Preformed Line Products Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Preformed Line Products Bundle

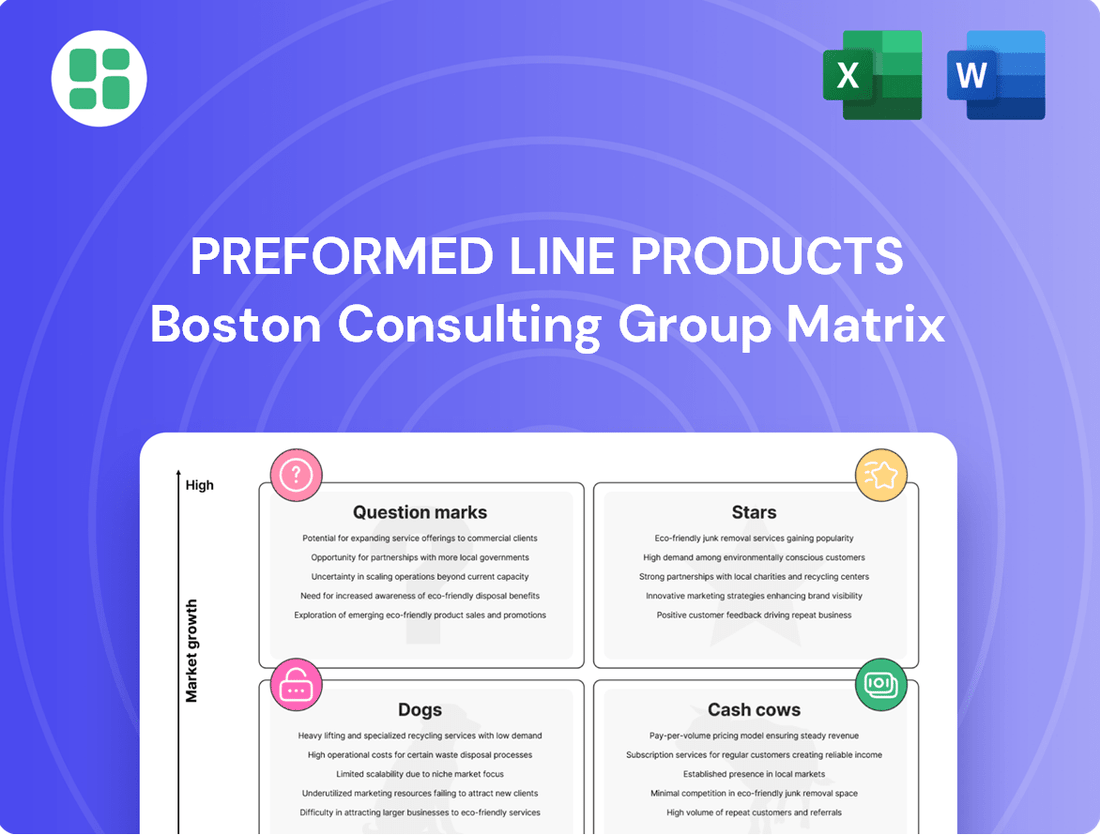

Unlock the strategic potential of Preformed Line Products' portfolio with our comprehensive BCG Matrix analysis. See at a glance which products are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

This preview offers a glimpse into how Preformed Line Products' offerings stack up in the market. For a complete, actionable understanding of their product lifecycle and strategic positioning, invest in the full BCG Matrix report.

Gain the competitive edge by purchasing the full BCG Matrix for Preformed Line Products. It's your essential guide to optimizing resource allocation and making informed decisions for future success.

Stars

The global demand for fiber optic connectivity solutions is experiencing a significant upswing, driven by the widespread adoption of Fiber-to-the-Home (FTTH) initiatives and the accelerating deployment of 5G networks. This trend positions Preformed Line Products' (PLP) COYOTE® fiber optic product line as a star in their portfolio, reflecting substantial market share and ongoing investment to maintain its leading edge in this rapidly expanding sector.

These advanced fiber optic closures and splices are fundamental components for constructing the essential infrastructure of contemporary telecommunications, directly contributing to PLP's growth trajectory. For instance, the global fiber optics market was valued at approximately $13.7 billion in 2023 and is projected to reach over $23.5 billion by 2028, showcasing the immense potential for PLP's offerings.

