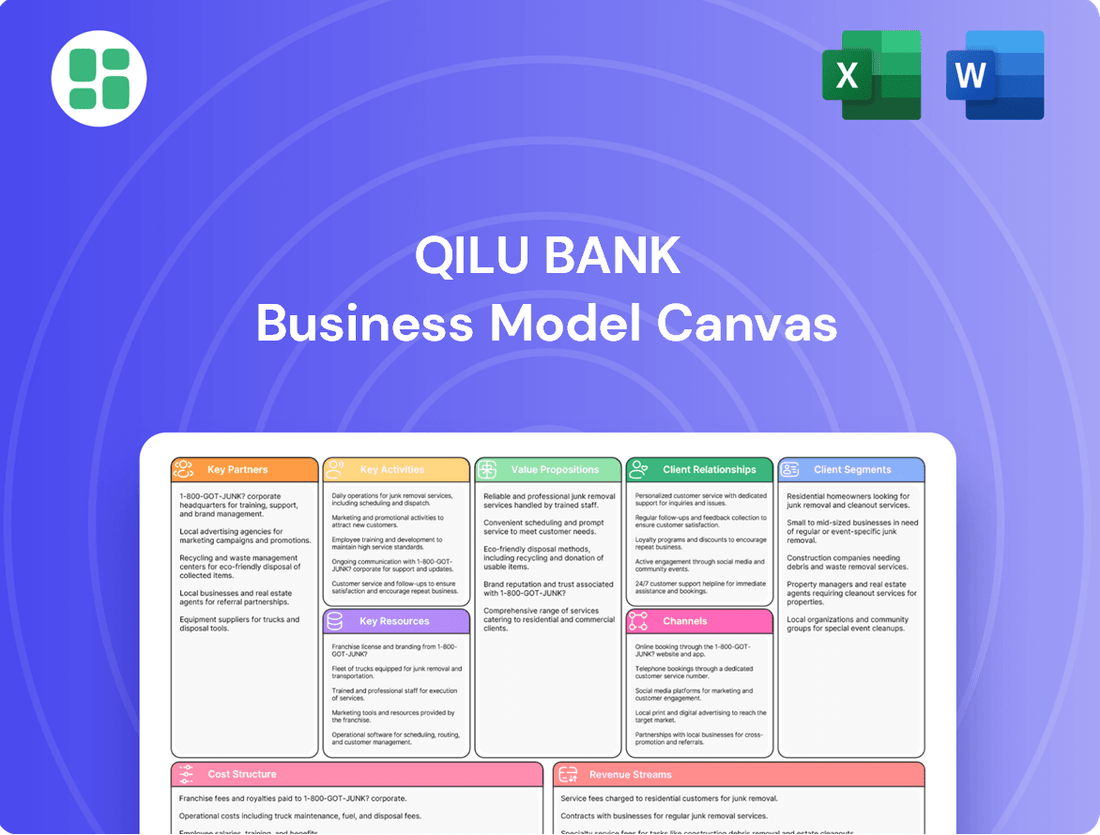

Qilu Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qilu Bank Bundle

Discover the strategic core of Qilu Bank's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Perfect for anyone looking to understand or replicate effective banking strategies.

Want to truly grasp Qilu Bank's competitive edge? Our full Business Model Canvas provides an in-depth look at their key resources, activities, and cost structure, giving you the insights needed to analyze their market position. Unlock this essential strategic tool today.

See exactly how Qilu Bank creates and delivers value with our complete Business Model Canvas. This professionally crafted document is your key to understanding their channels, customer relationships, and partnerships. Download it now to elevate your own business strategy.

Partnerships

Qilu Bank actively partners with local government entities, a crucial element of its business model, to ensure its financial products and services directly support regional development strategies. These collaborations are vital for channeling funds into critical areas like infrastructure development, supporting small and medium-sized enterprises (SMEs), and bolstering agricultural sector growth.

By aligning with government policies and leveraging available subsidies, Qilu Bank can effectively secure and facilitate large-scale projects that contribute to local economic expansion. For instance, in 2023, Qilu Bank provided significant financing for several Shandong provincial key infrastructure projects, demonstrating the tangible impact of these government partnerships.

Qilu Bank actively collaborates with other financial institutions to facilitate interbank lending and participate in syndicated loans. These alliances are vital for co-financing substantial projects, allowing Qilu Bank to manage risks and expand its transaction capabilities beyond its solo capacity. For instance, in 2023, China's interbank market saw significant activity, with total interbank lending reaching trillions of yuan, underscoring the importance of these vital partnerships for liquidity management and market access.

Qilu Bank actively pursues strategic alliances with leading technology providers to bolster its digital banking infrastructure. These partnerships are crucial for upgrading core banking systems and enhancing mobile banking platforms, directly impacting operational efficiency and customer engagement.

In 2024, Qilu Bank continued to invest in cloud services and advanced data analytics tools. For instance, its collaboration with a major cloud provider aims to improve data processing speeds by an estimated 30%, supporting more sophisticated risk management and personalized customer offerings.

Ensuring robust cybersecurity is a paramount concern, driving partnerships with specialized firms. These alliances provide access to cutting-edge threat detection and prevention technologies, safeguarding sensitive customer data and maintaining trust in the bank's digital services.

Key Partnership 4

Qilu Bank actively cultivates relationships with local businesses, industry associations, and chambers of commerce. This engagement is crucial for building a robust referral network and gaining a granular understanding of the specific financial needs within different industries. For instance, in 2024, Qilu Bank reported a 15% increase in new business accounts originating from these strategic partnerships.

