Rio Tinto Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rio Tinto Bundle

Rio Tinto operates in a highly competitive global mining industry, where buyer power can significantly impact pricing and profitability due to the commodity nature of its products.

The threat of new entrants is generally low, thanks to the substantial capital requirements and established infrastructure needed to compete. However, understanding the nuances of supplier power and the intensity of rivalry among existing players is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Rio Tinto’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Rio Tinto's reliance on a concentrated group of specialized suppliers, such as heavy equipment manufacturers like Caterpillar and Komatsu, grants these suppliers considerable bargaining power. The high switching costs associated with critical machinery and the unique nature of their offerings mean Rio Tinto has limited alternatives, amplifying supplier leverage.

Rio Tinto's reliance on specialized mining equipment, advanced technology, and consistent energy supplies highlights the critical nature of its key inputs. These components are frequently differentiated, often due to proprietary designs or unique technological capabilities, which inherently strengthens the bargaining position of their suppliers.

The essential role these inputs play in Rio Tinto's extraction and processing activities, coupled with the difficulty in finding readily available substitutes, significantly amplifies supplier leverage. For instance, the acquisition of cutting-edge autonomous mining vehicles or specialized processing chemicals can be highly specific, making it challenging and costly to switch to alternative providers.

In 2024, the global demand for critical minerals, essential for renewable energy technologies and advanced manufacturing, has put upward pressure on the prices of specialized inputs. Suppliers of these high-demand materials and technologies are therefore in a stronger position to negotiate favorable terms with major players like Rio Tinto, potentially impacting the company's cost structure.

Rio Tinto faces significant switching costs when dealing with its suppliers in large-scale mining operations. These costs can include the expense of retooling heavy machinery, retraining specialized personnel, and reconfiguring complex, integrated supply chains. For instance, a change in a critical component supplier might necessitate extensive testing and certification processes, adding months and millions to the transition.

These substantial switching costs directly limit Rio Tinto's flexibility and leverage in price negotiations. It becomes more challenging for the company to demand lower prices or more favorable contract terms from its existing suppliers when the alternative is so costly and disruptive. This dynamic inherently strengthens the bargaining power of suppliers who have established themselves within Rio Tinto's operational framework.

Threat of Forward Integration by Suppliers

While outright takeover of mining operations by suppliers is rare due to the immense capital required, the threat of forward integration by specialized technology or service providers does exist. These suppliers could potentially move into areas like advanced processing or logistics, offering more comprehensive solutions. This capability enhances their bargaining power by providing value-added services that are difficult for mining companies like Rio Tinto to replicate internally.

For instance, a supplier of advanced mineral processing equipment might start offering a full-service package including operation and maintenance, thereby capturing more of the value chain.

- Specialized Suppliers: Companies providing unique mining technology or processing expertise pose a greater risk of forward integration.

- Value-Added Services: Suppliers offering integrated solutions beyond just equipment or raw materials gain leverage.

- Capital Intensity Barrier: The high capital expenditure in mining generally limits the feasibility of full-scale forward integration by most suppliers.

- Increased Bargaining Power: The potential for suppliers to offer more comprehensive, hard-to-replace services strengthens their negotiating position.

Availability of Substitute Inputs

The availability of substitute inputs for Rio Tinto's core operations, such as specialized mining equipment or specific processing chemicals, is generally low. This scarcity of alternatives for critical components strengthens the bargaining power of their suppliers. While some more common supplies might have readily available substitutes, the unique or highly specialized nature of many inputs means Rio Tinto often relies on a limited number of providers.

This limited substitutability directly impacts Rio Tinto's cost structure and operational flexibility. For instance, in 2024, the global supply chain disruptions continued to highlight the challenges in sourcing specialized components for large-scale mining operations. Companies like Rio Tinto often face situations where the proprietary nature of certain machinery or the specific chemical formulations required for mineral processing mean there are few, if any, alternative suppliers capable of meeting their stringent quality and volume demands.

- Limited Substitutability: Key inputs for Rio Tinto's specialized mining and processing activities often lack readily available alternatives.

- Supplier Leverage: The scarcity of substitutes grants suppliers significant bargaining power, influencing pricing and terms.

