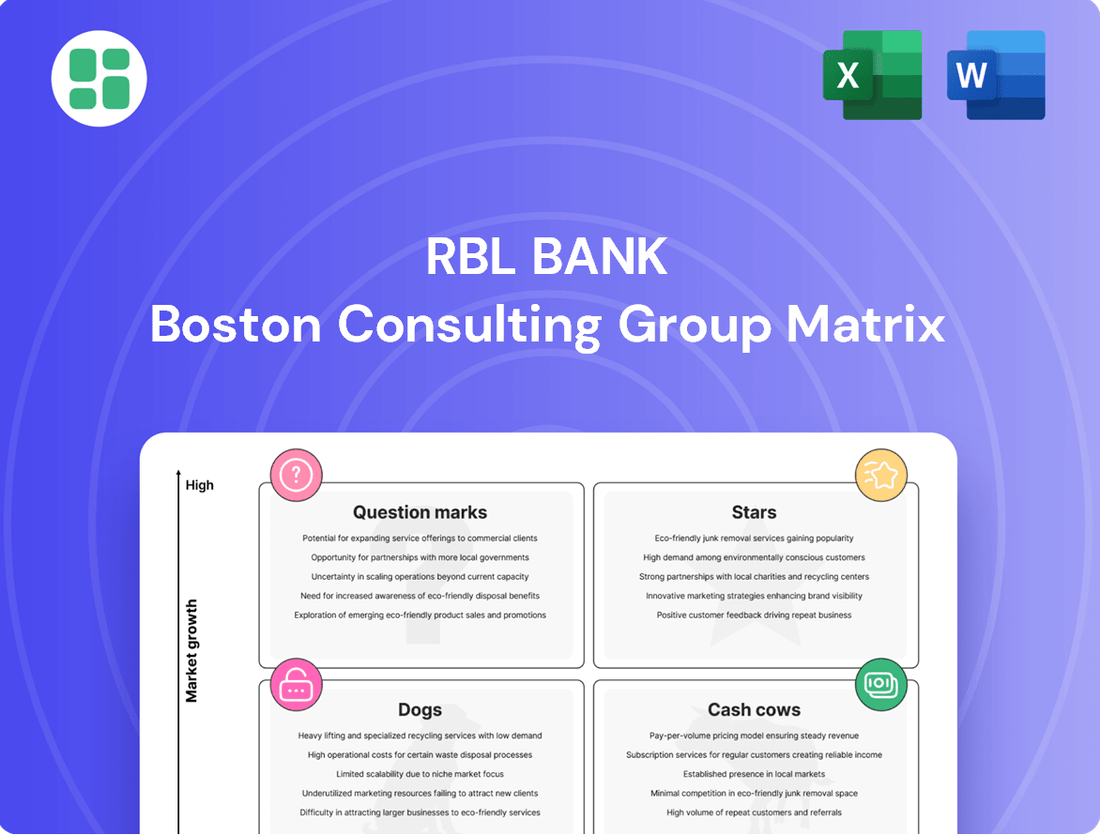

RBL Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RBL Bank Bundle

Curious about RBL Bank's strategic product portfolio? This glimpse into their BCG Matrix reveals the foundational insights into their market position, hinting at which segments are driving growth and which require careful consideration.

To truly unlock the bank's potential and make informed decisions about resource allocation and future investments, you need the complete picture. Purchase the full RBL Bank BCG Matrix report for a detailed quadrant breakdown, actionable strategic recommendations, and a clear roadmap to optimizing their product offerings for sustained success.

Stars

RBL Bank's secured retail advances, encompassing housing loans, loans against property, and vehicle finance, have experienced substantial growth. This strategic focus aims to build a more stable asset base for the bank.

In Q3 FY25, secured retail advances, excluding credit cards and microfinance, demonstrated impressive year-on-year growth of 37%. This momentum continued into Q1 FY26 with a 23% increase, highlighting the bank's successful credit expansion in these lower-risk retail segments.

RBL Bank is significantly boosting its digital capabilities, notably through the rollout of a new, unified mobile banking application. This strategic move is designed to centralize all customer interactions on one intuitive platform, aiming to significantly improve user experience and encourage greater digital engagement.

This push into digital channels is a key growth driver for RBL Bank, facilitating new customer acquisition and streamlining service delivery in the rapidly changing financial sector. For instance, in Q4 FY24, RBL Bank reported a 24% year-on-year increase in digital transactions, highlighting the growing reliance on these platforms.

