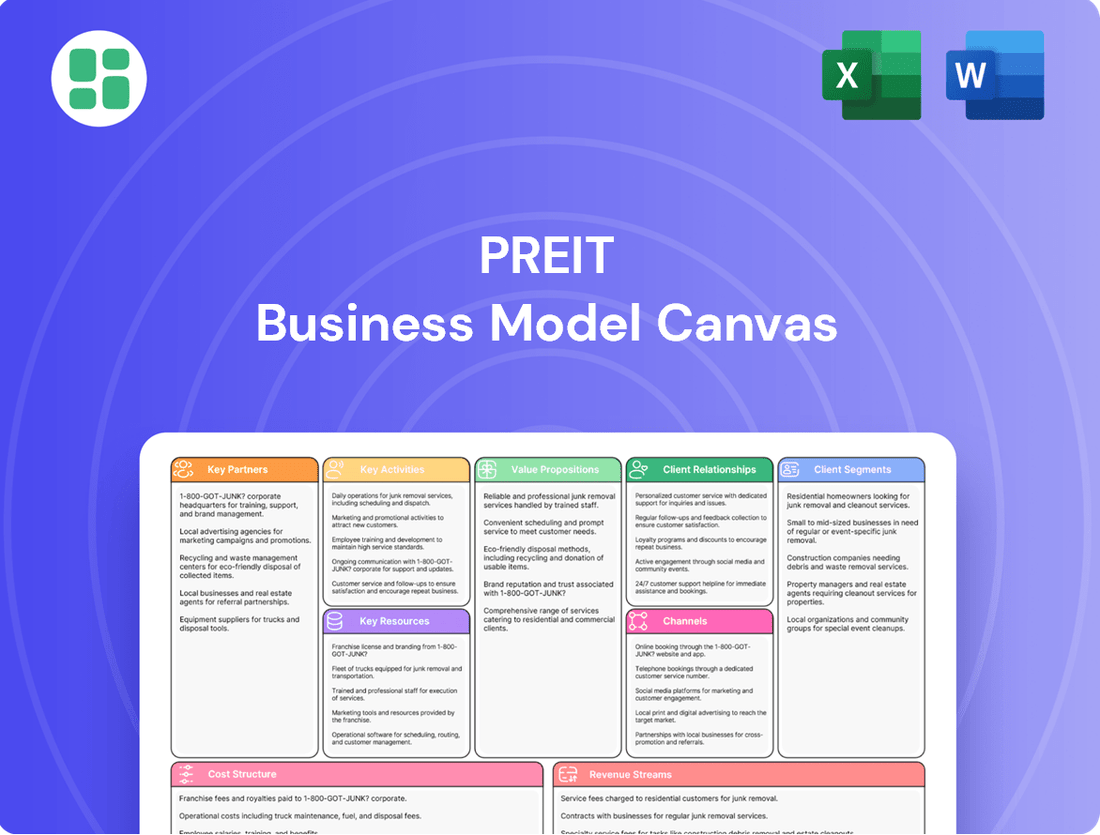

PREIT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PREIT Bundle

Unlock the strategic blueprint of PREIT’s business model with our comprehensive Business Model Canvas. Discover how PREIT effectively manages its key resources, cultivates vital partnerships, and delivers unique value propositions to its diverse customer segments. This detailed analysis is essential for anyone seeking to understand the core drivers of PREIT's success and market positioning.

Partnerships

PREIT cultivates enduring partnerships with a wide array of retail tenants, encompassing major anchor stores and niche specialty boutiques. These collaborations are fundamental, generating the bulk of PREIT's income via rental contracts and significantly influencing the attractiveness and footfall of its properties.

PREIT's ability to thrive hinges on strong relationships with financial institutions and investors. These partnerships are crucial for securing the substantial capital needed for property acquisitions, ambitious development projects, and the day-to-day operational needs of its extensive retail portfolio.

In 2024, PREIT continued to leverage its established banking relationships, accessing credit facilities that underpin its financial flexibility. For instance, the company's commitment to deleveraging and strengthening its balance sheet in recent years has made it an attractive partner for lenders and institutional investors seeking stable, income-generating assets.

PREIT collaborates with a wide array of property management and service providers. These partners are crucial for maintaining the high standards of its shopping malls, covering everything from essential upkeep and security to specialized cleaning services. For instance, in 2024, PREIT continued to leverage these relationships to ensure its properties, like Fashion District Philadelphia, remain appealing and functional for both its retail tenants and the visiting public.

Government and Regulatory Bodies

PREIT actively collaborates with government and regulatory bodies to ensure smooth operations and development. This includes engaging with local and state agencies for permits and zoning, crucial for their retail and mixed-use properties. For instance, navigating land use policies is vital for their urban redevelopment projects.

These partnerships are fundamental to PREIT's ability to comply with building codes and land use regulations, directly impacting their capacity to develop or redevelop properties efficiently. In 2024, PREIT continued to focus on strategic relationships with these entities to support their portfolio enhancements and ongoing property management.

- Permitting and Compliance: Essential for obtaining necessary approvals for property development and renovations.

- Zoning and Land Use: Navigating these policies is critical for site selection and project execution.

- Regulatory Adherence: Ensuring all properties meet building codes and safety standards.

- Community Engagement: Building positive relationships with local authorities to facilitate projects.

Marketing and Event Promoters

PREIT partners with marketing and event promoters to boost shopper engagement and property appeal. These collaborations are crucial for driving foot traffic and creating a vibrant atmosphere within their retail centers.

