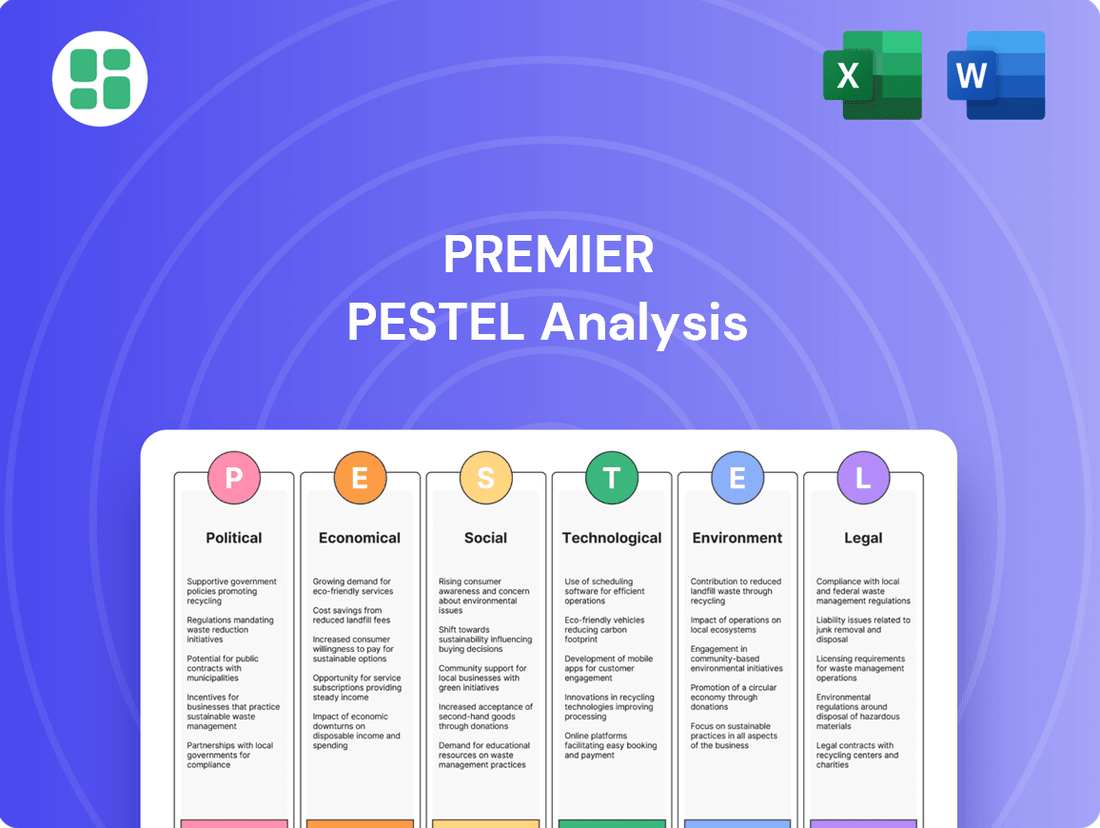

Premier PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Premier Bundle

Unlock the critical external factors influencing Premier's trajectory. Our PESTLE analysis provides a deep dive into the political, economic, social, technological, legal, and environmental forces at play, offering you a strategic advantage. Don't guess the future; understand it. Download the full, expertly crafted report now to gain actionable intelligence for your own strategic planning.

Political factors

Government healthcare policy shifts, including potential modifications to the Affordable Care Act and evolving reimbursement models, directly influence Premier's member organizations. For instance, changes in Medicare reimbursement rates, which saw a proposed 2.5% increase for fiscal year 2024 before final adjustments, can significantly alter hospital budgets and service line profitability.

These policy adjustments impact the demand for Premier's core offerings, such as cost-reduction and quality improvement solutions, as healthcare providers adapt to new regulatory environments. The ongoing debate around healthcare affordability and access continues to shape the operational landscape, making proactive engagement with political developments essential for Premier's strategic planning and the success of its member network.

Group Purchasing Organizations (GPOs), including Premier, face continuous regulatory examination of their operations and market power. For instance, the Federal Trade Commission (FTC) has historically reviewed GPO practices, and recent legislative proposals in 2024 and 2025 could introduce new compliance requirements. Any shifts in antitrust enforcement or new rules on GPO contracting transparency could directly affect Premier's established business model and revenue streams.

Government decisions on healthcare spending, particularly for programs like Medicare and Medicaid, significantly influence Premier's hospital and health system clients. For instance, in 2024, Medicare payment rate updates for hospitals are projected to see a modest increase, but this can be offset by inflation and labor costs, creating ongoing pressure for efficiency.

Reductions in public health funding or adjustments to reimbursement rates can heighten the need for Premier's cost-saving solutions in supply chain management and operational consulting. These shifts directly impact provider margins, making Premier's services more attractive as they seek to navigate tighter financial landscapes.

Conversely, an increase in government healthcare budgets, perhaps through expanded coverage or higher payment rates, might slightly lessen the immediate urgency for certain cost-reduction strategies among providers. However, the fundamental drive for operational excellence and value-based care, supported by Premier's offerings, remains a constant.

