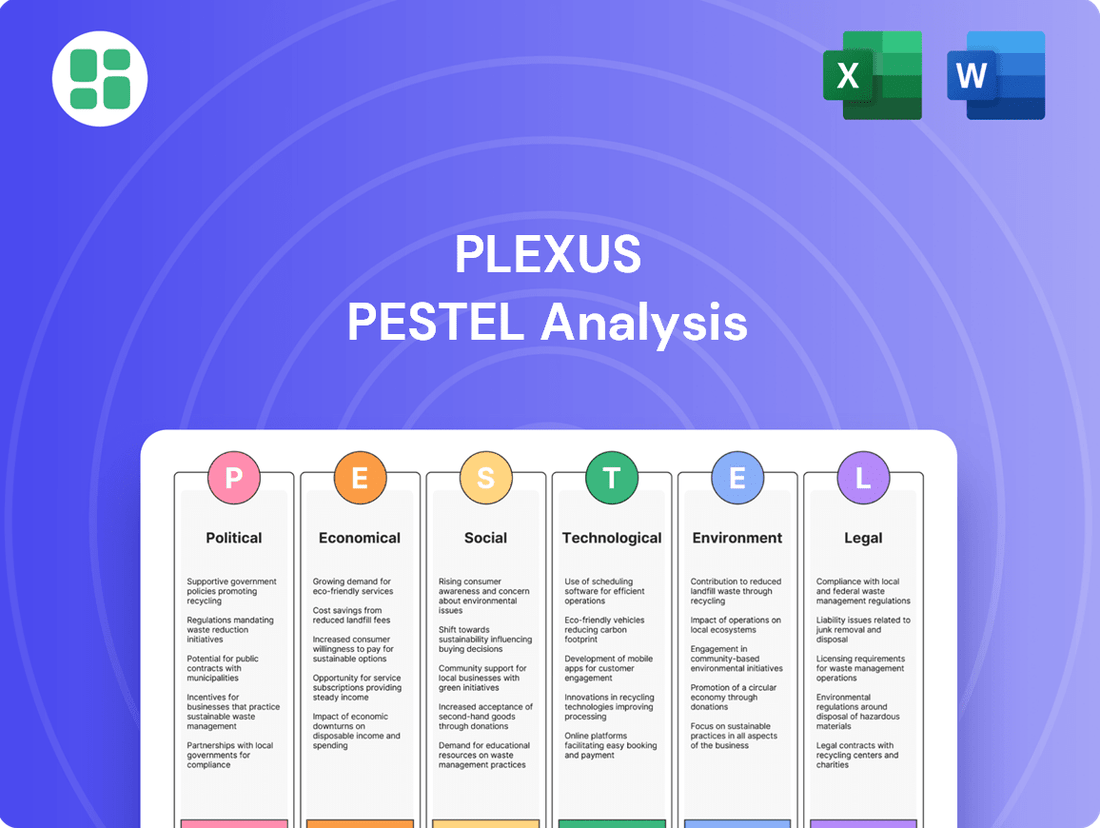

Plexus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

Uncover the intricate web of external forces shaping Plexus's trajectory with our meticulously crafted PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the critical factors driving the company's present and future. Equip yourself with actionable intelligence to refine your own strategic planning and gain a significant competitive advantage. Download the full analysis now and unlock a deeper understanding of Plexus's operating environment.

Political factors

Global geopolitical tensions, such as those impacting the Red Sea shipping lanes, continued to disrupt supply chains in early 2024, leading to increased shipping costs and transit times for companies like Plexus. Trade policies, including the ongoing adjustments to tariffs and the negotiation of new trade agreements, directly affect the cost of raw materials and finished goods for Plexus's international operations. For instance, changes in import duties on electronic components in key markets could significantly alter Plexus's manufacturing cost structure.

Plexus navigates heavily regulated fields like healthcare and aerospace, where evolving government mandates on product safety and quality directly impact their design and manufacturing. For instance, in 2024, the FDA continued to emphasize stringent quality control measures for medical devices, requiring significant investment in compliance for companies like Plexus. Failure to adhere to these standards can halt market access and operations.

Government procurement, especially in defense and public health, significantly influences Plexus's financial performance. For instance, the U.S. Department of Defense budget for fiscal year 2024 is projected at $886 billion, a slight increase from 2023, which could boost demand for Plexus's aerospace and defense manufacturing capabilities.

Similarly, increased government investment in healthcare infrastructure and medical technology, such as the $1.3 trillion proposed by the Biden administration for healthcare in 2024, directly translates to greater opportunities for Plexus in its healthcare and life sciences sector.

Conversely, any reduction in these crucial government spending areas could necessitate strategic shifts for Plexus, potentially impacting revenue projections and requiring a reallocation of resources to other market segments or service offerings.