The global push for renewable energy, particularly solar and wind, is driving significant demand for specialized grid interconnection hardware. Preformed Line Products (PLP) is well-positioned in this high-growth sector with its solutions for utility-scale renewable projects, including solar ground mounts and electric vehicle charging infrastructure.

PLP's focus on these rapidly expanding markets, such as solar energy which saw global capacity additions reach approximately 440 GW in 2023, indicates a strong market presence. Their expertise in providing essential components for connecting these new energy sources to the existing grid likely contributes substantially to their overall revenue and market share.

Advanced 5G infrastructure components are crucial for the expanding global 5G network. These specialized parts, essential for cell sites, small cells, and distributed antenna systems, are seeing significant investment. For example, the global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a strong demand for these products.

Preformed Line Products' (PLP) innovation in this area is key. Their ability to develop and deliver these high-demand telecommunications products positions them to capture a significant share of this growing market. These components directly contribute to improved network capacity and speed, ensuring networks can meet future connectivity needs.

Smart Grid and Grid Modernization Hardware

Investments in smart grid technology are booming, with the global smart grid market projected to reach approximately $100 billion by 2027, indicating a strong upward trend. Preformed Line Products (PLP) is well-positioned in this high-growth sector, supplying essential hardware like advanced sensor mounts and specialized connectors that are crucial for integrating distributed energy resources and enhancing grid reliability.

PLP's smart grid and grid modernization hardware plays a vital role in upgrading existing infrastructure to meet future energy demands. These components are key enablers for utilities seeking to improve energy efficiency and resilience. For instance, the demand for grid modernization solutions is driven by the need to accommodate renewable energy sources, which saw a significant increase in global capacity additions in 2023.

- High Growth Market: The smart grid sector is experiencing substantial expansion, driven by utility investments in efficiency and reliability.

- PLP's Role: PLP provides critical hardware like sensor mounts and connectors for smart grid integration.

- Future-Proofing: These solutions are essential for modernizing energy infrastructure to handle new energy sources and demands.

- Market Drivers: The integration of renewable energy and the need for grid resilience are key factors fueling market growth.

High-Performance Underground Cable Protection Systems

High-Performance Underground Cable Protection Systems are a star in Preformed Line Products' (PLP) BCG Matrix. This segment benefits from increasing urbanization and the global push for grid resilience, driving demand for durable underground infrastructure. PLP's advanced solutions are designed to safeguard critical power and communication cables, positioning them in a growing market where their specialized knowledge translates to a significant market share.

These systems are crucial for developing reliable and discreet infrastructure, especially in densely populated urban areas. For instance, the global market for underground power cables was valued at approximately $35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030, driven by infrastructure upgrades and renewable energy integration.

- Market Growth: Driven by urbanization and grid modernization initiatives.

- PLP's Position: Strong market share due to specialized expertise in protection solutions.

- Key Drivers: Need for reliable, discreet, and resilient underground infrastructure.

- Industry Value: The underground cable protection market is a substantial and expanding sector within the broader utility infrastructure landscape.

Preformed Line Products' (PLP) COYOTE® fiber optic product line is a clear star within their portfolio. This segment thrives on the global surge in fiber optic connectivity, fueled by widespread Fiber-to-the-Home (FTTH) deployments and the rapid expansion of 5G networks. The market's robust growth, with the global fiber optics market valued at approximately $13.7 billion in 2023 and projected to exceed $23.5 billion by 2028, underscores the significant potential and PLP's strong position.

PLP's expertise in advanced fiber optic closures and splices directly supports the build-out of essential telecommunications infrastructure. This strategic focus allows them to capture a substantial share of a market driven by increasing demand for faster and more reliable internet access.

