PREIT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PREIT Bundle

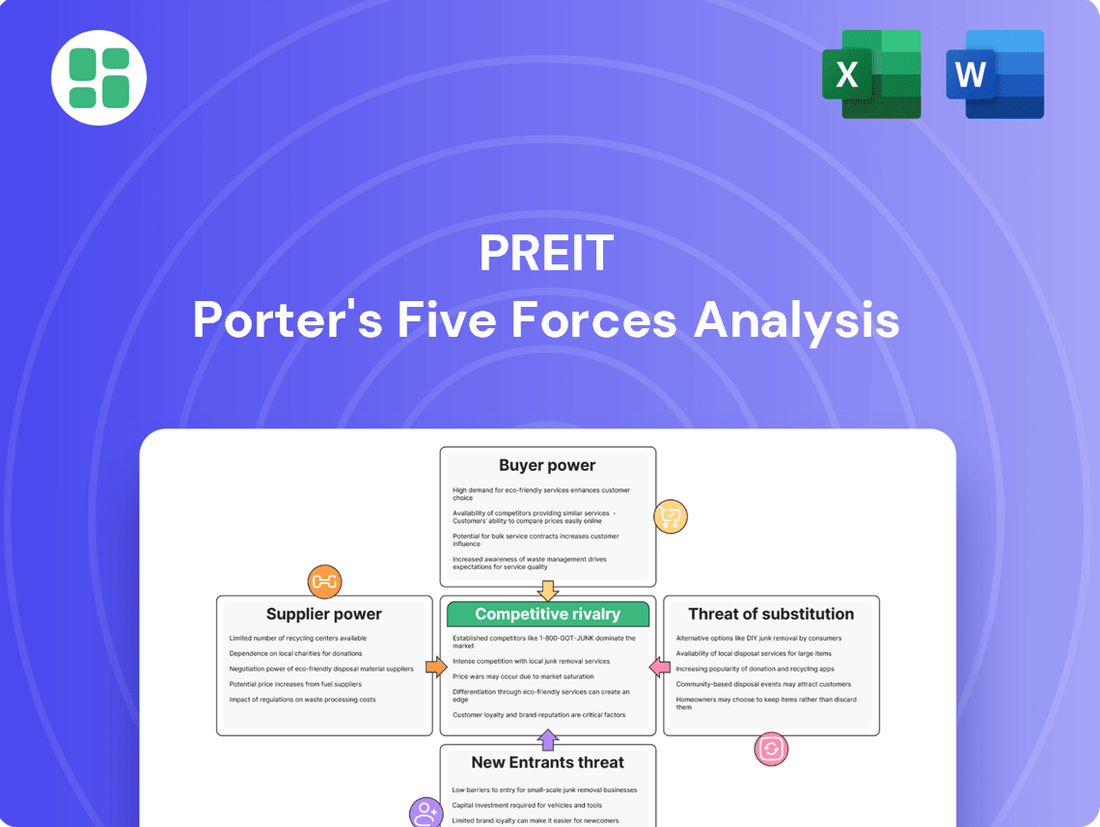

PREIT's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of substitute products. Understanding these dynamics is crucial for navigating the retail real estate sector.

The full analysis reveals the strength and intensity of each market force affecting PREIT, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

PREIT's primary suppliers are land, construction services, and ongoing operational providers. For land acquisition and large-scale development projects, the bargaining power of these suppliers can be moderate, given the specialized nature and significant capital investment required. However, PREIT's strategy of engaging multiple contractors for its projects helps to dilute the leverage of any single construction firm.

For routine services such as utilities, maintenance, and security, PREIT benefits from a broad market with numerous providers. This abundance of options significantly limits the bargaining power of individual service suppliers, allowing PREIT to negotiate favorable terms and maintain cost efficiency in its operations.

When PREIT embarks on substantial renovations or redevelopments of its retail properties, it often turns to specialized construction and design firms. The particular skills required for these large-scale commercial projects can grant these suppliers a moderate level of bargaining power.

