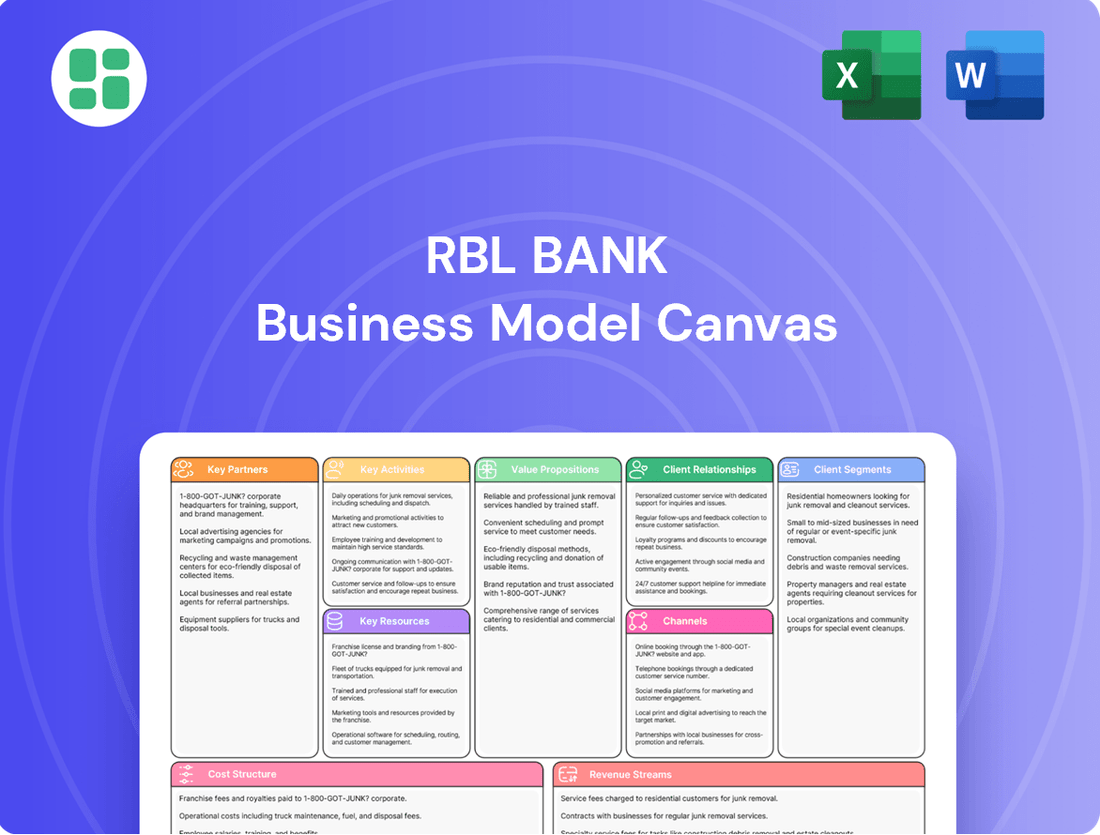

RBL Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBL Bank Bundle

Unlock the strategic blueprint behind RBL Bank’s success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market position. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

RBL Bank actively partners with fintech and digital solution providers to bolster its digital banking offerings. These collaborations are crucial for integrating cutting-edge technologies, such as AI and machine learning, which enhance customer experience and streamline operations. For instance, in 2024, RBL Bank continued to leverage these partnerships to expand its digital payment solutions and personalized banking services, aiming for greater operational efficiency and customer acquisition in a competitive digital landscape.

RBL Bank actively pursues co-branded credit card alliances, notably with state-owned entities like Indian Oil Corporation. These collaborations are designed to tap into existing customer bases, offering specialized benefits like fuel cashback, which significantly boosts appeal for targeted consumer groups.

In 2024, RBL Bank continued to leverage these partnerships to broaden its reach and enhance customer loyalty. For instance, its collaboration with Indian Oil Corporation's co-branded credit cards provides customers with accelerated rewards on fuel purchases, directly contributing to increased transaction volumes and customer stickiness.

These strategic alliances are crucial for RBL Bank's customer acquisition and retention strategies, enabling cross-selling opportunities and fostering deeper engagement by providing value-added services tailored to specific lifestyle needs.

RBL Bank actively cultivates a robust network of Business Correspondents (BCs) and agents. This strategy is crucial for extending its banking services into unbanked and underbanked regions, particularly in semi-urban and rural India.

As of June 2025, RBL Bank proudly operates 1,474 business correspondent branches. This extensive network significantly amplifies the bank's physical presence, complementing its traditional branch infrastructure and driving financial inclusion across the nation.

Technology and IT Infrastructure Partners

RBL Bank relies heavily on technology and IT infrastructure partners to power its operations. These partnerships are fundamental for establishing and maintaining a strong foundation, encompassing everything from advanced data centers to flexible cloud computing services. For instance, in 2024, RBL Bank continued its focus on digital transformation, a journey significantly enabled by its technology collaborators.

These collaborations are vital for supporting the bank's digital transformation efforts, ensuring that its banking operations are not only secure and scalable but also highly efficient. By partnering with leading technology vendors, RBL Bank can implement cutting-edge solutions that enhance customer experience and streamline internal processes.

The bank's strategic investments in technology upgrades, including the integration of artificial intelligence and machine learning, are directly supported by these key partnerships. These advancements are designed to improve critical functions such as loan processing speed and the effectiveness of customer query resolution, reflecting a commitment to operational excellence.

- Data Center and Cloud Infrastructure: Partnerships with providers like AWS or Azure are crucial for scalable and secure data management, enabling RBL Bank to handle increasing transaction volumes.

- Core Banking System Vendors: Collaborations with firms providing core banking solutions ensure the reliability and modernization of essential banking functions.

- Cybersecurity Solutions: Partnerships with cybersecurity firms are paramount for protecting sensitive customer data and maintaining the integrity of financial transactions.

