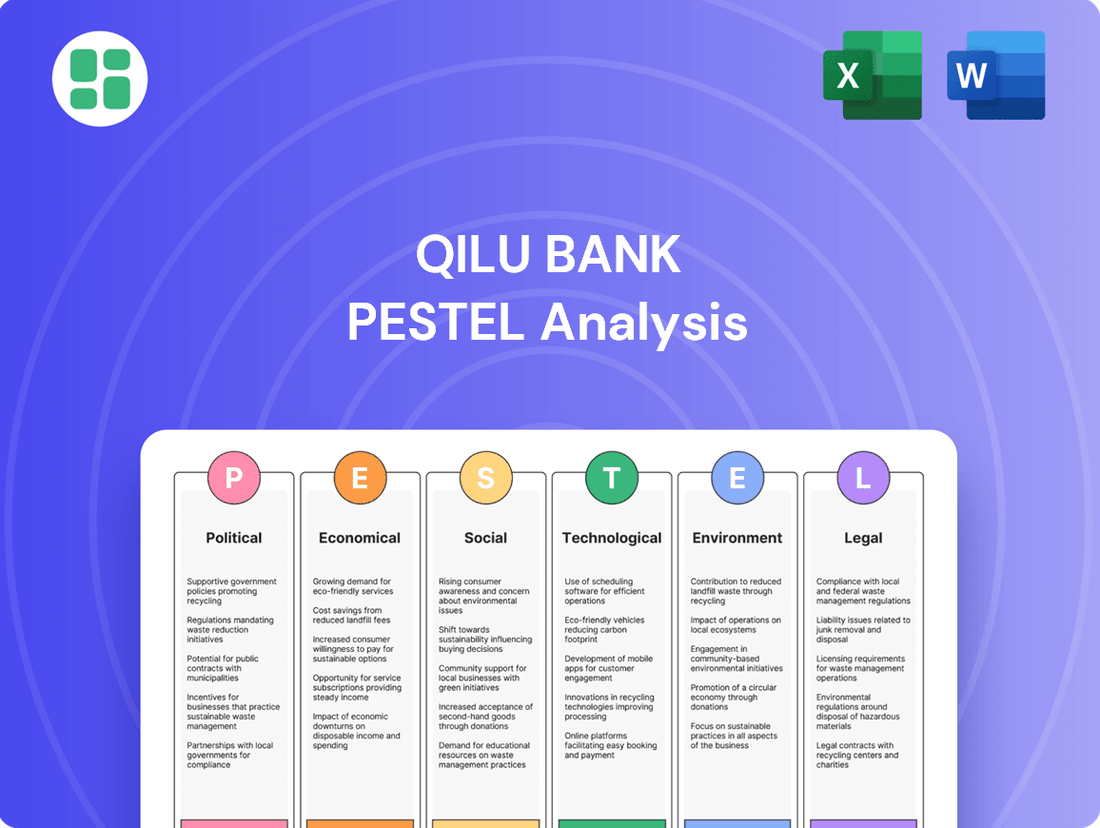

Qilu Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qilu Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Qilu Bank's trajectory. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a decisive market advantage.

Political factors

The Chinese government, spearheaded by entities like the National Financial Regulatory Administration (NFRA), is actively implementing directives to bolster financial stability and mitigate risks, particularly within the realm of smaller and medium-sized financial institutions. This focus directly shapes Qilu Bank's operational landscape and necessitates rigorous adherence to evolving regulatory frameworks.

NFRA's strategic priorities for 2025 underscore an unwavering commitment to orderly risk prevention and the enhancement of regulatory oversight. This proactive stance means Qilu Bank must continuously adapt its risk management strategies and compliance protocols to align with national financial stability objectives.

Qilu Bank, being a city commercial bank rooted in Shandong, benefits from strong backing for regional economic development from both central and local governments. This governmental focus directly aligns with the bank's mission to serve the economic growth of its operating regions.

Shandong province's economic strategy for 2025 is particularly relevant. It emphasizes boosting consumption and enhancing investment effectiveness, alongside fostering new quality productive forces. These priorities translate into significant lending opportunities for Qilu Bank, as businesses in Shandong will likely seek financing to align with these provincial goals.

