Premier Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Premier Bundle

Porter's Five Forces provides a powerful lens to understand the competitive landscape Premier operates within, revealing the intensity of rivalry and the power of buyers and suppliers. This framework helps identify key threats and opportunities that shape industry profitability.

The complete report reveals the real forces shaping Premier’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in healthcare, especially for specialized medical devices and pharmaceuticals, is a key factor influencing Premier's bargaining power. When a small number of suppliers control critical components, they can dictate higher prices and less favorable terms.

For instance, the market for certain advanced diagnostic imaging equipment or biologics is often dominated by a few major players. This limited competition allows these suppliers to exert significant leverage, even against large purchasing groups like Premier.

While Premier, as a Group Purchasing Organization (GPO), aggregates demand from numerous healthcare providers to strengthen its negotiating position, the inherent power of concentrated suppliers for highly specialized products remains a challenge. This dynamic was evident in 2024 as supply chain disruptions continued to affect the availability and pricing of certain essential medical supplies.

The costs and complexities Premier faces when switching suppliers are significant. These include the expense and effort of renegotiating contracts, integrating new products into established supply chains, and the potential for disruptions to member operations. These hurdles directly enhance the bargaining power of Premier's current suppliers, as the difficulty of changing makes Premier less likely to demand more favorable terms.

Suppliers providing highly differentiated or critical products and services with limited alternatives wield significant bargaining power. For instance, a supplier offering a patented drug or a unique medical technology that Premier's member hospitals cannot easily substitute will have a stronger negotiating position. This is a key factor influencing the cost of goods and services Premier can secure for its network.

Importance of Premier to Supplier Revenue

The bargaining power of suppliers is significantly shaped by how crucial Premier's purchasing volume is to their overall revenue. If Premier accounts for a substantial percentage of a supplier's business, that supplier will likely be more accommodating with pricing and terms to secure Premier's continued patronage. For instance, if a key supplier like Procter & Gamble, whose net sales reached $82 billion in fiscal year 2023, finds that Premier represents a meaningful portion of their retail distribution, they have a greater incentive to negotiate favorably.

Conversely, if Premier's orders represent a small fraction of a supplier's total sales, the supplier holds more leverage. A large supplier with diverse clientele might not feel the need to offer special concessions to Premier if their business with Premier is not a significant driver of their own financial performance. This dynamic means Premier's ability to influence supplier behavior is directly tied to its importance in the supplier's revenue stream.

- Supplier Dependence: Premier's aggregated purchasing volume directly impacts a supplier's reliance on its business.

- Revenue Significance: A higher percentage of a supplier's revenue derived from Premier translates to greater supplier willingness to negotiate favorable terms.

- Negotiating Leverage: If Premier is a minor customer for a large supplier, the supplier's bargaining power increases.

- Strategic Importance: Premier's ability to command better terms is often a function of its strategic importance to a supplier's sales targets and market presence.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward poses a significant challenge to Premier's bargaining power. If suppliers were to bypass group purchasing organizations (GPOs) like Premier and directly offer their products and services to individual hospitals, they could gain considerable leverage. This direct engagement would allow suppliers to negotiate terms independently, potentially undermining Premier's ability to aggregate demand and secure favorable pricing.

However, the practicalities of such a move are complex. Managing thousands of individual contracts with diverse health systems, each with unique needs and purchasing volumes, is a resource-intensive undertaking for most suppliers. This operational complexity generally limits the feasibility of widespread forward integration by suppliers, thereby mitigating the immediate threat to Premier's model.

For instance, in 2024, the healthcare supply chain continued to grapple with efficiency challenges. While some specialized suppliers might explore direct-to-hospital models for niche products, the sheer scale of the market and the administrative burden make a complete shift unlikely for major manufacturers. Premier's role in streamlining these complex negotiations remains a critical value proposition.

- Supplier Forward Integration: Suppliers could directly contract with hospitals, bypassing GPOs like Premier.

- Impact on Premier: This would erode Premier's value by reducing its aggregated purchasing power and negotiation leverage.

- Feasibility Concerns: The complexity of managing numerous individual hospital contracts makes widespread supplier forward integration challenging.