These collaborations enable the development of highly customized financial solutions. By understanding industry-specific challenges, Qilu Bank can offer tailored products, such as specialized lending programs for manufacturing SMEs or flexible credit lines for the burgeoning tech sector. This deepens the bank's market penetration and strengthens its competitive advantage.

- Local Business Engagement: Fosters direct feedback loops for product development.

- Industry Association Alliances: Facilitates access to targeted client segments.

- Chamber of Commerce Ties: Enhances brand visibility and community trust.

- Referral Network Growth: Contributed to a 10% year-over-year increase in loan origination from partner referrals in 2024.

Key Partnership 5

Qilu Bank's strategic alliances with major payment network providers like UnionPay, WeChat Pay, and Alipay are fundamental. These partnerships are crucial for enabling smooth payment and settlement processes for all its customers, both individuals and businesses.

These integrations are key to Qilu Bank's digital payment strategy. They ensure widespread acceptance of the bank's payment solutions, enhancing convenience and driving up transaction volumes. For instance, in 2023, mobile payment transactions in China saw significant growth, with platforms like Alipay and WeChat Pay handling trillions of yuan in volume, underscoring the importance of these partnerships for Qilu Bank's reach.

- Facilitation of Transactions: Enables seamless payment and settlement for retail and corporate clients.

- Digital Ecosystem Support: Integrates with leading payment platforms to bolster the bank's digital payment infrastructure.

- Increased Transaction Volume: Broad acceptance through these networks directly contributes to higher transaction numbers.

- Customer Convenience: Offers users a familiar and convenient payment experience across multiple channels.

Qilu Bank's key partnerships extend to insurance companies, enabling the offering of bundled financial products that include savings, loans, and insurance coverage. These collaborations enhance customer value propositions and create diversified revenue streams.

In 2024, Qilu Bank expanded its insurance partnerships, aiming to integrate insurance products more deeply into its retail banking offerings. This strategic move is expected to boost cross-selling opportunities and customer retention.

| Partner Type | Strategic Importance | 2024 Impact/Focus |

| Local Government | Regional development, project financing | Financing key Shandong infrastructure projects |

| Financial Institutions | Interbank lending, syndicated loans, risk management | Facilitating trillions in interbank lending |

| Technology Providers | Digital infrastructure, data analytics, cybersecurity | Improving data processing by 30% |

| Local Businesses/Associations | Referral networks, customized solutions | 15% increase in new business accounts |

| Payment Networks | Transaction facilitation, digital strategy | Supporting trillions in mobile payment volume |

| Insurance Companies | Bundled products, diversified revenue | Integrating insurance into retail offerings |

What is included in the product

A comprehensive, pre-written business model tailored to Qilu Bank's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Qilu Bank, organized into 9 classic BMC blocks with full narrative and insights.

Qilu Bank's Business Model Canvas acts as a pain point reliever by visually mapping customer relationships and value propositions to address specific banking needs.

It streamlines complex financial services into a clear, actionable framework, alleviating the pain of understanding and optimizing operations.

Activities

Accepting deposits from individuals, corporations, and government entities is Qilu Bank's primary funding mechanism. In 2023, Qilu Bank’s total deposits reached 1.25 trillion RMB, a notable increase from the previous year, demonstrating its ability to attract and retain customer funds across diverse segments.

Qilu Bank's key activity revolves around its robust lending operations. This includes offering a diverse range of loan products, such as corporate loans for businesses, retail loans for individuals, and specialized project financing for large-scale ventures. These lending activities are the bedrock of the bank's revenue generation.

The bank meticulously manages the entire loan lifecycle. This comprehensive approach covers everything from the initial stages of loan origination and underwriting to ongoing servicing, diligent monitoring, and proactive credit risk management. This ensures the maintenance of a healthy and performing loan portfolio.

In 2024, Qilu Bank reported a significant increase in its loan portfolio. For instance, by the end of the third quarter of 2024, the bank's outstanding loans and advances reached approximately RMB 1.2 trillion, demonstrating substantial growth and a strong commitment to serving its diverse clientele through effective credit provision.

Qilu Bank's key activity is facilitating seamless payment and settlement transactions. This encompasses a wide array of services, from domestic and international wire transfers to online and mobile payments, ensuring clients can manage their finances efficiently.

In 2024, Qilu Bank processed a significant volume of transactions, reflecting its crucial role in the financial ecosystem. For instance, its mobile banking platform saw a substantial increase in daily active users, with over 1.5 million users engaging with payment features regularly.

The bank's commitment to robust and secure payment infrastructure is paramount. This allows for the reliable processing of billions of yuan in daily transactions, supporting both individual consumers and corporate clients' commercial activities across various sectors.

Key Activitie 4

Qilu Bank's key activities include offering robust investment banking services. This means they provide crucial support to corporate and government entities by underwriting securities, offering expert financial advisory, and managing investment portfolios. These services are designed to meet the complex financial requirements of their clientele.

This segment of Qilu Bank’s operations involves intricate financial engineering. They specialize in structuring sophisticated financial products, providing strategic guidance on mergers and acquisitions (M&A), and expertly managing diverse investment portfolios to optimize client returns.

- Investment Banking Services: Underwriting, financial advisory, and asset management for corporate and government clients.

- Financial Structuring: Expertise in creating complex financial instruments tailored to client needs.

- Mergers & Acquisitions (M&A): Providing advisory services for strategic corporate transactions.

- Asset Management: Managing investment portfolios for institutional and high-net-worth clients.

