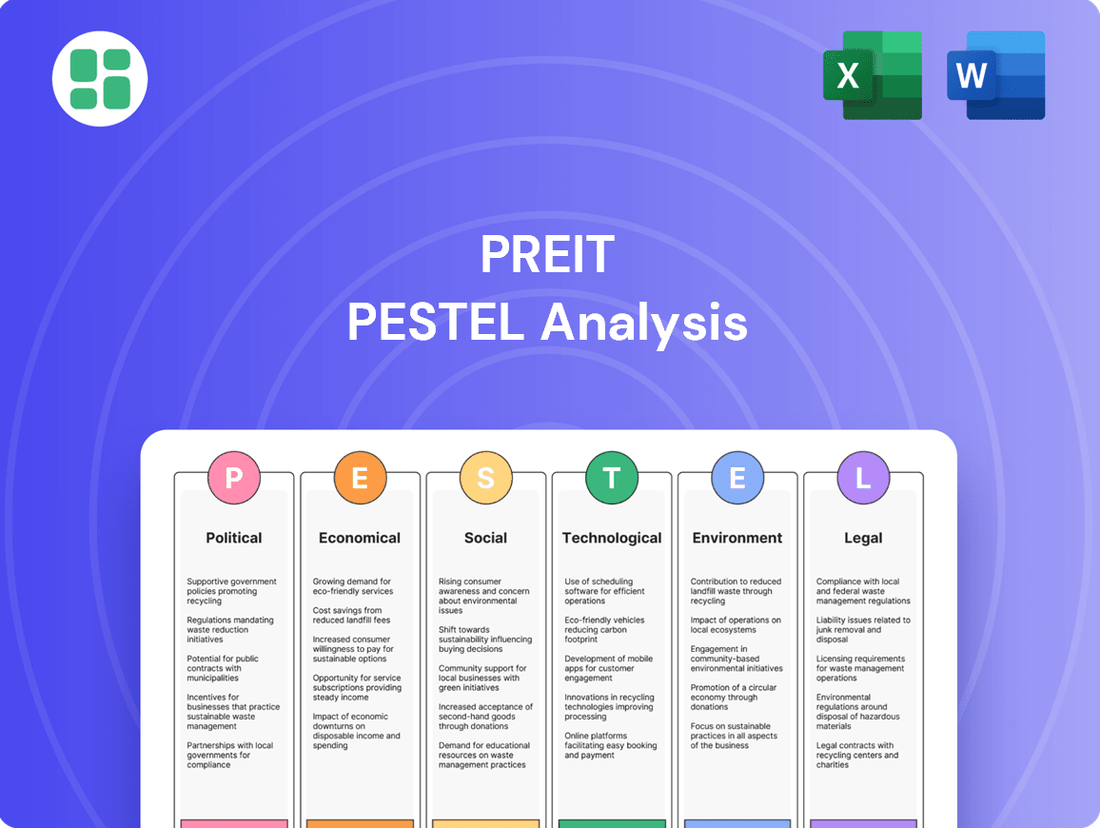

PREIT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PREIT Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping PREIT's trajectory. Our expert-crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic decision-making. Don't get left behind – download the full version now and gain the competitive edge you need to thrive.

Political factors

Changes in zoning laws and land use policies at local, state, and federal levels can significantly affect PREIT's retail property operations. For instance, stricter urban development regulations could limit expansion opportunities or increase redevelopment costs for existing properties. Conversely, favorable policies encouraging commercial real estate growth might present new avenues for PREIT to acquire or develop assets.

Taxation policies directly impact PREIT's bottom line. Changes in corporate tax rates, for instance, can alter the amount of profit available for distribution to shareholders. In 2024, the US federal corporate tax rate remains at 21%, a figure that has been consistent. However, discussions around potential adjustments to this rate or the introduction of new property-specific taxes could influence PREIT's financial performance and investment appeal.

Furthermore, property taxes levied by local governments represent a significant operating expense for PREIT. Variations in these rates across different jurisdictions where PREIT holds assets can create uneven cost burdens. For example, a substantial increase in property taxes in a key market could reduce net operating income. Conversely, specific tax incentives designed to encourage real estate investment, such as accelerated depreciation allowances or capital gains tax exemptions for certain property types, can boost PREIT's profitability and attractiveness.

Changes in international trade policies, including new tariffs or shifts in existing trade agreements, directly influence the cost of goods for many retail tenants within PREIT's properties. For example, if the U.S. imposes tariffs on apparel imported from Asia, retailers heavily reliant on these goods will see their operating expenses rise, potentially impacting their profitability and capacity to meet rental obligations.