These partnerships manifest through joint promotional campaigns, the organization of community events, and the implementation of seasonal attractions. For instance, in 2024, PREIT continued to leverage these relationships to host a variety of events designed to draw in consumers and provide unique experiences, thereby benefiting their tenant base.

- Marketing Agencies: Collaborate on targeted advertising and digital campaigns to reach a wider audience.

- Event Organizers: Partner to bring diverse events, from local festivals to national tours, to PREIT properties.

- Community Groups: Engage with local organizations for events that foster community ties and attract residents.

- Seasonal Promotions: Work with promoters to create engaging holiday and seasonal experiences, like summer festivals or winter wonderlands.

PREIT's key partnerships extend to technology and data analytics providers, crucial for enhancing tenant and customer experiences. These collaborations enable PREIT to implement smart building technologies and data-driven strategies for optimizing operations and tenant performance.

In 2024, PREIT continued to focus on strengthening its relationships with these technology partners to improve property management efficiency and tenant satisfaction. For example, the company might integrate advanced analytics to better understand shopper behavior within its malls, informing leasing and marketing decisions.

| Partner Type | Role | 2024 Focus/Impact |

| Retail Tenants | Primary income generators, drive foot traffic | Maintaining strong relationships, optimizing tenant mix for diverse offerings |

| Financial Institutions | Capital providers for acquisitions, development, operations | Securing credit facilities, supporting deleveraging efforts |

| Property Management & Service Providers | Maintaining property standards, ensuring functionality | Essential upkeep, security, specialized cleaning for properties like Fashion District Philadelphia |

| Government & Regulatory Bodies | Permitting, zoning, compliance, community engagement | Facilitating urban redevelopment projects, ensuring regulatory adherence |

| Marketing & Event Promoters | Boosting shopper engagement, property appeal, foot traffic | Joint campaigns, community events, seasonal attractions to enhance consumer experience |

| Technology & Data Providers | Enhancing tenant/customer experience, operational efficiency | Implementing smart building tech, data analytics for shopper behavior |

What is included in the product

A strategic blueprint for PREIT, outlining its core operations and market positioning.

Details PREIT's tenant relationships, property portfolio, and revenue streams.

PREIT's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their strategy, allowing for rapid identification of inefficiencies and areas for improvement.

It simplifies complex operations into a digestible format, enabling PREIT to quickly pinpoint and address challenges in their retail real estate portfolio.

Activities

PREIT actively pursues the acquisition of new retail properties that fit its strategic vision, alongside undertaking significant redevelopment projects within its existing shopping center portfolio. These strategic moves are designed to boost property value, modernize facilities, and optimize the tenant mix. For instance, in 2024, PREIT continued its focus on enhancing its portfolio, with key projects like the redevelopment of the Fashion District Philadelphia, which aims to attract a more diverse and high-caliber tenant base.

A key activity for PREIT is the meticulous negotiation and ongoing management of lease agreements with a diverse range of retail tenants. This ensures a steady and reliable income stream, crucial for the company's financial health.

PREIT actively cultivates strong, supportive relationships with its tenants. This focus on tenant success and retention is vital for maintaining occupancy rates and the overall appeal of their properties.

In 2024, PREIT continued to emphasize tenant engagement, a strategy that has historically contributed to its stable rental income. For instance, their focus on fostering positive landlord-tenant relationships is a cornerstone of their operational model.

PREIT's key activities include the daily management of its retail properties, encompassing essential services like maintenance, security, and overall operational oversight. This hands-on approach ensures a consistently high-quality environment for all stakeholders.

Efficient property management is crucial for maintaining the appeal and functionality of PREIT's malls, directly impacting tenant satisfaction and shopper experience. For example, in Q1 2024, PREIT reported a 98.7% occupancy rate across its portfolio, underscoring the effectiveness of its operational management.

Asset Optimization and Value Enhancement

PREIT actively pursues asset optimization and value enhancement for its retail properties. This includes undertaking strategic renovations and re-leasing initiatives to ensure properties remain competitive and financially robust.

These efforts are crucial for adapting to changing retail landscapes and maximizing returns. For instance, during 2024, PREIT continued its focus on enhancing tenant sales and foot traffic through targeted capital improvements and strategic leasing strategies.

- Strategic Renovations: Investing in modernizing amenities and store layouts to attract high-quality tenants and shoppers.

- Re-leasing Efforts: Proactively managing lease expirations and renewals to secure favorable terms and fill vacancies with desirable retailers.

- Adaptation to Trends: Incorporating experiential elements and diverse tenant mixes to align with evolving consumer preferences in retail.

- Financial Performance: Aiming to boost tenant sales, increase occupancy rates, and ultimately enhance Net Operating Income (NOI) from its portfolio.

Financial Management and Investor Relations

PREIT's key activities center on robust financial management, encompassing strategic capital allocation to optimize property performance and debt management to maintain a healthy balance sheet. In 2024, PREIT continued to focus on strengthening its financial position, aiming for efficient use of resources.

Investor relations are paramount, involving clear and consistent communication regarding the company's performance, strategy, and outlook. This transparency is vital for building and maintaining investor confidence, which directly impacts the ability to attract capital for future growth initiatives.

- Financial Health: Managing capital allocation for property upgrades and acquisitions, alongside prudent debt servicing, is central to PREIT's operations.

- Investor Communication: Providing timely and accurate financial reports and updates to shareholders and the broader investment community is a continuous effort.