- 2024 Market Context: While niche opportunities exist, the overall administrative burden limits the broad viability of this strategy for most suppliers.

The bargaining power of suppliers is a critical element in Porter's Five Forces analysis, impacting Premier's ability to secure favorable terms. When suppliers are concentrated, offer unique products, or face low switching costs for buyers, their leverage increases. Premier's extensive network and aggregated purchasing volume in 2024 aimed to counter this, but the inherent power of specialized suppliers, particularly in areas like pharmaceuticals and advanced medical technology, remains a significant factor influencing costs.

| Factor | Impact on Premier | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High for specialized products, increasing supplier leverage. | Continued supply chain pressures highlighted this. |

| Switching Costs | High for Premier due to contract complexity and integration needs. | Makes it harder to shift away from existing suppliers. |

| Product Differentiation | Strong for patented drugs or unique technologies, giving suppliers power. | Essential for patient care, limiting negotiation flexibility. |

| Importance of Premier to Supplier | Low if Premier is a small part of a supplier's revenue, increasing supplier power. | Key large suppliers may have diverse client bases beyond Premier. |

What is included in the product

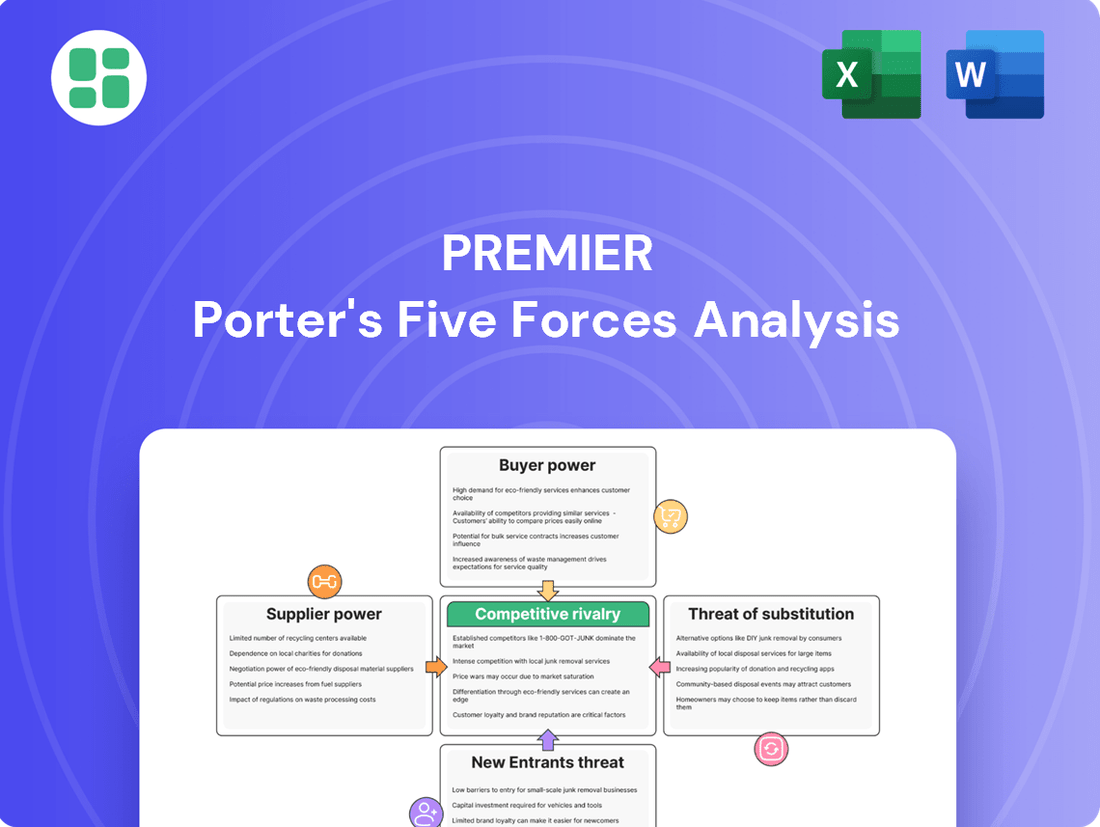

Premier Porter's Five Forces Analysis dissects the competitive intensity and profitability potential of Premier's industry by examining buyer power, supplier power, threat of new entrants, threat of substitutes, and existing rivalry.