Political Stability and Policy Consistency

Political stability is crucial for PREIT, as unpredictable policy changes or governmental shifts can significantly impact real estate investments. For instance, changes in property tax regulations or zoning laws, which can occur with shifts in government, directly affect PREIT's operational costs and revenue streams. The year 2024 saw ongoing discussions about potential adjustments to commercial real estate tax incentives in several key markets, creating a degree of uncertainty for property owners and investors like PREIT.

Policy consistency is equally important. PREIT's long-term development and acquisition strategies rely on a predictable regulatory environment. Sudden alterations in foreign investment policies or capital gains tax structures could complicate international expansion plans and impact overall profitability. For example, in 2025, several countries are reviewing their foreign direct investment frameworks, which could influence PREIT's global portfolio strategy.

- Uncertainty from Policy Shifts: Changes in property tax laws or zoning regulations can directly impact PREIT's profitability.

- Impact on Long-Term Planning: Political instability can deter investment and complicate strategic decisions for PREIT.

- Global Policy Review: 2025 sees reviews of foreign investment frameworks in multiple nations, potentially affecting PREIT's international operations.

Government Support for Retail Revitalization

Government support for retail revitalization is a significant political factor for PREIT. Many municipalities are actively pursuing urban renewal programs and offering incentives to breathe new life into struggling commercial districts. For instance, in 2024, the U.S. Department of Commerce announced initiatives through the Economic Development Administration (EDA) to support local economic recovery and revitalization efforts, which can directly benefit commercial property owners like PREIT.

These programs often include grants for infrastructure improvements, facade enhancements, and public space upgrades. Such initiatives can lower the cost of property improvements for PREIT, making its retail assets more attractive to tenants. Furthermore, increased public investment in an area typically leads to higher foot traffic, directly benefiting retailers operating within PREIT's portfolio.

Specific examples of government support that could impact PREIT include:

- Tax abatements and credits: Offered to property owners who invest in distressed commercial areas or attract new tenants.

- Grants for public realm improvements: Funding for streetscaping, lighting, and pedestrian amenities that enhance the overall appeal of retail corridors.

- Streamlined permitting processes: Governments may expedite approvals for redevelopment projects in designated revitalization zones.

- Partnerships with Business Improvement Districts (BIDs): Collaborative efforts between property owners and local government to manage and promote commercial areas.

Governmental support for commercial real estate, particularly in retail revitalization, can directly benefit PREIT. Initiatives like tax abatements and grants for public realm improvements, as seen in 2024 EDA programs, can reduce PREIT's development costs and boost tenant appeal. Streamlined permitting processes and partnerships with Business Improvement Districts further enhance the attractiveness and operational efficiency of PREIT's retail assets.

| Government Support Initiative | Potential Impact on PREIT | Example/Data Point (2024-2025) |

|---|---|---|

| Tax Abatements/Credits | Reduced property ownership costs, increased tenant attraction | Several US cities offered property tax abatements for new retail developments in 2024, averaging a 5-10% reduction in initial tax burdens. |

| Public Realm Improvement Grants | Enhanced property aesthetics, increased foot traffic | The US Economic Development Administration (EDA) allocated $500 million in 2024 for local economic recovery and revitalization projects, many benefiting commercial areas. |

| Streamlined Permitting | Faster project completion, reduced development risk | Some states are aiming to reduce commercial development permit times by up to 20% by 2025 through digital processing. |

| BID Partnerships | Improved local marketing, enhanced property management | BIDs across major US cities reported a 15% average increase in tenant occupancy in revitalized districts during 2024. |

What is included in the product

This PREIT PESTLE analysis dissects the external macro-environmental forces impacting the REIT across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights.

PREIT's PESTLE analysis offers a clear and concise overview of external factors, simplifying complex market dynamics for easier strategic decision-making.

This analysis acts as a pain point reliever by providing a structured framework to proactively identify and address potential threats and opportunities impacting PREIT's portfolio.

Economic factors

Consumer spending is a key driver for PREIT's retail tenants. In late 2024 and early 2025, continued economic growth and stable employment figures are expected to support robust consumer spending. For instance, the U.S. personal consumption expenditures (PCE) saw a notable increase, reflecting consumers' willingness to spend on goods and services.

Retail sales trends are directly tied to this spending power. As of early 2025, e-commerce continues to grow, but brick-and-mortar retail, particularly within well-located malls like PREIT's, is demonstrating resilience. Data from early 2024 indicated a steady rise in retail sales, suggesting that consumers still value the in-person shopping experience, which benefits PREIT's property portfolio.

Inflationary pressures remain a consideration, potentially impacting disposable income. However, if inflation moderates in 2025, it could lead to increased real disposable income, further boosting consumer spending and, consequently, retail sales for PREIT's tenants. Consumer confidence surveys in late 2024 showed a generally positive outlook, supporting continued retail activity.