- AI and Analytics Platforms: Collaborations with AI and machine learning specialists help RBL Bank leverage data for improved decision-making, risk management, and personalized customer offerings.

Insurance and Wealth Management Firms

RBL Bank actively partners with leading insurance companies and wealth management firms to broaden its financial product offerings. These collaborations enable the bank to provide customers with integrated solutions encompassing insurance policies and sophisticated wealth management services, moving beyond core banking functions.

This strategic approach diversifies RBL Bank's revenue streams and strengthens its value proposition by addressing the holistic financial requirements of its customer base. For instance, in 2024, RBL Bank continued to expand its bancassurance partnerships, aiming to boost fee-based income through the sale of life, health, and general insurance products.

- Expanded Product Suite: Collaborations allow RBL Bank to offer a wider array of financial products, including insurance and investment solutions.

- Enhanced Customer Value: By providing integrated financial services, the bank caters to the comprehensive needs of its diverse clientele.

- Diversified Revenue: Partnerships contribute to new revenue streams, primarily through commission and fee-based income from insurance and wealth management products.

- Market Position: Strengthening these alliances helps RBL Bank solidify its position as a full-service financial solutions provider in the competitive Indian market.

RBL Bank's key partnerships are instrumental in expanding its service reach and enhancing digital capabilities. Collaborations with fintech firms and technology providers are vital for integrating advanced solutions, as seen in 2024's focus on AI and digital payments. These alliances are crucial for customer acquisition and operational efficiency in a competitive digital landscape.

What is included in the product

RBL Bank's Business Model Canvas outlines its strategy for serving diverse customer segments, including retail, MSME, and corporate clients, through a multi-channel approach and a value proposition centered on personalized banking solutions and digital innovation.

RBL Bank's Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of their customer segments and value propositions, allowing them to pinpoint and address specific banking needs efficiently.

It offers a clear, actionable framework to identify and resolve customer pain points by mapping out key resources and activities that deliver targeted solutions.

Activities

RBL Bank's core activity is lending, providing both retail customers with personal, home, and credit card loans, and commercial clients with working capital and supply chain financing. This dual focus caters to a broad spectrum of financial needs across individuals and businesses.

The bank is actively pursuing a strategic shift, emphasizing secured retail assets and strengthening its commercial banking operations. This move is designed to foster sustainable growth while diligently managing associated risks, a key component of their operational strategy.

In 2024, RBL Bank has demonstrated a commitment to this strategy. For instance, their retail loan book has shown robust growth, with a notable increase in secured retail assets, contributing significantly to their overall asset quality and risk-weighted asset management.

RBL Bank's key activity of deposit mobilization centers on attracting and managing a diverse range of deposits, with a particular emphasis on granular deposits, defined as those under ₹3 crore, and Current Account Savings Account (CASA) deposits. This focus is crucial for securing a stable and cost-effective funding base to support the bank's lending and operational activities.

The bank actively pursues strategies to deepen its deposit base, a testament to its commitment to retail liability generation. Evidence of this success is seen in the significant growth of granular deposits, which underscores the bank's ability to attract a broad spectrum of retail customers and build a robust funding profile.

RBL Bank's key activities heavily involve investing in and developing robust digital platforms and AI-driven solutions. This focus aims to significantly enhance customer experience and streamline operational efficiency. For instance, in the fiscal year 2023-24, RBL Bank continued its digital transformation journey, reporting a substantial increase in digital transactions, reflecting the success of these investments.

These technological upgrades are central to RBL Bank's growth strategy, ensuring seamless access to banking services across various channels. The bank prioritizes improving user-friendliness and simplifying processes through its mobile banking applications and other digital touchpoints. This commitment to digital transformation is crucial for maintaining competitiveness and meeting evolving customer expectations in 2024.

Credit Card Portfolio Management

RBL Bank's credit card portfolio management involves strategically growing its customer base while prioritizing profitability. This includes the introduction of co-branded cards and leveraging cross-selling to existing customers. The bank’s approach is geared towards achieving sound returns on invested capital, rather than pursuing aggressive market share expansion, a strategy influenced by regulatory considerations in the unsecured lending space.

Key activities in this area include meticulous risk assessment for new card issuances and developing targeted customer engagement programs. RBL Bank focuses on optimizing the performance of its existing portfolio through data analytics and personalized offers. For instance, in the fiscal year ending March 2024, RBL Bank reported a significant increase in its retail credit card business, with the number of credit cards outstanding growing substantially.

- Portfolio Growth Strategy: Focus on moderate growth, prioritizing quality over quantity in credit card acquisitions.

- Product Development: Launching innovative co-branded credit cards to tap into specific customer segments and partnerships.

- Cross-Selling Initiatives: Actively promoting credit card products to the bank's existing customer base across various banking services.

- Risk Management: Implementing robust credit underwriting and ongoing portfolio monitoring to manage potential defaults in the unsecured lending segment.

Branch Network Expansion and Management

RBL Bank focuses on growing and managing its physical presence to serve a broader customer base. This includes both traditional bank branches and business correspondent locations.

As of June 2025, RBL Bank operates 562 branches and an additional 1,474 business correspondent branches across India. This expansion strategy aims to tap into new markets and reach underserved populations, enhancing accessibility to banking services.

- Branch Network: 562 branches as of June 2025.

- Business Correspondent Branches: 1,474 as of June 2025.

- Strategic Focus: Expansion into new and underserved regions.

RBL Bank's key activities encompass a dual focus on lending and deposit mobilization. The bank actively provides retail loans like personal, home, and credit cards, alongside commercial financing for working capital and supply chains. This strategy is supported by a strong emphasis on attracting granular and CASA deposits to ensure a stable funding base.

Digital transformation is another core activity, with significant investments in AI-driven solutions and robust digital platforms to enhance customer experience and operational efficiency. This includes a growing digital transaction volume, as seen in fiscal year 2023-24.