Pinpoint and neutralize competitive threats with a visual breakdown of each force, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Premier's customer base, predominantly U.S. hospitals and health systems, significantly influences its bargaining power. The sheer size and purchasing volume of large, integrated health systems, for instance, grant them considerable leverage. These entities can often negotiate more favorable terms due to their substantial commitment, potentially impacting Premier's pricing and service agreements.

The ease with which Premier's member organizations can switch to a different Group Purchasing Organization (GPO) or handle their supply chain in-house directly influences their bargaining power. If it's difficult and costly to switch, customers have less leverage.

High switching costs, such as the integration of Premier's technology, commitments through long-term contracts, and established operational routines, can significantly diminish a customer's ability to negotiate favorable terms. These factors lock customers in, reducing their bargaining power.

Premier actively works to foster strong, lasting relationships by offering integrated data and analytics platforms and co-management services. These offerings aim to increase customer stickiness, making it less appealing or practical for them to leave.

The availability of alternative Group Purchasing Organizations (GPOs) like Vizient and HealthTrust directly empowers healthcare providers, giving them leverage. These alternatives mean providers aren't solely reliant on Premier, forcing Premier to remain competitive on pricing and services to retain its members.

Furthermore, healthcare systems can explore forming their own GPOs or pursuing direct purchasing for specific supplies. This flexibility in procurement strategies adds another layer of pressure on existing GPOs, including Premier, to continually demonstrate value and cost savings to their client base.

Price Sensitivity of Customers

Healthcare providers are acutely aware of costs, constantly seeking ways to deliver quality care more affordably. This makes them highly sensitive to price changes. For instance, in 2024, the average hospital operating margin hovered around 3-4%, a tight figure that amplifies the need for cost-saving solutions.

This inherent price sensitivity empowers customers to shop around for the best value, giving them significant leverage when negotiating with Premier. They will actively compare offerings and prioritize those that demonstrate clear cost reductions without compromising essential services.

- Healthcare providers' focus on cost containment: In 2024, the average cost per patient day in U.S. hospitals continued to rise, placing further pressure on providers to find efficiencies.

- Customer demand for cost-effective solutions: Studies indicate that over 60% of healthcare purchasing decisions in 2024 were heavily influenced by price and demonstrable ROI.

- Premier's competitive advantage: Premier's core strategy relies on its ability to deliver substantial savings, directly addressing this customer price sensitivity and strengthening its bargaining position.

Customer's Ability to Integrate Backward

The customer's ability to integrate backward, meaning they can bring supply chain functions in-house, significantly impacts Premier's bargaining power. Large health systems, for instance, could develop their own supply chain management, data analytics, or even advisory services, lessening their need for Premier's offerings. This move is costly but might be considered for high-volume or strategically vital supplies.

For example, a major hospital network might invest in building its own group purchasing organization (GPO) capabilities or developing sophisticated data platforms to manage supplier relationships and costs. This backward integration directly challenges Premier's value proposition by offering an alternative that could potentially be more cost-effective or customized for the health system's specific needs. In 2024, the trend towards greater operational autonomy within large healthcare providers suggests this is a growing concern.

- Health systems may develop internal GPO functions.

- Investment in proprietary data analytics for supply chain optimization is increasing.

- Strategic supplies are prime candidates for backward integration.

- This reduces reliance on third-party providers like Premier.

Premier's customers, primarily large U.S. hospitals, wield significant bargaining power due to their substantial purchasing volume and the availability of alternative Group Purchasing Organizations (GPOs). This leverage is amplified by healthcare providers' intense focus on cost containment, a critical factor in 2024 as average hospital operating margins remained tight, often between 3-4%. The ease of switching GPOs or pursuing in-house supply chain management further empowers these customers to negotiate favorable terms, forcing Premier to continually demonstrate value and cost savings to retain its membership base.

| Factor | Impact on Bargaining Power | 2024 Context/Data |

|---|---|---|

| Customer Size & Volume | High | Large health systems represent significant purchasing power. |

| Availability of Alternatives | High | Presence of competitors like Vizient and HealthTrust. |

| Switching Costs | Moderate to High | Integration of technology and contract terms create stickiness. |

| Price Sensitivity | High | Average hospital operating margins around 3-4% in 2024. |

| Backward Integration Potential | Moderate | Increasing trend for health systems to develop internal capabilities. |

Full Version Awaits

Premier Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces Analysis delves into the competitive landscape of your chosen industry, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Gain actionable insights to strategize and enhance your market position with this ready-to-use, professionally formatted report.