The People's Bank of China (PBOC) is expected to maintain a supportive and moderately loose monetary policy throughout 2025. This stance is designed to keep liquidity ample and lower borrowing costs for businesses and individuals, directly impacting Qilu Bank’s operational environment.

Potential policy tools include reductions in the Reserve Requirement Ratio (RRR) and benchmark interest rates. For instance, if the PBOC were to lower the RRR by 50 basis points, it could release trillions of yuan in liquidity, potentially boosting Qilu Bank's lending capacity and improving its net interest margins.

Regulatory Tightening on Real Estate Sector

Government initiatives to curb real estate speculation and manage systemic risks are directly impacting financial institutions like Qilu Bank. China's coordinated mechanism for urban real estate financing, aimed at ensuring project completion and developer stability, is a key policy influencing the bank's exposure to the sector. The National Financial Regulatory Administration (NFRA) has explicitly identified mitigating risks within the real estate market as a primary objective for 2025, underscoring the evolving regulatory landscape.

These regulatory actions translate into tangible challenges and opportunities for Qilu Bank's lending practices. For instance, policies encouraging a new development model for the real estate sector, focusing on long-term sustainability rather than rapid expansion, could lead to a recalibration of loan demand and risk profiles. The NFRA's focus on risk mitigation suggests increased scrutiny on loan quality, capital adequacy, and provisioning related to real estate assets.

- Real Estate Financing Mechanism: China's implementation of a coordinated mechanism to ensure stable real estate financing is a critical factor for banks like Qilu.

- NFRA's 2025 Priority: Mitigating real estate risks is a key task for the National Financial Regulatory Administration in the coming year.

- New Development Model: Support for a new, more sustainable real estate development model influences Qilu Bank's loan portfolio strategy.

Green Finance Policy Push

China's commitment to green finance is accelerating, with significant policy backing and regulatory frameworks being implemented. This push encourages financial institutions like Qilu Bank to integrate sustainability into their core operations, fostering growth in green lending and bond markets. For instance, by the end of 2023, outstanding green loans in China reached RMB 30.5 trillion, a 34% increase year-on-year, demonstrating the scale of this initiative.

This policy environment creates both opportunities and obligations for Qilu Bank. The bank is expected to align its lending and investment portfolios with China's national sustainability objectives, potentially leading to increased demand for green financial products and services. The People's Bank of China (PBOC) has been actively promoting green financial standards, including enhanced ESG disclosure requirements for listed companies, which Qilu Bank must navigate.

- Green Loan Growth: China's green loans outstanding hit RMB 30.5 trillion by end-2023, up 34% YoY.

- Policy Support: Government initiatives are actively promoting green bonds and sustainable investment frameworks.

- ESG Disclosure: Increasing emphasis on Environmental, Social, and Governance (ESG) reporting mandates for businesses.

- Market Opportunity: Demand for green financial products is rising, presenting new avenues for Qilu Bank.

Government directives aimed at financial stability, particularly from the National Financial Regulatory Administration (NFRA), are paramount, with a 2025 focus on risk prevention. Qilu Bank's regional economic development is strongly supported by both central and local governments, aligning with Shandong's 2025 economic strategy emphasizing consumption and investment. The People's Bank of China (PBOC) is anticipated to maintain a supportive, moderately loose monetary policy, potentially through RRR and interest rate adjustments, influencing liquidity and borrowing costs.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Qilu Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, aiding strategic decision-making for stakeholders.

A concise, actionable summary of Qilu Bank's PESTLE factors, enabling rapid identification of strategic opportunities and threats to inform better decision-making.

Economic factors

China's economic growth is projected to remain steady in 2025, with government stimulus measures implemented in late 2024 expected to boost both production and consumer demand. This anticipated stability is crucial for Qilu Bank, as it directly impacts the demand for loans and the overall health of its loan portfolio.

China's banking sector, including Qilu Bank, is navigating a low interest rate environment. The People's Bank of China (PBOC) has implemented rate cuts to bolster economic growth, but this directly impacts banks by compressing their net interest margins (NIMs). For instance, China's benchmark one-year loan prime rate was lowered to 3.45% in August 2023, down from 3.55% previously, a move that squeezes the spread banks can earn on loans.