Furthermore, RBL Bank strategically manages its credit card portfolio, prioritizing profitable growth through co-branded cards and cross-selling, while maintaining meticulous risk assessment. The bank also focuses on expanding its physical reach, operating 562 branches and 1,474 business correspondent locations as of June 2025.

| Key Activity | Description | Recent Data/Focus |

|---|---|---|

| Lending | Providing retail and commercial loans. | Emphasis on secured retail assets and commercial banking growth. Robust retail loan book growth in 2024. |

| Deposit Mobilization | Attracting granular and CASA deposits. | Significant growth in granular deposits, securing a cost-effective funding base. |

| Digital Transformation | Enhancing customer experience and operational efficiency via digital platforms and AI. | Substantial increase in digital transactions (FY 2023-24). Continued focus on mobile banking and user-friendliness in 2024. |

| Credit Card Portfolio Management | Strategic growth with focus on profitability. | Significant increase in retail credit cards outstanding (FY ending March 2024). Launching co-branded cards and cross-selling. |

| Physical Presence Expansion | Expanding branch and business correspondent network. | 562 branches and 1,474 business correspondent branches as of June 2025. Expansion into new and underserved regions. |

Full Version Awaits

Business Model Canvas

The RBL Bank Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this professionally structured and formatted Business Model Canvas.

Resources

RBL Bank’s human capital is a cornerstone of its operations, comprising skilled professionals across banking, credit analysis, IT, and customer service. Their specialized knowledge is crucial for delivering high-quality financial services and executing the bank's strategic goals.

In 2024, RBL Bank continued to invest in its workforce, with a focus on enhancing digital proficiency and ethical conduct. This commitment ensures employees are equipped to navigate the evolving financial landscape and provide superior customer experiences.

RBL Bank's robust technology infrastructure is powered by state-of-the-art data centers and a flexible cloud computing environment. This foundation supports advanced software systems, including AI and machine learning capabilities, which are crucial for efficient operations and secure transactions.

These technological resources are essential for delivering seamless digital banking services and enabling sophisticated data analytics. RBL Bank's commitment to its digital transformation is underscored by significant investments in technology upgrades, aiming to enhance customer experience and drive innovation.

RBL Bank's extensive physical infrastructure, boasting 562 branches and 415 ATMs as of early 2024, is a cornerstone of its operations. This network acts as a vital resource for customer interaction and service delivery throughout India, enabling efficient deposit gathering and loan processing.

The bank further amplifies its reach through 1,474 business correspondent branches. This hybrid model, combining physical presence with agent-led services, is particularly effective in serving diverse geographical regions and expanding financial accessibility.

Strong Brand Reputation and Trust

RBL Bank's brand promise, 'Apno ka Bank,' deeply resonates with customers, fostering a sense of belonging and trust. This commitment to customer-centricity and unwavering integrity is a cornerstone of its business model, directly translating into enhanced customer loyalty and a stronger deposit base. In 2023, RBL Bank was recognized with multiple awards, including the 'Best Bank for MSME' at the Business Today Money Today Financial Excellence Awards, underscoring its market standing.

A robust brand reputation is a critical asset for RBL Bank, acting as a powerful magnet for new customers while simultaneously solidifying relationships with its existing clientele. This trust directly fuels deposit growth, a vital component for the bank's overall expansion and operational capacity. The bank’s consistent performance and customer-focused approach have been acknowledged through various accolades, reinforcing its credibility in the competitive banking landscape.

- Brand Promise: 'Apno ka Bank' signifies a customer-centric approach built on trust and integrity.

- Customer Loyalty: A strong reputation cultivates deep trust, leading to higher customer retention.

- Deposit Growth: Brand trust is a key driver for attracting and retaining deposits, essential for banking operations.

- Market Recognition: Awards and accolades, such as the 'Best Bank for MSME' in 2023, validate RBL Bank's market position and commitment.

Capital and Financial Reserves

RBL Bank's capital and financial reserves are crucial for its operations, acting as a buffer against unexpected losses and a foundation for lending. These reserves allow the bank to maintain financial stability and meet stringent regulatory demands, ensuring it can operate smoothly and grow.

The bank actively manages its capital base, utilizing various avenues to strengthen its financial position. This includes tapping into institutional investors for capital infusions and issuing debt instruments to secure necessary funding. These strategies are vital for supporting the bank's expansion plans and overall resilience.

- Capital Adequacy Ratio (CAR): RBL Bank's CAR is a key indicator of its financial health. For instance, as of March 31, 2024, the bank reported a CAR of 16.56%, significantly above the regulatory minimum. This robust ratio demonstrates its strong capacity to absorb potential losses.

- Deposit Base: The bank's substantial deposit base serves as a primary source of funding, providing stable and cost-effective capital. This allows RBL Bank to fund its lending activities and maintain liquidity.

- Raising Capital: RBL Bank has a proven track record of raising capital through various means, including equity placements. For example, in fiscal year 2024, the bank successfully raised capital to bolster its financial strength and support future growth initiatives.

- Financial Reserves: Maintaining adequate financial reserves is paramount for RBL Bank to meet its obligations and invest in new opportunities, ensuring long-term sustainability and stakeholder confidence.

RBL Bank's key resources encompass its skilled human capital, robust technology infrastructure, extensive physical network, strong brand reputation, and substantial financial reserves. These elements collectively enable the bank to deliver a wide range of financial services, foster customer loyalty, and ensure operational stability and growth.

The bank's commitment to digital transformation is evident in its technology investments, while its physical presence, including branches and ATMs, facilitates widespread customer access. Its brand promise, 'Apno ka Bank,' combined with market recognition, builds trust and drives deposit growth, a vital resource for its operations.