Rivalry Among Competitors

The healthcare group purchasing organization (GPO) and improvement services market is quite crowded, with a few dominant companies like Vizient, HealthTrust, and Premier. This concentration means these large, established players are constantly competing for business from healthcare providers, which naturally ramps up the rivalry.

The healthcare Group Purchasing Organization (GPO) market is experiencing growth, with projections indicating a compound annual growth rate (CAGR) of around 7.5% through 2028. However, the pace of this expansion varies across different GPO services. Slower growth in established areas can intensify competition as GPOs vie for existing market share.

Premier's strategic emphasis on technology and artificial intelligence (AI) is a direct response to these evolving market dynamics. By investing in these areas, Premier aims to unlock new avenues for growth and differentiate itself in a competitive landscape. This focus on innovation is crucial for maintaining relevance and capturing value in a market where traditional service offerings might be maturing.

Competitors are increasingly moving beyond simple price wars, focusing on unique value propositions. This includes leveraging advanced data analytics, integrating AI for smarter solutions, and building robust supply chain resilience, all while offering specialized advisory services.

Premier's strategy heavily relies on differentiating its offerings through brands like PINC AI, which integrates data from various sources to provide actionable insights. Their strategic alliances, such as the one with Epic, a major electronic health record provider, are crucial for creating a distinct ecosystem and offering integrated solutions that competitors may struggle to replicate.

Switching Costs for Customers

Premier strives to lock in its members by offering a suite of integrated services, which naturally increases the cost and effort for a customer to switch to a competitor. This integration aims to make leaving less attractive. However, the competitive landscape is dynamic, with rivals actively working to dismantle these barriers.

Competitors frequently offer attractive incentives, such as discounted pricing or enhanced service packages, specifically designed to lure providers away from established GPOs like Premier. The perceived ease of transitioning between group purchasing organizations (GPOs) or service providers significantly fuels the intensity of this rivalry, as providers weigh the benefits of switching against the disruption.

- High Switching Costs: Premier's integrated service model is designed to create significant switching costs for its members.

- Competitive Counter-Strategies: Competitors actively work to reduce these switching costs or offer compelling incentives for providers to move.

- Ease of Transition: The simplicity of moving between GPOs or service providers can heighten competitive pressures.

Exit Barriers

High exit barriers can significantly influence competitive rivalry by keeping companies invested in a market even when profitability declines. These barriers can include substantial investments in specialized fixed assets, such as the dedicated infrastructure required for certain manufacturing or service industries. For instance, companies in the semiconductor fabrication industry often face enormous capital expenditures for cleanrooms and advanced machinery, making divestment extremely costly.

Long-term contracts with customers or suppliers also act as a powerful deterrent to exiting. Consider the telecommunications sector, where providers might be locked into multi-year service agreements or infrastructure build-out commitments. Breaking these contracts can incur substantial penalties, forcing companies to continue operations despite unfavorable market conditions. In 2024, the average contract length in the fixed broadband market remained around 24 months in many developed economies, illustrating this commitment.

The specialized nature of a business further compounds exit barriers. If a company's assets and employee expertise are highly specific to its current industry, they may have little to no resale value or applicability elsewhere. This was evident in the retail sector during the early 2020s, where many brick-and-mortar stores, heavily invested in physical layouts and location-specific leases, struggled to pivot or sell off assets efficiently when facing online competition.

- Specialized Assets: Businesses with unique, industry-specific machinery or facilities find it difficult and expensive to repurpose or sell these assets, trapping capital.

- Long-Term Contracts: Commitments to customers or suppliers, often spanning several years, create financial liabilities if prematurely terminated, discouraging departure.

- Employee Specialization: Highly trained workforces with skills only relevant to the current industry present a challenge for redeployment or sale, increasing exit costs.

