RBL Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBL Bank Bundle

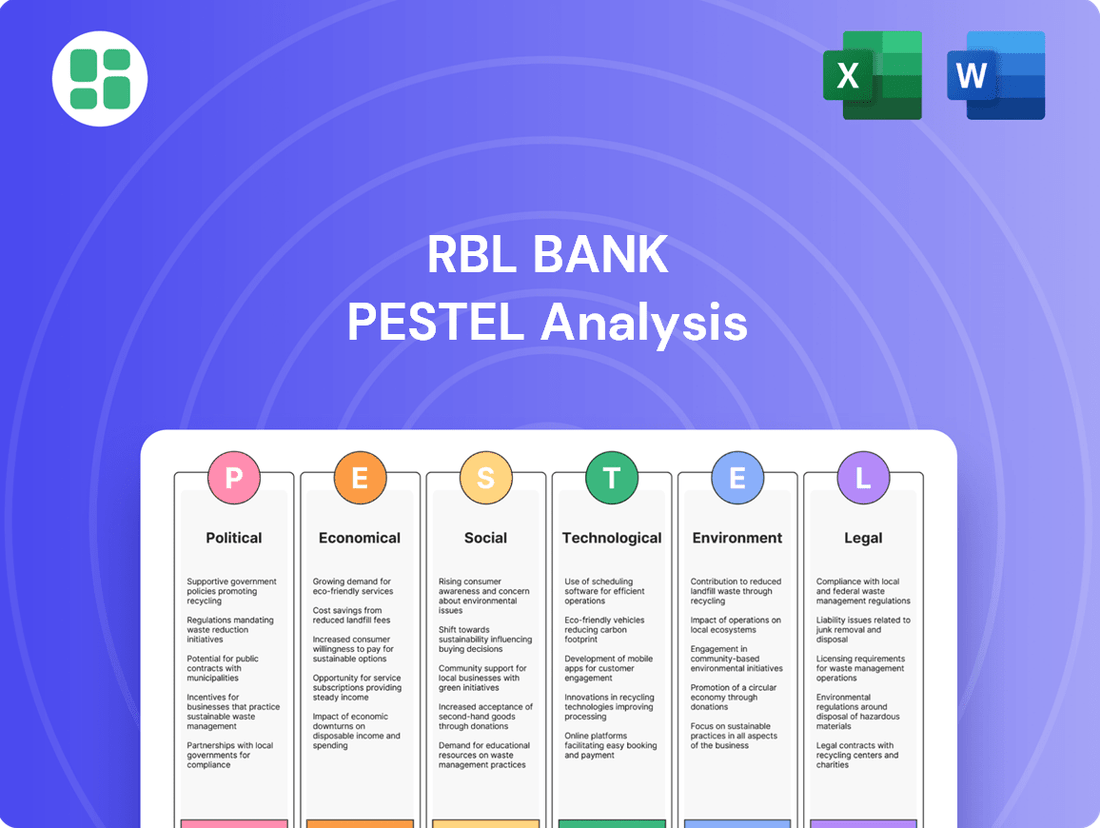

Uncover the critical external factors shaping RBL Bank's strategic landscape with our comprehensive PESTLE analysis. From evolving political stability to shifting economic tides and technological advancements, understand the forces driving change. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now for a decisive competitive advantage.

Political factors

RBL Bank benefits significantly from India's stable political landscape and the Reserve Bank of India's (RBI) consistent regulatory approach. This stability fosters a predictable operating environment essential for financial institutions.

The recent passage of the Banking Laws (Amendment) Bill, 2024, in December 2024, is a key development. This legislation is designed to bolster governance and improve efficiency across the banking sector, directly influencing RBL Bank's operational structure and overall stability.

The RBI's continuous initiatives to modernize India's banking system and uphold financial stability create a reliable foundation for RBL Bank's strategic planning and sustained growth. For instance, as of Q3 FY24, RBL Bank reported a Capital Adequacy Ratio of 18.5%, well above regulatory requirements, underscoring its robust position within this stable framework.

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on interest rates, directly shapes RBL Bank's operational landscape. Decisions on policy rates influence the bank's ability to attract deposits and extend credit, thereby impacting its net interest margin (NIM). For instance, a higher repo rate generally translates to increased borrowing costs for banks, potentially squeezing margins if deposit rates rise faster than lending rates.

RBL Bank's management anticipates a rebound in its margins, projecting an improvement starting from the third quarter of fiscal year 2026. This optimism is partly fueled by strategic adjustments in deposit rates, reflecting a proactive response to anticipated monetary policy shifts. As of the latest available data, the RBI's repo rate stands at 6.50%, a level that has been maintained since February 2023, providing a degree of stability but also necessitating careful management of funding costs.

