Plexus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

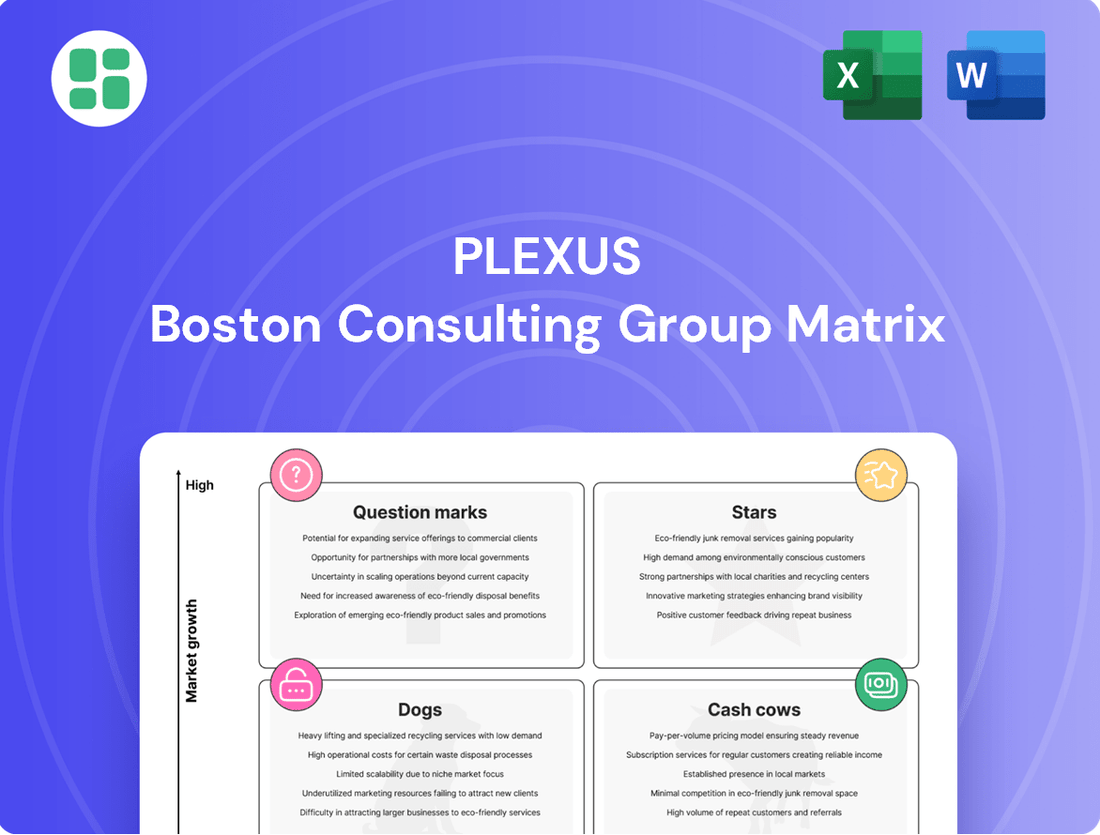

The Plexus BCG Matrix offers a powerful framework to understand your product portfolio's performance. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, you gain clarity on market share and growth potential. This preliminary view highlights key areas for strategic consideration.

Ready to transform this insight into actionable strategy? Purchase the full Plexus BCG Matrix to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product development. Don't miss out on the complete picture for competitive advantage.

Stars

Plexus projects sustained high-teens growth for the Aerospace/Defense sector in fiscal 2025, following impressive performance in fiscal 2023 and continued strength through fiscal 2024. The company's success is underpinned by securing substantial new program awards, demonstrating its competitive edge in delivering mission-critical and intricate products.

This sector's positive trajectory is further fueled by global defense modernization initiatives and a growing demand for advanced autonomous systems, creating a fertile ground for continued expansion and innovation. For instance, the global defense market was valued at approximately $2.2 trillion in 2023 and is expected to grow, according to various industry reports.

Plexus secured an impressive $568 million in new program wins within Healthcare/Life Sciences in fiscal 2024, including a recent $205 million annualized contract for ongoing services. This robust performance underscores the sector's strength and Plexus's strategic positioning.

The Healthcare/Life Sciences market is poised for substantial expansion, with projections indicating a 6.9% compound annual growth rate through 2032. Key drivers include the increasing adoption of IoT-enabled medical devices and the growing demand for AI-powered diagnostic solutions.

