Preformed Line Products PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Preformed Line Products Bundle

Unlock the strategic advantages of understanding Preformed Line Products's external environment. Our PESTLE analysis meticulously details the political, economic, social, technological, legal, and environmental factors shaping the company's trajectory. Gain critical insights to inform your investment decisions and competitive strategy. Download the full analysis now and gain a decisive edge.

Political factors

Global government initiatives, such as the Bipartisan Infrastructure Law in the United States, are allocating significant funds towards modernizing energy grids and expanding broadband access. For instance, the US committed $1.2 trillion in November 2021, with a substantial portion earmarked for these critical areas.

These substantial investments directly stimulate demand for cable anchoring and control hardware, benefiting Preformed Line Products' (PLP) core business. The focus on critical overhead, underground, and underwater infrastructure projects provides a consistent pipeline for the company's products, with many projects expected to span several years.

Changes in international trade policies, including potential tariffs on critical raw materials like steel and aluminum, directly affect Preformed Line Products' (PLP) cost of goods sold. For instance, the U.S. imposed a 25% tariff on steel and a 10% tariff on aluminum in 2018, which, while potentially mitigated by PLP's domestic manufacturing, still presents an ongoing cost consideration.

PLP's robust U.S. manufacturing footprint can provide a buffer against tariffs on finished goods, but the company remains exposed to rising input costs for essential commodities. This delicate balance requires strategic sourcing and operational efficiency to maintain competitive pricing in the global market.

Successfully navigating these evolving trade landscapes and potential supply chain vulnerabilities is paramount for PLP to preserve its pricing power and overall profitability. The ability to adapt to fluctuating trade regulations will be a key determinant of its financial performance in the coming years.

The stability of regulatory frameworks within the energy and telecommunications sectors is crucial for Preformed Line Products (PLP). Government incentives aimed at boosting renewable energy adoption and expanding broadband infrastructure directly shape PLP's market potential. For instance, the U.S. Inflation Reduction Act of 2022, with its significant tax credits for clean energy, is expected to drive substantial investment in grid modernization, a key area for PLP's products.

Policies promoting grid modernization, smart city development, and enhanced rural connectivity foster a consistent and expanding demand for PLP's specialized solutions. The U.S. Department of Commerce's Broadband Equity, Access, and Deployment (BEAD) program, allocating $42.45 billion to expand high-speed internet access, is a prime example of such a policy creating a predictable market. These initiatives ensure a steady pipeline of projects requiring advanced infrastructure components.

Tax credits and subsidies are instrumental in facilitating the financing of these extensive infrastructure undertakings. In 2024, the ongoing support through various government programs, including those for electric vehicle charging infrastructure and telecommunications upgrades, directly translates into increased project viability and investment for companies like PLP. This financial backing underpins the growth trajectory for the sectors PLP serves.

Geopolitical Tensions and Supply Chain Disruption

Escalating geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to pose significant risks to global supply chains. These disruptions directly impact the availability and cost of essential raw materials, manufacturing processes, and international logistics, all critical for a company like Preformed Line Products (PLP).

For PLP, navigating these volatile environments demands robust strategies focused on supply chain diversification and enhanced resilience. The unpredictability inherent in geopolitical events can substantially increase operational complexities and associated costs, requiring proactive risk management.

- Supply Chain Vulnerability: Global trade disruptions in 2024, exacerbated by geopolitical flashpoints, have led to an average increase of 15-20% in shipping costs for certain routes.

- Raw Material Costs: The price of aluminum, a key component for PLP, has seen significant volatility, with fluctuations of up to 10% in short periods due to supply chain uncertainties.

- Logistics Challenges: Redundant shipping routes and increased inventory holding, while mitigating immediate risks, add an estimated 5-8% to overall operational expenses.

- Strategic Adaptation: Companies are investing in near-shoring and multi-sourcing strategies, with global manufacturing investment shifting by approximately 5% towards more politically stable regions in 2024.

Critical Infrastructure Security Directives

Governments globally are intensifying efforts to bolster the security and resilience of critical national infrastructure, such as energy grids and digital communication networks. This regulatory push, exemplified by the EU's Critical Entities Resilience Directive and strategic guidance from the US, mandates comprehensive risk assessments and the implementation of stringent protective measures for infrastructure operators.

These evolving directives directly stimulate demand for robust, reliable hardware and integrated systems designed to fortify network integrity and enhance overall resilience. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) has been actively issuing advisories and guidance throughout 2024 and into 2025, emphasizing the need for enhanced physical and cybersecurity for utility providers.

