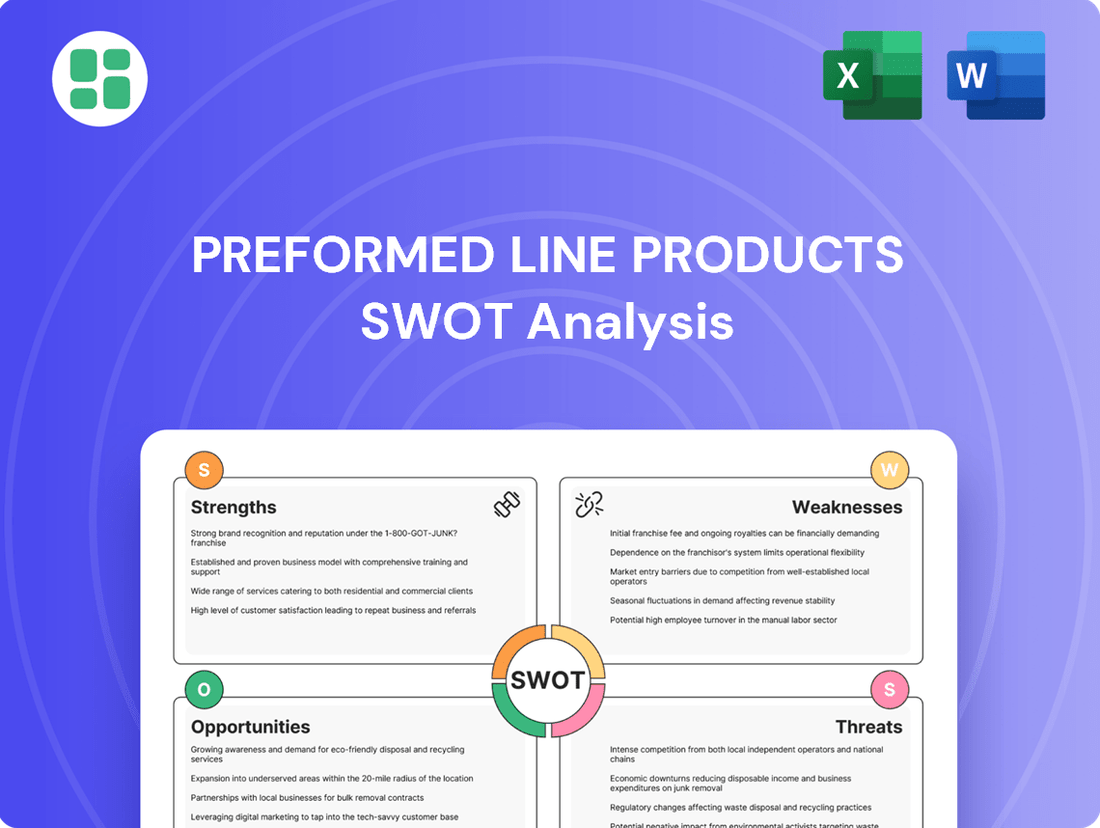

Preformed Line Products SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Preformed Line Products Bundle

Preformed Line Products (PLP) boasts strong brand recognition and a robust product portfolio, but faces increasing competition and potential supply chain disruptions. Understanding these internal capabilities and external market forces is crucial for strategic decision-making.

Want the full story behind PLP’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Preformed Line Products (PLP) boasts a diverse product portfolio that includes a wide array of cable anchoring and control hardware, effectively serving various infrastructure needs. This broad offering allows the company to cater to a multitude of sectors, from utilities to telecommunications.

This strategic diversification is a significant strength, as it mitigates risk by reducing reliance on any single product line or market segment. For instance, in 2023, PLP's revenue streams were well-distributed across its various product categories, with no single segment accounting for an overwhelming majority of sales, demonstrating resilience against sector-specific downturns.

Furthermore, the comprehensive nature of PLP's product range enables the company to provide integrated solutions to its clients. This capability allows customers to source multiple essential components from a single, trusted supplier, streamlining procurement and project management. This holistic approach fosters strong customer relationships and positions PLP as a go-to partner for complex infrastructure projects.

