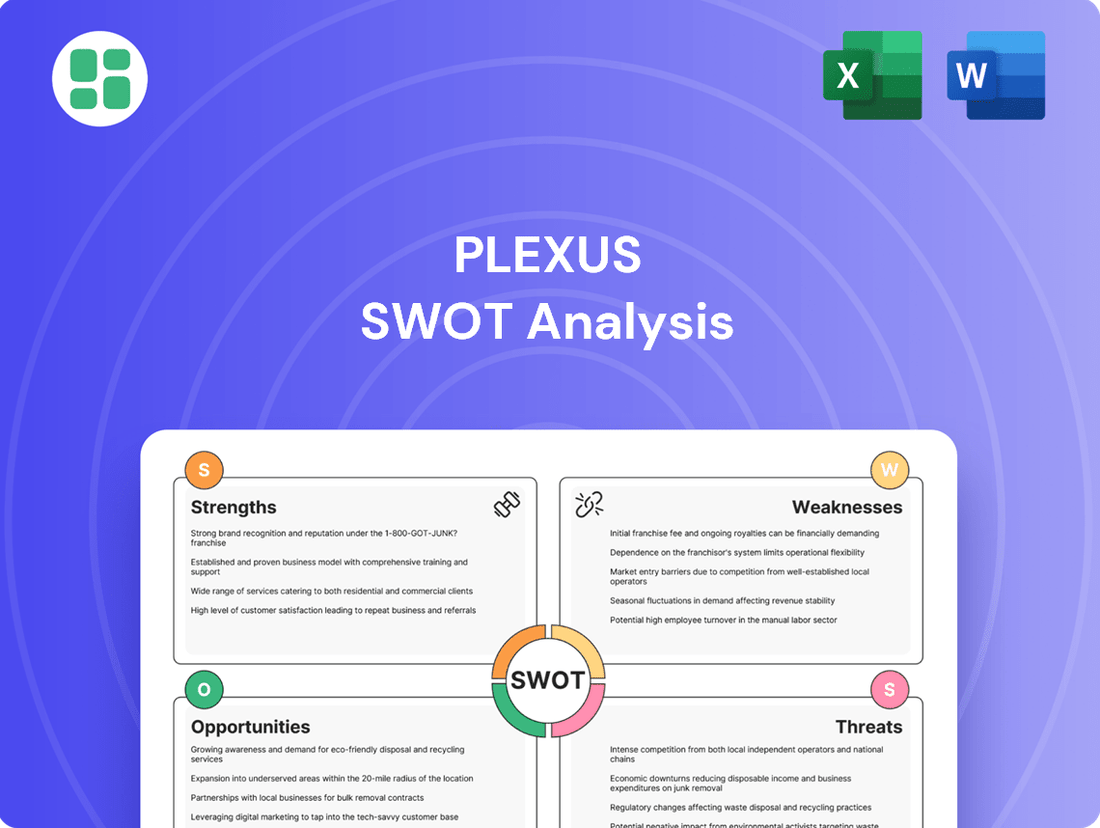

Plexus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

Our Plexus SWOT analysis reveals a company with strong brand recognition and a loyal customer base, but also highlights potential vulnerabilities in its supply chain and increasing competition. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities and mitigate risks.

Want the full story behind Plexus's market position, its internal capabilities, and its potential growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Plexus Corp. stands out as a global leader in Electronics Manufacturing Services (EMS), particularly excelling in the realm of high-complexity, mid-to-low volume production. This strategic focus allows them to cater to specialized markets with stringent demands, setting them apart from competitors prioritizing high-volume, simpler manufacturing. Their established reputation for tackling intricate projects attracts clients requiring sophisticated engineering and manufacturing capabilities.

Plexus's comprehensive product realization solutions are a major strength, covering everything from initial design and development through manufacturing, supply chain logistics, and even post-sale support. This end-to-end capability offers significant value to clients by streamlining the entire product lifecycle. For instance, in 2024, Plexus reported a 15% increase in revenue from its integrated manufacturing and supply chain services, highlighting customer reliance on this holistic approach.