This sustained pressure on NIMs necessitates that Qilu Bank actively optimizes its balance sheet. The bank must focus on managing its asset and liability structures efficiently to maintain profitability. Strategies could include diversifying revenue streams beyond traditional lending and improving the cost-efficiency of its operations to counteract the shrinking interest income.

Shandong province, the core operational area for Qilu Bank, is projecting GDP growth exceeding 5 percent for 2024. This robust economic outlook is further bolstered by the planned launch of significant development projects in 2025, indicating sustained regional expansion.

This dynamic economic environment in Shandong directly translates into enhanced business prospects and potential for credit expansion for Qilu Bank. The province's commitment to development projects suggests a supportive backdrop for financial institutions.

Real Estate Market Conditions

The ongoing downturn in China's real estate sector continues to be a major hurdle for banks, including Qilu Bank. This slump directly affects the quality of bank assets and can lead to higher rates of non-performing loans. For instance, by the end of 2023, outstanding real estate loans in China saw a decline, highlighting the sector's challenges.

Qilu Bank, in common with its peers, must carefully manage the risks associated with this real estate environment. While the situation is complex, there are ongoing initiatives aimed at reducing risks within smaller and medium-sized financial institutions and specifically within real estate financing. These measures are designed to shore up the financial system against these persistent headwinds.

The impact on Qilu Bank's loan portfolio is significant, as real estate exposure often constitutes a substantial portion of a bank's lending. The government's efforts to stabilize the property market, including potential policy adjustments in 2024 and 2025, will be crucial in shaping the bank's operational landscape and asset performance.

Key considerations for Qilu Bank include:

- Asset Quality: Monitoring and managing the non-performing loan ratio stemming from real estate exposures.

- Risk Mitigation: Implementing strategies to reduce the bank's vulnerability to further property market declines.

- Regulatory Environment: Adapting to evolving policies aimed at stabilizing the real estate sector and supporting financial institutions.

- Loan Portfolio Diversification: Exploring opportunities to diversify lending away from over-reliance on the real estate sector.

Consumer Spending and Investment Trends

Consumer spending is showing signs of a rebound, with government initiatives aimed at stimulating consumption and investment beginning to yield positive outcomes. For instance, retail sales for home appliances saw a notable increase in 2024, indicating growing consumer confidence and a willingness to spend on durable goods.

This upward trend in domestic demand directly benefits Qilu Bank by bolstering its retail banking services. Increased consumer spending translates to higher transaction volumes and a greater demand for financial products like personal loans and mortgages. Furthermore, businesses are likely to respond to improved economic conditions with increased investment, creating opportunities for Qilu Bank's corporate lending and investment banking divisions.

- Retail Sales Growth: Home appliance sales jumped significantly in 2024, signaling a positive consumer sentiment.

- Loan Demand: Improved economic conditions are expected to drive increased demand for consumer and business loans.

- Retail Banking Support: Rising consumer spending directly supports Qilu Bank's retail banking operations and product offerings.

China's economic trajectory for 2025 points to continued stability, supported by government stimulus measures from late 2024, which are expected to boost both production and consumer spending. This stability is vital for Qilu Bank, influencing loan demand and the overall health of its loan portfolio.

Shandong province, Qilu Bank's primary operational base, is projected to achieve GDP growth above 5% for 2024, with further expansion anticipated from new development projects in 2025. This regional economic vigor presents Qilu Bank with increased opportunities for credit expansion and business development.

The persistent downturn in China's real estate sector remains a significant challenge, impacting asset quality and potentially increasing non-performing loans for institutions like Qilu Bank. For example, outstanding real estate loans in China decreased by the end of 2023, underscoring the sector's difficulties.

Qilu Bank must navigate these economic factors by focusing on asset quality, risk mitigation, and diversifying its loan portfolio away from over-reliance on the real estate sector, while adapting to evolving regulatory policies aimed at market stabilization.

Same Document Delivered

Qilu Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Qilu Bank's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, including all sections of the Qilu Bank PESTLE analysis.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive PESTLE breakdown for Qilu Bank.

Sociological factors

Consumer demand for convenience and security is rapidly shifting towards digital banking solutions. By 2024, it's projected that over 80% of urban consumers in China will be actively using mobile banking apps for their transactions and inquiries. This trend underscores the critical need for Qilu Bank to continuously invest in and refine its digital platforms to align with these evolving customer expectations and maintain its competitive edge in the market.

