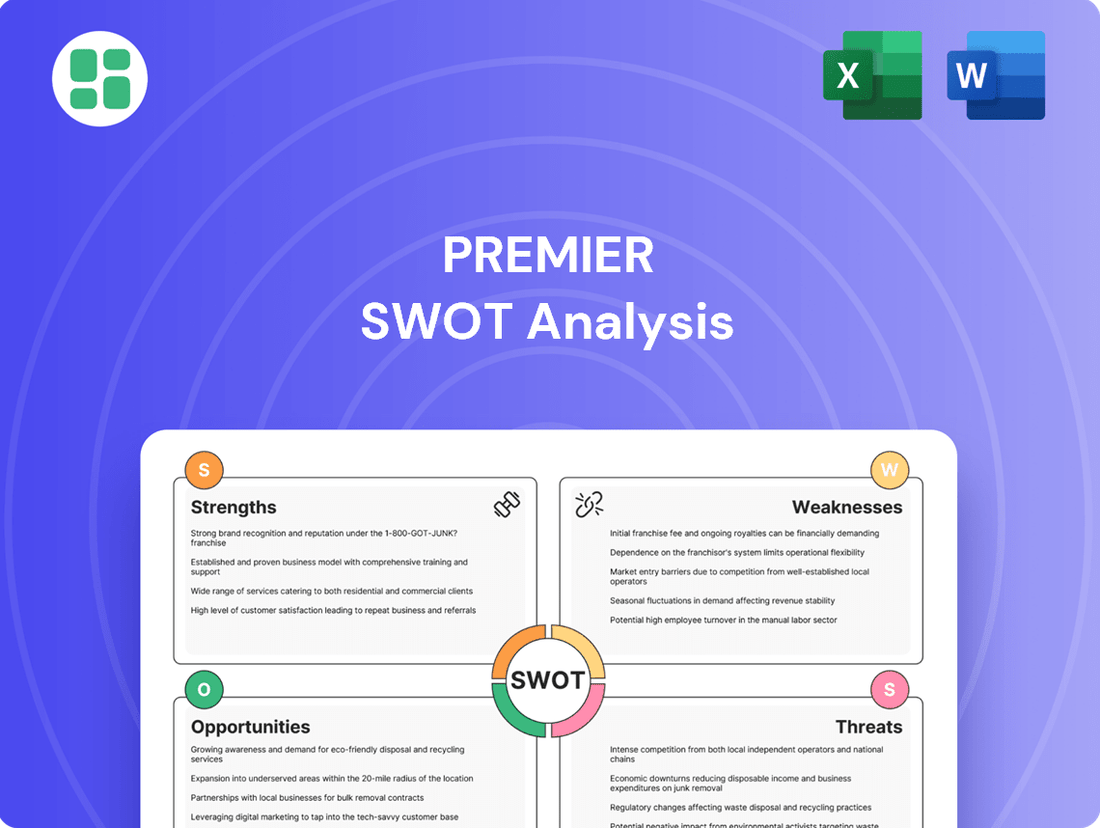

Premier SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Premier Bundle

This premier SWOT analysis offers a crucial glimpse into the company's strategic landscape, highlighting key advantages and potential hurdles. To truly harness this information for your business, dive deeper into the actionable strategies and expert analysis embedded within the full report. Unlock the complete picture and empower your decision-making today.

Strengths

Premier's strength lies in its massive healthcare alliance, uniting over 4,350 U.S. hospitals and health systems, plus around 325,000 other provider organizations. This sheer scale grants it significant leverage.

Through its robust Group Purchasing Organization (GPO), Premier harnesses this collective power to negotiate highly favorable contracts. This translates into substantial cost savings for its member organizations.

The extensive network also acts as a powerful conduit for disseminating best practices and innovative healthcare solutions. This widespread adoption accelerates improvements across the industry.

Premier's strength lies in its comprehensive data and analytics capabilities, powered by its PINC AI platform. This platform taps into over two decades of cost, quality, and operational data from a significant portion of U.S. hospital discharges and patient encounters.