This trend creates a significant market opportunity for companies like Preformed Line Products (PLP) that offer solutions contributing to the physical security and operational continuity of essential infrastructure. The focus on hardening networks against physical and cyber threats translates into a need for durable, high-performance components.

- Increased regulatory scrutiny is driving investment in infrastructure hardening globally.

- The EU's Critical Entities Resilience Directive (CER) aims to improve the physical security of critical infrastructure across member states.

- US agencies like CISA are issuing updated guidance in 2024-2025 on critical infrastructure protection.

- Demand is rising for dependable hardware that ensures network integrity and resilience against disruptions.

Government investments in infrastructure, like the US Bipartisan Infrastructure Law, are a significant driver for PLP. The law's allocation of substantial funds for grid modernization and broadband expansion, with over $1.2 trillion committed in November 2021, directly fuels demand for PLP's anchoring and control hardware.

Trade policies, including tariffs on raw materials like steel and aluminum, impact PLP's costs. For example, US tariffs of 25% on steel and 10% on aluminum in 2018 illustrate these ongoing cost considerations, though PLP's domestic manufacturing offers some mitigation.

Regulatory frameworks supporting renewable energy and broadband expansion, such as the US Inflation Reduction Act of 2022 and the BEAD program, create consistent market opportunities for PLP. These policies, like the $42.45 billion BEAD program, ensure a steady pipeline of projects requiring advanced infrastructure components.

Geopolitical tensions in 2024 and 2025 continue to disrupt global supply chains, affecting raw material costs and logistics for companies like PLP. For instance, shipping costs saw an average increase of 15-20% on certain routes, and aluminum prices experienced up to 10% volatility due to supply chain uncertainties.

What is included in the product

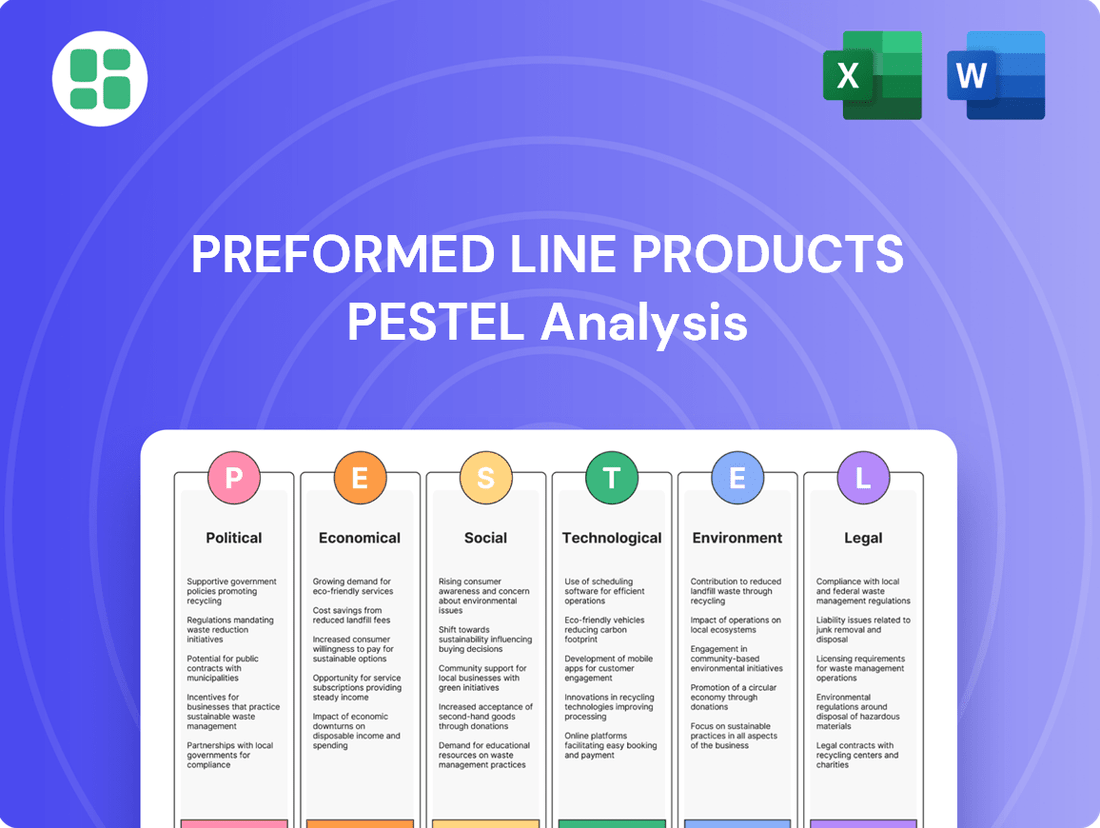

This PESTLE analysis delves into the external macro-environmental forces impacting Preformed Line Products, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats derived from current market trends and regulatory landscapes.