Government initiatives aimed at financial inclusion, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY), significantly broaden the potential customer base for banks like RBL. By the end of 2023, PMJDY had facilitated the opening of over 51 crore bank accounts, a substantial portion of which were in rural and unbanked areas, directly expanding the addressable market for banking services.

The push towards digital payments, further supported by government programs like the Unified Payments Interface (UPI), encourages greater adoption of formal banking channels. UPI transactions in India saw a remarkable surge, with over 120 billion transactions recorded in 2023, indicating a growing comfort and reliance on digital financial tools among the populace.

Geopolitical Stability and International Relations

India's geopolitical stability remains a key driver for foreign direct investment (FDI) and overall economic sentiment, directly impacting the banking sector's growth trajectory. Positive international relations foster confidence, encouraging capital inflows that benefit banks like RBL. For instance, India's strong ties with major economies in 2024 and projected into 2025 are expected to support continued FDI, which is crucial for expanding credit and financial services.

Major shifts in global alliances or trade disputes, though not a daily concern, could significantly influence capital flows and business confidence. Such events might affect RBL Bank's corporate and institutional client segments, particularly those engaged in international trade or reliant on foreign capital. For example, disruptions in global supply chains, a recurring theme in recent years, can indirectly impact loan demand and asset quality.

- FDI Inflows: India's FDI saw a notable increase in FY24, signaling investor confidence potentially bolstered by geopolitical stability.

- Trade Agreements: Ongoing negotiations for new trade agreements in 2024-2025 could open new avenues for Indian businesses and, consequently, for banking services.

- Global Economic Outlook: International bodies like the IMF provided revised global growth forecasts for 2024 and 2025, which indirectly shape the environment for Indian banks operating in an interconnected world.

Policy on Non-Performing Assets (NPAs)

Government and Reserve Bank of India (RBI) initiatives to manage Non-Performing Assets (NPAs) directly influence RBL Bank's asset quality and the capital it needs to set aside for potential losses. These policies are crucial for maintaining a healthy banking system.

RBL Bank's focus on NPA management is evident in its performance metrics. The bank's gross NPA ratio remained relatively stable, standing at 2.78% in the first quarter of fiscal year 2026. This compares to 2.69% in the same period of fiscal year 2025, reflecting the continuous effort to navigate the impact of these regulatory policies on its loan book.

- Policy Impact: Government and RBI policies on NPAs shape banks' strategies for loan recovery and provisioning.

- Asset Quality: RBL Bank's gross NPA ratio was 2.78% in Q1 FY26, a slight increase from 2.69% in Q1 FY25.

- Provisioning: These policies mandate specific provisioning levels, affecting profitability and capital adequacy.

- Regulatory Environment: Adherence to these policies is a key political factor influencing RBL Bank's operational framework.

India's stable political environment and the Reserve Bank of India's (RBI) consistent regulatory framework provide RBL Bank with a predictable operating landscape. The Banking Laws (Amendment) Bill, 2024, passed in December 2024, aims to enhance governance and efficiency, directly impacting RBL Bank's operational structure.

Government initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), which had over 51 crore accounts by the end of 2023, expand RBL Bank's potential customer base, particularly in unbanked areas. The widespread adoption of digital payments, evidenced by over 120 billion UPI transactions in 2023, further encourages formal banking channel usage.

Geopolitical stability is crucial for foreign direct investment (FDI), supporting the banking sector's growth. India's strong international relations in 2024-2025 are expected to bolster FDI, which is vital for RBL Bank's expansion of credit and financial services.

The RBI's policies on Non-Performing Assets (NPAs) directly influence RBL Bank's asset quality. The bank's gross NPA ratio was 2.78% in Q1 FY26, a slight increase from 2.69% in Q1 FY25, reflecting ongoing management efforts within this regulatory context.

| Political Factor | Impact on RBL Bank | Supporting Data/Fact |

| Political Stability | Predictable operating environment, fosters investor confidence. | India's stable political landscape. |

| Regulatory Framework (RBI) | Shapes operational structure, governance, and financial stability. | Banking Laws (Amendment) Bill, 2024 passed in Dec 2024. RBI repo rate at 6.50% since Feb 2023. |

| Government Initiatives (Financial Inclusion) | Expands customer base, particularly in rural/unbanked areas. | PMJDY had >51 crore accounts by end of 2023. |

| Digital Payment Push | Encourages formal banking, increases transaction volumes. | UPI transactions exceeded 120 billion in 2023. |

| Geopolitical Stability & FDI | Supports capital inflows, crucial for credit expansion. | India's strong international ties projected to support FDI in 2024-2025. |

| NPA Management Policies | Affects asset quality, provisioning, and capital adequacy. | RBL Bank's gross NPA ratio: 2.78% (Q1 FY26) vs 2.69% (Q1 FY25). |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting RBL Bank, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the bank's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of RBL Bank's external landscape to inform strategic decisions.