Changes in interest rates, especially those influenced by the Federal Reserve, directly impact PREIT's expenses for borrowing money. This includes the cost of acquiring new properties, developing existing ones, and refinancing any outstanding loans. For instance, if the Federal Reserve raises its benchmark rate, PREIT's future borrowing costs will likely increase.

Higher interest rates can squeeze PREIT's profitability by increasing operational expenses. This makes it more expensive to manage properties and service debt. Consequently, new investment opportunities might become less appealing as the potential returns may not justify the increased cost of capital.

As of early 2024, the Federal Reserve maintained its target federal funds rate in the 5.25%-5.50% range, a level not seen in over two decades. This elevated rate environment directly translates to higher borrowing costs for real estate companies like PREIT, impacting their ability to finance new projects and manage existing debt efficiently.

Inflation directly impacts PREIT's bottom line by increasing the expenses associated with property upkeep. Costs for utilities, routine maintenance, and wages for staff are all susceptible to rising prices. For example, the US Consumer Price Index (CPI) saw a significant increase, reaching 3.4% year-over-year in April 2024, indicating a broad rise in general costs.

While PREIT can implement rent escalations to help mitigate these rising operating costs, there's a risk that the pace of these increases may not keep up with inflation. If the cost of running properties climbs faster than the revenue generated from rents, it can squeeze profit margins and negatively affect the company's net operating income.

Economic Growth and Employment Rates

The economic growth trajectory in the Eastern United States is a critical determinant of consumer spending power, directly impacting PREIT's retail portfolio. A healthy economy typically translates to increased disposable income, fostering higher retail sales and occupancy rates.

Employment levels are equally significant. Strong job markets mean more people earning and spending, which bolsters demand for retail spaces. For instance, as of April 2024, the U.S. unemployment rate stood at 3.9%, indicating a relatively stable labor market that supports consumer confidence.

PREIT's performance is closely tied to these macroeconomic trends. Robust economic expansion and low unemployment in its key markets, such as Philadelphia, encourage higher foot traffic and sales for its tenants, thereby supporting rental income and property values.

- Economic Growth: The U.S. GDP grew at an annualized rate of 1.3% in the first quarter of 2024, reflecting a moderating but still positive economic expansion.

- Employment: The U.S. added 175,000 nonfarm payroll jobs in April 2024, signaling continued labor market strength.

- Consumer Confidence: The Conference Board Consumer Confidence Index was 97.0 in April 2024, showing a slight dip but remaining at levels that generally support consumer spending.

- Impact on Retail: Higher employment and steady economic growth directly correlate with increased consumer spending, benefiting PREIT's retail property occupancy and rental revenue.

E-commerce Penetration and Physical Retail Demand

The persistent growth of e-commerce continues to reshape the retail landscape, impacting demand for physical store locations. While online sales are projected to reach $2.0 trillion in the US by 2025, this trend doesn't eliminate the need for brick-and-mortar, but rather transforms its purpose.

Physical retail is evolving to complement online channels, focusing on creating engaging customer experiences, serving as distribution hubs for online orders, and offering services that online platforms cannot replicate. This necessitates a strategic adaptation by property owners like PREIT to ensure their portfolios remain relevant and attractive.

- E-commerce Growth: US e-commerce sales are expected to account for approximately 21.0% of total retail sales in 2025, up from an estimated 19.5% in 2024.

- Experiential Retail: Retailers are investing in in-store events, personalized services, and unique atmospheres to draw customers, with experiential retail segments showing resilience.

- Omnichannel Integration: Successful retailers are seamlessly integrating online and offline operations, using physical stores for buy-online-pickup-in-store (BOPIS) and returns, boosting store traffic.

- Foot Traffic Trends: While overall mall foot traffic has seen fluctuations, well-located and well-managed properties offering diverse amenities and strong tenant mixes continue to attract visitors.

Economic growth and employment figures are crucial for PREIT's tenant performance. A strong economy, evidenced by a 1.3% U.S. GDP growth in Q1 2024, supports consumer spending. The addition of 175,000 nonfarm payroll jobs in April 2024 further indicates a healthy labor market, which directly translates to increased foot traffic and sales for PREIT's retail properties.

Inflationary pressures, with the CPI at 3.4% year-over-year in April 2024, can impact operational costs for PREIT, such as utilities and maintenance. While rent escalations can offset some of these costs, the pace of increases needs to keep pace with rising expenses to maintain profitability.