Preformed Line Products (PLP) boasts a significant global market reach, operating and selling products across North America, Europe, Asia, and Australia. This expansive footprint, evidenced by its presence in over 120 countries, diversifies revenue streams and mitigates risks associated with reliance on any single economic region. In 2023, international sales represented a substantial portion of PLP's revenue, underscoring the strength of its global operations.

Preformed Line Products (PLP) excels with its critical infrastructure focus, supplying essential components for overhead, underground, and underwater networks. This strategic positioning ensures a steady demand, as infrastructure development and maintenance are ongoing necessities. Their solutions are fundamental for maintaining the integrity of power grids and communication networks, making them non-discretionary purchases for utility providers.

Innovation and Reliability

Preformed Line Products (PLP) places a significant emphasis on innovation and reliability, a critical factor for industries where infrastructure dependability is non-negotiable. This commitment translates into a strong reputation for quality and advanced solutions, cultivating deep customer loyalty and a distinct competitive edge. For instance, PLP's consistent investment in research and development, often reflected in their new product introductions and patent filings, ensures their offerings remain at the forefront of performance and technological advancement.

PLP's dedication to innovation and reliability is a cornerstone of its market strength.

- Reputation for Quality: PLP is recognized for producing durable and high-performing products essential for critical infrastructure.

- Customer Loyalty: Their focus on dependable solutions fosters strong, long-term relationships with clients.

- R&D Investment: Continuous funding into research and development keeps PLP's product line current and competitive.

- Industry Standards: PLP's innovative designs often set or exceed industry benchmarks for performance and safety.

Serving Growth Industries

Preformed Line Products (PLP) is strategically positioned within high-growth sectors like energy, telecommunications, and broadband communications. These industries are experiencing robust global expansion, creating a sustained demand for PLP's specialized solutions.

The ongoing build-out of renewable energy infrastructure, the widespread deployment of 5G networks, and the increasing need for reliable broadband internet connectivity directly fuel the demand for PLP's core product offerings. This strong alignment with expanding markets bodes well for the company's long-term prospects.

- Energy Sector Growth: The global renewable energy market is projected to reach approximately $1.97 trillion by 2030, according to some forecasts, indicating significant investment in grid infrastructure that PLP supports.

- Telecommunications Expansion: The 5G market alone is expected to grow substantially, with global revenues anticipated to reach hundreds of billions of dollars annually in the coming years, driving demand for advanced connectivity solutions.

- Broadband Connectivity: Increased demand for high-speed internet access, especially in underserved areas, continues to drive investment in broadband infrastructure, a key area for PLP's product application.

PLP's diverse product portfolio is a significant strength, allowing it to serve multiple critical infrastructure sectors like utilities and telecommunications. This broad offering reduces reliance on any single market, as seen in 2023 where revenue was well-distributed across product categories, demonstrating resilience.

The company's global market reach, spanning over 120 countries, diversifies revenue and mitigates regional economic risks. International sales constituted a substantial portion of PLP's revenue in 2023, highlighting the effectiveness of its expansive operational footprint.

PLP's focus on innovation and reliability, backed by consistent R&D investment, cultivates customer loyalty and a competitive edge. Their advanced solutions often set industry standards, ensuring their products remain at the forefront of performance and safety.

PLP is strategically positioned in high-growth sectors such as energy, telecommunications, and broadband, which are experiencing robust global expansion. This alignment with expanding markets, driven by renewable energy investments and 5G deployment, ensures sustained demand for their essential solutions.

What is included in the product

Analyzes Preformed Line Products’s competitive position through key internal and external factors, detailing its strengths in product innovation and market reach alongside potential weaknesses in supply chain and opportunities in renewable energy infrastructure and threats from emerging competitors.

Offers a clear, actionable framework for identifying and addressing competitive weaknesses.

Weaknesses

Preformed Line Products' (PLP) performance is significantly tied to the capital expenditure (CapEx) cycles of its key customer industries, namely energy, telecom, and broadband. When these sectors experience economic slowdowns or implement budget restrictions, PLP's sales volumes and overall revenue can see a direct and substantial impact.

This inherent cyclicality means PLP's revenue stream can be quite volatile, fluctuating with the broader economic health and investment priorities of its client base. For instance, a projected slowdown in utility infrastructure spending for 2024-2025 could translate to softer demand for PLP's specialized products.