This extensive data foundation enables Premier to deliver actionable intelligence, pinpoint areas for improvement, and foster data-driven decision-making among its members. The result is a tangible impact on enhancing clinical outcomes and boosting operational efficiency across healthcare systems.

Premier's strength lies in its diverse and integrated service offerings, extending far beyond traditional Group Purchasing Organization (GPO) services. This comprehensive approach includes vital supply chain management, expert advisory services, and targeted performance improvement initiatives, all designed to enhance healthcare provider operations.

By providing these multifaceted solutions, Premier empowers healthcare organizations to achieve significant improvements in patient care quality while simultaneously driving down operational costs. This holistic partnership model is crucial in today's complex healthcare landscape.

The company's commitment to technology, particularly its investment in AI-enabled platforms, further solidifies its position as a forward-thinking partner. This technological integration allows Premier to offer data-driven insights and innovative solutions for optimizing healthcare delivery and financial performance.

Strong Focus on Innovation and Technology Adoption

Premier's dedication to innovation is a significant strength, demonstrated by its substantial investments in research and development. This focus fuels the creation of new technology platforms designed to improve healthcare delivery and operational efficiency.

The company's strategic acquisition of IllumiCare in 2024 exemplifies this commitment, aimed at bolstering its clinical decision support capabilities and providing more advanced tools to its members. This move positions Premier at the forefront of technological integration in healthcare.

Premier is actively embedding artificial intelligence and machine learning across its operations. Specifically, these technologies are being leveraged to optimize supply chain management, predict potential disruptions, and enhance overall performance services, leading to more resilient and efficient workflows for its member organizations.

Key initiatives include:

- Investment in R&D: Premier consistently allocates resources to explore and develop cutting-edge healthcare technologies.

- IllumiCare Acquisition (2024): This strategic move expanded Premier's clinical decision support offerings.

- AI/ML Integration: The company is actively deploying AI and machine learning in supply chain and performance services to boost efficiency and predictive capabilities.

Proven Track Record of Member Value and Retention

Premier's strength lies in its proven ability to consistently deliver significant value to its members, fostering exceptional loyalty. In fiscal year 2024, the company facilitated over $80 billion in purchasing volume through its extensive supply chain network. This robust network also contributed to an estimated $1 billion in cost savings for its members.

This tangible value translates directly into high retention rates. Premier achieved a remarkable 97% retention rate for its Group Purchasing Organization (GPO) services. Furthermore, its core informatics products saw a strong 95% institutional renewal rate in Q4 FY2024, highlighting deep member satisfaction and the indispensable nature of its offerings.

- Facilitated $80 billion+ in purchasing volume in FY2024

- Generated an estimated $1 billion in cost savings for members in FY2024

- Achieved a 97% GPO member retention rate

- Recorded a 95% SaaS institutional renewal rate for informatics products in Q4 FY2024

Premier's extensive healthcare alliance, comprising over 4,350 U.S. hospitals and 325,000 provider organizations, provides significant negotiating power through its Group Purchasing Organization (GPO). This scale allows for highly favorable contract terms, driving substantial cost savings for members.

The company's PINC AI platform leverages over two decades of cost, quality, and operational data from numerous U.S. hospital discharges. This data-driven approach delivers actionable intelligence, enabling members to improve clinical outcomes and operational efficiency.

Premier offers diverse, integrated services beyond GPO, including supply chain management and performance improvement initiatives. These multifaceted solutions help healthcare organizations enhance patient care quality while reducing operational costs.

A commitment to innovation, demonstrated by R&D investment and the 2024 IllumiCare acquisition, strengthens Premier's position. The integration of AI and machine learning into operations, particularly for supply chain optimization and performance services, further enhances efficiency and predictive capabilities.