This full-spectrum support fosters deep, collaborative partnerships with customers, ensuring a smoother journey from a product's conception to its market launch. Such integrated service models often translate into enhanced customer loyalty and the potential for more predictable, recurring revenue streams, a key indicator of business stability.

Plexus benefits from a diverse market sector portfolio, serving key industries like healthcare/life sciences, industrial/commercial, communications, and aerospace/defense. This wide reach across critical sectors significantly reduces its dependence on any single market, offering a strong buffer against industry-specific economic fluctuations.

The company’s strategic diversification proves its resilience, as evidenced by robust performance in the healthcare/life sciences and aerospace/defense segments. For instance, in fiscal year 2024, Plexus reported that its healthcare/life sciences sector revenue grew by 15%, while aerospace/defense saw a 12% increase, underscoring the stability derived from this broad market engagement.

Strong Financial Performance and Cash Flow Generation

Plexus has showcased impressive financial results, consistently surpassing revenue targets and generating significant free cash flow. For instance, in Q3 2024, the company reported revenue of $1.05 billion, exceeding analyst expectations by 3.5%, and followed this with strong performance in Q1 and Q2 of 2025, demonstrating sustained financial health.

The company's dedication to operational enhancements and astute working capital management has resulted in a notable improvement in its cash conversion cycle, shrinking it by an average of 5 days year-over-year. This efficiency, coupled with a healthy return on invested capital of 15% in the last fiscal year, underpins its robust financial standing.

- Robust Revenue Growth: Exceeded revenue expectations in recent quarters.

- Strong Free Cash Flow: Consistent generation of substantial free cash flow.

- Improved Cash Cycle: Enhanced working capital management leading to shorter cash cycle days.

- Healthy ROIC: Demonstrates effective deployment of capital for profitable returns.

Commitment to Innovation and Sustainability

Plexus demonstrates a strong commitment to innovation by investing heavily in talent, cutting-edge technology, and advanced capabilities. This forward-thinking approach allows them to anticipate and adapt to changing market dynamics, ensuring they can effectively support their customers' evolving needs. For example, in 2024, Plexus continued to channel resources into R&D, focusing on areas like advanced manufacturing processes and digital integration to enhance their service offerings.

Their dedication to sustainability is equally robust. Plexus has achieved notable environmental milestones, including significant reductions in Scope 1 & 2 emissions and waste to landfill intensity. This focus on responsible operations extends throughout their supply chain, bolstering their brand image and resonating with stakeholders who increasingly prioritize Environmental, Social, and Governance (ESG) performance. By the end of fiscal year 2024, Plexus reported a 15% reduction in waste to landfill intensity compared to their 2020 baseline.

- Investment in Talent & Technology: Proactive navigation of evolving landscapes through continuous upskilling and adoption of advanced capabilities.

- Sustainability Achievements: Demonstrated commitment through substantial reductions in Scope 1 & 2 emissions and waste to landfill intensity.

- Responsible Supply Chain Practices: Ensuring ethical and sustainable operations across their entire network.

- Enhanced Brand Reputation: Alignment with growing customer and investor demand for strong ESG performance, a key differentiator in the 2024-2025 market.

Plexus's core strength lies in its specialization in high-complexity, mid-to-low volume electronics manufacturing, a niche that commands premium pricing and attracts clients with demanding technical requirements. Their end-to-end product realization solutions, encompassing design, manufacturing, and lifecycle support, provide significant customer value and foster strong, collaborative partnerships. This integrated approach, coupled with a diverse market sector portfolio including healthcare, industrial, communications, and aerospace, ensures business resilience and mitigates risks associated with single-market dependency.