As a manufacturer, Preformed Line Products' (PLP) cost of goods sold is directly impacted by the fluctuating prices of key raw materials like metals and polymers. For instance, copper prices saw significant volatility in 2024, impacting manufacturers reliant on this commodity. If PLP cannot pass these increased costs onto its customers, its profit margins are at risk of being squeezed.

This inherent exposure to commodity market volatility presents a notable weakness for PLP. The company is susceptible to unforeseen spikes in material costs, which can disrupt production planning and pricing strategies. For example, a sudden surge in aluminum prices in early 2025 could directly affect PLP's profitability if not managed proactively.

The market for cable anchoring and control hardware is quite crowded, featuring a mix of long-standing companies and nimble, specialized outfits. This intense rivalry can squeeze profit margins and cap growth, making it harder to gain ground.

For Preformed Line Products (PLP), this means constant pressure on pricing and a fight to maintain market share. In 2023, the electrical transmission and distribution sector, where PLP operates, saw significant investment, but also increased competition for projects. PLP's ability to stand out through novel product development and superior customer support is therefore paramount to navigating this challenging landscape.

Supply Chain Dependencies

Preformed Line Products (PLP) faces significant risks due to its reliance on a global supply chain for raw materials and components. Geopolitical tensions, trade disputes, and unforeseen events like natural disasters can easily disrupt this intricate network. For instance, the semiconductor shortages experienced globally in 2021-2022, which continued to some extent into 2023, impacted various manufacturing sectors, including those supplying PLP, leading to production delays and increased input costs.

These dependencies can directly translate to higher operational expenses and extended lead times for customers. In 2024, the ongoing volatility in global shipping, with factors like port congestion and container availability fluctuations, continues to pose challenges. This can affect PLP's ability to meet demand promptly, potentially impacting sales and customer satisfaction.

Specific vulnerabilities include:

- Concentrated Supplier Base: Reliance on a limited number of key suppliers for critical components can create bottlenecks if those suppliers experience issues.

- Logistical Bottlenecks: Shipping delays and rising freight costs, as seen with the Red Sea shipping disruptions in early 2024, directly impact delivery timelines and profitability.

- Geopolitical Instability: Trade wars or regional conflicts can disrupt the flow of goods and increase the cost of imported materials.

Product Obsolescence Risk

The telecommunications and energy sectors are evolving at a breakneck speed, posing a significant risk of product obsolescence for Preformed Line Products (PLP). Even with a strong focus on innovation, PLP faces the challenge of ensuring its product portfolio remains current amidst rapid technological advancements. For instance, the shift towards higher bandwidth fiber optic cables and advanced grid technologies necessitates continuous adaptation of connection and protection solutions. Failing to keep pace could see demand for PLP's existing offerings dwindle, impacting revenue streams.

To mitigate this, PLP must maintain substantial and consistent investment in research and development. This commitment is crucial for staying ahead of industry trends and developing next-generation products that meet emerging needs. In 2024, companies in the infrastructure sector are allocating significant portions of their budgets to R&D, with some reporting increases of 10-15% year-over-year to stay competitive in areas like smart grid technology and 5G deployment. PLP's ability to innovate directly correlates with its long-term market relevance.

- Technological Pace: Rapid advancements in telecommunications (e.g., 5G, fiber optics) and energy (e.g., smart grid, renewable integration) can quickly render existing products outdated.

- R&D Investment Necessity: Continuous and significant investment in research and development is paramount for PLP to keep its product lines competitive and aligned with industry evolution.

- Market Relevance: Failure to adapt product offerings to new technological standards and infrastructure demands could lead to a decline in market share and customer demand for older solutions.

- Competitive Landscape: Competitors actively investing in future-proof technologies put pressure on PLP to innovate or risk losing ground in key markets.

Preformed Line Products' (PLP) profitability is susceptible to the fluctuating costs of raw materials like metals and polymers. For instance, copper prices experienced notable volatility throughout 2024, directly impacting manufacturers reliant on this commodity. If PLP cannot effectively pass these increased costs to its customers, its profit margins face considerable pressure.

The company operates in a highly competitive market, facing pressure from both established players and agile, specialized firms. This intense rivalry can lead to price erosion and hinder market share expansion, making it challenging for PLP to maintain robust growth. For example, in the electrical transmission and distribution sector during 2023, increased investment was met with heightened competition for project wins.

