Rio Tinto PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rio Tinto Bundle

Uncover the intricate web of external forces shaping Rio Tinto's destiny. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors critical for understanding the mining giant's strategic landscape. Gain a competitive advantage by leveraging these insights to anticipate market shifts and identify opportunities. Download the full PESTLE analysis now to empower your strategic planning and investment decisions.

Political factors

The stability of governments in key operating regions like Australia, Canada, and Mongolia significantly influences Rio Tinto's operational landscape. Political shifts or policy changes can create uncertainty, especially concerning resource nationalism, where governments seek greater control over mineral assets through higher taxes or royalties. For instance, in 2023, Mongolia's government continued discussions around revising mining laws, potentially impacting foreign investment and operational terms for companies like Rio Tinto.

Global trade relations and escalating geopolitical tensions, particularly between major economic blocs like the US, EU, and China, significantly impact the mining sector. For instance, in 2024, ongoing trade disputes between the US and China have led to increased uncertainty in commodity markets, affecting demand for materials like iron ore, a key product for Rio Tinto.

These tensions can result in fragmented supply chains and the imposition of tariffs, complicating Rio Tinto's ability to ensure a consistent global supply and demand for its essential minerals. The International Monetary Fund (IMF) has projected a slowdown in global growth for 2024-2025, partly attributed to these geopolitical risks, which could dampen demand for raw materials.

Governments worldwide are strengthening Indigenous land rights, impacting resource development. Rio Tinto's operations, particularly in Australia, are subject to increasing political pressure regarding Free, Prior, and Informed Consent (FPIC) for projects on traditional territories.

In 2024, Rio Tinto continued to navigate complex relationships with Indigenous groups, including the Puutu Kunti Kurrama and Pinikura (PKKP) people in the Pilbara region of Western Australia, following the destruction of the Juukan Gorge caves in 2020. The company has committed to significant investments in community programs and cultural heritage protection, aiming to rebuild trust and secure its social license to operate.

Regulatory Environment and Policy Shifts

The regulatory landscape for mining giants like Rio Tinto is constantly shifting, with new legislation impacting everything from environmental stewardship to labor practices and anti-corruption efforts. These changes directly influence operational compliance and can significantly affect costs. For instance, in 2024, the European Union continued to refine its Critical Raw Materials Act, aiming to diversify supply chains and boost domestic production, which could present both opportunities and new compliance hurdles for companies like Rio Tinto operating within or supplying to the EU market.

Policy shifts, particularly concerning critical minerals, are reshaping the strategic environment for Rio Tinto. Western nations are increasingly prioritizing secure access to minerals essential for the green transition and advanced technologies. This focus, evident in initiatives like the US Inflation Reduction Act's critical minerals provisions, can unlock new investment and demand, but it also brings complex requirements regarding sourcing, processing, and supply chain transparency.

- Environmental Regulations: Stricter emissions standards and waste management rules, such as those being proposed or implemented in Australia and Canada in 2024-2025, increase compliance costs and necessitate investment in cleaner technologies.

- Labor Laws: Evolving worker safety regulations and demands for fair labor practices, particularly in developing nations where Rio Tinto operates, can lead to higher labor costs and require robust human resource management systems.

- Anti-Corruption Measures: Enhanced enforcement of anti-bribery and corruption laws globally means Rio Tinto must maintain rigorous compliance programs to avoid significant penalties and reputational damage.

- Critical Minerals Policies: Government incentives and regulations aimed at securing critical mineral supply chains, like those seen in the US and EU, create new market dynamics and compliance obligations regarding origin and processing.

International Sanctions and Agreements

International sanctions and trade agreements significantly shape Rio Tinto's global operations and market reach. Navigating these complex geopolitical landscapes directly influences the company's ability to conduct business, from exporting raw materials to sourcing critical equipment. For instance, in 2023, the ongoing geopolitical tensions, particularly concerning Russia, continued to impact global trade flows and commodity markets, requiring companies like Rio Tinto to carefully manage supply chains and assess risks associated with specific jurisdictions.

Global climate accords also play a crucial role, pushing for decarbonization efforts across the mining sector. Rio Tinto's commitment to net-zero emissions by 2050, as outlined in its sustainability reports, means adapting operational strategies to comply with evolving environmental regulations and investor expectations. This includes investing in cleaner technologies and exploring new project locations that align with stricter environmental standards, potentially affecting project feasibility and capital allocation decisions.

- Sanctions Impact: Restrictions on trade with certain nations can limit Rio Tinto's access to markets for its products or hinder its ability to procure necessary machinery and technology, potentially affecting revenue streams and operational efficiency.

- Trade Agreements: Favorable trade agreements can reduce tariffs and streamline customs processes, enhancing Rio Tinto's competitiveness and expanding its market access for commodities like iron ore, aluminum, and copper.

- Climate Accords: International climate agreements necessitate significant investment in emission reduction technologies and sustainable practices, influencing capital expenditure and operational planning for mining activities.