Financially, Plexus demonstrates robust health, consistently exceeding revenue expectations and generating substantial free cash flow. For instance, in Q3 2024, revenue reached $1.05 billion, surpassing forecasts by 3.5%, with continued strong performance into early 2025. Their operational efficiency is highlighted by an improved cash conversion cycle, shrinking by an average of 5 days year-over-year, and a healthy return on invested capital of 15% in the last fiscal year, underscoring effective capital deployment.

Plexus's commitment to innovation is evident through significant investments in talent, technology, and advanced manufacturing processes, allowing them to adapt to evolving market needs and maintain a competitive edge. Furthermore, their dedication to sustainability, marked by substantial reductions in emissions and waste intensity by the end of fiscal year 2024, enhances brand reputation and aligns with growing stakeholder demand for strong ESG performance.

| Metric | 2023 Performance | 2024 Performance | 2025 Outlook |

|---|---|---|---|

| Revenue Growth | 12% | 15% | Projected 14% |

| Free Cash Flow | $250M | $290M | Projected $320M |

| Cash Conversion Cycle | 105 Days | 100 Days | Targeting 95 Days |

| ROIC | 14% | 15% | Targeting 16% |

What is included in the product

Delivers a strategic overview of Plexus’s internal and external business factors, highlighting its competitive position and market challenges.

Uncovers hidden opportunities and mitigates potential threats, acting as a strategic roadmap for pain point resolution.

Weaknesses

Plexus's reliance on global supply chains leaves it vulnerable to disruptions. Shortages and delays in critical components, a recurring issue in recent years, can significantly hike up procurement costs and hinder production. For instance, the semiconductor shortage that impacted many electronics manufacturers in 2022-2023 also presented challenges for companies like Plexus in securing necessary parts, leading to potential production slowdowns and impacting their ability to meet customer demand promptly.

While Plexus operates across various industries, a notable weakness lies in customer concentration. The company's revenue can be heavily reliant on a few major clients. For example, during the first two quarters of fiscal year 2025, the top 10 customers accounted for 51% of total revenue. This trend continued from fiscal year 2024, where these same customers represented 48% of revenue.

This significant dependence on a small customer base presents a considerable risk. Should any of these key clients decide to decrease their order volumes, experience financial difficulties, or opt for alternative suppliers, Plexus's revenue stream could be severely impacted, leading to instability.

The electronics manufacturing services (EMS) sector is incredibly crowded, with a multitude of companies competing fiercely for business. This intense rivalry often translates into significant pressure on profit margins, as companies must offer competitive pricing to secure contracts. Plexus, like its peers, navigates this challenging landscape where efficiency and cost control are paramount to maintaining profitability.

In 2023, the EMS industry saw continued price competition. While Plexus reported a gross margin of 20.3% for its fiscal year ending September 30, 2023, which is robust compared to some industry averages, the overall market dynamics necessitate constant vigilance. For instance, some of the larger, more commoditized segments of the EMS market can experience gross margins in the low to mid-teens, underscoring the importance of Plexus's focus on higher-value services and operational excellence.

Capital Expenditure Requirements and Working Capital Needs

Plexus faces significant capital expenditure requirements to invest in advanced manufacturing technologies and facilities, crucial for supporting its growth trajectory. The company anticipates this trend to continue, with increased capital spending projected for fiscal 2025.

Managing working capital also presents a challenge. As Plexus ramps up new programs and expands its operations, there can be periods where cash is used to fund inventory and receivables, even with strong overall free cash flow generation.

- Significant Investment in Technology: Continued investment in advanced manufacturing capabilities and facilities is necessary to maintain a competitive edge and support future growth.

- Anticipated Fiscal 2025 CapEx Increase: Plexus has indicated plans for higher capital expenditures in fiscal year 2025, reflecting ongoing expansion and modernization efforts.

- Working Capital Demands: Growth phases, particularly during program ramps, necessitate substantial working capital management, potentially leading to short-term cash outflows.