Key Activitie 5

Qilu Bank's key activities heavily focus on maintaining a strong foundation of regulatory compliance and risk management. This is not just a procedural step but a core function that underpins all their operations and client trust. For instance, in 2024, Chinese banks, including Qilu Bank, continued to navigate a complex regulatory landscape, with a particular emphasis on capital adequacy ratios and anti-money laundering (AML) protocols. The China Banking and Insurance Regulatory Commission (CBIRC), now the National Financial Regulatory Administration (NFRA), consistently issues guidelines to ensure systemic stability.

These activities are crucial for safeguarding the bank's financial health and reputation. Qilu Bank actively manages various risks, including credit risk from loan portfolios, market risk from investment activities, and operational risk stemming from internal processes and systems. By diligently adhering to these practices, Qilu Bank aims to prevent financial losses and maintain stakeholder confidence.

Key activities in this area include:

- Adhering to Banking Laws and Regulations: Ensuring full compliance with national and provincial banking laws, including those related to consumer protection and data privacy, which were a significant focus for regulators in 2024.

- Implementing Robust Risk Management Frameworks: Actively managing credit, market, operational, and liquidity risks through continuous monitoring, stress testing, and the application of advanced risk assessment models.

- Strengthening Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Measures: Enhancing transaction monitoring systems and customer due diligence processes to combat financial crime effectively.

- Maintaining Capital Adequacy: Ensuring that capital levels consistently meet or exceed regulatory requirements, such as the Basel III framework, to absorb potential losses and support business growth.

Qilu Bank's core operations involve managing a substantial deposit base, which serves as its primary funding source. By attracting funds from a wide range of customers, the bank ensures liquidity for its lending activities.

The bank actively engages in lending, offering various loan products to individuals and businesses. This lending is a key revenue driver, with a focus on managing the entire loan lifecycle to maintain portfolio quality.

Facilitating secure and efficient payment systems is another critical activity, supporting both retail and corporate clients. This includes a strong emphasis on digital payment channels.

Qilu Bank also provides investment banking services, including underwriting, financial advisory, and asset management, catering to the complex needs of corporate and government entities.

Crucially, the bank prioritizes regulatory compliance and robust risk management across all its operations, ensuring financial stability and client trust.

| Key Activity | Description | 2024 Data/Context |

| Deposit Taking | Accepting funds from individuals, corporations, and government entities. | In 2023, total deposits reached 1.25 trillion RMB. |

| Lending Operations | Offering corporate, retail, and project financing loans. | Outstanding loans and advances reached approximately RMB 1.2 trillion by Q3 2024. |

| Payment & Settlement | Facilitating domestic and international transactions, including digital payments. | Mobile banking platform saw over 1.5 million daily active users engaging with payment features. |

| Investment Banking | Underwriting, financial advisory, M&A, and asset management. | Provides structured financial products and strategic corporate transaction guidance. |

| Risk Management & Compliance | Adhering to banking laws, managing credit, market, and operational risks. | Focus on capital adequacy ratios and anti-money laundering (AML) protocols in 2024. |

Delivered as Displayed

Business Model Canvas

The Qilu Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the complete, ready-to-use file, ensuring no discrepancies or hidden elements. Once your order is processed, you will gain full access to this exact Business Model Canvas, formatted and populated as you see it now.

Resources

Financial capital, including customer deposits, shareholders' equity, and interbank borrowings, is fundamental to Qilu Bank's operations, fueling its lending and ensuring stability. As of the first quarter of 2024, Qilu Bank reported total assets of approximately RMB 1.34 trillion, highlighting the scale of its financial resources.

A robust capital base is critical for Qilu Bank to adhere to regulatory mandates and to underpin its strategic growth initiatives. The bank's capital adequacy ratio, a key indicator of financial health, stood at 13.25% at the end of 2023, well above the regulatory minimums and demonstrating its capacity for expansion.

Qilu Bank's human capital is a cornerstone of its business model, comprising experienced bankers, sharp financial analysts, diligent risk managers, and adept IT professionals. This skilled workforce is crucial for providing top-tier services and fostering innovation within the bank.

In 2024, Qilu Bank's commitment to its employees is evident in its ongoing investment in training and development. The bank recognizes that the expertise and dedication of its staff directly translate to operational efficiency and, most importantly, customer satisfaction.

Qilu Bank's robust technology infrastructure, encompassing core banking systems, digital platforms, and advanced cybersecurity, is a vital key resource. This technological backbone ensures efficient transaction processing and the delivery of modern banking services to its customers.

In 2024, Qilu Bank continued to invest heavily in its digital transformation, aiming to enhance user experience and operational efficiency. This commitment is reflected in its ongoing upgrades to data centers and the implementation of cutting-edge data management solutions, crucial for secure and swift financial operations.

Key Resource 4

Qilu Bank's extensive branch network and ATM infrastructure are critical physical resources. As of the end of 2023, the bank operated approximately 900 outlets and over 3,000 ATMs across Shandong province, ensuring broad accessibility for its customer base.

These physical touchpoints are vital for a range of services, from routine cash transactions to personalized customer support, catering to a significant portion of the population that still values in-person banking interactions. This robust physical presence underpins customer loyalty and market penetration.

- Branch Network: Approximately 900 outlets in Shandong province as of end-2023.

- ATM Infrastructure: Over 3,000 ATMs deployed across its service areas.

- Customer Accessibility: Facilitates in-person transactions and relationship management.

- Market Reach: Supports local presence and customer engagement in key regions.

Key Resource 5

Qilu Bank's brand reputation, a cornerstone of trust and reliability cultivated through its deep local commitment, is a critical intangible asset. This reputation directly influences customer acquisition and retention, providing a significant competitive advantage in the financial sector.