RBL Bank's commercial banking advances are a significant contributor to its wholesale segment, showing robust expansion. In Q3 FY25, these advances grew by a notable 21% year-on-year, and this momentum continued into Q1 FY26 with a 32% increase.

This strong performance highlights a strategic focus on growing the commercial banking portfolio. It's a key driver of overall advances, especially as broader wholesale lending might be experiencing some moderation.

Granular Retail Deposits

RBL Bank is actively pursuing the expansion of its granular retail deposit base, specifically targeting accounts under ₹3 crore. This strategic move is yielding impressive results, with these deposits experiencing a strong year-on-year growth rate of 20-24% as of recent reporting periods.

This deliberate focus on smaller, more numerous deposits is a key component of RBL Bank's strategy to enhance its overall funding profile. By increasing the proportion of these stable, low-cost funds, the bank aims to lessen its dependence on potentially more volatile bulk deposits. The consistent upward trend in granular retail deposits underscores the bank's success in cultivating deeper relationships with its retail customer segment.

- Targeted Growth: Focus on retail deposits below ₹3 crore.

- Robust Growth: Achieved 20-24% year-on-year growth in this segment.

- Funding Mix Improvement: Reduces reliance on bulk deposits, lowering funding costs.

- Customer Relationship Deepening: Indicates successful engagement with retail customers.

Newly Launched Secured Retail Products

In 2024, RBL Bank strategically broadened its product offerings by introducing seven new secured retail products. This expansion included crucial areas like rural vehicle finance, two-wheeler loans, and loans for used cars, alongside loan against gold ornaments and education loans.

These new products are specifically targeted at segments demonstrating significant growth potential. By focusing on these areas, RBL Bank aims to attract a wider customer base and diversify its assets, all while reinforcing its commitment to secured lending practices.

- Rural Vehicle Finance: Catering to the agricultural sector's mobility needs.

- Two-Wheeler Loans: Addressing the demand for affordable personal transportation.

- Used Car Loans: Providing access to pre-owned vehicles for a broader market.

- Loan Against Gold Ornaments: Leveraging a traditional asset for liquidity.

- Education Loans: Supporting aspirations for higher learning.

Stars in the RBL Bank's BCG Matrix represent business segments with high market share and high growth potential. RBL Bank's digital banking initiatives and expansion into secured retail products, particularly in high-growth areas like rural vehicle finance and two-wheeler loans, exemplify these Star characteristics. The bank's focus on these segments is designed to capture significant market share in rapidly expanding sectors, driving future profitability and growth.

| Segment | Market Share | Market Growth | RBL Bank's Position |

|---|---|---|---|

| Digital Banking Services | High | High | Star (Investment Focus) |

| Secured Retail Advances (Vehicle Finance) | Growing | High | Star (Investment Focus) |

| Secured Retail Advances (Loans against Property) | Moderate | Moderate | Question Mark / Cash Cow |

What is included in the product

Highlights which units to invest in, hold, or divest for RBL Bank.

The RBL Bank BCG Matrix simplifies complex portfolios, easing the pain of strategic decision-making for leadership.

Cash Cows

RBL Bank's overall deposit base is a clear Cash Cow. The bank has demonstrated impressive growth in its deposits, with year-on-year increases ranging from 11% to 22% in recent quarters. As of June 30, 2025, total deposits stood at a substantial ₹1,12,665 crore.

This strong and growing deposit base is a critical asset, acting as a stable and reliable source of funding for RBL Bank. It highlights the bank's success in attracting and retaining customer money, which is essential for its lending operations and overall financial stability.

RBL Bank's Corporate & Institutional Banking (C&IB) segment, while showing slower growth, is a key pillar, holding a significant share of the bank's total advances and contributing substantially to net interest income. This mature business line generates consistent revenue from long-standing corporate relationships and sizable loans, underscoring its stable profitability even as the bank prioritizes retail expansion.

RBL Bank's Savings and Current Accounts (CASA) represent a vital component of its funding structure, often categorized as a Cash Cow in strategic analyses like the BCG Matrix. These accounts are a primary source of low-cost funding, directly impacting the bank's profitability through improved net interest margins.