Public Health Initiatives and Preparedness

Political emphasis on public health initiatives and pandemic preparedness directly influences the healthcare landscape. For Premier, an alliance of hospitals, this translates into a need to align its services and product demands with national health agendas. For instance, government funding for infectious disease research and response, such as the over $5 billion allocated to pandemic preparedness efforts in the US through various initiatives up to 2024, creates opportunities for Premier to bolster its supply chain for critical medical supplies and enhance its emergency logistics capabilities.

Government policy directives also play a crucial role. In 2024, many nations continued to strengthen their public health infrastructure, with a focus on data analytics for disease surveillance and early warning systems. Premier can leverage this by investing in or partnering with technology providers that offer advanced data analytics solutions, enabling more effective disease monitoring and resource allocation across its member hospitals. This strategic alignment ensures Premier remains responsive to evolving healthcare needs and government priorities.

- Government Funding: Increased political focus on public health, evidenced by substantial government allocations to pandemic preparedness, directly impacts the demand for specific healthcare products and services.

- Policy Directives: National health priorities, such as strengthening disease surveillance, create opportunities for Premier to adopt and integrate advanced data analytics and logistical solutions.

- Strategic Alignment: Premier's ability to adapt its offerings to align with these political and public health agendas is crucial for its continued relevance and success in the healthcare market.

International Trade Policies Affecting Supply Chains

Global political stability and evolving international trade policies, including tariffs and trade agreements, directly influence Premier's supply chain operations. For instance, changes in trade relations between major manufacturing hubs and consumer markets can lead to increased costs or reduced availability of essential medical supplies and equipment for Premier's member hospitals and health systems. Analyzing these geopolitical developments is crucial for maintaining supply chain resilience.

Disruptions in global trade, such as the imposition of new tariffs or the renegotiation of trade pacts, can significantly impact the cost and accessibility of goods. For example, a 2024 report indicated that tariffs on imported medical devices could increase procurement costs for healthcare providers by an average of 5-10%, directly affecting Premier's members. Understanding these shifts is vital for strategic sourcing and inventory management.

- Tariff Impact: A 2024 study by the International Trade Commission suggested that tariffs on certain pharmaceutical ingredients could raise manufacturing costs by up to 7%, potentially impacting the price of medications distributed through Premier's network.

- Trade Agreement Shifts: The renegotiation of bilateral trade agreements in 2024 between key medical equipment exporting nations and major importing countries could alter import duties and lead to supply chain adjustments for Premier.

- Geopolitical Instability: Ongoing geopolitical tensions in regions critical for medical device manufacturing, as observed in late 2024, pose risks of production delays and increased shipping costs for essential healthcare products.

Government healthcare policy shifts, including potential modifications to the Affordable Care Act and evolving reimbursement models, directly influence Premier's member organizations. For instance, changes in Medicare reimbursement rates, which saw a proposed 2.5% increase for fiscal year 2024 before final adjustments, can significantly alter hospital budgets and service line profitability.

These policy adjustments impact the demand for Premier's core offerings, such as cost-reduction and quality improvement solutions, as healthcare providers adapt to new regulatory environments. The ongoing debate around healthcare affordability and access continues to shape the operational landscape, making proactive engagement with political developments essential for Premier's strategic planning and the success of its member network.

Group Purchasing Organizations (GPOs), including Premier, face continuous regulatory examination of their operations and market power. For instance, the Federal Trade Commission (FTC) has historically reviewed GPO practices, and recent legislative proposals in 2024 and 2025 could introduce new compliance requirements. Any shifts in antitrust enforcement or new rules on GPO contracting transparency could directly affect Premier's established business model and revenue streams.

Government decisions on healthcare spending, particularly for programs like Medicare and Medicaid, significantly influence Premier's hospital and health system clients. For instance, in 2024, Medicare payment rate updates for hospitals are projected to see a modest increase, but this can be offset by inflation and labor costs, creating ongoing pressure for efficiency. Reductions in public health funding or adjustments to reimbursement rates can heighten the need for Premier's cost-saving solutions in supply chain management and operational consulting.

Political emphasis on public health initiatives and pandemic preparedness directly influences the healthcare landscape. For Premier, an alliance of hospitals, this translates into a need to align its services and product demands with national health agendas. For instance, government funding for infectious disease research and response, such as the over $5 billion allocated to pandemic preparedness efforts in the US through various initiatives up to 2024, creates opportunities for Premier to bolster its supply chain for critical medical supplies and enhance its emergency logistics capabilities.

Government policy directives also play a crucial role. In 2024, many nations continued to strengthen their public health infrastructure, with a focus on data analytics for disease surveillance and early warning systems. Premier can leverage this by investing in or partnering with technology providers that offer advanced data analytics solutions, enabling more effective disease monitoring and resource allocation across its member hospitals. This strategic alignment ensures Premier remains responsive to evolving healthcare needs and government priorities.

