PREIT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PREIT Bundle

PREIT's current market position is shaped by both robust retail real estate assets and the evolving landscape of consumer spending. Understanding their unique strengths, potential weaknesses, market opportunities, and competitive threats is crucial for anyone looking to invest or strategize within the retail sector.

Want the full story behind PREIT's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

PREIT significantly strengthened its financial position by emerging from its second Chapter 11 bankruptcy in April 2024. This restructuring slashed its total debt by an impressive $835 million to $880 million.

This substantial debt reduction has equipped PREIT with a much healthier and more manageable balance sheet. It effectively removes a critical financial pressure point that had previously raised concerns about potential defaults.

PREIT's transition to private ownership in April 2024 is a significant strength, allowing for more flexibility in strategic planning and operational execution away from the quarterly demands of public markets. This shift can foster a longer-term perspective on investments and development projects.

The appointment of Jared Chupaila as CEO in 2024, bringing over two decades of retail real estate experience, injects valuable leadership and a fresh strategic outlook. His expertise is expected to guide PREIT through its evolving market landscape.

PREIT is strategically repositioning its enclosed malls into dynamic mixed-use destinations, integrating residential, healthcare, and entertainment components alongside retail. This approach is designed to foster community engagement and build resilient, diversified revenue streams, moving beyond a singular reliance on traditional shopping. For instance, redevelopment plans at Moorestown Mall and Plymouth Meeting Mall are progressing, with residential construction anticipated to commence in early 2025, signaling a tangible shift toward these community-centric hubs.

Focused Portfolio in High-Demand Markets

PREIT's strength lies in its concentrated portfolio of retail properties, primarily situated in high-demand Eastern U.S. markets. This strategic geographic focus taps into densely populated areas with robust existing infrastructure, leading to significant foot traffic. For instance, as of early 2024, PREIT's portfolio included key assets in major metropolitan areas like Philadelphia, offering prime retail destinations.

This specialization allows PREIT to effectively leverage its locations for redevelopment, aiming to enhance community offerings. By concentrating on these prime retail environments, the company is well-positioned to capitalize on consumer spending trends and redefine the shopping experience in its operating regions.

Key aspects of this strength include:

- Geographic Concentration: Focus on the Eastern U.S. with a high density of population and economic activity.

- High Foot Traffic Potential: Locations chosen are typically in areas with proven consumer engagement.

- Redevelopment Opportunities: Strategic positioning enables the company to upgrade and modernize its properties to meet evolving consumer demands.

Secured New Capital Commitments

PREIT has bolstered its financial position by securing approximately $130 million in new capital commitments. This funding includes both debtor-in-possession and exit revolver financing, crucial elements of its restructuring efforts.

This influx of capital signals a significant vote of confidence from investors, underscoring their belief in PREIT's ongoing business plan and long-term viability. The $130 million injection provides essential liquidity to manage day-to-day operations and execute strategic initiatives following its bankruptcy proceedings.

- Secured $130 million in new capital commitments

- Financing includes debtor-in-possession and exit revolver facilities

- Demonstrates renewed investor confidence

- Provides crucial liquidity for operations and strategic initiatives

PREIT's emergence from bankruptcy in April 2024 significantly improved its financial health, reducing debt by $835 million to $880 million. This restructuring, coupled with securing $130 million in new capital, including exit financing, demonstrates renewed investor confidence and provides essential liquidity. The company’s strategic shift to private ownership in April 2024 offers greater flexibility for long-term planning, unburdened by public market pressures.

| Financial Metric | Value (as of April 2024) | Significance |

|---|---|---|

| Total Debt Reduction | $835 million | Improved balance sheet and reduced default risk |

| New Capital Commitments | $130 million | Enhanced liquidity and investor confidence |

| Ownership Structure | Private | Increased strategic and operational flexibility |

What is included in the product

Delivers a strategic overview of PREIT’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address PREIT's strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

PREIT's financial stability has been significantly challenged by recurrent bankruptcy filings. The company underwent Chapter 11 bankruptcy proceedings in 2020 and again in December 2023, successfully emerging in April 2024. This pattern of financial distress highlights persistent vulnerabilities in its business model and its struggle to navigate evolving market conditions.

These repeated filings raise serious concerns about PREIT's long-term credibility and its ability to attract and retain crucial business relationships, including potential tenants and strategic partners. The market's perception of a company with such a history can lead to increased caution and potentially higher costs of capital.

Following its emergence from Chapter 11 bankruptcy in April 2024, PREIT is no longer a publicly traded entity. This transition, while potentially granting more operational freedom, significantly curtails its ability to raise capital through public equity markets, a crucial avenue for funding future expansion and strategic initiatives.