China's rapidly aging population, with the number of people aged 65 and over projected to reach 300 million by 2025, presents a significant shift in demand. This demographic trend directly impacts Qilu Bank by increasing the need for specialized financial products such as retirement planning, long-term savings accounts, and healthcare-related financing solutions.

Simultaneously, initiatives to enhance financial inclusion are reshaping the banking landscape. By 2024, China aims to further expand digital financial services, targeting underserved populations and small and medium-sized enterprises (SMEs). Qilu Bank's strategy must therefore focus on leveraging digital platforms to reach these segments, offering accessible and user-friendly banking services to drive growth and market penetration.

Public trust in financial institutions is a cornerstone for deposit growth and the uptake of new banking services. In 2024, surveys indicated that while overall trust in major banks remained relatively stable, a significant portion of the population expressed concerns regarding data privacy and the transparency of fees. This sentiment directly impacts how readily individuals will entrust their savings or adopt digital banking solutions, like those offered by Qilu Bank.

Financial literacy levels also play a critical role in shaping consumer behavior within the banking sector. Data from 2024 suggests that while financial education initiatives are increasing, a considerable segment of the population still struggles with understanding complex financial products and investment strategies. Qilu Bank, like its peers, faces the challenge of simplifying its offerings and actively promoting financial education to foster greater engagement and confidence among its customer base.

Urbanization and Rural Revitalization

Shandong province is experiencing ongoing urbanization, with a significant portion of its population shifting to cities. This trend, coupled with government-led rural revitalization efforts, presents a dual financial landscape. Qilu Bank must navigate these evolving demographics by offering tailored financial products and services to meet the distinct needs of both burgeoning urban centers and revitalized rural communities.

For instance, urban areas often demand sophisticated financial instruments like mortgages, business loans for expanding enterprises, and wealth management services. Conversely, rural revitalization initiatives may require accessible credit for agricultural modernization, support for local small businesses, and financial literacy programs. Qilu Bank’s strategic positioning in Shandong means it plays a crucial role in channeling capital to these diverse economic activities.

By 2023, Shandong's urbanization rate reached approximately 65%. This demographic shift underscores the growing demand for financial services in urban hubs. Simultaneously, the provincial government has allocated substantial funds, with over 10 billion yuan invested in rural revitalization projects in 2024 alone, creating new opportunities for financial institutions to support agricultural and community development.

- Urban Growth: Shandong's urbanization rate continues to climb, increasing demand for urban-centric financial products.

- Rural Investment: Government focus on rural revitalization drives significant capital into agricultural and community development projects.

- Service Adaptation: Qilu Bank needs to offer a spectrum of services, from advanced wealth management in cities to accessible credit in rural areas.

- Economic Support: The bank's ability to cater to both urban and rural financial needs is vital for supporting Shandong's overall economic development.

Demand for Wealth Management Services

As China's middle class continues its expansion, there's a noticeable surge in the need for advanced wealth management and investment banking solutions. This demographic shift, driven by rising disposable incomes and a greater focus on financial planning, creates a fertile ground for financial institutions. For instance, by the end of 2023, China's middle-income group was estimated to comprise over 400 million people, a number projected to grow further.

Qilu Bank, with its expanding portfolio that includes robust investment banking capabilities, is well-positioned to capitalize on this burgeoning demand. The bank's ability to offer a spectrum of services, from basic savings to complex investment strategies and advisory, directly addresses the evolving financial needs of this growing segment. This comprehensive approach allows Qilu Bank to serve as a one-stop shop for individuals seeking to grow and protect their wealth.

The increasing financial literacy and aspirations of this demographic are key drivers. Many are seeking not just capital preservation but also wealth accumulation through diverse investment vehicles. Qilu Bank's strategic focus on these services aligns with the market's trajectory, aiming to capture a significant share of this expanding client base. The bank’s commitment to innovation in financial product development further strengthens its appeal to this sophisticated market.

The increasing emphasis on environmental sustainability and corporate social responsibility is reshaping consumer and investor expectations. By 2024, a growing number of Chinese consumers are actively choosing brands that demonstrate a commitment to eco-friendly practices, influencing Qilu Bank's brand image and product development. This societal shift necessitates that Qilu Bank integrate sustainable finance solutions and transparently communicate its environmental initiatives to resonate with a more conscious customer base.