This power is amplified if the expertise offered is highly niche or if there's a significant demand for their specialized services within the market. For instance, if a particular firm possesses unique sustainable building certifications or advanced smart-building integration capabilities, PREIT might find itself with fewer alternatives, increasing the supplier's leverage.

Utility providers, such as electricity, water, and gas companies, often function as regional monopolies. This monopolistic structure grants them substantial bargaining power over entities like PREIT, which rely on these essential services for their operations. PREIT's ability to negotiate rates or switch providers for these critical utilities is severely restricted, making them a significant factor in operational costs.

While PREIT can focus on energy efficiency to mitigate consumption, the fundamental inability to bargain for better pricing or alternative supply sources means utility costs remain largely dictated by these dominant providers. This lack of leverage directly impacts PREIT's operating expenses and profitability, as seen in the consistent upward trend of utility costs across the real estate sector in recent years, with many regions experiencing energy cost increases exceeding 5% annually in 2024.

Technology and Software Vendors Influence

The increasing reliance on technology in property management, including software, data analytics, and smart building solutions, grants technology and software vendors a degree of influence. For PREIT, this means that providers of these essential systems can exert moderate bargaining power, particularly when their solutions are integrated or involve high switching costs.

For instance, the property technology market is projected to grow significantly. In 2024, global PropTech spending was estimated to reach over $100 billion, underscoring the critical role these vendors play. This reliance can translate into pricing power for vendors, especially those offering proprietary or deeply embedded systems that are difficult and costly to replace.

- Vendor Lock-in: Proprietary software and integrated platforms can create significant switching costs for PREIT, limiting its ability to easily change providers.

- Data Integration: The complexity of integrating various data analytics and smart building solutions means PREIT may be dependent on specific vendors for seamless operation.

- Market Concentration: In certain niches of property management technology, a few key players may dominate, giving them increased leverage over buyers like PREIT.

Fragmented Service Provider Market

For many essential day-to-day operational services such as cleaning, landscaping, and general property maintenance, PREIT typically encounters a highly fragmented market. This means there are numerous small to medium-sized companies competing to provide these services.

This fragmentation significantly dilutes the bargaining power of any single supplier. PREIT can leverage this by negotiating favorable terms and pricing, knowing that if one provider becomes too demanding, there are many alternatives available. For instance, in 2024, the commercial cleaning services market in the US alone comprised over 100,000 establishments, highlighting the competitive landscape.

- Fragmented Market: Numerous small providers for services like cleaning and maintenance.

- Reduced Supplier Power: Individual suppliers have limited ability to dictate terms.

- Negotiation Advantage: PREIT can secure favorable pricing and contracts.

- Provider Flexibility: Easy to switch suppliers if terms are not met.

The bargaining power of suppliers for PREIT varies significantly across different categories. While fragmented markets for routine services like cleaning and landscaping limit supplier leverage, essential utilities and specialized technology providers can exert considerable influence due to market concentration or unique capabilities. This dynamic impacts PREIT's operational costs and strategic flexibility.

| Supplier Category | Bargaining Power | Key Factors | 2024 Data/Impact |

|---|---|---|---|

| Land Acquisition | Moderate | Specialized nature, capital investment | High demand for prime retail locations can increase seller leverage. |

| Construction Services | Moderate to High | Specialized skills, niche expertise, market demand | Shortages in skilled construction labor in 2024 could increase contractor pricing power. |

| Utility Providers | High | Regional monopolies, essential services | Utility cost increases, potentially exceeding 5% annually in some regions in 2024, directly impact PREIT's operating expenses. |

| Property Technology (PropTech) | Moderate to High | Vendor lock-in, data integration complexity, market concentration | Global PropTech spending exceeding $100 billion in 2024 highlights vendor importance and potential pricing power for integrated solutions. |

| Routine Operational Services (Cleaning, Landscaping) | Low | Fragmented market, numerous small providers | The US commercial cleaning market alone had over 100,000 establishments in 2024, ensuring competitive pricing for PREIT. |

What is included in the product

This analysis dissects the competitive forces impacting PREIT, evaluating the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

PREIT's Porter's Five Forces analysis offers a structured framework to pinpoint and alleviate competitive pressures, enabling proactive strategic adjustments.