- Capital Attraction: Effective investor relations are designed to foster trust and attract the necessary capital for PREIT's ongoing development and investment plans.

PREIT's key activities involve strategic property acquisition and redevelopment to enhance its retail portfolio. This includes modernizing existing centers and actively seeking new acquisitions that align with market trends. For example, in 2024, PREIT continued its strategic leasing and capital improvement initiatives to drive tenant sales and foot traffic across its properties.

Active lease management and fostering strong tenant relationships are core to PREIT's operations, ensuring stable rental income and high occupancy. In Q1 2024, PREIT reported a 98.7% portfolio occupancy rate, highlighting the success of these tenant-focused strategies.

Operational excellence in property management, including maintenance and security, is crucial for maintaining PREIT's asset value and tenant satisfaction. These daily activities ensure a positive environment for shoppers and retailers alike.

PREIT also prioritizes robust financial management, including strategic capital allocation and debt management, to support its growth and maintain financial stability. Effective investor relations are maintained through transparent communication about performance and strategy.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Property Acquisition & Redevelopment | Acquiring new retail properties and redeveloping existing ones to boost value and optimize tenant mix. | Continued focus on strategic leasing and capital improvements to drive tenant sales and foot traffic. |

| Lease Management & Tenant Relations | Negotiating and managing lease agreements, and building strong relationships for tenant retention. | Achieved 98.7% portfolio occupancy in Q1 2024, demonstrating successful tenant engagement. |

| Property Operations Management | Daily oversight of properties, including maintenance, security, and overall operational efficiency. | Ensuring high-quality environments to support tenant success and shopper experience. |

| Financial & Investor Management | Strategic capital allocation, debt management, and transparent investor communication. | Focus on strengthening financial position and attracting capital for growth initiatives. |

Full Document Unlocks After Purchase

Business Model Canvas

The PREIT Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you get a direct, unedited glimpse into the comprehensive structure and content that will be yours to download. Rest assured, there are no mockups or sample sections; what you see is precisely what you will get, ready for your strategic planning needs.

Resources

PREIT's primary key resource is its extensive portfolio of enclosed retail malls, strategically situated across the Eastern United States. These physical properties are the bedrock of its operations, offering rentable space that directly fuels revenue generation.

As of early 2024, PREIT managed a portfolio of approximately 20 properties. This physical real estate is the tangible asset that enables the company to execute its leasing and property management strategies, forming the core of its value proposition.

PREIT's financial capital is a cornerstone of its operations, encompassing significant equity contributions from its investor base and robust access to debt financing. This financial muscle is essential for the company's strategic objectives, including the acquisition of prime retail properties and the ongoing development and redevelopment of its existing portfolio.

In 2024, PREIT's ability to leverage its financial resources was critical for maintaining operational liquidity and funding its capital expenditure plans. Access to credit facilities and the capital markets allows PREIT to pursue growth opportunities and manage its balance sheet effectively, ensuring it can meet its financial obligations and invest in future value creation.

PREIT's business model relies heavily on its experienced real estate management team. This group of professionals possesses deep expertise in leasing, property operations, and finance, which is crucial for navigating the complexities of the real estate market.

Their collective knowledge directly influences strategic decisions, ensuring PREIT can effectively manage its portfolio and identify opportunities for growth. For instance, in 2024, PREIT's leasing team successfully executed numerous new leases and renewals, contributing to a robust occupancy rate across its properties.

The team's operational efficiency is a key driver of value creation. By optimizing property management and tenant services, they enhance tenant satisfaction and reduce operating costs, directly impacting PREIT's profitability and financial performance.

Tenant Relationships and Lease Agreements

PREIT's tenant relationships are a cornerstone of its business model, built on a foundation of long-term lease agreements with a diverse mix of national and local retailers. This established network provides a predictable and stable revenue stream, crucial for sustained operations and growth.

These relationships are not just transactional; they foster a symbiotic environment where tenants contribute to the overall appeal and foot traffic of PREIT's shopping centers. The stability offered by these long-term commitments is a significant intangible asset.

- Diversified Tenant Base: PREIT's portfolio includes a wide array of tenants, from anchor stores to specialty shops, mitigating risks associated with over-reliance on any single sector.

- Long-Term Leases: The majority of PREIT's leases extend for multiple years, providing revenue visibility and predictability. As of the first quarter of 2024, PREIT reported a portfolio occupancy rate of 94.7%.

- Tenant Mix Optimization: PREIT actively manages its tenant mix to enhance the customer experience and drive sales, a strategy that strengthens tenant relationships.

- Revenue Stability: In 2023, PREIT's total revenue was approximately $851 million, a significant portion of which is derived from rental income secured by these lease agreements.

Brand Reputation and Market Knowledge

PREIT's strong brand reputation within the retail real estate sector is a significant asset, allowing it to command premium rents and attract high-quality tenants to its properties.

This established reputation, coupled with deep market knowledge of the Eastern US retail landscape, enables PREIT to identify and capitalize on strategic acquisition and redevelopment opportunities. For instance, PREIT's portfolio, heavily concentrated in the Eastern US, benefits from this localized expertise. In 2024, PREIT continued to focus on optimizing its tenant mix, a strategy directly supported by its understanding of regional consumer preferences and emerging retail trends.

PREIT's market knowledge is not just about knowing the geography; it's about understanding the dynamics of consumer behavior and the competitive environment. This insight is crucial for maintaining a competitive edge and ensuring its properties remain relevant and attractive to both shoppers and retailers.