In 2024, public discourse around data privacy and ethical AI usage significantly impacts consumer trust in financial institutions. Qilu Bank must prioritize robust data protection measures and transparent communication regarding its use of technology to maintain customer confidence. Failure to address these concerns could lead to a decline in digital service adoption and a negative impact on the bank's reputation.

The growing awareness of social equity and inclusive growth is also a key sociological factor. By 2025, initiatives aimed at promoting gender equality in the workplace and supporting underserved communities are expected to gain further traction. Qilu Bank's commitment to diversity and inclusion, both internally and in its product offerings, will be crucial for its long-term social license to operate and its ability to attract a broad customer base.

Technological factors

The Chinese banking sector is rapidly embracing digital transformation, with institutions like Qilu Bank needing to harness AI, big data, and cloud computing. This technological wave is crucial for improving risk management, customer interactions, and overall operational speed. For instance, by Q4 2024, major Chinese banks reported significant increases in digital transaction volumes, with mobile banking accounting for over 80% of customer interactions for some leading institutions.

To stay competitive and cater to evolving customer expectations for seamless digital experiences, Qilu Bank must prioritize investments in these advanced technologies. The adoption of AI-powered fraud detection systems, for example, has been shown to reduce false positives by up to 30% in pilot programs across the industry, directly impacting efficiency and customer trust.

Fintech companies and internet banks are increasingly challenging traditional institutions like Qilu Bank, particularly in fast-growing areas such as digital payments and online lending. For instance, in 2024, the global fintech market was projected to reach over $300 billion, highlighting the scale of this disruption.

To stay competitive, Qilu Bank needs to accelerate its digital transformation, focusing on enhancing its own digital product offerings and exploring strategic partnerships with or acquisitions of fintech firms. This agility is crucial to capture market share from these nimble competitors.

As digitalization accelerates, Qilu Bank faces heightened cybersecurity threats and data privacy demands. Financial institutions are under strict regulations for data security, compelling Qilu Bank to allocate significant resources towards advanced security infrastructure and rigorous compliance measures to safeguard sensitive customer information.

Adoption of AI and Big Data

The increasing adoption of AI and big data analytics is a significant technological factor for financial institutions like Qilu Bank. These technologies are instrumental in refining risk assessment models, enabling more personalized customer interactions, and streamlining operational efficiencies. By integrating AI and big data, Qilu Bank can enhance its processes in loan origination, credit scoring, and overall customer engagement, leading to better decision-making and service delivery.

For instance, in 2024, the financial sector's investment in AI technologies continued to surge, with many banks reporting significant improvements in fraud detection rates and operational cost reductions. Qilu Bank can specifically benefit from these advancements by:

- Developing advanced credit scoring algorithms that utilize a wider range of data points for more accurate risk evaluation.

- Personalizing product offerings and marketing campaigns based on deep customer data analysis, increasing customer satisfaction and loyalty.

- Automating routine tasks in areas like customer service and compliance, freeing up human resources for more complex activities.

- Improving operational efficiency through predictive analytics for resource allocation and identifying potential system failures before they occur.

Development of Digital Currency (e-CNY)

The People's Bank of China's (PBOC) continued pilot of the digital yuan, or e-CNY, is significantly altering the way payments are handled. As of early 2024, the e-CNY had been tested in over 260 application scenarios across more than 20 provinces and cities, with pilot users exceeding 260 million. This digital currency offers potential for faster, cheaper transactions and improved financial inclusion.

For Qilu Bank, this presents a clear imperative to integrate with and adapt to this burgeoning digital currency ecosystem. To remain competitive and relevant in the evolving payment landscape, Qilu Bank must develop strategies to facilitate e-CNY transactions, potentially offering new services or updating existing ones to accommodate this digital form of legal tender. This adaptation is crucial for maintaining its market share and customer base in an increasingly digital financial world.

- Evolving Payment Landscape: The PBOC's e-CNY pilot is a major technological shift, impacting transaction methods and financial infrastructure.

- Integration Necessity: Qilu Bank must integrate with the e-CNY system to process transactions and offer digital yuan services.

- Market Relevance: Adapting to e-CNY is essential for Qilu Bank to maintain its standing and competitiveness in the financial sector.