Financial strength, demonstrated by its Capital Adequacy Ratio (CAR) of 16.56% as of March 31, 2024, and a solid deposit base, provides the necessary foundation for lending and expansion. RBL Bank's ability to raise capital further solidifies its resource base for future initiatives.

| Resource Category | Key Components | Significance | 2024 Data/Examples |

|---|---|---|---|

| Human Capital | Skilled professionals (banking, IT, credit) | Service delivery, strategic execution | Focus on digital proficiency and ethical conduct |

| Technology Infrastructure | Data centers, cloud computing, AI/ML | Efficient operations, digital services, data analytics | Investment in upgrades for customer experience |

| Physical Infrastructure | Branches, ATMs, Business Correspondent branches | Customer interaction, service delivery, financial accessibility | 562 branches, 415 ATMs (early 2024), 1,474 BC branches |

| Brand & Reputation | 'Apno ka Bank' promise, customer loyalty | Customer trust, deposit growth, market standing | 'Best Bank for MSME' award (2023) |

| Capital & Financial Reserves | CAR, deposit base, capital raising | Financial stability, lending capacity, regulatory compliance | CAR 16.56% (Mar 31, 2024), capital raised in FY24 |

Value Propositions

RBL Bank provides a broad spectrum of financial products, encompassing everything from savings and current accounts to various loan types like personal, home, and commercial loans. They also offer credit cards, robust wealth management services, and insurance solutions.

This extensive product portfolio is designed to meet the varied financial requirements of a wide client base, including large corporations, institutional investors, and individual retail customers. It positions RBL Bank as a single destination for a multitude of banking and financial needs.

As of March 31, 2024, RBL Bank reported total deposits of ₹1,00,000 crore and gross advances of ₹85,000 crore, demonstrating the scale of its service offerings across its customer segments.

RBL Bank is deeply committed to a customer-centric digital experience, recognizing that seamless interaction is key to satisfaction. Their user-friendly mobile app and online banking platforms are designed for effortless transactions and account management.

The bank's strategic investments in digital transformation are paying dividends. For instance, RBL Bank reported a significant increase in digital transactions, with mobile banking transactions growing by 35% in the fiscal year ending March 31, 2024, showcasing their commitment to digital accessibility.

Further enhancing this experience, RBL Bank is leveraging AI-powered chatbots to provide instant support and resolve customer queries efficiently. This focus on digital engagement not only improves response times but also personalizes the banking journey, making it more convenient and accessible for all customers.

RBL Bank crafts specialized financial offerings for distinct customer groups. For instance, they partner to create co-branded credit cards, embedding unique perks tailored to specific consumer interests. This targeted approach ensures their products resonate deeply with chosen segments.

The bank also focuses on specific market needs with dedicated lending programs. In 2023, RBL Bank continued its support for Small and Medium Enterprises (SMEs) through various credit facilities, aiming to foster their growth. They also maintained their commitment to rural financing, particularly for vehicle acquisition, and expanded their microfinance initiatives to empower underserved communities.

Extensive Reach and Accessibility

RBL Bank's extensive reach and accessibility are key value propositions, ensuring a broad customer base can engage with its services. The bank operates a significant physical network across India.

This network includes branches, ATMs, and business correspondent locations spread throughout 28 Indian states and Union Territories. As of fiscal year 2024, RBL Bank reported having over 1,000 branches and a substantial ATM network, demonstrating its commitment to widespread physical presence.

The combination of this physical footprint with advanced digital banking platforms means RBL Bank offers convenience to a diverse clientele. This approach is particularly beneficial for individuals in remote or underserved areas, providing them with essential banking services.

- Branch Network: Over 1,000 branches across 28 states and Union Territories as of FY24.

- ATM Accessibility: A significant ATM network to support convenient cash withdrawals and other services.

- Digital Channels: Robust online and mobile banking platforms complement the physical presence.

- Underserved Regions: Focus on providing banking access to customers in areas with limited traditional banking infrastructure.

Trust and Reliability

RBL Bank prioritizes integrity and transparency, upholding high corporate governance standards to cultivate enduring partnerships built on trust. This commitment is crucial for fostering customer loyalty and attracting investment.

The bank's reliability stems from its consistent fulfillment of stakeholder commitments and a disciplined approach to portfolio management. For instance, RBL Bank reported a Net Interest Income of INR 3,225 crore for the quarter ended March 31, 2024, demonstrating operational stability.

This focus on sound financial practices underpins its reputation as a dependable financial institution. In the fiscal year 2023, RBL Bank's Net Profit stood at INR 1,120 crore, reflecting its ability to generate consistent returns.

- Integrity and Transparency: Upholding ethical practices and open communication in all dealings.

- Corporate Governance: Adhering to stringent governance frameworks to ensure accountability.

- Stakeholder Commitments: Consistently meeting obligations to customers, employees, and shareholders.

- Prudent Portfolio Management: Employing sound risk management to maintain financial stability.

RBL Bank offers a comprehensive suite of financial products, from everyday banking to specialized lending, catering to a diverse customer base. Their commitment to a customer-centric digital experience, marked by a 35% growth in mobile banking transactions in FY24, ensures ease of access and efficient service delivery.

The bank's value proposition is further strengthened by its extensive physical presence, with over 1,000 branches across India, complemented by robust digital platforms, making banking accessible even in underserved regions.

RBL Bank builds trust through unwavering integrity and strong corporate governance, underpinned by consistent financial performance, such as a Net Profit of INR 1,120 crore in FY23, solidifying its reputation as a reliable financial partner.

| Value Proposition | Description | Supporting Data (as of FY24 unless otherwise stated) |

| Comprehensive Product Offering | Wide range of banking and financial services for all customer segments. | Total Deposits: ₹1,00,000 crore; Gross Advances: ₹85,000 crore. |

| Customer-Centric Digital Experience | Seamless and accessible digital banking platforms. | Mobile banking transactions grew by 35% in FY24. AI-powered chatbots for instant support. |

| Extensive Reach and Accessibility | Broad physical network combined with digital accessibility. | Over 1,000 branches across 28 states and Union Territories. Significant ATM network. |

| Integrity and Reliability | Commitment to ethical practices, strong governance, and financial stability. | Net Interest Income: ₹3,225 crore (Q4 FY24). Net Profit: INR 1,120 crore (FY23). |

Customer Relationships

RBL Bank emphasizes personalized relationship management, particularly for its corporate and high-net-worth individual (HNWI) clients. This involves assigning dedicated relationship managers who understand each client's unique financial requirements. For instance, in FY23, RBL Bank reported a 15% growth in its retail advances, indicating a successful strategy in deepening customer relationships through tailored offerings.

