Premier Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Premier Bundle

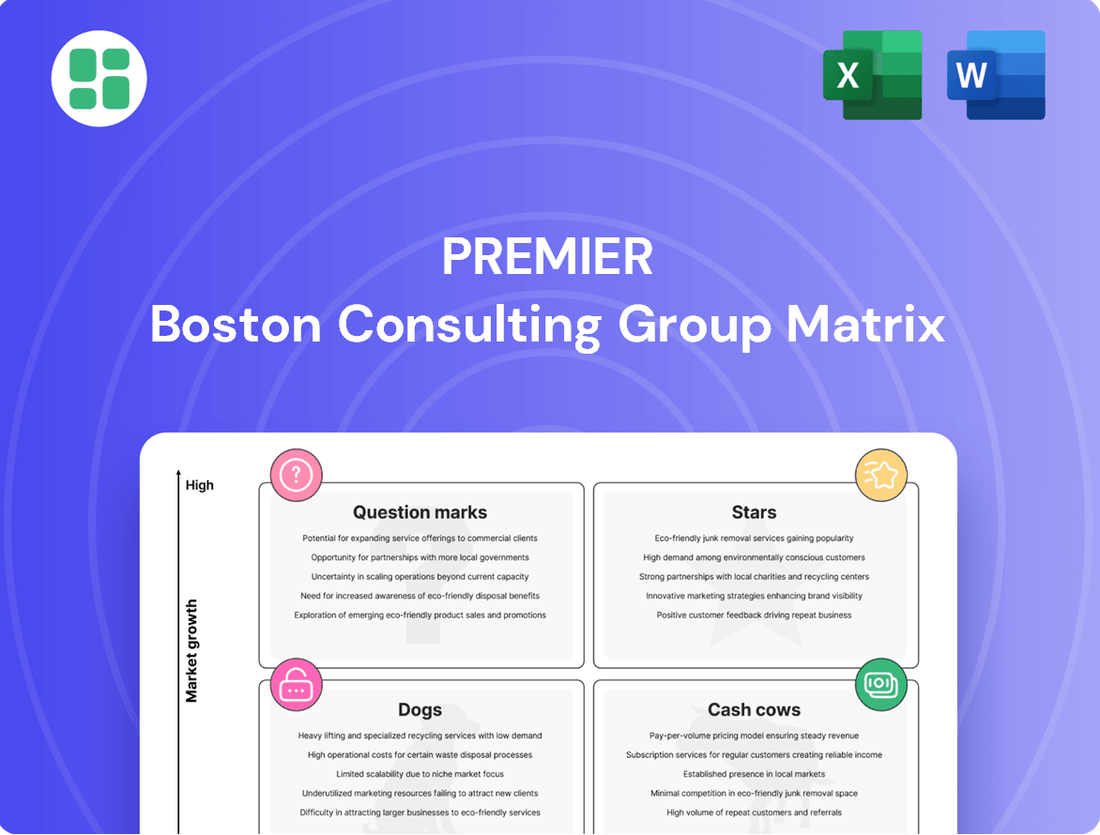

The Premier BCG Matrix offers a powerful snapshot of a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This initial view highlights key areas of strength and potential challenges. To truly unlock strategic growth and make informed investment decisions, dive deeper into the full report.

Gain a comprehensive understanding of your product's market share and growth potential with the complete Premier BCG Matrix. This detailed analysis provides actionable insights for optimizing resource allocation and driving future success. Purchase the full version to transform this valuable data into a clear roadmap for your business.

Stars

Premier's PINC AI platform is a significant Star in its portfolio, embodying the company's commitment to data-driven healthcare transformation. This integrated platform, combining data, analytics, and artificial intelligence, is designed to empower healthcare providers with advanced insights. It facilitates improvements across clinical, financial, and operational aspects of healthcare delivery.

The PINC AI platform is strategically positioned to capitalize on the burgeoning AI in healthcare market. This sector is experiencing rapid expansion, with projections indicating substantial growth in the coming years. For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is anticipated to reach over $187 billion by 2030, demonstrating a compound annual growth rate of around 43%. This robust market growth underscores PINC AI's potential as a high-growth, high-market-share offering for Premier.

Premier is making substantial investments in AI and machine learning to enhance supply chain efficiency for healthcare organizations. This strategic move addresses the increasing demand for cost savings and streamlined operations within the dynamic healthcare sector.

