Rio Tinto SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rio Tinto Bundle

Rio Tinto, a giant in the mining industry, faces a dynamic landscape. While its immense scale and diverse commodity portfolio are clear strengths, understanding the nuances of its operational challenges and evolving market demands is crucial for strategic advantage.

Want the full story behind Rio Tinto's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Rio Tinto's strength lies in its highly diversified global portfolio, which includes significant operations in iron ore, aluminum, copper, and diamonds. This broad range of commodities, spread across various geographies, acts as a natural hedge against the volatility of any single market. For instance, in the first half of 2024, iron ore revenue remained robust, partially offsetting softer conditions in other segments, demonstrating the benefit of this diversification.

Rio Tinto demonstrates exceptional financial health, boasting a remarkably low net debt position. This solid balance sheet is a testament to prudent financial management and a core strength for the company.

The company's ability to generate substantial free cash flow is a significant advantage. For instance, in the first half of 2024, Rio Tinto reported underlying EBITDA of $10.7 billion, showcasing its strong operational cash generation.

This robust cash flow provides Rio Tinto with considerable financial flexibility. It enables strategic investments in new projects, weathering economic downturns, and consistently rewarding shareholders through dividends and buybacks, reinforcing its appeal to investors.

Rio Tinto is strategically shifting its portfolio towards future-facing commodities essential for the global energy transition. This includes significant investments in copper and aluminum, metals crucial for electrification and renewable energy infrastructure.

The company's increased exposure to critical minerals is evident in its development of projects like the Rincon Lithium Project in Argentina. This project is expected to contribute to the growing demand for lithium, a key component in electric vehicle batteries.

Furthermore, Rio Tinto’s acquisition of Arcadium Lithium in 2024, valued at approximately $10.5 billion, underscores its commitment to securing a strong position in the lithium market. This move directly targets the booming electric vehicle sector and broader decarbonization initiatives.

Commitment to Sustainability and Decarbonization

Rio Tinto's dedication to sustainability and decarbonization is a significant strength, evidenced by its comprehensive plan to slash Scope 1 and 2 greenhouse gas emissions. The company aims to achieve a 15% reduction in these emissions by 2025 compared to a 2018 baseline, a crucial step in its long-term net-zero ambitions.

This commitment is further solidified by the integration of climate disclosures into its 2024 Annual Report, demonstrating transparency and accountability in its environmental performance. Such proactive engagement with ESG targets not only bolsters its social license to operate but also resonates with the increasing demand from investors and stakeholders for responsible mining practices.

- Decarbonization Targets: Aiming for a 15% reduction in Scope 1 and 2 emissions by 2025 (vs. 2018 baseline).

- Climate Disclosure: Integrating climate-related information into its 2024 Annual Report.

- ESG Alignment: Strengthening its social license to operate through adherence to environmental, social, and governance principles.

- Future Focus: Positioning itself to meet evolving global expectations for sustainable resource extraction.

Operational Excellence and Project Pipeline

Rio Tinto is actively pursuing operational excellence, aiming to become a 'Best Operator' through its Safe Production System. This focus is designed to maximize the value of its existing assets in a safe and sustainable manner. For instance, in 2023, the company reported a 3% increase in iron ore shipments compared to 2022, reaching 337.9 million tonnes, demonstrating consistent operational performance.

The company's robust project pipeline is a significant strength, poised to fuel future growth. Key developments include substantial progress at the Oyu Tolgoi copper mine in Mongolia, which is expected to significantly boost copper production in the coming years. Additionally, the Simandou iron ore project in Guinea is advancing, with first production anticipated in 2025, promising substantial new supply.

These strategic projects are crucial for Rio Tinto’s long-term production outlook.

- Safe Production System: Initiatives like the Safe Production System are central to Rio Tinto's operational strategy, aiming for enhanced safety and efficiency.

- Oyu Tolgoi Advancements: Significant progress at this Mongolian copper mine is a key driver for future copper output.

- Simandou Iron Ore Project: Expected to commence production in 2025, this project in Guinea will add considerable iron ore capacity.

- Iron Ore Shipments: Rio Tinto's 2023 iron ore shipments of 337.9 million tonnes underscore its current operational capacity and efficiency.