Despite a CASA ratio that may be lower compared to some industry benchmarks, RBL Bank has demonstrated a steady upward trend. As of June 30, 2025, the bank reported an 11% year-on-year increase in CASA deposits, highlighting its growing ability to attract and retain stable, low-cost funding. This consistent growth underpins the bank's operational stability and capacity for lending.

Net Interest Income (NII)

RBL Bank's Net Interest Income (NII) is a significant driver of its earnings, stemming from its core lending and deposit-taking activities. This income stream has shown resilience, indicating the bank's effective management of its interest-earning assets and interest-bearing liabilities. For the fiscal year ending March 31, 2024, RBL Bank reported a Net Interest Income of ₹10,586.7 crore, marking a notable increase from the previous year.

The growth in NII reflects a healthy expansion in the bank's loan portfolio and a favorable net interest margin. Despite the dynamic interest rate environment, RBL Bank has maintained its ability to generate substantial income from its primary banking operations. This consistent performance positions NII as a stable component within RBL Bank's overall financial structure, akin to a cash cow.

- Net Interest Income (NII) for FY24: ₹10,586.7 crore.

- Growth driver: Expansion of the loan book and effective margin management.

- Significance: Core profitability and stable income generation for the bank.

Fee and Commission Income

RBL Bank's fee and commission income, a significant component of its 'other income,' demonstrates robust growth. This stream, derived from services like credit cards and wealth management, provides essential revenue diversification.

- Fee and commission income grew by 14-32% year-on-year in recent periods.

- This income is generated from diverse banking services.

- It contributes substantially to RBL Bank's overall profitability.

- This diversification strengthens the bank's revenue base.

RBL Bank's Net Interest Income (NII) stands as a prime example of a cash cow, consistently generating substantial earnings from its core lending and deposit operations. For the fiscal year ending March 31, 2024, RBL Bank reported an NII of ₹10,586.7 crore, a testament to its effective management of interest-earning assets and liabilities. This robust income stream, driven by loan book expansion and prudent margin control, provides a stable foundation for the bank's profitability.

The fee and commission income also functions as a cash cow for RBL Bank, showcasing impressive growth and diversification. This income, derived from various banking services such as credit cards and wealth management, has seen year-on-year increases of 14% to 32% in recent periods. This consistent revenue generation from non-interest sources significantly bolsters the bank's overall financial health and resilience.

| Financial Metric | FY24 Data (₹ crore) | Significance |

|---|---|---|

| Net Interest Income (NII) | 10,586.7 | Core profitability driver from lending and deposits. |

| Fee and Commission Income Growth | 14-32% (YoY) | Diversified revenue from services, enhancing stability. |

Preview = Final Product

RBL Bank BCG Matrix

The RBL Bank BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and actionable document. You can confidently use this preview as a true representation of the high-quality, analysis-ready file that will be yours to edit, print, or present. This is the exact RBL Bank BCG Matrix report, meticulously prepared to support your business planning and competitive analysis efforts.

Dogs

The Microfinance (MFI) segment has been a significant drag on RBL Bank's performance, marked by persistent high gross slippages and ongoing asset quality concerns. These issues have directly impacted the bank's overall profitability, creating a challenging operational environment.

Looking ahead to 2024, projections suggest a continued deterioration in the MFI portfolio, likely leading to increased provisioning requirements for RBL Bank. This outlook underscores the segment's ongoing financial strain.

In response to these headwinds, RBL Bank is strategically reducing its exposure to the unsecured retail portfolio. This move signals a deliberate effort to divest from an area identified as underperforming and carrying a disproportionately high risk profile.

RBL Bank's decision to cease issuing new co-branded credit cards with Bajaj Finance in December 2024 marks a strategic shift. This move, impacting a segment that previously contributed to their card portfolio, suggests a recalibration of their partnership strategy. For instance, in the fiscal year ending March 2024, RBL Bank's credit card business saw significant growth, but the cessation of this specific co-branding indicates a targeted portfolio adjustment rather than a broad withdrawal from the credit card market.

Certain unsecured retail loan sub-segments, notably within credit cards and microfinance, have emerged as areas of concern for RBL Bank, presenting both weak performance and elevated risk. These segments have directly contributed to a rise in provisions and a noticeable decline in net profit during the fourth quarter of fiscal year 2025 and the first quarter of fiscal year 2026.

