Rio Tinto Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rio Tinto Bundle

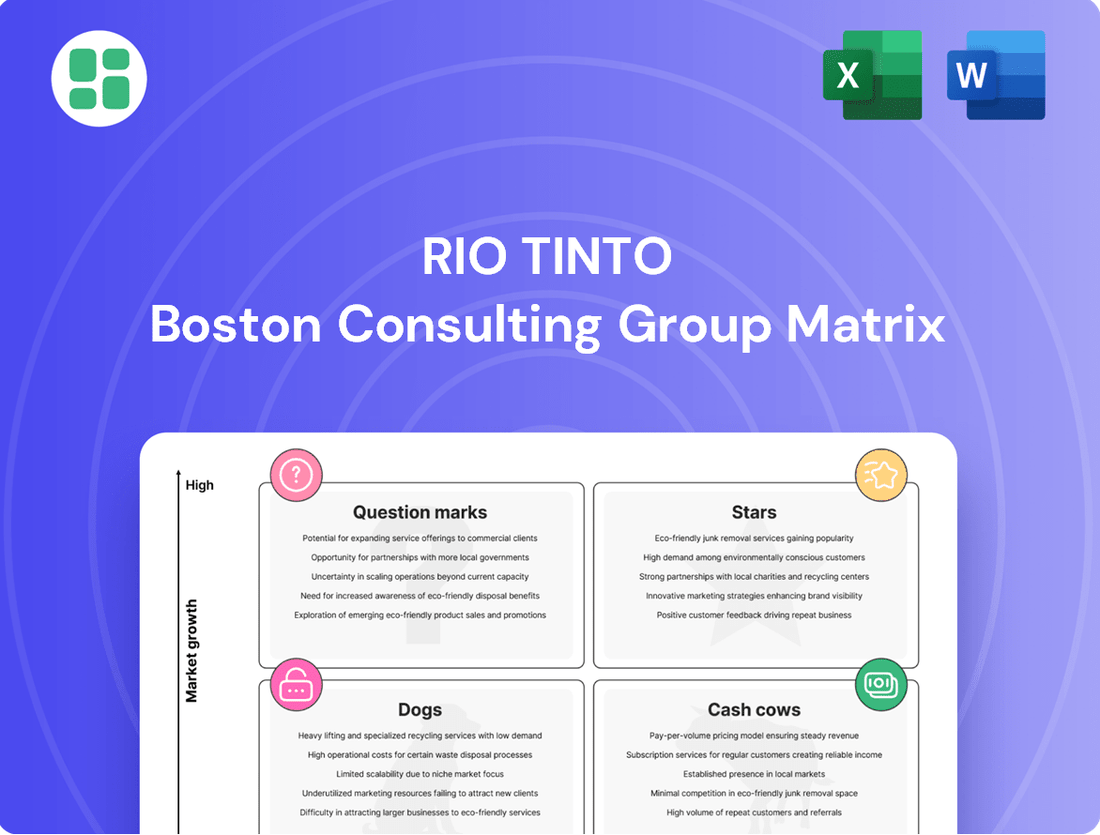

Curious about Rio Tinto's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. Understand where their mining operations and future ventures fall into Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete Rio Tinto BCG Matrix report. Gain a comprehensive, data-driven understanding of their market position and actionable strategies for optimizing resource allocation and driving future success.

Stars

Rio Tinto's copper assets are firmly positioned as Stars in the BCG Matrix. The company is undertaking a substantial expansion, with copper production projected to rise by more than 30% between 2024 and 2028, aiming for 1 million tonnes annually by 2030. This growth is fueled by robust demand from sectors like renewable energy and electric vehicles.

A significant contributor to this Star status is the Oyu Tolgoi mine in Mongolia. Production at Oyu Tolgoi is anticipated to surge by over 50% in 2024 alone. By the close of the decade, it is expected to rank as the fourth-largest copper mine globally, underscoring its strategic importance and high growth potential.

Lithium Ventures, representing Rio Tinto's significant foray into the burgeoning lithium market, would likely be positioned as a Star in the BCG Matrix. This is driven by substantial investments, such as the proposed $6.7 billion acquisition of Arcadium Lithium and the development of the Rincon lithium project in Argentina. These initiatives underscore Rio Tinto's ambition to capture a leading position in the rapidly expanding battery materials sector.