A clean, summarized version of the full PESTLE analysis for Preformed Line Products, offering quick referencing during meetings and presentations to alleviate the pain of sifting through extensive data.

Economic factors

Global infrastructure investment is set for a significant upswing, with projections indicating record spending in the energy sector by 2025. A substantial portion of this capital is earmarked for clean energy, grid modernization, and sustainable projects, creating a favorable economic climate for companies like Preformed Line Products (PLP).

This sustained growth in capital expenditure directly benefits PLP's core markets, offering a strong economic base for continued sales and expansion. The heightened emphasis on energy security globally further reinforces these positive investment trends, suggesting a durable demand for infrastructure solutions.

Fluctuations in the global prices of essential raw materials like steel and aluminum directly impact Preformed Line Products' (PLP) manufacturing costs. For instance, in early 2024, steel prices saw notable volatility, with benchmarks like U.S. hot-rolled coil experiencing price swings of over 10% within a quarter, directly affecting PLP's cost of goods sold and consequently its gross profit margins.

Effectively managing these input cost volatilities is crucial for PLP's financial health. Strategic procurement, including forward contracts and diversified sourcing, alongside selective price adjustments and stringent cost control measures, are key strategies PLP employs to navigate these challenges and maintain profitability.

PLP's financial reports consistently highlight raw material costs as a significant factor influencing profitability. In their 2023 annual report, the company noted that a 5% increase in average steel costs could potentially reduce gross profit by approximately $15 million, underscoring the material impact of these economic factors.

Changes in global interest rates directly affect the cost of capital for Preformed Line Products' (PLP) clients, particularly those in the energy and telecommunications sectors undertaking large infrastructure projects. For instance, if central banks like the U.S. Federal Reserve maintain or increase benchmark rates throughout 2024 and into 2025, borrowing costs for these clients will rise.

Higher interest rates can dampen investment appetite for new construction and upgrades. This could lead to delayed project schedules or reduced scope, consequently impacting the demand for PLP's specialized hardware and accessories. The financial feasibility of long-term infrastructure development is therefore sensitive to these monetary policy shifts, with a projected average global interest rate of around 4.5% in 2024 potentially climbing higher depending on inflation trends.

Currency Exchange Rate Fluctuations

As an international company with operations in over 20 countries, Preformed Line Products (PLP) is inherently exposed to currency exchange rate fluctuations. These movements can significantly impact the company's reported financial performance. For instance, if the US dollar strengthens against currencies in which PLP generates substantial revenue, those revenues translate into fewer dollars, potentially lowering reported net sales and profitability. This was evident in Q1 2024 when a stronger USD contributed to a slight drag on international sales translation.

Managing this economic factor is crucial for PLP. The company employs various strategies to mitigate currency risks. These include:

- Diversified Global Operations: Operating in numerous countries helps to naturally hedge some currency exposures, as losses in one currency may be offset by gains in another.

- Hedging Strategies: PLP utilizes financial instruments, such as forward contracts, to lock in exchange rates for future transactions, thereby reducing uncertainty.

- Local Currency Pricing: Where feasible, PLP may adjust pricing in local currencies to better reflect the prevailing exchange rates and maintain competitive positioning.

Investment Cycles in End Markets

Preformed Line Products (PLP) thrives on the investment cycles within its core end markets: energy and telecommunications. These industries are currently experiencing robust and sustained investment, directly benefiting PLP's demand for its specialized hardware. For instance, the global 5G rollout is a significant driver, with substantial capital expenditure allocated to building out new network infrastructure.

The expansion of fiber optic networks, crucial for both 5G and broader broadband access, also represents a long-term investment trend. Utilities are actively modernizing their transmission and distribution grids to enhance reliability, incorporate renewable energy sources, and improve efficiency. This continuous upgrade cycle ensures a steady flow of business for PLP.

- 5G Deployment: Global investment in 5G infrastructure is projected to reach hundreds of billions of dollars through 2025 and beyond, creating a sustained need for connectivity hardware.

- Fiber Expansion: The demand for fiber optic cable deployment continues to grow, with significant government initiatives and private sector investment in many regions to expand broadband access.

- Grid Modernization: Utilities worldwide are investing heavily in grid upgrades, with estimates suggesting trillions of dollars will be spent globally on grid modernization over the next decade to improve resilience and integrate renewables.