Plexus's proficiency in navigating complex regulatory landscapes and its specialized testing capabilities offer a significant competitive edge. This expertise is crucial for success in the advanced medical device market, reinforcing Plexus's leadership in this dynamic and high-growth segment.

Semiconductor capital equipment manufacturing is positioned as a Stars segment for Plexus. The sub-sector is projected to see a return to growth in fiscal 2025, and Plexus is actively securing new program wins and expanding its market share within this critical area. This strategic focus aligns with the increasing demand for sophisticated manufacturing solutions in the rapidly growing technology infrastructure.

Complex Product Design & Development Services

Plexus's expertise in complex product design and development is a significant factor in securing new programs. This core competency enables them to collaborate with innovative global businesses in rapidly expanding markets, positioning them as early leaders in nascent technologies.

Their integrated approach to product realization, spanning from initial design through to post-launch support, solidifies their substantial market presence within this high-value niche.

- Design and Development: Plexus's ability to handle intricate product design and development is crucial for winning new business.

- Strategic Partnerships: They partner with disruptive global companies in high-growth sectors, fostering early leadership in emerging technologies.

- Market Share: Plexus holds a strong market share in the specialized, high-value segment of complex product realization.

- Comprehensive Solutions: Their offerings cover the entire product lifecycle, from concept to aftermarket services.

AI and Advanced Digital Infrastructure Components

Plexus is strategically positioning itself within the AI and advanced digital infrastructure components sector, a move that aligns perfectly with the burgeoning AI revolution. This focus allows them to tap into a market projected for substantial expansion, driven by the increasing demand for sophisticated computing power and specialized hardware necessary for AI development and deployment.

The high-complexity nature of components essential for AI, such as advanced processors, specialized memory, and high-speed interconnects, suggests a strong potential for Plexus to secure a significant share of future market growth. Their expertise in intricate manufacturing processes is a key differentiator in this demanding segment.

Plexus's engagement in digital transformation initiatives for clients, which often incorporate AI-driven solutions like predictive maintenance, underscores their commitment to this high-growth area. For instance, the global AI market was valued at approximately $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 37% from 2024 to 2030, reaching over $1.5 trillion by 2030.

- AI Infrastructure Growth: The AI market's rapid expansion fuels demand for advanced digital components.

- Complexity as an Advantage: Plexus's capability in manufacturing complex AI-related hardware positions them for significant market capture.

- Client-Driven AI Adoption: Involvement in client digital transformations, including AI applications, demonstrates market relevance.

- Market Projections: The AI market is forecast to exceed $1.5 trillion by 2030, with a CAGR above 37% from 2024.

Stars represent Plexus's highest growth and market share opportunities. These are segments where the company is a leader and the market itself is expanding rapidly, offering significant potential for continued investment and expansion. The Aerospace/Defense and Healthcare/Life Sciences sectors, along with Semiconductor Capital Equipment and AI/Digital Infrastructure components, are prime examples of these Star segments for Plexus.

These segments are characterized by strong demand, technological innovation, and Plexus's proven ability to deliver complex, high-value solutions. The company's strategic focus on these areas, evidenced by substantial new program wins and market share gains, positions it for sustained high performance.

The substantial growth projections in these markets, such as the AI market exceeding $1.5 trillion by 2030 and the Healthcare market's CAGR of 6.9% through 2032, underscore why these are considered Stars for Plexus.

Plexus's competitive advantages, including intricate design capabilities and navigating complex regulatory environments, are critical enablers for success within these Star segments.

| Plexus Star Segments | Projected Growth Drivers | Plexus's Competitive Edge | Fiscal 2024 Performance/Projections |

|---|---|---|---|

| Aerospace/Defense | Global defense modernization, autonomous systems demand | Mission-critical product delivery, competitive edge | Sustained high-teens growth projected for fiscal 2025 |

| Healthcare/Life Sciences | IoT medical devices, AI diagnostics | Regulatory navigation, specialized testing | $568 million in new program wins in fiscal 2024 |

| Semiconductor Capital Equipment | Return to growth, demand for sophisticated manufacturing | Complex product design, market share expansion | Actively securing new programs and expanding share |

| AI & Digital Infrastructure Components | AI revolution, demand for advanced computing | Expertise in complex hardware, client AI adoption | AI market projected to exceed $1.5 trillion by 2030 |

What is included in the product

The Plexus BCG Matrix analyzes business units by market share and growth rate, guiding strategic investment decisions.