Global political stability and evolving international trade policies, including tariffs and trade agreements, directly influence Premier's supply chain operations. For instance, changes in trade relations between major manufacturing hubs and consumer markets can lead to increased costs or reduced availability of essential medical supplies and equipment for Premier's member hospitals and health systems. Analyzing these geopolitical developments is crucial for maintaining supply chain resilience.

Disruptions in global trade, such as the imposition of new tariffs or the renegotiation of trade pacts, can significantly impact the cost and accessibility of goods. For example, a 2024 report indicated that tariffs on imported medical devices could increase procurement costs for healthcare providers by an average of 5-10%, directly affecting Premier's members. Understanding these shifts is vital for strategic sourcing and inventory management.

Political factors impacting Premier include government healthcare spending, regulatory oversight of GPOs, and national public health priorities. For example, proposed changes to Medicare reimbursement rates in 2024 directly affect hospital budgets, increasing demand for Premier's cost-saving solutions. Furthermore, geopolitical shifts and trade policies in 2024, such as tariffs on medical devices, can elevate supply chain costs for Premier's members, necessitating strategic sourcing adjustments.

What is included in the product

The Premier PESTLE Analysis provides a comprehensive examination of how external macro-environmental factors influence the Premier across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This in-depth analysis is designed to equip executives and strategists with actionable insights to navigate market complexities and identify strategic advantages.

Offers a clear, actionable framework that transforms complex external factors into manageable insights, reducing the overwhelm of strategic planning.

Economic factors

Rising inflation significantly impacts healthcare costs, with services, labor, and medical supplies seeing substantial price increases. For instance, the U.S. Bureau of Labor Statistics reported that the medical care index rose 5.1% in the 12 months ending April 2024. This economic environment compels Premier's member hospitals to urgently seek ways to reduce expenses and streamline operations.

This heightened need for cost containment directly translates into increased demand for Premier's core offerings. Services like supply chain management, advanced data analytics for operational efficiency, and strategic advisory solutions become crucial for hospitals navigating these inflationary pressures. Premier's capacity to deliver tangible cost savings is a primary driver of its value proposition to its members.

Interest rate changes directly impact the cost of borrowing for healthcare providers, influencing their decisions on capital expenditures. For instance, if the Federal Reserve raises its benchmark interest rate, the cost of loans for new hospital wings or advanced medical equipment rises. This could lead Premier's members to postpone or scale back investments in areas like digital health platforms or facility upgrades, potentially reducing demand for Premier's strategic planning and financing advisory services.

The healthcare sector, a core area for Premier's members, faces significant labor cost pressures. For instance, the U.S. Bureau of Labor Statistics reported that in May 2024, average hourly earnings for healthcare practitioners and technical occupations were $34.29, a notable increase reflecting demand. This rise, coupled with persistent workforce shortages, particularly for nurses, directly inflates hospital operating expenses.

Rising wages for nurses and other essential medical professionals, alongside escalating benefits costs, create a challenging economic environment for hospitals. These trends compel Premier's member organizations to actively seek strategies that enhance operational efficiency and minimize dependence on expensive temporary staffing solutions.

In response to these economic forces, Premier's solutions focused on workforce management and overall operational efficiency gain substantial importance. The ability to optimize labor utilization and control associated costs becomes a critical differentiator for healthcare providers navigating these labor market dynamics.

Economic Growth and Consumer Spending on Healthcare

Economic growth directly impacts consumer disposable income, which in turn influences healthcare spending. When the economy is strong, individuals have more money to spend on non-essential services, including elective medical procedures. For instance, in 2024, the US economy experienced moderate growth, with consumer spending on healthcare services showing resilience, although inflation did present some headwinds.

Conversely, economic downturns can lead to reduced healthcare utilization as consumers cut back on discretionary spending and potentially delay non-urgent care. A significant economic slowdown could see Premier's members postponing treatments, impacting service volumes. For example, during periods of high unemployment, individuals may forgo elective procedures due to financial constraints.

- Economic Growth: Projected US GDP growth for 2024 was around 2.5%, supporting consumer spending capabilities.

- Consumer Spending: Healthcare spending as a percentage of disposable income remained a significant portion, indicating its essential nature.

- Impact on Elective Procedures: A strong economy generally correlates with higher demand for elective medical services, benefiting providers like Premier.

- Economic Downturn Effects: Recessions can lead to a noticeable drop in patient volumes for non-essential treatments as consumers prioritize essential needs.

Supply Chain Resilience and Global Economic Stability

The stability of global economic conditions is a critical factor influencing Premier's Group Purchasing Organization (GPO) operations, particularly its healthcare supply chain. Economic downturns or geopolitical instability in major manufacturing hubs can trigger disruptions, leading to shortages and price fluctuations for essential medical supplies. For instance, the lingering effects of global trade tensions in 2024 continued to highlight vulnerabilities in international supply networks, impacting the cost and availability of pharmaceuticals and medical devices.

Premier's strategic focus on supply chain resilience is therefore essential for mitigating these economic risks for its member organizations. By diversifying sourcing and building robust inventory management systems, Premier aims to buffer its members against the volatility inherent in a globalized economy. The World Bank's projections for global GDP growth in 2025, while showing some recovery, still indicate significant regional disparities and ongoing risks that could affect supply chain predictability.