The Rincon project, a key component of this strategy, is projected to yield 60,000 tonnes of battery-grade lithium carbonate annually, with production slated to commence in 2028. This substantial output capacity, coupled with the strategic importance of lithium in the electric vehicle supply chain, firmly places Lithium Ventures in a high-growth, high-market-share quadrant.

Rio Tinto is actively broadening its critical minerals portfolio beyond established players like copper and lithium. The company is making significant moves into minerals such as scandium, a vital component for advanced lightweight alloys used in aerospace and other high-tech applications. This strategic pivot aims to capture growth in emerging technology sectors.

Demonstrating this commitment, Rio Tinto is advancing projects like the Burra scandium project located in Australia. Furthermore, the company has already achieved initial production milestones at its Sorel-Tracy facility in Canada, signaling tangible progress in its diversification strategy. These developments underscore a proactive approach to securing future revenue streams.

This diversification into critical minerals with high demand and growth potential serves a dual purpose. It not only lessens Rio Tinto's dependence on traditional commodity cycles but also positions the company to capitalize on the worldwide drive towards new energy solutions and technological innovation. For instance, scandium's use in aluminum alloys can significantly improve fuel efficiency in vehicles and aircraft.

Oyu Tolgoi Underground Expansion

The Oyu Tolgoi underground expansion is a key growth driver for Rio Tinto, positioned as a star in its BCG matrix. This massive project in Mongolia is set to dramatically increase copper production and cash flow for the company. By 2024, the underground operations are expected to be in full swing, unlocking higher-grade ore and significantly contributing to Rio Tinto's global copper output.

This world-class asset is crucial for Rio Tinto's long-term copper strategy, solidifying its market leadership. The underground mine is projected to produce an average of 475,000 tonnes of copper per year between 2025 and 2035. This substantial output will enhance Rio Tinto's revenue and profitability for years to come.

- Projected Copper Production: Oyu Tolgoi's underground expansion is expected to contribute significantly to Rio Tinto's copper output, with an average of 475,000 tonnes per year from 2025 to 2035.

- Strategic Importance: It represents a cornerstone of Rio Tinto's copper growth strategy, aiming to boost production and cash flow.

- Market Position: The project is designed to solidify Rio Tinto's standing as a major player in the global copper market.

- Investment: The total investment for the underground development is estimated to be around $7 billion, underscoring its scale and importance.

Strategic Partnerships for Growth

Rio Tinto is actively pursuing strategic partnerships to fuel its growth, particularly in emerging commodities. A prime example is its joint venture at the Winu copper-gold project with Sumitomo Metal Mining, a move designed to share the significant capital expenditure and leverage Sumitomo's expertise.

Furthermore, the collaboration with Codelco for the Salar de Maricunga lithium project highlights Rio Tinto's commitment to the battery materials sector. These alliances are crucial for de-risking investments, accessing specialized knowledge, and expediting the development of assets with substantial future market potential.

- Winu Project Partnership: Joint venture with Sumitomo Metal Mining for copper-gold development.

- Lithium Collaboration: Partnership with Codelco for the Salar de Maricunga lithium project.

- Strategic Rationale: These partnerships aim to de-risk investments, enhance expertise, and accelerate growth in future-facing commodities.

Rio Tinto's copper assets, particularly the Oyu Tolgoi mine, are undeniably Stars in the BCG matrix. With copper production projected to increase by over 30% between 2024 and 2028, reaching 1 million tonnes annually by 2030, these assets represent high growth and high market share.

The Oyu Tolgoi underground expansion is a critical driver, expected to contribute an average of 475,000 tonnes of copper per year from 2025 to 2035. This massive project, with an estimated $7 billion investment, solidifies Rio Tinto's market leadership in copper.

Rio Tinto's strategic expansion into lithium, exemplified by the proposed $6.7 billion acquisition of Arcadium Lithium and the Rincon project, also positions its lithium ventures as Stars. Rincon is slated to produce 60,000 tonnes of battery-grade lithium carbonate annually from 2028, tapping into the high-growth electric vehicle market.