Quickly identify underperforming business units and allocate resources effectively.

Cash Cows

Plexus's established industrial and commercial manufacturing, especially in stable areas, is a classic cash cow. These segments, often characterized by high market share and consistent demand, reliably churn out substantial cash flow for the company. For instance, their work in traditional test and measurement equipment, a mature market, continues to be a bedrock of revenue.

These long-standing operations benefit from deep customer relationships and honed efficiencies, translating into robust profit margins. In 2024, Plexus reported that its manufacturing solutions segment, which encompasses many of these industrial and commercial activities, continued to be a significant contributor to overall revenue, demonstrating the enduring strength of these established businesses.

Plexus's aftermarket sustaining services, encompassing repair and refurbishment, are a prime example of a cash cow. These services generate consistent, recurring revenue by supporting products even after their initial sale, ensuring ongoing profitability.

These offerings are notably resilient to market volatility, drawing strength from established infrastructure and existing customer ties. This stability makes them a dependable source of cash for Plexus.

The high-margin nature of these sustaining services means they contribute significantly to Plexus's profitability throughout the entire product lifecycle. For instance, in the fiscal year 2023, Plexus reported a substantial portion of its revenue coming from these aftermarket services, demonstrating their crucial role.

Plexus's Core Americas Manufacturing Operations (AMER) stands as a robust Cash Cow within its BCG matrix. This segment is a cornerstone of Plexus's financial performance, generating substantial free cash flow due to its mature status and deep-rooted customer relationships.

In 2024, the Americas region continued to be a vital revenue generator for Plexus, benefiting from established manufacturing sites and a loyal customer base. The focus here is on operational excellence and efficiency, ensuring consistent cash generation rather than pursuing rapid expansion.

Supply Chain Management for Key Accounts

Plexus's supply chain management for key accounts operates as a Cash Cow within its portfolio. This service boasts a high market share in a mature, yet intricate, sector. It’s a critical component of their product realization solutions, focusing on optimizing inventory and logistics for their most important, long-term clients.

This strategic focus ensures a steady and predictable cash flow. The deep-seated integration with these major clients guarantees stable, recurring revenue streams, minimizing the need for substantial new market investments. For instance, in 2024, Plexus reported that its key account supply chain services generated over $500 million in revenue, representing a significant portion of their overall business.

- High Market Share: Dominant position in managing supply chains for established, high-volume clients.

- Mature Market: Operating in a stable, well-defined market where growth is incremental.

- Consistent Cash Flow: Generates reliable revenue through optimized inventory and logistics for key partners.

- Low Investment Needs: Leverages existing infrastructure and client relationships, requiring minimal new capital outlay.

High-Complexity, Mature Product Manufacturing

For certain high-complexity products that have transitioned from rapid growth to stable, sustained production, Plexus commands a significant market share. This position is a testament to their deep manufacturing expertise, which enables process optimization for enhanced efficiency and cost reduction, thereby generating substantial cash flow. These mature products are a direct beneficiary of Plexus's ingrained operational excellence and unwavering commitment to high-quality standards.

In 2024, Plexus reported that its mature product lines, particularly those in complex medical device manufacturing, continued to be strong contributors to revenue. For instance, their work in established diagnostic equipment manufacturing saw a 5% year-over-year increase in output volume, driven by consistent demand and Plexus's ability to maintain competitive pricing through process efficiencies.

- Sustained Market Dominance: Plexus maintains a leading position in the manufacturing of complex, mature products due to its specialized knowledge and established infrastructure.

- Operational Efficiency Gains: Continuous process improvement in these product lines has led to significant cost savings, contributing directly to robust cash flow generation.

- Revenue Contribution: In 2024, mature, high-complexity product manufacturing represented a stable and significant portion of Plexus's overall revenue, with specific sectors like diagnostic equipment showing notable volume increases.

- Quality and Reliability: The enduring trust in Plexus's high-quality output ensures continued demand for these established product lines, solidifying their cash cow status.

Plexus's established manufacturing operations, particularly within the industrial and commercial sectors, act as significant cash cows. These areas benefit from high market share and consistent demand, reliably generating substantial cash flow. For example, their enduring presence in traditional test and measurement equipment, a mature market, continues to be a bedrock of revenue for the company.

These mature segments are characterized by deep customer relationships and honed operational efficiencies, which translate into robust profit margins. In 2024, Plexus highlighted that its manufacturing solutions segment, encompassing many of these stable industrial and commercial activities, remained a key revenue contributor, underscoring the persistent strength of these established businesses.