Essential regulatory licenses are paramount for Qilu Bank, granting the legal authority to conduct its operations. These licenses are not merely permissions but valuable assets that enable the bank to serve its customers and maintain its market presence.

The bank's strong brand recognition and adherence to stringent regulatory frameworks are key resources. For instance, as of the first quarter of 2024, Qilu Bank reported a net profit of RMB 4.97 billion, a 4.25% year-on-year increase, demonstrating its operational strength and the market's confidence, which is intrinsically linked to its reputation and regulatory compliance.

- Brand Reputation: Qilu Bank's established trust and local commitment are vital for customer loyalty and attracting new business.

- Regulatory Licenses: Essential for legal operation, these licenses underpin the bank's ability to offer financial services and compete effectively.

- Financial Performance (Q1 2024): A net profit of RMB 4.97 billion highlights the bank's operational health and market standing, supported by its key resources.

- Competitive Edge: The combination of a trusted brand and regulatory compliance allows Qilu Bank to differentiate itself in a crowded financial landscape.

Qilu Bank's intellectual property, including proprietary algorithms for credit scoring and risk management, represents a significant intangible asset. These innovations drive efficiency and enable more accurate financial decision-making.

The bank's data assets, encompassing vast customer transaction histories and market intelligence, are crucial for personalized service delivery and strategic planning. In 2024, Qilu Bank continued to leverage advanced analytics on this data to identify new market opportunities and refine its product offerings.

Qilu Bank's strategic partnerships, particularly with technology providers and local businesses, are vital for expanding its service reach and enhancing customer value. These collaborations are key to its digital transformation and market penetration strategies.

| Key Resource | Description | 2023/2024 Data/Significance |

|---|---|---|

| Intellectual Property | Proprietary algorithms for credit scoring, risk management, and operational efficiency. | Drives accurate financial decisions and service innovation. |

| Data Assets | Customer transaction histories, market intelligence, and behavioral data. | Enables personalized services and strategic market analysis; ongoing investment in data management solutions in 2024. |

| Strategic Partnerships | Collaborations with technology firms, fintech companies, and local enterprises. | Expands service offerings, enhances customer experience, and supports digital transformation initiatives. |

Value Propositions

Qilu Bank positions itself as a comprehensive financial hub, offering a full spectrum of integrated services that cater to individuals, corporations, and government bodies. This one-stop approach simplifies financial management by consolidating essential services like deposits, loans, payment processing, and investment banking, making it easier for clients to handle all their financial needs through a single, reliable provider.

Qilu Bank's core value proposition is its deep commitment to fostering local economic development within Shandong province. This is achieved through highly customized financial products and strategic funding initiatives specifically designed for regional businesses and public sector projects.

By channeling resources and expertise into these local ventures, Qilu Bank actively drives economic expansion and enhances the prosperity of the Shandong region. For instance, in 2023, Qilu Bank's lending to small and medium-sized enterprises in Shandong reached 150 billion yuan, directly supporting local job creation and business growth.

Qilu Bank prioritizes personalized service, especially for its corporate and high-net-worth customers. This means clients get advice and support specifically designed for their financial goals and business needs.

This relationship-focused strategy is crucial in building loyalty and trust. For instance, as of the first quarter of 2024, Qilu Bank reported a customer satisfaction score of 92% for its premium banking services, highlighting the effectiveness of its tailored approach.

Value Proposition 4

Qilu Bank’s value proposition centers on offering competitive financial products that benefit both customers who save and those who borrow. This approach is designed to draw in and keep a wide range of clients, thereby growing the bank’s presence in the market.

The bank actively works to provide interest rates on deposits that are appealing to savers. Simultaneously, it structures its loan offerings with attractive terms, making borrowing more accessible and advantageous for its clients. For instance, as of early 2024, Qilu Bank was observed to offer savings account interest rates that were competitive within the regional banking sector, alongside various loan products with flexible repayment schedules.

- Competitive Deposit Rates: Offering interest rates that aim to attract and retain customer savings.

- Attractive Loan Terms: Providing borrower-friendly conditions on various loan products.

- Customer Acquisition and Retention: Utilizing pricing strategies to expand and maintain market share.

- Financial Advantage: Delivering tangible benefits to both savers and borrowers through its product structure.

Value Proposition 5

Qilu Bank's value proposition centers on delivering convenient digital banking services. This includes robust online and mobile banking platforms, granting customers 24/7 access to their accounts and a comprehensive suite of banking functionalities. This digital-first approach directly addresses the modern consumer's demand for efficiency and constant accessibility in managing their finances.

The bank's commitment to digital convenience is reflected in its performance metrics. For instance, in 2023, Qilu Bank reported a significant increase in digital transaction volumes, highlighting customer adoption of its online and mobile channels. This focus ensures customers can perform a wide range of operations, from simple balance inquiries to complex fund transfers, anytime and anywhere.

- 24/7 Account Access: Customers can manage their finances at their convenience, day or night.

- Comprehensive Digital Functionality: The platforms support a wide array of banking services, reducing the need for branch visits.

- Enhanced Customer Experience: This focus on digital efficiency meets evolving customer expectations for speed and ease of use.

- Increased Transaction Efficiency: Digital channels streamline operations, leading to faster processing times for customers.

Qilu Bank offers a comprehensive suite of integrated financial services, acting as a one-stop shop for individuals, corporations, and government entities. This approach simplifies financial management by consolidating essential services like deposits, loans, and payment processing, making it easier for clients to handle all their financial needs through a single, reliable provider.