Vulnerability to Economic Slowdowns and Demand Weakness

As an Electronics Manufacturing Services (EMS) provider, Plexus faces inherent risks tied to broader economic conditions. A slowdown in the global economy or specific industrial sectors can directly impact their business. For instance, certain industrial markets experienced noticeable demand weakness during the third quarter of 2024.

This vulnerability is further highlighted by trends in key regions; the European EMS market, for example, registered negative growth throughout 2024. Such economic downturns often translate into reduced capital expenditure by customers, leading to adjustments in manufacturing forecasts and ultimately affecting Plexus's revenue streams.

- Economic Sensitivity: Plexus's reliance on industrial sector demand makes it susceptible to macroeconomic cycles.

- Market Trends: Negative growth observed in markets like European EMS in 2024 indicates a challenging operating environment.

- Customer Behavior: Economic downturns can trigger decreased investment and revised demand forecasts from Plexus's clientele.

Plexus's significant reliance on a concentrated customer base is a notable weakness. In the first two quarters of fiscal year 2025, its top 10 customers represented 51% of revenue, a slight increase from 48% in fiscal year 2024. This dependency creates substantial risk, as a downturn in business from even a few key clients could severely impact the company's financial stability and revenue generation.

The company also faces intense competition within the crowded Electronics Manufacturing Services (EMS) sector. This rivalry often leads to considerable pressure on profit margins, forcing Plexus to maintain competitive pricing strategies. While Plexus achieved a gross margin of 20.3% in fiscal year 2023, some market segments can see margins as low as the mid-teens, highlighting the constant need for cost control and operational efficiency.

Furthermore, Plexus requires substantial capital investment for advanced manufacturing technologies and facilities to support growth, with increased capital expenditures anticipated for fiscal year 2025. Managing working capital also poses a challenge, particularly during program ramp-ups, where cash may be tied up in inventory and receivables, potentially creating short-term liquidity demands.

| Weakness | Description | Impact | Supporting Data (FY2024/2025) |

|---|---|---|---|

| Customer Concentration | Heavy reliance on a few major clients. | Significant revenue disruption if key clients reduce orders or switch suppliers. | Top 10 customers accounted for 51% of revenue in H1 FY2025. |

| Intense Industry Competition | Crowded EMS market with price pressures. | Can erode profit margins, requiring constant focus on efficiency and value-added services. | Gross margin of 20.3% in FY2023, while strong, faces market segments with mid-teen margins. |

| Capital Expenditure & Working Capital Needs | Requires significant investment in technology and managing cash flow during growth. | Strain on financial resources during expansion and program launches. | Increased CapEx anticipated for FY2025; working capital demands during program ramps. |

Preview the Actual Deliverable

Plexus SWOT Analysis

This is the actual Plexus SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real data and structure that will be yours to use. Unlock the full, detailed report immediately after checkout.

Opportunities

Plexus has a significant opportunity to grow by focusing on high-demand sectors like semiconductor capital equipment and the rapidly expanding AI infrastructure market. These areas are experiencing substantial investment and innovation, creating a fertile ground for Plexus's manufacturing capabilities.

The overall Electronic Manufacturing Services (EMS) market is also on an upward trajectory, propelled by advancements in the Internet of Things (IoT), the rollout of 5G technology, and the increasing sophistication of medical devices. These trends present broad avenues for Plexus to secure new business.

With its demonstrated proficiency in producing intricate and technologically advanced products, Plexus is well-positioned to capitalize on these emerging technology trends. For instance, the semiconductor equipment market alone was projected to reach over $100 billion in 2024, showcasing the scale of opportunity.

Original Equipment Manufacturers (OEMs) are increasingly turning to outsourcing to streamline operations and cut expenses, allowing them to concentrate on their core strengths. This shift is a prime opportunity for Electronic Manufacturing Services (EMS) providers like Plexus to win new business and grow their market presence.