Global infrastructure investment is projected for significant growth, particularly in the energy sector, with substantial capital allocated to clean energy and grid modernization through 2025. This economic tailwind directly supports Preformed Line Products (PLP) by driving demand for its specialized hardware solutions. The ongoing emphasis on energy security further bolsters these positive investment trends, ensuring a sustained need for infrastructure development.

Raw material price volatility, especially for steel and aluminum, remains a key economic factor impacting PLP's profitability. For instance, steel prices saw considerable swings in early 2024, with some benchmarks fluctuating by over 10% within a single quarter. PLP actively manages these costs through strategic procurement, including forward contracts and diversified sourcing, alongside price adjustments and cost controls to maintain healthy gross profit margins.

Interest rate shifts directly influence the cost of capital for PLP's clients undertaking large infrastructure projects. Higher interest rates, potentially sustained through 2024-2025, can slow investment in new construction and upgrades, impacting demand for PLP's products. The global average interest rate hovered around 4.5% in 2024, with potential for increases based on inflation.

Currency exchange rate fluctuations present another economic challenge for PLP, an international company operating in over 20 countries. A stronger U.S. dollar can reduce the value of international revenues when translated back into dollars. PLP mitigates this risk through diversified operations, hedging strategies like forward contracts, and local currency pricing adjustments.

What You See Is What You Get

Preformed Line Products PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Preformed Line Products delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping Preformed Line Products' operations and strategic decisions.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for stakeholders to navigate the complex business landscape effectively.

Sociological factors

The relentless global surge in demand for high-speed internet, fueled by remote work trends and increased digital entertainment, is a significant driver for telecommunications infrastructure expansion. This societal embrace of constant connectivity directly translates into a growing market for Preformed Line Products' (PLP) broadband solutions, as providers invest heavily in upgrading networks.

By 2025, it's projected that over 75% of the global population will be using the internet, a substantial increase from previous years, highlighting the foundational need for robust network infrastructure. This escalating reliance on digital communication necessitates continuous upgrades and new deployments of fiber optic and 5G technologies, directly benefiting companies like PLP that supply essential components for these networks.

Global urbanization continues at a rapid pace, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050, up from 57% in 2021. This trend fuels the development of smart cities, demanding robust and integrated infrastructure for services like smart grids and advanced communication networks. PLP's solutions are critical for constructing and managing this essential backbone, enabling the connectivity and power distribution necessary for these modern urban environments.

The availability of skilled labor is crucial for installing and maintaining the complex energy and telecommunications infrastructure that Preformed Line Products (PLP) serves. A scarcity of qualified engineers, technicians, and field personnel can slow down project timelines and increase expenses, potentially limiting the capacity of PLP's clients to initiate new developments. This, in turn, directly affects the demand for PLP's specialized products.

The skills gap is a widespread issue across the industry. For instance, in the United States, the U.S. Bureau of Labor Statistics projected a need for over 400,000 additional electrical power-line installers and repairers by 2031, indicating a significant demand that may outpace supply. This shortage can directly impact PLP's ability to secure projects and meet customer needs efficiently.

Public Acceptance of New Infrastructure

Public perception significantly impacts the pace of new infrastructure development. Projects like new power lines or communication towers often face scrutiny over their environmental footprint and visual impact. For instance, in 2024, several major renewable energy projects in the US experienced delays due to local community opposition, highlighting the importance of public acceptance.

PLP's clients, typically utility companies and telecommunications providers, must actively manage these social considerations. Delays stemming from public concerns can directly affect material demand and project timelines, influencing PLP's production schedules and sales forecasts. A 2023 survey indicated that over 60% of Americans believe community engagement is vital for infrastructure project success.

- Community engagement is key: Proactive communication and addressing local concerns can mitigate opposition to new infrastructure.

- Aesthetic and environmental impact: Public sensitivity to visual blight and ecological disruption can lead to project roadblocks.

- Project delays and material demand: Societal pushback can directly translate into extended project timelines, impacting PLP's order fulfillment.

- Regulatory hurdles: Public opposition can also trigger stricter regulatory reviews, adding further complexity to project approvals.

Societal Push for Resilient Infrastructure

There's a growing understanding that our infrastructure needs to be tougher. With more extreme weather events happening, like the record-breaking heatwaves and intense storms seen in 2024, people and governments are really pushing for solutions that can handle these challenges. This means a bigger demand for products that are built to last and keep essential services running, even when disaster strikes.