- Operational Dependence: Reliance on a narrow range of suppliers for critical inputs can create vulnerabilities in Rio Tinto's supply chain.

- Impact on Costs: The inability to easily switch suppliers for essential materials can lead to higher operational costs for Rio Tinto.

Rio Tinto's bargaining power with suppliers is constrained by the highly specialized nature of its inputs, including advanced mining machinery and proprietary processing chemicals. The significant switching costs, encompassing retooling and retraining, further solidify supplier leverage. In 2024, the robust demand for critical minerals amplified the pricing power of suppliers of these essential technologies and materials.

The limited availability of substitutes for crucial components, such as specialized autonomous vehicles or specific chemical reagents, means Rio Tinto often relies on a select few providers. This scarcity, exacerbated by ongoing global supply chain challenges in 2024, directly translates into stronger negotiating positions for these suppliers, impacting Rio Tinto's cost structure.

| Supplier Category | Key Inputs | Supplier Bargaining Power Factor | 2024 Market Trend Impact |

|---|---|---|---|

| Heavy Equipment Manufacturers | Autonomous mining vehicles, large-scale excavators | High switching costs, proprietary technology | Increased demand for mining equipment due to critical mineral needs |

| Technology & Software Providers | Mine planning software, operational analytics platforms | Integration complexity, specialized expertise | Growing adoption of digital solutions in mining operations |

| Chemical Suppliers | Processing reagents, flotation chemicals | Specific formulations, quality control requirements | Upward price pressure on key industrial chemicals |

| Energy Providers | Electricity, diesel fuel | Essential input, market volatility | Fluctuations in global energy prices impacting operational costs |