High-Performance Underground Cable Protection Systems also represent a star for PLP. This area benefits from increased urbanization and the critical need for grid resilience, driving demand for robust underground infrastructure solutions. PLP's specialized products safeguard vital power and communication cables in a market valued at around $35 billion in 2023, with projected growth exceeding 5% annually through 2030.

| Product Line | BCG Category | Key Market Drivers | 2023 Market Value (Approx.) | Projected Growth |

| COYOTE® Fiber Optics | Star | FTTH, 5G Deployment | $13.7 Billion (Global Fiber Optics) | > 5% CAGR (2023-2028) |

| Underground Cable Protection | Star | Urbanization, Grid Resilience | $35 Billion (Global Underground Cables) | > 5% CAGR (through 2030) |

What is included in the product

This BCG Matrix analysis categorizes Preformed Line Products' offerings into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear BCG Matrix visually identifies Preformed Line Products' Stars, Cash Cows, Question Marks, and Dogs, simplifying strategic resource allocation.

Cash Cows

Standard Overhead Transmission Line Hardware represents Preformed Line Products' (PLP) cash cows. These are the essential, foundational components like clamps, spacers, and vibration dampers that keep existing power grids running smoothly. Think of them as the nuts and bolts of the electricity infrastructure we rely on every day.

While the market for these established products experiences low growth, PLP has likely maintained a strong and stable market share for many years. This translates into a dependable and substantial cash flow for the company, a hallmark of a true cash cow. For instance, in 2024, the global transmission and distribution hardware market was valued at approximately $15 billion, with PLP holding a notable position in segments requiring specialized, high-quality components.

These cash cow products typically demand minimal new investment from PLP. Their established nature means the manufacturing processes are efficient and well-understood, allowing them to generate reliable income without requiring significant capital expenditure for innovation or market expansion. This consistent revenue stream is crucial for funding other areas of PLP's business.

Traditional telecommunications cable management products, such as cable ties and splices for legacy copper and aerial/buried lines, represent Preformed Line Products' (PLP) cash cows. This segment operates in a mature market where demand is stable, driven by the ongoing maintenance of existing, extensive networks. PLP's strong brand recognition and deep customer relationships have solidified its high market share in this area.

The reliability of these cash cow products is underscored by their essential role in the vast, established telecom infrastructure. While the market for new installations might be slowing, the need for upkeep ensures consistent revenue. For instance, in 2024, the global telecommunications infrastructure maintenance market was valued at approximately $150 billion, with a significant portion attributed to legacy systems that still rely on these fundamental components.

Basic Distribution Line Accessories for Utilities represent Preformed Line Products' (PLP) cash cows. These are the everyday hardware items, like dead-ends, splices, and connectors, essential for local power distribution networks. This segment operates in a mature market, characterized by high volumes and consistent demand.

PLP's dominant market position in this category is a direct result of their long-standing customer relationships and a reputation for product reliability. This stability translates into a steady and predictable cash flow for the company, a hallmark of a cash cow in the BCG matrix. For instance, in 2024, the global utility hardware market continued to show steady growth, with distribution accessories forming a significant portion of this expansion.

Substation Connectors and Fittings

Substation connectors and fittings are vital components within the stable energy infrastructure, forming a mature market with slow but steady growth. Preformed Line Products (PLP) leverages its established reputation for quality and enduring contracts with utility companies to maintain a significant market share in this segment.

This consistent high market share translates into predictable demand and robust, high-margin profitability for PLP. These products represent a reliable revenue stream, underpinning the company's financial stability.

- Market Stability: Components are essential to the energy grid, ensuring consistent demand.

- High Market Share: PLP's quality and long-term utility contracts secure a dominant position.

- Predictable Profitability: The segment offers reliable revenue with strong profit margins, contributing significantly to overall financial performance.

Standard Guy Wire and Anchor Systems

Standard Guy Wire and Anchor Systems represent a classic Cash Cow for Preformed Line Products (PLP). These are the backbone of utility pole and tower stability, a segment characterized by its maturity and consistent, if not explosive, demand. Think of them as the reliable workhorses of the infrastructure world.

PLP holds a dominant position in this market, a testament to years of established relationships and product quality. This strong market share translates directly into predictable and substantial cash flow, funding other, more growth-oriented ventures within the company. The low need for ongoing research and development further solidifies their Cash Cow status, as they require minimal investment to maintain their position.

- Mature Market: Guy wire and anchor systems are essential but have seen limited technological advancement, leading to stable demand.

- High Market Share: PLP's historical dominance in this segment ensures consistent revenue generation.