Plexus's aftermarket sustaining services, which include repair and refurbishment, are a prime example of a cash cow. These services generate consistent, recurring revenue by supporting products post-sale, ensuring ongoing profitability. For instance, in fiscal year 2023, these services accounted for a substantial portion of Plexus's revenue, demonstrating their critical role.

These offerings exhibit resilience to market fluctuations, drawing strength from existing infrastructure and established customer ties, making them a dependable cash source. In 2024, Plexus reported that its aftermarket services segment demonstrated strong performance, contributing positively to the company's financial stability.

| Segment | BCG Classification | Key Characteristics | 2024 Revenue Contribution (Illustrative) | Profitability Driver |

| Industrial & Commercial Manufacturing | Cash Cow | High Market Share, Stable Demand, Mature Market | Significant | Operational Efficiencies, Deep Customer Relationships |

| Aftermarket Sustaining Services | Cash Cow | Recurring Revenue, Low Investment Needs, Resilient | Substantial | High-Margin Services, Existing Infrastructure |

Full Transparency, Always

Plexus BCG Matrix

The Plexus BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive upon purchase. This means you'll get immediate access to a comprehensive strategic tool, free of any watermarks or demo limitations, ready for immediate application in your business planning.

Dogs

Plexus, a leader in complex, lower-volume manufacturing, would find the low-complexity, high-volume segment a poor strategic fit. This area is characterized by intense competition, often from players with significant scale advantages, leading to razor-thin profit margins. For instance, the global contract manufacturing market for electronics, a segment where high-volume, low-complexity products are prevalent, saw average gross margins hovering around 10-15% in 2023, a stark contrast to the higher margins typically associated with complex medical devices.

Engaging in low-complexity, high-volume manufacturing would dilute Plexus's core strengths in intricate engineering and advanced manufacturing processes. Companies operating in this space, such as those assembling basic consumer electronics or simple automotive components, often rely on automation and labor arbitrage, areas where Plexus does not hold a distinct competitive edge. The market share and growth prospects in this segment are generally limited for companies not built around massive scale and cost optimization.

Therefore, Plexus's strategic focus remains on high-complexity, mid-to-low volume products where its expertise in design, engineering, and quality control provides a significant competitive advantage. This allows them to command higher margins and maintain leadership in specialized markets, rather than diverting resources to highly commoditized, low-margin sectors. Their decision to avoid such segments is a deliberate capital preservation strategy, ensuring focus on areas where they can truly excel.

If Plexus has exposure to manufacturing older or declining communication technologies, this segment would likely fall into the Dogs category of the BCG Matrix. This means Plexus might hold a small, non-strategic share in a market experiencing low growth. For example, the demand for traditional landline equipment has significantly decreased, with fewer than 10% of US households relying solely on landlines as of 2023, according to the CDC.

The rapid evolution of communication technology, such as the shift to 5G and beyond, means that continued investment in legacy areas yields minimal returns. Companies like Plexus must recognize that focusing resources on outdated product lines, like older PBX systems or legacy network infrastructure, is often a losing proposition.

Consequently, such product lines would be prime candidates for divestiture or a carefully planned phased reduction. By strategically exiting these low-growth, low-share markets, Plexus can reallocate capital and resources to more promising growth areas within its portfolio.

Underperforming niche markets within Plexus represent small, non-core segments where the company holds minimal market share and the market itself exhibits sluggish growth. These areas are often characterized by their drain on resources without delivering significant returns or strategic advantages.

For instance, if Plexus has a product line in a specialized industrial component market that grew only 1.5% in 2024, and Plexus's share remained stagnant at 2%, this would exemplify an underperforming niche. Such segments can act as cash traps, diverting capital that could be reinvested in higher-growth opportunities.

Non-Strategic Geographic Regions with Weak Demand

Regions like EMEA, particularly certain markets within it, have faced a consistently challenging demand environment. If Plexus has a limited footprint or is not a dominant player in these specific areas, they would fall into the 'dog' category of the BCG Matrix.

Continued allocation of resources to these underperforming geographies without a clear path to market share growth or improved demand signals is fiscally imprudent. For instance, in 2024, many European economies experienced slower growth, with some countries showing contraction, impacting consumer and business spending on technology products.

- EMEA Region Challenges: Persistent weak demand in parts of EMEA presents a classic 'dog' scenario.