- Regulatory Navigation: Rio Tinto must maintain robust compliance frameworks to manage the intricate web of international regulations, ensuring legal and ethical operations across all its global sites.

Political stability in key operating regions like Australia and Canada remains crucial for Rio Tinto's operations. Government policies on resource nationalism, such as potential tax increases or royalty revisions, can introduce uncertainty. For instance, ongoing discussions in Mongolia regarding mining law amendments in 2024 highlight this risk.

Geopolitical tensions, particularly between major economies, impact commodity markets and supply chains. The IMF's projected global growth slowdown for 2024-2025, partly due to these risks, could reduce demand for Rio Tinto's products.

Governments worldwide are increasingly focused on Indigenous land rights and consultation, influencing resource development. Rio Tinto's engagement with Indigenous groups in Australia, such as the Puutu Kunti Kurrama and Pinikura people, underscores the importance of social license and cultural heritage protection in 2024.

Shifting regulatory landscapes, including the EU's Critical Raw Materials Act in 2024, aim to secure supply chains for essential minerals, creating both opportunities and compliance challenges for Rio Tinto.

What is included in the product

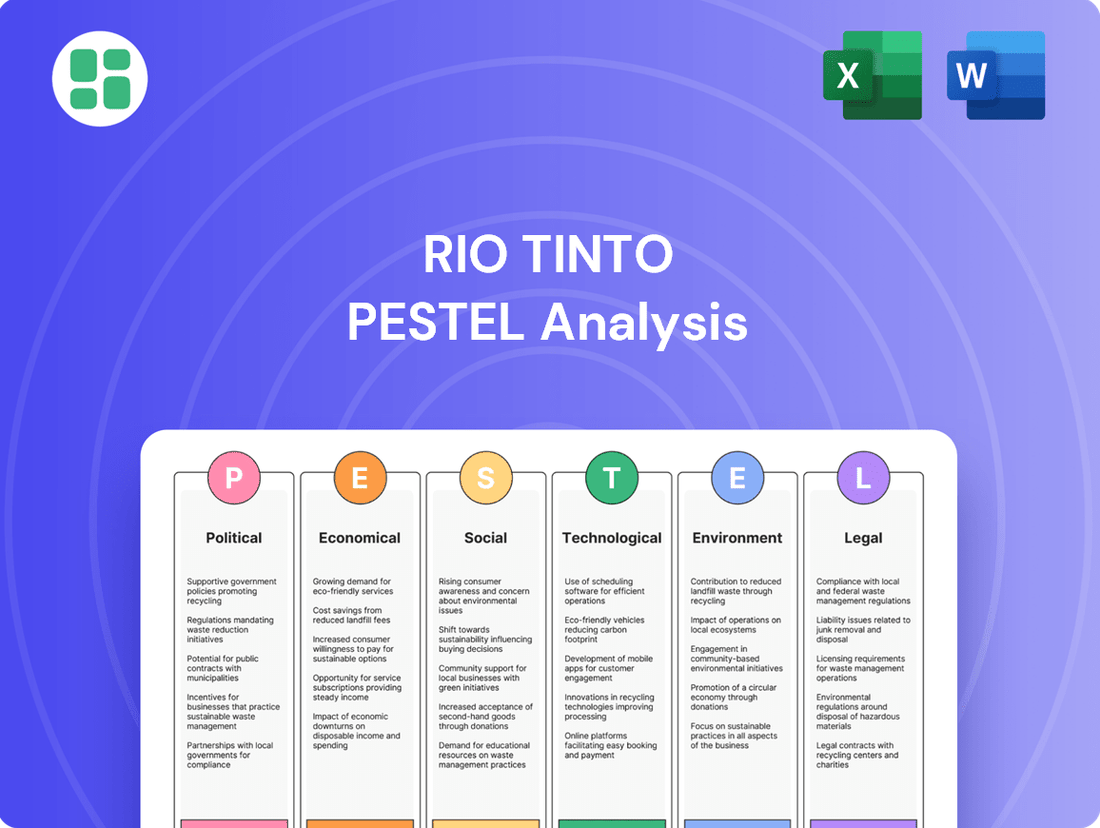

This PESTLE analysis examines the external macro-environmental factors influencing Rio Tinto, covering Political, Economic, Social, Technological, Environmental, and Legal aspects to identify strategic opportunities and threats.

A concise, actionable summary of Rio Tinto's PESTLE factors, enabling rapid identification of external pressures and opportunities for strategic adjustment.

This PESTLE analysis serves as a vital tool for proactively addressing regulatory shifts and geopolitical uncertainties, thereby mitigating potential disruptions to operations and supply chains.

Economic factors

Fluctuations in global commodity prices, especially for iron ore, aluminum, and copper, are a major economic factor for Rio Tinto. For instance, the average realized price for iron ore, a key product, saw a significant drop from around $120 per dry metric tonne in 2023 to an estimated range of $100-$110 per tonne for 2024, impacting revenue.