Economic factors

India's economic growth trajectory is a significant driver for RBL Bank. For FY 2024-25, projections indicate robust expansion, with the IMF forecasting 6.5% GDP growth, and for FY 2025-26, it's expected to remain strong at 6.7%. This sustained growth fuels demand for credit across various sectors, directly benefiting banks like RBL.

Despite potential global headwinds affecting export growth, India's position as the fastest-growing major economy provides a favorable operating environment. This economic dynamism translates into opportunities for RBL Bank to expand its lending portfolio and enhance its profitability through increased business volumes.

India's retail inflation, measured by the Consumer Price Index (CPI), was recorded at 4.83% in April 2024, a slight decrease from 4.85% in March 2024, according to government data. The Reserve Bank of India (RBI) has maintained its policy repo rate at 6.50% since February 2023, indicating a cautious stance on further rate hikes while keeping an eye on inflation. This stable interest rate environment, however, still presents a challenge for banks like RBL Bank, as managing the spread between lending and deposit rates becomes crucial amidst ongoing inflationary pressures.

The sustained, albeit moderating, inflation necessitates careful management of the bank's cost of funds. If inflation were to accelerate, the RBI might consider rate adjustments, directly impacting RBL Bank's borrowing costs and potentially squeezing its net interest margins. For instance, a 1% increase in the repo rate could translate to higher operational expenses for the bank, affecting its profitability and the affordability of loans for its customer base, thereby influencing loan demand and asset quality.

The expansion of RBL Bank's loan portfolio is significantly influenced by the overall credit growth in the Indian banking industry, especially within the retail and commercial sectors. This sustained demand for credit is a key economic driver for banks like RBL.

The Reserve Bank of India (RBI) projects a healthy upward trend in credit growth for scheduled commercial banks, anticipating an increase from 11.5% in FY2025 to 12.4% in FY2026. This forecast points to a robust economic environment where businesses and individuals are actively seeking financing.

Reflecting this trend, RBL Bank reported a 9% increase in its net advances during the first quarter of FY2026. Notably, its secured retail loans experienced a substantial surge of 23%, demonstrating RBL's successful strategy in capturing demand within this high-growth segment.

Disposable Income and Consumer Spending

Changes in how much money people have left after taxes and essential bills directly impact the demand for RBL Bank's retail loans and credit card services. When consumers have more disposable income, they tend to spend more, which can boost the bank's asset growth, especially in areas like vehicle loans and mortgages. For example, India's household disposable income saw a notable increase in recent years, driven by economic recovery and wage growth.

A rising middle class, a key demographic for RBL Bank, is a significant driver of increased consumer spending. This segment of the population typically has more discretionary funds available, leading to greater uptake of wealth management services and higher credit card balances. Reports from 2024 indicate a continued expansion of the Indian middle class, with projections suggesting further growth in their purchasing power.

- Growing Disposable Income: India's nominal household disposable income is projected to continue its upward trend through 2025, supporting increased consumer credit demand.

- Middle-Class Expansion: The expanding Indian middle class, estimated to represent a significant portion of the population by 2025, is a primary target for RBL Bank's retail banking products.

- Consumer Spending Trends: Increased spending on discretionary items, facilitated by higher disposable incomes, directly benefits RBL Bank's credit card and retail loan portfolios.

Competition in the Banking Sector

The Indian banking sector is intensely competitive, with RBL Bank facing pressure from established public sector banks, major private players, and increasingly, nimble foreign banks. This diverse competitive environment directly impacts RBL Bank's ability to maintain and grow its market share and profitability.

Emerging neo-banks and fintech companies are further disrupting the traditional banking model, forcing RBL Bank to adapt rapidly. These new entrants often offer specialized digital services and can operate with lower overheads, creating a significant challenge for incumbent banks.

To thrive, RBL Bank must focus on innovation and differentiation. This means developing unique product offerings, enhancing customer experience through digital channels, and potentially forging strategic partnerships to leverage new technologies and reach wider customer segments.

- Market Share Dynamics: In FY24, public sector banks held a significant portion of total deposits and advances, while private banks also maintained a strong presence, indicating a crowded market for RBL Bank.

- Fintech Growth: The digital payments market in India is projected to reach substantial figures by 2025, highlighting the growing influence of fintech and the need for banks like RBL to compete effectively in this space.

- Customer Acquisition Costs: Increased competition can drive up the cost of acquiring new customers, putting pressure on RBL Bank's marketing and operational budgets.

- Margin Compression: Intense competition often leads to reduced net interest margins as banks compete on pricing for loans and deposits.