What is included in the product

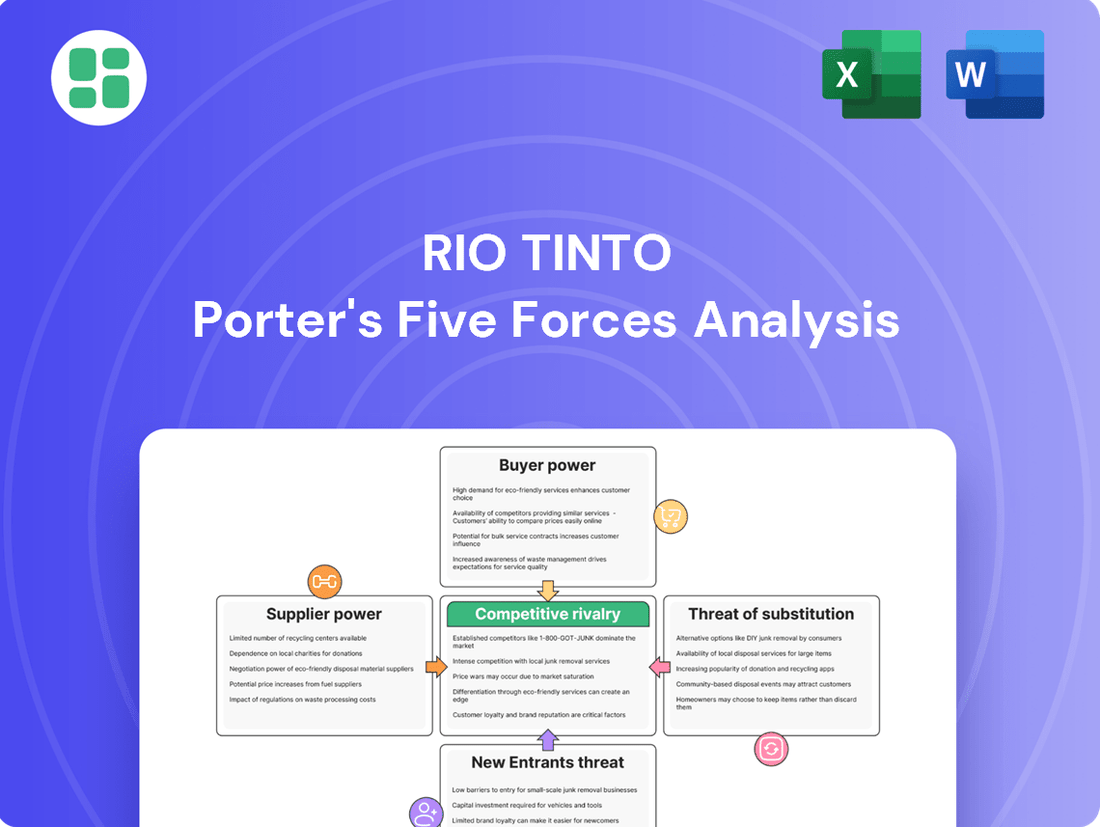

Explores the competitive intensity within the mining sector, assessing Rio Tinto's vulnerability to new entrants, buyer/supplier power, and substitute products.

Instantly identify and mitigate competitive threats with a clear, actionable overview of Rio Tinto's Porter's Five Forces.

Customers Bargaining Power

Rio Tinto's customer base is largely comprised of major industrial entities like steel manufacturers and aluminum smelters. These customers typically buy in massive quantities, often representing a substantial portion of Rio Tinto's overall revenue.

This concentration of large-volume buyers grants them significant bargaining power. They can leverage their substantial purchasing volume to negotiate more favorable prices and contract terms, which can exert downward pressure on Rio Tinto's pricing.

Rio Tinto's position in commodities like iron ore and aluminum means many of its products are essentially the same as those offered by competitors. This lack of unique features makes them undifferentiated commodities.

When products are interchangeable, customers have a strong incentive to seek the lowest price. For instance, in 2023, the benchmark iron ore price fluctuated significantly, demonstrating how sensitive buyers are to cost when sourcing these raw materials.

This interchangeability directly enhances the bargaining power of customers. They can readily switch to another supplier if Rio Tinto's pricing or terms are not competitive, as demonstrated by the global nature of commodity markets where numerous producers exist.

For Rio Tinto's customers, the costs associated with switching suppliers for bulk commodities like iron ore or aluminum are typically quite low, especially for standard product grades. This means buyers can readily shift their sourcing to different major mining firms if they find better pricing, more dependable supply, or more efficient logistics elsewhere.

This low switching cost gives customers significant leverage to negotiate favorable prices and contract terms. For instance, in 2024, the global iron ore market saw prices fluctuate, and buyers were quick to capitalize on any dips by adjusting their purchase volumes between suppliers like Rio Tinto, Vale, and BHP.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large industrial buyers like steel and aluminum manufacturers, poses a significant challenge to Rio Tinto. These major consumers might consider acquiring or developing their own mining operations to guarantee supply and manage expenses. For instance, in 2024, several major automotive manufacturers announced plans to invest in raw material sourcing, signaling a growing trend towards vertical integration to secure critical components.

While the capital investment for such ventures is substantial, the mere possibility of customers becoming competitors can compel Rio Tinto to offer more attractive pricing and terms. This pressure helps retain these vital clients and mitigates the risk of them establishing their own supply chains. The bargaining power of customers is amplified when they have the financial capacity and strategic incentive to control their inputs.

- Customer Integration Risk: Large industrial customers, such as steel and aluminum producers, possess the potential to integrate backward by acquiring or developing their own mining assets.

- Cost Control and Supply Security: This integration aims to secure a stable supply of raw materials and gain greater control over production costs.

- Bargaining Leverage: The perceived threat of backward integration by key customers can significantly enhance their bargaining power, pressuring Rio Tinto to offer more favorable terms.

- Market Dynamics: In 2024, trends indicated increased strategic investments by end-users in raw material sourcing, underscoring the real and present nature of this threat.

Customer Price Sensitivity and Information Availability

Customers in the industrial metals sector, including those Rio Tinto serves, are acutely price-sensitive because raw materials represent a substantial component of their overall production expenses. For instance, in 2024, the cost of key inputs like iron ore can fluctuate significantly, directly impacting the profitability of steel manufacturers, a major customer base for Rio Tinto. This sensitivity means customers actively seek the best possible prices.