Rio Tinto's diversified commodity portfolio, spanning iron ore, aluminum, copper, and diamonds, provides a crucial buffer against market fluctuations. This broad operational base ensures resilience, as demonstrated by strong iron ore performance in early 2024, which helped offset weaker results in other sectors.

The company maintains a robust financial position with notably low net debt, reflecting sound financial management. This strong balance sheet is a key pillar of its stability and operational capacity.

Rio Tinto generates substantial free cash flow, evidenced by its $10.7 billion in underlying EBITDA for the first half of 2024. This consistent cash generation grants significant financial flexibility for investments and shareholder returns.

A strategic pivot towards future-facing commodities like copper and aluminum positions Rio Tinto favorably for the energy transition. Its acquisition of Arcadium Lithium in 2024 for approximately $10.5 billion highlights its commitment to securing a leading role in the critical minerals sector, particularly for electric vehicles.

Rio Tinto's commitment to sustainability is a core strength, with a target to reduce Scope 1 and 2 greenhouse gas emissions by 15% by 2025 from a 2018 baseline. The company's 2024 Annual Report integration of climate disclosures further underscores its dedication to ESG principles and responsible resource management.

Operational excellence is a continuous focus, driven by initiatives like the Safe Production System. This is supported by strong performance metrics, such as the 337.9 million tonnes of iron ore shipped in 2023, a 3% increase from the prior year.

A strong project pipeline, including advancements at the Oyu Tolgoi copper mine and the Simandou iron ore project in Guinea (expected to start production in 2025), is set to drive future growth and production volumes.

| Metric | 2023 Value | H1 2024 Value | Significance |

|---|---|---|---|

| Iron Ore Shipments (Mt) | 337.9 | N/A | Demonstrates operational capacity and efficiency. |

| Underlying EBITDA ($bn) | N/A | 10.7 | Highlights strong cash generation. |

| Arcadium Lithium Acquisition | N/A | ~$10.5bn | Strategic move into future-facing commodities. |

| GHG Emission Reduction Target | 15% by 2025 (vs 2018) | On Track | Commitment to sustainability and decarbonization. |

What is included in the product

Analyzes Rio Tinto’s competitive position through key internal and external factors, detailing its strengths in resource reserves and market demand, weaknesses in operational costs and environmental impact, opportunities in emerging markets and technological advancements, and threats from commodity price volatility and regulatory changes.

Offers a clear, actionable framework to navigate Rio Tinto's complex operational challenges and leverage its market strengths.

Weaknesses

Rio Tinto's substantial reliance on iron ore, despite its diversification strategies, remains a key weakness. In 2024, iron ore was a dominant contributor to the company's underlying earnings, underscoring its critical role in financial performance.

The company experienced a negative impact on its 2024 financial results due to a downturn in iron ore prices. Projections for 2025 indicate continued price weakness, presenting a considerable risk to Rio Tinto's revenue streams and overall profitability.

Rio Tinto's financial performance in fiscal 2024 showed a significant downturn, with sales revenue, underlying EBITDA, and underlying earnings per share all experiencing a decline. This marks the company's lowest full-year earnings in five years, underscoring a challenging period.

The primary driver behind this underperformance was the decrease in iron ore prices, a key commodity for Rio Tinto. This dip in prices directly impacted the company's profitability, raising questions about its short-term financial health and its capacity to sustain its historical dividend payouts to shareholders.

Operational hurdles persisted at critical Rio Tinto sites throughout 2024. The Iron Ore Company of Canada experienced disruptions impacting its output, while Kennecott faced challenges related to its concentrator operations. Rio Tinto Iron & Titanium also grappled with production inefficiencies, collectively impacting the company's ability to maximize throughput and meet targets.

Project Development Risks and Delays

Rio Tinto's ambitious project pipeline, while promising, is inherently exposed to significant development risks and potential delays. Bringing new mining operations online demands massive capital outlay and carries substantial execution uncertainties. For example, the Jadar lithium project in Serbia, a key component of Rio Tinto's future growth strategy, has encountered considerable setbacks due to local environmental opposition, demonstrating the challenges in realizing new resource developments.

These project-specific hurdles can have a ripple effect on the company's overall production targets and financial forecasts. The ongoing delays at Jadar, which was initially slated for production in the mid-2020s, underscore the unpredictable nature of large-scale resource projects. Such delays not only push back revenue generation but also increase the overall cost of capital investment, impacting profitability.