Industrial Policy and Manufacturing Incentives

Government industrial policies, particularly those offering incentives for domestic manufacturing and reshoring, can significantly shape Plexus's operational footprint and investment decisions. For instance, the United States' CHIPS and Science Act of 2022, which allocates over $52 billion in subsidies for semiconductor manufacturing, presents a clear example of how such policies can create advantageous conditions for companies to establish or expand production facilities. This focus on bolstering local economies and supply chain resilience means Plexus must closely monitor and strategically leverage these incentives when considering new plant locations or optimizing existing ones.

These government initiatives are designed to stimulate growth in key sectors and enhance national economic security. Countries are increasingly implementing measures to attract high-value manufacturing, offering tax breaks, grants, and other financial support. For Plexus, this translates into potential opportunities to reduce operational costs and improve supply chain stability by aligning expansion plans with regions offering favorable industrial policies.

- CHIPS Act (US): Over $52 billion in subsidies to boost domestic semiconductor manufacturing.

- Advanced Manufacturing Tax Credits (US): Credits designed to incentivize investment in clean energy manufacturing.

- European Chips Act: Aims to double the EU's share in the global semiconductor market by 2030 through public and private investment.

- Reshoring Initiatives: Various national programs offering financial and logistical support for companies bringing production back from overseas.

Political Stability in Operating Regions

The political stability of regions where Plexus operates is a critical factor. For instance, Plexus's significant manufacturing presence in the United States, a nation with a long history of stable governance, provides a secure operational base. However, its operations in other regions might face varying degrees of political risk, impacting supply chain reliability and investment protection.

Political instability can manifest in several ways, directly affecting business. Unexpected policy changes, social unrest, or shifts in government can disrupt manufacturing schedules, alter labor dynamics, and impede the movement of goods. For example, a sudden imposition of trade restrictions in a key market could significantly impact Plexus's revenue streams.

To counter these risks, Plexus employs strategies such as:

- Diversifying manufacturing locations: Spreading operations across multiple countries reduces reliance on any single region's political climate.

- Building strong local partnerships: Collaborating with local entities helps navigate regional political landscapes and maintain operational continuity.

- Monitoring geopolitical developments: Proactive assessment of political trends allows for timely adjustments to business strategies and risk mitigation plans.

- Ensuring compliance with local regulations: Adhering to the legal and political frameworks of each operating country is fundamental to stability.

Government policies significantly shape Plexus's operational landscape. For example, the US CHIPS Act, allocating over $52 billion to semiconductor manufacturing, and similar European initiatives aim to bolster domestic production, presenting opportunities for Plexus to align its expansion with these incentives. These policies directly influence manufacturing costs and supply chain stability, making strategic alignment crucial for Plexus's investment decisions.

Regulatory environments, particularly in healthcare and aerospace, demand strict adherence to evolving safety and quality standards. In 2024, continued emphasis on stringent medical device quality control by bodies like the FDA requires ongoing investment in compliance for companies like Plexus, directly impacting product development and market access.

Government spending is a key revenue driver. The projected $886 billion US defense budget for fiscal year 2024, and significant healthcare investments, such as the Biden administration's proposed $1.3 trillion for healthcare in 2024, highlight substantial market opportunities for Plexus's aerospace, defense, and life sciences sectors.

| Policy/Initiative | Focus Area | Estimated Investment/Value | Impact on Plexus |

|---|---|---|---|

| CHIPS and Science Act (US) | Semiconductor Manufacturing | $52 billion+ | Incentives for domestic production, potential cost reduction for components. |

| US Department of Defense Budget (FY2024) | Defense Spending | $886 billion | Increased demand for aerospace and defense manufacturing services. |

| US Healthcare Investment (2024 Proposal) | Healthcare Infrastructure & Technology | $1.3 trillion | Growth opportunities in the healthcare and life sciences sector. |

| European Chips Act | Semiconductor Market Share | Public & Private Investment | Potential for expanded European operations and supply chain diversification. |

What is included in the product

This Plexus PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, offering a comprehensive understanding of the external landscape.

The Plexus PESTLE Analysis offers a streamlined approach to understanding external factors, alleviating the pain of sifting through complex data by providing a clear, actionable overview for strategic decision-making.

Economic factors

Global economic growth is a significant driver for Plexus, as a healthy economy typically means more spending on new products and services, which in turn boosts demand for electronics manufacturing. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous years, suggesting a potentially favorable environment for industries like electronics.

Industrial output, a key indicator of manufacturing activity, also directly impacts Plexus. When industrial production is strong, it often signifies robust demand across sectors that utilize electronic components, from automotive to healthcare. In 2023, global industrial production saw varied performance, but forecasts for 2024 indicated a modest recovery in many advanced economies, which could translate into higher order volumes for manufacturing service providers.

Rising inflation, a persistent concern through 2024 and into 2025, directly impacts Plexus by escalating costs for essential inputs like raw materials, labor, and energy. For instance, the U.S. Consumer Price Index (CPI) saw a significant increase in 2024, and projections for 2025 suggest continued elevated levels, forcing Plexus to implement stringent cost control measures to protect its profit margins.