The transparency of global commodity markets, with readily accessible pricing data, significantly bolsters customer bargaining power. In 2024, platforms providing real-time quotes for metals like aluminum and copper allow buyers to instantly gauge market rates. This easy access to information empowers customers to negotiate more aggressively with suppliers like Rio Tinto, as they are well-informed about prevailing market conditions and can readily compare offers.

- Price Sensitivity: Industrial customers often see raw materials as a significant cost driver, making them highly responsive to price changes.

- Information Availability: Global commodity markets offer transparent pricing, enabling customers to easily compare and negotiate.

- Negotiating Power: Informed customers can leverage market data to exert considerable pressure on suppliers' pricing strategies.

Rio Tinto's customers, primarily large industrial players, wield significant bargaining power due to their substantial purchase volumes and the commoditized nature of many of its products. This allows them to negotiate favorable pricing and terms, directly impacting Rio Tinto's profitability. For example, in 2024, the iron ore market saw buyers leveraging price fluctuations to secure better deals.

Low switching costs for customers further amplify their leverage. Buyers can easily shift to alternative suppliers if Rio Tinto's offers are not competitive, a common occurrence in the global commodity markets. This dynamic is evident in 2024, where shifts in supply and demand for metals like aluminum allowed buyers to play suppliers against each other.

The potential for backward integration by major customers, such as steel manufacturers acquiring their own mining assets, also pressures Rio Tinto. This threat, highlighted by increased investments in raw material sourcing by end-users in 2024, forces Rio Tinto to maintain competitive pricing and terms to retain these crucial clients.

| Factor | Impact on Rio Tinto | Customer Action Example (2024) |

|---|---|---|

| High Purchase Volume | Enables price negotiation | Large steel mills consolidating orders |

| Commoditized Products | Reduces differentiation, increases price sensitivity | Switching between iron ore suppliers based on spot prices |

| Low Switching Costs | Facilitates supplier changes | Aluminum smelters adjusting sourcing based on logistics costs |

| Backward Integration Threat | Drives competitive pricing | Automotive firms investing in critical mineral supply chains |

Preview Before You Purchase

Rio Tinto Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Rio Tinto, detailing the competitive landscape and strategic implications for the mining giant. You are looking at the actual document, which will be instantly available for download upon purchase, ensuring you receive the full, professionally formatted analysis without any alterations or placeholders.

Rivalry Among Competitors

The global mining sector, particularly for vital resources like iron ore, aluminum, and copper, is dominated by a handful of major companies. Giants such as BHP, Vale, and Fortescue Metals Group, alongside Rio Tinto, create a concentrated market. This oligopolistic environment means that the strategic moves of any one of these large entities have a substantial ripple effect on the others.

This intense rivalry among a few key players fuels aggressive competition. Companies actively engage in strategies focused on production levels, pricing tactics, and securing market share. For instance, in 2024, the iron ore market saw continued strategic output adjustments by these major players, directly influencing global benchmark prices.

Mining is inherently capital-intensive, with significant upfront investments in exploration, mine development, and infrastructure. For instance, the Simandou iron ore project in Guinea, a key Rio Tinto asset, is expected to require billions of dollars in development. These high fixed costs compel companies to prioritize high capacity utilization to spread costs and achieve profitability.

This drive for scale means that even when commodity demand falters, major players like Rio Tinto often continue production to cover their substantial fixed expenses. In 2023, for example, Rio Tinto's iron ore production reached 336.9 million tonnes (wet basis), reflecting a commitment to maintaining operational levels. This can lead to market oversupply, intensifying price competition among producers.

Rio Tinto faces significant competitive rivalry due to the high degree of product homogeneity in many of its key commodities, like iron ore and aluminum. These are largely seen as interchangeable goods, meaning buyers often prioritize price and delivery over unique product attributes.

This lack of differentiation intensifies price-based competition among industry players. For instance, the global seaborne iron ore market, a core business for Rio Tinto, is dominated by a few large producers where price is a primary competitive lever. In 2023, the average spot price for benchmark 62% Fe fines iron ore fluctuated significantly, impacting margins for all participants.

Consequently, companies like Rio Tinto are compelled to relentlessly pursue cost efficiencies and operational excellence to remain competitive. Maintaining low production costs is crucial for profitability and market share in such a price-sensitive environment. This constant pressure to reduce costs is a defining characteristic of the rivalry in these commodity sectors.