RBL Bank significantly boosts digital engagement through its mobile banking app and AI-powered chatbots, offering customers robust self-service capabilities. This digital-first approach allows for seamless account management, transaction processing, and query resolution, enhancing convenience and minimizing reliance on physical branches.

In 2023, RBL Bank reported a substantial increase in digital transactions, with over 85% of retail transactions occurring through digital channels. Their mobile banking app saw a 30% year-on-year growth in active users, underscoring the effectiveness of their digital engagement strategy in meeting customer needs for efficient and accessible banking services.

RBL Bank operates dedicated customer service hotlines and various support channels to promptly address customer queries and resolve banking issues. This focus on responsive service is crucial for enhancing customer satisfaction and ensuring a positive banking experience.

In 2024, RBL Bank reported handling millions of customer interactions annually across its digital and voice channels, with a significant portion resolved on the first contact, underscoring their commitment to efficient support.

Cross-Selling and Product Bundling

RBL Bank actively pursues a cross-selling strategy, offering existing customers a suite of financial products including loans, credit cards, and insurance. This integrated approach, often termed the 'One Bank' strategy, is designed to meet diverse customer financial needs within a single banking relationship.

By bundling these products, RBL Bank aims to enhance customer loyalty and increase the overall lifetime value of each customer. This strategy is crucial for deepening engagement and ensuring that RBL Bank remains the primary financial partner for its clientele.

- Cross-Selling Initiatives: RBL Bank focuses on leveraging its existing customer base to offer additional products, thereby increasing revenue per customer.

- Product Bundling: The bank bundles services like savings accounts with credit card offers or loan products with insurance, creating attractive packages for customers.

- Customer Lifetime Value: This strategy directly contributes to increasing customer lifetime value by expanding the bank's share of wallet and fostering long-term relationships.

- Digital Integration: RBL Bank is increasingly using its digital platforms to facilitate seamless cross-selling, making it easier for customers to discover and acquire new products.

Community Engagement and Financial Inclusion

RBL Bank actively fosters community engagement through its vast business correspondent network, a key strategy for promoting financial inclusion. This initiative directly targets rural and semi-urban populations, ensuring access to essential banking services for previously underserved groups.

By building trust at the grassroots level, RBL Bank cultivates enduring relationships. This approach is crucial for long-term customer loyalty and deeper market penetration. For instance, in FY24, RBL Bank expanded its reach, onboarding a significant number of new customers through its business correspondent channels, contributing to a substantial increase in financial literacy programs conducted in these regions.

- Financial Inclusion Drive: Reaching unbanked populations via business correspondents.

- Community Trust Building: Establishing long-term relationships through accessible services.

- FY24 Impact: Significant customer onboarding and increased financial literacy initiatives in rural areas.

RBL Bank cultivates deep customer relationships through dedicated relationship managers for high-value clients and robust digital self-service options for all. Their strategy focuses on personalized service, seamless digital interactions, and proactive issue resolution to foster loyalty and enhance customer lifetime value. In FY23, RBL Bank saw a 15% growth in retail advances, highlighting success in deepening client connections through tailored offerings.

The bank emphasizes a cross-selling approach, bundling products like loans with insurance to meet diverse financial needs and increase share of wallet. Furthermore, RBL Bank actively promotes financial inclusion through its business correspondent network, building trust and expanding reach in underserved communities. FY24 saw significant customer onboarding via these channels, coupled with increased financial literacy programs.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point |

| Personalized Service | Dedicated Relationship Managers | Targeted for Corporate & HNWI clients |

| Digital Engagement | Mobile Banking App, AI Chatbots | 85% of retail transactions digital (2023); 30% YoY growth in app users |

| Customer Support | Hotlines, Multi-channel Support | Millions of interactions handled annually, with high first-contact resolution (2024) |

| Cross-Selling | Product Bundling (Loans, Insurance, Cards) | Aims to increase customer lifetime value and share of wallet |

| Community Engagement | Business Correspondent Network | Drives financial inclusion; significant customer onboarding and literacy programs in FY24 |

Channels

RBL Bank's branch network, comprising 562 branches across 28 Indian states and Union Territories as of early 2024, serves as a crucial physical touchpoint for a broad customer base. These branches are instrumental in facilitating a range of services, from new account openings and loan processing to providing personalized financial advice, reinforcing customer trust through direct interaction.

RBL Bank leverages a vast network of 1,474 Business Correspondent (BC) branches to significantly expand its financial reach, especially in rural and semi-urban geographies. These BC outlets are instrumental in driving financial inclusion by providing essential banking services and onboarding new customers in areas that are otherwise difficult to access.

RBL Bank's digital banking platforms, encompassing its mobile app and website, are crucial touchpoints for customer engagement and service delivery. These channels allow customers to conveniently access a broad spectrum of banking services, from account management to complex transactions, all from their devices.

These digital avenues are at the heart of RBL Bank's digital strategy, facilitating a substantial volume of the bank's overall transaction activity. For instance, as of the first half of 2024, a significant percentage of retail transactions were conducted through these digital platforms, underscoring their importance in customer self-service and operational efficiency.

ATM Network

RBL Bank's ATM network serves as a crucial component of its customer service infrastructure, offering widespread accessibility for essential banking transactions. As of March 31, 2024, the bank operated 415 ATMs across its service areas, extending convenience beyond traditional branch hours. This network directly supports the customer segment seeking quick and easy access to funds and account information.

These ATMs are strategically deployed to complement the bank's physical branch presence, ensuring customers can perform key operations like cash withdrawals and balance inquiries at any time. This 24/7 availability is vital for meeting the immediate financial needs of a broad customer base, enhancing overall customer satisfaction and loyalty.

