Pets at Home Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pets at Home Group Bundle

Pets at Home Group is a dominant force in the UK pet care market, leveraging strong brand recognition and a comprehensive omni-channel strategy. However, understanding the nuances of their competitive landscape, potential regulatory shifts, and evolving consumer demands is crucial for sustained success.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Pets at Home Group Plc commands a dominant position in the UK pet care sector, offering a complete suite of services including retail, veterinary care through Vets for Pets and Companion Care, and grooming via The Groom Room. This integrated approach creates a convenient hub for pet owners, driving customer retention and encouraging repeat purchases.

The company's integrated ecosystem, particularly the strong performance of its veterinary division, acts as a significant profit driver and a key differentiator against rivals. As of the fiscal year ending March 2024, Pets at Home reported a 6.8% increase in revenue for its Vet Group, highlighting its robust contribution to the overall business.

The Vet Group division is a powerhouse for Pets at Home, consistently delivering impressive growth and becoming a major profit driver. This segment’s strength is evident in its FY2025 performance, where vet business revenue surged by 13%, contributing more than half of the Group's underlying profit before tax.

This robust expansion is fueled by a combination of factors, including a rise in customer visits and an increase in the average amount spent per transaction. Furthermore, the success of their Care Plans is a key enabler, making essential veterinary services more attainable and budget-friendly for a growing number of pet owners.

Pets at Home boasts a robust customer loyalty program, with its Pets Club membership soaring to 8.2 million in fiscal year 2025. This significant membership base is a goldmine for data, offering deep insights into pet owner habits and preferences.

The company effectively leverages this rich customer data, coupled with strategies like auto-enrolment on its new digital platform, to deliver highly personalized marketing campaigns and services. This targeted approach is instrumental in fostering strong customer retention and driving repeat business.

Omnichannel and Digital Transformation

Pets at Home Group has made substantial investments in its digital infrastructure, notably launching a new digital platform and consolidating its distribution network into a single, optimized center. This strategic move underpins a powerful omnichannel strategy, ensuring a smooth and integrated experience for customers whether they shop online or in physical stores.

The company's digital platform has demonstrated impressive growth, particularly in subscription services and app-based sales. For instance, in the fiscal year ending March 2024, the digital segment continued to be a key growth driver, with the company reporting a strong uptake in its subscription services, contributing significantly to revenue. This digital focus is crucial for Pets at Home's future expansion and operational efficiency.

- Digital Platform Growth: Continued strong performance in subscriptions and app sales, reflecting successful digital transformation.

- Omnichannel Integration: Seamless online and in-store experiences are a key competitive advantage.

- Distribution Network Optimization: A single, efficient distribution center supports the omnichannel model and cost savings.

- Future Potential: The digital investments position the company well for sustained growth in an increasingly online retail environment.

Commitment to Pet Welfare and Sustainability

Pets at Home Group's core purpose, 'to create a better world for pets and the people who love them,' is a significant strength, driving initiatives like pet adoption and welfare advice. This resonates strongly with modern pet owners who view their pets as family, prioritizing quality, wellness, and ethical practices. In 2024, the company continued to emphasize this, with their adoption centers facilitating thousands of successful rehomings, demonstrating a tangible impact on pet welfare.

The company's dedication to sustainability is also a key differentiator. Efforts to sustainably source private label products and reduce plastic packaging, a trend observed throughout 2024 and into early 2025, directly address growing consumer environmental consciousness. This commitment is not just ethical; it's a strategic advantage in a market where consumers increasingly favor brands with strong environmental credentials.

- Clear Purpose: 'A better world for pets and the people who love them' guides operations and builds brand loyalty.

- Pet Welfare Focus: Facilitating pet adoption and providing welfare advice attracts and retains ethically-minded customers.

- Sustainability Initiatives: Sustainable sourcing and plastic reduction efforts align with increasing consumer demand for eco-friendly products.

- Brand Reputation: These commitments foster a positive brand image, enhancing customer perception and trust.

Pets at Home Group's integrated model, particularly its strong veterinary division, is a significant strength. The Vet Group revenue grew by 13% in FY2025, contributing over half of the Group's profit before tax, demonstrating its role as a key profit driver and differentiator.

The company's extensive customer loyalty program, with 8.2 million Pets Club members in FY2025, provides valuable data for personalized marketing and drives repeat business.

Significant investments in a new digital platform and an optimized distribution network underpin a powerful omnichannel strategy, ensuring a seamless customer experience and positioning the company for future growth in online retail.

Pets at Home's core purpose, focused on pet welfare and sustainability, resonates with ethically-minded consumers, enhancing brand reputation and customer loyalty.