Plexus is well-positioned to capitalize on this trend, given its comprehensive expertise in product design, advanced manufacturing processes, and robust supply chain management. These capabilities make Plexus a highly desirable partner for OEMs looking to outsource complex manufacturing projects.

For instance, the global electronics contract manufacturing market was valued at approximately $600 billion in 2023 and is projected to grow significantly, with many industry reports indicating a compound annual growth rate (CAGR) of over 7% through 2030. This expansion is largely driven by the OEM outsourcing trend.

The electronics manufacturing services (EMS) sector often experiences a consolidation trend during economic downturns, creating strategic acquisition opportunities for companies like Plexus. These challenging periods can make smaller, specialized firms more accessible for acquisition, allowing Plexus to integrate new technologies or market niches efficiently. For instance, in 2024, the EMS industry saw continued M&A activity as companies sought to strengthen their positions and expand service portfolios, a trend Plexus can leverage.

Furthermore, forging strategic partnerships can significantly bolster Plexus's competitive edge. By collaborating with other industry players, Plexus can enhance its technological capabilities, broaden its geographical market reach, and diversify its service offerings. The company's existing strong relationships with key customers and its recent success in securing new program wins underscore its ability to build and benefit from such strategic alliances, which are crucial for navigating the evolving demands of the market.

Advancements in Automation and Smart Manufacturing

Plexus can leverage advancements in automation and smart manufacturing, embracing Industry 4.0 principles. This includes implementing AI for quality assurance, predictive maintenance to minimize downtime, and modular production lines for greater flexibility. These technological shifts are key to enhancing operational efficiency and creating distinct service offerings.

By investing in smart factory technologies, Plexus can achieve tangible benefits. For instance, AI-driven visual inspection systems can reduce defect rates by up to 90% compared to manual processes, directly impacting quality and reducing scrap. Predictive maintenance, powered by IoT sensors and machine learning, can cut unplanned downtime by an estimated 25-30%, leading to significant cost savings and improved throughput.

These investments also unlock opportunities for more sophisticated customer services:

- Enhanced Product Quality: AI-powered inspection systems can identify defects with greater precision and speed, leading to a reduction in field failures.

- Reduced Operational Costs: Predictive maintenance minimizes unexpected equipment failures, lowering repair costs and maximizing asset utilization.

- Increased Production Agility: Modular manufacturing lines allow for quicker retooling and adaptation to changing customer demands, improving time-to-market.

- Data-Driven Insights: The integration of smart technologies generates vast amounts of data, enabling better decision-making and continuous process optimization.

Regionalization and Supply Chain Resilience Initiatives

Geopolitical shifts and the lingering effects of past supply chain disruptions are accelerating a move toward regionalization and nearshoring in manufacturing. Plexus, already possessing a significant global presence, is well-positioned to capitalize on this trend. By strategically expanding its manufacturing facilities and enhancing capabilities in critical geographic areas, Plexus can provide customers with more robust and localized supply chain solutions, reducing lead times and mitigating risks.

This strategic pivot offers significant opportunities for Plexus to differentiate itself in the market. For instance, the company can focus on building out its capabilities in North America to serve clients seeking to reshore production, potentially increasing its market share in this growing segment. Furthermore, by investing in advanced manufacturing technologies within these regional hubs, Plexus can offer enhanced flexibility and quicker response times, crucial for customers prioritizing supply chain resilience.

- Expanding North American Footprint: Plexus could invest in new or expanded facilities in the U.S. or Mexico to capture nearshoring demand.

- Diversifying Asian Operations: While regionalizing, Plexus can also strengthen its presence in Southeast Asia to offer alternative resilient hubs outside of traditional China-centric models.

- Leveraging Existing Global Network: Plexus's existing global footprint allows for the strategic redeployment of resources and expertise to support regionalization efforts effectively.

Plexus is poised to benefit from the increasing demand for semiconductor manufacturing equipment, a market projected to exceed $100 billion in 2024. This growth is fueled by advancements in AI and the ongoing need for sophisticated electronics across various industries.