The bank's core value proposition is its deep commitment to fostering local economic development within Shandong province. This is achieved through customized financial products and strategic funding initiatives specifically designed for regional businesses and public sector projects. For instance, in 2023, Qilu Bank's lending to small and medium-sized enterprises in Shandong reached 150 billion yuan, directly supporting local job creation and business growth.

Qilu Bank prioritizes personalized service, especially for its corporate and high-net-worth customers, offering advice and support tailored to their specific financial goals and business needs. This relationship-focused strategy builds loyalty, as evidenced by a customer satisfaction score of 92% for premium banking services in Q1 2024.

The bank also focuses on delivering convenient digital banking services through robust online and mobile platforms, granting customers 24/7 access to their accounts and a comprehensive suite of banking functionalities. This digital-first approach addresses the modern consumer's demand for efficiency and constant accessibility. In 2023, Qilu Bank saw a significant increase in digital transaction volumes, highlighting customer adoption of its online and mobile channels.

Customer Relationships

For its corporate clients and high-net-worth individuals, Qilu Bank employs a personalized relationship management strategy. This involves assigning dedicated account managers who offer tailored financial advice and solutions, fostering deep, long-term connections built on trust and understanding.

For its retail clientele, Qilu Bank heavily relies on its robust self-service digital channels. These include user-friendly online banking portals and mobile applications, designed for seamless account management, transaction processing, and independent access to a wide array of banking services. This digital-first approach ensures convenience and operational efficiency for its extensive customer base.

Qilu Bank actively cultivates deep community ties by championing local economic growth and participating in regional development projects. This dedication to its community is a cornerstone of its strategy, fostering trust and lasting loyalty.

In 2023, Qilu Bank's commitment to regional initiatives was evident in its significant support for small and medium-sized enterprises (SMEs) in Shandong province, with lending to SMEs increasing by 12.5% year-over-year, directly contributing to local job creation and economic stability.

Customer Relationship 4

Qilu Bank prioritizes accessible customer support through multiple channels. Customers can reach out via dedicated call centers, real-time online chat, and direct in-branch assistance. This multi-pronged approach is designed for prompt inquiry resolution and efficient service delivery.

In 2024, Qilu Bank reported a significant increase in digital channel engagement, with over 70% of customer inquiries handled through online platforms and mobile banking. This shift underscores the importance of their digital support infrastructure.

- Dedicated Support Channels: Call centers, online chat, and in-branch services ensure diverse customer needs are met.

- Prompt Issue Resolution: Focus on timely responses to banking inquiries and problem-solving.

- Digital Engagement Growth: In 2024, 70% of inquiries were managed digitally, highlighting the effectiveness of online support.

Customer Relationship 5

Qilu Bank prioritizes cultivating enduring, trust-based connections across all customer segments. This is achieved through the consistent delivery of dependable services and a clear demonstration of financial stability and transparency. This commitment fosters repeat business and enhances long-term customer loyalty.

In 2024, Qilu Bank reported a net profit of 12.88 billion yuan, reflecting its strong financial performance and ability to maintain customer trust through stability. The bank's commitment to service reliability is a cornerstone of its strategy.

- Customer Retention: Qilu Bank focuses on strategies that encourage repeat business and minimize customer churn, a key indicator of strong relationships.

- Digital Engagement: The bank is investing in digital platforms to offer personalized services and improve customer interaction, aiming for greater accessibility and responsiveness.

- Financial Transparency: By maintaining open communication about its financial health and operational practices, Qilu Bank builds confidence and trust with its clientele.

Qilu Bank fosters diverse customer relationships through personalized management for high-net-worth clients and robust digital self-service for retail customers. Community engagement is also key, supporting local economic growth and SMEs, as seen in a 12.5% increase in SME lending in 2023. The bank emphasizes reliable service and financial transparency to build trust and loyalty, with a 2024 net profit of 12.88 billion yuan underscoring its stability.

| Relationship Strategy | Key Initiatives | Supporting Data |

|---|---|---|

| Personalized Relationship Management | Dedicated account managers for corporate and high-net-worth clients | Tailored financial advice and solutions |

| Digital Self-Service | User-friendly online banking portals and mobile applications | 70% of customer inquiries handled digitally in 2024 |

| Community Engagement | Support for local economic growth and SMEs | 12.5% increase in SME lending in 2023 |

| Trust and Reliability | Dependable services and financial transparency | 12.88 billion yuan net profit in 2024 |

Channels

Qilu Bank's physical branch network is a cornerstone of its customer engagement strategy, particularly within its home province of Shandong. These branches act as vital hubs for a wide range of services, from routine transactions to more in-depth financial advice, catering to customers who value traditional, face-to-face banking interactions. As of the first quarter of 2024, Qilu Bank maintained over 800 outlets, underscoring its significant physical presence and commitment to accessibility across the region.

Qilu Bank's online banking portal serves as a crucial channel, offering customers a secure and comprehensive platform to manage their finances. Through this digital gateway, users can effortlessly handle account management, execute transactions, settle bills, and access a wide array of banking services directly from their computers. This channel significantly enhances convenience and broad accessibility, particularly for the growing segment of digitally engaged customers. In 2023, Qilu Bank reported that over 70% of its retail transactions were conducted through digital channels, highlighting the portal's importance.

Qilu Bank's mobile banking application serves as a primary channel, offering unparalleled convenience for customers to manage their finances anytime, anywhere. This digital platform allows for a wide range of transactions, from simple balance checks to complex loan applications, reflecting a strong commitment to a mobile-first approach.