PLP's reliance on a global supply chain exposes it to disruptions from geopolitical events, trade disputes, and logistical challenges. Shipping delays and rising freight costs, as evidenced by the Red Sea disruptions in early 2024, directly affect delivery times and overall profitability. Additionally, a concentrated supplier base for critical components can create significant bottlenecks if those suppliers encounter operational issues.

The rapid pace of technological advancement in the telecommunications and energy sectors presents a risk of product obsolescence for PLP. Keeping its product portfolio current with evolving industry standards, such as the shift to higher bandwidth fiber optics and advanced grid technologies, requires substantial and continuous investment in research and development. Failure to innovate could lead to a decline in demand for existing solutions and a loss of market relevance.

What You See Is What You Get

Preformed Line Products SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Preformed Line Products. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

This is the same SWOT analysis document included in your download. The full content, detailing strategic insights into Preformed Line Products' market position and future potential, is unlocked after payment.

Opportunities

Governments globally are channeling substantial funds into infrastructure development, with projections indicating over $15 trillion in global infrastructure investment by 2025, according to various industry reports. This surge includes significant upgrades to energy grids and telecommunications networks, directly benefiting companies like Preformed Line Products (PLP) that supply essential hardware.

These large-scale government initiatives create a robust and sustained demand for PLP's specialized cable anchoring and tensioning solutions. The focus on modernizing and enhancing the resilience of critical infrastructure means ongoing project pipelines for the foreseeable future, offering a significant growth avenue for PLP.

The global shift to renewable energy, particularly solar and wind, is a significant opportunity for Preformed Line Products (PLP). This transition necessitates substantial investment in new transmission and distribution infrastructure to integrate these intermittent sources into the existing power grid. PLP's specialized products, designed for reliable connections and support, are crucial for building out this essential infrastructure, directly tapping into a rapidly expanding market segment.

This growing demand for renewable energy connections represents a powerful, long-term growth driver for PLP. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global renewable capacity additions will continue to accelerate, with solar PV alone expected to account for over 60% of the renewable capacity added by 2028. This expansion directly translates into increased demand for PLP’s portfolio of pole line hardware, anchoring and guying solutions, and specialized connectors.

The global push for 5G and enhanced broadband connectivity is a major tailwind for Preformed Line Products (PLP). This ongoing infrastructure build-out directly drives demand for PLP's specialized products used in aerial and underground network construction. The market for these essential components is expanding significantly as countries worldwide invest billions in upgrading their communication networks. For instance, global spending on 5G infrastructure was projected to reach over $300 billion in 2024, a figure expected to climb further in 2025, directly benefiting companies like PLP that supply critical components for these networks.

Smart Grid Development and Modernization

The global smart grid market is experiencing robust growth, projected to reach an estimated $100 billion by 2027, according to recent market analyses. This expansion fuels significant investment by utilities in upgrading their infrastructure, directly benefiting companies like PLP whose products are integral to these modernization efforts. The ongoing transition to smarter, more resilient power networks creates a sustained demand for advanced grid components.

PLP is well-positioned to capitalize on this trend, as utilities worldwide are prioritizing grid automation and modernization to enhance operational efficiency and reliability. This includes the deployment of advanced metering infrastructure, grid monitoring systems, and communication networks, all of which require specialized hardware solutions that PLP provides. The recurring nature of upgrades and expansions within smart grid development offers a consistent revenue stream.

- Increased Utility Spending: Global smart grid investments are projected to exceed $600 billion cumulatively by 2030, creating substantial opportunities for infrastructure suppliers.

- Demand for Advanced Components: The push for grid resilience and automation necessitates the adoption of advanced conductors, connectors, and protective hardware, aligning with PLP's core product lines.

- Recurring Revenue Potential: Smart grid modernization is not a one-time event but an ongoing process of upgrades and expansions, offering PLP a consistent pipeline of business.

Strategic Acquisitions and Partnerships

Preformed Line Products (PLP) can leverage strategic acquisitions and partnerships to enhance its market standing. For instance, acquiring a company with advanced composite materials technology could bolster PLP's offerings in the growing renewable energy sector. In 2024, the global market for advanced composites was valued at approximately $19.5 billion, with significant growth projected, presenting a ripe opportunity for inorganic expansion.