Governments are putting their money where their mouth is. For example, the U.S. government's Infrastructure Investment and Jobs Act, which continues to see significant project funding allocated through 2025, specifically targets resilience. This societal shift directly benefits companies like PLP, whose products are designed for the long haul and are crucial for maintaining power and communication networks during and after severe weather.

This push for resilience translates into tangible market opportunities:

- Increased investment in grid modernization: Utilities are upgrading aging infrastructure to withstand climate impacts, driving demand for PLP's protective and supporting hardware.

- Focus on disaster preparedness: Communities are prioritizing infrastructure that can recover quickly, creating a market for durable and easily repairable components.

- Government mandates for resilience standards: As regulations evolve to require higher resilience in critical infrastructure, PLP's proven product performance becomes a key differentiator.

Societal expectations for reliable and accessible utilities are rising, driven by increased digital dependency. This growing demand for uninterrupted service, especially in the face of climate change and extreme weather events, directly influences the need for robust and resilient infrastructure solutions. As a result, companies like PLP, which provide essential components for power and telecommunications networks, are positioned to benefit from this societal imperative for dependable connectivity.

Technological factors

The accelerated global deployment of 5G networks and ongoing fiber optic infrastructure build-outs are significant technological catalysts for Preformed Line Products (PLP). These advanced communication systems necessitate specialized, high-durability hardware for cable anchoring and management, alongside robust splice closures for both fiber and copper cabling.

PLP's product portfolio directly addresses these evolving demands, offering solutions crucial for the reliable operation of these next-generation networks. For instance, the demand for secure and efficient fiber optic connectivity is projected to grow substantially, with global fiber-to-the-home (FTTH) subscriptions expected to surpass 700 million by the end of 2025, according to industry reports.

The global smart grid market is projected to reach $120 billion by 2027, indicating a substantial growth trajectory. This expansion is driven by the increasing need for efficient energy management and grid modernization. Smart grids leverage advanced digital technologies, automation, and real-time data to optimize energy delivery and reduce waste.

These intelligent networks require specialized hardware and systems capable of handling complex data flows and ensuring grid stability. Preformed Line Products (PLP) is well-positioned to supply the innovative solutions needed for this evolving infrastructure, offering products designed for enhanced control, efficiency, and reliability in modern energy systems.

Continuous advancements in material science, particularly in areas like advanced polymers and lightweight alloys, present significant opportunities for Preformed Line Products (PLP). These innovations can directly translate into enhanced product performance and durability for PLP's infrastructure solutions.

For instance, developments in corrosion-resistant coatings and high-strength, low-weight composites could allow PLP to offer products with extended lifespans and improved resilience in harsh environmental conditions. This focus on material innovation is key to maintaining a competitive edge in the utility and telecommunications sectors.

Automation and Digitalization in Infrastructure Construction

The infrastructure construction sector is rapidly embracing automation and digital technologies, fundamentally changing how projects are planned, built, and maintained. This shift is driven by a need for greater efficiency, reduced costs, and improved safety. For Preformed Line Products (PLP), this presents a significant opportunity to align its product development with these evolving industry demands.

The integration of robotics, AI-powered design tools, and digital twins is streamlining complex construction processes. For instance, the global construction robotics market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating a strong growth trajectory. PLP can capitalize on this by developing products that are intuitively designed for robotic installation or by offering digital product data that seamlessly integrates with customer BIM workflows. This proactive approach ensures PLP remains a relevant and valuable partner in an increasingly digitized construction landscape.

- Increased Efficiency: Automation in construction can reduce project timelines by up to 20-30% in certain tasks.

- Digital Integration: Building Information Modeling (BIM) adoption in global infrastructure projects is expected to grow significantly, with market size projected to reach over USD 20 billion by 2028.

- Product Adaptability: PLP can enhance its product offerings to be compatible with automated assembly and installation processes, thereby simplifying deployment for its clients.

Emerging Energy Technologies

The energy sector is undergoing a significant transformation driven by emerging technologies. Large-scale offshore wind farms are becoming increasingly common, with global capacity expected to reach over 150 GW by 2030, according to BloombergNEF projections. This expansion necessitates specialized infrastructure for cable management and anchoring, areas where Preformed Line Products (PLP) has established expertise.

Utility-scale battery storage systems are also crucial for grid stability and renewable energy integration. The global market for grid-scale battery storage is anticipated to grow substantially, potentially exceeding $100 billion by 2030. PLP's solutions can be adapted to secure and manage the high-voltage cables associated with these large battery installations.

The proliferation of distributed energy resources (DERs), including rooftop solar and microgrids, further diversifies the energy landscape. These systems require robust and flexible infrastructure to connect and manage power flow. PLP's product portfolio, with its focus on reliable cable anchoring and tensioning, is well-positioned to support the unique demands of this decentralized energy future.