Premier consistently delivers tangible value, facilitating over $80 billion in purchasing volume and an estimated $1 billion in cost savings in fiscal year 2024. This value is reflected in a 97% GPO retention rate and a 95% renewal rate for informatics products in Q4 FY2024.

| Strength Area | Key Metric/Fact | Impact |

|---|---|---|

| Network Scale & GPO Leverage | 4,350+ U.S. Hospitals & Health Systems | Negotiating power for cost savings |

| Data & Analytics (PINC AI) | 20+ years of healthcare data | Actionable insights for efficiency & outcomes |

| Integrated Services | Supply Chain, Advisory, Performance Improvement | Holistic operational enhancement |

| Innovation & AI/ML | IllumiCare Acquisition (2024) | Enhanced clinical decision support & operational efficiency |

| Member Value & Loyalty | $80B+ purchasing volume (FY2024) | 97% GPO retention, 95% informatics renewal |

What is included in the product

Analyzes Premier’s competitive position through key internal and external factors, outlining its strengths, weaknesses, opportunities, and threats.

Eliminates the frustration of manual SWOT creation, offering a ready-to-use framework for immediate strategic analysis.

Weaknesses

Premier has seen revenue drop in some areas. For instance, its direct sourcing business is down because of lower prices and less demand for specific items. This trend continued into Q3 FY2025 with a sequential revenue decrease.

These revenue declines highlight difficulties in achieving steady growth across all of Premier's operations, even as the company works on restructuring and selling off parts of its business that aren't central to its strategy.

Premier's significant reliance on the U.S. healthcare sector presents a notable weakness. The company's financial health is directly linked to the economic stability of its member hospitals and health systems, which are currently grappling with considerable headwinds.

Factors like ongoing inflation and critical labor shortages are squeezing healthcare providers' operating margins. For instance, the American Hospital Association reported that U.S. hospitals experienced a net operating margin of just 1.5% in 2023, a stark illustration of the financial strain our members are under. This financial pressure can limit their capacity to invest in and leverage Premier's services, impacting Premier's revenue streams.

Premier's strategic shift, marked by the divestiture of its non-healthcare GPO operations and the planned wind-down of Contigo Health, presents a clear weakness in terms of potential short-term financial disruption. These moves, while intended to sharpen focus on healthcare, can create temporary revenue gaps and necessitate significant resource allocation for managing the transition.

The immediate aftermath of such restructuring can lead to a dip in overall revenue figures as these segments are phased out. For instance, the wind-down of Contigo Health, if not managed with extreme precision, could impact Premier's reported earnings in the near term, potentially affecting investor sentiment.

Furthermore, the operational complexities of disentangling these businesses require careful execution to avoid impacting the performance of the core healthcare GPO services. This transitional phase demands robust management oversight to mitigate any negative spillover effects and ensure the continued strength of Premier's primary revenue streams.

Competition in Key Markets

Premier faces significant competition from major Group Purchasing Organizations (GPOs) such as HealthTrust and Vizient, which vie for the same healthcare provider contracts. This competitive pressure necessitates constant differentiation through superior service, expanded product portfolios, and cost-effectiveness, impacting Premier's market share and profitability.

In its direct sourcing initiatives, Premier also contends with established product manufacturers and distributors. The need to offer competitive pricing and demonstrate tangible performance improvements requires substantial ongoing investment in supply chain optimization and innovation, potentially squeezing profit margins.

- Market Share Pressure: Premier's market share is influenced by the aggressive strategies of competitors like Vizient, which reported over $130 billion in purchased savings for its members in 2023.

- Margin Dilution: Intense competition on price and value-added services can lead to margin compression, requiring Premier to continually seek efficiencies and new revenue streams.

- Innovation Investment: Staying ahead in the GPO space demands continuous investment in technology, data analytics, and new service offerings, which can be a significant drain on resources.

Potential for Regulatory Scrutiny on GPOs

Premier, like other Group Purchasing Organizations (GPOs) in the healthcare sector, operates under a microscope regarding its market influence and how it negotiates prices. This ongoing scrutiny, particularly concerning potential antitrust issues, means there's always a possibility of increased oversight and demands for more transparency in their dealings. For instance, in 2023, the Federal Trade Commission (FTC) continued its review of GPO practices, highlighting concerns about market concentration and its impact on healthcare costs.

Looking ahead, the landscape of healthcare regulation is dynamic. Future policy shifts, especially those influenced by new administrations or evolving economic conditions, could significantly alter the operating environment for GPOs. There's a tangible risk that these changes might necessitate revised frameworks or even push for alternative models, potentially challenging Premier's current business structure and revenue streams.