These strategic moves can accelerate market penetration and diversify PLP's revenue streams. By integrating new technologies or expanding into underserved regions through joint ventures, PLP can rapidly scale its operations and solidify its competitive advantage.

- Acquire specialized technology firms to integrate cutting-edge materials science into PLP's product lines.

- Form strategic alliances with regional distributors to expand reach into emerging markets, potentially tapping into the projected 7% CAGR of the global electricity transmission and distribution market through 2028.

- Partner with utility companies for co-development of next-generation grid solutions, aligning innovation with direct market needs.

The significant global investment in infrastructure, projected to exceed $15 trillion by 2025, provides a substantial opportunity for Preformed Line Products (PLP). This includes widespread upgrades to energy grids and telecommunications networks, directly boosting demand for PLP's essential hardware. The ongoing modernization efforts create a sustained demand for PLP's specialized solutions, ensuring a healthy project pipeline for years to come.

The accelerating transition to renewable energy sources, like solar and wind, is a key growth driver. Integrating these intermittent sources requires extensive new transmission and distribution infrastructure, where PLP’s reliable connection and support products are vital. The International Energy Agency (IEA) anticipates that by 2028, solar PV will constitute over 60% of new renewable capacity, directly increasing the need for PLP's hardware.

The global expansion of 5G and broadband networks presents another major opportunity, with worldwide spending on 5G infrastructure projected to surpass $300 billion in 2024 and continue rising into 2025. PLP's components are crucial for both aerial and underground network construction, tapping into this expanding market. Furthermore, the growing smart grid market, estimated to reach $100 billion by 2027, fuels utility investments in grid automation and modernization, areas where PLP’s advanced components are essential for enhancing efficiency and reliability.

Strategic acquisitions and partnerships offer a path to accelerate market penetration and diversify revenue. For example, acquiring firms with advanced composite materials technology, a market valued at approximately $19.5 billion in 2024, could enhance PLP's offerings in the renewable energy sector. Collaborations with regional distributors or utility companies for co-development can also expand reach into emerging markets and align innovation with direct market needs, potentially capturing a share of the global electricity transmission and distribution market’s projected 7% CAGR through 2028.

| Opportunity Area | Market Driver | PLP Relevance | Projected Market Growth/Value (2024-2028) |

|---|---|---|---|

| Infrastructure Development | Global government spending | Essential hardware for grid and telecom upgrades | >$15 trillion global investment by 2025 |

| Renewable Energy Integration | Shift to solar and wind power | Connectors and supports for new transmission lines | Solar PV to be >60% of new renewable capacity by 2028 (IEA) |

| 5G & Broadband Expansion | Increased demand for connectivity | Components for aerial and underground network construction | >$300 billion 5G infrastructure spending in 2024 |

| Smart Grid Modernization | Utility investment in automation & resilience | Advanced components for grid automation and monitoring | ~$100 billion market by 2027; >$600 billion cumulative investment by 2030 |

| Strategic Growth | Technological advancement and market expansion | Acquisition of composite tech; partnerships for market access | ~$19.5 billion advanced composites market (2024); 7% CAGR for T&D market |

Threats

Economic downturns pose a significant threat to Preformed Line Products (PLP). Severe recessions can lead to sharp cutbacks in capital spending by utilities and telecom providers, the primary customers for PLP's products. For instance, during the 2008-2009 financial crisis, global infrastructure investment saw a notable slowdown, impacting companies reliant on such spending.

This reduction in investment directly translates to lower demand for PLP's essential infrastructure components. Consequently, PLP's revenue streams could be significantly curtailed during periods of economic contraction. This vulnerability highlights an external factor largely outside of PLP's direct influence, necessitating robust financial planning and diversification strategies.

Preformed Line Products (PLP) faces a significant threat from intensified competition, especially with new entrants from lower-cost manufacturing regions. This influx can lead to aggressive pricing, directly impacting PLP's profitability and potentially forcing price reductions. For instance, in the broader utility hardware market, reports from 2024 indicate a growing trend of price sensitivity among buyers, with some procurement contracts seeing bids that are 5-10% lower than previous cycles due to new competitive pressures.