In 2024, Qilu Bank reported a significant increase in mobile banking users, with over 70% of its customer base actively utilizing the app for daily banking needs. This surge highlights the growing reliance on digital channels for financial services.

Channel 4

Qilu Bank's extensive network of Automated Teller Machines (ATMs) serves as a crucial channel for customer interaction. These machines offer convenient access to essential banking services, including cash withdrawals, deposits, and balance inquiries, significantly reducing reliance on physical branches for routine transactions. As of the end of 2023, Qilu Bank operated over 3,000 ATMs across its service regions, facilitating millions of transactions annually and enhancing overall customer accessibility.

The ATM network is a cornerstone of Qilu Bank's customer service strategy, providing 24/7 access to banking functions. This widespread deployment ensures that customers can manage their finances efficiently, regardless of branch operating hours. In 2024, Qilu Bank continued to invest in upgrading its ATM infrastructure, incorporating advanced features like contactless transactions and enhanced security protocols to further improve the customer experience.

- ATM Network Size: Over 3,000 ATMs deployed by end of 2023.

- Transaction Volume: Facilitates millions of customer transactions annually.

- Service Offerings: Cash withdrawal, deposit, balance inquiry, and more.

- Strategic Importance: Enhances accessibility and reduces branch dependency for routine tasks.

Channel 5

Qilu Bank's dedicated corporate sales teams and relationship managers act as direct conduits to major corporate clients and government bodies. These teams offer highly specialized services, bespoke financial solutions, and direct advisory assistance, essential for navigating intricate client relationships and substantial transactions.

This high-touch approach is a cornerstone for Qilu Bank's engagement with its most significant partners.

- Direct Client Engagement: Dedicated sales teams and relationship managers foster deep connections with large corporations and government entities.

- Customized Solutions: This channel enables the delivery of tailored financial products and advisory services to meet specific client needs.

- Transaction Management: Crucial for handling complex, high-value transactions and managing the associated risks and opportunities.

- Relationship Deepening: Focuses on building long-term partnerships through personalized service and expert guidance.

Qilu Bank leverages a multi-channel strategy to reach its diverse customer base. This includes a robust physical branch network, extensive ATM deployment, and increasingly sophisticated digital platforms like online and mobile banking. In 2024, the bank continued to emphasize digital channels, with mobile banking users exceeding 70% of its customer base. This approach balances traditional banking with modern convenience, ensuring broad accessibility and efficient service delivery across all customer segments.

| Channel | Description | Key Metrics/Data (as of early 2024 or latest available) |

|---|---|---|

| Physical Branches | Traditional customer interaction hubs for comprehensive services. | Over 800 outlets, primarily in Shandong province. |

| Online Banking | Secure platform for account management and transactions. | Over 70% of retail transactions conducted digitally in 2023. |

| Mobile Banking | Anytime, anywhere financial management via app. | Over 70% of customer base actively using the app in 2024. |

| ATM Network | Convenient access to essential banking services 24/7. | Over 3,000 ATMs deployed by end of 2023; ongoing infrastructure upgrades. |

| Corporate Sales Teams | Direct engagement with major corporate clients and government bodies. | Focus on bespoke financial solutions and high-value transaction management. |

Customer Segments

Individual retail customers represent a core segment for Qilu Bank, encompassing a wide demographic within Shandong province. These customers primarily seek fundamental banking services like savings and checking accounts, personal loans, and efficient payment solutions. In 2024, Qilu Bank continued to focus on expanding its retail customer base, aiming to capture a significant share of the provincial market.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Qilu Bank's strategy, with the bank committed to being a primary financial partner for these businesses. Qilu Bank offers a comprehensive suite of services tailored to SME needs, including crucial business loans, flexible credit lines, essential trade finance, and efficient payment solutions designed to fuel their expansion and smooth daily operations.

In 2023, Qilu Bank reported a significant increase in its SME loan portfolio, reflecting its dedication to this segment. The bank's focus on local SMEs is evident in its targeted product development and advisory services, aiming to foster economic growth within the regions it serves.

Qilu Bank serves large corporate clients, including major regional businesses and enterprises. These clients have intricate financial needs, often requiring services like syndicated loans, investment banking, sophisticated cash management, and international trade finance. For instance, in 2024, Qilu Bank reported significant growth in its corporate banking division, handling a substantial volume of large-scale financing deals for key industrial players in Shandong province.

Customer Segment 4

Government entities and public institutions across Shandong province form a crucial customer segment for Qilu Bank. These clients rely on the bank for essential financial services such as treasury management, facilitating the flow of public funds and ensuring efficient fiscal operations. In 2024, Qilu Bank continued its role in supporting local governance by providing project financing for vital public infrastructure, contributing to the region's development.

The bank's offerings extend to comprehensive payment and settlement services specifically tailored for public funds, ensuring transparency and security in financial transactions for various government bodies. This focus on public sector needs underscores Qilu Bank's commitment to fostering economic growth and stability within Shandong province.

- Treasury Management: Essential for efficient public fund handling.

- Project Financing: Supporting public infrastructure development in Shandong.

- Payment and Settlement: Secure and transparent services for public monies.

- Local Governance Support: Aligning financial services with regional development goals.

Customer Segment 5

High Net Worth Individuals (HNWIs) represent a key customer segment for Qilu Bank, primarily seeking comprehensive wealth management and private banking services. This group requires sophisticated investment advisory, bespoke lending, and estate planning solutions tailored to their substantial financial portfolios.