Customers Bargaining Power

Anchor tenants, such as major department stores and large national retailers, wield significant bargaining power within PREIT's portfolio. Their ability to attract substantial foot traffic is crucial for the success of the entire mall, making them indispensable for filling large retail spaces and drawing in smaller businesses. This dependence grants them considerable leverage in negotiating lease terms, rental rates, and tenant improvement allowances.

Highly successful retailers, those consistently drawing significant foot traffic and sales, possess considerable bargaining power. This is particularly true in 2024, where strong brand recognition and proven sales performance allow these businesses to negotiate more favorable lease terms with property owners like PREIT. Their ability to guarantee consistent revenue streams makes them highly desirable tenants.

PREIT actively seeks out these in-demand retailers to boost the overall appeal and profitability of its shopping centers. This mutual interest can translate into more advantageous agreements for the retailers, potentially including lower rents, tenant improvement allowances, or more flexible lease durations. For instance, a retailer achieving over $500 in sales per square foot in a comparable PREIT property in 2024 would have significant leverage.

While PREIT's large anchor tenants wield considerable influence, the company's portfolio also comprises a multitude of smaller, in-line tenants. These smaller tenants, by themselves, possess less individual bargaining power. Their smaller footprint and often higher costs to relocate limit their leverage.

However, the collective demand from these numerous smaller tenants is vital for maintaining PREIT's overall mall occupancy rates. For instance, as of the first quarter of 2024, PREIT reported a portfolio occupancy rate of 92.1%, highlighting the importance of even smaller lease agreements in contributing to this figure.

Availability of Alternative Retail Channels

The proliferation of e-commerce and diverse retail formats, such as standalone stores and lifestyle centers, significantly reduces retailers' reliance on traditional enclosed malls. This shift grants them greater leverage when negotiating lease terms with property owners like PREIT, as they have more options for market access.

This increased bargaining power for retailers is evident as e-commerce sales continued their upward trajectory. For instance, U.S. retail e-commerce sales reached an estimated $1.19 trillion in 2024, representing a 7.0% increase from 2023, according to the U.S. Department of Commerce. This highlights the growing importance of non-mall channels.

- E-commerce Growth: Online sales are a substantial and growing portion of total retail, offering retailers alternatives to physical mall spaces.

- Diversification of Retail Formats: The rise of lifestyle centers and mixed-use developments provides additional venue options for retailers.

- Reduced Mall Dependence: Retailers are less beholden to enclosed malls, strengthening their negotiating position for leases.

- Impact on Landlords: Property owners like PREIT face increased pressure to offer favorable lease terms to attract and retain tenants in this evolving retail landscape.

Impact of Retail Sector Performance

The bargaining power of customers, particularly tenants within PREIT's portfolio, is significantly shaped by the overall health of the retail sector. When the retail landscape experiences a downturn, characterized by rising vacancies and reduced consumer spending, tenants find themselves in a stronger negotiating position. This leverage allows them to push for lower rents and more favorable lease agreements as PREIT prioritizes occupancy to mitigate losses from empty spaces.

For instance, in 2024, the retail sector faced ongoing challenges, with e-commerce continuing to capture market share. This trend put pressure on brick-and-mortar retailers, enhancing their ability to negotiate terms with landlords like PREIT. High vacancy rates in shopping centers, a persistent issue in recent years, further emboldened tenants.

- Retail Sector Health: A weaker retail environment increases tenant leverage.

- Vacancy Rates: Higher vacancies empower tenants to demand better lease terms.

- Occupancy Pressure: Landlords like PREIT are incentivized to retain tenants, even with concessions.

- Lease Flexibility: Tenants can negotiate for reduced rents and more adaptable lease structures.

