Plexus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plexus Bundle

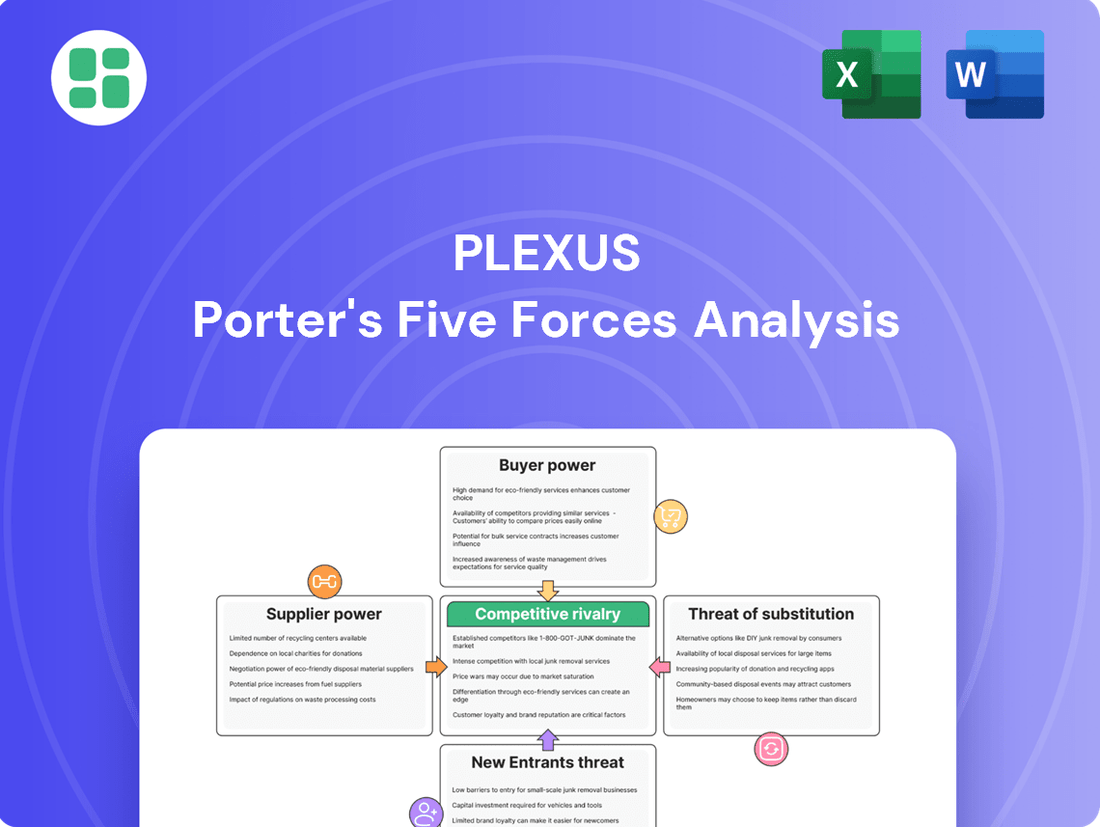

Plexus operates within a dynamic industry shaped by several key forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitutes is crucial for strategic planning. This brief overview hints at the complexities involved.

The complete report reveals the real forces shaping Plexus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Plexus's reliance on specialized electronic components, often sourced globally, highlights a key area of supplier bargaining power. The unique nature and limited availability of these critical parts, particularly proprietary items or those with extended production timelines, can significantly shift leverage towards suppliers. For instance, in 2024, the semiconductor industry, a vital supplier for electronics manufacturing, continued to experience supply chain constraints for certain advanced chips, impacting lead times and pricing for manufacturers like Plexus.

When a few suppliers control the market for essential parts or materials Plexus needs, their ability to negotiate terms grows significantly. This concentration means they can often set prices, delivery times, and other conditions, potentially raising Plexus's operational expenses and affecting its production schedules. For instance, in 2023, the semiconductor industry, a critical supplier for many electronics manufacturers like Plexus, saw significant supply chain disruptions due to geopolitical factors and increased demand, leading to price hikes for key components.