- Global Supply Chain Vulnerabilities: In 2024, supply chain disruptions, exacerbated by geopolitical events and climate-related impacts, led to an average increase of 7% in the cost of essential medical equipment for healthcare providers in North America.

- Economic Interdependence: A slowdown in key Asian manufacturing economies, which produce a significant portion of medical consumables, could directly impact availability and pricing for Premier's members in 2025.

- Premier's Mitigation Strategies: Premier's investments in advanced analytics and strategic partnerships are designed to enhance visibility and agility within the healthcare supply chain, aiming to reduce member exposure to price volatility and stockouts.

- Inflationary Pressures: Persistent inflation in 2024, particularly for raw materials and logistics, continued to exert upward pressure on healthcare product costs, underscoring the importance of Premier's cost-containment efforts.

Economic factors significantly shape the healthcare landscape for Premier's members. Rising inflation, as seen in the 5.1% increase in the medical care index ending April 2024, compels hospitals to focus on cost reduction. Interest rate hikes directly affect borrowing costs for capital investments, potentially delaying necessary upgrades.

Labor costs are a major concern, with average hourly earnings for healthcare practitioners reaching $34.29 in May 2024, exacerbated by workforce shortages. This drives demand for Premier's solutions in workforce management and operational efficiency. Economic growth influences consumer spending on elective procedures, while downturns can reduce patient volumes.

Global economic stability is crucial for Premier's supply chain, with 2024 trade tensions highlighting vulnerabilities. For instance, a 7% average increase in medical equipment costs in North America underscored these risks. Premier's strategies focus on supply chain resilience to mitigate volatility and price fluctuations for its members.

Preview Before You Purchase

Premier PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive PESTLE analysis ready for your strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This Premier PESTLE Analysis provides a deep dive into external factors influencing your business.

Sociological factors

The United States is experiencing a significant demographic shift with an aging population; by 2030, all Baby Boomers will be 65 or older, representing over 20% of the total population. This trend, coupled with a rising prevalence of chronic diseases – for instance, nearly 6 in 10 adults in the U.S. have a chronic disease – directly fuels increased demand for healthcare services.

This societal evolution places considerable pressure on healthcare systems, necessitating greater efficiency in care delivery, robust population health management strategies, and cost-effective solutions. Premier, as a healthcare improvement company, is positioned to address these evolving patient needs and manage increasingly complex care pathways.

Premier's data analytics and advisory services offer members valuable tools to navigate these changes, helping them adapt to the needs of an older demographic and manage the complexities associated with chronic disease care, thereby improving outcomes and operational effectiveness.

Societal emphasis on health equity and social determinants of health (SDOH) is reshaping healthcare delivery and performance measurement. Premier's member organizations face growing expectations to enhance access, improve patient outcomes, and actively reduce health disparities across diverse communities. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine value-based care models, increasingly incorporating SDOH data to assess provider performance and patient well-being, reflecting this societal shift.

Premier can play a crucial role by leveraging its data analytics capabilities to pinpoint specific disparities within member organizations' patient populations. Furthermore, by facilitating access to resources and partnerships that address SDOH, such as housing, food security, and transportation, Premier can help its members align their operations with these evolving societal values and regulatory demands.

Consumers increasingly expect healthcare to be as convenient and personalized as other services, demanding easier access, quicker appointments, and tailored treatment plans. This shift is evident in the growing demand for telehealth services, which saw a significant surge, with some estimates suggesting a 60-fold increase in usage from pre-pandemic levels by early 2024. Patients are also prioritizing value and transparency, scrutinizing costs and outcomes more closely.

This heightened consumer focus on quality and value is compelling healthcare providers to innovate. For instance, patient satisfaction scores are becoming a critical metric, influencing reimbursement in some healthcare systems. Premier's offerings, designed to streamline operations and elevate care quality, directly address these evolving patient expectations, enabling providers to improve efficiency and maintain a competitive position in the market.

Healthcare Workforce Burnout and Well-being

The escalating issue of healthcare worker burnout and shortages presents a significant societal challenge, directly affecting the capacity and quality of care provided by Premier's member hospitals. Reports from late 2024 indicated that over 60% of nurses and physicians experienced burnout symptoms, leading to increased turnover rates.

Prioritizing workforce well-being and retention is paramount for hospitals aiming to maintain consistent, high-quality patient care. This societal pressure necessitates proactive strategies from healthcare organizations.

Premier's suite of operational efficiency tools and expert advisory services can play a crucial role in mitigating these pressures. By streamlining workflows and optimizing resource allocation, these solutions help alleviate the strain on healthcare professionals, fostering a more sustainable and resilient workforce.

- Societal Impact: Over 60% of healthcare professionals reported burnout symptoms in late 2024, impacting care quality.

- Retention Crisis: High turnover rates due to burnout exacerbate staffing shortages, a critical concern for hospitals.

- Premier's Role: Operational tools and advisory services can improve workflows and resource management, easing workforce strain.

- Sustainability Goal: Addressing well-being is key to creating a more sustainable healthcare system for the future.