The bargaining power of customers, specifically PREIT's tenants, is amplified by the availability of alternative retail locations and the growing influence of e-commerce. This means tenants have more options and can push for better lease terms. For example, U.S. retail e-commerce sales in 2024 were projected to hit $1.19 trillion, a 7.0% increase from 2023, underscoring the shift away from traditional mall dependence.

| Factor | Impact on Tenant Bargaining Power | Example Data (2024) |

|---|---|---|

| E-commerce Growth | Increases tenant leverage by providing alternatives | $1.19 trillion in U.S. e-commerce sales |

| Retail Sector Health | Weakness empowers tenants to negotiate | Persistent high vacancy rates in shopping centers |

| Tenant Success | High-performing tenants gain significant negotiation power | Retailers achieving over $500/sq ft in sales |

Preview the Actual Deliverable

PREIT Porter's Five Forces Analysis

This preview showcases the comprehensive PREIT Porter's Five Forces Analysis, detailing the competitive landscape of the retail real estate investment trust. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering a thorough examination of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Rivalry Among Competitors

PREIT operates within a fiercely competitive retail Real Estate Investment Trust (REIT) landscape. Major players like Simon Property Group, Macerich, and CBL Properties are constantly vying for prime locations and attractive tenants, intensifying the rivalry for investor capital.

This competition is primarily driven by the quality and desirability of properties, strategic locations, and the curated tenant mix. The ability of REITs to adapt to changing consumer behaviors and retail trends, such as the growth of e-commerce, is a critical differentiator. For instance, as of the first quarter of 2024, the retail sector continued to see varied performance, with well-located, experiential centers showing resilience while others faced occupancy challenges.

PREIT's competitive landscape extends beyond other Real Estate Investment Trusts (REITs) to include private developers, institutional investors, and other real estate companies actively involved in retail and mixed-use property development. These players can present alternative retail environments or innovative development strategies that appeal to both tenants and shoppers, directly impacting PREIT's market share and tenant retention.

PREIT's competitive rivalry is significantly shaped by its capacity for property redevelopment, a strategy aimed at differentiating its retail assets. This involves not just physical upgrades but also innovating tenant mixes and crafting unique experiential destinations to attract shoppers. For instance, PREIT's recent redevelopment projects, like the revitalization of the Fashion District Philadelphia, demonstrate this commitment to enhancing property value and drawing in a diverse customer base, directly competing with rivals who are similarly investing in their portfolios to stay relevant in the evolving retail landscape.

Geographic Overlap and Market Saturation

PREIT faces significant competitive rivalry in several Eastern U.S. markets where its properties are situated. This geographic overlap means PREIT malls often compete directly with other retail centers for shoppers and, crucially, for retail tenants.

Market saturation in these regions exacerbates this rivalry. When too many retail options are available, it puts downward pressure on PREIT's ability to maintain high occupancy rates and achieve favorable rental income.

- Geographic Overlap: PREIT's portfolio is concentrated in the Mid-Atlantic and Northeast U.S., areas with a high density of retail destinations, increasing the likelihood of direct competition.

- Market Saturation Impact: In 2024, some of these saturated markets may see vacancy rates rise, forcing landlords like PREIT to offer incentives, potentially impacting net effective rents.

- Tenant Competition: Retailers in these overlapping areas have more choices, strengthening their negotiating power and potentially leading to higher tenant improvement allowances or rent concessions from PREIT.

Evolving Retail Landscape Fuels Competition

The retail sector is in constant flux, with consumer tastes rapidly evolving. This dynamism, particularly the growing demand for experiential shopping and seamless omnichannel integration, significantly heightens competition. PREIT, like its peers, faces pressure to adapt its properties and tenant mix to stay relevant.

In 2024, retail real estate investment trusts (REITs) are navigating a landscape where customer expectations are paramount. Retailers are increasingly seeking spaces that offer more than just transactions; they want environments that foster engagement and loyalty. This trend means that properties need to be flexible and attractive to a diverse range of tenants, from established brands to pop-up concepts.

- Shifting Consumer Preferences: A significant portion of consumers, especially Gen Z and Millennials, prioritize experiences over mere product acquisition, impacting how retail spaces are designed and utilized.