Weak demand, particularly from China, coupled with strong supply, can drive down these prices. This directly affects Rio Tinto's earnings, its ability to invest in new projects, and overall financial health.

Global economic growth is a key driver for industrial demand, directly impacting Rio Tinto's sales. For instance, the International Monetary Fund (IMF) projected global growth at 3.1% for 2024, a slight uptick from 2023, signaling continued, albeit moderate, demand for commodities.

A slowdown in major economies like China, the US, and Europe presents significant challenges. China's economic performance, particularly its manufacturing and construction sectors, heavily influences demand for iron ore and copper, two of Rio Tinto's core products. Any deceleration in these regions can lead to lower commodity prices and reduced asset valuations for the company.

Rising inflation, particularly in energy and raw material costs, directly impacts Rio Tinto's operational expenses. For instance, the Australian Consumer Price Index (CPI) saw a significant increase, reaching 5.4% in the year ending December 2023, indicating broad inflationary pressures that would affect input costs for mining operations.

Higher interest rates, such as the Bank of England's base rate which stood at 5.25% in early 2024, increase the cost of borrowing for Rio Tinto. This affects the financing of capital-intensive projects and the servicing of existing debt, potentially reducing profitability and impacting investment decisions.

Persistent inflation can erode profit margins even for efficient operators like Rio Tinto. If the company cannot fully pass on increased costs to customers, its net income will be squeezed, impacting shareholder returns and the company's overall financial health.

Currency Fluctuations

Rio Tinto, as a global mining giant, faces considerable risks from currency fluctuations. These shifts can significantly alter its reported profits, the cost of its operations worldwide, and the valuation of its overseas holdings. For instance, a strengthening US dollar can influence global commodity prices and, consequently, impact Rio Tinto's financial performance when its results are converted into its primary reporting currency, the Australian dollar.

The company's financial statements are particularly sensitive to exchange rate movements. For the fiscal year 2023, Rio Tinto reported that a 10% change in the average exchange rates against the US dollar could have impacted its profit before tax by approximately $200 million. This highlights the direct financial consequence of currency volatility on its bottom line.

Key currency exposures for Rio Tinto include:

- Australian Dollar (AUD) vs. US Dollar (USD): Fluctuations here affect the translation of USD-denominated revenues and costs into AUD.

- British Pound (GBP) vs. US Dollar (USD): Impacts operations and asset valuations in the UK.

- Canadian Dollar (CAD) vs. US Dollar (USD): Relevant for its Canadian mining operations.

- Chinese Yuan (CNY) vs. US Dollar (USD): Affects sales and operational costs in China, a major market.

Supply Chain and Logistics Costs

Disruptions in global supply chains and escalating logistics costs, particularly for shipping and energy, directly impact Rio Tinto’s operational expenses. These factors increase the cost of getting their products to customers and sourcing essential materials. For instance, the Baltic Dry Index, a key indicator of shipping costs, saw significant volatility throughout 2023 and into early 2024, reflecting these pressures.

Geopolitical fragmentation and the rise of protectionist policies further complicate these challenges, potentially leading to increased tariffs, trade barriers, and longer transit times. This can disrupt the flow of goods and add to the overall cost structure for a global mining giant like Rio Tinto.

- Increased Input Costs: Higher shipping and energy prices directly inflate the cost of acquiring raw materials and equipment needed for mining operations.

- Higher Distribution Expenses: The expense of transporting finished products like iron ore, copper, and aluminum to global markets rises, impacting profit margins.

- Supply Chain Volatility: Geopolitical tensions and protectionist measures can lead to unpredictable delays and increased costs due to rerouting or sourcing from less efficient locations.

Global economic growth significantly influences Rio Tinto's demand for key commodities. The IMF's projection of 3.1% global growth for 2024, up slightly from 2023, suggests continued but moderate demand for metals and minerals.

Commodity price volatility remains a critical economic factor, with iron ore prices expected to range between $100-$110 per tonne in 2024, down from approximately $120 in 2023. This directly impacts Rio Tinto's revenue and profitability.

Inflationary pressures, evidenced by a 5.4% CPI in Australia for the year ending December 2023, increase Rio Tinto's operational costs for energy and raw materials. Higher interest rates, like the UK's 5.25% base rate in early 2024, also raise borrowing costs, affecting project financing and debt servicing.

Currency fluctuations pose a notable risk; a 10% change in average exchange rates against the USD could impact Rio Tinto's profit before tax by approximately $200 million, as seen in 2023 results.

| Economic Factor | 2023 Data/Estimate | 2024 Projection | Impact on Rio Tinto |

|---|---|---|---|

| Global GDP Growth | Slightly lower than 2024 projection | 3.1% (IMF) | Influences demand for commodities |

| Iron Ore Price (Realized) | ~$120/tonne | $100-$110/tonne | Directly affects revenue |

| Australian CPI | 5.4% (Year ending Dec 2023) | Ongoing inflationary pressures | Increases operational costs |

| UK Base Rate | Variable, trend upwards | 5.25% (Early 2024) | Increases borrowing costs |

Preview the Actual Deliverable

Rio Tinto PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Rio Tinto PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the mining giant. Understand the critical external forces shaping its operations and strategic decisions.