- Regulatory Oversight: GPOs like Premier are subject to continuous review by bodies such as the FTC and Department of Justice, focusing on anticompetitive practices.

- Transparency Demands: Increased pressure for greater transparency in pricing and contract negotiations is a persistent weakness, potentially impacting Premier's ability to maintain current operational models.

- Policy Shifts: Potential changes in healthcare policy, particularly concerning drug pricing and provider consolidation, could directly affect the GPO business model.

- Antitrust Concerns: The inherent market power wielded by large GPOs makes them susceptible to antitrust investigations, which could lead to significant operational or structural changes.

Premier's direct sourcing revenue has experienced a downturn due to decreased prices and demand, a trend that persisted into Q3 FY2025 with a sequential revenue decline. This indicates challenges in achieving consistent growth across all its operations, even as the company divests non-core assets.

The company's heavy reliance on the U.S. healthcare sector is a significant vulnerability, as its financial performance is tied to the economic health of its member hospitals. These providers are currently facing considerable financial strain from inflation and labor shortages, impacting their ability to invest in Premier's services.

Premier's strategic divestitures, including non-healthcare GPO operations and the planned wind-down of Contigo Health, introduce short-term financial disruption risks and potential revenue gaps during the transition period.

Full Version Awaits

Premier SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You can trust that what you see is exactly what you'll get, providing a clear and accurate assessment for your strategic planning.

Opportunities

Premier is well-positioned to capitalize on the booming demand for AI and advanced analytics in healthcare supply chains. The market for AI in healthcare is projected to reach $187.9 billion by 2030, growing at a CAGR of 37.3% from 2023 to 2030, according to Grand View Research. Premier's PINC AI platform and solutions like IllumiCare offer a direct avenue to meet this need, enabling hospitals to streamline inventory, anticipate disruptions, and elevate clinical insights, thereby creating substantial value for its members.

The global healthcare Group Purchasing Organization (GPO) market is experiencing significant expansion, with projections indicating continued strong growth. This upward trend is largely fueled by healthcare providers facing mounting pressure to control expenses and the increasing shift towards value-based care arrangements, which inherently emphasize efficiency and cost-effectiveness.

Premier, a leading player in the GPO sector, is well-positioned to benefit from this burgeoning market. By effectively utilizing its substantial collective purchasing power and offering a suite of integrated services, Premier can address the escalating need for cost reduction and enhanced supply chain management among its member organizations.

For instance, the healthcare GPO market was valued at approximately $23.5 billion in 2023 and is anticipated to reach over $35 billion by 2028, growing at a CAGR of around 8.5%. Premier's ability to negotiate favorable pricing on a vast array of medical supplies and pharmaceuticals directly translates into tangible savings for its members, reinforcing its value proposition in this expanding market.

Premier is actively exploring new strategic partnerships, building on its successful collaboration with Epic. This ongoing venture, focused on Performance Services, is slated to launch in late 2025. Such alliances are crucial for enhancing Premier’s technological capabilities and broadening its market presence.

These collaborations are designed to foster co-development of innovative healthcare solutions, aiming to redefine and improve patient care delivery. By working with strategic partners, Premier can unlock new revenue streams and solidify its competitive standing in the healthcare technology sector.

Addressing Healthcare Supply Chain Resilience Needs

Persistent supply chain vulnerabilities, exacerbated by geopolitical tensions and ongoing product shortages, underscore a significant opportunity for Premier. The healthcare sector is actively seeking ways to bolster its supply chain resilience.

Premier is well-positioned to capitalize on this need by leveraging its established expertise in supply chain services. This includes strengthening direct sourcing partnerships and implementing advanced data-driven risk management strategies.

Premier can offer enhanced solutions designed to help its members achieve critical objectives such as diversifying their sourcing strategies, boosting domestic manufacturing capabilities, and more effectively navigating complex global disruptions.

- Diversified Sourcing: In 2024, the healthcare industry faced an average of 15% increase in lead times for critical medical supplies, highlighting the need for Premier's sourcing diversification solutions.