- Low R&D Needs: Minimal investment is required to maintain product relevance and market position.

- Reliable Cash Flow: This segment acts as a stable financial engine for the company, supporting other business units.

Preformed Line Products' (PLP) legacy fiber optic splice closures are considered Cash Cows. These products are crucial for protecting and managing fiber optic splices in existing telecommunications networks, a segment with stable, albeit low, growth. PLP's established reputation for durability and reliability in this mature market ensures a consistent demand.

The company benefits from a high market share in this segment due to its long history and deep understanding of customer needs for maintaining vast legacy fiber networks. This translates into predictable revenue streams with minimal need for significant new investment in research and development, allowing PLP to generate substantial cash flow.

| Product Segment | Market Characteristic | PLP's Position | Cash Flow Contribution |

|---|---|---|---|

| Legacy Fiber Optic Splice Closures | Mature, Low Growth | High Market Share, Established Reputation | Stable, Predictable Revenue |

| Standard Overhead Transmission Line Hardware | Mature, Stable Demand | Strong, Long-Term Market Share | Significant & Reliable Cash Generation |

| Traditional Telecom Cable Management | Mature, Maintenance-Driven | Dominant Market Position | Consistent Income Stream |

Full Transparency, Always

Preformed Line Products BCG Matrix

The Preformed Line Products BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be yours to download and utilize without any alterations or demo content. You are seeing the exact, professionally formatted BCG Matrix report ready for immediate application in your business planning and competitive strategy.

Dogs

Obsolete Copper Telecom Network Repair Kits are firmly in the Dogs category of the BCG Matrix for Preformed Line Products (PLP). The global telecommunications industry's accelerated migration from copper to fiber optics has drastically reduced the demand for products catering to legacy copper networks. This trend is projected to continue, with fiber optic deployment showing robust growth, further marginalizing copper infrastructure.

PLP's market share within this declining segment is likely to be low, as industry investment and innovation have largely shifted to fiber optic solutions. Continued investment in maintaining and repairing obsolete copper networks would therefore yield diminishing returns, making these repair kits a potential cash trap for the company.

Niche hardware designed for industrial applications that are on the decline, such as older telecommunications infrastructure or legacy manufacturing equipment, represent a category with limited growth potential. PLP's involvement in these specific, shrinking markets means their market share is likely modest, as overall demand naturally decreases with technological obsolescence and industry consolidation. For instance, the global market for legacy industrial automation components, while still existing, is projected to see a compound annual growth rate (CAGR) of less than 2% through 2028, indicating a stagnant or contracting demand.

Legacy analog communication line components, hardware built for older systems, are in a market experiencing a steep decline as digital and IP-based solutions take over. For Preformed Line Products (PLP), focusing on this segment offers little upside due to a low market share and a lack of future growth potential.

This category represents a drain on resources that could be more effectively deployed in areas with greater growth prospects. For instance, the global telecommunications infrastructure market, while growing, is increasingly dominated by fiber optics and 5G, leaving legacy copper components with diminishing demand.

Specialized Tools for Outdated Installation Methods

Tools designed for older installation methods, like those for traditional underground cable pulling, fall into the Dogs category. As the industry shifts towards more efficient techniques, such as direct burial or trenchless installation, the demand for these specialized, outdated tools naturally declines. For instance, the market for manual cable winches, once essential, has seen a significant drop as hydraulic and automated systems become standard. This decline is reflected in their low market share within a stagnant or shrinking market segment.

These products, characterized by their low growth and low market share, often represent a drain on resources. Companies might find themselves holding inventory or maintaining production lines for tools that are no longer widely adopted. In 2024, many manufacturers of such legacy equipment reported a decrease in sales volume by as much as 15-20% compared to the previous year, indicating a clear trend away from these solutions. Investing further in the development or production of these tools is generally not a sound strategy.

- Decreasing Demand: Tools for superseded installation methods face a shrinking market as new technologies emerge.

- Low Market Share: These products occupy a small portion of the overall market due to their outdated nature.

- Resource Tie-up: Maintaining production or inventory for these items can divert capital from more promising ventures.

- Not Advisable Investment: Further investment in tools for outdated methods is typically not recommended for future growth.