Industry Growth Rate and Demand Volatility

The mining sector's growth rate is intrinsically linked to global economic health, industrial output, and infrastructure projects, creating significant demand volatility. This cyclical nature means that during economic downturns, companies like Rio Tinto face intensified competition as they vie for a smaller market. This often leads to price wars, squeezing profit margins for all players.

Conversely, periods of robust economic expansion can ease competitive pressures, but they also tend to encourage substantial investment in new mining capacity. This expansion, if not carefully managed, can result in future oversupply, potentially driving down commodity prices and reigniting competitive intensity. For instance, the demand for key commodities like iron ore, a major product for Rio Tinto, is heavily influenced by construction activity, particularly in China. In 2023, while demand remained relatively strong, concerns about global economic slowdown and China's property sector continued to create a degree of uncertainty in pricing, impacting the competitive landscape.

- Demand Volatility: Mining demand is highly sensitive to global economic cycles, impacting companies like Rio Tinto.

- Intensified Competition: During economic slowdowns, companies fight for market share, often through aggressive pricing.

- Capacity Expansion Risks: Rapid growth can lead to oversupply if capacity expansions outpace demand.

- 2024 Outlook: Analysts in early 2024 observed continued sensitivity of commodity prices to geopolitical events and global growth forecasts, directly affecting competitive dynamics within the mining industry.

Strategic Objectives and Global Reach

Major mining giants like Rio Tinto pursue ambitious strategic objectives, aiming for global market leadership, diversification across various commodities and geographic regions, and the crucial securing of long-term resource access. This broad strategic vision inherently intensifies competition.

Rio Tinto's extensive global reach means that competitive battles are waged on numerous fronts. These include vying for exploration rights in new territories, securing funding and permits for project development, and establishing efficient logistical networks to transport materials worldwide. This broad competitive landscape fuels intense rivalry.

The sheer scale of operations and the long-term strategic horizons of companies like Rio Tinto contribute significantly to the high level of competitive rivalry within the industry. For instance, in 2023, Rio Tinto reported capital expenditure of $10.1 billion, a substantial investment reflecting its commitment to global growth and resource acquisition.

- Global Market Leadership: Companies strive to be dominant players across key commodity markets, influencing supply and pricing.

- Diversification Strategy: Spreading investments across different commodities and regions mitigates risk and captures broader market opportunities.

- Resource Access: Securing rights to new or existing mineral deposits is a critical competitive differentiator.

- Project Development: The ability to efficiently and profitably bring new mining projects online is a key competitive advantage.

The competitive rivalry for Rio Tinto is intense, primarily due to the concentrated nature of the global mining industry. A few major players, including BHP, Vale, and Fortescue Metals Group, dominate key commodity markets like iron ore and aluminum. This oligopolistic structure means that the actions of one company significantly impact the others, leading to aggressive competition focused on production, pricing, and market share. In 2023, Rio Tinto's iron ore production reached 336.9 million tonnes, underscoring the scale of operations that drive this rivalry.

Product homogeneity in core commodities like iron ore means that price is the primary competitive lever. Companies like Rio Tinto must relentlessly pursue cost efficiencies to remain profitable. For example, the average spot price for benchmark 62% Fe fines iron ore fluctuated in 2023, directly impacting margins for all major producers. This necessitates a constant focus on operational excellence and cost reduction.

Demand volatility, driven by global economic cycles, further intensifies competition. During economic slowdowns, companies vie for a smaller market, often leading to price wars. Conversely, periods of growth can spur capacity expansions, risking future oversupply. Analysts in early 2024 observed continued sensitivity of commodity prices to geopolitical events and global growth forecasts, directly affecting competitive dynamics within the mining industry.

Rio Tinto's global ambitions, including securing exploration rights, project development, and logistical networks, create broad competitive fronts. In 2023, the company reported capital expenditure of $10.1 billion, reflecting its commitment to growth and resource acquisition, a strategy that inherently fuels intense rivalry.