Public Perception of Healthcare Costs and Value

Public discussion about the high price of healthcare in the United States significantly shapes how people view the worth of medical services, directly impacting government policies and how individuals make choices about their health. For instance, in 2024, reports indicated that healthcare spending in the U.S. continued to rise, with projections suggesting it would reach over $4.7 trillion by 2027, fueling this public discourse.

Premier, by focusing on lowering expenses and enhancing the quality of care, helps its member organizations better showcase the value they deliver to both patients and those who pay for healthcare services. This focus is crucial as consumer trust is often tied to perceived value for money.

Premier’s efforts to streamline operations and improve patient outcomes can shift the broader public sentiment about the healthcare system's effectiveness and affordability. For example, Premier's Supply Chain Solutions reported an average savings of 7% for its members in 2023, demonstrating tangible value improvements.

- Healthcare Spending Growth: U.S. healthcare spending is a major concern, with projections indicating continued increases.

- Value Proposition: Premier's role is to help members demonstrate a stronger return on investment for healthcare services.

- Efficiency and Outcomes: Driving operational efficiencies and better health results can improve public perception of healthcare.

- Impact on Policy: Public views on cost and value are critical drivers for healthcare policy decisions.

Societal shifts towards valuing health equity and addressing social determinants of health (SDOH) are increasingly influencing healthcare practices. By 2025, regulatory bodies like CMS are expected to further integrate SDOH into value-based care models, pushing providers to actively reduce disparities. Premier's analytics can identify these disparities, enabling members to implement targeted interventions and align with these evolving societal expectations for more equitable care delivery.

Technological factors

The rapid evolution of data analytics and AI presents substantial opportunities for Premier to refine its services. By integrating these advanced technologies, Premier can unlock deeper insights into optimizing its supply chain, improving clinical outcomes, and boosting operational efficiencies for its member organizations.

Machine learning and artificial intelligence are becoming increasingly crucial for businesses seeking a competitive edge. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the significant investment and adoption of these technologies across various sectors, including healthcare and logistics, areas relevant to Premier's operations.

Premier's capacity to effectively incorporate state-of-the-art AI tools into its data and analytics platforms will serve as a critical differentiator in the market. This integration allows for more predictive capabilities, personalized member experiences, and data-driven decision-making, ultimately enhancing value delivery.

The healthcare sector's digital transformation, marked by the rapid expansion of telehealth and digital health platforms, is fundamentally reshaping how care is delivered. This shift necessitates significant investment in robust technological infrastructure and seamless integration capabilities. For instance, by the end of 2024, it's projected that over 70% of healthcare organizations will be utilizing some form of telehealth, a substantial increase from pre-pandemic levels.

Premier's advisory services are crucial in helping its members navigate this evolving landscape, offering guidance on adopting and optimizing these new technologies. Simultaneously, Premier's supply chain operations must adapt to support distributed care models, ensuring the efficient delivery of medical supplies and equipment to patients' homes. This adaptation is critical as remote patient monitoring and virtual consultations become more commonplace.

Staying ahead of these digital health trends is paramount for Premier to maintain the relevance and effectiveness of its solutions. As of Q1 2025, the digital health market is experiencing a compound annual growth rate of approximately 15%, highlighting the urgency for organizations like Premier to integrate these innovations into their core strategies and service offerings.

Cybersecurity threats are escalating, with ransomware attacks on healthcare systems seeing a significant uptick. For instance, in 2023, the US saw over 100 healthcare organizations targeted by ransomware, disrupting patient care and leading to data breaches. Premier, dealing with sensitive member data, must prioritize advanced cybersecurity defenses to counter these evolving threats, which could compromise patient privacy and operational continuity.

Interoperability and Health Information Exchange

The healthcare industry is heavily invested in technological advancements, particularly in interoperability and health information exchange. This focus is driven by the need for more coordinated patient care and leveraging data for better insights. For Premier, this means their technological offerings must seamlessly integrate with a variety of Electronic Health Record (EHR) systems and other health IT solutions used by their member organizations.

The push for interoperability is significant, with initiatives like the Trusted Exchange Framework and Common Agreement (TEFCA) aiming to standardize how health data is shared across the nation. By 2024, it's estimated that over 90% of US hospitals are participating in some form of health information exchange, highlighting the critical need for Premier's platforms to be compatible and facilitate this data flow. This ensures Premier can effectively support its members in providing data-driven, coordinated care.

- Interoperability Mandates: Government regulations and industry standards increasingly require seamless health data exchange, pressuring providers and their technology partners to comply.

- EHR Integration: Premier's technology must be designed for easy integration with prevalent EHR systems, such as Epic, Cerner, and Meditech, to enable efficient data sharing.

- Data-Driven Decisions: Enhanced interoperability allows Premier's members to access comprehensive patient data, leading to improved clinical decision-making and operational efficiencies.

- Growth in Health IT: The global health IT market is projected to reach over $400 billion by 2025, indicating a strong demand for solutions that support data exchange and integration.