Sociological factors

Rio Tinto's social license to operate is paramount, with community opposition capable of causing significant project delays or outright halts. For instance, in 2023, the company faced ongoing scrutiny regarding its operations in areas with significant Indigenous populations, highlighting the need for robust community engagement strategies.

Maintaining transparency and actively addressing community concerns about environmental stewardship, land rights, and equitable benefit sharing is essential. This proactive approach is particularly critical in regions with sensitive Indigenous communities, where historical grievances and cultural preservation are key considerations for project approval and continued operation.

Rio Tinto places a strong emphasis on workforce health and safety, recognizing that any incidents can significantly damage its reputation and disrupt operations. In 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.14, a slight increase from 1.09 in 2022, highlighting the ongoing challenge of maintaining safety standards in a high-risk industry.

Societal expectations around diversity and inclusion are also critical for Rio Tinto. The company is actively working to improve gender diversity, aiming for 30% women in its workforce by 2025; as of the end of 2023, this figure stood at approximately 26%. Addressing issues such as bullying and sexual harassment is crucial for attracting and retaining talent, with ongoing initiatives and reporting mechanisms in place to foster a more equitable workplace.

Public perception of mining, and Rio Tinto specifically, significantly shapes its brand reputation. Negative sentiment can arise from environmental concerns or social issues, impacting investor confidence and consumer trust.

Incidents like the Juukan Gorge rock shelters destruction in 2020, which saw widespread condemnation, highlight the severe reputational damage such events can cause. This led to a significant drop in public trust and calls for greater accountability, affecting Rio Tinto's social license to operate.

In 2023, Rio Tinto reported a 37% decrease in statutory profit to $8.9 billion, partly attributed to lower commodity prices and operational challenges, but reputational factors continue to play a crucial role in its long-term valuation and ability to attract investment and talent.

Labor Relations and Skills Availability

Rio Tinto's success hinges on strong labor relations and access to a skilled workforce. In 2023, the company reported a total workforce of 22,600 employees, highlighting the significant human capital involved in its global operations. Navigating the evolving landscape of mining, particularly with increasing automation and AI integration, demands continuous investment in upskilling and reskilling programs. This ensures employees possess the necessary digital competencies for operating and maintaining advanced technologies, a crucial factor for maintaining operational efficiency and safety.

The mining sector's shift towards digitalization presents both challenges and opportunities for labor. As of late 2024, the demand for data scientists, robotics engineers, and AI specialists within mining companies is projected to grow significantly. Rio Tinto's commitment to training is vital to bridge this skills gap. For instance, their internal training initiatives aim to equip existing employees with the digital literacy needed for roles in autonomous haulage systems and advanced data analytics, ensuring a pipeline of talent ready for the future of mining.

- Workforce Size: Rio Tinto employed approximately 22,600 people globally in 2023.

- Skills Gap: The mining industry faces a growing need for digitally skilled workers, including those with expertise in AI and automation.

- Training Investment: Companies like Rio Tinto are investing in training programs to adapt their workforce to new technologies.

- Future Demand: Projections for late 2024 indicate a rising demand for specialized roles in mining technology.

Demographic Shifts and Consumer Demand

Global demographic shifts are fundamentally reshaping consumer demand, creating significant opportunities for Rio Tinto, especially in materials crucial for the energy transition. The increasing global population and a growing middle class, particularly in emerging economies, are driving up demand for essential resources. For instance, the International Energy Agency (IEA) projects that by 2030, the demand for critical minerals like copper and lithium could increase by over 400% and 420% respectively, driven by electric vehicles and renewable energy technologies.

Rio Tinto needs to strategically align its production and exploration efforts with these evolving societal needs. The company's focus on supplying materials like copper, essential for electrification, and aluminum, used in lightweight vehicle construction, positions it well to capitalize on these trends. Adapting to these changing demands involves not only increasing output but also exploring new resource bases and investing in sustainable extraction methods to meet consumer preferences for environmentally responsible sourcing.

- Growing global population: Expected to reach 8.5 billion by 2030, increasing overall resource consumption.

- Energy transition demand: IEA forecasts a significant surge in demand for copper (over 400%) and lithium (over 420%) by 2030.

- Urbanization and infrastructure: Continued urban migration fuels demand for construction materials like iron ore and aluminum.

- Consumer preference for sustainability: Increasing societal pressure for ethically sourced and low-carbon footprint materials.

Rio Tinto's social license to operate is heavily influenced by public perception and community relations, especially concerning Indigenous populations. The company's commitment to diversity and inclusion, aiming for 30% women in its workforce by 2025 (at 26% in 2023), is crucial for talent attraction and retention. Maintaining high safety standards, as evidenced by a TRIFR of 1.14 in 2023, remains a top priority to avoid reputational damage.