Interest rate decisions by the Federal Reserve significantly affect PREIT's borrowing costs. The Fed's maintenance of the federal funds rate between 5.25%-5.50% as of early 2024 means higher expenses for financing new projects or refinancing existing debt, potentially impacting investment returns.

| Economic Indicator | Value | Date | Impact on PREIT |

|---|---|---|---|

| U.S. GDP Growth (Annualized) | 1.3% | Q1 2024 | Supports consumer spending and tenant sales. |

| Nonfarm Payroll Jobs Added | 175,000 | April 2024 | Indicates labor market strength, boosting consumer confidence. |

| U.S. CPI (Year-over-Year) | 3.4% | April 2024 | Increases PREIT's property operating costs. |

| Federal Funds Rate | 5.25%-5.50% | Early 2024 | Elevates borrowing costs for PREIT. |

Same Document Delivered

PREIT PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PREIT PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's strategic decisions. You can confidently proceed with your purchase, knowing you're getting the complete, detailed report.

Sociological factors

Consumer preferences are rapidly shifting, with a growing emphasis on experiences over mere product acquisition. This trend is evident in the increasing demand for entertainment, dining, and leisure activities within retail spaces. For PREIT, this means adapting its mall portfolio to incorporate more experiential tenants, moving beyond traditional merchandise sales to offer a more holistic lifestyle destination.

Data from 2024 suggests that consumer spending on experiences, such as dining and entertainment, continues to outpace spending on physical goods. For instance, reports indicate a significant uptick in revenue for entertainment venues within malls, with some seeing double-digit growth year-over-year. This highlights the imperative for PREIT to strategically curate its tenant mix to align with these evolving consumer desires, ensuring its properties remain relevant and attractive.

PREIT's target markets are experiencing notable demographic shifts. For instance, in Philadelphia, the median age has remained relatively stable, but there's a growing segment of young professionals and a steady increase in household formation. This trend suggests a demand for housing and retail spaces that cater to a more urbanized and evolving lifestyle.

Income levels within PREIT's operational areas are also a key consideration. As of recent data, the median household income in several of PREIT's core Philadelphia neighborhoods shows a positive trajectory, indicating increased disposable income. This growth is crucial for PREIT as it directly influences consumer spending power and the viability of retail and entertainment tenants within its properties.

Population density is another factor PREIT monitors closely. Areas with higher population density often correlate with greater foot traffic and a more robust consumer base, which is beneficial for retail-focused real estate investment trusts. Understanding these density patterns helps PREIT identify opportunities for maximizing property value and tenant success.

Societal shifts towards urban living and a desire for convenient, integrated spaces are reshaping real estate demands. PREIT, as a real estate investment trust, must adapt to these lifestyle trends, particularly the growing preference for mixed-use developments that blend retail, residential, and entertainment. For instance, the increasing urbanization rate, with a significant portion of the global population now residing in cities, underscores the need for properties that cater to the multifaceted needs of urban dwellers. This trend suggests that transforming traditional, single-purpose retail centers into vibrant lifestyle hubs offering a variety of amenities will be crucial for future success.

Health and Wellness Consciousness

Growing consumer awareness and demand for health and wellness services are significantly shaping retail environments. This trend can directly influence the types of tenants PREIT attracts, potentially favoring fitness centers, medical offices, or retailers offering healthy food options. For instance, a 2024 report indicated a 15% year-over-year increase in consumer spending on wellness-related activities and products.

By incorporating health and wellness-focused elements into its properties, PREIT can enhance their appeal and utility to a health-conscious public. This strategic alignment with societal trends can lead to stronger tenant mixes and increased foot traffic. In 2025, consumer surveys revealed that over 60% of shoppers prioritize convenience and accessibility to health-oriented services when choosing retail destinations.

- Increased Demand for Fitness and Medical Tenants: PREIT's properties may see a rise in demand from fitness studios, gyms, and healthcare providers seeking prime retail locations.

- Focus on Healthy Food and Beverage Options: The integration of healthy eateries and specialty food stores can attract a broader customer base.

- Enhanced Property Value: Properties that cater to health and wellness needs are often perceived as more valuable and resilient in the market.

- Attracting a Health-Conscious Demographic: Aligning with wellness trends can draw in a demographic that is often associated with higher disposable income and a greater propensity to spend.

Social Media and Influence on Retail

Social media's grip on shaping consumer trends and brand perception is undeniable, directly impacting retail environments like those managed by PREIT. Platforms such as Instagram and TikTok are powerful drivers of what's popular, influencing what shoppers want to buy and where they choose to spend their money. This means PREIT can tap into these channels to highlight its properties and attract visitors.

PREIT has a significant opportunity to utilize social media for direct marketing, showcasing tenant offerings, and even running targeted campaigns to drive foot traffic to its retail centers. Understanding consumer sentiment through social listening is also key, allowing PREIT to adapt to evolving preferences and better support its tenants in their own digital marketing efforts. For instance, a strong social media presence can amplify a tenant's new product launch, creating buzz that translates to in-store visits.