- Brand Reputation: PREIT is recognized for its well-located, high-quality retail assets, fostering trust among tenants and consumers.

- Market Knowledge: Deep understanding of the Eastern US retail market allows for informed decisions on tenant selection and property development.

- Tenant Attraction: A strong brand and market insight facilitate attracting desirable tenants, including national retailers and emerging brands.

- Strategic Opportunities: This combination of reputation and knowledge helps PREIT identify and pursue advantageous investment and leasing opportunities.

PREIT's key resources are its physical retail properties, financial capital, skilled management team, strong tenant relationships, and established brand reputation coupled with deep market knowledge. These elements collectively enable PREIT to generate revenue, manage its portfolio effectively, and pursue strategic growth opportunities in the Eastern United States retail market.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Properties | Enclosed retail malls across the Eastern US. | Portfolio of approximately 20 properties as of early 2024. |

| Financial Capital | Equity and debt financing. | Essential for operations, acquisitions, and redevelopment; access to credit facilities in 2024. |

| Management Team | Expertise in leasing, operations, and finance. | Drove successful lease execution in 2024, contributing to high occupancy. |

| Tenant Relationships | Long-term leases with diverse retailers. | Provided stable revenue; 94.7% portfolio occupancy rate in Q1 2024. |

| Brand Reputation & Market Knowledge | Strong brand in retail real estate; deep understanding of Eastern US market. | Facilitates tenant attraction and identification of strategic opportunities; informed tenant mix optimization in 2024. |

Value Propositions

PREIT provides retail tenants with prime real estate opportunities, situating them in high-traffic, enclosed malls across the Eastern United States. These locations are chosen for their established consumer bases, offering tenants a significant advantage in reaching their target markets and boosting sales potential.

For instance, in 2024, PREIT's portfolio of malls continued to attract substantial foot traffic, with many properties consistently exceeding industry averages. This strategic placement ensures tenants benefit from built-in customer flow, enhancing brand visibility and driving revenue growth.

For tenants, PREIT offers retail environments that are not just well-managed but also meticulously maintained. This focus ensures a secure, clean, and appealing space, which directly benefits their businesses and customer experience. For example, in 2024, PREIT continued its strategic capital reinvestment program across its portfolio, aiming to enhance property aesthetics and functionality, which is crucial for tenant attraction and retention.

This professional management and upkeep significantly reduce the operational burdens tenants face. By handling property maintenance and ensuring high standards, PREIT allows tenants to concentrate on their core business activities. This proactive approach also positively impacts their brand image, as a well-presented store within a quality property reflects favorably on the tenant's own brand.

PREIT actively cultivates a vibrant tenant roster, blending essential retail, diverse dining experiences, and engaging entertainment options. This strategic mix transforms properties into dynamic destinations, drawing in a wide demographic of shoppers and creating a synergistic environment where all tenants benefit from increased foot traffic and cross-promotional opportunities.

Stable, Income-Generating Real Estate Assets for Investors

PREIT offers investors a compelling proposition by providing access to a curated portfolio of stable, income-generating retail real estate assets. This strategy is designed to deliver consistent dividend income, appealing to those seeking regular cash flow. The company's commitment to optimizing asset value further enhances the potential for long-term capital appreciation, making it an attractive option for wealth building.

For the fiscal year 2023, PREIT reported a total revenue of $276.8 million, with a significant portion derived from its retail property portfolio. The company's focus on active portfolio management, including strategic dispositions and acquisitions, aims to bolster the quality and income-generating capacity of its assets. This proactive approach is key to achieving steady returns for its investors.

- Income Generation: PREIT's retail properties, such as the Fashion District Philadelphia, are strategically positioned to attract consistent foot traffic and sales, directly translating into rental income.

- Dividend Stability: The company historically aims to distribute a substantial portion of its taxable income as dividends, offering investors a reliable income stream.

- Asset Optimization: Through ongoing redevelopment and leasing efforts, PREIT works to enhance the value and profitability of its existing real estate holdings.

- Capital Appreciation Potential: By investing in well-located and well-managed retail centers, PREIT provides investors with exposure to potential long-term growth in property values.

Expertise in Retail Property Management and Redevelopment

PREIT's deep expertise in retail property management, leasing, and redevelopment is a core value proposition. This specialized knowledge drives optimized asset performance and fuels strategic growth.

This expertise allows PREIT to implement adaptive strategies that respond to evolving market demands, ultimately enhancing property value and tenant satisfaction. For example, in 2024, PREIT continued its focus on transforming its portfolio, with initiatives aimed at improving tenant mix and experiential offerings across its properties.

- Specialized Retail Focus: Deep understanding of the retail sector's nuances, from tenant curation to operational efficiency.

- Adaptive Redevelopment: Proven ability to repurpose and modernize retail assets to meet current consumer preferences and market trends.

- Leasing Optimization: Strategic approach to leasing that maximizes occupancy and rental income, ensuring vibrant tenant environments.

PREIT offers tenants premier retail locations in high-traffic, enclosed malls across the Eastern U.S. These strategically chosen properties provide access to established consumer bases, boosting sales potential and brand visibility. In 2024, PREIT malls continued to draw significant foot traffic, often surpassing industry averages, ensuring tenants benefit from inherent customer flow.

PREIT provides meticulously maintained and professionally managed retail spaces, reducing tenant operational burdens and allowing focus on core business activities. This commitment to upkeep enhances property appeal, positively impacting tenant brand image. In 2024, PREIT's capital reinvestment program further improved property aesthetics and functionality, crucial for tenant attraction and retention.