SSubstitutes Threaten

The growing momentum behind the circular economy and enhanced recycling capabilities present a notable threat, especially for materials like aluminum and copper. These recycled alternatives are appealing to manufacturers due to their reduced energy requirements and smaller environmental impact compared to primary metals.

As recycling systems become more efficient and economical, they directly challenge the market for newly extracted metals. For instance, the London Metal Exchange (LME) saw the premium for low-carbon aluminum rise significantly in 2024, reflecting increased demand for recycled content. This trend could potentially dampen demand for Rio Tinto's primary metal production.

The threat of substitutes for Rio Tinto's iron ore and aluminum is growing, particularly in construction and manufacturing. Engineered wood, advanced composites, and specialized concrete are increasingly viable alternatives to steel in certain building projects, potentially impacting demand for iron ore. For instance, the global engineered wood market is projected to reach over $100 billion by 2027, showcasing a significant shift in material preferences.

In the automotive and aerospace industries, the push for fuel efficiency and performance is driving the adoption of lighter materials. Carbon fiber, advanced plastics, and lightweight alloys are replacing traditional steel and aluminum in vehicle and aircraft components. For example, the average weight of a new passenger car in the US has been steadily decreasing, with a greater proportion of lightweight materials being used, which directly affects aluminum demand.

These material innovations represent a tangible threat, as they can gradually erode the demand for Rio Tinto's core products. As these substitutes become more cost-effective and performant, they offer compelling alternatives for customers, potentially leading to a reduction in the market share for base metals like iron ore and aluminum over the long term.

Ongoing technological advancements are a significant threat of substitutes for Rio Tinto. Innovations in material science, for instance, are enabling the creation of lighter yet stronger materials, potentially reducing the need for traditional metals like steel and aluminum in various applications. This means that even if demand for finished goods remains stable, the material intensity of those goods could decrease, impacting the volume of raw materials required.

For example, the automotive industry is increasingly exploring advanced composites and high-strength steels that allow for lighter vehicles, improving fuel efficiency. This trend, driven by environmental regulations and consumer demand for better mileage, directly substitutes for larger volumes of conventional steel and aluminum. In 2023, global electric vehicle sales surpassed 13 million units, a segment that often prioritizes weight reduction, further accelerating this substitution trend.

Furthermore, advancements in manufacturing processes, such as additive manufacturing (3D printing), allow for more complex designs and optimized material usage, often requiring less raw material overall. This efficiency gain, coupled with the development of novel materials with tailored properties, poses a continuous long-term substitution risk to the demand for Rio Tinto's primary commodity products.

Lab-Grown Diamonds and Other Gemstones

The threat of substitutes for Rio Tinto's diamond business is intensifying, primarily driven by the increasing acceptance and affordability of lab-grown diamonds (LGDs). These diamonds, possessing identical physical, chemical, and optical characteristics to natural diamonds, are now a significant alternative, particularly for price-conscious consumers. For instance, the LGD market saw substantial growth, with sales projected to reach $4.5 billion in 2024, a notable increase from previous years, indicating a direct challenge to the natural diamond sector.

Beyond LGDs, other gemstones also pose a substitution threat. Consumers looking for decorative stones in jewelry have a wide array of options, from sapphires and emeralds to more affordable semi-precious stones. This diversification of choices means that diamonds, whether natural or lab-grown, are not the sole option for adornment, further fragmenting the market and pressuring traditional diamond producers like Rio Tinto.

The competitive landscape is further shaped by the evolving consumer preferences and marketing efforts for LGDs. As LGD technology advances and production scales up, their cost advantage over natural diamonds is expected to widen. This trend is particularly relevant in 2024, as major jewelry retailers increasingly feature LGD options, making them more accessible and appealing to a broader demographic.

Key aspects of the threat of substitutes include:

- Growing Market Share of Lab-Grown Diamonds: LGDs are capturing an increasing share of the diamond market, projected to reach 10-15% of total diamond jewelry sales by 2024.

- Price Disparity: LGDs are typically priced 50-80% lower than natural diamonds of comparable quality, making them a compelling alternative for many consumers.

- Diversification of Gemstone Choices: The availability of a wide range of colored gemstones and other precious stones offers consumers alternatives to diamonds for engagement rings and other jewelry.