The delisting from public exchanges limits PREIT's access to a vital source of funding for growth, potentially hindering its ability to capitalize on new investment opportunities in the evolving retail real estate landscape. This lack of public market access can constrain the company's capacity to undertake large-scale development projects or acquisitions necessary to remain competitive.

Furthermore, ceasing to be a public company reduces the transparency typically afforded to external stakeholders. Investors and financial analysts will have less readily available information, potentially impacting the perception of PREIT's financial health and future prospects, and making it harder to attract new capital if it were to seek it privately.

PREIT has faced challenges with underperforming assets, evidenced by the sale of properties like Exton Square Mall. This mall reported a concerning occupancy rate of just 62% in spring 2024, underscoring the difficulty in maintaining consistent performance across the entire portfolio.

The necessity of divesting such assets, while beneficial for debt reduction, points to underlying issues in asset management and the ability to sustain high occupancy levels across all its holdings. This strategy highlights past difficulties in optimizing the performance of its real estate investments.

Vulnerability of Enclosed Mall Model

PREIT's reliance on enclosed malls presents a significant weakness. This retail format has been struggling with declining foot traffic as consumer shopping habits shift towards online channels and open-air centers. For instance, as of Q1 2024, PREIT's portfolio still heavily features enclosed malls, which are more susceptible to these secular trends.

While PREIT is actively redeveloping some of its assets, the core challenge of maintaining the relevance and appeal of traditional enclosed malls persists. This vulnerability impacts occupancy rates and rental income, especially when compared to more adaptable retail formats. The company's strategy to transform some of these spaces into mixed-use properties aims to address this, but the transition period carries inherent risks.

- Dominant Enclosed Mall Portfolio: PREIT's portfolio remains heavily weighted towards enclosed malls, a format facing long-term declines in popularity.

- Evolving Consumer Preferences: Shoppers increasingly favor experiential retail and online shopping, bypassing traditional enclosed malls.

- Foot Traffic Challenges: Maintaining consistent foot traffic in enclosed malls is a persistent hurdle, impacting sales for tenants and revenue for PREIT.

- Redevelopment Risks: While redeveloping, PREIT faces execution risks and the potential for prolonged vacancies during transformation phases.

Lingering Impact of Past Indebtedness

PREIT's history of substantial debt, including over $1 billion in unmade payments in late 2023, highlights a past vulnerability. While restructuring efforts have been made, this legacy can still affect investor confidence and necessitate a more conservative operational approach.

The previous financial architecture proved unsustainable, leading to significant challenges. Even with current improvements, the lingering impact of past indebtedness requires ongoing diligence to rebuild trust and ensure long-term financial stability.

- Past Debt Burden: PREIT faced over $1 billion in debt payments it could not meet in late 2023, indicating significant past financial strain.

- Perception and Caution: Despite restructuring, the memory of this large debt load can influence market perception and lead to increased operational caution.

- Unsustainable Structure: The company's prior financial setup was demonstrably unsustainable, necessitating a fundamental shift in its debt management strategy.

PREIT's significant exposure to enclosed malls, a retail format facing secular decline, remains a core weakness. As of early 2024, the company's portfolio still heavily featured these properties, which are increasingly challenged by shifting consumer habits toward online shopping and open-air centers. This reliance makes PREIT vulnerable to decreased foot traffic and rental income, impacting tenant sales and overall portfolio performance.

The company's past financial distress, highlighted by its second Chapter 11 bankruptcy filing in December 2023 and emergence in April 2024, underscores persistent vulnerabilities. This pattern of financial instability raises concerns about long-term credibility and the ability to attract essential business relationships. The recent delisting from public exchanges in April 2024 further limits its access to capital markets, hindering growth prospects and the ability to fund strategic initiatives.

PREIT has also grappled with underperforming assets, necessitating the divestiture of properties like Exton Square Mall, which reported a 62% occupancy rate in spring 2024. While asset sales help reduce debt, they also point to underlying issues in asset management and the capacity to maintain consistent performance across its holdings.

| Weakness | Description | Impact | Supporting Data (as of Q1 2024/April 2024) |

|---|---|---|---|

| Dominant Enclosed Mall Portfolio | Heavy reliance on enclosed malls, a retail format in decline. | Vulnerability to reduced foot traffic and rental income. | Portfolio still heavily features enclosed malls. |

| Past Financial Instability | Recurrent bankruptcy filings (2020, Dec 2023-April 2024). | Damaged credibility, difficulty attracting partners, limited capital access. | Second Chapter 11 filing and subsequent delisting. |

| Underperforming Assets | Need to sell assets like Exton Square Mall due to poor performance. | Indicates asset management challenges and inability to sustain occupancy. | Exton Square Mall occupancy at 62%. |

