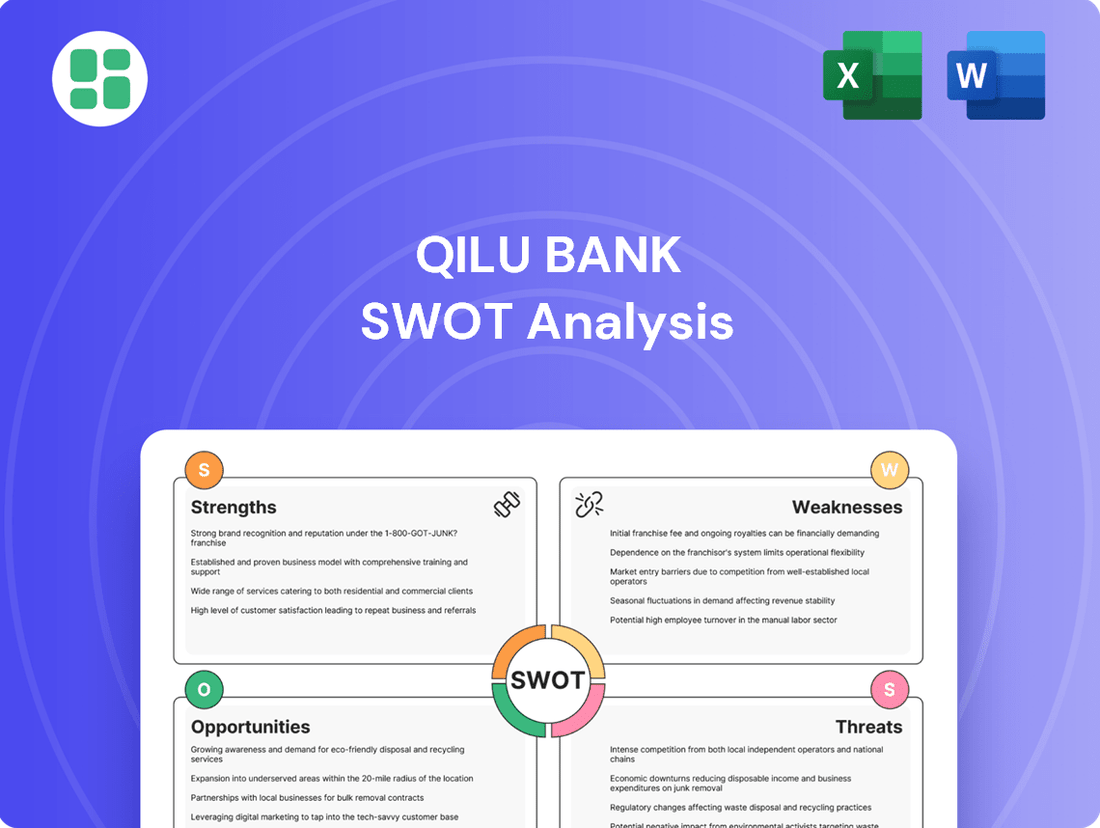

Qilu Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qilu Bank Bundle

Qilu Bank's robust digital transformation and strong regional presence are key strengths, but intense competition and evolving regulatory landscapes present significant challenges. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within China's banking sector.

Want the full story behind Qilu Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Qilu Bank's strength lies in its deep roots within Shandong province, a key economic hub in China. As a city commercial bank, its primary focus on this region allows for an intimate understanding of local market dynamics and a robust network of relationships with businesses and government bodies. This localized approach enables Qilu Bank to effectively align its financial offerings with regional development strategies, such as supporting the province's 'New and Old Kinetic Energy Conversion' policy.

This strong regional presence translates into a stable foundation for the bank. By catering to the specific financial needs of Shandong's economy, Qilu Bank cultivates a loyal customer base, leading to a consistent and reliable deposit base. This, in turn, supports sustained asset growth within its core operating territory, demonstrating the advantage of its focused regional strategy.

Qilu Bank has aggressively pursued digital transformation, establishing dedicated technology financial branches and centers. This strategic move underpins their commitment to integrating cutting-edge fintech solutions across their operations.

The bank's development of innovative digital products, such as the 'Future Star' and 'Rising Star' packages, directly caters to the burgeoning tech sector. These offerings, coupled with strategic alliances, empower technology companies and streamline Qilu Bank's service delivery.

Qilu Bank demonstrates a strong commitment to green finance, actively supporting national policies aimed at resource conservation and environmental protection. This dedication is highlighted by its 'Low Carbon Benefit Loan' product, which was recognized on the 2024 Shandong 'Haopin Financial' list, underscoring its role in financing green energy and ecological initiatives.