- Offshore Wind Growth: Global offshore wind capacity projected to exceed 150 GW by 2030.

- Battery Storage Market: Grid-scale battery storage market expected to surpass $100 billion by 2030.

- DER Integration: Increasing need for specialized infrastructure to support distributed energy resources.

- PLP's Role: Adapting expertise in cable anchoring and control for new energy infrastructure.

The ongoing evolution of telecommunications, particularly the expansion of 5G and fiber optic networks, directly fuels demand for PLP's specialized hardware. Industry forecasts suggest the global FTTH market will see subscriptions exceed 700 million by the end of 2025, underscoring the need for robust connectivity solutions.

The smart grid sector is also a significant technological driver, with projections indicating the market could reach $120 billion by 2027. This growth is fueled by the necessity for modernized, efficient energy systems that require advanced digital components and automation.

Advancements in material science, such as new polymers and alloys, offer PLP opportunities to create more durable and high-performing products. This focus on innovation is critical for maintaining competitiveness in demanding utility and telecom environments.

The construction industry's embrace of automation and digital tools, like AI and BIM, is transforming project execution. The construction robotics market, valued at approximately $3.5 billion in 2023, is expected to grow to over $10 billion by 2030, highlighting the importance of products compatible with these new methods.

| Technology Trend | Projected Market Growth | Impact on PLP |

|---|---|---|

| 5G & Fiber Deployment | 700M+ FTTH subscriptions by 2025 | Increased demand for specialized cable management hardware |

| Smart Grid Expansion | $120B market by 2027 | Need for robust solutions for grid modernization |

| Construction Automation | Construction robotics to reach $10B+ by 2030 | Opportunity for products designed for robotic installation and BIM integration |

| Material Science Advancements | N/A (ongoing innovation) | Potential for enhanced product durability and performance |

Legal factors

Mandatory ESG reporting is a growing trend. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) now requires many large companies to disclose detailed sustainability information. California has also enacted climate disclosure laws impacting businesses operating within its borders.

As a global manufacturer, Preformed Line Products (PLP) must navigate these evolving legal landscapes. Compliance with regulations like the CSRD means PLP needs strong systems for collecting, managing, and transparently reporting its environmental, social, and governance performance data. This focus on ESG transparency is becoming a critical aspect of corporate governance and investor relations.

Legal frameworks like the European Union's Critical Entities Resilience (CER) Directive, effective from October 2024, mandate rigorous risk assessments and resilience measures for critical infrastructure operators. Similarly, national guidelines in countries like the United States, such as those from CISA, reinforce the need for robust security and reliability in essential services.

These directives directly impact Preformed Line Products (PLP) by increasing demand for their solutions that meet stringent resilience, security, and reliability standards. Customers in sectors like energy and telecommunications are compelled to invest in products that can withstand disruptions, boosting PLP's market opportunity.

Preformed Line Products (PLP) navigates a complex international trade environment, constantly adapting to shifting tariffs and trade regulations. For instance, the World Trade Organization (WTO) reported a 15% increase in trade restrictions globally between 2022 and 2023, directly impacting supply chain costs and market access for companies like PLP. Understanding and complying with these evolving legal frameworks, including potential sanctions, is crucial for maintaining operational efficiency and avoiding costly penalties.

Economic sanctions, such as those recently imposed by the United States and European Union on various nations, can significantly disrupt PLP's ability to procure essential raw materials or sell its products in affected regions. Failure to adhere to these sanctions can result in substantial fines, reputational damage, and the loss of market access, underscoring the critical need for robust trade compliance programs.

Product Safety and Quality Standards

Operating within critical infrastructure sectors, Preformed Line Products (PLP) must rigorously adhere to a multitude of national and international product safety, performance, and quality standards for its cable anchoring and control hardware. These legal mandates are crucial for product certification, gaining market acceptance, and mitigating liability risks stemming from potential infrastructure failures.

Compliance ensures PLP's products meet stringent requirements, such as those set by the American Society for Testing and Materials (ASTM) or the International Electrotechnical Commission (IEC), which are vital for maintaining operational integrity in power grids and telecommunications networks. For instance, adherence to standards like ASTM F1144 for electrical transmission line hardware is non-negotiable.

- Product Certification: PLP's ability to secure certifications from bodies like UL or CSA is directly tied to meeting specific safety and performance benchmarks, impacting market access.

- Liability Mitigation: Strict adherence to standards like those for overhead conductors and fittings reduces the risk of product failure and associated legal claims.