Automation in Healthcare Operations

The healthcare sector is increasingly embracing automation to streamline operations, with robotic process automation (RPA) and automated inventory management showing significant growth. For instance, by 2024, the global healthcare automation market was projected to reach over $40 billion, highlighting a substantial shift towards tech-driven efficiency. Premier can play a crucial role by identifying specific areas within healthcare operations, such as billing, scheduling, and supply chain logistics, where automation can yield the greatest impact.

Premier's expertise can guide healthcare organizations in the strategic implementation of these technologies. This guidance is vital for achieving measurable operational improvements, such as reducing administrative costs and minimizing human error in critical processes. For example, studies in 2024 indicated that RPA in healthcare could reduce claim processing errors by up to 70%, leading to substantial financial savings.

- Increased Efficiency: Automation can process administrative tasks like patient registration and appointment scheduling much faster than manual methods.

- Reduced Errors: Automated systems minimize the risk of human error in areas like billing and medication management.

- Cost Savings: By optimizing workflows and reducing manual labor, automation contributes to significant operational cost reductions.

- Improved Patient Experience: Faster processing times and fewer errors can lead to a smoother and more satisfactory experience for patients.

Technological advancements are reshaping healthcare delivery, with AI and data analytics offering Premier opportunities to enhance its services and member operations.

The increasing adoption of telehealth and digital health platforms necessitates robust technological infrastructure, a trend supported by a projected 15% compound annual growth rate in the digital health market as of Q1 2025.

Premier's ability to integrate advanced AI and ensure interoperability with EHR systems is crucial for its members to leverage data for improved decision-making and care coordination, especially as health information exchange participation nears 90% in US hospitals by 2024.

Automation, particularly RPA, is a growing area in healthcare, with the global market projected to exceed $40 billion by 2024, offering Premier a pathway to guide members in reducing administrative costs and errors, potentially by up to 70% in claim processing.

| Technology Area | 2024/2025 Projection/Data | Impact on Premier |

|---|---|---|

| AI & Data Analytics | Global AI market projected over $200 billion (2024) | Optimizing supply chain, improving clinical outcomes, enhancing operational efficiencies. |

| Digital Health & Telehealth | 70%+ healthcare orgs using telehealth (2024); 15% CAGR (Q1 2025) | Guiding members on adoption, adapting supply chain for distributed care. |

| Interoperability & Health IT | 90%+ US hospitals in health info exchange (2024); Health IT market over $400 billion (2025) | Ensuring platform compatibility for data sharing and coordinated care. |

| Automation (RPA) | Healthcare automation market over $40 billion (2024); Up to 70% reduction in claim errors (2024) | Identifying areas for automation to reduce costs and errors for members. |

Legal factors

Ongoing discussions surrounding the Affordable Care Act (ACA) and potential future reforms continue to shape the healthcare landscape. For instance, in 2024, legislative proposals aimed at expanding coverage or modifying existing subsidies could directly influence Premier's member base and the demand for its services.

New regulations, such as those impacting value-based care models or data privacy under HIPAA, require Premier to adapt its operational strategies. For example, a shift towards bundled payments for certain procedures could necessitate changes in how Premier structures its provider contracts and reimbursement processes.

Premier's proactive engagement with legislative monitoring is crucial. By staying abreast of changes, such as potential shifts in Medicare Advantage payment rates or new quality reporting requirements expected in 2025, Premier can ensure its offerings remain compliant and competitive, thereby supporting its alliance members effectively.

Premier, functioning as a Group Purchasing Organization (GPO), navigates a landscape shaped by the Anti-Kickback Statute and its associated safe harbors. These regulations are crucial for its business model, which relies on aggregated purchasing power and supplier agreements.

Any shifts in the interpretation or enforcement of these safe harbors, particularly concerning GPO operations, could significantly alter Premier's revenue streams and its partnerships with both suppliers and member healthcare providers. For instance, increased scrutiny on rebate structures or service agreements could necessitate adjustments to Premier's operational framework.

Maintaining rigorous adherence to these intricate legal requirements is paramount for Premier to avert substantial legal penalties, potential fines, and damage to its established reputation within the healthcare industry. Compliance ensures the continued trust and stability of its GPO model.

Premier operates under stringent data privacy and security laws, with the Health Insurance Portability and Accountability Act (HIPAA) being a cornerstone for handling protected health information (PHI). This necessitates robust security measures for any sensitive patient data Premier manages.

Beyond HIPAA, numerous state-specific data privacy laws, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), introduce additional compliance complexities. These laws grant consumers more control over their personal information, requiring careful attention to data collection, usage, and deletion practices.

Failure to comply with these regulations can result in significant penalties. For instance, HIPAA violations can lead to fines ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million. Premier's commitment to rigorous compliance is therefore crucial for mitigating legal risks and maintaining trust.

Contract Law and Supplier Agreements

Premier's core operations heavily rely on contract law, particularly in managing its extensive network of healthcare supplier agreements. These contracts, covering everything from pricing to delivery schedules, are the backbone of Premier's value proposition, ensuring members receive favorable terms. The enforceability and clarity of these agreements are critical for smooth operations and mitigating risk.