- Brand and Reputation: A strong brand built over years can be damaged by a poorly managed exit, leading companies to persist rather than risk reputational harm.

The competitive rivalry within the healthcare GPO and improvement services market is intense, driven by a crowded field of established players like Vizient, HealthTrust, and Premier. This rivalry is further fueled by a market projected to grow at a CAGR of approximately 7.5% through 2028, with competition intensifying in slower-growing segments as GPOs fight for existing market share.

Companies are differentiating beyond price, focusing on unique value propositions such as advanced data analytics, AI integration, and supply chain resilience, alongside specialized advisory services. Premier, for instance, leverages its PINC AI platform and strategic alliances, like its partnership with Epic, to create integrated solutions and build member loyalty through high switching costs, though competitors actively seek to undermine these barriers with incentives and easier transition paths.

| Key Competitive Factors | Impact on Rivalry | Premier's Strategy |

|---|---|---|

| Market Concentration | High rivalry among dominant players | Differentiation through PINC AI and alliances |

| Market Growth Rate | Intensified competition in mature segments | Focus on AI and data analytics for new growth |

| Value Proposition Focus | Shift from price to unique services | Integrated solutions, member lock-in |

| Switching Costs | Barrier to entry for new players, retention tool | Leveraging integrated services to increase exit costs |

| Competitor Counter-Moves | Efforts to reduce switching costs, offer incentives | Constant innovation to maintain differentiation |

SSubstitutes Threaten

Healthcare providers, particularly large health systems, are increasingly building or enhancing their in-house supply chain management capabilities. This trend allows them to bypass external Group Purchasing Organizations (GPOs) like Premier by directly negotiating with manufacturers and managing their own logistics. For instance, some systems have reported significant cost savings through direct sourcing, though the initial investment in infrastructure and expertise can be substantial.

Hospitals and health systems increasingly explore direct purchasing from manufacturers or distributors, bypassing Group Purchasing Organizations (GPOs). This strategy is especially prevalent for high-volume consumables and expensive capital equipment, allowing for more tailored negotiations. For instance, in 2024, some large hospital networks reported achieving savings of up to 15% on select medical devices by engaging directly with manufacturers, diverting from traditional GPO contracts.

Independent healthcare consulting firms present a significant threat by offering specialized strategic advice, operational improvements, and cost-saving initiatives that can directly compete with Premier's performance services. These firms often leverage deep industry expertise and tailored solutions, potentially attracting clients seeking focused interventions.

Standalone health IT companies also pose a threat, particularly those providing robust data and analytics platforms. For instance, companies offering advanced predictive analytics or AI-driven insights in healthcare could be seen as alternatives to Premier's PINC AI, especially if they offer more specialized functionalities or a more competitive pricing structure.

The market for healthcare consulting and data analytics is dynamic, with numerous players vying for market share. For example, in 2024, the global healthcare analytics market was valued at approximately $34.1 billion and is projected to grow significantly, indicating a robust competitive landscape where substitutes are readily available.

Regional Buying Coalitions or Alliances

Regional buying coalitions present a significant threat of substitutes to national Group Purchasing Organizations (GPOs) like Premier. These alliances pool the purchasing power of healthcare providers within a specific geographic area, potentially securing more favorable pricing and terms than individual facilities could achieve.

For instance, a coalition of hospitals in the Midwest might negotiate directly with regional medical supply distributors, bypassing national GPO contracts. This localized approach can lead to cost savings and more responsive service, directly challenging the value proposition of larger, national organizations. In 2024, the healthcare supply chain continued to see a trend towards regionalization, with many smaller health systems exploring collaborative purchasing to combat rising costs and improve efficiency.

- Regional Alliances Offer Tailored Solutions: Local coalitions can customize their purchasing strategies to meet the specific needs of their member institutions, unlike the one-size-fits-all approach sometimes seen with national GPOs.

- Leveraging Local Market Dynamics: These groups can capitalize on regional supplier relationships and market conditions, potentially securing better deals than those available through broader national agreements.

- Increased Negotiating Power: By consolidating demand from multiple regional providers, these coalitions can exert significant leverage over suppliers, driving down costs.