The broader Electronic Manufacturing Services (EMS) market, valued at around $600 billion in 2023, presents substantial opportunities for Plexus. This sector is expanding at a CAGR of over 7% through 2030, largely driven by Original Equipment Manufacturers (OEMs) outsourcing complex production to focus on core competencies.

Plexus can capitalize on industry consolidation, acquiring smaller firms to integrate new technologies and expand its market reach, a trend observed with continued M&A activity in the EMS sector during 2024. Strategic partnerships also offer a pathway to enhance technological capabilities and market presence.

Embracing Industry 4.0, including AI for quality control and predictive maintenance, can significantly boost Plexus's operational efficiency. For example, AI inspection can reduce defect rates by up to 90%, while predictive maintenance can cut unplanned downtime by 25-30%.

The global trend toward regionalization and nearshoring in manufacturing creates a distinct advantage for Plexus. By expanding its North American footprint, the company can offer localized supply chain solutions, reducing lead times and mitigating risks for clients seeking to reshore production.

| Opportunity Area | Market Size/Growth (2024/2025 Data) | Plexus Advantage |

|---|---|---|

| Semiconductor Capital Equipment | Projected >$100B in 2024 | Leverages advanced manufacturing for high-tech components. |

| EMS Market Growth (OEM Outsourcing) | ~7%+ CAGR through 2030; ~$600B in 2023 | Well-positioned to capture outsourcing demand with comprehensive services. |

| Industry Consolidation/M&A | Continued M&A in EMS sector (2024) | Acquisition of specialized firms to expand capabilities. |

| Industry 4.0/Smart Manufacturing | AI inspection: up to 90% defect reduction; Predictive maintenance: 25-30% downtime reduction | Enhances operational efficiency, quality, and agility. |

| Regionalization/Nearshoring | Growing demand for localized supply chains | Strategic expansion in North America to serve reshoring trend. |

Threats

A global economic slowdown poses a significant threat to Plexus. For instance, if major economies like the United States or China experience a contraction, demand for the sophisticated electronic components Plexus manufactures could plummet across sectors like aerospace, defense, and medical devices. This could directly impact Plexus's revenue streams.

Market volatility further exacerbates these risks. Unpredictable shifts in economic conditions can lead to customers revising their forecasts, canceling existing orders, or delaying crucial program launches. This uncertainty makes it challenging for Plexus to manage its production schedules and inventory, potentially affecting profitability. For example, a sudden spike in inflation or interest rates in 2024 could prompt customers to reduce their capital expenditures, thereby impacting Plexus's order book.

Escalating geopolitical tensions, particularly concerning China, Taiwan, and the Middle East, present significant threats to Plexus's global operations. These tensions often manifest as trade disputes, tariffs, and other protectionist measures, directly impacting supply chain stability and increasing operational expenses.

The disruption to the flow of critical components and finished goods due to these geopolitical instabilities can have a tangible effect on Plexus's manufacturing timelines and profitability. For instance, in 2024, the ongoing trade friction between the US and China continued to create uncertainty, leading many electronics manufacturers to explore diversification of their supply chains, a trend that impacts companies like Plexus.

The electronics sector is a prime example of rapid technological obsolescence, demanding ongoing, significant capital outlays for R&D and cutting-edge manufacturing. For instance, in 2024, the global semiconductor industry alone saw investments in R&D and new fabrication facilities reach hundreds of billions of dollars, a trend expected to continue through 2025.

Failure to adapt quickly to emerging technologies, such as advancements in AI hardware or next-generation connectivity, could severely erode Plexus's competitive standing. This lag might render its current offerings outdated, diminishing customer demand for its design and manufacturing services in the face of more innovative competitors.

Intensified Competition from Larger and Niche Players

The Electronics Manufacturing Services (EMS) sector is a battlefield with established giants and agile specialists vying for dominance. This intense rivalry puts significant pressure on pricing, potentially eroding profit margins for companies like Plexus. For instance, in 2024, the global EMS market size was estimated to be around $700 billion, with growth projected to continue, intensifying the competitive landscape.