India's economic growth remains a strong tailwind for RBL Bank, with projections for FY2025-26 indicating continued expansion. This robust economic environment fuels demand for credit across sectors, directly benefiting banks like RBL. Despite global uncertainties, India's status as a fast-growing major economy provides a favorable landscape for RBL Bank to expand its lending and improve profitability.

Inflationary pressures, though moderating, necessitate careful management of funding costs for RBL Bank. The Reserve Bank of India's stance on interest rates, with the repo rate held at 6.50% since February 2023, creates a stable yet challenging environment for managing interest margins. Any upward adjustment in rates by the RBI could increase RBL Bank's borrowing costs and impact loan affordability.

The Indian banking sector is highly competitive, with RBL Bank facing pressure from public sector banks, private lenders, and fintech disruptors. This dynamic market requires RBL Bank to focus on innovation and digital enhancement to maintain its market share and profitability. The increasing influence of fintech companies, particularly in digital payments, underscores the need for RBL to adapt and compete effectively in this evolving landscape.

Full Version Awaits

RBL Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This RBL Bank PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping RBL Bank's environment, enabling informed strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is designed to equip you with the knowledge necessary to understand the dynamic landscape RBL Bank navigates.

Sociological factors

India's demographic profile, characterized by a young and rapidly urbanizing population, offers a fertile ground for RBL Bank's growth. By 2025, projections indicate a continued surge in urban populations, with a significant portion of India's youth entering their prime earning years.

RBL Bank can capitalize on this trend by focusing on digital banking solutions and credit products designed for the specific needs of urban and semi-urban dwellers. For instance, the bank's digital offerings can cater to the tech-savvy younger generation, while its credit products can support the burgeoning aspirations of this demographic.

The increasing disposable incomes in urban centers, coupled with a growing demand for financial services, create a substantial opportunity for RBL Bank to expand its retail customer base. This demographic shift is a key driver for increased demand in areas like personal loans, home loans, and digital payment solutions.

Consumers increasingly favor digital channels for their banking needs, with a significant portion of transactions now occurring through mobile apps and online platforms. This societal shift is driven by a demand for convenience and accessibility, pushing traditional banks to adapt. For instance, by July 2024, it was reported that over 70% of banking interactions for many major banks occurred digitally, highlighting this trend.

RBL Bank's strategic focus on digital transformation directly addresses these evolving consumer preferences. The bank's investment in a unified mobile banking application and the integration of artificial intelligence (AI) for customer service and personalized offerings are key initiatives. These efforts aim to provide a seamless and efficient banking experience, mirroring the digital-first approach many customers now expect.

India is seeing a significant push towards greater financial literacy and inclusion. This trend is driven by both government initiatives, like the Pradhan Mantri Jan Dhan Yojana, and industry efforts to reach unbanked populations. As of early 2024, the Jan Dhan Yojana has successfully opened over 51 crore bank accounts, demonstrating the scale of this inclusion drive.

This expanding financial awareness and access directly benefits formal banking institutions such as RBL Bank. By developing user-friendly products and educational materials tailored for underserved communities, RBL Bank can tap into a broader customer base, potentially increasing its market share in the retail banking segment.

Workforce Dynamics and Talent Availability

The banking sector, particularly in India, faces a dynamic talent landscape. RBL Bank's success in its digital transformation hinges on securing skilled professionals in areas like data analytics, artificial intelligence, and cybersecurity. In 2024, the demand for these specialized roles outstripped supply, leading to increased recruitment costs and potential delays in project execution.

Attracting and retaining top talent remains a significant sociological challenge. As of early 2025, employee turnover in the Indian banking sector, especially for tech-savvy roles, is estimated to be around 15-20% annually. This necessitates competitive compensation packages, robust training programs, and a positive work culture to ensure RBL Bank maintains its operational efficiency and fosters innovation.

- Talent Gap: A 2024 report indicated a shortage of over 500,000 skilled cybersecurity professionals in India, impacting banks like RBL.

- Digital Skill Demand: The need for AI and machine learning specialists in banking is projected to grow by 40% by the end of 2025.

- Retention Challenges: Banks are competing with tech giants for talent, making employee retention a critical focus for RBL.

Evolving Lifestyle and Spending Habits

Modern lifestyles are significantly reshaping how people spend their money. We're seeing a clear trend towards more flexible payment options, with services like Buy Now Pay Later (BNPL) gaining serious traction. This, alongside a continued reliance on credit cards, directly impacts what financial products consumers are looking for.

RBL Bank is actively responding to these shifts. By prioritizing the growth of its credit card portfolio and developing a wider array of financial solutions, the bank is positioning itself to meet these evolving consumer needs. This strategic focus allows RBL Bank to tap into the changing spending patterns driven by contemporary lifestyles.