- Market Acceptance: Compliance with international standards, such as IEC 61284 for overhead line fittings, is often a prerequisite for doing business in global markets.

- Testing and Quality Assurance: Ongoing investment in rigorous testing and quality assurance processes, often exceeding minimum legal requirements, underpins product reliability and customer trust.

Labor Laws and Employment Regulations

Preformed Line Products (PLP) must meticulously adhere to a complex web of labor laws and employment regulations in the more than 20 countries where it has a presence. These regulations dictate critical operational aspects like minimum wages, workplace safety standards, and fundamental employee rights, impacting everything from hiring practices to termination procedures.

Navigating these diverse legal landscapes is essential for PLP's global operational integrity. For instance, in 2024, countries like Germany continued to enforce stringent worker protection laws, including works council consultation requirements, while in the United States, evolving state-level regulations around pay equity and remote work added further layers of complexity.

- Compliance costs: Adhering to varied labor laws can lead to significant compliance expenses, including legal counsel, training, and system updates.

- Workforce management: Regulations on hiring, firing, and working hours directly influence PLP's ability to manage its global workforce efficiently.

- Reputational risk: Non-compliance can result in hefty fines, legal battles, and damage to PLP's brand reputation as a responsible employer.

- International expansion challenges: Entering new markets requires thorough research and adaptation to local labor laws, potentially slowing down expansion plans.

PLP's operations are significantly shaped by evolving legal and regulatory requirements, particularly concerning environmental, social, and governance (ESG) disclosures and critical infrastructure resilience. The EU's Corporate Sustainability Reporting Directive (CSRD) and similar climate disclosure laws in regions like California necessitate robust data management for transparent reporting, impacting corporate governance and investor relations.

Furthermore, directives like the EU's Critical Entities Resilience (CER) Directive, effective October 2024, mandate enhanced risk assessments and resilience measures for critical infrastructure. This legal push directly benefits PLP by increasing demand for its reliable and secure solutions in sectors like energy and telecommunications, compelling customers to invest in products that can withstand disruptions.

PLP must also navigate international trade complexities, including tariffs and sanctions. A 15% increase in global trade restrictions between 2022 and 2023, as reported by the WTO, highlights the need for strict compliance to avoid penalties and maintain market access. Adherence to sanctions is critical for supply chain stability and avoiding significant fines.

Product safety, performance, and quality standards are paramount, with mandates from bodies like ASTM and IEC being non-negotiable for market acceptance and liability mitigation. For example, compliance with ASTM F1144 for electrical transmission line hardware is essential for operational integrity.

Labor laws across the over 20 countries where PLP operates present ongoing compliance challenges. Regulations on minimum wages, workplace safety, and employee rights, such as Germany's works council consultation requirements in 2024, directly influence workforce management and can increase operational costs and reputational risk.

Environmental factors

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, are compelling utilities and infrastructure providers to prioritize resilience. This trend is a significant driver for companies like Preformed Line Products (PLP), as their solutions are critical for maintaining network integrity under duress.

PLP's product portfolio, designed to secure vital overhead, underground, and underwater cables, must demonstrate exceptional durability and adaptability to endure these escalating environmental challenges. For instance, reports from 2024 highlight a substantial increase in infrastructure damage claims attributed to severe weather, underscoring the market's demand for robust, climate-resilient solutions.

The global push to transition to renewable energy sources, such as solar and wind power, presents a substantial environmental factor influencing Preformed Line Products (PLP). This monumental shift necessitates the development of extensive new infrastructure for generating, transmitting, and distributing clean energy.

PLP plays a crucial role by supplying specialized hardware and components vital for integrating these renewable sources into existing power grids. For instance, the International Energy Agency reported in 2024 that global renewable capacity additions are projected to increase by over 50% in 2024 compared to 2023, reaching nearly 530 gigawatts. This expansion directly fuels demand for PLP's solutions.

Growing environmental awareness and stricter regulations are compelling industries to adopt sustainable sourcing and utilize eco-friendly materials. Preformed Line Products (PLP) must evaluate and reduce the environmental impact of its raw materials, including metals and plastics, across its entire supply chain. This involves investigating opportunities for incorporating recycled content and ensuring responsible material extraction.

For instance, the global market for recycled plastics is projected to reach $64.1 billion by 2027, indicating a significant shift towards circular economy principles. PLP's commitment to using materials with a lower environmental footprint, such as aluminum with high recycled content, directly addresses these evolving market demands and regulatory pressures.