- Jadar Project Delays: Environmental protests have stalled progress on Rio Tinto's critical Jadar lithium project in Serbia, impacting its projected 2025 timeline.

- Capital Intensity: Developing new mines requires billions in investment, with cost overruns a common risk that can strain financial resources.

- Execution Risks: Complex engineering, geological uncertainties, and supply chain disruptions can lead to unforeseen construction delays and increased operational costs.

- Regulatory Hurdles: Obtaining and maintaining permits, especially in environmentally sensitive areas or regions with strong community opposition, presents ongoing challenges.

Potential for Dividend Cuts

Following an 8% reduction in its dividend payout for 2024, Rio Tinto faces the potential for further dividend cuts in 2025. This is largely due to persistent weakness in iron ore prices, which directly impacts the company's profitability.

The challenging financial outlook, exacerbated by fluctuating commodity markets, could lead to a reassessment of shareholder returns. Such a move would likely diminish investor confidence and make the stock less appealing to those seeking consistent income streams.

- Dividend Reduction: Rio Tinto's dividend payout saw an 8% decrease in 2024.

- Market Headwinds: Weak iron ore prices are a primary driver for potential future dividend cuts.

- Investor Sentiment: Further cuts could negatively affect investor confidence and the stock's appeal to income investors.

- Financial Outlook: A challenging financial environment may necessitate a reconsideration of shareholder distributions.

Rio Tinto's reliance on iron ore, despite diversification efforts, remains a significant weakness. In 2024, iron ore was the dominant contributor to earnings, making the company highly susceptible to price fluctuations. Projections for 2025 indicate continued weakness in iron ore prices, posing a considerable risk to revenue and profitability.

Operational challenges at key sites in 2024, including disruptions at the Iron Ore Company of Canada and issues at Kennecott and Rio Tinto Iron & Titanium, hampered production and the ability to meet targets.

The company's ambitious project pipeline faces substantial development risks and potential delays. The Jadar lithium project in Serbia, crucial for future growth, has encountered significant setbacks due to local opposition, highlighting the challenges in bringing new resource developments online.

These project delays, such as the ongoing issues at Jadar which was initially expected to start production by mid-2020s, push back revenue generation and increase capital costs, impacting overall profitability.

| Weakness | Description | Impacted Period | Key Data/Event |

| Iron Ore Dependence | High reliance on iron ore for earnings | 2024-2025 | Dominant contributor to 2024 earnings; projected price weakness in 2025 |

| Operational Disruptions | Production issues at key mining sites | 2024 | Disruptions at IOC, Kennecott, and RTIT impacting output |

| Project Development Risks | Delays and challenges in new project execution | Ongoing (e.g., Jadar) | Jadar lithium project in Serbia facing environmental opposition and timeline shifts |