Preview Before You Purchase

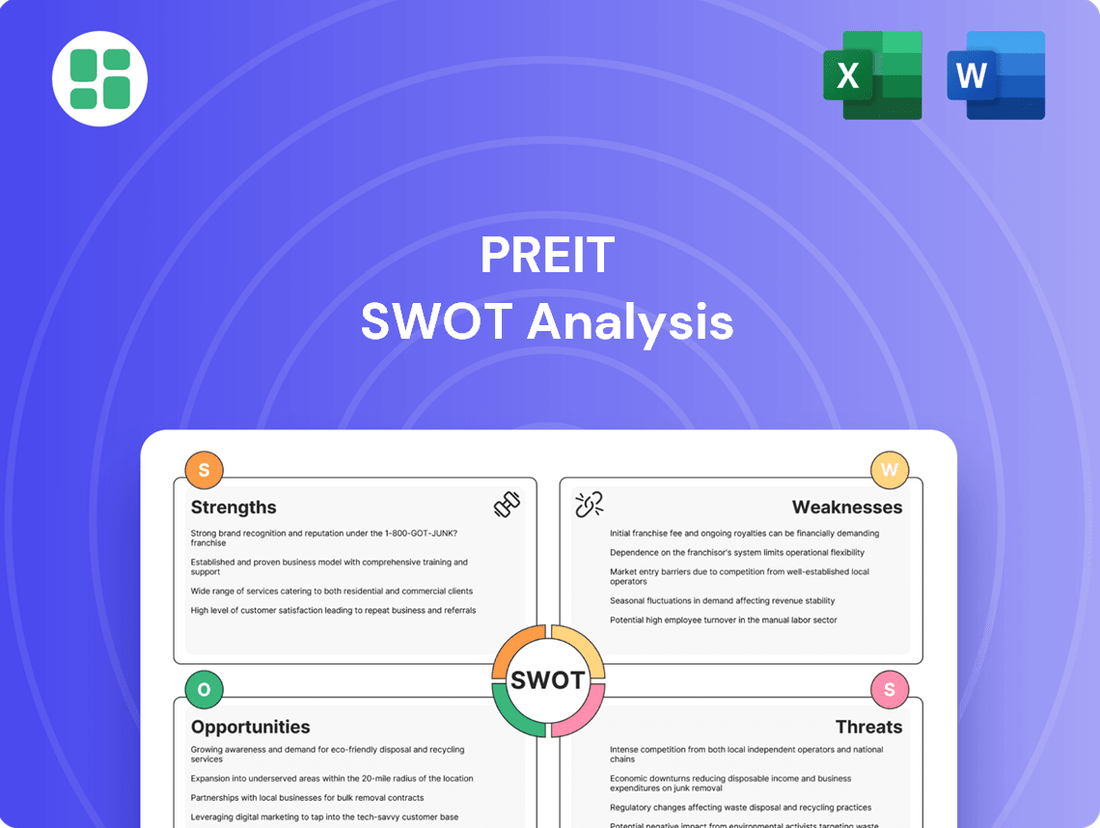

PREIT SWOT Analysis

The preview you see is the actual PREIT SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This excerpt showcases the comprehensive nature of the full report, providing a clear understanding of PREIT's strategic landscape. You can be confident that the complete document will offer the same level of detail and insight.

Opportunities

PREIT is strategically transforming its malls into mixed-use destinations, integrating residential, hospitality, healthcare, and entertainment components. This diversification moves beyond traditional retail, aiming to boost property appeal and foster lively community centers. For example, PREIT is developing residential units at Moorestown Mall, a key initiative to capture this growing market trend.

The retail sector is increasingly prioritizing experiential elements, with consumers actively seeking destinations offering entertainment and engagement beyond traditional shopping. PREIT is well-positioned to leverage this trend by integrating more immersive pop-up shops, diverse entertainment options, and distinctive attractions into its portfolio.

By fostering these 'purposeful places,' PREIT can expect a notable uplift in visitor numbers and extended stays, directly impacting sales and property value. For instance, a successful experiential retail strategy could see a 15-20% increase in foot traffic, as observed in similar successful redevelopments in 2024.

PREIT's strategic divestment of underperforming assets, exemplified by the sale of Exton Square Mall, is a key opportunity. This move streamlines the portfolio, allowing for a sharper focus on higher-potential properties and improved resource allocation. For instance, in the first quarter of 2024, PREIT reported a net loss of $10.2 million, highlighting the need for such strategic pruning to enhance overall portfolio performance.