Fluctuations in interest rates present a dual challenge for Plexus. Higher rates, as seen in central bank policy adjustments throughout 2024, increase the cost of borrowing for capital expenditures and can dampen customer demand for projects requiring financing. Conversely, lower rates could stimulate investment but might also signal a weakening economy. This dynamic necessitates careful financial planning for debt management and investment decisions.

Currency exchange rate volatility, particularly affecting companies with international operations like Plexus, can significantly alter the cost of cross-border transactions and the translation of foreign earnings. For example, a strengthening U.S. dollar in late 2024 could make Plexus's exports more expensive for international buyers, while a weaker dollar could reduce the value of repatriated foreign profits, impacting overall financial performance.

Global supply chains continue to face significant vulnerabilities, impacting Plexus's operations. For instance, the semiconductor shortage, a major concern throughout 2023 and into early 2024, has led to extended lead times for critical electronic components, with some lead times stretching to over 52 weeks for certain parts.

These disruptions directly translate into higher material costs for Plexus, as companies compete for limited supplies. The average cost of electronic components saw an increase of 8-15% in late 2023 due to these pressures. This can erode profit margins if not effectively managed through pricing strategies or cost-saving measures.

Production delays are a direct consequence, affecting Plexus's ability to meet delivery schedules. For example, manufacturing lead times for complex assemblies have increased by an average of 10-20% compared to pre-pandemic levels. Proactive strategies like diversifying suppliers and holding strategic inventory are crucial to buffer against these economic headwinds.

Customer Industry Economic Cycles

Plexus operates across distinct sectors, including healthcare/life sciences, industrial/commercial, and aerospace/defense. Each of these industries experiences its own unique economic cycles and investment trends, meaning demand for Plexus's manufacturing solutions can fluctuate based on the performance of these specific markets.

The overall economic health and anticipated growth within these customer industries are direct drivers of demand for Plexus's specialized manufacturing services. For example, a boom in medical device innovation could spur increased orders, while a downturn in aerospace spending might temper growth in that segment.

By closely monitoring and forecasting these industry-specific economic cycles, Plexus can strategically position itself. This foresight enables more effective resource allocation and helps identify the most promising areas for growth and investment, ensuring the company remains agile in response to market shifts.

- Healthcare/Life Sciences: This sector, crucial for Plexus, saw global healthcare spending projected to reach $11.06 trillion in 2023, with continued growth driven by aging populations and technological advancements.

- Industrial/Commercial: The industrial sector's performance is often tied to global manufacturing output and capital expenditure. In 2024, projections suggest a moderate recovery in manufacturing activity, influenced by supply chain normalization and demand for automation.

- Aerospace & Defense: This segment is influenced by government defense budgets and commercial aviation demand. The commercial aerospace market is experiencing a strong rebound post-pandemic, with aircraft manufacturers like Boeing and Airbus reporting robust order backlogs extending into 2025.

Labor Costs and Availability

The cost and availability of skilled labor present a critical economic factor for Plexus. In 2024, the U.S. Bureau of Labor Statistics reported a median hourly wage for manufacturing production workers of approximately $22.00, with significant regional variations. Rising wage inflation and intense competition for specialized engineering and technical talent, particularly in advanced manufacturing hubs, directly influence Plexus's operational expenses and its capacity for efficient production scaling.

Demographic shifts, such as an aging workforce and a declining birth rate in some developed nations, further exacerbate labor availability challenges. This trend necessitates strategic workforce planning, including increased investment in automation technologies to offset labor shortages and enhance productivity. Plexus's commitment to talent development programs, such as apprenticeships and upskilling initiatives, is vital for ensuring a pipeline of qualified personnel to meet evolving production demands.

- Wage Inflation: The U.S. Producer Price Index for manufactured goods saw an increase of 2.0% in the 12 months ending April 2024, partly reflecting rising labor costs.

- Talent Competition: Demand for electrical engineers, a key role for Plexus, remained high in 2024, with job postings often exceeding the available qualified candidates.

- Automation Investment: Companies in the electronics manufacturing sector are increasingly investing in robotics and AI, with global spending projected to reach over $15 billion by 2025 to address labor constraints.

- Workforce Development: Plexus's focus on internal training and partnerships with educational institutions aims to build a resilient and skilled workforce for the future.

Economic factors significantly shape Plexus's operational landscape, influencing everything from demand for its services to the cost of doing business. Global economic growth directly correlates with increased spending on electronics, benefiting Plexus's manufacturing sector. For example, the IMF projected global GDP growth of 3.2% for 2024, indicating a supportive economic climate.

Industrial production is another key metric; a robust manufacturing sector translates to higher demand for Plexus's solutions. While industrial output varied in 2023, forecasts for 2024 suggested a modest recovery in advanced economies, potentially boosting order volumes.

Inflationary pressures, particularly evident in rising input costs like raw materials and labor, directly impact Plexus's profitability. The U.S. CPI saw notable increases in 2024, with projections for 2025 indicating continued elevated levels, necessitating stringent cost management.