The costs associated with switching suppliers for critical electronic components can be incredibly high for companies like Plexus. This isn't just about finding a new vendor; it often involves significant investment in redesigning products, re-qualifying new parts to meet stringent quality standards, and potentially re-tooling manufacturing processes. For instance, in the semiconductor industry, a single component change can necessitate months of testing and validation, impacting production timelines and R&D budgets.

These substantial switching costs directly bolster the bargaining power of existing suppliers. When Plexus faces considerable disruption and expense to change vendors, suppliers are in a stronger position to dictate terms, including pricing and delivery schedules. This is particularly true for specialized components where only a few suppliers can meet the technical specifications, making it difficult and costly for Plexus to diversify its supply base.

Forward Integration Threat

Suppliers can threaten Plexus by integrating forward, meaning they might start manufacturing the electronic sub-assemblies or even complete products that Plexus currently produces. This move would directly compete with Plexus, potentially diminishing the demand for Plexus's services.

This competitive threat from suppliers can significantly shift the bargaining power in favor of the suppliers. By becoming direct competitors, they gain leverage in negotiations over pricing and terms for the components they supply, as Plexus would then be reliant on them for both raw materials and finished goods.

- Forward Integration Threat: Suppliers may enter Plexus's market by producing electronic sub-assemblies or finished products themselves.

- Reduced Demand: This action would decrease Plexus's need for their components, thereby weakening Plexus's position.

- Supplier Leverage: Suppliers would gain significant bargaining power in negotiations due to direct competition.

Importance of Supplier's Input to Plexus's Cost/Quality

The bargaining power of suppliers is a crucial factor in Plexus's operational success. The quality and cost of components directly impact Plexus's ability to deliver high-quality, competitive products to its customers.

If a supplier's input represents a significant portion of Plexus's product cost, or if that input is absolutely critical to the performance and functionality of Plexus's end products, then that supplier gains considerable bargaining power. This means they can potentially dictate terms, including pricing and delivery schedules, which can affect Plexus's profitability and market competitiveness.

- Component Cost Impact: For instance, in 2024, electronic components, a key input for many of Plexus's manufacturing solutions, saw price fluctuations due to ongoing supply chain challenges and demand for advanced semiconductors.

- Criticality of Input: If a specialized sensor or a proprietary microchip is essential for a Plexus client's product, the supplier of that item holds significant leverage.

- Supplier Concentration: The fewer suppliers available for a critical component, the greater their individual bargaining power.

- Switching Costs: High costs associated with changing suppliers for essential parts can also empower existing suppliers.

Suppliers wield significant bargaining power when they provide critical or highly differentiated components essential for Plexus's operations. This power is amplified if there are few alternative suppliers or if switching to a new supplier involves substantial costs for Plexus, including redesign and re-qualification efforts. In 2024, the semiconductor industry, a key supplier for electronics manufacturers, continued to demonstrate this by maintaining elevated prices for certain advanced chips due to persistent demand and limited production capacity for cutting-edge nodes.

| Factor | Impact on Plexus | Example (2023-2024) |

|---|---|---|

| Supplier Concentration | Increased pricing power for suppliers | Limited number of manufacturers for high-end ASICs |

| Switching Costs | Supplier leverage due to high exit barriers | Redesigning PCBs for a new processor can take months |

| Input Criticality | Suppliers can dictate terms for essential components | Proprietary sensor modules vital for medical devices |

| Forward Integration Threat | Suppliers may become direct competitors | A component supplier starting to offer sub-assembly services |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Plexus's position in the electronics manufacturing services industry.

Instantly identify and prioritize competitive threats with a visually intuitive breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Plexus's focus on mid-to-low volume, high-complexity products means that individual customer contracts can represent a significant portion of its overall revenue. This concentration amplifies the bargaining power of these key clients.

If a few major customers account for a substantial percentage of Plexus's sales, they can leverage this volume to negotiate more favorable pricing, payment terms, or even product specifications. For instance, if a top customer represents over 10% of Plexus's revenue, their ability to shift their business elsewhere, even if costly, grants them considerable leverage.

While customers might face initial expenses like design transfers and re-qualification when switching Electronic Manufacturing Services (EMS) providers, Plexus's approach cultivates significant long-term switching costs. These costs arise from the deep integration of Plexus's specialized expertise into a customer's product lifecycle, making a move to another provider complex and resource-intensive.