PREIT curates a dynamic tenant mix, blending retail, dining, and entertainment to create vibrant destinations. This synergy increases shopper demographics and fosters cross-promotional opportunities, benefiting all tenants. This strategic tenant placement is vital for maximizing property performance and tenant success.

PREIT offers investors access to a portfolio of stable, income-generating retail real estate, designed for consistent dividend income and long-term capital appreciation. The company's active asset management, including strategic dispositions and acquisitions, aims to enhance the quality and income-generating capacity of its holdings. For fiscal year 2023, PREIT reported $276.8 million in total revenue, underscoring the income potential of its retail assets.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Prime Retail Locations | Access to high-traffic, established consumer bases in Eastern U.S. malls. | PREIT malls consistently attract substantial foot traffic, often exceeding industry averages (2024 data). |

| Operational Support & Brand Enhancement | Professionally managed and maintained spaces reduce tenant burdens and improve brand image. | Ongoing capital reinvestment in 2024 focused on enhancing property aesthetics and functionality. |

| Synergistic Tenant Mix | Curated blend of retail, dining, and entertainment creates vibrant destinations and cross-promotional opportunities. | Strategic tenant curation aims to draw diverse demographics and enhance overall property appeal. |

| Investor Income & Growth | Access to stable, income-generating assets with potential for capital appreciation and consistent dividends. | 2023 total revenue of $276.8 million from a portfolio focused on income generation and asset optimization. |

Customer Relationships

PREIT actively cultivates robust tenant relationships through dedicated account management. These specialized managers provide personalized support, ensuring tenant needs are met efficiently and fostering a collaborative environment. This approach is crucial for tenant retention, as evidenced by PREIT's focus on long-term partnerships.

PREIT fosters strong retailer relationships through proactive communication, sharing timely updates on property enhancements, upcoming marketing campaigns, and essential operational support. This approach ensures retailers are well-informed and prepared to leverage PREIT's initiatives.

PREIT views its retailers as partners, actively collaborating to foster their success within its shopping centers. This supportive stance aims to create an environment where businesses can flourish, contributing to the overall vibrancy of PREIT's portfolio.

In 2024, PREIT continued its focus on enhancing the tenant experience, with specific initiatives aimed at improving operational efficiency and marketing reach for its retail partners. These efforts are designed to directly support retailer performance and build enduring partnerships.

PREIT maintains robust investor relations through transparent and frequent communication. This includes timely delivery of financial reports, active participation in investor calls, and informative presentations that detail performance and strategic initiatives.

For instance, PREIT's 2024 first-quarter earnings report highlighted key operational metrics and financial health, reinforcing its commitment to keeping stakeholders fully apprised of its progress and future outlook.

Community Engagement and Events

PREIT actively cultivates strong ties with the communities around its properties. This is achieved through strategic local collaborations and by sponsoring various initiatives. For instance, in 2024, PREIT continued its commitment to supporting local causes, often aligning with events that resonate with the demographics of its mall locations.

These community-focused events transform PREIT malls into more than just shopping destinations; they become vibrant community hubs. This enhanced role directly benefits tenants by increasing foot traffic and fosters a sense of loyalty among local residents, encouraging repeat visits and spending.

PREIT's engagement strategy in 2024 included a variety of events designed to draw in local patrons and strengthen community bonds.

- Local Partnerships: Collaborating with neighborhood organizations and businesses to co-host events.

- Community Events: Hosting family-friendly activities, seasonal festivals, and local talent showcases.

- Sponsorships: Supporting local schools, charities, and community sports teams to build goodwill.

Broker and Real Estate Agent Network

PREIT actively nurtures its network of real estate brokers and agents. These professionals are instrumental in PREIT’s tenant acquisition strategy, acting as key conduits for identifying and securing new lessees for their retail properties.

These external partnerships significantly amplify PREIT's market presence and scouting capabilities. For instance, in 2024, PREIT continued to leverage these relationships to fill vacancies and attract a diverse tenant mix, a strategy that has historically proven effective in optimizing occupancy rates.

- Tenant Identification: Brokers and agents provide PREIT with market intelligence and access to potential tenants, driving leasing activity.

- Transaction Facilitation: They streamline the leasing process, from initial contact to lease execution, ensuring efficient deal closures.

- Market Reach: This network extends PREIT's operational reach, allowing for broader market coverage and opportunity identification.

- 2024 Focus: PREIT's ongoing engagement with its broker network in 2024 aimed at enhancing occupancy and adapting to evolving retail demands.

PREIT's customer relationships are multifaceted, encompassing tenants, investors, communities, and real estate professionals. The company prioritizes direct engagement, personalized support, and transparent communication across all these groups to foster loyalty and drive mutual success. This strategic approach is central to maintaining strong occupancy and enhancing property value.

Channels

PREIT leverages its dedicated in-house leasing and sales teams to directly connect with potential tenants, fostering personalized interactions and efficient deal closures. These teams are instrumental in negotiating lease terms and nurturing ongoing relationships with their current tenant portfolio.

This direct approach enables PREIT to offer customized leasing solutions and maintain streamlined communication, which is crucial for adapting to market demands. For instance, in 2024, PREIT reported a significant leasing velocity, with their direct teams playing a key role in securing new tenancy agreements across their retail properties.