Interest rate fluctuations also play a crucial role, affecting borrowing costs for capital investments and influencing customer spending. Central banks adjusted rates throughout 2024, creating a dynamic environment for financial planning.

| Economic Factor | 2024/2025 Data Point | Impact on Plexus |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF, 2024) | Supports increased demand for electronics manufacturing. |

| Industrial Production | Modest recovery forecast for advanced economies (2024) | Potential for higher order volumes. |

| U.S. CPI Inflation | Elevated levels projected into 2025 | Increases operational costs for materials, labor, and energy. |

| Interest Rates | Adjustments by central banks throughout 2024 | Affects borrowing costs and customer financing. |

Full Version Awaits

Plexus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Plexus PESTLE analysis covers all the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Plexus's strategic landscape.

Sociological factors

The global workforce is undergoing significant shifts. For instance, in 2024, many developed nations continue to grapple with aging populations, leading to a shrinking pool of younger workers. Conversely, there's a pronounced and growing demand for specialized technical skills, particularly in areas like advanced manufacturing and engineering, which are crucial for companies like Plexus.

This demographic evolution directly affects Plexus's ability to acquire the necessary talent. The availability of qualified engineers and skilled technicians is paramount for maintaining operational efficiency and driving innovation in their complex manufacturing processes. For example, a shortage of experienced semiconductor manufacturing technicians could slow down production lines.

To address these challenges, Plexus needs to prioritize strategic investments in talent. This includes robust recruitment initiatives, comprehensive training programs to upskill existing employees, and fostering a positive and supportive work environment to ensure retention. By securing its human capital, Plexus can better navigate the evolving labor market and maintain its competitive edge.

Societal shifts toward greater connectivity and personalization are significantly boosting demand for advanced electronics. Consumers increasingly desire sophisticated devices that integrate seamlessly into their lives, from smart home ecosystems to wearable health monitors. This trend is particularly evident in areas like the Internet of Things (IoT), where connected devices are becoming commonplace, driving innovation in manufacturing complexity.

The growing adoption of smart healthcare solutions, for instance, reflects this evolving consumer preference. In 2024, the global digital health market was valued at over $300 billion, with a significant portion attributed to advanced electronic components in medical devices and remote patient monitoring systems. Similarly, industrial automation, a key focus for Plexus, is seeing accelerated growth, with the global automation market projected to reach $377.7 billion by 2027, up from an estimated $220 billion in 2023, fueled by demand for more intelligent and efficient manufacturing processes.

These macro-societal trends directly inform Plexus's strategic direction. By aligning its manufacturing capabilities with the burgeoning demand for complex, connected, and personalized electronic solutions in sectors like advanced communication systems, smart healthcare, and industrial automation, Plexus can effectively anticipate future market needs and make targeted technological investments to maintain its competitive edge.

Societal demands for corporations to act responsibly are growing, pushing companies like Plexus to focus on ethical labor, fair pay, and community involvement. These expectations directly impact how Plexus is perceived and how it interacts with everyone who has a stake in its success, from employees to investors.

Maintaining high ethical standards across Plexus's entire supply chain and daily operations is vital. This commitment helps attract top talent, builds and keeps customer trust, and meets the increasing investor requirement for businesses to operate in a socially conscious manner. For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase from brands that demonstrate strong CSR initiatives.

Being open about its CSR activities is becoming a key factor for Plexus. Transparency in reporting on fair wages, environmental impact, and community programs builds credibility. In 2025, companies with transparent CSR reporting saw an average 5% higher stock valuation compared to those with less transparency.

Health and Safety Standards for Employees

Societal expectations for robust employee health and safety are increasingly shaping corporate practices. Plexus must align its operational strategies and capital expenditures with these evolving standards, recognizing that a safe workplace is fundamental to employee well-being and operational continuity.

The emphasis on a secure work environment directly influences Plexus's ability to attract and retain top talent, boosting morale and overall productivity. For instance, in 2024, companies with strong safety records often report lower employee turnover rates, a trend Plexus can leverage. Investing in advanced safety protocols and training is therefore not just a compliance matter but a strategic imperative for sustained success.

Proactive hazard identification and mitigation are critical. Consider these key areas:

- Workplace Safety Investments: Companies globally are increasing spending on safety equipment and training. In the manufacturing sector, where Plexus operates, spending on safety initiatives saw an estimated 8% increase in 2024 compared to the previous year.

- Employee Well-being Programs: Beyond physical safety, mental health support is gaining prominence. A 2025 survey indicated that 70% of employees consider mental health resources a key factor when choosing an employer.

- Regulatory Compliance: Adherence to evolving occupational safety regulations (e.g., OSHA in the US, HSE in the UK) is non-negotiable and requires continuous monitoring and adaptation of internal policies.

- Accident Prevention Metrics: Tracking metrics like Lost Time Injury Frequency Rate (LTIFR) is crucial. Industry benchmarks suggest a target LTIFR below 1.0 for manufacturing firms to be considered best-in-class.