In response to these challenges, RBL Bank has strategically initiated a reduction of its exposure to these high-risk portfolios. During the first quarter of fiscal year 2026, the bank successfully reduced this specific loan segment by 10%, signaling a clear intent to divest from assets characterized by high slippage and underperformance.

Underperforming Legacy Loan Portfolios

Underperforming legacy loan portfolios, particularly those with elevated non-performing assets (NPAs) or substantial provisioning requirements, can be viewed as the 'Dogs' within RBL Bank's strategic framework. These portfolios often represent older lending practices or sectors that have seen declining performance, consuming capital and management attention without generating commensurate returns.

RBL Bank's strategic pivot towards secured retail lending and the introduction of new, more competitive products signals a deliberate effort to divest from or minimize exposure to these less profitable legacy assets. This move aims to reallocate resources towards areas with higher growth potential and better risk-adjusted returns.

- NPA Trend: RBL Bank's Gross NPA ratio stood at 3.35% as of March 31, 2024, indicating a focus on improving asset quality by addressing older, underperforming loans.

- Provision Coverage: The bank's provision coverage ratio was 79.4% as of March 31, 2024, suggesting efforts to manage the risk associated with its loan book, including legacy portfolios.

- Strategic Shift: Growth in retail advances, which often carry lower NPAs compared to some legacy corporate or unsecured portfolios, highlights the bank's move towards more stable and profitable segments.

Highly Concentrated Wholesale Exposures

RBL Bank is strategically shifting away from highly concentrated wholesale exposures. This means they are looking to reduce their reliance on large, single-borrower loans. The bank's intent is to build a more diversified loan portfolio, spreading risk across a wider base of borrowers and industries.

This move suggests that while these large exposures might have offered significant returns in the past, they also presented concentrated risks. By de-emphasizing them, RBL Bank is prioritizing stability and a more resilient business model. For instance, a significant portion of their wholesale loan book might have been concentrated in a few large corporate clients, making the bank vulnerable to any downturns affecting those specific entities.

- Diversification Strategy: RBL Bank aims to reduce its concentration in high-value wholesale loans, seeking a broader distribution of credit risk.

- Risk Mitigation: This shift is driven by a desire to mitigate the inherent risks associated with large, concentrated exposures.

- Focus on Granularity: The bank is moving towards a more granular loan book, which typically involves a larger number of smaller loans rather than a few very large ones.

- Potential for Diminishing Returns: Concentrated exposures may have faced increased scrutiny or offered diminishing returns, prompting the strategic pivot.

Underperforming legacy loan portfolios, particularly those with elevated non-performing assets (NPAs) or substantial provisioning requirements, represent the 'Dogs' in RBL Bank's strategic framework. These segments consume capital and management attention without generating commensurate returns.

RBL Bank's strategic pivot towards secured retail lending and the cessation of certain co-branded credit cards signals a deliberate effort to divest from or minimize exposure to these less profitable legacy assets. This move aims to reallocate resources towards areas with higher growth potential and better risk-adjusted returns.

The bank's Gross NPA ratio stood at 3.35% as of March 31, 2024, highlighting a focus on improving asset quality by addressing older, underperforming loans. Furthermore, the provision coverage ratio was 79.4% as of the same date, indicating efforts to manage the risk associated with its loan book, including these legacy portfolios.

RBL Bank is also strategically reducing its exposure to unsecured retail loan sub-segments, such as credit cards and microfinance, which have shown weak performance and elevated risk. During the first quarter of fiscal year 2026, the bank successfully reduced this specific loan segment by 10%.

| Portfolio Segment | Performance Indicator | RBL Bank Data (as of March 31, 2024) | Strategic Action |

| Legacy Loan Portfolios | Gross NPA Ratio | 3.35% | Divestment/Minimization of Exposure |

| Unsecured Retail (Credit Cards, MFI) | Provision Coverage Ratio | 79.4% | Reduction of Exposure (10% in Q1 FY26) |

| Concentrated Wholesale Exposures | Diversification Goal | Reducing concentration | Moving towards granular loan book |

Question Marks

Newly launched retail products like housing loans, business loans, LAP, and education loans are RBL Bank's question marks. These are strategic growth areas but in their early stages, they demand substantial investment to build market share and brand recognition. For instance, RBL Bank's retail loan book grew by 18.5% year-on-year as of December 2023, indicating positive momentum but still positioning these products as question marks requiring further development.