Preview Before You Purchase

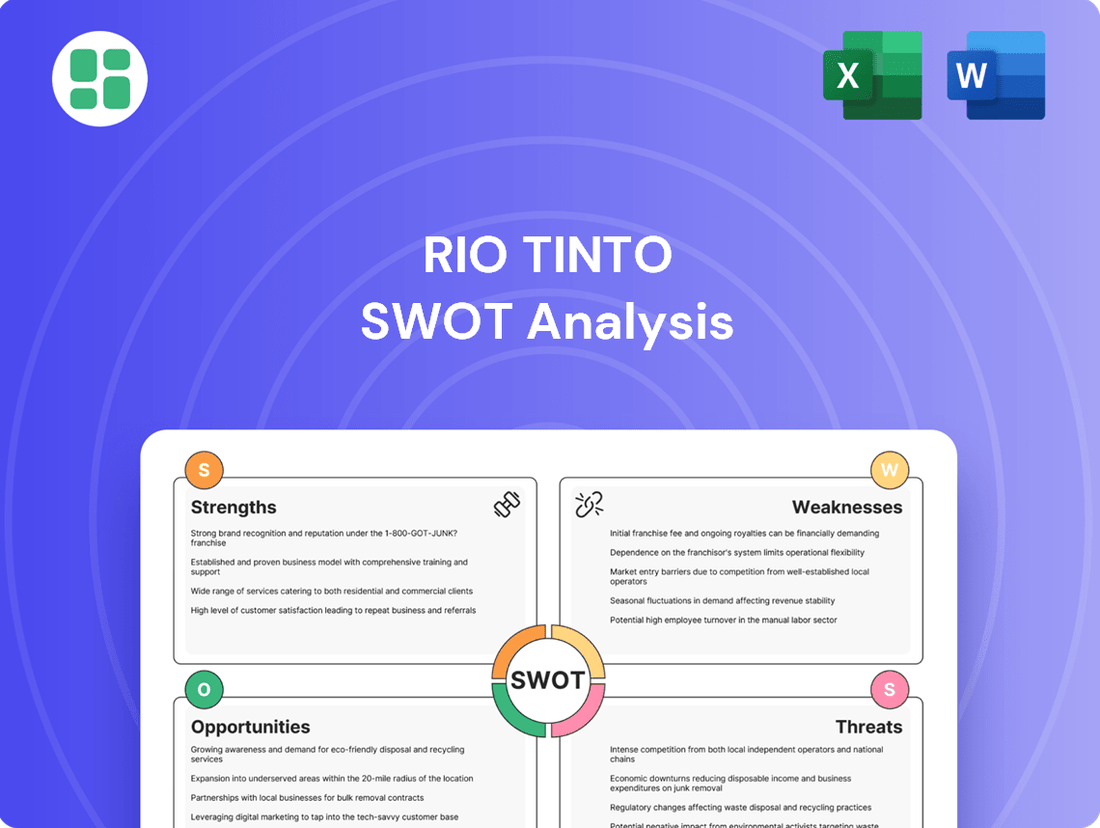

Rio Tinto SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Rio Tinto's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive strategic overview.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The global shift towards cleaner energy, particularly the widespread adoption of electric vehicles (EVs), is creating a significant surge in demand for essential minerals. This trend directly benefits companies like Rio Tinto, which is well-positioned to supply key materials. For instance, the International Energy Agency (IEA) projected in its 2024 report that demand for lithium could increase sixfold by 2030 compared to 2022 levels, and copper demand is expected to nearly double.

Rio Tinto's proactive strategy, including substantial investments in its aluminum and copper operations, aligns perfectly with this growing market need. The company's expanding portfolio in these critical commodities, such as its recent advancements in the Simandou iron ore project in Guinea which also produces aluminum, allows it to directly capitalize on this long-term structural growth trend, ensuring a strong market presence in the coming years.

Global infrastructure development is a significant tailwind for Rio Tinto. The International Monetary Fund projected global infrastructure investment needs to reach $94 trillion by 2040, a figure that underscores the sustained demand for the raw materials Rio Tinto provides. This ongoing spending, particularly in emerging economies, directly translates into increased demand for iron ore for construction and aluminum for transportation and building materials.

Urbanization trends are further amplifying this demand. By 2050, an estimated 68% of the world's population will live in urban areas, according to the United Nations. This concentration of people necessitates massive investment in housing, transportation networks, and utilities, all of which rely heavily on commodities like copper and bauxite, key products for Rio Tinto.

Rio Tinto's position as a leading producer of iron ore, aluminum, and copper places it in a prime position to capitalize on these macro trends. For instance, in 2023, Rio Tinto's iron ore shipments reached 327.7 million tonnes, a testament to its capacity to meet this robust global demand.

Rio Tinto's strategic acquisition of Arcadium Lithium in late 2024, valued at approximately $3.8 billion, significantly bolsters its critical minerals portfolio. This move, alongside a binding agreement to acquire a stake in the Salares Altoandinos lithium project in Chile, underscores a clear M&A-driven growth strategy. These actions are designed to enhance its competitive edge in the burgeoning electric vehicle battery supply chain.

Development of Major Growth Projects

The advancement of major growth projects presents a significant opportunity for Rio Tinto. The Oyu Tolgoi underground copper mine in Mongolia is progressing, and the Simandou iron ore project in Guinea is poised to start production in late 2025.

Simandou is particularly noteworthy, as it is expected to introduce a substantial volume of high-grade iron ore to the global market. This project is projected to significantly enhance Rio Tinto's overall production capacity and market position in the coming years.