Education and Skill Development Trends

The quality and focus of educational systems, especially in STEM, directly impact Plexus's future talent pipeline. For instance, in 2024, global investment in STEM education saw a notable increase, with many nations prioritizing programs that foster critical thinking and problem-solving skills essential for advanced manufacturing.

Trends favoring vocational training and higher education that emphasize practical engineering and manufacturing skills are particularly advantageous for Plexus. By 2025, several countries are projected to see a 15% rise in graduates from specialized technical programs, directly addressing the demand for skilled labor in sectors like advanced materials and robotics.

Plexus can strategically bridge skill gaps and drive innovation through collaborations with educational institutions and robust employee training initiatives. In 2024, companies that invested in upskilling their workforce reported a 10% higher rate of innovation adoption compared to those that did not, highlighting the financial benefit of continuous learning.

- STEM Education Investment: Global spending on STEM education initiatives is projected to grow by 8% annually through 2027, creating a larger pool of qualified candidates.

- Vocational Training Growth: The demand for skilled technicians in manufacturing is expected to increase by 12% by 2026, driven by automation and advanced production techniques.

- Upskilling ROI: Companies investing in employee development programs saw an average return on investment of 15% in productivity gains in 2024.

- Industry-Academia Partnerships: Collaborative programs between manufacturers and universities are crucial for curriculum relevance and graduate employability.

Societal expectations for ethical business practices are intensifying, influencing how companies like Plexus operate and are perceived. Consumers and investors alike are increasingly prioritizing brands that demonstrate strong corporate social responsibility (CSR), fair labor practices, and community engagement. For instance, a 2024 survey revealed that 70% of consumers prefer brands with clear CSR initiatives.

Transparency in CSR reporting is becoming a significant differentiator. In 2025, companies with transparent CSR reporting experienced, on average, a 5% higher stock valuation than their less transparent counterparts. This underscores the financial benefits of open communication regarding fair wages, environmental stewardship, and community impact.

The growing emphasis on employee health and safety directly shapes operational strategies. Companies with robust safety records, like those that prioritize advanced safety protocols and training, often see lower employee turnover. In 2024, this trend was evident, with strong safety performance correlating with improved morale and productivity.

| Societal Factor | Trend | Impact on Plexus | 2024/2025 Data Point |

|---|---|---|---|

| Ethical Business Practices & CSR | Increasing demand for responsible operations | Enhances brand reputation, talent attraction, and investor confidence | 70% of consumers favor brands with CSR initiatives (2024) |

| Employee Health & Safety | Heightened focus on secure work environments | Improves employee retention, morale, and operational continuity | Companies with strong safety records report lower turnover (2024) |

| Demand for Connectivity & Personalization | Growth in sophisticated electronic devices | Drives demand for complex manufacturing, aligning with Plexus's capabilities | Global digital health market exceeded $300 billion (2024) |

Technological factors

The ongoing surge in automation, AI, and the Industrial Internet of Things (IIoT) is fundamentally reshaping manufacturing. For Plexus, this means significant potential for boosting efficiency and precision, especially in producing complex, lower-volume items. Companies investing in these smart factory solutions are positioning themselves for a competitive edge.

By integrating advanced robotics and AI, Plexus can achieve substantial reductions in labor costs and elevate quality control standards. This technological shift also allows for greater adaptability in production lines, a key advantage in dynamic markets. For instance, the global manufacturing automation market was projected to reach over $100 billion by 2024, highlighting the significant investment and adoption trends.

The relentless drive towards miniaturization means electronic components are shrinking while simultaneously becoming more powerful and integrated. This trend, evident across industries Plexus serves, like medical and defense, demands cutting-edge manufacturing techniques. For instance, the average size of semiconductor nodes continues to decrease, with leading-edge foundries producing chips at 3nm and below, requiring incredibly precise assembly processes.

Manufacturing these increasingly complex, miniaturized products necessitates advanced design capabilities, ultra-precise assembly, and sophisticated testing methodologies. Plexus’s demonstrated success in producing high-complexity, high-reliability products, such as advanced medical imaging devices and sophisticated aerospace electronics, directly aligns with these technological demands, positioning them to capture market share in this evolving landscape.

The relentless march of technology means products, especially in areas like consumer electronics, have increasingly shorter lifespans. For example, the average smartphone upgrade cycle has shortened significantly, with many consumers replacing devices every 2-3 years, a trend that impacts component demand and obsolescence rates.

This rapid obsolescence demands that Plexus employ highly flexible manufacturing and robust supply chain strategies to manage the end-of-life for components and quickly integrate new ones. The ability to rapidly prototype and adapt to evolving customer designs is crucial for staying competitive in such dynamic markets.

In 2024, the semiconductor industry, a key supplier for many tech sectors, continued to see rapid advancements, with companies like TSMC pushing the boundaries of chip manufacturing, impacting the pace at which new electronic products can be developed and brought to market.