- Growing BNPL Adoption: In India, the BNPL market is projected to reach $10-12 billion by 2026, a substantial increase from previous years, reflecting a significant shift in consumer payment preferences.

- Credit Card Penetration: As of early 2024, credit card penetration in India continues to rise, with millions of new cards issued annually, indicating a strong demand for credit-based spending.

- Digital Payment Integration: Consumers increasingly expect seamless integration of payment options across digital platforms, influencing demand for user-friendly banking apps and payment gateways.

- Demand for Personalized Offers: Evolving lifestyles also drive a demand for personalized financial products and rewards, pushing banks to offer tailored credit card benefits and loan structures.

India's youthful demographic and increasing urbanization present significant growth avenues for RBL Bank, particularly with a rising young workforce and growing disposable incomes in urban areas. This demographic shift fuels demand for digital banking and credit products, aligning with RBL's strategic focus on digital transformation and customer-centric solutions.

The societal embrace of digital channels for banking, with over 70% of interactions occurring online by mid-2024, underscores the need for RBL's investment in user-friendly mobile applications and AI-driven services. Furthermore, government initiatives promoting financial literacy and inclusion, such as the Pradhan Mantri Jan Dhan Yojana which had over 51 crore accounts by early 2024, open up opportunities for RBL to expand its customer base by catering to underserved populations.

However, RBL Bank faces challenges in attracting and retaining talent, especially in specialized tech roles, with an estimated 15-20% annual turnover in the Indian banking sector for such positions as of early 2025. The bank's ability to navigate this talent gap, exacerbated by competition from tech giants, is crucial for its ongoing digital initiatives and operational efficiency.

Evolving consumer lifestyles are driving demand for flexible payment options like Buy Now Pay Later (BNPL), with the Indian BNPL market projected to reach $10-12 billion by 2026. RBL Bank is adapting by expanding its credit card offerings and developing diverse financial solutions to meet these changing spending patterns and consumer expectations for personalized financial products.

| Sociological Factor | Description | Implication for RBL Bank |

|---|---|---|

| Demographics & Urbanization | Young, growing, and urbanizing Indian population with increasing disposable income. | Increased demand for retail banking, digital services, and credit products. |

| Digital Adoption | High preference for digital banking channels, with over 70% of transactions online by mid-2024. | Necessitates continued investment in user-friendly digital platforms and AI for customer service. |

| Financial Inclusion & Literacy | Government-led initiatives expanding access to formal banking for underserved populations. | Opportunity to acquire new customers from previously unbanked segments. |

| Talent Landscape | Shortage of skilled tech professionals and high employee turnover (15-20%) in the banking sector. | Requires competitive strategies for talent acquisition and retention to support digital transformation. |

| Lifestyle Changes | Growing adoption of flexible payment methods like BNPL and demand for personalized financial products. | Need to expand credit card portfolios and offer tailored financial solutions to meet evolving consumer needs. |

Technological factors

RBL Bank is heavily invested in digital transformation, aiming to streamline operations and customer interactions. A key initiative is the development of a unified mobile banking app, designed to offer a seamless experience for users. This digital push is critical for staying competitive in the evolving financial landscape.

The bank is also migrating its core applications to cloud platforms, such as Amazon Web Services (AWS). This strategic move is expected to boost operational efficiency and significantly reduce the time it takes to launch new financial products and services. By embracing cloud technology, RBL Bank is positioning itself for greater agility and innovation.

RBL Bank is actively integrating AI and Machine Learning to personalize financial offerings and improve credit risk assessment. This technological shift is crucial for optimizing customer experiences and automating internal processes.

The bank's strategic adoption of AI, including Generative AI, aims to enhance customer service interactions and boost operational efficiency. For example, in 2024, RBL Bank reported a significant increase in digital transactions, partly attributed to AI-driven analytics improving fraud detection and customer support.

Cybersecurity is a critical technological factor for RBL Bank, especially with the surge in digital banking. Protecting sensitive customer data and ensuring the integrity of online transactions are paramount to maintaining trust and operational stability. For instance, in 2023, the global cost of cybercrime was estimated to reach $10.5 trillion annually by 2025, highlighting the immense financial risk involved.

RBL Bank must invest in robust cybersecurity measures, including RegTech solutions for compliance and AI-driven fraud detection. These investments are crucial for adhering to evolving data privacy regulations like the Digital Personal Data Protection Act, 2023 in India, and for safeguarding against increasingly sophisticated cyber threats. Real-time risk monitoring and advanced threat intelligence are key components in this strategy.

Fintech Collaborations and Ecosystems

The Indian fintech landscape is experiencing robust expansion, with projections indicating continued strong growth through 2025. RBL Bank can strategically partner with these agile fintech firms, utilizing Banking-as-a-Service (BaaS) frameworks and open API integrations. This approach allows RBL Bank to deliver novel financial products and extend its customer base more effectively.