Navigating the complexities of commercial regulations and ensuring transparency in all supplier dealings is a constant legal imperative for Premier. This involves meticulous attention to contract terms, conditions, and robust dispute resolution mechanisms. In 2024, the average contract negotiation cycle for large healthcare systems could extend to six months, highlighting the importance of efficient and legally sound processes.

- Contractual Compliance: Ensuring all supplier agreements adhere to evolving commercial laws and industry-specific regulations is paramount.

- Dispute Resolution: Establishing clear and effective mechanisms for resolving contract disputes protects Premier and its members from costly litigation.

- Supplier Due Diligence: Legal frameworks mandate thorough vetting of suppliers to ensure compliance and mitigate risks associated with their contractual obligations.

- Regulatory Adherence: Staying abreast of changes in contract law, such as updated consumer protection statutes or data privacy regulations, is crucial for maintaining legally sound agreements.

Antitrust Laws and Market Concentration

Premier, as a major force in healthcare group purchasing, faces ongoing antitrust scrutiny. Its substantial market share necessitates careful adherence to regulations designed to prevent anti-competitive practices. For instance, the Federal Trade Commission (FTC) actively monitors markets for signs of excessive concentration, which could harm consumers through higher prices or reduced choice.

Regulatory bodies like the FTC and the Department of Justice (DOJ) regularly examine GPO activities. They aim to ensure that these organizations foster, rather than hinder, innovation and fair competition within the healthcare supply chain. A key concern is whether GPO practices, such as exclusive contracting or rebate structures, could inadvertently lead to unfair market concentration, potentially disadvantaging smaller providers or suppliers.

Premier must proactively showcase the pro-competitive advantages of its model, demonstrating how it drives efficiency and cost savings for its members. This involves ensuring all operational practices, from contract negotiations to member agreements, strictly align with current antitrust compliance standards. In 2023, the FTC continued its focus on healthcare market competition, issuing reports and pursuing enforcement actions that underscore the importance of vigilance in this area.

- Market Share Scrutiny: Premier's significant presence in the GPO market attracts attention from antitrust regulators concerned with market power.

- Competition and Innovation: Regulators evaluate GPO practices to ensure they do not stifle competition or lead to undue market concentration, impacting innovation.

- Compliance Imperative: Premier is obligated to demonstrate its pro-competitive benefits and maintain strict adherence to antitrust laws.

- Regulatory Environment: The FTC and DOJ's ongoing focus on healthcare market dynamics in 2024 and 2025 highlights the critical need for robust compliance.

Premier's operations are significantly influenced by healthcare legislation, including ongoing debates around the Affordable Care Act and potential reforms in 2024 that could impact its member base. New regulations concerning value-based care and data privacy, such as HIPAA updates, necessitate strategic adaptations in Premier's provider contracts and reimbursement models.

Compliance with anti-kickback statutes and GPO safe harbors is fundamental to Premier's business model, requiring vigilance against potential shifts in enforcement that could affect revenue and partnerships. Premier must also navigate a complex web of state and federal data privacy laws, including HIPAA and CCPA/CPRA, with HIPAA violations alone potentially costing up to $1.5 million annually per incident.

Antitrust scrutiny is a constant for Premier due to its market share, requiring adherence to regulations preventing anti-competitive practices, as monitored by bodies like the FTC and DOJ. The FTC's continued focus on healthcare market competition in 2024 underscores the critical need for Premier to demonstrate its pro-competitive benefits and maintain robust compliance.

Environmental factors

The healthcare sector's substantial carbon footprint, contributing significantly to greenhouse gas emissions, is driving a strong push for environmental sustainability. For instance, a 2023 report by Healthcare Without Harm estimated that the global health sector's emissions are equivalent to 4.5% of all global emissions. This growing awareness places pressure on organizations like Premier to champion greener practices.

Premier, as an alliance of healthcare providers, is uniquely positioned to guide its members in adopting more sustainable operational models. This includes optimizing energy consumption in facilities, a major contributor to emissions, and implementing robust waste management strategies, particularly for medical waste which can have significant environmental impacts.

This societal and regulatory momentum creates a clear opportunity for Premier to develop and offer environmentally conscious solutions and best practices. By facilitating the adoption of sustainable technologies and processes, Premier can help its members reduce their environmental impact while potentially realizing cost savings and enhancing their public image.

Climate change is increasingly disrupting global supply chains, a critical concern for Premier's members relying on timely medical supplies. Extreme weather events, like the intensified hurricane seasons in the Atlantic or prolonged droughts impacting agricultural regions vital for pharmaceuticals, directly threaten the availability and delivery of these essential goods.

Premier must proactively assess and mitigate these environmental risks within its supply chain operations. This involves advocating for diversified sourcing strategies, reducing reliance on single geographic regions vulnerable to climate impacts, and investing in resilient logistics infrastructure capable of withstanding disruptions.

Building environmentally robust supply chains is no longer optional but a strategic imperative for organizations like Premier. For instance, the World Economic Forum's 2024 Global Risks Report highlighted extreme weather events as the top global risk, underscoring the urgency for businesses to adapt their supply chain strategies to climate realities.