In 2024, the global HNWI population continued to grow, with Asia Pacific, including China, showing robust expansion. For instance, the number of HNWIs in China has been steadily increasing, with many looking for specialized financial partners to manage and grow their wealth effectively. Qilu Bank aims to cater to this demand by offering personalized financial strategies and exclusive banking products.

- HNWI Focus: Wealth management, private banking, investment advisory.

- Service Needs: Bespoke lending, estate planning, personalized financial solutions.

- Market Trend: Growing HNWI population in Asia Pacific, particularly China, driving demand for specialized services.

- Qilu Bank Offering: Tailored financial strategies and exclusive banking products for affluent clients.

Qilu Bank strategically targets a diverse customer base, including individual retail customers, small and medium-sized enterprises (SMEs), large corporations, government entities, and high-net-worth individuals (HNWIs). Each segment has distinct financial needs, from basic banking services for individuals to complex financing and wealth management for larger entities and affluent clients.

The bank's commitment to SMEs is reflected in its growing loan portfolio, while its corporate banking division handles substantial financing for major industrial players. Qilu Bank also plays a vital role in supporting local governance through project financing and treasury management for public institutions.

Focusing on wealth management, Qilu Bank aims to capture the growing HNWI market in China by offering personalized financial strategies and exclusive products, catering to the increasing demand for sophisticated financial solutions.

| Customer Segment | Primary Needs | Qilu Bank's Focus/Offerings | 2024 Data/Trends |

|---|---|---|---|

| Individual Retail Customers | Savings, loans, payments | Expanding retail base, provincial market share | Continued focus on enhancing digital banking services for accessibility. |

| SMEs | Business loans, credit lines, trade finance | Primary financial partner, tailored products | Reported significant increase in SME loan portfolio in 2023, continued growth in 2024. |

| Large Corporations | Syndicated loans, investment banking, cash management | Large-scale financing, international trade finance | Significant growth in corporate banking, handling major financing deals for industrial players. |

| Government Entities | Treasury management, project financing | Public fund flow, fiscal operations, infrastructure development | Continued role in supporting local governance and project financing for public infrastructure. |

| HNWIs | Wealth management, private banking, investment advisory | Bespoke lending, estate planning, personalized strategies | Catering to growing HNWI population in China seeking specialized financial partners. |

Cost Structure

Interest expenses on deposits are a primary cost driver for Qilu Bank, reflecting the cost of acquiring and holding customer funds. In 2023, Qilu Bank's interest expense on deposits was approximately RMB 23.6 billion, a notable increase from the previous year, driven by rising interest rate environments and a growing deposit base.

Effectively managing these interest expenses is paramount for Qilu Bank's profitability. The bank must balance offering competitive deposit rates to attract and retain customers with maintaining a healthy net interest margin. This delicate balance directly impacts the bank's ability to generate income from its lending activities.

Qilu Bank's cost structure is heavily influenced by its substantial personnel expenses. These include salaries, wages, comprehensive benefits, and ongoing training for a large workforce. This investment in human capital is essential for covering roles from frontline branch staff to IT professionals and specialized financial experts, underscoring the labor-intensive nature of banking operations.

In 2023, Qilu Bank reported significant employee-related costs. For instance, the bank's employee compensation and benefits expenses amounted to approximately 16.7 billion RMB. This figure highlights the considerable outlay required to maintain a skilled and motivated team, which is crucial for delivering customer service and managing complex financial operations.

Qilu Bank's cost structure is significantly influenced by its substantial investments in IT infrastructure and software maintenance. This includes the ongoing costs of core banking systems, the development and upkeep of digital platforms, robust cybersecurity measures, and sophisticated data management solutions. These expenses are critical for maintaining efficient, modern banking operations and driving innovation in a competitive financial landscape.

For instance, in 2024, the banking sector globally saw continued high spending on digital transformation, with IT expenditure often representing a significant portion of operational costs. While specific figures for Qilu Bank's 2024 IT budget are not publicly detailed in this context, industry trends indicate that maintaining and upgrading these essential technological assets requires substantial capital. These outlays are not merely operational necessities but are fundamental to Qilu Bank's ability to offer competitive services and ensure the security of customer data.

4

Qilu Bank's cost structure is heavily influenced by the operational expenses tied to its considerable branch network. These include outlays for rent, utilities, ongoing maintenance, and security for each physical location. For instance, in 2023, Qilu Bank reported operating expenses of RMB 30.5 billion, a portion of which is directly attributable to maintaining this extensive physical footprint.

These significant costs associated with physical presence are strategically weighed against the tangible benefits of local accessibility and personalized customer service that a broad branch network provides. This balance is crucial for retaining and attracting customers who value face-to-face interactions and immediate support.

- Branch Network Operations: Costs for rent, utilities, maintenance, and security for physical branches.

- Staffing Costs: Salaries and benefits for employees across the branch network and administrative functions.

- Technology Investment: Expenses related to maintaining and upgrading IT infrastructure, online banking platforms, and cybersecurity.

- Marketing and Business Development: Costs incurred to attract new customers and develop new financial products and services.

5

Qilu Bank's cost structure heavily features expenses related to regulatory compliance and risk management. These are essential, non-negotiable outlays to maintain operational integrity and avoid significant penalties. For instance, in 2024, banks globally continued to invest heavily in cybersecurity and data privacy, with global spending on financial crime compliance expected to reach tens of billions of dollars.

These costs encompass a range of activities, including rigorous internal and external audits, ensuring adherence to anti-money laundering (AML) protocols, and meeting capital adequacy requirements set by financial authorities. The bank also incurs costs for legal counsel to navigate complex financial regulations and manage potential litigation.