By offering advanced AI solutions for inventory control, purchasing, and delivery, Premier is solidifying its leadership in a market actively embracing digital advancements. For instance, in 2024, healthcare supply chain costs represented a significant portion of overall hospital spending, often exceeding 25%, highlighting the critical need for optimization.

Premier's acquisition of IllumiCare significantly bolsters its Clinical Decision Support (CDS) capabilities, positioning this segment as a Star. This strategic move directly addresses the growing demand for integrated, evidence-based guidance within clinical workflows, aiming to improve both patient outcomes and operational efficiency. The healthcare technology market is rapidly expanding, with AI in diagnostics and patient care showing particularly strong growth, further validating CDS as a key high-growth area for Premier.

AI-Powered Care Transformation Tools

Premier's AI-powered care transformation tools are designed to revolutionize healthcare delivery by embedding data-driven insights. These solutions help providers elevate clinical quality, minimize care inconsistencies, and bolster patient safety.

The demand for optimizing clinical processes is driving significant growth in this sector. In 2024, the global healthcare analytics market was projected to reach over $40 billion, highlighting the increasing adoption of data-driven solutions.

- Enhanced Clinical Quality: AI tools analyze patient data to identify best practices and predict outcomes, leading to more effective treatment plans.

- Reduced Care Variation: By standardizing protocols based on real-world evidence, these tools help ensure consistent, high-quality care across different settings.

- Improved Patient Safety: Predictive analytics can flag potential risks, such as adverse drug events or hospital-acquired infections, allowing for proactive intervention.

- Operational Efficiency: Automation of administrative tasks and optimized resource allocation contribute to significant cost savings for healthcare organizations.

Margin Improvement Analytics

Premier's Margin Improvement Analytics, a key component of its BCG Matrix positioning as a Star, leverages AI to help healthcare providers achieve greater financial sustainability. This is particularly crucial given the persistent rise in healthcare expenditures, making effective cost optimization tools highly sought after.

The company's AI-driven solutions pinpoint areas for margin enhancement, directly addressing the industry's need for improved financial performance. Premier's strong market standing, coupled with its advanced analytics for financial metrics, solidifies its position as a leading player in this critical segment.

- AI-Powered Cost Optimization: Premier's technology identifies inefficiencies and opportunities to reduce expenses within healthcare operations.

- Addressing Rising Healthcare Costs: The demand for margin improvement tools is amplified by the ongoing trend of increasing healthcare spending.

- Market Leadership: Premier's established presence and innovative analytics give it a competitive edge in delivering financial sustainability solutions.

- Data-Driven Insights: The focus is on actionable, data-backed strategies to realize tangible margin improvements for providers.

Premier's PINC AI platform, its Clinical Decision Support (CDS) capabilities bolstered by the IllumiCare acquisition, and its Margin Improvement Analytics all represent significant Stars within its portfolio. These offerings are characterized by high market growth and strong competitive positions, driven by the increasing adoption of AI and data analytics in healthcare. The company's strategic investments in these areas position it to capitalize on the demand for improved efficiency, cost savings, and enhanced patient care.

| Premier's Star Offerings | Market Growth Driver | 2024 Relevance | Key Benefit |

|---|---|---|---|

| PINC AI Platform | AI in Healthcare Market Expansion | Facilitates data-driven healthcare transformation. | Improves clinical, financial, and operational aspects. |

| Clinical Decision Support (CDS) | Healthcare Technology Adoption | Enhances integrated, evidence-based clinical guidance. | Improves patient outcomes and operational efficiency. |

| Margin Improvement Analytics | Rising Healthcare Expenditures | Leverages AI for financial sustainability. | Drives cost optimization and financial performance. |

What is included in the product

Strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Premier BCG Matrix offers a clear, one-page overview of your business units, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Premier's core Group Purchasing Organization (GPO) services represent a classic Cash Cow within its business portfolio. This segment boasts a commanding market share, serving two-thirds of all U.S. healthcare providers, and effectively utilizes $84 billion in collective purchasing power.

The GPO model consistently delivers substantial administrative fees, evidenced by a remarkable 97% retention rate. This stability translates into predictable and robust cash flow, a hallmark of a mature and high-performing business unit.

Premier's established supply chain co-management agreements are a solid Cash Cow, generating consistent revenue by partnering with health systems to streamline operations. These agreements, often long-term, tap into Premier's extensive industry knowledge and existing client connections, ensuring predictable income. The strategy centers on operational excellence and nurturing client loyalty, rather than aggressive market growth.