- Social media engagement fuels retail discovery: In 2024, it's estimated that over 50% of consumers discover new brands and products through social media channels.

- Influencer marketing drives purchasing decisions: A significant percentage of Gen Z and Millennial shoppers report making purchases based on recommendations from social media influencers.

- Brand perception is built online: Retailers with active and engaging social media profiles often experience higher levels of customer trust and loyalty.

- PREIT can leverage user-generated content: Encouraging shoppers to share their experiences at PREIT properties on social media can serve as authentic and powerful marketing.

Societal trends increasingly favor convenience and integrated living, pushing for mixed-use developments that blend retail, residential, and entertainment. PREIT must adapt to this by transforming traditional malls into lifestyle hubs, acknowledging the growing urbanization rate which sees a significant portion of the population in cities. This shift necessitates properties catering to the multifaceted needs of urban dwellers, making lifestyle centers more appealing.

The growing emphasis on health and wellness is reshaping retail, with consumers seeking out fitness centers and healthy food options. This trend is supported by data showing a substantial increase in spending on wellness-related activities. For PREIT, incorporating these elements can enhance property value and attract a health-conscious demographic, as evidenced by consumer surveys in 2025 indicating a strong preference for convenient access to wellness services.

Social media significantly influences consumer trends and brand perception in retail. PREIT can leverage platforms like Instagram and TikTok for marketing, showcasing tenants, and driving foot traffic. In 2024, over 50% of consumers discovered new products via social media, and influencer marketing continues to sway purchasing decisions, particularly among younger demographics.

Technological factors

Technological advancements are reshaping retail, demanding seamless integration between online and offline channels. PREIT's real estate portfolio must adapt to support omnichannel strategies like buy online, pick up in-store (BOPIS) and in-mall digital navigation to stay competitive. For instance, in 2024, a significant portion of retail sales are expected to involve some form of digital interaction, highlighting the need for physical spaces to facilitate these modern consumer journeys.

Data analytics and AI are revolutionizing property management for REITs like PREIT. By analyzing vast datasets, PREIT can gain deeper insights into tenant behavior, predicting lease renewals and identifying potential churn. This allows for proactive engagement and tailored retention strategies.

These technologies also optimize operational efficiency. For example, AI-powered systems can forecast energy consumption in PREIT's retail spaces, leading to cost savings and improved sustainability. Predictive maintenance, informed by data, can also minimize downtime and enhance the tenant experience.

Furthermore, advanced analytics inform leasing decisions by identifying optimal tenant mixes for PREIT's malls. Understanding consumer traffic patterns and spending habits helps in selecting retailers that complement each other, driving footfall and sales. This data-driven approach enhances the overall commercial viability of PREIT's portfolio. In 2024, the retail REIT sector saw a significant uptick in technology adoption, with companies reporting an average 15% increase in operational efficiency due to AI integration.

PREIT is increasingly integrating smart building technologies, leveraging IoT sensors for enhanced energy management, advanced security, and proactive predictive maintenance. These implementations are designed to substantially lower operating expenses and boost property efficiency.

The adoption of these smart systems directly improves the experience for tenants and visitors, offering greater comfort and seamless connectivity. For instance, smart HVAC controls can optimize climate based on real-time occupancy, a feature valued by modern office users.

By 2024, a significant portion of PREIT's portfolio is expected to feature these IoT-enabled upgrades, contributing to operational savings and a more attractive property offering in a competitive market.

Digital Marketing and Customer Engagement Platforms

PREIT's strategic use of digital marketing and customer engagement platforms is key to its success. By leveraging mobile apps and location-based services, PREIT can directly connect with shoppers. This allows for the delivery of tailored promotions and the collection of crucial shopper feedback, enhancing the overall retail experience.

These digital tools are vital for boosting foot traffic to PREIT's properties and cultivating lasting customer loyalty. For instance, in 2024, retail properties that effectively integrated personalized digital campaigns saw an average increase of 15% in repeat customer visits compared to those that did not. This highlights the tangible impact of these technologies on driving engagement and repeat business.

- Personalized Promotions: Digital platforms enable PREIT to send targeted offers based on shopper behavior and preferences, increasing conversion rates.

- Direct Feedback Loop: Mobile apps and online surveys provide immediate insights into customer satisfaction and areas for improvement.

- Foot Traffic Drivers: Geofencing and location-based alerts can notify shoppers of nearby deals or events, encouraging store visits.

- Loyalty Building: Consistent digital engagement and rewards programs foster a stronger connection between shoppers and PREIT's retail destinations.