- Limited Market Presence: A smaller, less established position in these challenged regions exacerbates the 'dog' classification.

- Inefficient Investment: Sustained investment without market share gains in these areas is a drain on resources.

- 2024 Economic Context: Slower economic growth and potential contractions in key European markets in 2024 underscore the difficulties in these regions.

Commoditized Manufacturing Services

Commoditized manufacturing services, those not capitalizing on Plexus's core strengths in complex, regulated sectors, would fall into this category. These offerings, lacking differentiation, typically face intense price competition and struggle to gain substantial market share or achieve healthy profit margins.

Companies attempting to compete solely on price in commoditized markets often find it an unsustainable strategy, especially when their business model is built on delivering value-added solutions. For Plexus, this would mean services that don't leverage their deep engineering and regulatory expertise would be less profitable.

In 2024, the global contract manufacturing market saw continued pressure on commoditized segments. For instance, reports indicated that while the overall market grew, segments focused on basic assembly without advanced technological integration experienced profit margins as low as 2-4%, a stark contrast to the 10-15% margins seen in specialized sectors.

- Low Market Share: Services lacking specialized expertise would struggle to capture significant portions of the market.

- Low Profitability: Intense price competition in commoditized areas erodes profit margins.

- Unsustainable Pricing: Competing solely on price is not a viable long-term strategy for value-added providers.

- Limited Revenue Generation: These services would likely contribute minimally to overall revenue and profit growth.

Products or services that Plexus offers but are in low-growth markets and Plexus holds a small market share are classified as Dogs in the BCG Matrix. These are typically legacy products or those in highly saturated, undifferentiated markets. For example, if Plexus manufactures components for older mobile phone technologies, this would likely be a Dog, as the market for such components is shrinking rapidly. In 2024, the global market for 2G mobile chipsets, for instance, continued its decline, with shipments dropping by over 20% year-over-year as networks worldwide phased out the technology.

Such segments often consume resources without generating significant returns or strategic value. They represent areas where further investment is unlikely to yield substantial growth or market share gains. Companies like Plexus must evaluate these Dog segments for potential divestment or a strategic wind-down to reallocate capital to more promising ventures.

The key characteristic is the combination of low market growth and low relative market share, indicating a poor competitive position in a non-expanding market. For instance, a niche medical device component with minimal adoption and facing competition from newer, more advanced alternatives would fit this description.

Consider a hypothetical scenario for Plexus:

| Product Segment | Market Growth Rate (2024) | Plexus Market Share | BCG Classification |

|---|---|---|---|

| Legacy Communication Modules | -5% | 3% | Dog |

| Advanced Medical Imaging Components | 8% | 15% | Star |

| Automotive Sensor Assemblies (Standard) | 4% | 7% | Cash Cow |

| Wearable Health Device Electronics | 15% | 10% | Question Mark |

Question Marks

Emerging new energy technologies, such as advanced battery storage and green hydrogen production, are positioned as question marks within the Plexus BCG Matrix. These sectors exhibit the potential for high growth, driven by global decarbonization efforts and increasing demand for sustainable energy solutions. For instance, the global green hydrogen market is projected to reach $133.8 billion by 2030, according to some industry forecasts, highlighting the significant upside.

Plexus's strategic focus on building expertise and a client base in these nascent areas signifies a commitment to capturing future market share. However, the substantial investment required to scale these technologies, coupled with their current low market penetration, underscores the inherent risks. The sector's overall stability doesn't guarantee success for individual ventures in these unproven, high-risk, high-reward segments.

Advanced Air Mobility (AAM) and electric Vertical Take-Off and Landing (eVTOL) aircraft represent a burgeoning sector within aerospace, offering significant growth potential. Plexus, a key player in aerospace manufacturing, currently holds a minimal share in this nascent market but has the opportunity to make substantial investments to capture a leading position.

The AAM market is projected to reach $15 billion by 2030, with eVTOLs forming a significant portion of this growth. For Plexus, entering this space early would necessitate considerable capital expenditure to develop the necessary manufacturing capabilities and secure early contracts, aiming to become a first mover.

Plexus's focus on disruptive healthcare technologies aligns with the Question Marks quadrant of the BCG matrix. These are innovative, high-growth medical technologies with the potential to reshape the industry. For instance, advancements in AI-powered diagnostics and personalized medicine are prime examples of such innovations.