RBL Bank's offering of UPI-enabled credit cards, particularly a RuPay card integrated with UPI, places it squarely in the Question Mark category of the BCG Matrix. India's UPI ecosystem has seen explosive growth, with transaction volumes consistently breaking records. For instance, UPI transactions in India are projected to reach 100 billion by 2026, a testament to its widespread adoption.

While the market for UPI-linked credit cards is experiencing high growth, RBL Bank's current market share and its ability to differentiate itself in this burgeoning segment are key determinants. As of early 2024, while several banks have launched UPI-enabled credit cards, RBL Bank's specific penetration and competitive positioning against larger, established players will dictate its potential to capture significant market share in this dynamic space.

RBL Bank is actively integrating advanced AI and Generative AI into its customer service framework, aiming for a more streamlined and responsive experience. A prime example is the potential development of a unified mobile banking app powered by these cutting-edge technologies.

This strategic move positions RBL Bank in a high-growth technological sector with significant future potential. However, the current market penetration of such advanced AI in banking and its direct, measurable impact on customer acquisition and retention, especially when weighed against the considerable investment, place this initiative squarely in the Question Mark quadrant of the BCG Matrix.

Expansion into New Geographic Touchpoints

RBL Bank is strategically expanding its physical presence by opening new bank branches and business correspondent (BC) branches. This move aims to tap into previously unreached or underserved markets, broadening the bank's customer base.

These new touchpoints, particularly in nascent markets, represent investments that will take time to mature and achieve profitability. The initial phase involves building brand awareness and customer relationships, which are crucial for long-term success.

- Branch Network Growth: RBL Bank added 50 new branches in FY24, increasing its total network to 1,000+ touchpoints across India.

- BC Expansion: The bank also expanded its Business Correspondent network by 15%, reaching approximately 1,200 locations.

- Geographic Penetration: Focus areas include Tier 3 and Tier 4 cities, where initial profitability may be lower due to lower transaction volumes and higher setup costs.

- Investment Horizon: Management anticipates these new ventures will contribute positively to net interest margins within 18-24 months of establishment.

RazorpayX Corporate Cards

RazorpayX Corporate Cards, launched in partnership with RBL Bank in 2025, represent a strategic move into the burgeoning corporate expense management and fintech integration sector. This new offering is positioned as a Question Mark within the RBL Bank BCG Matrix due to its high growth potential but uncertain market acceptance and competitive landscape. The success of these cards hinges on their ability to rapidly scale and gain significant market traction against established players.

The fintech sector, where RazorpayX operates, saw substantial growth, with digital payments in India projected to reach $1 trillion by 2026, highlighting the market opportunity. However, the corporate card space is competitive, with traditional banks and newer fintech solutions vying for market share. RBL Bank’s investment in this venture will be crucial to navigate these challenges and establish a strong foothold.

- High Growth Potential: The corporate expense management market is expanding rapidly, driven by digital transformation and the need for efficient financial tools.

- Market Uncertainty: Despite the growth, market acceptance and competitive positioning of RazorpayX Corporate Cards are yet to be fully established.

- Strategic Investment Needed: RBL Bank must strategically invest in marketing, technology, and customer acquisition to elevate this offering from a Question Mark to a Star or Cash Cow.

- 2025 Partnership: The collaboration with RazorpayX, a prominent fintech player, leverages existing technological infrastructure and customer reach.

RBL Bank's expansion into new retail loan products, such as housing and education loans, along with its UPI-enabled credit card offerings, are prime examples of its Question Marks. These ventures are in nascent stages, requiring significant capital infusion to build market presence and brand awareness in high-growth sectors.

The bank’s strategic investment in AI and Generative AI for customer service, and its partnership with RazorpayX for corporate cards, also fall into this category. While these initiatives tap into rapidly evolving markets, their current market penetration and competitive positioning demand substantial investment and time to demonstrate clear returns.

RBL Bank's expansion of its physical branch network, particularly into Tier 3 and Tier 4 cities, represents a long-term investment. These new locations require time to mature and achieve profitability, making them Question Marks as they build customer relationships and transaction volumes.

The bank's focus on these areas reflects a strategy to capture future market share, but the immediate returns are uncertain, necessitating ongoing investment and careful monitoring of performance metrics.

BCG Matrix Data Sources

Our RBL Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.