This heightened competition means Plexus faces challenges in not only retaining its existing market share but also in acquiring new contracts, especially for projects that are complex yet require lower production volumes. Smaller, niche players can often offer specialized expertise or more flexible solutions, directly challenging Plexus's ability to secure these specific types of business.

- Intensified competition from both large, diversified EMS providers and specialized niche players.

- Threat of pricing pressure due to a crowded market.

- Risk of market share erosion, particularly in mid-to-low volume, high-complexity segments.

- Difficulty in securing new business against competitors with specialized capabilities.

Labor Shortages and Rising Operational Costs

Plexus, like many in the electronics manufacturing services (EMS) sector, is navigating a landscape marked by escalating labor expenses and a persistent scarcity of skilled workers. This trend is particularly acute in specialized manufacturing roles, impacting production efficiency and increasing recruitment costs. For instance, in 2024, the U.S. manufacturing sector continued to grapple with an unemployment rate for production and nonsupervisory employees that, while fluctuating, remained at historically low levels, signaling ongoing labor market tightness.

Compounding these labor challenges are rising operational costs driven by inflation. The cost of essential raw materials, such as semiconductors and various metals, has seen significant upward pressure throughout 2024 and into early 2025. This inflationary environment, coupled with increased energy prices, directly impacts Plexus’s cost of goods sold. For example, the Producer Price Index (PPI) for manufactured goods, a key indicator of input costs, showed a notable year-over-year increase in many categories relevant to electronics production during this period, potentially squeezing profit margins if these costs cannot be effectively absorbed or transferred to clients.

- Labor Market Tightness: Continued low unemployment rates in manufacturing sectors in 2024-2025 exacerbate the challenge of finding and retaining skilled labor.

- Rising Input Costs: Inflationary pressures on raw materials and energy throughout 2024-2025 directly increase production expenses for EMS providers.

- Margin Erosion Risk: Without effective cost management or price adjustments, increased operational expenses threaten to reduce Plexus's profitability.

The threat of rapid technological obsolescence necessitates continuous, substantial investment in research and development and advanced manufacturing capabilities. For instance, the global semiconductor industry alone is projected to see R&D and new fabrication facility investments in the hundreds of billions of dollars through 2025, a trend that demands constant adaptation from companies like Plexus.

Failure to keep pace with emerging technologies, such as advancements in AI hardware or next-generation connectivity, could significantly weaken Plexus's competitive position. This lag might render its current offerings outdated, decreasing customer demand for its design and manufacturing services as more innovative competitors emerge.

The electronics manufacturing services (EMS) sector is highly competitive, with established large players and agile niche specialists vying for market share. This intense competition exerts considerable pricing pressure, potentially impacting Plexus's profit margins. In 2024, the global EMS market was valued at approximately $700 billion, with continued growth expected to intensify this competitive dynamic.

| Threat Category | Specific Threat | Impact on Plexus | 2024-2025 Data/Trend |

|---|---|---|---|

| Technological Obsolescence | Failure to adapt to new technologies (e.g., AI hardware) | Reduced competitiveness, outdated offerings | Global semiconductor R&D investment in hundreds of billions through 2025 |

| Market Competition | Intensified rivalry from large EMS providers and niche players | Pricing pressure, potential margin erosion | Global EMS market size ~ $700 billion in 2024, with ongoing growth |

| Supply Chain Disruptions | Geopolitical tensions affecting component flow | Manufacturing delays, increased operational costs | Ongoing US-China trade friction impacting supply chain diversification efforts in 2024 |

SWOT Analysis Data Sources

This Plexus SWOT analysis is built upon a robust foundation of data, drawing from verified financial statements, comprehensive market intelligence, and expert industry commentary to ensure a thorough and accurate assessment.