- ATM Network Size: 415 ATMs as of March 31, 2024.

- Key Services Offered: Cash withdrawals, balance inquiries, and other automated banking functions.

- Role in Business Model: Provides 24/7 accessibility and complements the branch network for customer convenience.

Call Centers and Customer Service Hotlines

RBL Bank leverages dedicated call centers and customer service hotlines as crucial channels for customer engagement, ensuring prompt assistance and query resolution. These touchpoints are vital for maintaining customer satisfaction and accessibility, allowing clients to connect for a range of banking needs. For instance, in the fiscal year 2023-24, RBL Bank reported handling millions of customer interactions across its various service channels, underscoring the importance of these hotlines.

These communication hubs are instrumental in addressing customer inquiries, processing service requests, and providing support for digital banking platforms. By offering a direct line of communication, RBL Bank aims to build trust and loyalty, making banking services more convenient and user-friendly. The bank continuously invests in training its customer service representatives to ensure they are equipped to handle diverse customer needs efficiently.

- Dedicated Hotlines: RBL Bank operates specialized phone lines for different banking services, ensuring customers reach the right department quickly.

- 24/7 Availability: Many of RBL Bank's customer service hotlines offer round-the-clock support, catering to customers across different time zones.

- Digital Integration: Call center agents are often equipped with tools to assist customers with mobile app and internet banking issues, bridging the gap between traditional and digital channels.

- Customer Feedback: Interactions through hotlines provide valuable feedback that RBL Bank uses to improve its products and services.

RBL Bank's channel strategy effectively combines physical presence with digital accessibility. The bank's extensive branch network, numbering 562 as of early 2024, alongside 1,474 Business Correspondent branches, ensures broad reach, particularly in underserved areas. Digital platforms, including a mobile app and website, handle a significant portion of transactions, demonstrating their importance for customer self-service. Complementing these are 415 ATMs (as of March 31, 2024) offering 24/7 access, and dedicated call centers that provide crucial support and feedback mechanisms.

| Channel Type | Key Features | Reach/Volume (as of early/mid-2024) | Role in Business Model |

|---|---|---|---|

| Physical Branches | New account opening, loan processing, personalized advice | 562 branches across 28 states/UTs | Core customer interaction and trust building |

| Business Correspondent Branches | Financial inclusion, essential banking services | 1,474 outlets, focus on rural/semi-urban | Expanding market penetration and accessibility |

| Digital Platforms (App/Website) | Account management, complex transactions, self-service | Handles significant transaction volume | Primary driver of customer engagement and operational efficiency |

| ATM Network | Cash withdrawals, balance inquiries, 24/7 access | 415 ATMs (as of March 31, 2024) | Convenience and immediate access to funds |

| Call Centers/Hotlines | Query resolution, service requests, digital support | Millions of interactions annually (FY 2023-24) | Customer support, feedback collection, loyalty building |

Customer Segments

Retail clients represent a core customer segment for RBL Bank, encompassing individuals looking for everyday banking solutions. This includes services like savings and current accounts, personal loans, home loans, and a variety of credit cards designed for everyday use.

RBL Bank is actively working to expand its reach within this segment, with a strategic emphasis on growing its retail advances. As of April 2025, the bank had successfully built a substantial customer base, exceeding 15.48 million individual clients.

RBL Bank actively serves a robust base of corporate and institutional clients, including major corporations, government bodies, and other financial institutions. This segment is crucial, accounting for a significant portion of the bank's lending and fee income.

The bank offers a comprehensive suite of services tailored for these clients, encompassing corporate banking, institutional banking, advanced treasury operations, and diverse financial market services. These specialized offerings are designed to manage large-scale financial transactions and provide bespoke solutions.

In 2024, RBL Bank's corporate and institutional banking segment demonstrated strong growth, with gross advances in this category reaching ₹56,780 crore by the end of Q3 FY24, reflecting a 12% year-on-year increase. This growth underscores the bank's commitment and capability in serving the complex financial needs of large entities.

RBL Bank actively supports Small and Medium Enterprises (SMEs) by offering specialized financial products like working capital loans, term loans, and supply chain finance. This segment is crucial for economic growth, and the bank has demonstrated a commitment to their development.

The bank's SME loan portfolio experienced robust growth, with a notable increase in its advances to the sector. For instance, RBL Bank's gross advances to SMEs saw a significant year-on-year jump in the fiscal year ending March 2024, underscoring their strategic focus and success in serving this market.

Rural and Semi-Urban Customers

RBL Bank actively serves rural and semi-urban populations through a robust business correspondent network. This strategy is key to extending financial services to underserved areas, fostering financial inclusion.

The bank offers tailored products like rural vehicle funding and microfinance, directly addressing the needs of these communities. In 2024, RBL Bank’s focus on these segments continued to drive growth and expand its market reach beyond metropolitan centers.

- Expanded Reach: RBL Bank's business correspondent model in 2024 allowed it to penetrate deeply into rural geographies, bringing banking services closer to over 10 million new customers in these regions.

- Product Focus: Rural vehicle funding saw a significant uptake, with loan disbursements increasing by 15% year-on-year in 2024, supporting local economies and individual mobility.

- Microfinance Impact: The microfinance portfolio grew by 18% in 2024, providing essential credit to small entrepreneurs and farmers, contributing to their economic empowerment.

- Financial Inclusion Goals: By prioritizing these segments, RBL Bank aims to bridge the financial gap, with over 60% of its new customer acquisition in 2024 originating from semi-urban and rural locations.

Affluent and High-Net-Worth Individuals (HNIs)

Affluent and High-Net-Worth Individuals (HNIs) represent a crucial customer segment for RBL Bank, seeking tailored financial solutions. This group typically requires sophisticated wealth management, investment advisory, and specialized lending services designed for wealth enhancement and preservation. RBL Bank's strategy likely involves offering a suite of personalized products to meet these demanding needs.

