USD Billion) | ~150-170 | ~160-180 | Steady Growth |

| Number of Freight Brokerage Firms | 10,000+ | 10,000+ | Fragmented, High Rivalry |

| Logistics Technology Investment (USD Billion) | ~20-25 | ~25-30 | Increasing Focus on Efficiency |

SSubstitutes Threaten

Large shippers possess the capability to develop their own internal logistics operations, including private fleets and dedicated in-house departments, which directly substitutes the need for third-party providers like RXO. This option becomes particularly compelling for companies with consistent, high-volume shipping needs, allowing them to exert greater control over costs and service.

For instance, many large retailers and manufacturers have invested heavily in their own trucking fleets and sophisticated logistics software. This trend was evident in 2024, with several major companies expanding their private fleet operations to mitigate rising freight costs and ensure supply chain reliability, thereby reducing their reliance on external carriers.

The rise of sophisticated digital platforms is a significant threat, enabling shippers to bypass traditional freight brokers like RXO. These platforms facilitate direct connections between shippers and carriers, streamlining the booking process. For instance, in 2023, digital freight matching platforms saw substantial growth, with some reporting double-digit increases in transaction volumes, directly challenging the intermediary role of brokers.

While freight brokers provide crucial value through extensive carrier networks and load optimization, the growing ease of direct engagement presents a clear substitution threat. Shippers can increasingly find and book capacity independently, reducing their reliance on brokers for basic transactions. This trend is expected to continue as technology further simplifies direct communication and contract negotiation in the freight industry.

While RXO excels in truckload, LTL, and last-mile services, shippers can explore alternatives like rail, air cargo, or waterborne transport. For instance, in 2024, intermodal rail, which combines truck and rail, continued to be a cost-effective option for long-haul freight, often offering savings of 10-30% compared to over-the-road trucking for suitable cargo.

These substitute modes can be particularly attractive for bulk goods or when transit time is less critical, potentially impacting RXO's market share for specific freight segments. Air cargo, though typically more expensive, offers speed for time-sensitive shipments, and waterborne transport remains vital for heavy, non-perishable goods, especially in international trade where it accounts for a significant portion of global commerce.

Integrated Third-Party Logistics (3PL) Providers with Assets

Integrated third-party logistics (3PL) providers that own and operate their own assets, such as fleets of trucks and extensive warehouse networks, present a significant threat of substitution. These asset-based 3PLs can offer shippers a more vertically integrated and potentially more reliable service, bypassing the need for brokers who primarily manage capacity through third-party carriers.

For shippers seeking end-to-end control and a single point of accountability, these asset-heavy 3PLs can be a compelling alternative. This is particularly true for those with consistent, high-volume freight needs where the scale and direct control offered by asset ownership can translate into cost efficiencies or service guarantees not always achievable through brokered solutions.

- Asset-based 3PLs offer a direct alternative to asset-light brokers by controlling their own transportation and warehousing resources.

- Shippers may view these integrated providers as a more seamless or cost-effective substitute, especially for predictable, high-volume shipments.

- The direct ownership of assets by some 3PLs can reduce reliance on the spot market or brokered capacity, posing a substitution threat.

Evolution of Digital Freight Matching and Marketplaces

The rise of digital freight matching platforms and online marketplaces poses a significant threat of substitutes to traditional freight brokerage models. These platforms, often powered by artificial intelligence, directly connect shippers with carriers, aiming to bypass intermediaries like RXO. For instance, by mid-2024, platforms like Truckstop.com and DAT Solutions reported significant increases in load postings and carrier connections, indicating a growing preference for direct engagement.

These digital solutions offer greater transparency in pricing and streamlined booking processes, directly challenging the value proposition of traditional brokers. Many of these platforms are expanding their service offerings, moving beyond simple load boards to include features like real-time tracking, automated payments, and even freight factoring, further enhancing their appeal as substitutes.

The competitive landscape is intensifying as these digital marketplaces gain traction. For example, a 2024 industry survey indicated that over 30% of shippers are actively exploring or utilizing digital freight platforms for a portion of their transportation needs, a figure that has steadily climbed in recent years. This trend suggests a tangible shift in how freight is sourced and managed, directly impacting the market share of established players.

- Digital Platforms' Growing Market Share: Industry reports from early 2024 show a consistent year-over-year increase in freight volume handled by digital marketplaces, with some estimates placing it at over 15% of the total spot market freight.

- Disintermediation Efforts: Many digital platforms actively market their ability to cut out broker fees, directly appealing to cost-conscious shippers and carriers.

- Technological Advancements: AI-driven load matching and dynamic pricing algorithms offered by these substitutes are improving efficiency and reducing the need for manual broker intervention.

- Shipper Adoption Rates: Surveys from late 2023 and early 2024 indicate a growing segment of shippers, particularly small to medium-sized businesses, find digital platforms more accessible and cost-effective.

Shippers can bypass traditional brokers like RXO by developing their own logistics operations, such as private fleets. This internal capability offers greater control over costs and service for high-volume needs. For example, many large retailers expanded their private fleets in 2024 to manage freight expenses and ensure supply chain stability, reducing their reliance on external providers.

Alternative transportation modes also serve as substitutes, particularly for specific cargo types or when transit times are flexible. Intermodal rail, combining truck and rail, remained a cost-effective option in 2024 for long-haul shipments, potentially offering significant savings over pure trucking. Similarly, air cargo provides speed for urgent deliveries, while waterborne transport remains crucial for bulk goods, especially in international trade.