The company's diversification into critical minerals like scandium, with projects such as Burra in Australia and initial production at Sorel-Tracy, Canada, also points to Star status. These ventures capitalize on demand from advanced materials sectors, further strengthening Rio Tinto's high-growth portfolio.

| Asset/Venture | BCG Category | Key Growth Drivers | Projected Impact/Capacity | Strategic Significance |

| Copper Assets (e.g., Oyu Tolgoi) | Star | Renewable energy & EV demand, Underground expansion | 30%+ production increase (2024-2028), 1M tonnes/yr by 2030, 475K tonnes/yr (2025-2035) | Market leadership, significant cash flow |

| Lithium Ventures (e.g., Rincon, Arcadium Lithium acquisition) | Star | EV battery demand, Strategic investments | 60K tonnes/yr lithium carbonate (Rincon from 2028) | Leading position in battery materials |

| Scandium Projects (e.g., Burra, Sorel-Tracy) | Star | Aerospace & high-tech alloy demand | Initial production achieved (Sorel-Tracy) | Diversification into emerging technologies |

What is included in the product

Rio Tinto's BCG Matrix highlights which mining assets to invest in, hold, or divest based on market share and growth.

Rio Tinto's BCG Matrix offers a clear, one-page overview of its business units, relieving the pain of strategic uncertainty.

Cash Cows

Rio Tinto's Pilbara iron ore operations are undeniably its cash cow, a powerhouse of profitability. In 2023, these operations delivered a staggering EBITDA of $22.5 billion, highlighting their immense cash-generating capacity. This robust performance is driven by the sheer scale of operations, cost efficiencies, and a dominant market position.

Despite fluctuations in iron ore prices, the Pilbara remains the primary engine of Rio Tinto's earnings. For the first half of 2024, the company reported a 2% increase in Pilbara iron ore shipments to 169.3 million tonnes, underscoring its consistent output and market demand. This consistent cash flow is crucial for funding new projects and strengthening the company's financial health.

Rio Tinto's aluminium division, covering bauxite and alumina, acts as a cash cow, generating stable returns with healthy profit margins in a well-established market. The company has been actively working to enhance the efficiency of these operations.

In 2024, Rio Tinto reported consistent bauxite output, underscoring the reliability of this segment. Furthermore, primary aluminium production saw steady growth, reflecting the ongoing demand and operational stability.

The global aluminium market is projected to maintain strong demand, particularly from key sectors like transportation and packaging. This sustained demand ensures that Rio Tinto's aluminium assets will continue to be a significant source of cash generation for the company.

The Kennecott copper operations in the US are a cornerstone cash cow for Rio Tinto. While the broader copper market is seen as a star for future growth, Kennecott's established presence ensures stable, high-volume production. This long-life asset is a major contributor to Rio Tinto's copper output, underpinning its financial strength.

In 2023, Kennecott produced approximately 200,000 tonnes of copper. This consistent output, supported by long-term offtake agreements, generates reliable cash flow. This financial stability allows Rio Tinto to invest in and develop other promising copper assets within its portfolio.

Strong Balance Sheet and Dividend Policy

Rio Tinto's robust balance sheet, characterized by minimal net debt, directly supports its standing as a cash cow. This financial strength is a testament to the consistent, substantial free cash flow generated by its established, market-leading assets, particularly in iron ore and aluminum.

The company's commitment to a progressive dividend policy further highlights the maturity and cash-generating power of these core businesses. For instance, in 2023, Rio Tinto returned approximately $7.1 billion to shareholders through dividends, demonstrating its capacity to reward investors even while reinvesting in its operations.

- Strong Financial Health: Rio Tinto's balance sheet showcases a healthy net cash position, enabling strategic flexibility.

- Consistent Dividend Payouts: The company's dividend policy reflects the stable cash flows from its mature assets, with dividends paid out in 2023 totaling $7.1 billion.

- Cash Flow Generation: High-market-share operations in iron ore and aluminum are the primary drivers of significant free cash flow.

- Shareholder Returns: The financial stability allows for consistent returns to shareholders alongside funding for future growth initiatives.

Diversified Portfolio Resilience

Rio Tinto's diversified portfolio, particularly its strong presence in iron ore and aluminum, acts as a bedrock for resilient earnings. This diversity helps the company navigate the inherent volatility of commodity markets, ensuring a steady cash flow even when individual commodity prices fluctuate. For instance, in 2023, iron ore continued to be a significant contributor, while the aluminum segment also demonstrated robust performance, underscoring the benefit of this balanced approach.

This diversified structure is a strategic advantage. If one market experiences a downturn, other segments of the business can compensate, maintaining overall financial stability. This allows Rio Tinto to continue generating strong cash flows across its operations. The company's focus remains on preserving this balance while strategically allocating capital towards materials crucial for the future economy.

- Dominant Iron Ore Position: Rio Tinto holds a leading global position in iron ore production, a key driver of its earnings.

- Aluminum Segment Strength: The company's aluminum business provides a significant and stable revenue stream, complementing its iron ore operations.