Premier's administrative fees, primarily derived from the high transaction volume of its member organizations utilizing GPO contracts, represent a significant and reliable revenue stream. In 2024, these fees are projected to contribute substantially to Premier's overall financial health, underscoring the essential role of its procurement services within the healthcare sector.

This consistent income, a direct result of the deeply embedded nature of GPO services, provides Premier with a predictable financial foundation. This stability is crucial, enabling strategic allocation of capital towards growth initiatives and operational enhancements across the organization.

Standardized Contract Portfolios (SURPASS and Ascend)

Premier's SURPASS and Ascend programs are prime examples of Cash Cows within their GPO offerings. These initiatives have achieved widespread adoption by members, highlighting their maturity and strong market share. Their proven ability to deliver cost savings and clinical standardization solidifies their position as reliable revenue generators for Premier.

The success of SURPASS and Ascend is directly tied to their value proposition, which has resonated deeply with Premier's member base. This has led to significant contract penetration, a key indicator of a Cash Cow's strength. For instance, in 2024, Premier reported that these programs continued to be a cornerstone of their member value, contributing to substantial savings across various healthcare categories.

- High Market Share: SURPASS and Ascend have captured a substantial portion of the market for standardized contract portfolios.

- Proven Value Proposition: Members consistently benefit from cost savings and clinical standardization, driving continued engagement.

- Mature Offering: These programs represent established, reliable revenue streams for Premier.

- Investment Focus: Premier's investment is directed towards maintaining competitive pricing and maximizing contract penetration to sustain their Cash Cow status.

Long-Standing Provider Alliance Network

Premier's position as a Cash Cow is significantly bolstered by its extensive and long-standing alliance network. This network, comprising over 4,350 U.S. hospitals and health systems and approximately 325,000 other providers, represents a deeply entrenched customer base.

This vast reach translates into substantial market penetration, ensuring a stable and consistent demand for Premier's core offerings. The deep integration and trust cultivated over many years with these partners are key drivers of this reliable revenue stream, firmly cementing Premier's status as a Cash Cow.

- Network Size: Over 4,350 U.S. hospitals and health systems, plus ~325,000 other providers.

- Customer Base: Provides a stable and predictable customer foundation.

- Market Penetration: Achieves significant reach and consistent demand.

- Competitive Advantage: Deep integration and long-standing trust reduce churn and ensure recurring business.

Premier's GPO services are a clear Cash Cow, leveraging significant purchasing power and a high retention rate to generate consistent revenue. These mature offerings benefit from established client relationships and a proven value proposition, ensuring predictable financial performance.

The SURPASS and Ascend programs exemplify this, demonstrating strong market share and member adoption due to their cost-saving benefits. Premier's extensive alliance network further solidifies this Cash Cow status, providing a stable and deeply integrated customer base that drives recurring business.

| Business Unit | BCG Category | Key Metrics | 2024 Data/Projections |

|---|---|---|---|

| Core GPO Services | Cash Cow | Market Share | Serves 2/3 of U.S. healthcare providers |

| Purchasing Power | $84 billion | ||

| Retention Rate | 97% | ||

| SURPASS & Ascend Programs | Cash Cow | Member Adoption | Widespread |

| Value Proposition | Cost savings & clinical standardization | ||

| Alliance Network | Cash Cow | Network Size | 4,350+ U.S. hospitals/health systems |

| Other Providers | ~325,000 | ||

| Revenue Stream | Stable and consistent |

What You’re Viewing Is Included

Premier BCG Matrix

The BCG Matrix report you are currently previewing is the precise, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Premier's divestiture of its S2S Global direct sourcing business in October 2024 strongly suggests this segment was categorized as a 'dog' within its BCG Matrix. This classification implies low market growth and a low relative market share, making it a less attractive investment. The decision to sell, particularly in late 2024, points to a strategic move to shed an underperforming asset.

Such divestitures are common when a business unit is seen as a cash trap, consuming resources without generating significant returns or contributing to overall strategic goals. For instance, if S2S Global's revenue growth was projected to be below 3% annually, and its market share was less than 10% of its largest competitor, it would fit the 'dog' profile. Premier likely aims to redeploy capital from this sale into higher-growth, higher-market-share ventures.

Premier is strategically divesting its majority stake in Contigo Health, its direct-to-employer business. This move signals that Contigo Health, while initially promising, has not met Premier's expectations for market penetration and growth, placing it firmly in the 'Dog' category of the BCG Matrix. For instance, Premier's 2023 annual report highlighted Contigo Health's modest revenue contribution compared to its core supply chain services.