This portfolio optimization directly supports improved overall performance and enables more targeted investments in prime locations. By shedding non-core assets, PREIT strengthens its balance sheet and sharpens its future strategic direction, positioning it for more impactful growth in its core holdings.

New Leadership and Strategic Direction

The appointment of Jared Chupaila as CEO of PREIT in late 2023 marks a significant opportunity for the company. Chupaila brings a wealth of experience in retail real estate, previously serving as Executive Vice President of Retail Leasing at Simon Property Group. This leadership change offers a chance for renewed strategic vision and more effective execution.

Chupaila's background is expected to accelerate PREIT's ongoing shift towards a mixed-use strategy, integrating retail with residential, office, and hospitality components. This approach is designed to create more resilient and adaptable properties that better meet evolving consumer preferences and market demands. For example, PREIT's portfolio includes properties like the Fashion District Philadelphia, which has seen investment in experiential retail and entertainment offerings, aligning with this mixed-use focus.

- Leadership Transition: Jared Chupaila's CEO appointment in late 2023 brings extensive retail real estate expertise to PREIT.

- Strategic Acceleration: Opportunity to fast-track the mixed-use development strategy, enhancing property resilience.

- Innovation Focus: Potential for new approaches in property management and tenant engagement to meet modern consumer needs.

Favorable Retail Real Estate Market Recovery

The retail real estate market is demonstrating a notable recovery in 2024 and 2025, creating a more favorable landscape for companies like PREIT. This upturn is evidenced by positive performance trends across the broader retail REIT sector, with specific strength observed in regional malls.

Key indicators supporting this recovery include:

- Rising Mall Traffic: Foot traffic in malls has largely returned to pre-pandemic levels, signaling renewed consumer engagement with physical retail spaces.

- Decreasing Vacancy Rates: Retail vacancy rates are on a downward trend, indicating increased demand for leased spaces. For instance, some reports suggest vacancy rates in well-located malls are approaching 8-9% in early 2025, down from peaks exceeding 10% in prior years.

- Positive REIT Returns: The retail REIT sector has seen improved overall returns, with some analysts projecting mid-single-digit growth for 2025.

PREIT's strategic pivot towards mixed-use development, integrating residential, hospitality, and entertainment, presents a significant opportunity to diversify revenue streams and enhance property value beyond traditional retail. The company's focus on creating experiential destinations, like the residential development at Moorestown Mall, taps into evolving consumer preferences for engaging spaces. This diversification is crucial as the retail sector increasingly prioritizes experiences over pure transactions, with successful experiential retail strategies showing potential for 15-20% foot traffic increases in 2024.

The divestment of underperforming assets, such as the sale of Exton Square Mall, allows PREIT to concentrate resources on its most promising properties, streamlining its portfolio for improved performance. This strategic pruning is essential, especially given the Q1 2024 net loss of $10.2 million, enabling a sharper focus on high-potential locations and a stronger balance sheet. The retail real estate market is also showing signs of recovery in 2024-2025, with rising mall traffic and decreasing vacancy rates, creating a more favorable operating environment.

Jared Chupaila's appointment as CEO in late 2023 offers a leadership opportunity to accelerate PREIT's mixed-use strategy, leveraging his extensive retail real estate background. His expertise is expected to drive innovation in property management and tenant engagement, aligning with the need for adaptable properties that meet modern consumer demands. This leadership transition, coupled with a recovering market, positions PREIT to capitalize on emerging trends and improve its overall financial health.

| Opportunity Area | Description | Supporting Data/Examples |

|---|---|---|

| Mixed-Use Development | Diversifying properties into residential, hospitality, and entertainment hubs. | Residential development at Moorestown Mall; potential for 15-20% foot traffic increase with experiential retail (2024 trend). |

| Portfolio Optimization | Divesting underperforming assets to focus on high-potential properties. | Sale of Exton Square Mall; Q1 2024 net loss of $10.2 million highlights need for strategic pruning. |

| Market Recovery | Benefiting from a recovering retail real estate market in 2024-2025. | Rising mall traffic; decreasing vacancy rates (approaching 8-9% in prime malls by early 2025); projected mid-single-digit growth for retail REITs in 2025. |

| Leadership Expertise | Leveraging new CEO Jared Chupaila's experience to drive strategy. | Chupaila's background at Simon Property Group; potential to accelerate mixed-use strategy and innovation. |

Threats

The relentless growth of e-commerce poses a significant threat to enclosed malls like those owned by PREIT. As more consumers opt for online shopping, foot traffic in physical retail spaces, even those with mixed-use components, can decline. This trend, which has seen e-commerce sales in the US grow by an estimated 8.7% in 2024, directly impacts the demand for retail space.