- Simandou's projected start of production: late 2025

- Simandou's contribution: substantial high-grade iron ore supply

- Oyu Tolgoi's status: underground development

Technological Advancements and Decarbonization Solutions

Innovation in mining technology and the development of decarbonization solutions offer significant opportunities for Rio Tinto. For instance, the company is investing in autonomous haulage systems, which by 2024, are expected to reduce diesel consumption by up to 15% at its Pilbara operations. This focus on efficiency directly addresses environmental concerns and can lead to cost savings.

Rio Tinto's commitment to its 2025 Climate Action Plan underscores its strategic advantage. This plan targets a 15% reduction in Scope 1 and 2 emissions by 2025 compared to 2018 levels, with a long-term goal of net-zero by 2050. Achieving these targets through technological advancements can enhance its brand reputation and appeal to environmentally conscious investors.

The development of new decarbonization solutions, such as green steelmaking technologies or carbon capture utilization and storage (CCUS), presents potential new revenue streams. Rio Tinto's ongoing partnerships, like the one with Baowu Steel Group to explore low-carbon steelmaking, position it to capitalize on the growing demand for sustainable materials and processes.

Key opportunities include:

- Enhanced Operational Efficiency: Implementing advanced mining technologies like autonomous vehicles and predictive maintenance can significantly boost productivity and reduce operating costs.

- Reduced Environmental Footprint: Investing in and developing decarbonization solutions directly addresses climate change concerns, improving the company's ESG (Environmental, Social, and Governance) profile.

- New Revenue Streams: Exploring and commercializing green technologies and sustainable material solutions can open up new markets and revenue opportunities.

- Strengthened Stakeholder Relations: Proactive engagement with climate disclosures and action plans fosters trust and positive relationships with investors, regulators, and communities.

Rio Tinto is strategically positioned to benefit from the accelerating global demand for critical minerals driven by the clean energy transition and infrastructure development. The company's significant investments in copper and aluminum, coupled with its expansion into lithium through acquisitions like Arcadium Lithium in late 2024, directly align with these growth trends.

Major projects like the Simandou iron ore mine in Guinea, set to commence production in late 2025, and the Oyu Tolgoi copper mine in Mongolia, are poised to substantially increase Rio Tinto's output of essential commodities. These developments are expected to significantly bolster the company's production capacity and market share in the coming years.

Furthermore, Rio Tinto's commitment to innovation in mining technology and decarbonization offers a competitive edge. Investments in autonomous haulage systems, projected to reduce diesel consumption by up to 15% by 2024 at its Pilbara operations, not only enhance efficiency but also improve its environmental credentials. The company's 2025 Climate Action Plan, targeting a 15% reduction in Scope 1 and 2 emissions from 2018 levels, further solidifies its appeal to ESG-focused investors.

The exploration of new revenue streams through green steelmaking technologies and carbon capture solutions, exemplified by its partnership with Baowu Steel Group, presents additional avenues for growth. These initiatives position Rio Tinto to capitalize on the increasing market demand for sustainable materials and processes.

| Opportunity Area | Key Initiatives/Drivers | Projected Impact/Data Point |

|---|---|---|

| Clean Energy Demand | EV adoption, renewable energy infrastructure | IEA: Lithium demand sixfold by 2030 (vs 2022); Copper demand nearly doubled. |

| Infrastructure Development | Global urbanization, emerging economies | IMF: $94 trillion global infrastructure investment needed by 2040. |

| Project Advancements | Simandou (Guinea), Oyu Tolgoi (Mongolia) | Simandou start production: late 2025; Oyu Tolgoi underground development. |

| Lithium Expansion | Arcadium Lithium acquisition (late 2024) | Acquisition value: ~$3.8 billion; enhances EV battery supply chain. |

| Technological Innovation | Autonomous haulage, decarbonization solutions | Autonomous haulage: up to 15% diesel reduction by 2024 (Pilbara). |

| Climate Action | 2025 Climate Action Plan | Target: 15% Scope 1 & 2 emissions reduction by 2025 (vs 2018). |

Threats

The mining sector, including Rio Tinto, faces substantial risks from fluctuating commodity prices. Iron ore, a key revenue driver for the company, saw a significant price drop in 2024, impacting earnings. This volatility directly affects profitability and cash flow, creating uncertainty in financial performance.