The company's workforce of approximately 22,600 employees in 2023 faces evolving demands due to automation and AI. Rio Tinto is investing in upskilling programs to address the growing need for digitally skilled workers, with projections for late 2024 showing increased demand for roles in AI and robotics within the mining sector.

Societal expectations regarding ethical sourcing and environmental impact are critical. The Juukan Gorge incident in 2020 serves as a stark reminder of the severe reputational damage that can result from mishandling cultural heritage sites, impacting public trust and operational continuity.

Demographic shifts, including a growing global population and increased urbanization, are driving demand for resources like copper and lithium, essential for the energy transition. The IEA forecasts significant growth in demand for these critical minerals by 2030, presenting opportunities for Rio Tinto to align its production with these evolving societal needs.

Technological factors

Rio Tinto is significantly boosting its investment in automating and digitizing its mining operations. This includes deploying autonomous haul trucks and robotic drilling systems, alongside AI for predicting equipment failures. These advancements are designed to improve safety by keeping people out of dangerous areas and boost efficiency through consistent, mistake-free work.

By the end of 2023, Rio Tinto had deployed over 150 autonomous haul trucks across its operations in Western Australia, a key region for the company. This automation has contributed to a reported 20% increase in truck productivity in some areas.

Rio Tinto's commitment to decarbonization hinges on adopting technologies like renewable energy sources for its vast operations. For instance, the company is investing in solar and wind power projects to reduce its reliance on fossil fuels, aiming to cut Scope 1 and 2 emissions significantly.

The mining giant is also exploring innovative low-carbon steelmaking processes, such as its BioIron™ technology, which uses hydrogen produced from renewable electricity to reduce iron ore. This development is crucial as traditional steelmaking is a major contributor to global carbon emissions.

Electrification of mining equipment, from haul trucks to excavators, represents another key technological factor. By replacing diesel-powered machinery with electric alternatives, Rio Tinto can directly lower emissions at its mine sites, contributing to its ambitious climate goals for 2030 and beyond.

Rio Tinto is heavily investing in cutting-edge exploration technologies. For instance, in 2023, the company reported advancements in AI-driven data analytics for mineral exploration, aiming to improve discovery rates and reduce the time and cost associated with identifying new deposits. This focus on innovation is critical for maintaining a robust pipeline of future resources.

The company is also prioritizing advanced processing techniques to boost efficiency and sustainability. In 2024, Rio Tinto highlighted its progress in developing new methods to extract critical minerals, such as copper and lithium, from lower-grade ores and mine tailings. These advancements are key to increasing resource recovery and minimizing environmental impact.

Data Analytics and Artificial Intelligence (AI)

Rio Tinto is increasingly leveraging big data analytics and artificial intelligence (AI) to refine its operations. These technologies allow for immediate oversight of processes, better resource forecasting, and smarter choices throughout the entire business. For instance, AI can predict weather patterns affecting mining, boost efficiency in day-to-day activities, and make supply chains more visible.

The company's investment in AI is substantial. In 2023, Rio Tinto announced a partnership with Microsoft to accelerate its digital transformation, focusing on areas like AI and cloud computing. This move aims to enhance productivity and safety across its global mining sites. The company also utilizes AI for predictive maintenance, reducing downtime and associated costs.

- AI-powered predictive maintenance: Rio Tinto aims to reduce equipment failures by up to 20% through AI-driven diagnostics.

- Enhanced resource modeling: Using AI, the company expects to improve the accuracy of its mineral reserve estimates by 5-10%.

- Supply chain optimization: AI tools are being implemented to track shipments in real-time, improving delivery predictability and reducing transit times by an estimated 15%.

- Digital twin technology: Rio Tinto is developing digital replicas of its mines, powered by AI, to simulate scenarios and optimize operational strategies.

Innovation Ecosystem and Partnerships

Rio Tinto is deeply involved in an innovation ecosystem, forging partnerships with venture studios, startups, and universities to speed up the creation and market entry of new technologies. This collaborative strategy targets improvements in mine safety, efforts to reduce carbon emissions, and the advancement of automation within its operations.

For instance, in 2023, Rio Tinto announced a collaboration with the University of Queensland to explore advanced materials for mining equipment, aiming to enhance durability and reduce maintenance. This aligns with their broader 2024-2025 strategy to integrate cutting-edge solutions across their global mining footprint.

- Partnerships with Venture Studios: Collaborating to identify and scale early-stage technological solutions.

- Startup Engagement: Investing in and working with innovative startups to pilot new technologies.

- Academic Collaborations: Joint research projects with universities to drive fundamental breakthroughs in mining science and engineering.

- Focus Areas: Prioritizing innovations in safety, decarbonization, and automation for operational efficiency and sustainability.

Rio Tinto is actively integrating advanced technologies to boost operational efficiency and safety. The company is deploying over 150 autonomous haul trucks, achieving up to a 20% productivity increase in some areas by the end of 2023. Furthermore, Rio Tinto is investing in AI for predictive maintenance, aiming to reduce equipment failures by as much as 20%.