Collaborations can unlock new revenue streams and enhance customer engagement by offering seamless digital experiences. For instance, by integrating with leading fintechs, RBL Bank can tap into specialized services like digital lending platforms or embedded finance solutions, which are rapidly gaining traction.

- Indian fintech market projected to reach $8.4 billion by 2025.

- API-driven BaaS models enable faster product deployment.

- Fintech partnerships can reduce customer acquisition costs.

- Embedded finance expected to grow significantly in the next few years.

Cloud Computing and IT Infrastructure Modernization

RBL Bank's strategic adoption of cloud computing, specifically partnering with AWS, marks a significant step in modernizing its IT infrastructure. This transition is geared towards enhancing scalability, minimizing physical hardware, boosting performance, and accelerating the delivery of new banking services.

This technological shift is crucial for RBL Bank to remain competitive in a rapidly evolving digital landscape. By leveraging cloud capabilities, the bank can more effectively manage vast amounts of data, improve customer experience through faster application rollouts, and ensure greater operational resilience.

- Scalability: Cloud infrastructure allows RBL Bank to dynamically adjust IT resources based on demand, ensuring smooth operations during peak times and cost savings during lulls.

- Performance Enhancement: Modernized IT systems powered by cloud services lead to quicker transaction processing and improved responsiveness for digital banking platforms.

- Faster Service Deployment: The agility offered by cloud platforms enables RBL Bank to develop and launch new financial products and customer-facing applications at a much quicker pace.

RBL Bank's technological advancements are central to its competitive strategy, with a strong focus on digital transformation, cloud migration, and AI integration. The bank's investment in a unified mobile banking app and cloud platforms like AWS aims to enhance customer experience and operational efficiency, positioning it for agility in the digital era.

The strategic adoption of AI and Machine Learning is enhancing personalized financial offerings and credit risk assessment, while Generative AI is being leveraged to improve customer service and operational efficiency. This focus on advanced technologies is crucial for RBL Bank to adapt to the rapidly evolving financial landscape.

Cybersecurity remains a paramount concern, with significant investments in robust measures like RegTech and AI-driven fraud detection to protect sensitive data and ensure transaction integrity, especially given the projected global cost of cybercrime.

RBL Bank is also strategically partnering with fintech firms, utilizing Banking-as-a-Service (BaaS) and open APIs to innovate and expand its reach, capitalizing on the projected growth of the Indian fintech market.

| Technological Factor | RBL Bank's Initiative | Impact/Benefit | Data Point (2024/2025) |

|---|---|---|---|

| Digital Transformation | Unified Mobile Banking App Development | Streamlined operations, enhanced customer interaction | Digital transactions increased significantly in 2024. |

| Cloud Migration | Migration to AWS | Increased scalability, faster service deployment, reduced hardware costs | Cloud infrastructure enables dynamic IT resource adjustment. |

| Artificial Intelligence | AI/ML for personalization and risk assessment | Optimized customer experiences, improved credit scoring | AI-driven analytics enhance fraud detection and customer support. |

| Cybersecurity | RegTech, AI-driven fraud detection | Data protection, transaction integrity, regulatory compliance | Global cybercrime cost to reach $10.5 trillion annually by 2025. |

| Fintech Partnerships | BaaS, Open APIs | Novel product delivery, extended customer base, new revenue streams | Indian fintech market projected to reach $8.4 billion by 2025. |

Legal factors

The Reserve Bank of India's (RBI) strict regulatory framework profoundly shapes RBL Bank's operational landscape, influencing its capital requirements, asset quality standards, and overall governance. This oversight is crucial for maintaining financial stability within the banking sector.

Recent RBI proposals unveiled in October 2024, aimed at harmonizing the operations of banks and their non-bank subsidiaries, represent a significant development. These potential changes could introduce new compliance burdens or strategic adjustments for private sector banks like RBL Bank, impacting their business models and operational structures.

The Digital Personal Data Protection (DPDP) Act, with full implementation anticipated by 2025, imposes stringent regulations on how personal data is gathered, utilized, and consented to. This legislation significantly impacts how entities like RBL Bank handle customer information.

As a major data fiduciary, RBL Bank is compelled to rigorously update its data security measures and guarantee complete transparency in its data handling practices. The Act may also necessitate the appointment of a dedicated Data Protection Officer to ensure adherence to the new legal framework.

Compliance with the DPDP Act is crucial for RBL Bank to avoid penalties and maintain customer trust in an increasingly data-conscious environment. The bank's proactive adaptation to these regulations will be key to its operational integrity and market standing in the coming years.