Low-Volume, Highly Customized Solutions Without Scalability

These are the niche products within Preformed Line Products that cater to highly specific, often one-time, customer needs. Think of custom-designed components for unique infrastructure projects or specialized applications where mass production isn't feasible. While they might satisfy a particular client, their extremely limited market reach means they contribute very little to overall market share.

The challenge with these low-volume, highly customized solutions is their inherent lack of scalability. Developing and producing these items demands significant engineering and manufacturing resources, often on a per-project basis. This high cost of customization, coupled with a minimal customer base, severely limits any potential for growth or substantial profit generation. For instance, if a company like Preformed Line Products dedicates 15% of its R&D to such bespoke items but they only account for 2% of revenue, it's a clear sign of inefficiency.

- Minimal Market Share: These products typically hold less than 1% of the overall market for related solutions.

- Low Growth Potential: Due to their specialized nature, there's little to no foreseeable expansion in demand.

- High Resource Consumption: Production and support costs per unit are disproportionately high compared to revenue generated.

- Divestiture Consideration: Their lack of profitability and growth makes them prime candidates for being phased out or sold off.

Products within Preformed Line Products' portfolio that fall into the Dogs category are those with low market share in industries experiencing significant decline or obsolescence. These are often legacy components for technologies being replaced, such as obsolete copper telecom network repair kits or tools for outdated installation methods. Their market is shrinking, making future growth unlikely.

The demand for these products is consistently decreasing as newer, more efficient technologies like fiber optics and automated installation systems gain traction. For example, the market for legacy analog communication line components is rapidly diminishing, with digital solutions now dominating. This decline means PLP's market share in these specific segments is inherently low, and further investment is generally not advisable.

These "Dogs" represent a drain on resources that could be better allocated to growing segments. Companies may find themselves holding inventory or maintaining production lines for items with minimal sales. In 2024, many manufacturers of legacy equipment saw sales volumes drop by 15-20% year-over-year, underscoring the trend away from these solutions.

The financial implications of maintaining "Dogs" are clear: they tie up capital and offer little return. Companies often consider phasing out or divesting these product lines to streamline operations and focus on more profitable areas. Their minimal market share, typically less than 1% for highly specialized items, coupled with low growth potential, makes them prime candidates for divestiture.

| Product Category | Market Trend | PLP Market Share | Growth Potential | BCG Classification |

|---|---|---|---|---|

| Obsolete Copper Telecom Repair Kits | Declining (Fiber Optic Migration) | Low | Very Low | Dog |

| Legacy Analog Communication Components | Steep Decline (Digital Solutions) | Low | Very Low | Dog |

| Tools for Outdated Installation Methods | Shrinking (Newer Techniques) | Low | Low | Dog |

| Niche, Highly Customized Components | Limited (Specific Projects) | Minimal (<1%) | Negligible | Dog |

Question Marks

The market for next-generation offshore wind farm interconnection hardware is a burgeoning sector, characterized by rapid technological advancement and significant growth potential. While Preformed Line Products (PLP) may be developing innovative solutions for this niche, the market itself is still in its formative stages, demanding substantial capital investment to establish a strong presence and capture market share.

This segment, while promising, likely represents a question mark in PLP's BCG matrix. The high investment required for research, development, and manufacturing of specialized offshore wind connectors, coupled with the evolving regulatory landscape and the need to secure initial contracts, positions it as a high-risk, high-reward opportunity. Success here could transform these nascent offerings into future Stars.

The electric vehicle charging infrastructure market is experiencing rapid expansion, with global EV sales projected to reach over 13 million units in 2024. This surge creates a significant demand for grid-side integration solutions, a segment where Preformed Line Products (PLP) is likely developing advanced technologies. However, as a nascent area, PLP's market share is expected to be minimal initially, necessitating substantial investment to secure future growth.

This high-growth, high-risk segment requires PLP to invest heavily in research and development to establish a strong foothold. The evolving nature of grid integration for EV charging means that early adoption of innovative solutions, even with initial low market share, is crucial for long-term competitive advantage.

Quantum communication networks represent a frontier technology with immense future potential, though currently, they are primarily in the research and development stage. Preformed Line Products (PLP) could explore developing foundational hardware for these nascent networks, positioning itself for future growth in this high-risk, high-reward segment.