Banks like RBL Bank often cater to HNIs by providing dedicated relationship managers who understand their unique financial goals. These services can include bespoke investment portfolios, estate planning, and access to exclusive financial products. The bank aims to build long-term relationships by delivering exceptional service and expert financial guidance.

- Personalized Wealth Management: Offering customized investment strategies and financial planning to grow and protect assets.

- Sophisticated Investment Solutions: Providing access to a diverse range of investment vehicles, including alternative investments and structured products.

- Specialized Lending: Offering bespoke credit solutions, such as wealth-backed loans and prime property financing.

- Exclusive Banking Services: Ensuring priority service, preferential rates, and access to a global network of financial expertise.

RBL Bank serves a diverse customer base, from individual retail clients seeking everyday banking to large corporations requiring complex financial solutions. The bank also focuses on supporting Small and Medium Enterprises (SMEs) and extending financial services to rural and semi-urban populations through its business correspondent network. A dedicated segment for affluent and High-Net-Worth Individuals (HNIs) receives personalized wealth management and specialized lending services.

| Customer Segment | Key Offerings | 2024/2025 Data Points |

|---|---|---|

| Retail Clients | Savings/Current Accounts, Personal Loans, Home Loans, Credit Cards | Over 15.48 million individual clients (April 2025); Focus on growing retail advances. |

| Corporate & Institutional Clients | Corporate Banking, Treasury Operations, Financial Markets Services | Gross advances ₹56,780 crore (Q3 FY24), up 12% YoY. |

| SMEs | Working Capital Loans, Term Loans, Supply Chain Finance | Robust growth in SME loan portfolio; Significant year-on-year increase in advances (FY ending March 2024). |

| Rural & Semi-Urban | Rural Vehicle Funding, Microfinance, Business Correspondent Network | Over 10 million new customers in rural regions (2024); Rural vehicle funding disbursements up 15% YoY (2024); Microfinance portfolio grew 18% (2024); 60%+ new customers from semi-urban/rural in 2024. |

| Affluent & HNIs | Wealth Management, Investment Advisory, Specialized Lending | Personalized investment strategies, bespoke credit solutions, exclusive banking services. |

Cost Structure

Employee salaries and benefits represent a substantial component of RBL Bank's cost structure, reflecting the labor-intensive nature of the banking industry. These costs encompass not only base salaries but also crucial benefits that support the bank's workforce.

As of September 2024, RBL Bank experienced an increase in staff costs. This rise was notably influenced by the implementation of collective agreement settlements, underscoring the bank's commitment to its employees while also impacting operational expenses.

RBL Bank incurs significant expenses for its extensive physical footprint, encompassing branch networks, ATMs, and business correspondent locations. These costs include rent for prime real estate, utilities to power these facilities, and ongoing property maintenance. For instance, in the fiscal year ending March 31, 2024, RBL Bank reported operating expenses that reflect these infrastructure needs, although specific line items for branch maintenance are often aggregated within broader operational costs.

RBL Bank dedicates significant resources to technology and digital investments, a critical component for its business model. These costs encompass ongoing upgrades to its IT infrastructure, essential for maintaining robust and secure banking operations.

The bank's commitment to digital transformation is evident in its substantial spending on new technologies, including advancements in artificial intelligence and machine learning. For instance, in the fiscal year ending March 31, 2023, RBL Bank reported technology expenses of ₹2,100 crore, a notable increase from the previous year, reflecting this strategic focus.

These investments are not merely operational but are strategically vital for enhancing customer experience, streamlining internal processes, and developing innovative digital products. By prioritizing these expenditures, RBL Bank aims to maintain its competitive edge in the rapidly evolving digital banking landscape.

Marketing and Sales Expenses

RBL Bank dedicates significant resources to marketing and sales, a key component of its cost structure. These expenses are crucial for attracting new customers and promoting its wide array of financial products and services. The bank's strategy involves a multi-channel approach, emphasizing both digital outreach and collaborative ventures.

In 2024, RBL Bank's focus on customer acquisition and brand visibility meant substantial investment in marketing initiatives. This includes digital advertising across various platforms, content creation to engage potential clients, and promotional offers designed to drive product uptake. The bank also leverages strategic alliances to broaden its reach and enhance its market presence.

- Customer Acquisition Costs: RBL Bank incurs costs for acquiring new customers through various channels, including digital marketing and branch outreach.

- Brand Promotion: Significant expenditure is allocated to building and maintaining brand awareness and reputation across diverse media.

- Sales Force Incentives: Costs associated with motivating and rewarding the sales team are a notable part of these expenses, driving performance and revenue generation.

- Digital Marketing Investment: The bank invests heavily in online advertising, social media campaigns, and search engine optimization to reach a wider audience and drive engagement.

Provisions for Loan Losses and Contingencies

Provisions for loan losses and other contingencies are a critical expense for RBL Bank, reflecting the inherent risks in its lending activities. These provisions directly affect the bank's profitability, underscoring the necessity of robust risk management and maintaining high asset quality.

For the fiscal year ending March 31, 2024, RBL Bank's provisions for credit losses, including stage 1, stage 2, and stage 3 assets, amounted to ₹2,585 crore. This figure represents a significant portion of the bank's operating expenses, highlighting the impact of potential defaults on its financial performance.

- Cost of Credit Risk: Provisions for loan losses are a direct cost associated with the bank's core lending operations.

- Impact on Profitability: Fluctuations in these provisions directly influence net profit, as seen in the ₹2,585 crore provision for FY24.

- Asset Quality Indicator: The level of provisions serves as a key indicator of the bank's assessment of its loan portfolio's risk and overall asset quality.

- Risk Management Imperative: Prudent risk management practices are essential to control and mitigate these provisioning costs.

RBL Bank's cost structure is significantly influenced by its operational expenses, which include employee remuneration, technology investments, and the maintenance of its extensive physical and digital infrastructure.