Solid Financial Performance and Asset Quality

Qilu Bank demonstrates solid financial performance, evidenced by reported increases in both revenue and net profit. By the close of 2023, its total assets surpassed 600 billion yuan, underscoring consistent growth.

The bank maintains a strong asset quality, with a non-performing loan ratio of just 1.26 percent. Coupled with a provision coverage ratio of 303.58 percent, this indicates a substantial safety margin and prudent risk management.

- Consistent Revenue and Profit Growth

- Total Assets Exceeding 600 Billion Yuan (End of 2023)

- Low Non-Performing Loan Ratio of 1.26%

- High Provision Coverage Ratio of 303.58%

Diversified Service Offerings and Support for Real Economy

Qilu Bank's strength lies in its broad spectrum of financial services catering to individuals, businesses, and government bodies. This includes everything from basic deposit accounts and diverse loan products to sophisticated payment systems and investment banking capabilities. This comprehensive approach ensures a wide customer base and multiple revenue streams.

A significant advantage is Qilu Bank's dedicated support for the real economy. By channeling funds into strategic emerging industries and technology-focused companies, the bank not only fosters economic growth but also builds a resilient loan portfolio. For instance, by June 2024, general loans extended to technology enterprises reached an impressive 31.2 billion yuan, highlighting this commitment.

- Diversified Services: Offers a full suite of banking and financial products, from deposits and loans to payment solutions and investment banking.

- Real Economy Focus: Actively supports strategic emerging industries and technology enterprises.

- Loan Growth in Tech: Provided 31.2 billion yuan in general loans to tech enterprises as of June 2024.

- Market Resilience: Diversified offerings and economic support contribute to a stronger market position.

Qilu Bank's deep regional expertise in Shandong province provides a significant advantage, fostering strong relationships and a nuanced understanding of local economic needs. This localized focus translates into a stable and loyal customer base, underpinning consistent asset growth and a resilient deposit foundation.

The bank's strategic investment in digital transformation is a key strength, evidenced by its dedicated technology financial centers and the development of innovative digital products tailored for the tech sector. This forward-looking approach enhances service delivery and market competitiveness.

Qilu Bank's commitment to green finance, exemplified by its recognized 'Low Carbon Benefit Loan' product, aligns with national environmental policies and positions it favorably for sustainable growth. This dedication to eco-friendly financing is a growing differentiator.

The bank exhibits robust financial health, with total assets exceeding 600 billion yuan by the end of 2023. Its strong asset quality, marked by a low non-performing loan ratio of 1.26% and a high provision coverage ratio of 303.58%, demonstrates prudent risk management and financial stability.

| Key Strength | Description | Supporting Data |

| Regional Focus | Deep understanding and presence in Shandong province. | Strong relationships with local businesses and government. |

| Digital Transformation | Investment in fintech and digital product development. | Dedicated technology financial branches and centers. |

| Green Finance | Support for environmental initiatives and policies. | 'Low Carbon Benefit Loan' recognized on 2024 Shandong 'Haopin Financial' list. |

| Financial Performance | Solid asset growth and asset quality. | Total Assets: >600 billion yuan (End of 2023); NPL Ratio: 1.26%; Provision Coverage: 303.58%. |

What is included in the product

Provides a clear SWOT framework for analyzing Qilu Bank’s business strategy, detailing its internal capabilities and external market environment.

Offers a clear, actionable roadmap for Qilu Bank by pinpointing key strengths and weaknesses to leverage opportunities and mitigate threats.

Weaknesses

While Qilu Bank's deep roots in Shandong province are a core strength, this intense regional focus also creates a significant concentration risk. The bank's operations are predominantly within this single province, leaving it highly exposed to any economic slowdowns, regulatory shifts, or market saturation specific to Shandong. This lack of geographical diversification could hinder its future growth prospects and amplify its vulnerability to localized economic shocks.

The Chinese banking sector, particularly city commercial banks, has been contending with declining market interest rates throughout 2024. This environment inherently squeezes net interest margins (NIMs), impacting the core profitability derived from lending and deposit-taking activities.

Qilu Bank, while actively supporting the real economy, is not immune to this industry-wide challenge. The downward pressure on interest rates is anticipated to affect its NIM, potentially creating headwinds for its overall financial performance in the near term.

Qilu Bank, operating as a city commercial bank, contends with significant competitive pressures from larger state-owned and joint-stock banks. These established institutions benefit from substantial capital reserves, extensive branch networks, and a wider array of financial products and services. For instance, in 2023, the total assets of China's "Big Four" state-owned banks exceeded 100 trillion RMB, dwarfing the asset base of regional banks like Qilu Bank.