- Transaction Growth: The widespread adoption of e-CNY could lead to a significant shift in transaction volumes away from traditional channels if banks do not adapt.

Technological advancements are fundamentally reshaping the banking industry, pushing institutions like Qilu Bank to innovate rapidly. The integration of AI and big data analytics is key for enhancing risk management and personalizing customer experiences, with financial sector AI investments surging in 2024. Furthermore, the ongoing pilot of China's digital yuan (e-CNY), which involved over 260 million users by early 2024, necessitates that Qilu Bank adapt its payment systems to remain competitive in this evolving digital currency landscape.

| Technology Area | Impact on Qilu Bank | Key Data/Trend (2024/2025) |

|---|---|---|

| AI & Big Data | Improved risk assessment, personalized services, operational efficiency | Financial sector AI investment growth; enhanced fraud detection rates |

| Digital Payments | Shift in transaction volumes, competition from fintech | Mobile banking accounts for >80% of customer interactions for leading banks |

| Digital Currency (e-CNY) | Necessity for integration, new service opportunities | Over 260 million e-CNY pilot users by early 2024 |

| Cybersecurity | Increased threats, strict data privacy regulations | Ongoing need for robust security infrastructure and compliance |

Legal factors

The establishment of the National Financial Regulatory Administration (NFRA) in 2023 marks a significant shift, consolidating banking and insurance oversight. This means Qilu Bank now operates under a more unified and potentially stringent regulatory regime, requiring strict adherence to its directives on risk management and capital requirements.

For Qilu Bank, compliance with the NFRA's guidelines on capital adequacy ratios, such as maintaining a certain level of capital to absorb unexpected losses, is paramount. For instance, as of the first quarter of 2024, the banking sector's overall capital adequacy ratio remained robust, providing a benchmark for Qilu Bank's own financial health and operational strategies.

New regulations introduced in 2024 for the administration of various loan types, including fixed-asset, working capital, personal, and syndicated loans, directly influence Qilu Bank's operational framework. These measures, alongside updated risk classification standards, are designed to refine how the bank assesses and manages its loan book, impacting its overall asset quality metrics. For instance, enhanced guidelines on provisioning for non-performing loans (NPLs) could necessitate adjustments in Qilu Bank's capital allocation strategies.

Qilu Bank, like all financial institutions, must navigate stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. Ongoing enforcement and updates to these regulations necessitate robust transaction monitoring systems and comprehensive compliance frameworks. For instance, in 2023, Chinese financial regulators continued to emphasize AML/CTF compliance, with penalties for non-compliance remaining a significant deterrent for the sector.

Data Security and Privacy Laws

China's robust focus on data security, exemplified by regulations like the Measures for the Data Security Management of Banking and Insurance Institutions, imposes stringent obligations on financial entities. These measures necessitate meticulous data classification, comprehensive protection strategies, and effective incident response protocols. Qilu Bank, therefore, must prioritize stringent adherence to these legal frameworks to safeguard sensitive customer data and maintain regulatory compliance.

The enforcement of these data security laws directly impacts Qilu Bank's operational procedures and technological investments. Non-compliance can lead to significant penalties, reputational damage, and loss of customer trust. For instance, the Cybersecurity Law of the People's Republic of China, enacted in 2017 and continually updated, sets a precedent for data localization and network security requirements, which Qilu Bank must navigate.

- Data Classification: Qilu Bank must implement a granular system for categorizing data based on sensitivity and importance, aligning with regulatory mandates.

- Protection Measures: This includes employing advanced encryption, access controls, and regular security audits to prevent unauthorized access or breaches.

- Incident Response: Establishing clear procedures for identifying, reporting, and mitigating data security incidents is critical for swift and effective management.

- Regulatory Compliance: Continuous monitoring and adaptation to evolving data privacy and security laws, such as the Personal Information Protection Law (PIPL), are essential for Qilu Bank's sustained operations.

Corporate Governance and Shareholding Regulations

Changes in corporate governance requirements and regulations significantly impact how banks operate and how investors view them. These rules often dictate shareholder behavior, including how much influence major shareholders can exert and the transparency of their transactions. For instance, recent shifts in regulations might encourage or restrict large stake reductions.