Within Premier's Performance Services segment, some of its legacy advisory services are showing signs of weakness. These older consulting practices are growing slower and losing ground to newer, tech-focused solutions. This underperformance was particularly evident in Q2 FY2025, where the segment's overall growth lagged expectations.

Niche, Low-Adoption Technology Platforms

Niche, Low-Adoption Technology Platforms within Premier's portfolio represent offerings that have struggled to gain traction. These might include specialized software solutions or hardware components that, while perhaps innovative at their inception, have been overshadowed by more broadly applicable or advanced technologies. For instance, if Premier had a proprietary data analytics tool designed for a very specific industrial process that has since been superseded by cloud-based, AI-driven platforms, this would fit the description.

The strategic imperative for Premier to focus on AI-enabled platforms means that resources allocated to these low-adoption technologies are likely being re-evaluated. In 2024, companies across the tech sector are increasingly divesting from or sunsetting products that do not align with current growth drivers. This trend is driven by the need to optimize R&D spend and capitalize on high-demand areas. Premier's own financial reports for 2023 indicated a significant increase in investment in AI and machine learning initiatives, signaling a clear pivot away from less impactful legacy systems.

- Limited Market Share: These platforms often represent a small fraction of Premier's overall revenue, potentially less than 1-2% based on industry averages for similar portfolio diversifications.

- High Maintenance Costs: Despite low revenue generation, legacy platforms can incur substantial costs for ongoing support, updates, and specialized personnel.

- Strategic Divergence: Premier's stated goal to become a leader in AI solutions means these niche platforms are misaligned with the company's future direction.

- Resource Reallocation: The capital and human resources tied up in these low-adoption technologies could be more productively deployed in developing and scaling AI-driven offerings.

Non-Healthcare GPO Operations

Premier divested its non-healthcare group purchasing organization (GPO) operations during fiscal year 2024. This strategic move is characteristic of managing a 'Dog' in a BCG matrix, a business segment with low relative market share and low market growth potential. The divestiture signals that these operations were not contributing significantly to Premier's overall growth and were likely consuming resources that could be better allocated elsewhere.

The decision to sell off these non-healthcare GPO activities aligns with Premier's strategy to concentrate on its core healthcare market. By shedding these less profitable or stagnant segments, Premier can sharpen its focus and invest more heavily in areas with higher growth prospects and stronger competitive advantages within the healthcare industry. This allows for a more efficient deployment of capital and management attention.

- Divestiture in FY24: Premier completed the sale of its non-healthcare GPO operations in fiscal year 2024.

- 'Dog' Characteristics: This business segment likely exhibited low market share and limited growth potential, fitting the 'Dog' profile in the BCG matrix.

- Strategic Focus: The divestiture allows Premier to concentrate its resources and strategic efforts on its core healthcare business.

- Value Unlocking: By exiting these operations, Premier aims to unlock value and improve overall financial performance.

Premier's divestiture of its S2S Global direct sourcing business in October 2024, along with its majority stake in Contigo Health, strongly suggests these segments were categorized as 'dogs' within its BCG Matrix. This classification implies low market growth and a low relative market share, making them less attractive investments. These moves signal a strategic effort to shed underperforming assets and redeploy capital into higher-growth ventures, as evidenced by Premier's increased investment in AI initiatives in 2023.

The sale of non-healthcare GPO operations in fiscal year 2024 further reinforces this strategy. These segments likely exhibited low market share and limited growth potential, fitting the 'dog' profile. By exiting these operations, Premier aims to unlock value and concentrate resources on its core healthcare business, aligning with its stated goal to become a leader in AI solutions.

Premier's legacy advisory services within its Performance Services segment are also showing signs of weakness, growing slower and losing ground to newer, tech-focused solutions, particularly evident in Q2 FY2025. Similarly, niche, low-adoption technology platforms, such as a proprietary data analytics tool that has been superseded by cloud-based, AI-driven platforms, represent offerings that have struggled to gain traction.

These 'dog' segments, characterized by limited market share (potentially less than 1-2% of overall revenue) and high maintenance costs despite low revenue generation, are misaligned with Premier's future direction. The company is strategically re-evaluating resources tied up in these low-adoption technologies to optimize R&D spend and capitalize on high-demand areas like AI.