Customers in competitive industries are often highly price-sensitive, actively seeking cost efficiencies and comparing offerings. While Plexus provides significant value through its design and supply chain expertise, this inherent price sensitivity means customers will continue to push for favorable pricing, particularly for mature products or when economic conditions tighten.

For instance, in 2024, many sectors experienced persistent inflation, leading businesses to scrutinize all expenditure. Companies reliant on Plexus's services, especially those with high-volume, standardized components, are likely to leverage this environment to negotiate better terms, directly impacting Plexus's margins.

Customer's Ability to Backward Integrate

Plexus's significant customers, especially those with substantial order volumes, may possess the technical expertise and financial resources to establish their own manufacturing capabilities. This potential for backward integration means they could choose to produce their complex products internally rather than relying on Plexus. For instance, a major electronics manufacturer might evaluate the cost-benefit of bringing Plexus's specialized assembly processes in-house.

The credible threat of customers developing their own manufacturing operations serves as a potent bargaining chip during price negotiations. Knowing that a large client could potentially bring production in-house gives them leverage to demand more favorable terms from Plexus. This is particularly true for clients whose products represent a significant portion of Plexus's revenue, as losing such a client would have a substantial impact.

- Customer Leverage: The possibility of customers performing manufacturing internally enhances their negotiation power.

- Strategic Consideration: Large clients assess the feasibility and cost-effectiveness of backward integration.

- Market Dynamics: This threat influences pricing and contract terms for Plexus's services.

Product Uniqueness and Differentiation

Plexus's strategic focus on high-complexity, mid-to-low volume products inherently creates significant product uniqueness. This specialization means that customers seeking these niche manufacturing capabilities have fewer viable alternatives. For instance, in 2024, Plexus continued to secure contracts in sectors like aerospace and defense, where intricate designs and stringent quality control are paramount, sectors often characterized by limited supplier options.

This high degree of customization and specialized engineering directly translates to reduced customer bargaining power. Customers are less likely to switch to a competitor if Plexus offers a unique solution that meets their specific, complex needs. In the dynamic electronics manufacturing services (EMS) market, this differentiation is key. For example, a report from late 2024 highlighted that companies specializing in advanced medical devices, a core Plexus market, often face long qualification processes for new suppliers, reinforcing the value of established, differentiated relationships.

The consequence of this differentiation is that Plexus becomes a more indispensable partner for its clients. When alternatives are scarce and the required expertise is specialized, customers have less leverage to demand lower prices or more favorable terms. This is particularly true for clients requiring end-to-end solutions, from design to full-scale production, a service Plexus excels at providing.

- Product Uniqueness: Plexus concentrates on complex, lower-volume production runs, demanding specialized engineering and manufacturing expertise.

- Reduced Alternatives: This specialization limits the number of Electronic Manufacturing Services (EMS) providers capable of matching Plexus's offerings, diminishing customer choice.

- Customer Dependence: Clients requiring these highly specialized capabilities become more reliant on Plexus, thereby reducing their bargaining power.

- Market Position: In 2024, Plexus's strong presence in sectors like medical devices and defense, known for their high barriers to entry and differentiation, underscored this reduced customer leverage.

The bargaining power of Plexus's customers is influenced by several factors, including their concentration, the switching costs involved, price sensitivity, and the potential for backward integration. While Plexus's specialization in complex, lower-volume products reduces the number of viable alternatives for customers, thus limiting their leverage, the sheer size of some contracts can still grant significant negotiation power. For example, in 2024, the ongoing inflationary pressures pushed many businesses to seek cost reductions, intensifying negotiations with suppliers like Plexus, especially for more standardized components within their product lines.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Example (2024 Context) |

|---|---|---|

| Customer Concentration | High for large, significant clients | A top customer representing over 10% of revenue can leverage this volume for better terms. |

| Switching Costs | Low to Moderate, mitigated by Plexus's integration | While initial qualification is costly, Plexus's deep expertise reduces ease of switching. |

| Price Sensitivity | Moderate to High, especially in competitive or cost-conscious sectors | Inflation in 2024 led many companies to scrutinize all expenditures, increasing pressure on pricing. |

| Threat of Backward Integration | Low to Moderate, dependent on customer capabilities | Major clients might evaluate bringing specialized assembly in-house, a credible threat during negotiations. |

Preview the Actual Deliverable

Plexus Porter's Five Forces Analysis

This preview showcases the complete Plexus Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use and strategic application.