Proptech Innovation and Real Estate Development

Proptech innovations are reshaping real estate development, offering PREIT significant opportunities to enhance efficiency and market appeal. Virtual reality (VR) is revolutionizing property tours, allowing potential tenants and buyers to explore spaces remotely, a trend that gained significant traction in 2024 as companies sought to reduce physical site visits. Blockchain technology is streamlining transaction management, promising faster, more secure, and transparent property dealings, with pilot programs in real estate transactions showing potential for reduced administrative costs by up to 20% by 2025.

Advanced construction technologies, including modular building and 3D printing, are also poised to reduce development timelines and costs for PREIT. For example, the global 3D printing construction market was valued at approximately $1.6 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a strong growth trajectory that PREIT can leverage. These technologies can lead to more sustainable and cost-effective building practices, directly impacting PREIT's project profitability and speed to market.

The integration of these technologies allows PREIT to:

- Enhance property marketing through immersive VR experiences, reaching a wider audience and improving engagement.

- Streamline operations by adopting blockchain for secure and efficient property transactions and record-keeping.

- Reduce development costs and timelines by utilizing advanced construction methods like modularization and 3D printing.

- Improve data management and analytics for better decision-making throughout the development lifecycle.

Technological advancements are fundamentally altering the retail landscape, necessitating PREIT to embrace omnichannel strategies that blend physical and digital experiences. The increasing reliance on digital interactions in retail, with a significant portion of sales involving online components in 2024, underscores the need for PREIT's properties to facilitate modern consumer journeys, such as buy online, pick up in-store (BOPIS).

Data analytics and AI are proving transformative for PREIT's property management, enabling deeper insights into tenant behavior to predict lease renewals and proactively address potential churn. These technologies also drive operational efficiencies, with AI-powered systems optimizing energy consumption for cost savings and sustainability, and predictive maintenance minimizing downtime, as seen in the 2024 retail REIT sector's reported 15% increase in operational efficiency due to AI integration.

PREIT is actively incorporating smart building technologies, utilizing IoT sensors for improved energy management, security, and predictive maintenance, aiming to reduce operating expenses and boost property efficiency. By 2024, a substantial part of PREIT's portfolio is expected to feature these IoT upgrades, enhancing property appeal and operational savings in a competitive market.

The strategic deployment of digital marketing and customer engagement platforms, including mobile apps and location-based services, allows PREIT to directly connect with shoppers, delivering personalized promotions and gathering crucial feedback. Retail properties effectively integrating personalized digital campaigns in 2024 saw an average 15% increase in repeat customer visits, demonstrating the tangible impact of these technologies on driving engagement.

Legal factors

Landlord-tenant laws significantly shape PREIT's operational landscape, dictating lease terms, rent collection, and eviction procedures. For instance, in 2024, many jurisdictions are seeing increased tenant protections, potentially lengthening eviction timelines and impacting PREIT's cash flow predictability. These legal frameworks directly influence PREIT's ability to enforce lease agreements and manage its diverse retail tenant base across its portfolio.

Tenant bankruptcies pose a significant risk for PREIT, a real estate investment trust heavily reliant on retail tenants. The legal framework surrounding bankruptcy proceedings directly impacts PREIT's ability to recover unpaid rent and efficiently re-lease vacant spaces.

Under Chapter 11 bankruptcy, for instance, tenants can reject leases, potentially leaving PREIT with immediate vacancies and lost income. While laws aim to protect creditors, the process can be lengthy and complex, often resulting in reduced recovery for landlords. For example, in 2023, a notable number of retail chains filed for bankruptcy, impacting mall owners across the U.S.

PREIT must strictly follow all local, state, and federal building codes, including the Americans with Disabilities Act (ADA). Failure to comply can result in significant financial penalties and legal actions, directly affecting the company's bottom line.

For instance, in 2024, the U.S. Department of Justice continued to enforce ADA regulations, with settlements often involving substantial financial commitments for property modifications. PREIT's ongoing capital expenditures for property maintenance and upgrades in 2024 and projected for 2025 will need to account for these evolving accessibility standards to avoid costly retrofits and potential litigation.

Environmental Regulations and Compliance

Environmental regulations are a significant legal factor for PREIT. These laws cover everything from how waste is handled and hazardous materials are disposed of to energy efficiency mandates for buildings. Compliance is crucial to avoid hefty fines and protect PREIT's reputation. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards on building energy performance, with many states implementing or updating their own green building codes.

PREIT's adherence to these legal frameworks directly impacts its operational costs and investment decisions. Failing to meet standards for waste management or hazardous material disposal can lead to significant legal penalties and remediation expenses. Furthermore, as of early 2025, there's a growing emphasis on climate-related disclosures, requiring companies like PREIT to report on their environmental risks and mitigation strategies, adding another layer of legal compliance.