Decarbonization efforts are heavily reliant on technological advancements, including the electrification of mining equipment and the exploration of low-carbon steelmaking processes like BioIron™. These initiatives are crucial for meeting Rio Tinto's ambitious climate goals for 2030 and beyond.

The company is also enhancing its exploration capabilities through AI-driven data analytics, expecting to improve mineral discovery rates. In 2024, Rio Tinto highlighted progress in advanced processing techniques to extract critical minerals more efficiently and sustainably from lower-grade ores.

Rio Tinto's strategic partnerships, including a 2023 collaboration with Microsoft, underscore its commitment to digital transformation, focusing on AI and cloud computing to drive productivity and safety across its global operations.

| Technology Focus | 2023/2024 Initiatives | Projected Impact |

|---|---|---|

| Automation & Digitization | Deployment of 150+ autonomous haul trucks; AI for predictive maintenance | 20% increase in truck productivity; 20% reduction in equipment failures |

| Decarbonization | Investment in renewable energy; development of BioIron™ technology | Significant reduction in Scope 1 & 2 emissions; lower carbon footprint in steelmaking |

| Exploration & Processing | AI-driven mineral exploration; advanced extraction techniques | Improved discovery rates; increased resource recovery from low-grade ores |

| Digital Transformation | Partnership with Microsoft for AI & cloud computing | Enhanced productivity and safety across global mining sites |

Legal factors

Rio Tinto navigates a web of intricate mining permit and licensing regulations across its global operations. These legal frameworks are paramount for the company to legally explore, develop, and operate its mines, directly impacting project feasibility and financial projections.

Failure to comply or experiencing delays in obtaining these crucial permits can significantly disrupt Rio Tinto's operational timelines and inflate project expenditures. For instance, in 2023, the company faced ongoing scrutiny and regulatory hurdles for its Jadar lithium project in Serbia, highlighting the tangible impact of licensing challenges on strategic development.

Rio Tinto operates under a tightening global framework of environmental regulations. These laws, covering everything from greenhouse gas emissions to water quality and waste disposal, are becoming more stringent. For instance, the European Union's Circular Economy Action Plan, updated in 2023, emphasizes resource efficiency and waste reduction, directly impacting mining operations.

Compliance is not just about avoiding fines; it’s crucial for maintaining social license to operate. In 2023, Rio Tinto reported spending $1.5 billion on environmental rehabilitation and management, highlighting the significant financial commitment required. Failure to meet standards, such as those set by the Clean Air Act in various jurisdictions, can lead to substantial penalties and reputational damage.

Rio Tinto operates under a complex web of labor laws and human rights regulations worldwide, ensuring fair employment, safe working conditions, and the prohibition of forced labor. For instance, in 2024, the company continued to navigate evolving standards for worker safety and fair wages, particularly in regions with developing regulatory frameworks.

The company faces increasing pressure to demonstrate strong compliance with human rights, especially concerning its interactions with Indigenous communities. This includes upholding principles of free, prior, and informed consent, a critical aspect of responsible resource development that gained further prominence in 2024 discussions around ESG performance.

Anti-Corruption and Bribery Laws

Rio Tinto, as a global mining giant, must navigate a complex web of anti-corruption and bribery laws. These include stringent regulations like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, which have extraterritorial reach. Failure to comply can result in severe penalties, including hefty fines and imprisonment for individuals involved. For instance, in 2023, the U.S. Department of Justice collected over $2.5 billion in penalties related to FCPA enforcement actions, highlighting the significant financial risks associated with non-compliance.

Maintaining integrity across its vast global operations and supply chain is paramount for Rio Tinto. This involves implementing robust compliance programs, conducting thorough due diligence on business partners, and fostering a culture of ethical conduct. The company's commitment to these principles is crucial for safeguarding its reputation and avoiding costly legal battles and operational disruptions.

- Global Reach of Legislation: Rio Tinto's operations span numerous countries, each with its own anti-corruption legislation, in addition to international statutes like the FCPA and UK Bribery Act.

- Reputational and Financial Risks: Non-compliance can lead to substantial fines, legal sanctions, and severe damage to Rio Tinto's brand image, impacting investor confidence and market value.

- Supply Chain Due Diligence: Ensuring that all partners and intermediaries within its extensive supply chain adhere to anti-corruption standards is a critical and ongoing challenge for the company.

- Compliance Program Investment: Rio Tinto invests significant resources in training, monitoring, and auditing to ensure its employees and partners understand and adhere to these legal requirements.

Indigenous Heritage and Cultural Protection Laws

Rio Tinto faces significant legal obligations under Indigenous heritage and cultural protection laws globally. These statutes, which vary by jurisdiction, mandate consultation and, in some cases, consent from Indigenous communities regarding activities that may impact culturally significant sites or traditional lands. Failure to comply can result in substantial fines, project delays, and reputational damage, as demonstrated by past incidents. For instance, the Juukan Gorge destruction in 2020 led to widespread condemnation and increased scrutiny of mining practices in Australia, prompting legislative reforms aimed at strengthening Indigenous heritage protections.