What is included in the product

This SWOT analysis offers a comprehensive view of Pets at Home Group's internal strengths and weaknesses, alongside external opportunities and threats, to understand its strategic positioning and future prospects.

Offers a clear, actionable framework to identify and address Pets at Home Group's strategic challenges and opportunities.

Weaknesses

Despite the veterinary segment's success, the retail division of Pets at Home Group has faced significant headwinds. In the fiscal year 2025, consumer retail revenue saw a decline of 1.8%, signaling a tough retail environment. This underperformance suggests that factors like cautious consumer spending and a return to pre-pandemic pet ownership levels are impacting sales.

The company's substantial Pets Club membership, a strong asset, has not yet translated into the desired retail revenue growth. This presents a key challenge for Pets at Home to better leverage its loyal customer base and convert membership into increased purchasing activity within its retail offerings.

Pets at Home Group's significant reliance on the UK market presents a key weakness. This geographic concentration means the company is highly exposed to the economic health and regulatory landscape of a single country, making it vulnerable to localized downturns or policy shifts.

While a strong UK presence is an advantage, the absence of international diversification could hinder long-term growth opportunities. Competitors with a global footprint may be better positioned to weather regional economic storms and tap into broader market expansion, leaving Pets at Home susceptible to concentrated market risks.

Pets at Home's recent move to a new digital platform and a consolidated distribution center, while a strategic move for future expansion, has naturally brought about some bumps in the road. These operational shifts, often referred to as transitionary impacts, have led to increased non-underlying costs. For instance, the company reported that the integration of its new IT system contributed to a £14 million increase in costs during the first half of fiscal year 2024, impacting its bottom line.

These changes can cause temporary disruptions, like occasional issues with product availability, and these disruptions come with their own set of expenses. Such short-term challenges can affect immediate profitability and how smoothly operations run day-to-day, even as the company aims for greater efficiency in the long run.

Vulnerability to Economic Headwinds

Pets at Home is susceptible to downturns in the wider economy. For instance, the company observed subdued growth in the pet sector during FY2025, directly linked to a challenging UK consumer environment. This sensitivity means that as economic conditions worsen, consumer spending on pets can decline.

Inflation and increasing costs of living can significantly impact discretionary spending, which includes items like pet accessories and premium pet foods. This poses a hurdle for the recovery of the retail segment, as consumers may cut back on non-essential pet purchases during tougher economic times.

- Economic Sensitivity: The business model is directly influenced by the broader economic climate.

- FY2025 Observation: Noted subdued growth in the pet sector due to a soft UK consumer backdrop.

- Impact on Retail: Inflation and rising living costs can reduce discretionary spending on pet products.

- Consumer Confidence: Lower consumer confidence directly affects purchasing decisions for premium pet items.

Competition in the Online and Discount Market

Pets at Home contends with formidable competition from online-only players and discount retailers. These competitors often leverage lower overheads to offer more aggressive pricing and convenient direct-to-door delivery, particularly impacting sales of pet food and accessories. For instance, the UK online retail market for pet products saw significant growth in 2024, with pure-play e-commerce businesses capturing a larger share.

This intense rivalry puts pressure on Pets at Home's retail margins and market share. To counter this, the company must continually invest in competitive pricing strategies and develop unique value propositions beyond just product availability. The ongoing price sensitivity among consumers in the pet care sector, especially for staple items, makes this a critical challenge.

- Intensified Online Competition: Pure-play online retailers in the UK pet market experienced an estimated 15% year-on-year growth in 2024, challenging Pets at Home's established presence.

- Price Sensitivity: A significant portion of UK pet owners, particularly those purchasing pet food, are highly responsive to price differences, impacting retailer margins.

- Delivery Convenience: Competitors offering faster or more flexible delivery options can draw customers away from traditional omnichannel models.

The company's retail division faces challenges, with consumer retail revenue declining by 1.8% in fiscal year 2025 due to cautious consumer spending. Despite a large Pets Club membership, converting this loyalty into increased retail purchases remains a hurdle. Furthermore, the heavy reliance on the UK market exposes Pets at Home to localized economic downturns and regulatory changes, lacking international diversification for broader growth.