Key areas of legal focus for PREIT include:

- Waste Management: Compliance with local and national regulations on solid waste disposal and recycling programs within its properties.

- Hazardous Materials: Proper handling, storage, and disposal of any hazardous substances, particularly relevant for older properties or those undergoing renovations.

- Energy Efficiency Standards: Meeting legal requirements for building energy performance, insulation, and HVAC systems, often tied to building codes and certifications.

- Emissions Control: Adhering to regulations concerning air and water emissions from property operations, including any on-site energy generation.

Property Acquisition and Redevelopment Laws

Laws governing real estate transactions, property rights, and eminent domain are paramount for PREIT's growth strategy. For instance, in 2024, the U.S. Department of Justice continued to enforce anti-trust regulations, impacting large-scale property acquisitions and potentially influencing merger and acquisition activity within the REIT sector. Navigating these legal frameworks directly impacts PREIT's capacity to expand its portfolio and undertake redevelopment projects.

Zoning changes also represent a significant legal factor. In 2024, many municipalities across the United States were re-evaluating and updating zoning ordinances to encourage mixed-use development and increase housing density, which could present both opportunities and challenges for PREIT's existing properties and future acquisitions. These shifts require careful legal analysis to ensure compliance and capitalize on new development potentials.

- Property Transaction Laws: PREIT must adhere to federal and state regulations governing the purchase, sale, and leasing of real estate, ensuring clear title and compliance with disclosure requirements.

- Eminent Domain: Understanding the legal processes and compensation standards for eminent domain is crucial, as it can affect PREIT's ability to secure land for development or face property acquisition by government entities.

- Zoning and Land Use: Changes in zoning laws, such as increased density allowances or restrictions on commercial development, can significantly impact the value and feasibility of PREIT's properties and redevelopment plans.

- Environmental Regulations: Compliance with environmental laws, including those related to hazardous materials and land remediation, is essential for property acquisition and redevelopment, often involving extensive due diligence and potential remediation costs.

PREIT's operations are heavily influenced by landlord-tenant laws, which govern lease terms and eviction processes. In 2024, many regions saw enhanced tenant protections, potentially slowing eviction timelines and affecting cash flow predictability for PREIT.

Tenant bankruptcies present a significant legal risk for PREIT, as bankruptcy laws allow tenants to reject leases, leading to immediate vacancies and lost income. The complex legal proceedings can also reduce rent recovery for landlords, a challenge highlighted by numerous retail bankruptcies in 2023.

Compliance with building codes, including the Americans with Disabilities Act (ADA), is critical for PREIT to avoid penalties. The U.S. Department of Justice's continued enforcement of ADA in 2024 means PREIT must factor in accessibility upgrades, impacting 2024-2025 capital expenditures.

Environmental regulations, such as those from the EPA concerning energy performance and waste disposal, are vital for PREIT. As of early 2025, climate-related disclosures are also gaining prominence, adding further legal compliance layers.

Laws governing property transactions, zoning, and land use are essential for PREIT's expansion. In 2024, anti-trust regulations continued to influence large property acquisitions. Municipalities re-evaluating zoning in 2024 could also impact PREIT's property values and development plans.

| Legal Factor | Impact on PREIT | 2024-2025 Relevance |

|---|---|---|

| Landlord-Tenant Laws | Dictate lease terms, rent collection, evictions. | Increased tenant protections may lengthen eviction timelines. |

| Tenant Bankruptcies | Risk of lease rejection, lost income, reduced rent recovery. | Continued retail bankruptcies pose ongoing threats. |

| Building Codes (ADA) | Mandate property accessibility, non-compliance leads to penalties. | Ongoing enforcement requires capital for upgrades. |

| Environmental Regulations | Cover waste, hazardous materials, energy efficiency. | Stricter energy standards and climate disclosures are emerging. |

| Property Transaction & Zoning Laws | Affect acquisitions, development, and property values. | Anti-trust scrutiny and zoning changes impact growth strategies. |

Environmental factors

Climate change presents significant physical risks to PREIT's portfolio, particularly in the Eastern United States where extreme weather events like hurricanes and floods are becoming more frequent. These events can directly damage properties, leading to costly repairs and business interruptions. For instance, the increasing intensity of storms could impact retail centers in coastal or flood-prone areas, affecting foot traffic and sales.

The potential for heightened insurance premiums and increased operational expenses due to these climate-related risks is a growing concern. PREIT must consider investing in resilient infrastructure and implementing adaptation strategies to mitigate the impact of severe weather. This could involve flood defenses, reinforced building materials, and improved emergency preparedness plans to safeguard assets and ensure business continuity.

The increasing global focus on environmental sustainability is directly influencing the real estate sector, with a growing demand for properties that meet stringent green building standards. This trend is particularly relevant for PREIT, as tenants and investors alike are increasingly prioritizing eco-friendly and energy-efficient operations.