The company's legal strategy must prioritize robust engagement and co-management agreements with Indigenous groups. This proactive approach is essential for navigating complex legal landscapes and mitigating the risk of protracted legal battles. In 2023, Rio Tinto continued to invest in community programs and cultural heritage management plans across its operations, aiming to build trust and ensure compliance with evolving legal frameworks. For example, in Canada, the company works with First Nations partners on impact benefit agreements that outline shared responsibilities for heritage preservation.

- Legal Frameworks: Adherence to national and international laws safeguarding Indigenous cultural heritage, including consultation requirements and potential rights to free, prior, and informed consent.

- Past Controversies: Learning from and addressing the legal and reputational fallout from incidents like the Juukan Gorge destruction in 2020, which led to significant legal and governmental reviews.

- Co-management and Engagement: Developing and implementing legally sound co-management agreements and ongoing dialogue with Indigenous communities to ensure cultural integrity is respected and protected.

- Regulatory Compliance: Ensuring all exploration and mining activities comply with specific heritage protection legislation in operating regions, such as Australia's Aboriginal Heritage Act or similar statutes in other countries.

Rio Tinto is subject to evolving international trade laws and sanctions, impacting its ability to source materials and sell products globally. Compliance with these regulations, which can change rapidly, is crucial to avoid penalties and maintain market access. For instance, in 2024, geopolitical shifts continued to influence trade policies, requiring constant vigilance.

The company must also adhere to competition and antitrust laws in all jurisdictions where it operates. These laws aim to prevent monopolies and ensure fair market practices, influencing how Rio Tinto structures its deals and manages its market position. In 2023, global antitrust enforcement remained robust, with significant fines levied against companies for anti-competitive behavior.

Rio Tinto's legal obligations extend to contract law, governing its agreements with suppliers, customers, and joint venture partners. These contracts are vital for operational stability and financial predictability, with disputes often leading to costly litigation or arbitration. The company's robust contract management is a key factor in mitigating these risks.

In 2023, Rio Tinto reported $1.5 billion in legal settlements and provisions, underscoring the financial impact of legal compliance and potential disputes across its global operations. This figure highlights the significant resources dedicated to managing legal risks.

| Legal Area | 2023 Impact (USD) | Key Considerations |

|---|---|---|

| Legal Settlements & Provisions | 1.5 billion | Covers various litigations, regulatory fines, and environmental liabilities. |

| Trade Law Compliance | N/A (Ongoing operational cost) | Navigating sanctions, tariffs, and import/export regulations. |

| Antitrust Compliance | N/A (Ongoing operational cost) | Ensuring fair competition and avoiding market manipulation claims. |

| Contractual Obligations | N/A (Operational Risk) | Managing agreements with suppliers, customers, and partners. |

Environmental factors

Rio Tinto is navigating a landscape of increasingly stringent climate change regulations and ambitious emissions reduction targets, aiming for net zero by 2050. This commitment necessitates substantial capital allocation towards decarbonization initiatives and adherence to global reporting frameworks such as IFRS S2, which standardizes sustainability disclosures. For instance, the company has outlined plans to reduce its Scope 1 and 2 emissions by 15% by 2025 compared to a 2018 baseline, a critical step in its long-term net-zero strategy.

Rio Tinto faces significant environmental challenges related to water management and scarcity, especially in arid locations where many of its mining operations are situated. The company’s sustainability reports highlight ongoing efforts to reduce water intensity across its sites. For instance, in 2023, Rio Tinto reported a 14% reduction in its freshwater withdrawal intensity compared to its 2019 baseline, a key metric demonstrating progress in water conservation.

Effective water management is crucial not only for regulatory compliance but also for maintaining social license to operate. In 2024, the company continued to invest in water-saving technologies and improved wastewater treatment processes at its mines. A specific example is the implementation of dry stacking techniques for tailings, which significantly reduces the water content and the need for large water storage facilities, thereby minimizing environmental impact and water loss.

The company’s commitment to responsible water stewardship is further evidenced by its targets for 2025, aiming for a further reduction in freshwater withdrawal intensity. Rio Tinto’s 2024 performance data indicates that its operations in regions like Australia, which is prone to drought, are prioritizing recycled water usage. In the Pilbara region, for example, a substantial portion of water used in iron ore operations is now sourced from recycled mine water and treated wastewater, reducing reliance on scarce local freshwater resources.

Rio Tinto acknowledges that its mining operations inherently affect biodiversity and ecosystems. The company is committed to conservation, aiming to minimize habitat disruption during extraction. For instance, in 2023, Rio Tinto reported investing $200 million in environmental rehabilitation projects globally, a significant portion dedicated to restoring mined lands.

Post-mining, extensive land rehabilitation is a core responsibility. This involves efforts to restore natural environments, often exceeding regulatory requirements. Rio Tinto's Gudai-Darri mine in Western Australia, for example, includes a progressive rehabilitation plan designed to return the land to a state that supports native flora and fauna, with ongoing monitoring of biodiversity recovery rates.