- Resilience Through Diversification: The combined strength of these core commodities creates a robust earnings base capable of weathering market cycles.

- Strategic Investment Focus: Rio Tinto aims to maintain this diversified strength while investing in materials essential for future growth, such as those used in renewable energy technologies.

Rio Tinto's Pilbara iron ore operations and its aluminum segment are the company's primary cash cows. These established, high-volume businesses consistently generate substantial profits, providing the financial bedrock for Rio Tinto's operations and investments. The consistent cash flow from these segments allows for strategic flexibility and shareholder returns.

| Business Segment | 2023 Contribution (EBITDA/Key Metric) | Rationale as Cash Cow |

|---|---|---|

| Pilbara Iron Ore | $22.5 billion EBITDA | Dominant market share, scale, and cost efficiency ensure consistent, high-volume cash generation. |

| Aluminum (Bauxite & Alumina) | Consistent output and steady growth in primary aluminium production | Stable returns in a mature market with ongoing demand from key sectors like transportation and packaging. |

| Kennecott Copper | Approx. 200,000 tonnes copper produced in 2023 | Long-life asset with stable, high-volume production and long-term offtake agreements, contributing reliable cash flow. |

What You See Is What You Get

Rio Tinto BCG Matrix

The Rio Tinto BCG Matrix preview you see is the complete, unaltered document you will receive upon purchase, offering a clear strategic overview of their business units. This preview accurately represents the final report, ensuring you get a professionally formatted and analysis-ready tool without any watermarks or demo content. Once purchased, this exact BCG Matrix will be immediately available for your use in strategic planning and decision-making. You are viewing the definitive version of the Rio Tinto BCG Matrix, ready for immediate download and application to your business analysis.

Dogs

Rio Tinto's diamond business, largely represented by the Diavik mine, has experienced a downturn. In 2024, this segment saw declining production and operational issues, leading to a significant revenue drop and a reported loss.

The company's strategic exit from diamonds is evident with the closure of the Argyle mine in 2020 and the planned closure of Diavik in 2026. This positions the diamond segment as a low-growth, low-market-share area that Rio Tinto is actively divesting from.

Legacy High-Cost or Divested Assets represent Rio Tinto's older or less efficient operations, or those not fitting its strategic focus on core commodities and energy transition materials. These assets might offer minimal growth and could be candidates for divestment or restructuring.

While specific recent divestments beyond diamonds are not extensively detailed, Rio Tinto regularly evaluates its asset portfolio. For instance, in 2023, the company continued to refine its portfolio, though specific figures for legacy asset divestments weren't prominently highlighted in general reports.

Rio Tinto's portfolio includes early-stage exploration projects that, while not currently showing significant promise, are continuously evaluated. These "Dogs" in the BCG matrix represent ventures with limited potential for scale, grade, or strategic alignment, meaning they might not progress to commercial viability.

Such projects, if they fail to demonstrate sufficient advancement beyond initial assessments, consume capital without contributing to future operations or market share. In 2023, Rio Tinto reported its exploration expenditure was approximately $931 million, with a portion allocated to a broad range of early-stage opportunities.

The company's rigorous capital allocation process ensures that resources are directed towards projects with the highest probability of success. This ongoing assessment helps to prune underperforming assets and refocus investment on more promising ventures within its global exploration pipeline.

Assets Facing Significant Regulatory or Geopolitical Hurdles

Rio Tinto's portfolio includes assets grappling with substantial regulatory and geopolitical challenges, often classifying them as potential 'Dogs' in a BCG-style analysis. These are projects where progress is significantly hampered by ongoing regulatory hurdles, environmental activism, or major geopolitical instability, leading to prolonged delays and inflated operational expenses. Such situations can transform an asset into a considerable drain on resources with uncertain future returns.

A prime example is Rio Tinto's Jadar lithium project in Serbia. Despite its considerable potential in the booming lithium market, the project has encountered persistent opposition and legal challenges. In 2023, the Serbian government officially cancelled Rio Tinto's permits for the Jadar project, a significant setback. This cancellation underscores the severe impact of regulatory and geopolitical risks on large-scale resource development, making the future of such ventures highly uncertain and potentially unprofitable.

These challenging assets require careful scrutiny and strategic decisions regarding their future. Options might include divesting the asset, attempting to navigate the complex regulatory landscape, or significantly restructuring the project to mitigate risks. The financial implications are substantial, as these stalled projects continue to incur costs without generating revenue, impacting overall profitability and capital allocation.