- Technological Advancements: Continuous improvements in LGD manufacturing technology are leading to higher quality stones at potentially lower production costs, strengthening their substitution threat.

Energy Transition and Material Shifts

The global energy transition presents a significant threat of substitutes for traditional materials used in fossil fuel-based industries. As economies shift towards renewable energy, the demand for materials like copper and aluminum in electric vehicles and infrastructure is expected to rise. For instance, electric vehicles can use up to four times more copper than conventional cars, and wind turbines require substantial amounts of aluminum. However, this transition also signals a potential decline in demand for materials tied to legacy industrial processes.

Rio Tinto must navigate this evolving landscape where material preferences are changing. The long-term viability of certain metals could be challenged if new technologies emerge that utilize alternative materials or reduce reliance on conventional ones. This dynamic necessitates a proactive approach to material innovation and adaptation to secure future market positions.

- Shifting Demand: The move to renewables, like solar and wind power, is projected to significantly boost demand for materials such as copper and aluminum.

- Technological Disruption: Advancements in battery technology and energy storage could introduce new material requirements, potentially displacing existing ones.

- Fossil Fuel Decline: A sustained reduction in reliance on fossil fuels will inevitably impact the demand for materials historically linked to these sectors.

The threat of substitutes for Rio Tinto's products is multifaceted, spanning from material innovation to evolving consumer preferences. In construction, engineered wood and advanced composites are increasingly viable alternatives to steel, impacting iron ore demand. Similarly, lightweight materials like carbon fiber are replacing aluminum in automotive and aerospace, driven by efficiency goals. The rise of lab-grown diamonds also directly challenges Rio Tinto's diamond segment, offering a more affordable and ethically perceived alternative.

The energy transition also reshapes material demand, potentially reducing reliance on some traditional commodities while boosting others like copper and aluminum for renewables. This dynamic necessitates continuous adaptation and innovation to mitigate the impact of these evolving substitutes.

| Product Segment | Key Substitute | Impact/Trend | 2024 Data/Projection |

|---|---|---|---|

| Iron Ore | Engineered Wood, Advanced Composites | Reduced demand in construction | Engineered wood market projected >$100B by 2027 |

| Aluminum | Recycled Aluminum, Advanced Plastics | Lower energy requirements, lighter vehicles | LME low-carbon aluminum premium rose significantly in 2024 |

| Diamonds | Lab-Grown Diamonds (LGDs) | Price parity, ethical appeal | LGD market sales projected $4.5B in 2024; LGDs capturing 10-15% of diamond jewelry sales |

Entrants Threaten

The mining industry, particularly for global giants like Rio Tinto, necessitates staggering capital outlays. Think billions of dollars for exploration, developing new mines, building essential infrastructure like railways and ports, and setting up processing plants. For instance, the development of a new large-scale mine can easily cost upwards of $5 billion, making it incredibly difficult for smaller companies to even consider entering the market.

These enormous upfront investments act as a significant deterrent for potential new entrants. It’s not just about having the money; it’s about the sheer scale of financial commitment required to get a mining operation off the ground and running competitively. This high barrier effectively limits the number of new players who can realistically challenge established companies.

Furthermore, existing players like Rio Tinto enjoy substantial economies of scale. They can spread their massive fixed costs over a much larger output volume, leading to lower per-unit production costs. In 2023, Rio Tinto reported iron ore production of 327.7 million tonnes, a volume that allows for significant cost efficiencies that a new, smaller entrant would find nearly impossible to replicate without equally massive, and therefore risky, investment.

The global mining sector faces significant regulatory hurdles and environmental compliance demands that act as a strong deterrent to new entrants. For instance, in 2024, the average time to obtain mining permits in Australia remained lengthy, often exceeding several years, a process requiring substantial upfront investment and specialized knowledge. Rio Tinto, like other major players, navigates these complex frameworks, including evolving ESG standards, which demand considerable financial and operational resources to meet.

The threat of new entrants concerning access to quality resources and land rights for companies like Rio Tinto is significantly low. Incumbents already control a vast majority of economically viable mineral deposits through long-term leases and exploration rights, making it extremely difficult for newcomers to find and secure new, significant resource bases. For instance, in 2024, the exploration success rate for new mining projects globally remains a persistent challenge, often requiring substantial upfront capital and advanced geological expertise that new entrants typically lack.