China's economic trajectory presents a significant threat to Rio Tinto. A considerable percentage of Rio Tinto's revenue, especially from iron ore, is tied to Chinese demand. For instance, in 2023, China remained a critical market, absorbing a large share of global iron ore exports, which directly influences Rio Tinto's sales volumes and pricing power.

Any prolonged weakness in China's property sector, a key driver of steel demand, or unexpected shifts in industrial policy could lead to a substantial drop in demand for iron ore and other commodities Rio Tinto supplies. This downturn would directly impact the company's financial performance, potentially reducing revenues and profitability.

Rising geopolitical tensions and a global trend towards trade protectionism present a significant threat to Rio Tinto. For instance, the potential for US tariffs on copper, a key commodity for the company, alongside existing tariffs on Canadian aluminum, could directly impact pricing and market access.

These protectionist measures risk disrupting established global supply chains, leading to increased operational costs and potentially limiting the markets where Rio Tinto can sell its diverse range of products. Such policies can create significant uncertainty, making long-term strategic planning more challenging.

Increasing Regulatory Burdens and Environmental Scrutiny

Rio Tinto, like many in the mining sector, is navigating a landscape of escalating regulatory requirements and heightened environmental oversight. This is particularly true for new ventures and the company's ambitious decarbonization targets. For instance, in 2023, Rio Tinto reported increased capital expenditure related to environmental management and rehabilitation efforts, reflecting the growing costs associated with compliance and sustainability initiatives.

The challenge lies in adhering to these evolving environmental standards and maintaining the social license to operate, which is crucial for project continuity. Failure to do so can result in significant project delays and necessitate higher capital outlays. For example, the company has faced scrutiny and potential delays on projects requiring extensive environmental impact assessments and community consultations, impacting timelines and budgets.

- Increased Compliance Costs: Growing environmental regulations necessitate higher spending on monitoring, reporting, and mitigation strategies.

- Project Delays: Lengthy approval processes and environmental impact assessments can push back project start dates, affecting revenue projections.

- Social License to Operate: Maintaining positive community relations and addressing environmental concerns are critical for uninterrupted operations and future growth.

Competition and New Supply Entering the Market

The iron ore market, a core area for Rio Tinto, faces significant threats from new, large-scale projects. For instance, the Simandou iron ore project in Guinea, in which Rio Tinto is a partner, is anticipated to bring substantial new supply online. While Rio Tinto benefits from this partnership, the sheer volume of iron ore entering the global market from such ventures can create an oversupply situation.

This potential oversupply, coupled with increased production from existing competitors, could lead to downward pressure on iron ore prices. For example, if Simandou reaches its projected output of 100 million tonnes per year, it would represent a significant addition to global supply. Such market dynamics directly threaten Rio Tinto's pricing power and could erode its market share if competitors are more agile or cost-effective in their operations.

- Increased Supply Risk: The ramp-up of projects like Simandou, potentially adding over 100 million tonnes of iron ore annually, poses a significant supply-side risk.

- Price Volatility: Greater supply can lead to more volatile and potentially lower iron ore prices, impacting Rio Tinto's revenue and profitability.

- Competitive Pressure: New entrants and expanded production from rivals intensify competition, potentially squeezing margins and market share.

The mining industry, including Rio Tinto, faces significant threats from geopolitical instability and escalating trade protectionism. For instance, the ongoing trade disputes and sanctions impacting various global markets in 2024 and early 2025 could disrupt supply chains and affect commodity prices. This environment increases operational risks and can limit market access for Rio Tinto's diverse product portfolio.

Furthermore, the increasing focus on environmental, social, and governance (ESG) standards presents both opportunities and threats. Rio Tinto's commitment to decarbonization, for example, requires substantial investment. In 2023, the company allocated significant capital to sustainability initiatives, and continued pressure for faster progress in 2024-2025 could strain financial resources or lead to project delays if not managed effectively.

The company's reliance on key markets, particularly China, remains a vulnerability. Any slowdown in China's economic growth or shifts in its industrial policies, as seen with fluctuating steel demand in 2024, directly impacts Rio Tinto's revenue streams. For example, a continued moderation in China's infrastructure spending could reduce demand for iron ore, a major profit driver for the company.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, incorporating Rio Tinto's official financial reports, comprehensive market intelligence, and expert commentary from industry analysts to ensure a thorough and accurate assessment.