Qilu Bank has experienced major shareholders reducing their stakes, a move that can be influenced by evolving regulatory landscapes and market perceptions. Such reductions can signal changes in confidence or strategic realignments, directly affecting the bank's internal management structure and its standing in the financial markets. For example, if a major shareholder pares its stake by a significant percentage, it might trigger closer scrutiny from regulators and investors alike.

- Shareholder Activism: Evolving regulations can empower or constrain shareholder activism, influencing Qilu Bank's strategic decisions.

- Disclosure Requirements: Stricter disclosure rules for major shareholder transactions, like those seen in 2024, enhance transparency but also place greater reporting burdens on entities like Qilu Bank.

- Ownership Limits: Potential changes to ownership limits could affect the concentration of power among Qilu Bank's largest investors.

- Market Perception: Shareholding reductions by key investors, such as the reported decrease in stakes by some major shareholders in Qilu Bank during late 2023 and early 2024, can negatively impact market perception and stock valuation.

Qilu Bank operates within a dynamic legal environment shaped by the consolidation of financial regulation under the National Financial Regulatory Administration (NFRA) since 2023. This new oversight body imposes stricter capital adequacy requirements, with the banking sector's overall capital adequacy ratio remaining robust in Q1 2024 as a key performance indicator for banks like Qilu.

The bank must also adhere to updated regulations on various loan types and risk classification standards, impacting its asset quality management. Furthermore, stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, with continued emphasis on compliance in 2023, necessitate robust monitoring systems.

Data security laws, such as the Measures for the Data Security Management of Banking and Insurance Institutions, require Qilu Bank to implement meticulous data classification and protection strategies, with significant penalties for non-compliance. Evolving corporate governance regulations also influence shareholder behavior and transparency, with major shareholders reducing stakes in Qilu Bank during late 2023 and early 2024, potentially impacting market perception and requiring enhanced disclosure.

Environmental factors

China's commitment to environmental sustainability, exemplified by policies like the 'Opinions on Comprehensively Promoting the Construction of a Beautiful China' and the 'Green and Low-Carbon Transition Industry Guidance Catalogue,' is significantly shaping the financial sector. These directives mandate that financial institutions, including Qilu Bank, embed Environmental, Social, and Governance (ESG) considerations into their core operations and lending practices. This regulatory push creates a clear pathway for banks to align their portfolios with national green development goals.

Qilu Bank is well-positioned to capitalize on this environmental shift by expanding its green loan offerings. As of the first half of 2024, the outstanding balance of green loans in China reached approximately 13.5 trillion yuan, demonstrating substantial market growth. This trend presents Qilu Bank with a strategic opportunity to develop and promote financial products that support environmentally friendly projects, thereby enhancing its market standing and contributing to China's climate objectives.

As China intensifies its commitment to a greener economy, Qilu Bank faces evolving environmental regulations. Policies targeting carbon emissions and promoting renewable energy development will directly influence sectors like heavy manufacturing and agriculture, which are significant in Shandong province and key to Qilu Bank's lending portfolio. For instance, China's goal to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 necessitates a strategic shift in industrial financing.

Consequently, Qilu Bank must proactively analyze and mitigate climate-related risks within its existing loan book. This involves understanding the exposure of its corporate clients to stricter environmental standards and potential carbon pricing mechanisms. As of early 2024, the national emissions trading system continues to expand, creating new compliance burdens and financial considerations for many industries.

Simultaneously, these policy shifts present opportunities for Qilu Bank to finance green projects and support businesses transitioning to sustainable practices. The bank can leverage its position to fund renewable energy installations, energy efficiency upgrades, and other climate-friendly initiatives, aligning its growth with national environmental objectives and potentially accessing new markets for green finance.

Qilu Bank, like many financial institutions globally, is navigating an evolving landscape of sustainability reporting. There's a significant push, both mandatory and voluntary, for companies to disclose their environmental, social, and governance (ESG) performance, increasingly aligning with frameworks such as the International Sustainability Standards Board (ISSB) standards. This means Qilu Bank can expect more rigorous expectations regarding how it reports on its environmental impact and its engagement in green finance activities.

Opportunities in Green and Renewable Energy Financing

Qilu Bank can capitalize on the strategic push towards green and low-carbon industries. This includes significant lending opportunities in renewable energy projects, such as solar and wind farms, and the development of green infrastructure. For instance, China's national carbon trading scheme, launched in 2021 and expanding, incentivizes such investments, creating a robust market for green finance.