Rivalry Among Competitors

The Electronic Manufacturing Services (EMS) sector, especially for intricate, lower-volume production, is populated by a mix of large, globally recognized firms and specialized smaller companies. This dense competitive landscape means many players are constantly vying for the same client contracts and market share, driving up the intensity of rivalry.

In 2024, the EMS market is highly fragmented. For instance, while Foxconn (Hon Hai Precision Industry) remains the largest player by revenue, with sales projected to exceed $200 billion in 2024, numerous other significant competitors like Pegatron, Wistron, and Jabil Circuit also command substantial portions of the market. Beyond these giants, hundreds of smaller, regional EMS providers cater to niche demands, further fragmenting the competitive environment and intensifying the battle for business.

The electronics manufacturing services (EMS) sector, where Plexus operates, is influenced by broader industry growth but also by the specific trajectories of its key end markets. While the global electronics market saw robust growth, with some segments experiencing double-digit expansion in early 2024, others, particularly those tied to more mature consumer electronics, might exhibit more moderate increases. This divergence means that while overall demand is present, competition can become fiercer in slower-growing niches as companies vie for market share.

Plexus distinguishes itself by concentrating on high-complexity, mid-to-low volume products and offering complete product realization services. This specialization allows them to cater to niche markets requiring advanced manufacturing capabilities.

However, the competitive landscape is dynamic. Other players are also actively pursuing differentiation strategies, which can intensify rivalry. If these differentiation efforts become less pronounced across the industry, the focus often shifts to price and delivery speed as key competitive battlegrounds.

In 2024, the electronics manufacturing services (EMS) sector, where Plexus operates, saw continued demand for specialized services. Companies like Jabil and Sanmina also compete in similar high-complexity segments, highlighting the ongoing need for unique value propositions to stand out.

Exit Barriers

High fixed costs in the Electronics Manufacturing Services (EMS) sector create substantial exit barriers. These include significant investments in manufacturing facilities, specialized machinery, and the need for a highly skilled workforce.

These substantial sunk costs mean that companies often continue operating even when facing low profitability, as the cost of shutting down and liquidating assets can be prohibitive. This situation directly fuels intensified competitive rivalry within the industry.

For instance, in 2024, many EMS providers continued to invest in advanced automation and Industry 4.0 technologies, further increasing the capital intensity and thus the exit barriers for smaller or less capitalized players.

- High Capital Investment: Significant upfront expenditure on advanced manufacturing equipment and facilities.

- Specialized Workforce: Costs associated with training and retaining skilled labor for complex production processes.

- Asset Write-offs: Potential for substantial losses if specialized equipment cannot be repurposed or sold easily.

- Contractual Obligations: Long-term supply agreements can also make exiting the market difficult without incurring penalties.

Customer Loyalty and Switching Costs

Customer relationships in the complex Electronics Manufacturing Services (EMS) sector are typically built on long-term partnerships, often involving deep integration of processes and supply chains. This integration creates substantial switching costs for customers, making it difficult and expensive to change providers. For instance, a major automotive manufacturer relying on a specific EMS provider for critical components might face significant retooling, qualification, and supply chain disruption costs if they decide to switch.

These high switching costs, while beneficial for incumbent providers, also mean that new entrants or existing competitors must make considerable investments to woo potential clients away from established relationships. This dynamic intensifies rivalry, as companies vie for market share by offering compelling value propositions, innovative solutions, or aggressive pricing to overcome customer inertia. In 2023, the global EMS market was valued at approximately $700 billion, indicating the scale of investment required to capture even a small percentage of this market.

- High Integration: EMS customer relationships are often deeply embedded, making transitions costly.

- Switching Costs: Customers face significant expenses and operational risks when changing EMS providers.

- Competitive Investment: Competitors must invest heavily in R&D, sales, and marketing to attract clients.

- Market Dynamics: The need to overcome customer loyalty fuels intense competition for existing business.