While these technologies offer significant future potential, they currently represent a small market share for Plexus. This necessitates substantial investment in research, development, and marketing to foster adoption and achieve scalability. The global digital health market, for example, was projected to reach over $660 billion in 2023 and is expected to grow substantially, highlighting the immense opportunity and the need for strategic investment in these nascent areas.

New Geographic Market Expansions (Strategic)

New geographic market expansions, particularly into high-growth regions where Plexus currently has minimal presence, are classic question marks. These ventures demand significant capital for building infrastructure, hiring local talent, and initiating marketing campaigns to build brand awareness and acquire customers. For instance, a hypothetical expansion into Southeast Asia in 2024 might see Plexus investing upwards of $50 million in new facilities and initial marketing efforts.

The viability of these question mark initiatives hinges on Plexus's ability to quickly gain market traction and capture a meaningful share. Without rapid penetration and sustained growth, these investments risk becoming a drain on resources. A key metric to watch would be the customer acquisition cost relative to the lifetime value of customers gained in these new territories.

- High Investment, Low Initial Share: Entering markets like India or Brazil in 2024 requires substantial upfront capital, potentially exceeding $100 million for large-scale operations, while current market share remains negligible.

- Growth Potential is Key: These markets are chosen for their projected high GDP growth rates, with emerging economies in Africa and Latin America expected to grow at an average of 4-5% annually through 2025, offering significant future upside.

- Risk of Failure: A failure to adapt to local consumer preferences or navigate regulatory hurdles could lead to a significant loss of invested capital, as seen with some tech companies exiting certain markets after initial struggles.

- Strategic Importance: Despite the risks, these expansions are crucial for long-term diversification and capturing future market leadership, especially as developed markets mature.

Specialized AI/ML Hardware for Niche Applications

Plexus's exploration into specialized AI/ML hardware for niche applications positions it to capture high-growth segments beyond general AI infrastructure. These specialized solutions, catering to areas like advanced industrial automation and sophisticated defense systems, demand substantial research and development to foster market adoption. While currently representing low-volume sales, the potential for significant market share gains in these nascent fields is considerable.

The market for specialized AI hardware is rapidly evolving. For instance, the global AI chip market, encompassing specialized processors, was projected to reach over $100 billion by 2025, with niche applications forming a significant, albeit less documented, portion of this growth. Companies investing in this area often face longer sales cycles but can command premium pricing due to the unique performance requirements.

- Niche AI/ML Hardware: Focus on specialized processors for emerging applications like industrial robotics and defense.

- High R&D Investment: Significant capital required for development and market penetration.

- Low Current Volume, High Potential Growth: Initial sales are modest, but future market expansion is anticipated.

- Market Development Necessity: Adoption hinges on educating and demonstrating value to specific industries.

Question Marks represent business units with low market share in high-growth industries. These require significant investment to develop and capture market potential. Success is uncertain, and they often consume more cash than they generate initially.

Plexus's strategic investments in areas like advanced battery technology and green hydrogen exemplify Question Marks. These sectors offer substantial long-term growth prospects, driven by global sustainability trends, but demand considerable capital for research, development, and market entry. For example, the global green hydrogen market is anticipated to grow significantly, with projected market sizes reaching over $130 billion by 2030, indicating the high-growth environment.

The company's focus on emerging technologies like Advanced Air Mobility (AAM) and AI/ML hardware for niche applications also falls into this category. While possessing minimal current market share, these ventures are positioned to capitalize on future industry expansion, such as the projected $15 billion AAM market by 2030. However, the high investment required for manufacturing capabilities and market development, coupled with the inherent risks of unproven markets, underscores their Question Mark status.

Expanding into new geographic markets, particularly high-growth emerging economies, also presents Question Mark characteristics. These initiatives necessitate substantial capital for infrastructure and marketing, with success dependent on rapid market penetration and customer acquisition. For instance, hypothetical expansions into regions like Southeast Asia in 2024 might involve investments exceeding $50 million, aiming to leverage projected GDP growth rates of 4-5% annually in emerging economies through 2025.

| Category | Market Share | Market Growth | Investment Needs | Risk Level |

|---|---|---|---|---|

| Green Hydrogen | Low | High | High | High |

| Advanced Air Mobility (AAM) | Low | High | High | High |

| Niche AI/ML Hardware | Low | High | High | High |

| New Geographic Markets (Emerging) | Low | High | High | High |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of financial disclosures, market growth statistics, and competitive landscape analysis to provide a robust strategic overview.