Question Marks

Remitra, Premier's digital invoicing and payables automation solution, is positioned as a Question Mark within the Premier BCG Matrix. It taps into the high-growth healthcare supply chain automation market, a sector that saw significant digital transformation acceleration in 2024, with many providers adopting new technologies to streamline operations and reduce costs.

While the market for such solutions is expanding rapidly, Remitra's market share is still in its nascent stages. This means it operates in a high-growth industry but hasn't yet established a dominant position. Premier's strategic integration of Remitra with its broader Supply Chain Services underscores a commitment to nurturing this business.

This alignment suggests Premier views Remitra as having substantial potential to evolve into a Star performer. The company's investment in Remitra signals confidence in its ability to capture a larger market share, driven by the ongoing demand for efficiency and cost savings within healthcare procurement and payment processes.

Premier's innovation pipeline includes early-stage AI solutions focused on niche healthcare challenges, like advanced diagnostics for rare diseases. These specialized tools, while promising significant future growth, currently represent a small fraction of the market as adoption is just beginning.

The market for AI in diagnostics, particularly for rare conditions, is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 30% in the coming years. This nascent stage means current market penetration is minimal, but the potential for disruption and high returns is considerable.

Premier's strategic partnerships in emerging digital health areas, particularly those focusing on novel technologies with low current market adoption but high disruption potential, are crucial for future growth. These ventures, often requiring substantial investment, are positioned to capitalize on significant future market expansion.

For example, in 2024, Premier announced a collaboration with a startup specializing in AI-driven personalized preventative care. This partnership targets a segment projected to grow from $15 billion in 2023 to over $50 billion by 2028, showcasing the high-risk, high-reward nature of these investments.

Pilot Programs for Novel Technology Integrations

Premier frequently initiates pilot programs with its member organizations to evaluate and improve new technology integrations designed to meet evolving healthcare demands.

These pilot projects focus on rapidly expanding sectors but currently hold minimal market share because they are experimental and not yet widely implemented.

For instance, in 2024, Premier launched a pilot for AI-driven diagnostic imaging analysis in oncology, targeting a market projected to reach $1.8 billion by 2028, with initial deployment in 15 leading hospitals.

The success of these pilots is crucial, as they represent potential future Stars in Premier's portfolio.

- Pilot Program Focus: Testing novel technology integrations in healthcare.

- Market Position: High-growth areas with currently low market share due to experimental nature.

- Potential Outcome: Successful pilots can be scaled to become future Stars.

- 2024 Example: AI-driven diagnostic imaging analysis in oncology, targeting a $1.8 billion market by 2028.

Expansion into New Adjacent Markets via Technology

Premier is strategically eyeing expansion into new, adjacent markets, specifically those exhibiting high growth potential and a strong need for technological integration. The company is focusing on leveraging its advanced AI and technology platforms to penetrate sectors such as value-based care and innovative care delivery models.

These new ventures are currently positioned as Question Marks within the Premier BCG Matrix. While they offer significant upside, they require considerable investment and a dedicated strategic approach to build market share. For instance, the telehealth market, a key adjacent area, saw a substantial increase in adoption, with reports indicating a 62% rise in telemedicine visits in 2024 compared to the previous year, underscoring the opportunity.

- Leveraging AI for Value-Based Care: Premier aims to use AI for predictive analytics in value-based care, identifying at-risk patient populations and optimizing treatment pathways.

- New Care Delivery Models: The company is exploring partnerships and acquisitions to introduce novel care delivery services, potentially reducing healthcare costs by an estimated 15-20% through efficiency gains.

- Market Entry Challenges: Initial market share in these adjacent sectors is low, necessitating aggressive marketing, product development, and strategic alliances to gain traction.

- Investment Focus: Significant capital allocation is earmarked for R&D and market penetration efforts, with projections suggesting these new ventures could represent 10% of Premier's total revenue by 2027 if successful.

Question Marks represent business units or products in high-growth markets but with low current market share. Premier's Remitra, its digital invoicing solution, fits this category within the healthcare supply chain automation market, which experienced significant digital acceleration in 2024.

Similarly, early-stage AI diagnostic tools for rare diseases are also Question Marks, operating in a sector with projected growth rates over 30% but minimal current penetration.

Premier's expansion into adjacent markets like value-based care and new care delivery models also falls under the Question Mark designation, requiring substantial investment to build market share in rapidly growing areas like telehealth, where visits increased by 62% in 2024.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer acquisition costs, and industry growth rates, to accurately assess product portfolio performance.