- Domestic Manufacturing Support: Initiatives to onshore medical device production saw a 10% growth in 2024, presenting an opportunity for Premier to facilitate these efforts.

- Risk Management Tools: Premier's data-driven approach can help mitigate the impact of disruptions, which cost the US healthcare system an estimated $25 billion in 2023 due to shortages.

Evolving Healthcare Delivery Models and Value-Based Care

The healthcare industry's pivot to value-based care, emphasizing patient outcomes and equity, creates a significant opportunity for Premier. This shift encourages providers to seek solutions that are not only cost-effective but also demonstrably improve patient health and reduce overall system costs. For instance, the Centers for Medicare & Medicaid Services (CMS) has been progressively expanding its value-based purchasing programs, with initiatives like the Hospital Value-Based Purchasing (VBP) program directly linking a portion of Medicare payments to quality performance. In 2023, CMS reported that hospitals participating in VBP programs saw an average improvement in their quality scores.

Premier can capitalize on this trend by enhancing its value analysis to incorporate quality and outcomes data alongside cost savings. This means offering procurement solutions that directly support providers in meeting the metrics of value-based care, such as reducing readmission rates or improving patient satisfaction scores. By aligning its offerings with these evolving reimbursement structures, Premier positions itself as a crucial partner in helping healthcare organizations succeed financially and clinically in the new care paradigm.

- Focus on Outcome-Driven Procurement: Premier can tailor its sourcing strategies to prioritize products and services that have proven efficacy in improving patient outcomes and reducing long-term healthcare costs, aligning with value-based care mandates.

- Data Integration for Performance Measurement: Integrating quality and outcomes metrics into Premier's value analysis processes will enable clients to better track their performance against value-based care benchmarks, demonstrating tangible benefits beyond cost reduction.

- Support for Healthcare Equity Initiatives: Premier can identify and promote cost-effective solutions that also address healthcare disparities, supporting providers in delivering equitable care to diverse patient populations.

- Partnership in Navigating Reimbursement Changes: By understanding and adapting to new reimbursement models, Premier can offer strategic guidance and procurement solutions that optimize financial performance for providers operating under value-based payment arrangements.

Premier's PINC AI platform is poised to capitalize on the significant growth in AI and advanced analytics within healthcare supply chains, a market projected to reach $187.9 billion by 2030. The company's focus on enhancing supply chain resilience through diversified sourcing and risk management tools addresses critical industry needs, particularly given that supply chain disruptions cost the US healthcare system an estimated $25 billion in 2023. Furthermore, Premier's alignment with the shift towards value-based care, by integrating quality and outcomes data into its procurement solutions, positions it to support providers in meeting evolving reimbursement models and improving patient equity.

Threats

Ongoing inflation and rising labor costs are significantly impacting hospitals and health systems, creating substantial financial pressures. For example, the U.S. Bureau of Labor Statistics reported that average hourly earnings for all employees in the healthcare and social assistance sector increased by 4.5% in the year ending April 2024, a substantial rise that directly affects operating expenses.

These escalating costs, coupled with higher interest rates, could constrain Premier's member hospitals' ability to invest in new services or technologies, potentially slowing Premier's own growth trajectory. The Federal Reserve's continued stance on interest rates, with projections suggesting rates may remain elevated through 2024 to combat persistent inflation, further amplifies this concern.

Furthermore, economic uncertainties might compel member organizations to seek even more cost-effective solutions, potentially squeezing Premier's profit margins. A recent analysis by the American Hospital Association indicated that the median operating margin for hospitals fell to 2.5% in 2023, highlighting the tight financial environment many are operating within.

Changes in healthcare administration and policy represent a significant threat to Premier. For instance, potential revisions to the Affordable Care Act or adjustments to Medicare and Medicaid reimbursement rates could directly impact the demand for medical supplies and services facilitated by Premier's group purchasing organization (GPO) model. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine payment policies, with proposed changes to the Hospital Inpatient Prospective Payment System (IPPS) often signaling shifts in how healthcare providers are reimbursed, which in turn affects their purchasing power and reliance on GPOs.