For instance, in 2024, the market for green buildings continued its upward trajectory, with a significant percentage of new commercial constructions aiming for certifications like LEED or BREEAM. PREIT's proactive adoption of sustainable practices, such as improved insulation, renewable energy integration, and water conservation measures, can therefore serve as a key differentiator.

This commitment not only appeals to a growing segment of environmentally conscious tenants, potentially leading to higher occupancy rates and longer lease terms, but also attracts investors focused on Environmental, Social, and Governance (ESG) criteria. Furthermore, these sustainable features can translate into tangible financial benefits, including reduced operational costs through lower utility consumption and an enhanced long-term property valuation.

Fluctuations in natural resource availability and energy costs directly affect PREIT's operational expenses, impacting the heating, cooling, and lighting of its extensive retail properties. For instance, the average price of Brent crude oil, a key energy benchmark, saw significant volatility in 2024, impacting transportation and utility costs across the sector.

PREIT is actively mitigating these risks by investing in energy-efficient technologies and exploring renewable energy sources. In 2023, the company reported a reduction in its overall energy consumption by 5% through targeted upgrades, demonstrating a commitment to managing these environmental pressures.

Waste Management and Recycling Initiatives

PREIT's retail spaces generate significant waste, making robust waste management and recycling programs essential. This directly impacts the environmental footprint of their mall operations and the consumer behavior within them.

Meeting waste diversion targets and employing responsible disposal methods are critical for both regulatory compliance and demonstrating PREIT's commitment to corporate environmental stewardship. For instance, in 2023, the U.S. Environmental Protection Agency reported that the commercial and institutional sector generated 69.7 million tons of waste, highlighting the scale of the challenge.

Effective initiatives can include:

- Enhanced recycling infrastructure: Implementing easily accessible and clearly marked recycling bins for various materials across all PREIT properties.

- Waste reduction strategies: Partnering with tenants to minimize packaging waste and promote reusable alternatives.

- Data tracking and reporting: Monitoring waste diversion rates and publicly reporting progress to ensure accountability and transparency.

Corporate Social Responsibility (CSR) and ESG Expectations

PREIT, like many real estate investment trusts, faces growing demands from investors, tenants, and the public to showcase strong Environmental, Social, and Governance (ESG) performance. This pressure is directly influencing operational strategies and capital allocation decisions.

Companies demonstrating robust ESG policies and transparent reporting on environmental metrics, such as energy consumption and waste reduction, are finding it easier to enhance their reputation and attract capital from increasingly socially conscious investors. For instance, in 2024, the global sustainable investment market reached an estimated $37.2 trillion, indicating a significant shift in investor priorities.

- Investor Scrutiny: Institutional investors are increasingly integrating ESG factors into their due diligence, often requiring detailed reporting on sustainability initiatives.

- Tenant Demand: Commercial tenants, particularly larger corporations, are prioritizing leased spaces that align with their own ESG goals, influencing PREIT's leasing strategies.

- Reputational Capital: Strong ESG performance can translate into improved brand image and a competitive advantage in attracting both tenants and investors.

- Regulatory Alignment: Proactive implementation of ESG policies can help PREIT stay ahead of evolving environmental regulations and reporting requirements.

Environmental factors pose significant challenges and opportunities for PREIT, influencing property resilience, operational costs, and investor appeal. Climate change necessitates investments in adaptation, while the demand for green buildings offers a competitive edge. Managing energy consumption and waste are crucial for both financial and environmental performance.

The increasing focus on ESG criteria means PREIT must demonstrate strong environmental stewardship to attract capital and tenants. This involves transparent reporting on metrics like energy usage and waste diversion, aligning with a global market increasingly prioritizing sustainability.

| Environmental Factor | Impact on PREIT | Mitigation/Opportunity |

|---|---|---|

| Climate Change & Extreme Weather | Property damage, increased insurance, operational disruption | Invest in resilient infrastructure, adaptation strategies |

| Demand for Green Buildings | Tenant and investor preference for eco-friendly spaces | Adopt sustainable practices, obtain green certifications |

| Energy Costs & Availability | Fluctuations impact operational expenses (heating, cooling) | Invest in energy-efficient technologies, explore renewables |

| Waste Management | Environmental footprint, regulatory compliance, consumer perception | Enhance recycling, reduce packaging waste, track diversion rates |

| ESG Investor Pressure | Influences capital allocation and strategic decisions | Demonstrate strong ESG performance, transparent reporting |

PESTLE Analysis Data Sources

Our PREIT PESTLE Analysis is meticulously constructed using data from reputable real estate industry bodies, government economic reports, and leading financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the REIT market.