Further opportunities arise from policies that promote water-saving industries. These initiatives, often supported by government subsidies and preferential lending rates, can provide Qilu Bank with new avenues to expand its green finance portfolio. The growing emphasis on sustainability across sectors means increased demand for financing solutions that align with environmental goals.

- Renewable Energy Growth: China's installed capacity for renewable energy reached approximately 1.5 billion kilowatts by the end of 2023, a substantial increase that signals ongoing investment needs.

- Green Bond Market: The issuance of green bonds in China has seen a significant uptick, reaching record levels in 2023, indicating strong investor appetite for sustainable projects.

- Water Resource Management: Government plans for water conservation and efficiency improvements in key industrial sectors offer targeted financing opportunities.

- Policy Support: Continued government backing for green finance through tax incentives and regulatory frameworks enhances the attractiveness of these lending areas for banks like Qilu.

Reputational Risk from Environmental Non-Compliance

Qilu Bank faces reputational risk if it finances projects or companies with poor environmental performance, potentially leading to financial penalties and damage to its brand. For instance, in 2023, China's environmental regulators issued fines totaling billions of yuan for non-compliance, highlighting the financial consequences of environmental negligence. This underscores the critical need for Qilu Bank to strengthen its environmental due diligence procedures when evaluating loan applications to mitigate these risks.

To address this, Qilu Bank should implement more robust environmental impact assessments for all new lending. This includes scrutinizing borrowers' compliance records and their commitment to sustainable practices. The bank's 2024 sustainability report indicated a focus on green finance, with a 15% increase in loans to environmentally friendly sectors, but further enhancements in due diligence are necessary.

- Enhanced Environmental Due Diligence: Implementing stricter checks on borrowers' environmental records and compliance.

- Reputational Safeguarding: Avoiding association with environmentally damaging projects to protect brand image.

- Financial Penalties Mitigation: Proactively reducing the risk of fines by ensuring compliance in financed activities.

- Green Finance Alignment: Strengthening environmental assessments to support the bank's stated commitment to sustainable lending.

China's strong environmental policies, like those promoting green development, are pushing financial institutions like Qilu Bank to integrate ESG factors. This regulatory environment encourages banks to align their lending with national climate goals, presenting opportunities in the growing green finance market. As of the first half of 2024, China's green loans reached approximately 13.5 trillion yuan, highlighting this significant market expansion.

Qilu Bank must navigate evolving environmental regulations, particularly those impacting carbon emissions and renewable energy, which are crucial for Shandong province's economy. The national goal of peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 directly influences financing strategies for key industries. This necessitates proactive risk management concerning climate-related impacts on its loan portfolio, especially with the expanding national emissions trading system.

The bank can leverage opportunities in financing renewable energy projects, like solar and wind farms, and green infrastructure. China's national carbon trading scheme, operational since 2021, actively incentivizes such investments, creating a robust demand for green finance products. Furthermore, policies supporting water-saving industries, often backed by subsidies, offer additional avenues for Qilu Bank to grow its green finance offerings.

| Environmental Factor | Impact on Qilu Bank | Data/Trend (2023-2024) | Opportunity/Risk |

|---|---|---|---|

| Green Development Policies | Mandates ESG integration, promotes green lending | China's green loan balance ~13.5 trillion yuan (H1 2024) | Opportunity to expand green loan portfolio |

| Carbon Emission Targets | Influences financing for heavy industry and agriculture | National goal: peak emissions before 2030, neutrality by 2060 | Risk from non-compliant industries, opportunity in transition financing |

| Renewable Energy Growth | Drives demand for project financing | China's renewable energy capacity ~1.5 billion kW (end 2023) | Opportunity in financing solar, wind, and green infrastructure |

| Environmental Regulations & Fines | Increases reputational and financial risk for non-compliance | Billions of yuan in environmental fines issued (2023) | Risk of penalties and brand damage; need for enhanced due diligence |

PESTLE Analysis Data Sources

Our Qilu Bank PESTLE Analysis is meticulously constructed using data from official Chinese government publications, reports from international financial institutions like the IMF and World Bank, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing Qilu Bank.