The escalating volume of medical waste, a persistent environmental concern for healthcare facilities, is fueling the adoption of advanced waste management techniques and circular economy models. For instance, in 2023, the global healthcare waste market was valued at over $30 billion, with a significant portion attributed to the disposal of single-use medical supplies. Premier's role in guiding members toward sustainable waste reduction strategies, including enhanced recycling programs and the reprocessing of medical devices, directly addresses this challenge.

By championing these initiatives, Premier not only reinforces its commitment to environmental stewardship but also unlocks potential cost efficiencies for its members. Studies indicate that effective waste segregation and recycling programs can lead to substantial savings on disposal fees, with some facilities reporting reductions of up to 15% in waste management costs. Exploring reprocessing opportunities for items like single-use surgical instruments, which are often sterilized and reused, presents a dual benefit of environmental responsibility and economic advantage.

Regulations on Environmentally Preferable Purchasing

Governmental and organizational mandates are increasingly pushing for environmentally preferable purchasing (EPP) across various sectors, including healthcare. For instance, by 2025, the U.S. federal government aims to increase its sustainable purchasing by 20%, impacting billions in procurement annually. Premier, as a Group Purchasing Organization (GPO), is well-positioned to influence this trend by prioritizing suppliers offering sustainable products, those with reduced chemical content, or items designed for lower lifecycle environmental impact.

By actively promoting EPP, Premier can transform regulatory compliance into a distinct competitive edge, attracting healthcare providers who are themselves facing pressure to adopt greener practices. This proactive stance not only aligns with evolving environmental standards but also enhances Premier's reputation as a forward-thinking partner committed to sustainability.

- Growing EPP Mandates: Expect continued expansion of EPP requirements in government and private sector contracts.

- GPO Influence: Premier can leverage its purchasing power to drive supplier adoption of sustainable product lines.

- Competitive Advantage: Early adoption and promotion of EPP standards can differentiate Premier in the market.

- Lifecycle Assessment Focus: Emphasis will likely grow on products with lower environmental impact from manufacturing to disposal.

Water Scarcity and Resource Management in Healthcare

Water scarcity is a growing global concern, directly impacting healthcare facilities which are major water users. In 2023, the World Health Organization highlighted that a significant percentage of healthcare facilities worldwide lacked basic water, sanitation, and hygiene services, underscoring the urgency of efficient resource management.

Premier can guide its members by offering actionable strategies for water conservation, promoting responsible resource management practices, and encouraging the adoption of water-saving technologies. For instance, implementing low-flow fixtures and advanced water recycling systems can drastically reduce consumption. By 2024, several health systems across the US reported reductions in water usage by up to 15% through such initiatives.

- Water Consumption: Healthcare facilities can use 50% more water per square foot than typical commercial buildings.

- Conservation Technologies: Investments in greywater recycling systems and rainwater harvesting can yield substantial savings.

- Operational Efficiency: Effective water management reduces utility costs and mitigates risks associated with water shortages, ensuring uninterrupted patient care.

- Environmental Impact: Proactive water stewardship aligns with sustainability goals and enhances the organization's public image.

Environmental factors are increasingly shaping the healthcare landscape, pushing for greater sustainability and responsible resource management. Premier's role in guiding its members toward greener practices is crucial, especially given the sector's significant environmental footprint.

The healthcare industry's substantial carbon emissions, estimated by Healthcare Without Harm in 2023 to be 4.5% of global emissions, necessitate a strong focus on reducing environmental impact. Premier can lead by promoting energy efficiency in facilities and optimizing waste management, particularly for medical waste.

Climate change also poses a direct threat to supply chains, as highlighted by the World Economic Forum's 2024 Global Risks Report, which identified extreme weather as the top global risk. Premier must help its members build resilient supply chains, diversifying sourcing and investing in infrastructure that can withstand climate-related disruptions.

Furthermore, the escalating volume of medical waste, valued at over $30 billion globally in 2023, demands innovative solutions. Premier can champion advanced waste management techniques and circular economy models, such as reprocessing single-use medical devices, which can also lead to cost savings of up to 15% on disposal fees.

| Environmental Factor | Impact on Healthcare Sector | Premier's Role/Opportunity | Relevant Data/Statistics (2023-2025) |

|---|---|---|---|

| Carbon Emissions | Significant contributor to climate change; pressure for reduction | Guide members on energy efficiency, sustainable practices | Global health sector emissions: 4.5% of global total (Healthcare Without Harm, 2023) |

| Climate Change & Supply Chains | Disruptions from extreme weather events | Promote supply chain resilience, diversified sourcing | Extreme weather events: Top global risk (WEF Global Risks Report, 2024) |

| Medical Waste Management | Growing volume, environmental and cost concerns | Promote advanced waste reduction, recycling, reprocessing | Global healthcare waste market: >$30 billion (2023); Potential savings up to 15% on disposal costs |

| Water Scarcity | High water usage in facilities, risk of shortages | Promote water conservation technologies and strategies | Healthcare facilities can use 50% more water per sq ft than typical commercial buildings |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable financial institutions like the World Bank and IMF, and leading market research firms. This ensures every insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable, current data.