The competitive rivalry within the Electronic Manufacturing Services (EMS) sector is fierce due to a fragmented market populated by both large global players and specialized smaller firms. This density of competitors means constant pressure to win contracts and market share, often leading to price wars and aggressive pursuit of innovation. Companies must continually differentiate themselves through specialized services or cost-efficiency to maintain their position.

In 2024, the EMS market remains highly competitive, with major players like Foxconn, Pegatron, and Jabil Circuit actively vying for business. Even with overall market growth, intense competition exists within specific niches, forcing companies to offer compelling value propositions to attract and retain clients. This dynamic is further fueled by high exit barriers and significant customer switching costs.

| Competitor | 2024 Revenue Estimate (USD Billions) | Key Focus Area |

|---|---|---|

| Foxconn (Hon Hai Precision Industry) | >200 | Broad EMS, Consumer Electronics, Cloud |

| Pegatron | ~50-60 | Consumer Electronics, Communications |

| Jabil Circuit | ~30-35 | Healthcare, Cloud, Automotive, Industrial |

| Wistron | ~20-25 | Consumer Electronics, IT |

| Sanmina | ~8-10 | Communications, Medical, Defense |

SSubstitutes Threaten

In-house manufacturing presents a significant threat of substitution for electronics manufacturing services (EMS) providers like Plexus. Companies, especially those with substantial production volumes or highly proprietary intellectual property, may opt to build and maintain their own internal manufacturing capabilities. This can offer greater control over the production process and intellectual property, potentially reducing reliance on external partners.

For instance, some large technology firms have historically invested heavily in their own manufacturing infrastructure. While this requires substantial upfront capital and ongoing operational expertise, it can be a strategic choice for companies seeking to tightly integrate R&D with production or to secure a competitive advantage through specialized manufacturing processes. The ongoing advancements in automation and manufacturing technology also lower the barrier to entry for some in-house operations.

Technological advancements, such as the increasing integration of functionalities into single chips or the development of novel materials, pose a threat to traditional electronics manufacturing. For instance, advancements in printed electronics could offer a more cost-effective and flexible alternative for certain applications, potentially reducing the demand for complex, multi-component assemblies that Plexus specializes in. In 2023, the global printed electronics market was valued at approximately $3.5 billion and is projected to grow significantly, indicating a shift in manufacturing paradigms.

For less complex or higher-volume applications, customers might opt for readily available, standardized off-the-shelf electronic modules or complete products instead of custom-designed solutions from Plexus. This bypasses the need for a specialized EMS provider.

The market for standardized electronic components is vast, with many manufacturers offering broad product lines. For instance, in 2024, the global market for electronic components was valued in the hundreds of billions of dollars, indicating a significant availability of alternatives that don't require custom manufacturing.

When a product's functionality can be met by a widely available, mass-produced item, the incentive to engage a custom electronics manufacturing services (EMS) provider like Plexus diminishes. This is particularly true for applications where cost and speed to market are primary drivers, and unique technical specifications are not critical.

Software-Based Solutions

The increasing capability of software-based solutions presents a significant threat of substitutes for companies like Plexus, which often deal with complex hardware manufacturing. As software advances, it can increasingly replicate or augment functions previously requiring specialized physical components. This trend could diminish the demand for intricate electronics manufacturing, thereby acting as an indirect substitute for Plexus’s core services.

Consider the automotive industry, where advanced driver-assistance systems (ADAS) are increasingly software-driven, potentially reducing the need for certain dedicated hardware modules. In 2024, the global market for automotive software was projected to reach over $70 billion, highlighting the rapid growth and increasing sophistication of these solutions.

- Software replacing hardware functions: Complex tasks once requiring dedicated chips or circuits can now be handled by sophisticated algorithms running on more generalized processors.

- Reduced demand for physical electronics: This shift can lead to a decrease in the overall volume of physical electronic components needed, impacting manufacturers reliant on hardware production.

- Cost-effectiveness of software: Software solutions can often be more cost-effective to develop and deploy than custom hardware, making them an attractive alternative for businesses.

- Faster innovation cycles: Software development typically allows for quicker iteration and updates compared to hardware, enabling faster adaptation to market needs.