- Jadar Project Status: Permits officially revoked by the Serbian government in 2023, halting development.

- Financial Impact: Continued operational and administrative costs without revenue generation, representing a cash drain.

- Market Context: Despite global demand for lithium, regulatory and geopolitical factors have overridden market potential for Jadar.

- Strategic Consideration: Rio Tinto faces difficult decisions on whether to pursue legal avenues or exit the project entirely.

Mature Mines with Declining Ore Grades and High Costs

Rio Tinto's mature mines, characterized by declining ore grades and escalating operational expenses, represent a significant challenge. For instance, in 2023, the company continued efforts to optimize operations at its older iron ore assets in Western Australia, where ore grades have naturally decreased over time. These mines, while still contributing to cash flow, demand rigorous cost management to remain competitive against newer, higher-grade operations.

The focus for these "cash cows" in the BCG matrix is on efficient extraction and cost control. Rio Tinto's strategy involves extending the life of these mines through innovative mining techniques and processing improvements, rather than immediate divestment. However, the company must also plan for their eventual, responsible closure, ensuring minimal environmental impact and a smooth transition for the workforce.

- Declining Ore Grades: Older mines often experience a natural decrease in the concentration of valuable minerals, increasing the volume of material that needs to be processed.

- Rising Operational Costs: As mines mature, extraction becomes more complex and expensive, leading to higher energy consumption and maintenance expenditures.

- Profitability Pressure: The combination of lower ore grades and higher costs can squeeze profit margins, making these assets more vulnerable to market price fluctuations.

- Strategic Management: Rio Tinto's approach involves maximizing efficiency and planning for the long-term lifecycle, including potential decommissioning.

Rio Tinto's diamond business, primarily its Diavik mine, is a clear example of a 'Dog' in the BCG matrix. Facing declining production and operational challenges in 2024, this segment is characterized by low growth prospects and is slated for closure in 2026, following the Argyle mine's closure in 2020.

Early-stage exploration projects also fall into this category. While representing a small portion of Rio Tinto's substantial 2023 exploration expenditure of approximately $931 million, these ventures have limited potential for scale or strategic alignment, consuming resources without guaranteed future returns.

Assets like the Jadar lithium project in Serbia, where permits were revoked by the government in 2023 due to regulatory and geopolitical issues, exemplify 'Dogs'. Despite market demand for lithium, these projects become cash drains due to prolonged delays and inflated costs, making their future highly uncertain.

These 'Dog' assets, whether mature or facing significant hurdles, require careful management to avoid becoming a substantial drain on capital and resources, impacting the company's overall financial performance.

Question Marks

The Simandou iron ore project in Guinea, a substantial high-grade undeveloped resource, is a key strategic asset for Rio Tinto. It demands significant capital investment and complex infrastructure, positioning it as a potential high-growth but early-stage commercialization venture.

With first production anticipated in late 2025 and full capacity by 2028, Simandou is a future-oriented project. Its success is contingent on ongoing development and navigating logistical hurdles, reflecting its 'question mark' status in the BCG matrix as it requires substantial investment to realize its potential.

The Resolution Copper Project in Arizona, a joint venture between Rio Tinto and BHP, is a prime example of a question mark in the BCG matrix. It boasts one of the largest undeveloped copper deposits globally, suggesting significant future growth potential in a sector driven by electrification and infrastructure development. In 2024, the demand for copper remains robust, with prices fluctuating but generally trending upwards due to these long-term trends.

Despite its immense resource potential, the project faces substantial hurdles. Extensive permitting processes and environmental reviews have continuously delayed its progress, consuming significant capital without generating revenue. This uncertainty about future production and market share positions it as a high-risk, high-reward investment, characteristic of a question mark asset.

Rio Tinto is actively pursuing emerging lithium projects beyond its flagship Rincon operation, demonstrating a strategic push into a burgeoning market. The recent acquisition of a stake in the Salares Altoandinos project in Chile exemplifies this diversification effort. These early-stage ventures are crucial for Rio Tinto's long-term battery materials strategy, aiming to capture a significant share in the rapidly expanding electric vehicle (EV) supply chain.

These new projects, while promising, represent nascent opportunities in a high-growth sector fueled by surging EV demand. Currently, their market share is minimal, and they necessitate substantial capital investment for exploration, feasibility studies, and eventual development. Successfully bringing these projects online is paramount for Rio Tinto to establish a robust and diversified portfolio of battery-grade lithium products.