Integrated, asset-based 3PLs that own their transportation and warehousing resources present a direct substitution threat. These providers can offer shippers end-to-end control and a single point of accountability, which can be more appealing than brokered solutions for consistent, high-volume freight. By controlling their own assets, these 3PLs can bypass the need for brokers who primarily manage capacity through third-party carriers.

Entrants Threaten

The asset-light model of freight brokerage significantly lowers the barrier to entry. Starting a basic brokerage operation requires considerably less initial capital than asset-heavy transportation businesses, making it an attractive proposition for new players. For instance, in 2024, many tech-enabled startups have emerged, focusing on digital platforms to connect shippers and carriers, thereby minimizing the need for physical assets.

RXO's proprietary technology, exemplified by its RXO Connect platform, presents a formidable hurdle for potential new entrants. This advanced system integrates freight management, real-time tracking, and data analytics, offering a sophisticated operational advantage that is difficult and costly for newcomers to replicate.

The established network of carriers and shippers that RXO has cultivated over years of operation creates powerful network effects. New players find it challenging to achieve the same density and breadth of connections, which are crucial for efficient logistics operations and competitive pricing, especially given RXO's significant market presence.

Replicating the scale and data insights that RXO leverages is a major barrier. The company's extensive operational data allows for optimized routing, predictive analytics, and improved efficiency, giving it a competitive edge that new entrants would struggle to match without substantial investment and time.

While the general barrier to entry for brokerage isn't excessively high, navigating the complex web of transportation regulations, licensing, and compliance requirements can pose a significant challenge for inexperienced new entrants in the logistics sector. For instance, in 2024, the Federal Motor Carrier Safety Administration (FMCSA) continued to enforce stringent safety and operational standards, requiring new carriers to obtain specific operating authority and adhere to Hours of Service regulations, adding layers of complexity and cost.

Brand Recognition and Customer Trust

New entrants face a significant hurdle in replicating the established brand recognition and deep customer trust that companies like RXO have cultivated over time. Shippers, particularly for time-sensitive and high-value goods, often lean on established relationships with providers they know and trust for reliability. This loyalty makes it challenging for newcomers to gain a foothold, even with competitive pricing.

Building this level of trust is a lengthy and capital-intensive process. For instance, in the freight brokerage sector, where RXO operates, a strong reputation for on-time delivery and damage-free shipments is paramount. A 2024 report indicated that over 70% of shippers prioritize carrier reliability and established relationships when selecting logistics partners, underscoring the brand equity factor.

- Brand Equity: RXO's established name provides immediate credibility.

- Customer Loyalty: Existing relationships create a barrier to entry.

- Trust Factor: Shippers value proven reliability in logistics.

- Market Perception: New entrants must overcome skepticism about their capabilities.

Access to Talent and Industry Expertise

Success in freight brokerage hinges on a strong foundation of industry knowledge, seasoned sales professionals, and adept logistics experts. Newcomers often face significant hurdles in recruiting and retaining the specialized talent needed to challenge established players.

For instance, a shortage of experienced freight agents can slow down market penetration. In 2024, the demand for skilled logistics personnel remained high, with reports indicating a persistent gap in qualified candidates across the supply chain sector.

- Talent Acquisition Challenges: Established companies have built robust networks and employer branding, making it harder for new entrants to attract top-tier talent.

- Retention Difficulties: New ventures may struggle to offer the same compensation, benefits, and career progression paths as incumbents, leading to higher turnover.

- Knowledge Gap: The intricacies of carrier relationships, regulatory compliance, and customer service in freight brokerage require years of on-the-job learning, a resource new entrants lack.

The threat of new entrants for RXO, while present due to the asset-light nature of brokerage, is significantly mitigated by substantial barriers. These include RXO's proprietary technology, established network effects, and the high cost of replicating its scale and data insights. Furthermore, regulatory complexities and the need to build brand trust and acquire specialized talent present considerable challenges for newcomers in the freight brokerage landscape.

| Barrier to Entry | Impact on New Entrants for RXO | 2024 Context/Data |

|---|---|---|

| Asset-Light Model | Lowers initial capital requirements, making it accessible. | Continued emergence of tech-focused startups in 2024. |

| Proprietary Technology (RXO Connect) | High cost and complexity to replicate advanced integration and analytics. | Difficult for new entrants to match RXO's operational efficiency. |

| Network Effects | Challenging to build density of shipper and carrier connections. | RXO's established market presence creates significant network advantages. |

| Scale and Data Insights | Requires substantial investment and time to achieve comparable optimization. | RXO leverages extensive data for routing and predictive analytics. |

| Regulatory Compliance | Navigating licensing, safety, and operational standards is complex. | FMCSA enforcement in 2024 maintained stringent requirements. |

| Brand Recognition & Trust | Shippers prioritize reliability, favoring established players. | Over 70% of shippers prioritize reliability and relationships (2024 data). |

| Industry Expertise & Talent | Recruiting and retaining skilled logistics professionals is difficult. | High demand and a persistent talent gap in the supply chain sector persisted in 2024. |

Porter's Five Forces Analysis Data Sources

Our RXO Porter's Five Forces analysis is built upon a robust foundation of data, including RXO's financial reports, industry-specific market research from firms like IBISWorld, and regulatory filings from bodies such as the SEC. We also incorporate insights from trade publications and macroeconomic data to provide a comprehensive view of the competitive landscape.