The market for quantum communication infrastructure is exceptionally small today, with global investments in quantum technology projected to reach tens of billions of dollars by 2030, but the segment specifically for network hardware is still a fraction of that. PLP's current market share in this nascent area would be negligible, underscoring its 'Question Mark' status within the BCG framework.

Modular and Decentralized Grid Connectivity Solutions

As energy grids increasingly embrace decentralization with microgrids and distributed energy resources, the demand for specialized modular connection hardware is on the rise. Preformed Line Products (PLP) is well-positioned to capitalize on this evolving landscape, offering solutions that are crucial for integrating these new grid architectures. While this market segment represents a significant growth opportunity, PLP's current market share in these nascent modular connectivity solutions may be relatively low, suggesting a need for strategic investment to elevate them to a Star in the BCG matrix.

These modular and decentralized grid connectivity solutions directly support the future of energy distribution. For instance, the global microgrid market was valued at approximately $31.4 billion in 2023 and is projected to reach $75.8 billion by 2030, growing at a CAGR of 13.5%. This expansion necessitates innovative hardware that can adapt to diverse generation sources and grid configurations. PLP's offerings are designed to meet these specific needs, providing the essential components for a more resilient and flexible grid infrastructure.

- Growing Demand: The global microgrid market's projected growth highlights the increasing need for decentralized energy solutions.

- Strategic Importance: Modular connectivity is vital for integrating diverse energy sources like solar and wind into the grid.

- Investment Opportunity: PLP's current low market share in this segment presents an opportunity for strategic investment to capture future growth.

- Future-Proofing: These solutions align with the long-term trend towards modernized, decentralized energy grids.

AI-Integrated Predictive Maintenance Hardware for Infrastructure

AI-integrated predictive maintenance hardware for infrastructure represents a burgeoning sector within the broader utility and infrastructure management landscape. This fusion of physical components with advanced artificial intelligence algorithms aims to proactively identify potential failures in critical assets, thereby minimizing downtime and operational costs. For a company like Preformed Line Products (PLP), venturing into this space would position them in a high-growth market, fueled by the increasing demand for enhanced infrastructure reliability and efficiency.

While the potential is significant, the market for such integrated solutions is still in its nascent stages. Consequently, PLP's market share in this specific niche would likely be minimal at present. This necessitates substantial investment in research and development to refine the technology and establish a strong foothold. Furthermore, considerable effort would be required for market penetration, educating potential clients on the benefits and building trust in these novel, AI-driven systems.

- Market Growth: The global predictive maintenance market is projected to reach approximately $25.9 billion by 2027, growing at a CAGR of 28.5% from 2020, indicating strong demand for AI-integrated solutions.

- R&D Investment: Companies in this space typically allocate 10-15% of their revenue to R&D to stay competitive and develop cutting-edge AI algorithms and hardware.

- Efficiency Gains: Predictive maintenance can reduce equipment downtime by up to 25% and maintenance costs by up to 10%, driving adoption across various infrastructure sectors.

- Early Adoption Challenges: Initial market penetration often faces hurdles related to data integration, cybersecurity concerns, and the need for skilled personnel to manage AI systems.

These are areas where PLP is investing but has not yet established a dominant market position. They require significant capital for development and market penetration. The high risk is balanced by the potential for these segments to become future market leaders if PLP can successfully capture market share.

The success of these Question Mark products hinges on strategic investment and innovation. Without substantial commitment, they risk being overtaken by competitors or becoming obsolete as technology evolves. PLP must carefully monitor market trends and competitor activities to make informed decisions about resource allocation.

The company's future growth trajectory will largely depend on its ability to convert these promising but unproven ventures into established revenue streams. This involves not only technological prowess but also effective sales, marketing, and customer support strategies.

The critical factor for Question Marks is the company's strategic decision-making regarding investment and market focus. Successful navigation can transform them into Stars, while missteps can lead to them becoming Dogs.

BCG Matrix Data Sources

Our Preformed Line Products BCG Matrix is built on verified market intelligence, combining financial data, industry research, and product performance metrics to ensure reliable, high-impact insights.