RBL Bank, like all financial institutions, must navigate a complex web of anti-money laundering (AML) and know your customer (KYC) regulations. These rules are constantly being updated by authorities like the Financial Intelligence Unit-India (FIU-IND) to combat financial crime. For instance, in 2023, FIU-IND issued advisories and guidelines that financial institutions needed to integrate into their processes, impacting customer onboarding and transaction monitoring.

Strict adherence to these evolving AML and KYC norms is not just a legal obligation but a critical business imperative for RBL Bank. Non-compliance can result in substantial penalties, as seen with other banks facing fines for inadequate KYC procedures. Maintaining a strong compliance framework is vital for safeguarding the bank's reputation and ensuring the continuity of its operational license.

Consumer Protection Laws and Fair Practices Code

Consumer protection laws are critical for RBL Bank, mandating fair lending, transparent pricing, and effective grievance resolution. For instance, the Reserve Bank of India's (RBI) Fair Practices Code, updated in recent years, sets clear guidelines for banks to follow, ensuring customers are treated equitably. Adherence to these regulations, such as those concerning loan origination and recovery, is paramount for building trust and mitigating legal challenges.

These legal frameworks directly impact RBL Bank's operations by requiring robust internal controls and customer communication protocols. Non-compliance can lead to significant penalties and reputational damage. For example, the Banking Ombudsman Scheme provides a readily accessible mechanism for customers to seek redressal for banking deficiencies, pushing banks like RBL to maintain high service standards.

Key aspects of consumer protection laws affecting RBL Bank include:

- Fair Lending Practices: Ensuring no discriminatory practices in loan approvals and interest rates.

- Transparency in Pricing: Clearly disclosing all fees, charges, and interest rates associated with financial products.

- Effective Grievance Redressal: Establishing efficient and timely mechanisms to address customer complaints.

- Data Privacy and Security: Protecting sensitive customer information as mandated by laws like the Digital Personal Data Protection Act, 2023.

Amendments to Banking Laws

Recent amendments to banking laws, such as the proposed Banking Laws (Amendment) Bill, 2024, are set to significantly impact operational procedures for institutions like RBL Bank. These changes, particularly concerning nominations for depositors' funds which could allow for up to four nominees, necessitate a thorough review and update of existing bank systems and customer service protocols to ensure seamless compliance and enhanced user experience.

RBL Bank must adapt its internal processes to accommodate these legislative shifts. This includes updating account opening forms, digital banking platforms, and customer communication strategies to reflect the new nomination rules. The goal is to maintain regulatory adherence while simplifying the process for customers to manage their accounts, potentially increasing customer satisfaction and reducing operational friction.

- New Nomination Rules: Amendments may permit up to four nominees for depositor accounts, requiring system upgrades.

- Compliance Burden: Banks like RBL must invest in updating IT infrastructure and training staff to meet new legal requirements.

- Customer Experience: Streamlined processes for nominations can improve customer convenience and trust in the banking system.

RBL Bank operates within a stringent regulatory environment shaped by the Reserve Bank of India (RBI), impacting capital, asset quality, and governance. New RBI proposals from October 2024 could harmonize bank and non-bank subsidiary operations, potentially altering RBL Bank's business models.

The Digital Personal Data Protection Act, fully effective by 2025, mandates strict data handling, requiring RBL Bank to enhance security and transparency, possibly appointing a Data Protection Officer.

Compliance with evolving anti-money laundering (AML) and know your customer (KYC) regulations is critical, with FIU-IND advisories in 2023 impacting transaction monitoring and customer onboarding processes.

Consumer protection laws, including the RBI's Fair Practices Code, necessitate fair lending and transparent pricing, with the Banking Ombudsman Scheme ensuring effective grievance redressal for RBL Bank customers.

Environmental factors

RBL Bank faces growing pressure to align with Environmental, Social, and Governance (ESG) principles, a trend amplified by regulatory bodies like the Reserve Bank of India (RBI). This means the bank must embed sustainability into its core operations and how it makes lending choices.

The RBI's proactive stance is evident in its February 2024 release of draft guidelines concerning the disclosure of climate-related financial risks. These regulations are slated to become mandatory for commercial banks starting from the fiscal year 2025-26, directly impacting RBL Bank's reporting and risk management frameworks.

Climate change presents significant financial risks for banks like RBL, as extreme weather events can directly impact borrowers' ability to repay loans. For instance, a severe drought in an agricultural region could cripple farmer income, increasing the likelihood of loan defaults.

The Reserve Bank of India (RBI) is actively working on new regulations that will require banks to disclose and manage their exposure to climate-related risks within their loan portfolios. This regulatory push is expected to accelerate RBL Bank's adoption of sustainable finance strategies and the expansion of its green lending initiatives.