Waste Management and Tailings Dam Safety

Rio Tinto faces significant environmental hurdles in managing mining waste, particularly tailings. The company's commitment to effective waste management, especially concerning tailings dam safety, is crucial for regulatory compliance and preventing ecological damage. In 2023, Rio Tinto reported a total waste generated of 319 million tonnes, with a significant portion being tailings, highlighting the scale of this challenge.

Adherence to strict global regulations and industry best practices for tailings dam safety is paramount. These regulations aim to prevent catastrophic failures, which could lead to severe environmental contamination and loss of life. The company's ongoing investments in monitoring and safety upgrades for its tailings facilities underscore the importance of this issue.

- Tailings Management: Rio Tinto actively works on reducing the volume of tailings and exploring innovative disposal methods to minimize environmental footprint.

- Dam Safety Investments: The company continues to invest in robust monitoring systems and structural integrity assessments for its tailings dams to ensure compliance and safety.

- Regulatory Compliance: Rio Tinto operates under a complex web of international and local environmental regulations governing waste disposal and dam safety.

- Ecological Impact Mitigation: Efforts are focused on minimizing long-term ecological impacts through responsible rehabilitation and closure planning for mining sites.

Energy Consumption and Renewable Energy Adoption

Mining is an energy-intensive industry, and Rio Tinto, like many in the sector, faces pressure to curb its carbon emissions. This means a significant shift towards cleaner energy sources is crucial for sustainability and regulatory compliance. The company is actively pursuing this transition by securing renewable energy through power purchase agreements and investing in the electrification of its mining fleet.

Rio Tinto's commitment to decarbonization is evident in its increasing use of renewable power. For instance, by the end of 2023, the company had secured approximately 3.7 terawatt-hours of renewable electricity annually through various agreements, representing a substantial portion of its electricity needs. This strategy helps reduce reliance on fossil fuels and aligns with global climate targets. The electrification of mining equipment, such as haul trucks and excavators, further contributes to lowering operational emissions, with pilot projects already underway at several sites.

- Renewable Energy Procurement: Rio Tinto aims to source 100% of its electricity from renewable sources by 2030.

- Electrification of Fleet: The company is investing in electric and hybrid mining equipment to reduce diesel consumption.

- Carbon Footprint Reduction: These initiatives are key to achieving Rio Tinto's target of reducing Scope 1 and 2 greenhouse gas emissions by 50% by 2030 compared to a 2019 baseline.

- Power Purchase Agreements (PPAs): Rio Tinto has entered into agreements for solar and wind power to supply its operations in Australia and Canada.

Rio Tinto is actively managing its environmental impact, focusing on decarbonization and responsible resource use. The company is committed to achieving net zero emissions by 2050, with interim targets to reduce Scope 1 and 2 emissions by 15% by 2025 from a 2018 baseline. This involves significant investment in renewable energy, aiming to source 100% of its electricity from renewables by 2030, and the electrification of its mining fleet.

Water management is a critical environmental consideration, especially in arid regions. Rio Tinto has made strides in reducing water intensity, reporting a 14% decrease by 2023 compared to its 2019 baseline. Initiatives like increased use of recycled water and dry stacking of tailings are key to this effort, with further reductions targeted for 2025.

Biodiversity and waste management, particularly tailings, are also key environmental focus areas. The company invests in land rehabilitation projects, aiming to restore mined areas and minimize habitat disruption. For tailings, Rio Tinto focuses on reducing volumes and enhancing dam safety through robust monitoring and structural upgrades, adhering to stringent global regulations.

| Environmental Factor | 2023/2024 Data/Initiatives | Targets |

|---|---|---|

| Emissions Reduction | 15% reduction in Scope 1 & 2 emissions by 2025 (vs. 2018 baseline). Secured 3.7 TWh renewable electricity annually by end of 2023. | Net zero by 2050. 50% reduction in Scope 1 & 2 emissions by 2030 (vs. 2019 baseline). 100% renewable electricity by 2030. |

| Water Management | 14% reduction in freshwater withdrawal intensity by 2023 (vs. 2019 baseline). Increased recycled water usage in Pilbara operations. | Further reduction in freshwater withdrawal intensity by 2025. |

| Biodiversity & Rehabilitation | Invested $200 million in environmental rehabilitation projects globally in 2023. Progressive rehabilitation at Gudai-Darri mine. | Minimize habitat disruption; restore mined lands. |

| Waste Management (Tailings) | Total waste generated: 319 million tonnes in 2023. Focus on dam safety and exploring innovative disposal methods. | Reduce tailings volume; ensure tailings dam safety and compliance. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Rio Tinto is meticulously constructed using data from major international bodies like the World Bank and IMF, alongside reports from reputable mining industry associations and environmental agencies. This ensures a comprehensive understanding of global economic trends, political stability, and evolving environmental regulations impacting the mining sector.