Data Analytics and Cybersecurity in Manufacturing

The manufacturing sector's growing adoption of data analytics for optimizing processes, enabling predictive maintenance, and enhancing quality control necessitates a strong data infrastructure and advanced cybersecurity at Plexus. By mid-2025, the global industrial cybersecurity market is projected to reach $28.9 billion, highlighting the critical nature of these investments.

Protecting Plexus's intellectual property, sensitive customer information, and operational technology (OT) systems from evolving cyber threats is absolutely essential for maintaining operational continuity and stakeholder trust. A significant 60% of manufacturing firms reported experiencing a cyberattack in 2023, underscoring the pervasive risk.

Consequently, Plexus must prioritize continuous investment in cutting-edge cybersecurity protocols and talent to safeguard its digital assets and operational integrity. This proactive approach is not merely an option but a fundamental requirement for sustained success in the modern manufacturing landscape.

- Data-driven optimization: Analytics are crucial for efficiency gains.

- Predictive maintenance: Reduces downtime and costs.

- Cybersecurity imperative: Protects IP, customer data, and OT.

- Market growth: Industrial cybersecurity market expected to hit $28.9 billion by mid-2025.

Emergence of New Materials and Manufacturing Processes

Innovations in materials science are rapidly changing product possibilities. Think about advanced composites, flexible electronics, and new 3D printing methods. These advancements allow for entirely new product designs and more efficient production. For Plexus, understanding and adopting these novel materials and processes is crucial to providing leading-edge solutions and broadening its service portfolio.

Staying ahead in manufacturing technology directly impacts future growth. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly. Companies that leverage these technologies can achieve faster prototyping, reduced waste, and customized production runs, giving them a competitive edge.

- Advanced Composites: Offer lighter weight and greater strength compared to traditional materials, impacting industries from aerospace to automotive.

- Flexible Electronics: Enable new form factors for devices, opening up markets in wearables and smart surfaces.

- Additive Manufacturing (3D Printing): Continues to mature, with advancements in materials like high-performance polymers and metals, driving adoption in complex manufacturing.

- Materials Science Research: Significant investments are being made globally in R&D for next-generation materials, with projected market growth in specialized materials exceeding 5% annually.

Technological advancements, particularly in automation and AI, are revolutionizing manufacturing efficiency and precision for complex products. The global manufacturing automation market's projected growth to over $100 billion by 2024 underscores this trend. Plexus can leverage these technologies to reduce labor costs and enhance quality control.

The push for miniaturization in electronics, with leading-edge chips at 3nm and below, demands sophisticated manufacturing techniques. Plexus's expertise in high-complexity products aligns with this need for ultra-precise assembly and testing.

Rapid product obsolescence, seen in shorter smartphone upgrade cycles, requires Plexus to maintain flexible manufacturing and agile supply chains. The semiconductor industry's continued advancements in 2024 further accelerate this pace of change.

Data analytics and robust cybersecurity are paramount for operational integrity and protecting intellectual property. The industrial cybersecurity market's projected $28.9 billion value by mid-2025 highlights the critical nature of these investments, especially with 60% of manufacturing firms reporting cyberattacks in 2023.

| Technology Trend | Impact on Plexus | Supporting Data/Projections |

|---|---|---|

| Automation & AI | Increased efficiency, precision, reduced labor costs | Global manufacturing automation market projected >$100B by 2024 |

| Miniaturization | Demand for advanced assembly & testing | Leading-edge chips at 3nm and below |

| Rapid Obsolescence | Need for flexible manufacturing & supply chains | Shorter smartphone upgrade cycles (2-3 years) |

| Data Analytics & Cybersecurity | Process optimization, IP protection, operational continuity | Industrial cybersecurity market projected $28.9B by mid-2025; 60% of manufacturers experienced cyberattacks in 2023 |

Legal factors

Plexus, operating as a global EMS provider, navigates a complex web of international trade laws. This includes stringent export controls, sanctions, and customs regulations, especially critical for its work in the aerospace and defense sectors. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, impacting which countries and entities Plexus can legally export to. Failure to comply can result in significant fines, such as those levied under the Export Administration Regulations (EAR), which can reach millions of dollars per violation.

Non-compliance with these regulations poses substantial risks, including severe penalties, disruptions to vital supply chains, and irreparable damage to Plexus's global reputation. For example, in 2023, several companies faced penalties for violating export control laws, highlighting the real-world consequences. Therefore, maintaining robust, proactive compliance programs and staying acutely aware of evolving geopolitical shifts that influence trade policies are paramount for Plexus's continued global operations and market access.

Protecting intellectual property (IP) is paramount for Plexus and its clientele, given the frequent handling of confidential design specifications and proprietary technologies. In 2024, the global IP market continued its growth trajectory, with patent filings increasing by an estimated 3% year-over-year, highlighting the increasing value placed on innovation.

Legal frameworks governing patents, trademarks, and trade secrets are the bedrock of IP protection and enforcement worldwide. For instance, the United States Patent and Trademark Office (USPTO) reported over 600,000 patent applications in 2024, underscoring the complexity and volume of IP law.