Uncertain economic conditions, including higher-than-average interest rates and inflation, pose a significant risk to retail spending and the financial health of PREIT's tenants. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, have increased borrowing costs for consumers and businesses alike, potentially reducing discretionary spending on retail goods.

Elevated interest rates directly impact PREIT's cost of capital, making future redevelopment projects more expensive and increasing the cost of refinancing existing debt, even after recent debt restructuring efforts. This financial pressure can limit the company's ability to invest in property upgrades or expansion, thereby affecting long-term growth prospects.

Furthermore, the specter of a potential recession, a growing concern in late 2023 and early 2024, could further dampen consumer confidence and significantly impact retail performance. A recessionary environment typically leads to job losses and reduced disposable income, directly translating to lower sales for PREIT's retail tenants and, consequently, affecting rental income and occupancy rates.

PREIT faces intense competition from various retail formats beyond traditional enclosed malls. Open-air shopping centers, lifestyle centers, and standalone retail parks are gaining traction, offering consumers different experiences and conveniences that can divert foot traffic and tenants from PREIT's properties. This diverse competitive landscape puts pressure on PREIT's ability to maintain occupancy and rental income.

Execution Risks of Redevelopment Projects

PREIT faces execution risks in its large-scale redevelopment projects, which demand substantial capital and navigate complex permitting. For instance, the company's ongoing redevelopment of the Gallery at Westbury Plaza into a mixed-use asset highlights the potential for construction delays and cost overruns, impacting projected timelines and budgets.

There's a tangible threat that these ambitious projects might not meet expected occupancy levels or revenue generation targets post-completion. This could stem from shifts in consumer demand or unforeseen market conditions, directly affecting PREIT's ability to recoup its significant investments and achieve profitability.

- Capital Intensive Nature: Redevelopments require significant upfront capital, potentially straining financial resources if not managed efficiently.

- Permitting and Regulatory Hurdles: Navigating local zoning laws and obtaining necessary permits can lead to protracted timelines and unexpected expenses.

- Construction Delays and Cost Overruns: Unforeseen site conditions or supply chain issues can push project completion dates and escalate construction costs beyond initial estimates.

- Market Adoption Risk: The success of mixed-use developments hinges on attracting and retaining tenants, with a risk of lower-than-anticipated occupancy rates or rental income.

Potential for Further Asset Devaluation

PREIT's remaining properties might still struggle with tenant attraction and retention, potentially causing occupancy rates and property values to fall further. This threat is particularly relevant as the company continues its portfolio transformation.

- Occupancy Challenges: Even with recent sales, some PREIT assets may not achieve desired occupancy levels, impacting rental income.

- Market Vulnerability: The success of transforming all properties into desirable destinations isn't assured, especially for those situated in weaker economic regions.

- Valuation Risk: Continued underperformance could lead to further asset devaluation, affecting PREIT's overall financial health and market capitalization.

The escalating competition from online retailers and alternative physical shopping formats presents a persistent threat to PREIT's mall portfolio. Economic headwinds, including elevated interest rates impacting borrowing costs and consumer spending, further exacerbate these challenges. Additionally, PREIT faces significant execution risks and market adoption uncertainties with its ambitious redevelopment projects, which require substantial capital and could underperform against expectations, potentially leading to further asset devaluation.

| Threat Category | Specific Threat | Impact on PREIT | Supporting Data/Context (2024-2025) |

|---|---|---|---|

| E-commerce Growth | Shift in Consumer Spending Online | Reduced Foot Traffic & Retail Demand | US e-commerce sales projected to grow 8.7% in 2024. |

| Economic Conditions | High Interest Rates & Inflation | Decreased Tenant Sales & Increased Borrowing Costs | Federal Funds Rate at 5.25%-5.50% (as of July 2023), impacting debt refinancing and consumer spending. |

| Competition | Rise of Open-Air Centers & Lifestyle Malls | Diversion of Foot Traffic & Tenants | Continued consumer preference for experiential retail. |

| Redevelopment Risks | Execution & Market Adoption | Cost Overruns, Delays, Lower-Than-Expected Revenue | Gallery at Westbury Plaza redevelopment highlights potential for budget and timeline issues. |

SWOT Analysis Data Sources

This PREIT SWOT analysis is built on a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert analyses of the real estate investment trust sector.