- Omnichannel Integration: Retailers are investing heavily in integrating their online and physical presences, requiring retail properties to support click-and-collect services, efficient returns, and in-store digital experiences.

- Evolving Tenant Mix: The rise of direct-to-consumer (DTC) brands and experiential service providers, such as fitness studios and curated food halls, challenges traditional retail anchors and necessitates a more dynamic leasing strategy.

- Competitive Response: PREIT's ability to attract and retain tenants depends on its capacity to offer modern, adaptable spaces that cater to these evolving retail strategies, directly impacting occupancy rates and rental income.

PREIT faces intense competition from other REITs and developers in its core markets, leading to pressure on rents and occupancy. The need to constantly update properties and attract desirable tenants means significant capital expenditure. In 2024, the retail sector's recovery varied, with well-located, experiential centers outperforming others. This dynamic environment compels PREIT to invest in redevelopment and adapt its tenant mix to remain competitive.

| Competitor Type | Key Differentiators | Impact on PREIT |

|---|---|---|

| Other Retail REITs (e.g., Simon Property Group) | Prime locations, large-scale portfolios, established tenant relationships | Direct competition for tenants and investor capital; pressure on rental rates |

| Private Developers & Institutional Investors | Agility in development, mixed-use integration, innovative concepts | Alternative retail environments; potential to draw shoppers and tenants away |

| Evolving Retail Landscape | Experiential retail, omnichannel integration, diverse tenant mix (DTC, services) | Need for property upgrades and flexible leasing to maintain relevance and occupancy |

SSubstitutes Threaten

The most significant substitute threatening PREIT's physical retail spaces, particularly its malls, is the burgeoning e-commerce sector. Online platforms offer unparalleled convenience, a vast array of products, and often more competitive pricing, directly siphoning sales away from brick-and-mortar retailers. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, a substantial figure that highlights the scale of this substitution threat.

Retailers are increasingly choosing standalone locations, strip malls, or open-air lifestyle centers. These alternatives offer distinct advantages over traditional enclosed malls, including easier access for consumers and potentially reduced operating expenses for businesses. For instance, the rise of e-commerce has fueled a demand for more convenient, localized retail experiences, making these substitute formats attractive.

These alternative retail formats directly compete with enclosed malls by providing a physical presence for brands. Retailers can achieve brand visibility and customer interaction in these spaces without the overhead or perceived limitations of a large, enclosed mall structure. This shift represents a significant threat as it diverts potential tenants and foot traffic away from traditional mall properties.

The rise of direct-to-consumer (DTC) models poses a significant threat to PREITs by diminishing the need for traditional brick-and-mortar retail spaces. Many brands, from apparel to electronics, are increasingly prioritizing online sales channels, bypassing the leased spaces that form the core of PREIT portfolios. This shift directly impacts rental demand, as brands can now reach customers without a physical store presence.

For example, in 2024, the global DTC e-commerce market continued its robust growth, with many established brands launching or expanding their own online platforms. This trend means fewer brands are looking to lease mall space, directly reducing the potential revenue streams for PREITs. The convenience and cost-effectiveness of DTC for brands translate into a direct threat to the occupancy rates and rental income of retail properties.

Experiential and Entertainment Venues Outside Malls

Consumers increasingly opt for dedicated entertainment complexes, theme parks, or standalone restaurants and leisure venues that offer unique experiences outside of traditional enclosed malls. This trend directly competes for discretionary spending and leisure time that might otherwise be allocated to mall visits.

These alternative venues can offer more specialized or immersive experiences, drawing customers away from the general retail and entertainment mix found in malls. For example, in 2024, the global theme park industry is projected to generate over $50 billion in revenue, highlighting a significant consumer appetite for dedicated entertainment options.

- Dedicated Entertainment Centers: These can include bowling alleys, arcades, and interactive gaming centers that provide focused leisure activities.

- Experiential Dining: Restaurants offering unique themes, interactive elements, or celebrity chef endorsements can attract diners seeking more than just a meal.

- Outdoor and Event-Based Entertainment: Festivals, concerts, and outdoor recreational activities also present viable alternatives for consumers' leisure budgets.