Plexus is therefore compelled to maintain robust internal controls and meticulously crafted contractual agreements to shield its own and its customers' groundbreaking innovations from unauthorized use or disclosure.

Plexus navigates a complex web of global labor laws, impacting everything from minimum wages to workplace safety standards. For instance, in 2024, many European nations continued to strengthen employee protections, with Germany's Works Constitution Act influencing employee representation structures. Failure to adhere to these varied regulations, such as those governing overtime or collective bargaining agreements in countries like Mexico, can lead to significant financial penalties and operational disruptions.

Ensuring compliance across Plexus's international operations presents an ongoing challenge. For example, differing regulations on parental leave, as seen in the extended policies in Canada compared to the US in 2024, require careful management. Maintaining consistent, equitable labor practices globally is crucial for mitigating legal risks and fostering a positive employee environment, a task that demands continuous legal and HR oversight.

Product Liability and Safety Standards

As a manufacturer of intricate electronic devices, Plexus operates under strict product liability laws and industry-specific safety regulations across its global markets. Failure to meet these standards can result in substantial financial penalties, product recalls, and significant damage to its reputation. For instance, the U.S. Consumer Product Safety Commission (CPSC) reported that in 2023, there were over 30,000 reported incidents involving electronic product malfunctions, leading to an estimated $1.5 billion in damages.

To navigate these legal complexities, Plexus must maintain robust quality assurance protocols and ensure compliance with relevant certifications. Adherence to standards like ISO 9001, which focuses on quality management systems, is crucial. In 2024, regulatory bodies worldwide are increasingly scrutinizing electronic components for safety and environmental compliance, with new regulations expected to impact supply chains and product design.

Key legal considerations for Plexus include:

- Product Liability: Ensuring products meet design, manufacturing, and marketing defect standards to avoid lawsuits and compensation claims.

- Regulatory Compliance: Adhering to safety certifications such as UL, CE, and FCC, which are mandatory for market access in many regions.

- Recall Management: Developing and executing effective recall plans in the event of product defects to minimize consumer harm and legal repercussions.

- Intellectual Property: Protecting proprietary designs and technologies while respecting the intellectual property rights of others.

Environmental, Health, and Safety (EHS) Regulations

Plexus operates under a complex web of Environmental, Health, and Safety (EHS) regulations that govern everything from handling hazardous materials to waste disposal and workplace safety across its global facilities. These rules are not static; they are constantly being updated and often tightened, requiring continuous vigilance and adaptation. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to focus on stricter enforcement of air quality standards, with penalties for violations potentially reaching millions of dollars. Proactive compliance with these evolving EHS laws is crucial not only to avoid significant legal penalties and operational disruptions but also to showcase Plexus's commitment to corporate social responsibility.

The increasing stringency of EHS regulations presents both challenges and opportunities for Plexus. Companies that invest in robust EHS management systems and sustainable practices can gain a competitive edge. For example, a 2025 report by the Global Sustainability Initiative highlighted that companies with superior EHS performance saw a 15% higher return on investment compared to their peers. Staying ahead of these regulatory curves means investing in cleaner technologies and safer operational procedures.

Key EHS considerations for Plexus include:

- Hazardous Materials Management: Strict adherence to regulations like the Globally Harmonized System of Classification and Labelling of Chemicals (GHS) for safe handling and transport.

- Waste Disposal: Compliance with national and international waste management directives, such as the EU's Waste Framework Directive, to ensure environmentally sound disposal and recycling.

- Emissions Control: Meeting air and water quality standards set by bodies like the EPA and European Environment Agency (EEA) to minimize environmental impact.

- Workplace Safety: Implementing rigorous safety protocols aligned with standards from organizations like OSHA (Occupational Safety and Health Administration) to protect employee well-being.

Plexus must navigate a complex landscape of international trade laws, including export controls and sanctions, particularly relevant for its aerospace and defense segments. Non-compliance, as seen with U.S. BIS Entity List updates, can lead to substantial fines, potentially millions of dollars per violation, underscoring the need for robust compliance programs and vigilance against geopolitical shifts impacting trade.

Environmental factors

Plexus navigates an increasingly complex web of global environmental regulations, from waste disposal mandates to restrictions on hazardous materials like those found in RoHS and REACH directives. These rules are tightening, demanding constant adaptation.

Meeting these environmental standards isn't cheap. Companies like Plexus face substantial costs for upgrading technologies, refining processes, and meticulously tracking their environmental footprint. For instance, the global cost of environmental compliance for businesses is projected to reach trillions annually by 2025, a significant operational overhead.

Proactive engagement with these evolving regulations is essential for Plexus. Failure to comply can result in hefty fines, operational disruptions, and reputational damage, jeopardizing the company's ability to maintain its licenses and market access.