Existing rivals are also employing more aggressive pricing strategies to capture market share, creating a challenging environment for PLP. This necessitates substantial investment in research and development to maintain a technological edge and justify premium pricing. Without this, PLP risks losing ground in key segments. The need to balance cost-effective production with innovation is paramount for sustained market relevance.

Rapid advancements in materials science and alternative infrastructure technologies pose a significant threat to Preformed Line Products (PLP). Emerging solutions could potentially reduce the reliance on traditional cable anchoring and control hardware, impacting PLP's core offerings.

PLP must remain vigilant in monitoring and adapting to these technological shifts. Failure to innovate and integrate new technologies could render their existing product lines obsolete, leading to market erosion.

For instance, the increasing adoption of composite materials in utility infrastructure, offering lighter weight and greater durability, could directly challenge the market share of PLP's established metal-based solutions. Companies investing heavily in R&D for these next-generation materials could gain a competitive edge.

Regulatory and Environmental Changes

New government regulations concerning infrastructure development, environmental standards, or trade policies present a significant threat to Preformed Line Products (PLP). For instance, evolving environmental regulations, such as those aimed at reducing emissions or promoting sustainable material sourcing, could necessitate costly adjustments to PLP's manufacturing processes and supply chain. In 2024, global spending on environmental compliance in manufacturing is projected to rise, potentially impacting PLP's operational expenses.

Stricter environmental mandates might require PLP to invest in new technologies or alter its material sourcing strategies. This could lead to increased production costs. Furthermore, changes in trade policies or the imposition of new tariffs, particularly in key markets like the United States or Europe, could directly affect PLP's ability to compete internationally and impact its overall profitability.

These regulatory shifts can translate into higher compliance costs and potential trade barriers, directly influencing PLP's bottom line. For example, if new regulations mandate specific material compositions for electrical conductors, PLP would need to adapt its product lines, potentially incurring research and development expenses and impacting existing inventory.

Key potential impacts include:

- Increased compliance costs: Adapting to new environmental or safety regulations may require significant capital investment in manufacturing upgrades.

- Supply chain disruptions: Changes in trade policies or material sourcing regulations could affect the availability and cost of raw materials.

- Reduced market access: Tariffs or non-tariff barriers could make PLP's products less competitive in certain international markets.

Supply Chain Volatility and Geopolitical Risks

Global supply chains are facing unprecedented volatility, driven by a complex web of geopolitical tensions and trade disputes. For Preformed Line Products (PLP), this translates into a tangible risk of raw material shortages and escalating shipping costs, impacting production schedules and overall profitability. For instance, the ongoing conflicts and trade restrictions in key manufacturing regions could significantly disrupt the availability and pricing of essential components in 2024 and 2025.

These disruptions can directly affect PLP's operational efficiency and financial performance. A recent report indicated that manufacturing disruptions in East Asia alone led to an average of 7% increase in lead times for critical components in late 2023, a trend expected to persist. This volatility necessitates robust risk management strategies to mitigate the impact on PLP's supply chain and bottom line.

- Increased Raw Material Costs: Geopolitical instability can drive up the price of aluminum, steel, and plastics, key inputs for PLP.

- Extended Lead Times: Disruptions in shipping and manufacturing can delay the delivery of essential components, impacting production output.

- Production Interruptions: Shortages of critical materials or components due to trade wars or natural disasters can halt manufacturing lines.

- Elevated Logistics Expenses: Higher fuel prices and container shortages contribute to increased transportation costs, squeezing profit margins.

Intensified competition, particularly from lower-cost regions, threatens PLP's market share and profitability. Reports from 2024 show a growing price sensitivity, with new entrants bidding 5-10% lower on some contracts.

Technological advancements in materials science, like advanced composites, could make PLP's traditional solutions obsolete, requiring continuous innovation to maintain relevance.

Evolving environmental regulations and trade policies present compliance cost increases and potential market access barriers, impacting operational expenses and international competitiveness.

Global supply chain volatility, driven by geopolitical tensions, risks raw material shortages and escalating shipping costs, affecting production schedules and profitability, with lead times for critical components seeing a 7% increase in late 2023.

SWOT Analysis Data Sources

This Preformed Line Products SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to deliver accurate and actionable insights.