Urban Mixed-Use Developments as Alternatives

The rise of urban mixed-use developments presents a significant threat of substitutes for traditional retail spaces like those operated by PREIT. These integrated environments, blending residential, office, and retail, are increasingly drawing consumer foot traffic and retailer interest by offering a comprehensive lifestyle experience.

These developments compete directly for consumer discretionary spending, providing convenience and a sense of community that can detract from the singular focus on shopping found in malls. For instance, the increasing popularity of walkable urban centers means consumers can fulfill multiple needs, from dining and entertainment to shopping, all within a single, often more engaging, location.

- Increased Consumer Preference: Consumers are showing a growing preference for integrated living and shopping experiences, which mixed-use developments fulfill better than standalone retail centers.

- Retailer Diversification: Retailers may find mixed-use developments more attractive due to built-in residential and office populations, offering a more captive audience and potentially higher sales volumes.

- Competition for Tenancy: As mixed-use projects gain traction, they create a competitive pressure for retailers to secure prime locations within these developments, potentially impacting leasing strategies and occupancy rates for traditional malls.

The threat of substitutes for PREIT's physical retail spaces is multifaceted, primarily driven by the digital shift and evolving consumer preferences. E-commerce continues to be a dominant substitute, with global online sales projected to exceed $6.3 trillion in 2024, directly impacting brick-and-mortar traffic. Additionally, the growing popularity of direct-to-consumer (DTC) models allows brands to bypass traditional retail leases altogether, as evidenced by the robust growth in the DTC e-commerce market throughout 2024.

Alternative retail formats like standalone locations, strip malls, and lifestyle centers also pose a threat by offering convenience and potentially lower costs for retailers. These formats compete for both tenants and foot traffic, diverting business from enclosed malls. Furthermore, dedicated entertainment venues and urban mixed-use developments are capturing consumer leisure spending and creating more integrated shopping experiences, drawing customers away from traditional mall environments.

| Substitute Category | Key Characteristics | Impact on PREIT | 2024 Data/Projection |

|---|---|---|---|

| E-commerce | Convenience, vast selection, competitive pricing | Reduced foot traffic, lower sales for physical retailers | Global sales > $6.3 trillion |

| Direct-to-Consumer (DTC) | Brand control, direct customer relationship, lower overhead | Reduced demand for mall leases, lower rental income | Continued robust market growth |

| Alternative Retail Formats (Strip Malls, Lifestyle Centers) | Easier access, localized experience, potentially lower costs | Competition for tenants and foot traffic | Increasing retailer preference for convenience |

| Dedicated Entertainment/Leisure Venues | Specialized experiences, unique offerings | Competition for discretionary spending and leisure time | Global theme park revenue > $50 billion |

| Urban Mixed-Use Developments | Integrated living, working, and shopping environments | Competition for consumer attention and retailer investment | Growing consumer preference for walkable urban centers |

Entrants Threaten

The threat of new enclosed malls entering the market is quite low. This is primarily because the sheer amount of money needed to even start is staggering. Think about buying land in a good location, then paying for all the construction and the necessary infrastructure – it’s a massive financial hurdle.

Building a large shopping mall isn't a quick or cheap project. It typically takes many years and can easily cost billions of dollars. For instance, the development of a major mall can easily exceed $500 million, with some reaching well over $1 billion, making it a very risky venture for any new player.

The scarcity of prime, high-traffic locations is a significant barrier for new entrants looking to establish large retail developments. Many of these desirable spots are already developed, often by established players like PREIT, making acquisition and necessary zoning a complex and costly hurdle. For instance, in 2024, the availability of undeveloped, large-scale retail land in major metropolitan areas continued to shrink, with prime sites often commanding premiums that deter smaller or newer competitors.

PREIT, like other established retail REITs, benefits from deep-rooted relationships with a diverse range of national and regional retailers. These aren't just casual connections; they represent years of successful leasing, tenant support, and mutual understanding. For instance, PREIT’s portfolio in 2024 likely includes anchor tenants that have been with them for decades, attracted by consistent foot traffic and effective property management.