Generic or Off-patent Products

The threat of substitutes is particularly potent for pharmaceutical and medical supply procurement when considering generic or off-patent products. These alternatives directly challenge brand-name or proprietary offerings, often at significantly lower price points. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continues to emphasize the importance of generic drug approvals, with over 1,000 generic drug approvals anticipated annually, reflecting a sustained effort to increase market competition and affordability.

This dynamic directly impacts the cost savings that Group Purchasing Organizations (GPOs) like Premier aim to deliver to their members. When a generic version of a drug or a less expensive, off-patent medical device becomes available, it provides a viable substitute for a more expensive, patented product. This forces GPOs to negotiate aggressively on behalf of their members to secure the best pricing for both branded and generic options, ensuring a comprehensive approach to cost management.

- Generic drug utilization in the U.S. reached approximately 90% of all prescriptions filled in 2023, highlighting their significant market penetration and impact on healthcare costs.

- The average savings from using generic drugs compared to their brand-name counterparts can range from 80% to 85%.

- In 2024, the market for biosimil drugs, which are analogous to generics for biologic medications, is also expanding, offering further substitution opportunities for higher-cost specialty treatments.

The threat of substitutes for organizations like Premier stems from alternative ways healthcare providers can achieve similar outcomes, particularly in supply chain management and cost savings. These substitutes range from direct sourcing and regional collaborations to specialized consulting and IT solutions.

In 2024, the healthcare sector continued to see a rise in independent consulting firms and standalone health IT companies offering data analytics, directly challenging Premier's service offerings. The global healthcare analytics market, valued at approximately $34.1 billion in 2024, underscores the breadth of these competitive alternatives.

Furthermore, the increasing adoption of generic pharmaceuticals, with U.S. generic drug utilization at around 90% of prescriptions filled in 2023, presents a significant substitute for brand-name products, impacting GPO value propositions.

| Substitute Category | Description | 2024 Market Context/Data Point |

|---|---|---|

| Direct Sourcing | Healthcare providers bypassing GPOs to negotiate directly with manufacturers. | Some large networks reported up to 15% savings on select devices in 2024. |

| Regional Buying Coalitions | Local alliances pooling purchasing power. | Trend towards regionalization in healthcare supply chains continued in 2024. |

| Independent Consulting Firms | Firms offering specialized strategic and operational advice. | Dynamic market with numerous players vying for share. |

| Standalone Health IT Companies | Providers of advanced data and analytics platforms. | Global healthcare analytics market valued at $34.1 billion in 2024. |

| Generic/Off-Patent Products | Lower-cost alternatives to brand-name pharmaceuticals and devices. | Generic drug utilization ~90% of U.S. prescriptions filled in 2023. |

Entrants Threaten

New entrants in the healthcare Group Purchasing Organization (GPO) and improvement services market face substantial hurdles due to the significant economies of scale that established players like Premier possess. Premier's extensive network, serving thousands of member hospitals and health systems, enables it to secure deeply discounted pricing from suppliers. For instance, in 2024, Premier’s aggregated purchasing power translated into substantial savings for its members, a benefit difficult for nascent competitors to replicate.

The capital requirements for establishing a Group Purchasing Organization (GPO) and healthcare improvement company are significant. Think about the investment needed for advanced technology, robust data analytics platforms, and building a network of experienced healthcare professionals. For instance, in 2024, many established GPOs reported annual IT spending in the tens of millions of dollars to maintain competitive data analytics and operational efficiency.

This substantial initial investment acts as a formidable barrier to entry for new players. A new entrant would need to secure considerable funding to even begin operations, let alone compete with established entities that have already amortized their initial capital outlays. This financial hurdle deters many potential competitors from entering the market.

Premier's established relationships with thousands of U.S. hospitals and health systems represent a significant barrier to new entrants. These long-standing connections are built on years of trust, proven cost savings, and the delivery of integrated services, making it challenging for newcomers to gain a foothold.

New competitors must not only offer a compelling value proposition but also invest heavily in building credibility within an industry that highly values established partnerships. Overcoming Premier's deeply ingrained brand loyalty requires substantial effort and a proven track record.