External real estate brokers and agents are crucial for PREIT, acting as a bridge to a broader tenant base and simplifying intricate lease agreements. Their established market connections help PREIT pinpoint ideal businesses for its properties.

In 2024, the commercial real estate brokerage sector saw significant activity, with transaction volumes reflecting the ongoing demand for diverse property types. Brokers' expertise in navigating market trends and tenant needs directly impacts PREIT's ability to secure high-quality leases and optimize occupancy rates.

PREIT's official website and investor portals are crucial digital touchpoints. These platforms offer tenants property details and lease information, while investors can access financial reports, press releases, and SEC filings. In 2024, PREIT continued to update these channels with leasing activity and financial performance data, ensuring transparency for all stakeholders.

Industry Conferences and Trade Shows

PREIT actively participates in key industry gatherings like ICSC RECon, a premier global retail real estate convention. In 2024, ICSC RECon saw over 30,000 attendees, offering PREIT a vital platform to connect with retailers, investors, and potential partners, showcasing its portfolio and strategic direction.

These events are crucial for staying abreast of market trends and competitor strategies. For instance, discussions at 2024 conferences highlighted the increasing demand for experiential retail and the integration of technology in physical spaces, insights PREIT can leverage in its property development and tenant mix strategies.

- Networking: Direct engagement with over 30,000 professionals at ICSC RECon 2024.

- Showcasing Properties: Presenting PREIT's retail assets to a targeted audience of retailers and investors.

- Opportunity Identification: Discovering new tenant prospects and potential collaborations within the retail real estate sector.

- Market Intelligence: Gathering insights on evolving consumer preferences and industry best practices.

Public Relations and Media Outreach

Public Relations and Media Outreach are crucial for PREIT to shape its public perception and highlight its portfolio. By strategically engaging with media outlets, PREIT can announce significant milestones, such as new property acquisitions or leasing successes, thereby drawing investor and tenant interest. For instance, in 2024, PREIT's proactive media engagement around its urban retail developments helped secure positive coverage, contributing to a stronger brand presence.

These efforts go beyond simple announcements; they involve crafting compelling narratives that underscore PREIT's value proposition and market position. This includes issuing press releases detailing financial performance, sustainability initiatives, and strategic partnerships. Media interviews with PREIT's leadership further amplify these messages, providing direct insights into the company's vision and operational strengths. In 2024, PREIT's CEO participated in several high-profile financial news interviews, discussing the company's resilience and growth prospects.

- Media Engagement: Issuing press releases for new developments and financial results.

- Brand Building: Utilizing news articles and interviews to enhance public image.

- Attracting Stakeholders: Generating interest from investors and potential tenants through positive media attention.

- 2024 Focus: Highlighting urban retail strategy and sustainability efforts in media outreach.

PREIT utilizes a multi-channel approach to reach its target audience. Direct leasing teams engage potential tenants, while external brokers expand reach. Digital platforms like the company website serve as information hubs for both tenants and investors. Industry events, such as ICSC RECon, provide networking and showcasing opportunities, while public relations efforts build brand awareness and attract stakeholders.

PREIT's channels work in concert to drive leasing success and investor relations. The direct leasing team's efforts in 2024 contributed to strong leasing velocity, directly impacting occupancy. Simultaneously, external brokers broadened PREIT's market access. Digital channels ensured information accessibility, and participation in events like ICSC RECon 2024, which drew over 30,000 attendees, facilitated crucial industry connections and market intelligence gathering. Media outreach in 2024 further bolstered PREIT's brand, with leadership interviews highlighting growth prospects.

| Channel | Description | Key 2024 Activities/Data |

|---|---|---|

| Direct Leasing Teams | In-house teams for tenant engagement and deal negotiation. | Key role in significant leasing velocity reported in 2024. |

| External Brokers | Utilizing third-party agents to access a wider tenant base. | Supported transaction volumes in a busy 2024 commercial real estate market. |

| Digital Platforms | Company website and investor portals for information dissemination. | Continuously updated with leasing activity and financial performance in 2024. |

| Industry Events | Participation in conventions like ICSC RECon for networking and showcasing. | ICSC RECon 2024 saw over 30,000 attendees, providing PREIT with direct engagement opportunities. |

| Public Relations | Media engagement to shape public perception and announce milestones. | Proactive 2024 media engagement focused on urban retail developments and leadership interviews. |

Customer Segments

Retail tenants, encompassing both established national chains and burgeoning local businesses, represent PREIT's core customer base. These diverse entities seek prime commercial spaces to reach consumers, making them PREIT's primary direct revenue generators.

In 2024, PREIT's portfolio, featuring properties like the Fashion District Philadelphia and Plymouth Meeting Mall, continues to attract a mix of national brands and independent retailers. The company's strategy focuses on curating a dynamic tenant mix that resonates with local demographics and broader consumer trends.

Institutional and individual investors are key customers for PREIT, seeking stable income and capital appreciation through real estate investments. These investors, including pension funds, mutual funds, and individual shareholders, are attracted to PREIT's portfolio of shopping malls and life science properties, aiming for consistent dividend payouts and growth in asset value.

In 2024, PREIT's focus on transforming its retail portfolio into mixed-use destinations is designed to appeal to these investors by enhancing property performance and tenant sales. For instance, the company's strategy aims to increase occupancy and rental income, directly impacting the financial metrics investors scrutinize, such as Funds From Operations (FFO) and Net Asset Value (NAV).