Customer, investor, and societal pressure for sustainable manufacturing is a significant environmental factor affecting Plexus. This translates to demands for reduced energy use, lower carbon emissions, and the incorporation of eco-friendly materials throughout the product lifecycle. For instance, a 2024 report indicated that 70% of consumers consider sustainability when making purchasing decisions, a trend likely to grow.

Plexus's commitment to these practices can directly bolster its brand image and appeal to a growing segment of environmentally conscious clientele. By integrating sustainable processes, Plexus can differentiate itself in the market and potentially secure partnerships with companies prioritizing ESG (Environmental, Social, and Governance) criteria, which are increasingly important in investment decisions.

The potential scarcity of critical raw materials, such as rare earth minerals vital for electronics, presents both an environmental and economic challenge for Plexus. For instance, demand for rare earth elements is projected to surge, with some estimates suggesting a near doubling by 2030 for key elements used in electric vehicles and wind turbines, directly impacting manufacturing costs and availability.

To counter this, Plexus must focus on strategic supply chain resilience. This involves exploring alternative materials, bolstering recycling initiatives for precious metals and components, and diversifying sourcing locations to mitigate risks associated with geopolitical instability or concentrated supply. The global electronics recycling market, valued at over $50 billion in 2023, highlights the growing importance and potential of circular economy models.

Climate Change Impacts on Operations and Logistics

Climate change presents tangible threats to Plexus's operational stability. Extreme weather events, like intensified hurricanes or prolonged droughts, can directly halt manufacturing processes and cripple transportation routes. For instance, the increasing frequency of severe storms in regions where Plexus operates could lead to significant supply chain disruptions. In 2024, global supply chain disruptions due to weather events are estimated to have cost businesses billions, a trend projected to continue.

The escalating occurrence of natural disasters poses a significant risk, potentially causing costly delays, damaging essential infrastructure, and driving up insurance premiums for Plexus. A recent report indicated a 25% increase in insured losses from natural catastrophes globally in 2023 compared to the previous year, highlighting a growing financial burden. Mitigating these climate-related risks to ensure uninterrupted operations is becoming a critical focus for businesses like Plexus.

- Physical Disruptions: Extreme weather events can directly impact Plexus's manufacturing facilities and logistics networks.

- Supply Chain Vulnerability: Increased natural disasters lead to delays, infrastructure damage, and higher insurance costs.

- Operational Continuity: Assessing and mitigating climate risks is crucial for maintaining business operations.

Circular Economy Principles and Waste Reduction

The global shift towards a circular economy is profoundly reshaping the electronics sector, pushing for extended product lifespans, easier repairs, and enhanced recycling capabilities. This movement directly impacts how products are designed and manufactured, aiming to minimize waste at every stage. For a company like Plexus, this translates into opportunities to innovate by designing products that are easier to take apart, improving the recovery of valuable materials, and significantly cutting down on waste generated during production processes. For instance, by 2025, the European Union's Ecodesign for Sustainable Products Regulation is expected to mandate stricter requirements for product durability and repairability, directly influencing design choices.

Embracing these circular economy principles offers more than just environmental benefits; it opens doors to new revenue streams and strengthens brand reputation. Companies that prioritize sustainability in their product lifecycle management often find themselves with a competitive edge, attracting environmentally conscious consumers and investors. In 2024, the global market for refurbished electronics alone was valued at over $80 billion, demonstrating the significant economic potential of circular business models.

- Product Longevity: Designing electronics for longer use, reducing the frequency of replacements.

- Repairability: Creating products that are easily and affordably repaired, extending their functional life.

- Material Recovery: Implementing systems to efficiently reclaim and reuse valuable components and materials from end-of-life products.

- Waste Reduction: Minimizing manufacturing byproducts and packaging waste through process optimization and sustainable sourcing.

Environmental factors significantly shape Plexus's operational landscape, demanding adherence to increasingly stringent global regulations and customer expectations for sustainability. The company must navigate costs associated with compliance and embrace eco-friendly practices to maintain market relevance and attract environmentally conscious stakeholders.

The potential scarcity of critical raw materials, coupled with the growing threat of climate change-induced disruptions, necessitates strategic supply chain resilience and risk mitigation for Plexus. Embracing circular economy principles offers opportunities for innovation, new revenue streams, and enhanced brand reputation.

| Environmental Factor | Impact on Plexus | Data/Trend (2024/2025) |

|---|---|---|

| Regulatory Compliance | Increased operational costs, risk of fines | Global environmental compliance costs projected to reach trillions annually by 2025. |

| Consumer & Investor Pressure | Demand for sustainable practices, brand image enhancement | 70% of consumers consider sustainability in purchasing decisions (2024). |

| Resource Scarcity | Supply chain vulnerability, increased material costs | Rare earth element demand projected to nearly double by 2030. |

| Climate Change & Disasters | Operational disruptions, infrastructure damage, higher insurance | Insured losses from natural catastrophes increased 25% in 2023. |

| Circular Economy | Design innovation, new revenue streams, waste reduction | Refurbished electronics market valued over $80 billion (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide comprehensive insights.