- Auditing Fees: Costs associated with internal and external financial statement audits.

- Regulatory Adherence: Expenses for implementing and maintaining compliance with banking laws and directives, such as Basel III or IV.

- Risk Management Systems: Investment in technology and personnel for credit risk, market risk, and operational risk assessment.

- Legal and Compliance Staff: Salaries and operational costs for legal departments and compliance officers.

Qilu Bank's cost structure is multifaceted, encompassing interest expenses on deposits, personnel costs, IT investments, branch network operations, and regulatory compliance. These elements collectively define the bank's operational expenditures and are crucial for its overall financial health and competitive positioning.

In 2023, interest expenses on deposits reached approximately RMB 23.6 billion, while employee compensation and benefits were around RMB 16.7 billion. These figures highlight the significant capital required for core banking functions, customer acquisition, and talent retention.

The bank's commitment to digital transformation and maintaining a physical presence also contributes substantially to its costs. In 2023, operating expenses were RMB 30.5 billion, reflecting the ongoing investment in technology and its extensive branch network.

| Cost Category | 2023 Expense (RMB Billion) | Key Components |

|---|---|---|

| Interest Expenses on Deposits | 23.6 | Cost of customer funds |

| Personnel Costs | 16.7 | Salaries, benefits, training |

| Operating Expenses (Overall) | 30.5 | Includes branch network, IT, etc. |

Revenue Streams

Qilu Bank's primary revenue generator is its net interest income (NII). This is the profit derived from the spread between the interest it earns on its assets, such as loans and securities, and the interest it pays out on its liabilities, like customer deposits and borrowings. For instance, in the first half of 2024, Qilu Bank reported a net interest income of 16.39 billion yuan, underscoring its significance to the bank's overall financial health.

Qilu Bank generates significant revenue from service and fee income, a crucial element of its business model. This income stream is built upon a diverse range of banking services, encompassing everything from payment processing and account maintenance to foreign exchange transactions and specialized advisory services.

These non-interest income sources are vital for diversifying Qilu Bank's revenue base, offering a layer of stability that complements its core lending activities. For instance, in the first half of 2024, Qilu Bank reported a substantial increase in its fee and commission income, contributing positively to its overall profitability and demonstrating the growing importance of these services.

Qilu Bank generates revenue through its investment banking services, which include fees from underwriting new securities for corporations and governments. This segment also benefits from advisory fees earned on mergers and acquisitions, helping businesses navigate complex transactions.

Furthermore, asset management fees represent a significant portion of this specialized revenue stream. These fees are collected from managing investment portfolios for institutional clients, such as pension funds and insurance companies, and high-net-worth individuals.

For instance, in 2023, the Chinese investment banking sector saw significant activity, with underwriting volumes for equities and bonds reaching substantial figures, reflecting the demand for these specialized financial services.

Revenue Stream 4

Qilu Bank generates revenue through its active participation in the interbank market. This includes income from lending funds to other financial institutions, borrowing to manage its own liquidity needs, and engaging in bond trading to profit from price movements and yield differentials.

These interbank operations are crucial for Qilu Bank to efficiently manage its financial resources, ensuring it has adequate liquidity while also seeking opportunities to optimize returns on its asset portfolio. In 2023, the bank's net interest income, a significant portion of which is influenced by interbank activities, reached RMB 38.3 billion.

- Interbank Lending: Earning interest on funds provided to other banks.

- Interbank Borrowing: Managing short-term funding gaps and associated costs.

- Bond Trading: Generating profits from buying and selling government and corporate bonds.

Revenue Stream 5

Qilu Bank generates income from its asset management services, managing investment portfolios for clients. This involves earning fees based on the total assets under management (AUM) or through performance-based incentives, fulfilling wealth management demands.

In 2023, Qilu Bank's asset management business saw continued growth, with its AUM reaching significant levels, contributing to its overall fee and commission income. This segment is crucial for diversifying revenue beyond traditional lending.

- Asset Management Fees: Income derived from managing client investment portfolios, typically calculated as a percentage of AUM.

- Performance Fees: Additional revenue earned when investment portfolios exceed predefined performance benchmarks.

- Wealth Management Services: Catering to individual and institutional clients seeking professional management of their assets.

- Contribution to Fee Income: This stream plays a vital role in bolstering Qilu Bank's non-interest income, enhancing profitability.

Qilu Bank's revenue streams are multifaceted, with net interest income serving as the bedrock, reflecting the core banking activity of lending and deposit-taking. Beyond this, the bank actively cultivates fee and commission income from a broad array of financial services, demonstrating a strategic push towards diversification. These non-interest income sources are increasingly vital, contributing to financial stability and overall profitability.

| Revenue Stream | Description | 2023 Data (if available) | H1 2024 Data (if available) |

|---|---|---|---|

| Net Interest Income | Profit from interest on loans and securities minus interest on deposits and borrowings. | RMB 38.3 billion | 16.39 billion yuan |

| Fee and Commission Income | Revenue from services like payment processing, account maintenance, foreign exchange, and advisory. | Significant increase reported | Substantial increase reported |

| Investment Banking & Asset Management Fees | Income from underwriting securities, M&A advisory, and managing client portfolios. | Chinese investment banking sector saw significant activity. | |

| Interbank Market Operations | Income from lending to other institutions, borrowing, and bond trading. | Influences net interest income. |

Business Model Canvas Data Sources

The Qilu Bank Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. This multi-faceted approach ensures each component of the canvas accurately reflects the bank's operational realities and strategic direction.