The Reserve Bank of India (RBI) has been actively promoting green finance, introducing frameworks for banks to accept green deposits and encouraging lending towards environmentally sustainable projects. This regulatory push signals a clear direction for the banking sector.

In response, RBL Bank, like its peers, is likely to face increasing pressure to strengthen its Environmental, Social, and Governance (ESG) policies. Developing and offering a robust suite of green financial products, such as green bonds or loans for renewable energy projects, will be crucial for RBL Bank to align with these evolving regulatory expectations and capitalize on growing market demand for sustainable finance.

Carbon Footprint and Operational Sustainability

Banks are increasingly being held accountable for their environmental impact, with a growing emphasis on measuring and reducing their carbon footprint from daily operations. This trend is particularly relevant in the Indian banking sector, where a collective push towards greater sustainability is evident.

The Indian banking industry is actively pursuing initiatives to minimize its environmental impact. Key strategies include reducing paper consumption through digitalization, implementing energy-efficient practices across branches and data centers, and promoting digital payment solutions to decrease reliance on physical cash and its associated environmental costs.

- Digitalization Drive: The Reserve Bank of India (RBI) has been a strong proponent of digital payments, with UPI transactions alone reaching an average of over 100 million per day in early 2024, significantly reducing paper-based transactions.

- Energy Efficiency: Many banks are investing in green building certifications for their offices and adopting energy-saving technologies, aiming to lower their overall energy consumption.

- Sustainable Finance: Beyond operational sustainability, there's a growing focus on integrating environmental, social, and governance (ESG) factors into lending and investment decisions, encouraging greener economic activities.

Stakeholder Expectations for Responsible Banking

Investors, customers, and the broader public are increasingly scrutinizing banks' environmental, social, and governance (ESG) performance. For RBL Bank, this translates to a growing expectation for robust commitments to sustainability. Institutions demonstrating strong environmental stewardship are more likely to attract capital and customer loyalty.

Adopting comprehensive ESG practices can significantly bolster RBL Bank's brand reputation. This enhanced image is crucial for attracting sustainable investment funds, which are a rapidly growing segment of the financial market. For instance, the global sustainable investment market reached an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance.

Furthermore, a focus on environmental responsibility contributes to long-term resilience and a stronger market position for RBL Bank. By integrating ESG principles, the bank can better manage climate-related risks and capitalize on emerging green finance opportunities.

- Investor Scrutiny: A growing number of institutional investors, managing trillions in assets, are integrating ESG factors into their investment decisions.

- Customer Preferences: Surveys consistently show that a significant percentage of consumers prefer to bank with institutions that demonstrate a commitment to environmental and social responsibility.

- Brand Enhancement: Strong ESG credentials can differentiate RBL Bank in a competitive market, attracting a more socially conscious customer base.

- Risk Mitigation: Proactive environmental management can reduce regulatory risks and operational disruptions, enhancing financial stability.

RBL Bank, like other financial institutions, faces increasing regulatory pressure regarding environmental impact. The Reserve Bank of India (RBI) has been proactive, with draft guidelines released in February 2024 mandating climate-related financial risk disclosures for commercial banks from FY 2025-26. This necessitates integrating sustainability into lending practices and risk management.

Climate change poses direct financial risks, as extreme weather can impair borrowers' repayment capacity, impacting loan portfolios. The RBI's push for green finance, including frameworks for green deposits and lending to sustainable projects, signals a clear direction for the sector.

Banks are also focusing on operational sustainability, such as digitalization to reduce paper usage, with UPI transactions averaging over 100 million daily in early 2024. This drive towards sustainability is crucial for RBL Bank to align with regulatory expectations and attract capital from a growing sustainable investment market, which was estimated at $37.8 trillion globally in 2024.

| Environmental Factor | Impact on RBL Bank | Key Initiatives/Regulations |

|---|---|---|

| Climate Change & Extreme Weather | Increased credit risk from affected sectors (e.g., agriculture); physical asset damage. | RBI's draft climate risk disclosure guidelines (effective FY25-26); need for climate risk assessment in lending. |

| Regulatory Push for Green Finance | Opportunity for new products (green bonds, loans); compliance requirements. | RBI frameworks for green deposits; promotion of lending to sustainable projects. |

| Operational Sustainability & ESG Scrutiny | Enhanced brand reputation; attraction of ESG-focused investors and customers. | Digitalization (e.g., high UPI usage); energy efficiency in operations; growing investor demand for ESG performance. |

PESTLE Analysis Data Sources

Our RBL Bank PESTLE Analysis is meticulously crafted using data from reputable financial institutions like the Reserve Bank of India, economic forecasting agencies, and government policy documents. We also incorporate insights from leading business publications and industry-specific reports to ensure a comprehensive understanding of the macro-environment.