Regulatory Hurdles and Compliance

The healthcare industry presents substantial regulatory hurdles that act as a significant barrier to entry for new Group Purchasing Organizations (GPOs). These organizations must navigate a complex web of legal and compliance frameworks, such as the Anti-Kickback Statute and Stark Law, which govern healthcare transactions and physician referrals. For instance, in 2024, the Office of Inspector General (OIG) continued to issue guidance and pursue enforcement actions related to improper financial arrangements within healthcare, underscoring the critical need for robust compliance programs. Establishing and maintaining these programs requires substantial investment in legal expertise and operational infrastructure, which can be prohibitive for nascent GPOs.

The sheer complexity of these regulations means new entrants often lack the established legal and compliance teams necessary to operate effectively and avoid costly penalties. This intricate environment demands specialized knowledge and ongoing adaptation to evolving legal interpretations and enforcement priorities. For example, the Consolidated Appropriations Act, 2023, which included provisions impacting healthcare pricing transparency, further adds to the compliance burden for all players in the healthcare supply chain, including GPOs.

- Healthcare regulations like the Anti-Kickback Statute and Stark Law are extensive and strictly enforced.

- New GPOs require significant investment in legal and compliance expertise to navigate these rules.

- Failure to comply can result in severe financial penalties and reputational damage, deterring new entrants.

- The evolving regulatory landscape, including pricing transparency mandates, adds further complexity and cost for new organizations.

Access to Proprietary Data and Networks

Premier’s formidable competitive advantage stems from its proprietary data and analytics platform, PINC AI. This platform taps into a vast network of healthcare providers, creating a unique and deep well of operational and supply chain data. New entrants face a significant hurdle in replicating this data asset, which is fundamental for delivering the advanced insights Premier offers to optimize healthcare performance.

The difficulty in accessing similar proprietary data and establishing comparable networks presents a substantial barrier to entry. For instance, Premier's ability to aggregate and analyze data from its extensive alliance of providers, which includes thousands of hospitals, allows for unparalleled benchmarking and predictive analytics. This data moat makes it exceptionally challenging for newcomers to offer comparable value propositions.

- Proprietary Data Asset: PINC AI's comprehensive dataset is a key differentiator, difficult for new entrants to replicate.

- Extensive Provider Network: Premier’s alliance of healthcare providers offers a scale of data that is hard to match.

- Deep Insights: The platform leverages this data to provide critical insights for healthcare optimization, a significant barrier for potential competitors.

The threat of new entrants in the healthcare Group Purchasing Organization (GPO) market, particularly concerning established players like Premier, is significantly mitigated by substantial barriers. These include immense economies of scale and the high capital requirements necessary to build competitive infrastructure. For example, in 2024, the ongoing investment in advanced data analytics and IT systems by leading GPOs often ran into tens of millions of dollars annually, a cost prohibitive for most newcomers.

Premier’s established network and deep supplier relationships are difficult for new entrants to replicate, offering members significant cost advantages. Furthermore, the complex regulatory landscape of the healthcare industry, including statutes like the Anti-Kickback Statute, necessitates considerable investment in legal and compliance expertise, acting as a major deterrent. The proprietary data and analytics platform, PINC AI, further solidifies Premier's position, creating a data moat that is exceptionally challenging for new competitors to breach.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Economies of Scale | Premier’s large purchasing volume secures deeply discounted prices from suppliers. | Difficult for new entrants to match pricing and achieve similar cost savings for members. |

| Capital Requirements | Significant investment needed for technology, data analytics, and network building. | High upfront costs deter potential competitors, especially in 2024 with ongoing IT spending. |

| Brand Loyalty & Relationships | Established trust and long-standing partnerships with thousands of U.S. hospitals. | Challenging for newcomers to gain credibility and displace incumbent GPOs. |

| Regulatory Hurdles | Navigating complex healthcare laws like Anti-Kickback and Stark Law. | Requires substantial investment in legal and compliance infrastructure, increasing operational costs. |

| Proprietary Data & Analytics | Premier's PINC AI platform offers unique insights derived from extensive data. | New entrants struggle to replicate the depth and breadth of data, hindering their ability to provide comparable value. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, publicly available financial statements, and competitor analysis from leading business intelligence platforms.