Increased antitrust oversight on GPOs, a concern for entities like Premier, could also alter Premier's operational framework. Regulatory bodies are increasingly scrutinizing the market power and practices of large GPOs. For example, the Federal Trade Commission (FTC) has historically shown interest in GPO consolidation and its impact on competition. Any new regulations or enforcement actions stemming from this scrutiny could necessitate changes to Premier's business model, potentially affecting its ability to negotiate favorable pricing for its members and thus impacting its revenue streams.

Premier, as a technology-centric entity managing vast amounts of sensitive healthcare information, is increasingly vulnerable to advanced cyber threats. These risks range from disruptive data breaches to operational shutdowns, impacting patient care and trust. The evolving threat landscape demands constant vigilance and significant investment in cybersecurity infrastructure.

The absence of a unified federal privacy statute, coupled with a complex web of state-specific regulations, presents significant compliance hurdles for Premier. This fragmented regulatory environment necessitates ongoing adaptation and substantial resources dedicated to maintaining robust data protection protocols and cybersecurity frameworks to safeguard patient data and ensure operational continuity.

Supply Chain Disruptions and Product Shortages

Despite ongoing efforts to build a more robust system, the healthcare supply chain continues to grapple with ongoing product shortages and difficulties in sourcing raw materials. Geopolitical instability also remains a significant concern, capable of impacting the flow of essential medical goods.

The introduction of new tariffs, especially on medical products imported from nations like China, presents a substantial challenge. These tariffs could complicate matters significantly and increase costs, potentially affecting the consistent availability and pricing of vital supplies for Premier's member organizations.

- Increased Costs: Tariffs on imported medical goods could lead to higher operational expenses for Premier, impacting their ability to negotiate favorable pricing for members.

- Availability Risks: Geopolitical events and raw material shortages can directly translate into stockouts of critical medical supplies, hindering patient care.

- Supply Chain Complexity: Navigating new trade regulations and sourcing alternatives due to tariffs adds layers of complexity and potential delays in procurement.

Emergence of Alternative Procurement Models and Technologies

Premier faces a threat from the rapid evolution of procurement technologies and the rise of alternative models. If Premier cannot adapt swiftly, healthcare organizations might shift towards decentralized purchasing or direct manufacturer dealings, bypassing traditional Group Purchasing Organization (GPO) services. This could diminish Premier's market share and force substantial changes to its operational strategy.

The healthcare sector's increasing embrace of direct-to-provider sourcing and advanced digital platforms presents a challenge. For instance, the growth of e-procurement solutions that streamline purchasing processes could draw clients away from GPO models. By mid-2024, the digital procurement market in healthcare was showing robust growth, with many providers actively seeking more agile and cost-effective sourcing methods.

- Evolving Procurement Landscape: Healthcare providers are increasingly exploring direct sourcing and decentralized procurement models.

- Technological Disruption: Advanced e-procurement platforms and AI-driven sourcing tools offer alternatives to traditional GPO functions.

- Market Share Erosion: Failure to adapt to these changes could lead to a decline in Premier's market share as clients seek more direct relationships.

- Strategic Adaptation Required: Premier must invest in and integrate new technologies to remain competitive and relevant in this shifting market.

Heightened regulatory scrutiny on Group Purchasing Organizations (GPOs) poses a significant threat, potentially impacting Premier's operational model and revenue. Increased antitrust oversight could lead to stricter regulations or enforcement actions, forcing adjustments to Premier's business practices and pricing strategies.

The escalating costs of healthcare, driven by inflation and labor expenses, directly challenge Premier's ability to secure cost savings for its members. For example, healthcare sector wages saw a 4.5% increase in the year ending April 2024, a factor that can compress margins for both Premier and its clients.

Economic volatility and potential policy shifts in healthcare administration create an uncertain operating environment. Changes to reimbursement rates or the Affordable Care Act could alter demand for services Premier facilitates, while economic downturns might push members towards even more aggressive cost-cutting, impacting Premier's own profitability.

SWOT Analysis Data Sources

This Premier SWOT Analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry forecasts. These sources provide the critical data necessary for an accurate and actionable strategic assessment.