Shoppers and consumers are a vital indirect customer segment for PREIT. Their desire to visit and spend at PREIT's properties directly fuels the success of its retail tenants, which in turn drives PREIT's rental income and overall profitability. For instance, in 2024, PREIT's portfolio of shopping centers and malls continued to see steady foot traffic, with average occupancy rates remaining robust, underscoring the importance of consumer engagement.

Financial Lenders and Debt Holders

Financial lenders, including banks and bondholders, are a crucial customer segment for PREIT, as they provide the necessary debt financing to fuel its operations and growth. These institutions are interested in PREIT's ability to generate stable cash flows and manage its leverage effectively. For instance, as of the first quarter of 2024, PREIT reported a debt-to-equity ratio of 0.71, indicating a manageable level of financial leverage that would appeal to lenders.

Maintaining robust relationships with these financial partners is paramount for PREIT to secure ongoing access to capital and to manage its existing debt obligations. This involves transparent communication regarding financial performance, property valuations, and strategic initiatives. In 2023, PREIT successfully refinanced a significant portion of its debt, demonstrating its ability to attract and retain lender confidence.

- Banks and Credit Facilities: These institutions provide revolving credit lines and term loans, essential for liquidity and development projects.

- Bondholders: Investors who purchase PREIT's corporate bonds, seeking regular interest payments and principal repayment.

- Rating Agencies: While not direct customers, their assessments (e.g., Moody's, S&P) significantly influence lender perception and borrowing costs.

- Debt Service Coverage: Lenders evaluate PREIT's ability to cover its debt payments from its operating income, a key metric for their investment decisions.

Real Estate Developers and Partners

PREIT's customer segments extend to other real estate developers and their partners, including joint venture collaborators and construction firms. These relationships are crucial for undertaking and executing specific development or redevelopment projects, pooling both specialized knowledge and necessary resources.

For instance, in 2024, PREIT continued to explore strategic partnerships to enhance its portfolio. These collaborations allow for risk sharing and access to diverse skill sets, vital for navigating complex urban real estate ventures. The company's focus on revitalizing existing assets often necessitates bringing in specialized development expertise.

- Strategic Partnerships: Collaborating with other developers and construction companies allows PREIT to share expertise and resources for specific projects.

- Joint Ventures: PREIT actively engages in joint ventures with partners to co-develop or redevelop properties, leveraging combined financial strength and market insights.

- Risk Mitigation: By sharing project responsibilities and financial exposure with partners, PREIT can mitigate risks associated with large-scale development initiatives.

- Access to Expertise: These relationships provide PREIT with access to specialized construction, design, and project management expertise that may not be available in-house.

The customer segments for PREIT are diverse, ranging from the direct revenue generators like retail tenants and the indirect but crucial shoppers, to the financial stakeholders who enable its operations and growth. Understanding these distinct groups is key to PREIT's business model.

Cost Structure

Property operating expenses represent a significant portion of PREIT's cost structure, encompassing the day-to-day management and upkeep of its retail portfolio. These costs are vital for ensuring properties remain attractive and functional for tenants and shoppers alike. For 2024, PREIT's property operating expenses, excluding depreciation and amortization, were approximately $250 million, reflecting the ongoing investment in utilities, repairs, security, and cleaning services. Property taxes alone accounted for roughly $70 million of this total, highlighting a substantial fixed cost inherent in real estate ownership.

PREIT's cost structure is significantly impacted by debt service and financing costs, reflecting the capital-intensive nature of its real estate portfolio. Interest payments on outstanding debt and other financing charges represent a major outflow, directly affecting profitability and financial flexibility.

For example, in the first quarter of 2024, PREIT reported interest expense of approximately $22.2 million, highlighting the substantial ongoing cost of its financing arrangements. Effective management of this debt load is paramount for maintaining financial stability and ensuring resources are available for property investments and operations.

General and Administrative (G&A) expenses for PREIT encompass the essential overhead needed to operate the company. These include costs like salaries for corporate leadership and support staff, legal counsel, accounting and auditing services, and general office upkeep. For instance, in 2024, PREIT's focus on streamlining these functions is crucial for maintaining a healthy bottom line.

Leasing and Marketing Expenses

PREIT’s cost structure heavily relies on leasing and marketing expenses. These are crucial for attracting and retaining tenants, which directly impacts revenue. Significant outlays are made for broker commissions, advertising initiatives, and creating marketing collateral to highlight available retail spaces.

In 2024, PREIT continued to invest in these areas to maintain occupancy and attract desirable retailers. For instance, their efforts to fill vacant spaces involved targeted marketing campaigns and incentives for new tenants.

- Broker Commissions: Payments made to real estate brokers for securing new tenants or renewing existing leases.

- Advertising and Promotion: Costs incurred for online and offline advertising, public relations, and event marketing to promote PREIT's properties and available spaces.

- Marketing Materials: Expenses related to the creation of brochures, digital presentations, and other collateral to showcase leasing opportunities.

- Tenant Improvement Allowances: While not strictly marketing, these are often negotiated as part of lease agreements and can be considered a cost of acquiring tenants.

Capital Expenditures and Redevelopment Costs

PREIT makes substantial capital investments in its properties. These include significant spending on property improvements, renovations, and major redevelopment projects. The goal is to boost the value of their assets and make them more appealing to potential tenants.

These capital expenditures are typically large, often one-time or project-specific costs. They are strategically undertaken to foster long-term growth and enhance the overall portfolio performance.

For instance, during the first quarter of 2024, PREIT reported capital expenditures of $29.7 million. This highlights the ongoing commitment to property enhancements and strategic redevelopment initiatives aimed at future value creation.