Direct Component Sourcing and Assembly

The threat of substitutes for Plexus's full-service product realization, particularly for larger clients, lies in direct component sourcing and in-house assembly. While these customers may not replicate Plexus's integrated approach, they can bypass the manufacturing and assembly services by managing these processes themselves, often using contract labor or specialized, albeit less comprehensive, assembly houses. This bypasses a significant portion of Plexus's value proposition.

For instance, a large electronics manufacturer might opt to source critical components directly from suppliers, leveraging their purchasing power. They could then contract with third-party logistics providers for warehousing and distribution, and utilize specialized assembly firms for the actual product build. This strategy allows them to potentially reduce costs on the manufacturing and assembly phases, even if it means sacrificing the end-to-end solutions Plexus provides.

- Direct Sourcing: Large clients can bypass Plexus by negotiating directly with component manufacturers, potentially securing better pricing due to volume.

- In-house or Contract Assembly: Companies may manage their own assembly lines or contract with specialized assembly houses that focus solely on the manufacturing process, not the full product realization.

- Cost Savings Potential: While sacrificing integration, these substitute methods can offer cost advantages for high-volume production runs.

- Reduced Complexity Management: By handling sourcing and assembly separately, clients can manage each stage with focused expertise, albeit with increased coordination effort.

The threat of substitutes for Plexus's services is multifaceted, encompassing both technological shifts and alternative business models. Companies can opt for in-house manufacturing, direct component sourcing with contract assembly, or even software-based solutions that reduce the need for physical hardware. These alternatives can offer cost efficiencies or greater control, impacting demand for integrated EMS providers.

For instance, the increasing sophistication of software solutions is a significant substitute. In 2024, the global automotive software market was projected to exceed $70 billion, demonstrating how software can increasingly replace functions previously requiring specialized hardware modules. This trend directly impacts the demand for complex electronics manufacturing.

Furthermore, the availability of standardized electronic modules and off-the-shelf products provides a substitute for custom solutions. The global electronic components market, valued in the hundreds of billions in 2024, highlights the vast array of readily available alternatives that bypass the need for specialized manufacturing services.

The threat also extends to clients managing their own sourcing and assembly. By leveraging their purchasing power for direct component sourcing and contracting with specialized assembly houses, clients can potentially reduce costs, even if it means sacrificing the end-to-end integration offered by firms like Plexus.

| Substitute Type | Description | Impact on EMS Providers | Example/Data Point |

|---|---|---|---|

| In-house Manufacturing | Companies building their own production capabilities. | Reduces reliance on external EMS providers. | Large tech firms investing in internal infrastructure. |

| Software-based Solutions | Software replicating hardware functions. | Decreases demand for physical electronic components. | Automotive ADAS market projected over $70 billion in 2024. |

| Off-the-Shelf Modules | Standardized, mass-produced electronic units. | Bypasses need for custom design and manufacturing. | Global electronic components market in hundreds of billions (2024). |

| Direct Sourcing & Contract Assembly | Clients manage component procurement and outsource assembly. | Reduces demand for integrated EMS services. | Clients leveraging purchasing power and specialized assembly houses. |

Entrants Threaten

Establishing a robust Electronic Manufacturing Services (EMS) company, particularly one geared towards intricate, lower-volume production, demands significant upfront capital. This includes investments in cutting-edge machinery, controlled environment cleanrooms, and advanced data management systems. For instance, a state-of-the-art SMT line alone can cost upwards of $500,000, with comprehensive facility upgrades easily reaching millions.

These substantial capital requirements act as a formidable barrier, effectively deterring many aspiring new entrants from entering the EMS market. The sheer scale of investment needed to compete on quality and capability means only well-funded organizations can realistically consider establishing a presence, thus limiting the threat of new competitors.

The threat of new entrants in high-complexity electronics manufacturing is significantly mitigated by the need for deep engineering expertise and specialized technology. Developing proprietary processes and acquiring the necessary technical know-how requires substantial investment in time and resources. For instance, companies like TSMC, a leader in semiconductor manufacturing, invest billions annually in research and development to maintain their technological edge, making it incredibly difficult for newcomers to compete on a technological level.

Operating in sectors like healthcare and aerospace, Plexus faces substantial regulatory and certification challenges. For instance, companies in the medical device industry must navigate FDA approval processes, which can be lengthy and costly, deterring new entrants. Similarly, aerospace manufacturers require AS9100 certification, a rigorous standard that demands significant investment in quality management systems.