This disparity in resources allows larger competitors to frequently offer more attractive interest rates on deposits and loans, and to invest more heavily in cutting-edge digital banking platforms. Consequently, Qilu Bank may find it challenging to retain customers, particularly those seeking premium services or the most competitive pricing, thereby impacting its market share in key business and retail segments.

Challenges in Managing Asset Quality in Specific Sectors

While Qilu Bank's non-performing loan ratio remains manageable, the broader Chinese economic landscape presents significant headwinds. A prolonged downturn in the property market and elevated local government debt are structural challenges that cannot be ignored. City commercial banks, including Qilu Bank, may have substantial exposure to these vulnerable sectors, potentially impacting overall asset quality.

Maintaining strong asset quality for Qilu Bank hinges on its capacity for prudent risk management, especially within these economically sensitive areas. For instance, as of the first quarter of 2024, the property sector's contribution to GDP growth remained subdued, and local government debt levels continued to be a point of concern for financial stability.

- Property Market Vulnerability: Continued weakness in real estate could increase loan defaults for Qilu Bank.

- Local Government Debt: High levels of local government debt pose a systemic risk that could spill over to the banking sector.

- Sectoral Concentration: City commercial banks often exhibit higher concentrations in sectors like property, amplifying risk.

- Risk Management Efficacy: Qilu Bank's ability to navigate these challenges will be tested by its risk mitigation strategies.

Reliance on Traditional Banking Models Amid Fintech Disruption

Qilu Bank, like many traditional financial institutions, faces the challenge of adapting to a rapidly evolving fintech landscape. While the bank is making strides in digital transformation, the broader banking sector, particularly in China, is seeing significant disruption from agile fintech firms and digital banks. These new players often boast lower overheads, innovative approaches, and a keen focus on customer experience, potentially leaving Qilu Bank less nimble in responding to swift technological shifts and changing consumer demands.

For instance, by the end of 2024, the digital banking sector in China is projected to continue its aggressive growth, with estimates suggesting that over 80% of new customer acquisitions for retail banking could be driven by digital channels. Qilu Bank's continued, albeit decreasing, reliance on traditional operational models could therefore pose a weakness if it hinders its ability to compete effectively with these digitally native competitors.

- Digital Disruption: Fintech companies are rapidly innovating, offering streamlined services that challenge traditional banking.

- Agility Gap: Traditional models may struggle to match the speed and user-centricity of new digital entrants.

- Customer Expectations: Evolving customer preferences for seamless digital interactions require constant adaptation.

Qilu Bank's intense regional focus on Shandong province presents a significant concentration risk, making it vulnerable to localized economic downturns and regulatory changes. This lack of geographical diversification could impede future growth and amplify its susceptibility to regional economic shocks.

The bank also faces intense competition from larger financial institutions with greater capital, wider networks, and more advanced digital platforms. This disparity can make it difficult to attract and retain customers, especially those seeking premium services or the most competitive rates, potentially impacting market share.

Furthermore, Qilu Bank, like other city commercial banks, is exposed to systemic risks stemming from China's property market weakness and high local government debt. Maintaining strong asset quality will depend heavily on its risk management capabilities in these sensitive sectors.

Finally, the rapid evolution of fintech poses a challenge. If Qilu Bank cannot match the agility and digital innovation of new entrants, it risks falling behind in meeting changing customer expectations for seamless digital banking experiences.

Same Document Delivered

Qilu Bank SWOT Analysis

This is the actual Qilu Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the bank's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

Opportunities

China's strategic emphasis on five key financial sectors – fintech, green finance, inclusive finance, pension finance, and digital finance – presents a significant opportunity for Qilu Bank. By aligning its operations with these national priorities, Qilu Bank can tap into burgeoning markets and gain a competitive edge.

Qilu Bank's existing investments in green finance and its commitment to technology-driven growth position it favorably to capitalize on these national directives. This strategic alignment can unlock new revenue streams and foster innovation in its product and service portfolio.

For instance, the push for green finance saw China's outstanding green loans grow by 20.5% year-on-year to reach 31.05 trillion yuan (approximately $4.3 trillion USD) by the end of the first quarter of 2024, according to the People's Bank of China. Qilu Bank's participation in this sector can attract substantial capital and policy support, enhancing its financial performance.

Qilu Bank's commitment to strategic emerging industries and high-tech talent development positions it well for China's shift towards high-quality development. By increasing lending and investment in these innovative sectors, the bank can tap into higher-growth loan portfolios and actively contribute to regional economic transformation. For instance, in 2023, Qilu Bank's loans to strategic emerging industries saw a notable increase, reflecting this strategic direction.