New Critical Minerals Exploration

Rio Tinto's strategic expansion into new critical minerals like nickel and cobalt, essential for the burgeoning energy transition, positions these ventures as question marks in their BCG matrix.

These exploratory projects carry substantial risk due to geological uncertainties and nascent market development, yet they offer the potential for significant future returns as demand for these materials escalates. In 2024, Rio Tinto announced a $7.5 billion investment over the next decade to develop its Rincon lithium project in Argentina, a key component of its strategy to diversify beyond traditional commodities and capitalize on the electric vehicle revolution.

- Exploration Focus: Nickel, cobalt, lithium, and rare earth elements are key targets for future growth.

- Investment Strategy: Significant capital allocation towards high-risk, high-reward exploration and development projects.

- Market Positioning: Aiming to secure future market share in minerals critical for decarbonization technologies.

- Risk vs. Reward: Balancing the uncertainty of new ventures with the potential for substantial long-term value creation.

Decarbonization Technologies & Green Steel Initiatives

Rio Tinto's investments in decarbonization technologies and green steel initiatives are pivotal for its long-term sustainability and future market positioning. These ventures, while essential for meeting environmental targets and adapting to evolving industry standards, represent significant capital expenditures with potential for delayed or uncertain immediate returns. For instance, the company is actively exploring and investing in low-carbon iron ore production methods, such as direct reduced iron (DRI) using hydrogen. This strategic focus acknowledges that future market competitiveness will increasingly depend on environmentally responsible production processes.

The company is committing substantial capital to achieve its ambitious decarbonization goals. In 2024, Rio Tinto announced plans to invest approximately $1.5 billion in decarbonization projects, with a significant portion allocated to reducing emissions from its Pilbara operations in Western Australia. These investments are not just about compliance but are strategic bets on shaping future industry norms and capturing consumer preference for greener products. The expectation is that these early investments will yield a competitive advantage as the global economy shifts towards net-zero emissions.

- Investments in Green Steel: Rio Tinto is exploring and investing in technologies like hydrogen-based DRI to reduce emissions in steelmaking, a key component of green steel.

- Capital Allocation: The company earmarked around $1.5 billion for decarbonization initiatives in 2024, highlighting the substantial financial commitment required.

- Strategic Importance: These investments are viewed as crucial for long-term sustainability and securing future market share in an increasingly environmentally conscious global market.

- Uncertainty of Returns: While vital, these projects involve significant capital outlays with uncertain immediate financial returns, reflecting their nature as strategic bets on future industry standards.

Question marks in Rio Tinto's BCG matrix represent ventures with high growth potential but uncertain market share and profitability. These are typically early-stage projects requiring significant investment to move towards commercialization.

The Simandou iron ore project and Resolution Copper project exemplify this category, demanding substantial capital for development and facing regulatory hurdles.

Rio Tinto's strategic push into emerging critical minerals like lithium, nickel, and cobalt also falls under question marks, as these are nascent markets with high investment needs and geological risks.

Investments in decarbonization technologies and green steel initiatives are also considered question marks due to their substantial capital outlays and uncertain immediate financial returns.

| Project/Initiative | Category | Key Characteristics | 2024/Recent Data |

|---|---|---|---|

| Simandou Iron Ore | Question Mark | High-grade, undeveloped resource; significant capital/infrastructure needed; first production late 2025. | Requires ongoing development and logistical solutions. |

| Resolution Copper | Question Mark | One of the largest undeveloped copper deposits; robust copper demand in 2024. | Delayed by extensive permitting and environmental reviews; significant capital consumed without revenue. |

| Emerging Lithium Projects | Question Mark | Early-stage ventures in a burgeoning market driven by EV demand; minimal current market share. | Acquisition of stake in Salares Altoandinos project; Rincon project investment of $7.5 billion over decade. |

| Nickel & Cobalt Exploration | Question Mark | Essential for energy transition; substantial risk from geological uncertainties and nascent markets. | Strategic expansion into these minerals to capitalize on escalating demand. |

| Decarbonization/Green Steel | Question Mark | Essential for sustainability; significant capital expenditure with uncertain immediate returns. | Investment of approx. $1.5 billion in decarbonization projects in 2024; focus on low-carbon iron ore production methods (e.g., hydrogen DRI). |

BCG Matrix Data Sources

Our Rio Tinto BCG Matrix leverages comprehensive data from company annual reports, global commodity market analyses, and internal operational performance metrics to provide accurate strategic insights.