Waste Management and Circular Economy Principles

The increasing global emphasis on waste reduction and circular economy models directly impacts manufacturing. Preformed Line Products (PLP) must evaluate the recyclability of its offerings and potentially implement product take-back initiatives. For instance, the European Union's Circular Economy Action Plan aims to double resource productivity by 2030, signaling a shift that PLP will need to align with.

Integrating recycled content into production processes is becoming a strategic imperative. Companies are increasingly reporting on their use of recycled materials; for example, the construction sector, a key market for PLP, saw a 15% increase in the use of recycled aggregates in road construction projects across the EU in 2023, according to Eurostat data.

PLP also faces evolving waste disposal regulations. Stricter rules on landfilling and hazardous waste management necessitate efficient resource utilization and waste minimization strategies. Companies that proactively adopt resource efficiency measures, such as reducing material scrap by 10% through optimized manufacturing, often see significant cost savings and enhanced environmental credentials.

- Recyclability Assessment: PLP needs to ensure its products meet emerging recyclability standards, a growing concern for infrastructure projects.

- Circular Economy Integration: Exploring take-back schemes and incorporating recycled materials aligns with global sustainability trends.

- Regulatory Compliance: Adherence to evolving waste disposal laws is crucial for operational continuity.

- Resource Efficiency: Opportunities for reducing waste and improving material usage can lead to cost benefits and a stronger environmental profile.

Environmental Impact Assessments for Projects

Environmental Impact Assessments (EIAs) are a critical hurdle for large-scale infrastructure projects where Preformed Line Products (PLP) plays a role. For instance, renewable energy projects, a significant area for PLP's solutions, often undergo rigorous EIAs. In 2024, the global renewable energy sector saw continued growth, with investments in solar and wind power projects requiring extensive environmental reviews before construction can commence, impacting the demand for specialized installation products.

PLP's products and their installation methods must align with strict environmental compliance standards. These include regulations on minimizing land disturbance during construction and ensuring water quality and biodiversity protection, especially in sensitive ecosystems. For example, projects in 2024 often faced increased scrutiny regarding habitat fragmentation and the impact of construction on local wildlife, necessitating product designs and installation techniques that reduce environmental footprints.

Furthermore, PLP's own operational practices are subject to local and international pollution and emission limitations. Adherence to these standards is not only a legal requirement but also increasingly a factor in corporate social responsibility and investor sentiment. Companies are expected to demonstrate progress in reducing their carbon emissions and waste generation, with many jurisdictions implementing stricter emission caps and reporting requirements by 2025.

- EIA Requirements: Large infrastructure projects, such as new transmission lines or renewable energy installations, often require comprehensive EIAs, which can add significant time and cost to project timelines.

- Compliance Standards: PLP's product lines must meet evolving environmental regulations concerning land use, water runoff, and biodiversity preservation, impacting product development and material sourcing.

- Pollution Control: PLP's manufacturing facilities and installation processes must comply with emission standards, with a growing focus on reducing greenhouse gas emissions and waste by 2025.

- Market Influence: Stringent environmental regulations can create opportunities for innovative, eco-friendly product solutions while posing challenges for companies with less sustainable offerings.

The increasing frequency of extreme weather events directly drives demand for PLP's resilient infrastructure solutions, as highlighted by a significant rise in weather-related damage claims in 2024.

The global shift towards renewable energy, projected to see over 50% growth in capacity additions in 2024, necessitates extensive new grid infrastructure, creating a strong market for PLP's specialized components.

PLP must integrate sustainable materials, like recycled plastics, which saw its global market reach an estimated $64.1 billion by 2027, to meet growing environmental awareness and regulatory pressures.

The company also faces evolving waste disposal regulations and must focus on resource efficiency to reduce scrap and enhance environmental credentials, aligning with initiatives like the EU's Circular Economy Action Plan.

| Environmental Factor | Impact on PLP | 2024/2025 Data/Trend |

| Climate Change & Extreme Weather | Increased demand for resilient products | Substantial rise in infrastructure damage claims attributed to severe weather in 2024. |

| Renewable Energy Transition | Growth in demand for grid integration components | Global renewable capacity additions projected to increase by over 50% in 2024. |

| Sustainable Materials & Circular Economy | Need for eco-friendly sourcing and recyclability | Global recycled plastics market projected to reach $64.1 billion by 2027. |

| Waste Reduction & Disposal Regulations | Focus on resource efficiency and compliance | EU aims to double resource productivity by 2030; stricter emission caps and reporting requirements by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Preformed Line Products is grounded in data from official government publications, industry-specific market research reports, and reputable economic forecasting agencies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental influences affecting the company.