Qilu Bank's continued investment in digital transformation, particularly in AI and big data, offers a substantial runway for growth. By leveraging these technologies, the bank can streamline operations, leading to cost savings and increased efficiency. For instance, AI-powered analytics can help identify and mitigate risks more effectively, a crucial aspect in the current financial landscape.

This technological push also allows for hyper-personalized customer experiences, a key differentiator in attracting and retaining clients. Imagine AI chatbots providing instant, tailored support or data analytics predicting individual customer needs. This focus on digital innovation is vital for Qilu Bank to stay ahead of the curve and meet the increasingly sophisticated digital expectations of its customer base, especially as digital banking adoption continues to surge globally.

Growth in Wealth Management and Pension Finance Services

The expanding Chinese middle class and overall economic development are fueling a significant rise in demand for wealth management and pension finance services. Qilu Bank is well-positioned to leverage this trend, especially with government backing and supportive policies for pension finance.

This strategic move into non-interest income areas offers a crucial avenue for Qilu Bank to diversify its revenue streams. By developing and offering specialized wealth management and pension products, the bank can effectively mitigate the ongoing pressures faced by traditional net interest margins. For instance, China's wealth management market saw substantial growth, with assets under management reaching approximately RMB 130 trillion (around $18 trillion USD) by the end of 2023, indicating a robust opportunity for expansion.

- Growing Demand: The increasing affluence of China's middle class directly translates to a higher need for sophisticated financial planning and retirement solutions.

- Policy Support: Favorable government initiatives and reforms in the pension finance sector provide a conducive environment for banks like Qilu to innovate and expand their offerings.

- Revenue Diversification: Shifting focus towards wealth management and pension services helps Qilu Bank reduce its reliance on traditional lending income, thereby improving its overall financial resilience.

- Market Potential: With a vast population and a growing awareness of financial security, the potential market for these services in China remains immense, offering significant long-term growth prospects.

Supporting Regional Economic Development and Urbanization

Shandong province's robust economic development and urbanization efforts present significant opportunities for Qilu Bank. The bank can leverage these trends by financing key infrastructure projects and supporting the expansion of small and medium-sized enterprises (SMEs) within the region. This focus on local growth, including its county finance business, allows Qilu Bank to deepen its market penetration and build enduring community trust.

Key opportunities include:

- Financing Urbanization Projects: Qilu Bank can capitalize on Shandong's ongoing urbanization by providing essential funding for new residential developments, commercial centers, and public infrastructure, aligning with provincial development plans.

- SME Support: By offering tailored financial products and services to SMEs, Qilu Bank can tap into the growing entrepreneurial spirit and contribute to job creation and economic diversification in Shandong.

- County Finance Expansion: Strengthening its presence in county-level finance allows Qilu Bank to capture a larger share of the rural and suburban markets, fostering local economic resilience and expanding its customer base.

Qilu Bank can leverage China's strategic focus on key financial sectors like green finance and digital finance to its advantage. By aligning with national priorities, the bank can tap into growing markets and enhance its competitive position, especially as green loans in China reached 31.05 trillion yuan by Q1 2024.

The expansion of the middle class in China fuels a strong demand for wealth management and pension services, presenting Qilu Bank with a significant opportunity for revenue diversification. With China's wealth management market reaching approximately RMB 130 trillion by the end of 2023, this sector offers substantial growth prospects.

Shandong province's economic development and urbanization initiatives provide a fertile ground for Qilu Bank to finance infrastructure and support local SMEs. Deepening its presence in county finance further strengthens its market penetration and community ties.

Threats

China's economic landscape presents a significant headwind, with weak domestic demand and ongoing pressure on businesses. The property market, in particular, remains in a prolonged downturn, a critical factor for financial institutions.

A substantial economic slowdown or a worsening real estate crisis could directly translate into higher non-performing loans for banks like Qilu Bank. This deterioration in asset quality would inevitably impact the bank's profitability and overall financial stability.

For instance, China's GDP growth slowed to 5.2% in 2023, a figure that, while seemingly robust, masks underlying weaknesses. If this trend continues or reverses, it could exacerbate the risks associated with property sector exposure for Qilu Bank.

Intensifying regulatory scrutiny presents a significant threat to Qilu Bank. Evolving frameworks, including new capital regulations and ongoing oversight of risk control, could necessitate costly adjustments. For example, the Total Loss-Absorbing Capacity (TLAC) requirements, slated for implementation in 2025, may place additional capital adequacy pressures on smaller banks like Qilu Bank, potentially impacting its lending capacity and profitability.