New entrants would find it incredibly difficult to replicate this established network. Building trust and securing commitments from major retailers, especially sought-after anchor tenants, requires time, a proven track record, and often, significant incentives. This barrier means that new competitors would struggle to populate their properties with the same caliber of tenants that PREIT already has secured.

Regulatory Hurdles and Development Complexity

New mall developments are significantly hampered by intricate zoning regulations, rigorous environmental impact assessments, and lengthy permitting procedures that span local, state, and federal jurisdictions. These multifaceted regulatory requirements can extend development timelines by years and substantially increase upfront costs, creating a formidable barrier for any aspiring new entrants seeking to establish a physical presence in the retail real estate market.

For instance, in 2024, major urban redevelopments often face public hearings and community feedback periods that can delay project approvals. The average time for securing all necessary permits for a large commercial project in the US can exceed two years, with associated costs sometimes reaching millions of dollars in consulting and legal fees alone.

- Complex Zoning Laws: Navigating diverse local zoning ordinances is a primary hurdle.

- Environmental Reviews: Compliance with environmental protection acts adds time and cost.

- Permitting Processes: Securing approvals from multiple government bodies is a lengthy endeavor.

- Development Complexity: The sheer scale and technical requirements of modern mall construction deter many.

Market Saturation and Oversupply Concerns

The threat of new entrants for PREIT, specifically concerning traditional enclosed malls, is considerably low due to widespread market saturation. Many regions already grapple with an oversupply of these retail spaces, diminishing the economic viability for new large-scale developments. This oversupply directly impacts potential returns, making new entrants hesitant.

For instance, in 2024, the retail real estate sector continued to face headwinds, with vacancy rates in many enclosed malls remaining stubbornly high. Reports from various commercial real estate firms indicated that new mall development has been minimal for years, a trend expected to persist. This lack of new construction signifies a strong deterrent for any potential new players looking to enter the enclosed mall market.

The high capital investment required to build and establish a new enclosed mall, coupled with the existing oversupply and evolving consumer shopping habits, creates significant barriers. New entrants would face immense difficulty in securing prime locations and attracting anchor tenants when established malls are already struggling to maintain occupancy. This economic reality significantly dampens the incentive for new competition.

Key factors contributing to this low threat include:

- Market Saturation: Many established markets have an excess of enclosed mall inventory, limiting opportunities for new developments.

- High Capital Requirements: The substantial upfront investment needed for new mall construction acts as a significant barrier to entry.

- Evolving Consumer Behavior: A shift towards e-commerce and experiential retail reduces the appeal and projected success of traditional enclosed malls for new investors.

- Limited New Development: In 2024, new enclosed mall construction remained exceptionally low, reflecting the unattractive market conditions for new entrants.

The threat of new enclosed malls entering the market for PREIT is low. This is due to the immense capital required, estimated to be over $500 million to over $1 billion for a single development, alongside the difficulty in securing prime, already developed locations. In 2024, the scarcity of large retail land in metropolitan areas continued to be a significant deterrent, with existing players often holding these valuable sites.

Furthermore, established REITs like PREIT possess strong relationships with national and regional retailers, including long-standing anchor tenants. Replicating this network and securing commitments from desirable tenants would be a considerable challenge for newcomers. For instance, PREIT's 2024 portfolio likely features tenants with decades-long partnerships, built on trust and consistent performance.

Regulatory hurdles, including complex zoning laws, environmental reviews, and lengthy permitting processes that can take over two years and cost millions in 2024, add further complexity and cost. Combined with market saturation and evolving consumer preferences favoring e-commerce and experiential retail, these factors significantly dampen the attractiveness of new enclosed mall development.

Porter's Five Forces Analysis Data Sources

Our PREIT Porter's Five Forces analysis is built on a foundation of comprehensive data, including publicly available financial statements, investor presentations, and property portfolio disclosures. We supplement this with insights from industry-specific real estate research reports and market intelligence from reputable real estate data providers.