Established Customer Relationships and Reputation

Plexus has cultivated deep, long-standing relationships with a diverse clientele, building a formidable reputation for unwavering reliability and exceptional quality. This established trust is a significant barrier for newcomers aiming to penetrate the market.

New entrants must overcome the considerable hurdle of disrupting these entrenched customer networks and earning the trust necessary to compete for high-value, intricate contracts. For instance, in the aerospace sector, where Plexus is a major player, securing initial contracts often requires extensive vetting and proven performance, which can take years to achieve.

- Established Trust: Plexus's history of consistent delivery and quality fosters strong customer loyalty, making it difficult for new competitors to gain traction.

- Reputational Capital: A strong reputation for reliability and expertise in complex manufacturing processes acts as a significant deterrent to potential new entrants.

- Contractual Hurdles: Securing initial contracts, especially in highly regulated industries like aerospace and defense, demands a proven track record, which new companies lack.

- Customer Inertia: Existing customers are often reluctant to switch suppliers due to the perceived risks and costs associated with onboarding new partners, especially for critical components.

Supply Chain Complexity and Scale

The intricate global supply chain for specialized electronics components presents a significant barrier for new entrants. Plexus manages a vast network of thousands of diverse parts, demanding substantial scale and advanced logistical systems. For instance, in 2024, the electronics manufacturing services (EMS) industry, where Plexus operates, continued to grapple with supply chain disruptions, highlighting the critical need for established relationships and robust management capabilities.

Replicating Plexus's established supplier relationships and the efficiency of its complex network would be a formidable and costly undertaking for any new competitor. Building such a sophisticated system requires years of investment and operational refinement, making it difficult for newcomers to compete on cost and reliability.

- Scale of Operations: Plexus's ability to source and manage a vast array of specialized components globally is a key differentiator.

- Supplier Relationships: Years of cultivating strong ties with suppliers provide Plexus with preferential access and terms.

- Logistical Sophistication: Advanced systems are required to efficiently manage the flow of thousands of diverse parts.

- Cost and Efficiency: New entrants would face significantly higher initial costs and operational inefficiencies in building a comparable supply chain.

The threat of new entrants in the electronics manufacturing services (EMS) sector, particularly for complex, lower-volume production, is significantly curtailed by immense capital requirements. Establishing a facility with advanced machinery, cleanrooms, and data systems can easily run into millions of dollars. For example, a single state-of-the-art SMT line can cost over $500,000, presenting a substantial initial investment hurdle.

Furthermore, the need for deep engineering expertise and specialized technology creates another formidable barrier. Developing proprietary processes and acquiring the necessary technical know-how demands years of investment and resources, making it difficult for newcomers to challenge established players technologically.

Regulatory and certification hurdles, especially in industries like aerospace and healthcare, add further complexity. Navigating FDA approvals or achieving AS9100 certification requires significant time and financial commitment, effectively deterring many potential entrants.

The established trust and long-standing relationships Plexus has with its clients are also critical deterrents. New entrants must overcome the challenge of disrupting these entrenched networks and proving their reliability, a process that can take years, especially in sectors like aerospace where initial contracts demand extensive vetting and proven performance.

Finally, the intricate global supply chain for specialized electronic components, managed by companies like Plexus, represents a significant barrier. Replicating the scale, supplier relationships, and logistical sophistication of an established player would be a costly and time-consuming endeavor for any new competitor.

| Barrier Type | Description | Estimated Cost/Timeframe |

| Capital Requirements | Investment in advanced machinery, cleanrooms, and IT infrastructure. | Millions of dollars for a comprehensive facility. |

| Technological Expertise | Development of proprietary processes and acquisition of specialized know-how. | Billions invested annually by industry leaders in R&D. |

| Regulatory Compliance | Meeting stringent industry standards and certifications (e.g., FDA, AS9100). | Lengthy and costly approval processes. |

| Customer Relationships | Building trust and securing contracts in established client networks. | Years of proven performance and vetting. |

| Supply Chain Management | Establishing and managing a complex global network of component suppliers. | Years of investment and operational refinement. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company financial statements, and expert interviews to provide a comprehensive view of competitive dynamics.