- Capital Investments: Significant outlays for property improvements and renovations.

- Redevelopment Projects: Funding for large-scale projects to enhance asset value.

- Tenant Attraction: Expenditures aimed at making properties more desirable for new tenants.

- Long-Term Growth Focus: Investments are strategic, targeting sustained portfolio growth.

PREIT's cost structure is dominated by property operating expenses and financing costs. In 2024, property operating expenses, excluding depreciation, were around $250 million, with property taxes alone reaching $70 million. The company also incurred substantial interest expenses, reporting $22.2 million in the first quarter of 2024, underscoring the capital-intensive nature of its real estate investments.

| Cost Category | 2024 Estimate/Q1 2024 Data | Significance |

| Property Operating Expenses | ~$250 million (excluding D&A) | Day-to-day management and upkeep of retail portfolio. |

| Property Taxes | ~$70 million | Significant fixed cost of real estate ownership. |

| Interest Expense | ~$22.2 million (Q1 2024) | Major outflow due to debt financing. |

| Capital Expenditures | $29.7 million (Q1 2024) | Investments in property improvements and redevelopment. |

Revenue Streams

PREIT's core revenue generation comes from the base rent paid by its retail tenants. These are typically fixed amounts agreed upon in long-term lease contracts, offering a stable and predictable income stream for the company. For instance, in 2024, PREIT continued to rely heavily on this foundational revenue, which underpins its operational stability and ability to manage its portfolio.

PREIT's revenue model includes percentage rent, where tenants pay a portion of their sales above a predetermined threshold. This structure directly links PREIT's income to tenant performance, fostering a shared interest in sales growth.

For instance, in 2023, PREIT's retail segment, which relies heavily on this model, saw continued tenant sales recovery. While specific overage figures are dynamic, this revenue stream is crucial for capturing upside from successful retail partners.

PREIT's revenue model includes Common Area Maintenance (CAM) reimbursements, where tenants pay for their share of costs like cleaning, security, and landscaping. This is a crucial component for managing the operational expenses of their retail properties.

In 2024, PREIT's focus on optimizing these reimbursements helps to directly offset the significant costs associated with maintaining its portfolio of malls, contributing to a more stable and predictable income stream.

Property Tax and Insurance Reimbursements

PREIT also benefits from property tax and insurance reimbursements, a common practice in commercial real estate leases. These costs, which are essential for maintaining the properties, are effectively passed through to tenants as part of their rental obligations.

These reimbursements help PREIT manage its operational expenses and ensure that the net operating income from its properties remains stable. For instance, in 2023, PREIT's total operating revenue was $878.7 million, with reimbursements playing a role in offsetting property-level costs.

- Property Tax Reimbursements: Tenants are billed for their pro-rata share of property taxes based on their leased space.

- Insurance Reimbursements: Similarly, tenants cover their portion of the insurance premiums for the buildings they occupy.

- Cost Recovery Mechanism: This revenue stream acts as a direct pass-through, recovering costs associated with property ownership and protection.

Specialty Leasing and Ancillary Income

PREIT's specialty leasing and ancillary income streams are crucial for diversifying revenue beyond traditional tenant rents. These include income generated from temporary kiosks, pop-up shops, and advertising displays strategically placed within their shopping centers. For example, in 2024, PREIT actively sought to maximize these opportunities to enhance the tenant experience and capture incremental revenue.

These ancillary sources are designed to leverage underutilized areas and capitalize on seasonal or event-driven demand. Income from parking fees and other non-traditional uses of mall space further contributes to a more robust financial profile. This strategy helps PREIT adapt to evolving retail landscapes by creating dynamic leasing opportunities.

- Kiosks and Pop-Up Shops: Providing flexible, short-term leasing options for emerging brands and seasonal retailers.

- Advertising and Sponsorships: Monetizing high-traffic areas through digital screens, banners, and event sponsorships.

- Parking and Other Services: Generating revenue from parking facilities and other value-added services offered to mall visitors.

PREIT's revenue streams are multifaceted, extending beyond base rent to include variable income and cost recovery. Percentage rent, where tenants pay a share of sales above a threshold, directly ties PREIT's earnings to tenant success, as seen in the 2023 retail segment sales recovery. Common Area Maintenance (CAM) and property tax/insurance reimbursements are vital for offsetting operational costs, ensuring stable net operating income. For instance, in 2023, PREIT's total operating revenue reached $878.7 million, with these reimbursements playing a key role.

| Revenue Stream | Description | 2023 Data/Context |

|---|---|---|

| Base Rent | Fixed income from long-term tenant leases. | Forms the stable foundation of PREIT's income. |

| Percentage Rent | Rent based on tenant sales exceeding a threshold. | Crucial for capturing upside from successful retail partners. |

| CAM Reimbursements | Tenants pay for shared costs like security and maintenance. | Helps offset significant portfolio upkeep expenses. |

| Property Tax & Insurance Reimbursements | Tenants cover their pro-rata share of these ownership costs. | Contributes to stable net operating income. |

| Specialty Leasing & Ancillary Income | Revenue from kiosks, pop-ups, advertising, and parking. | Diversifies income and leverages underutilized spaces. |

Business Model Canvas Data Sources

The PREIT Business Model Canvas is informed by a blend of internal financial disclosures, investor reports, and publicly available property data. This ensures a data-driven approach to understanding PREIT's operational and financial strategies.