Established Infrastructure and Supply Chains

Rio Tinto, like other established mining giants, benefits immensely from its existing, vast infrastructure. This includes dedicated rail lines, deep-water ports, and robust power generation capabilities, all critical for efficient resource extraction and transportation. For instance, in 2023, Rio Tinto continued to invest in its Pilbara rail network in Western Australia, a vital artery for its iron ore operations.

Furthermore, these companies have cultivated deeply integrated supply chains and forged long-term relationships with both suppliers and a global customer base. Building such networks from scratch is an enormous undertaking, requiring substantial capital and time. New entrants face the daunting challenge of replicating this established ecosystem, which presents a significant barrier to entry.

The sheer cost of developing comparable infrastructure and securing reliable supply chain partners is often prohibitive for new players. This capital intensity, coupled with the time required to establish operational efficiency and market trust, creates a substantial competitive disadvantage for potential entrants into the mining sector.

Key infrastructure advantages for established players include:

- Extensive rail and port networks: Essential for moving large volumes of commodities efficiently.

- Integrated power generation: Reduces operational costs and ensures reliable energy supply.

- Long-standing customer and supplier relationships: Provide stability and market access.

- Sophisticated logistics and supply chain management: Optimize delivery and reduce lead times.

Brand Reputation and Customer Relationships

While commodity markets often appear price-sensitive, Rio Tinto's success hinges on more than just cost. Reliability of supply, consistent product quality, and deep-seated customer relationships, cultivated over many years, are paramount for securing significant, long-term contracts. This is particularly true for major industrial clients who depend on predictable, high-quality inputs for their own operations.

Rio Tinto's brand reputation, built on a foundation of operational excellence and a vast global customer network, acts as a significant barrier to entry. New companies would face immense challenges in replicating the trust and established connections that Rio Tinto enjoys. This makes it difficult for them to quickly secure the substantial off-take agreements necessary to gain meaningful traction in the market.

- Brand Loyalty: Decades of consistent performance have fostered strong loyalty among Rio Tinto's key customers, making them less likely to switch suppliers based solely on price.

- Contractual Strength: Rio Tinto's ability to secure long-term, high-volume contracts is a testament to its established reputation and reliable supply chain, which new entrants cannot easily replicate.

- Operational Track Record: A history of successful, large-scale mining operations bolsters confidence in Rio Tinto's capacity to meet demand consistently, a critical factor for major buyers.

The threat of new entrants in the global mining sector, particularly for established players like Rio Tinto, is considerably low. This is primarily due to the immense capital requirements, often exceeding billions of dollars, needed for exploration, mine development, and infrastructure. For example, a new large-scale mine development can easily surpass $5 billion, a prohibitive cost for most potential newcomers.

Furthermore, regulatory hurdles and the lengthy, complex process of obtaining mining permits, which can take several years as seen in 2024, add significant financial and time-based barriers. Companies like Rio Tinto also benefit from massive economies of scale, with 2023 iron ore production reaching 327.7 million tonnes, allowing for cost efficiencies unattainable by smaller, emerging entities.

| Barrier Type | Description | Example Data (2023-2024) |

|---|---|---|

| Capital Requirements | Staggering upfront investment for mine development and infrastructure. | New mine development costs often exceed $5 billion. |

| Regulatory & Permitting | Lengthy and complex approval processes for mining operations. | Permit acquisition in Australia averaged several years in 2024. |

| Economies of Scale | Cost advantages derived from high production volumes. | Rio Tinto's 2023 iron ore output: 327.7 million tonnes. |

| Infrastructure & Logistics | Existing, extensive networks of rail, ports, and supply chains. | Rio Tinto's ongoing investment in Pilbara rail network (2023). |

Porter's Five Forces Analysis Data Sources

Our Rio Tinto Porter's Five Forces analysis is built upon a robust foundation of data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the SEC. This is supplemented by insights from reputable industry analysis firms, macroeconomic indicators, and global commodity market data.