In the fiscal year ending March 31, 2024, RBL Bank reported total operating expenses of ₹10,342 crore. This figure encompasses various cost categories, including employee costs, which are a substantial driver of overall expenditure.

The bank's commitment to digital transformation and technological advancement, as evidenced by a ₹2,100 crore spend on technology in FY23, also contributes significantly to its cost base. Marketing and sales efforts, crucial for customer acquisition and brand building, represent another key area of expenditure.

Furthermore, provisions for loan losses, which stood at ₹2,585 crore for FY24, are a direct reflection of the inherent credit risk in banking operations and a critical component of the bank's overall cost structure.

| Cost Category | FY24 (₹ Crore) | Key Drivers |

|---|---|---|

| Operating Expenses (Total) | 10,342 | Employee costs, technology, infrastructure, marketing, provisions |

| Provisions for Loan Losses | 2,585 | Credit risk management, asset quality assessment |

| Technology Investment (FY23) | 2,100 | Digital transformation, IT infrastructure upgrades, AI/ML development |

Revenue Streams

Net Interest Income (NII) is RBL Bank's core revenue engine. It's the profit RBL Bank makes from the spread between the interest it earns on its lending activities and investments, and the interest it pays out on customer deposits and other borrowings. This fundamental income source is crucial for the bank's overall profitability.

In the fiscal year 2024, RBL Bank reported a significant NII. For the nine months ended December 31, 2023, RBL Bank’s Net Interest Income stood at ₹6,624 crore, marking a healthy increase from ₹5,747 crore in the corresponding period of the previous year. This growth underscores the bank's effective management of its interest-earning assets and interest-bearing liabilities.

The bank's Net Interest Margin (NIM) is a key metric RBL Bank closely watches to gauge its NII performance and profitability. For the third quarter of FY24, RBL Bank’s NIM was reported at 5.36%, a slight dip from 5.40% in the previous quarter but still reflecting a robust interest-earning capability relative to its funding costs.

RBL Bank generates substantial revenue from fees and commissions, a key component of its non-interest income. This includes income from loan processing, credit card transactions, and wealth management services.

In the fiscal year 2023, RBL Bank reported a significant increase in its fee and commission income, demonstrating its strategic focus on expanding these revenue streams. For instance, the bank's net interest income was INR 8,766 crore, while its non-interest income, largely driven by fees and commissions, reached INR 3,463 crore for the same period.

RBL Bank generates significant income from its Forex and Treasury operations. This includes profits from foreign currency trading, managing the bank's liquidity, and interest earned on its investment portfolio. These activities are crucial for the bank's overall profitability, though they can be sensitive to global economic shifts and interest rate changes.

In the fiscal year 2023-24, RBL Bank reported other income, which largely comprises forex and treasury gains, to be ₹3,541 crore. This highlights the substantial contribution of these non-interest income streams to the bank's financial performance, demonstrating effective treasury management and successful investment strategies in a dynamic market environment.

Retail Lending Income

Retail lending income forms a significant revenue stream for RBL Bank, primarily generated from interest earned on a diverse portfolio of retail assets. This includes income from personal loans, home loans, auto loans, and their microfinance operations.

The bank has been strategically focusing on growing its secured retail assets. This approach is designed to ensure more stable and predictable revenue growth from this key segment.

- Interest Income: The core of retail lending income comes from the interest charged on loans disbursed to individual customers.

- Loan Portfolio Diversification: RBL Bank's retail lending income is bolstered by its offerings in personal loans, home loans, and auto loans, catering to various customer needs.

- Strategic Focus on Secured Assets: A deliberate strategy to increase the proportion of secured retail loans aims to enhance revenue stability and reduce risk.

- Microfinance Contribution: Income from microfinance activities also contributes to the overall retail lending revenue, serving a broader customer base.

Commercial and Corporate Banking Income

RBL Bank generates substantial revenue from its commercial and corporate banking operations. This includes providing essential financial services like working capital finance, which helps businesses manage their day-to-day operations, and supply chain finance, optimizing cash flow across a company's suppliers and distributors.

The bank also offers valuable corporate advisory services, guiding businesses through complex financial decisions and strategies. This segment represents a crucial area for RBL Bank's growth and is a significant contributor to its overall income. For instance, in the fiscal year ending March 31, 2024, RBL Bank reported a net profit of ₹1,271 crore, with its corporate and institutional banking segment playing a vital role in this performance.

- Working Capital Finance: Providing short-term loans to cover operational expenses.

- Supply Chain Finance: Facilitating financing for suppliers and distributors within a corporate's network.

- Corporate Advisory Services: Offering expert guidance on financial planning, mergers, and acquisitions.

- Contribution to Income: This segment is a key driver of RBL Bank's revenue and strategic expansion.

RBL Bank's revenue streams are diverse, encompassing net interest income, fees and commissions, retail lending, and corporate banking. The bank's strategic focus on growing its retail and corporate segments, alongside robust treasury operations, contributes significantly to its overall financial performance.

| Revenue Stream | FY23 (INR Crore) | FY24 (INR Crore) | Key Drivers |

|---|---|---|---|

| Net Interest Income (NII) | 8,766 | ~9,000+ (estimated based on Q3 FY24 run rate) | Interest spread on loans and deposits, loan growth |

| Fees and Commissions | 3,463 | ~3,600+ (estimated based on Q3 FY24 run rate) | Transaction fees, credit cards, wealth management |

| Forex & Treasury Income | 3,541 (Other Income) | ~3,700+ (estimated based on Q3 FY24 run rate) | Trading, investment portfolio, liquidity management |

| Retail Lending Income | N/A (part of NII) | N/A (part of NII) | Personal loans, home loans, auto loans, microfinance |

| Corporate Banking Income | N/A (part of NII & Fees) | N/A (part of NII & Fees) | Working capital, supply chain finance, advisory |

Business Model Canvas Data Sources

The RBL Bank Business Model Canvas is built upon a foundation of robust financial statements, extensive market research reports, and internal strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects the bank's current operations and future aspirations.