The financial landscape is rapidly evolving, with fintech companies and digital-only banks presenting a formidable challenge to traditional institutions like Qilu Bank. These agile competitors often leverage cutting-edge technology to provide streamlined, cost-effective, and user-friendly financial services, directly impacting Qilu Bank's ability to retain customers, especially in areas like digital payments and online lending. For instance, by mid-2024, the global fintech market was projected to reach over $33 trillion, showcasing the immense scale of this disruptive force.

This digital disruption means Qilu Bank faces pressure to innovate its own offerings to remain competitive. The convenience and often lower fees associated with fintech solutions can draw customers away from established banks. By the end of 2023, digital banking adoption continued its upward trend, with a significant percentage of consumers preferring online channels for transactions, a clear indicator of the shift Qilu Bank must navigate.

Furthermore, integrating advanced AI-based solutions into existing legacy systems presents a significant operational hurdle for traditional banks. This technological gap can slow down innovation and make it difficult to match the speed and responsiveness of newer, digitally native competitors, potentially impacting Qilu Bank's market share and profitability in the coming years.

Credit Risk and Asset Quality Deterioration

While Qilu Bank currently boasts a satisfactory asset quality, ongoing economic uncertainties pose a significant threat. Vulnerabilities in sectors like local government debt and specific industries could escalate credit risk.

A notable rise in non-performing loans, especially from corporate clients or local government financing vehicles, would directly impact Qilu Bank's profitability and capital adequacy. For instance, if non-performing assets were to rise by even 1% from their current levels in late 2024, it could necessitate significant provisioning.

- Economic Headwinds: Persistent global and domestic economic slowdowns increase the likelihood of borrowers defaulting.

- Sector-Specific Risks: Exposure to sectors with high leverage or facing structural challenges, like certain real estate segments or local government financing vehicles (LGFVs), presents a concentrated risk.

- Impact on Profitability: An uptick in NPLs would require higher loan loss provisions, directly reducing net interest income and overall profitability.

- Capital Adequacy Pressure: Deteriorating asset quality can erode a bank's capital base, potentially impacting its ability to lend and its regulatory standing.

Shareholder Holdings Reduction and Market Volatility

A notable trend impacting Qilu Bank involves a potential reduction in shareholder holdings. Recent reports indicate that a significant shareholder, alongside a broader increase in listed bank shareholders, is considering or actively reducing their stake. This could stem from various factors, including concerns about future valuations or capitalizing on recent stock price gains.

While shareholder activity is a natural market occurrence, a persistent pattern of divestment could foster negative market sentiment. This sentiment can directly influence Qilu Bank's stock performance and erode overall investor confidence. For instance, if a major shareholder reduces their stake by a substantial percentage, it might be interpreted by the market as a signal of underlying issues, even if the shareholder's rationale is purely personal or portfolio-driven. As of early 2024, for example, several regional banks in China experienced significant institutional investor sell-offs, contributing to market volatility in the sector.

The implications of such a trend for Qilu Bank are multifaceted:

- Decreased Shareholder Confidence: A large shareholder exiting can signal a lack of faith in future growth prospects.

- Downward Pressure on Stock Price: Increased selling volume without corresponding demand can drive down share prices.

- Impact on Investor Sentiment: Broader market perception of Qilu Bank could sour, making it harder to attract new investors.

- Potential for Increased Volatility: Reduced holdings by key investors can amplify market swings around Qilu Bank's stock.

Intensifying competition from fintech and digital banks poses a significant threat, as these agile players leverage technology for cost-effective services, potentially eroding Qilu Bank's customer base. By mid-2024, the global fintech market was projected to exceed $33 trillion, highlighting the scale of this disruption. Furthermore, evolving regulatory frameworks, such as the 2025 TLAC requirements, could impose additional capital burdens, impacting lending capacity.

Economic headwinds, particularly a prolonged downturn in China's property market and weak domestic demand, present substantial risks. A significant economic slowdown or worsening real estate crisis could lead to an increase in non-performing loans, directly impacting Qilu Bank's profitability and financial stability. China's GDP growth of 5.2% in 2023, while positive, masks underlying economic vulnerabilities that could exacerbate these risks.

A potential reduction in significant shareholder holdings could negatively impact market sentiment and stock performance. If major investors divest, it might be perceived by the market as a signal of underlying issues, potentially leading to increased stock volatility. For instance, several Chinese regional banks experienced institutional sell-offs in early 2024, contributing to sector-wide volatility.

SWOT Analysis Data Sources

This analysis draws from Qilu Bank's official financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and insightful SWOT assessment.