What You See Is What You Get

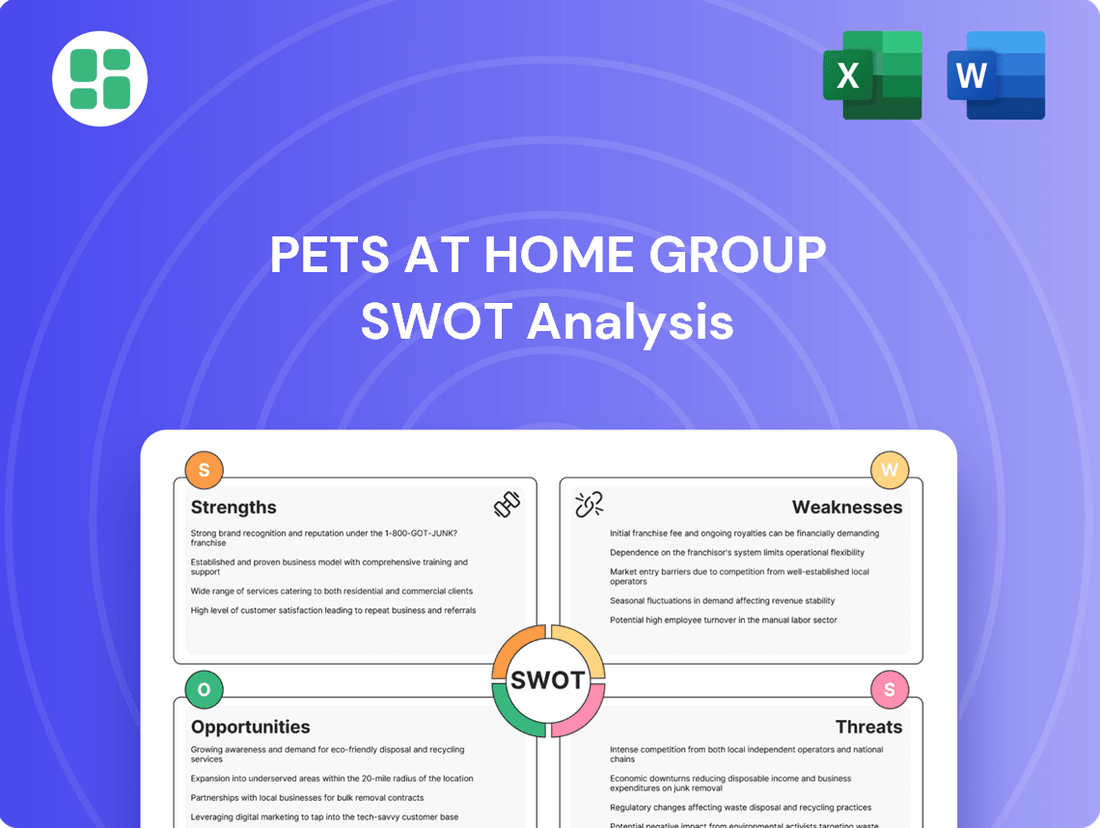

Pets at Home Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a comprehensive overview of Pets at Home Group's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is unlocked upon purchase, offering actionable insights for strategic planning.

Opportunities

Pets at Home's Vet Group has shown robust performance, with strategic plans to speed up the opening of new joint-venture practices and extensions. This expansion is a key opportunity to boost revenue and profitability.

Further developing and broadening these higher-margin veterinary and grooming services, particularly in urban areas with less market penetration, offers a clear path for consistent revenue and profit increases. The company can effectively utilize its existing retail locations to support this growth.

Pets at Home Group's investment in its digital platform, coupled with a growing Pets Club membership, presents a significant opportunity to bolster subscription services. This expansion into recurring revenue streams for essentials like pet food and treatments is a key strategic move.

By leveraging the data gathered from its digital channels and the Pets Club, the company can offer highly personalized product and service recommendations. This data-driven approach is crucial for increasing customer loyalty and maximizing their lifetime value.

For instance, as of early 2024, Pets at Home reported a substantial increase in its customer base, with digital engagement showing strong year-on-year growth. This digital footprint is the bedrock for scaling subscription models, which are projected to contribute increasingly to overall revenue by 2025.

The growing trend of pet humanization, where owners increasingly view their pets as family members, is a significant opportunity. This shift fuels demand for premium pet food, natural ingredients, and advanced veterinary care. Pets at Home is well-positioned to benefit by expanding its offerings in these high-growth segments, potentially introducing more specialized nutrition lines and enhanced pet wellness services.

Strategic Partnerships and Acquisitions

Pets at Home could significantly enhance its market position by forging strategic partnerships or acquiring smaller, forward-thinking pet businesses. This approach allows for rapid expansion into new service areas, such as advanced pet tech or specialized wellness products, and can quickly boost market share. For instance, a partnership with a leading pet telehealth platform could offer immediate access to a growing digital health market.

This inorganic growth complements Pets at Home's existing organic expansion, particularly in burgeoning sectors like pet technology and niche health solutions. The company's strong financial standing, with reported revenue of £1.4 billion for the fiscal year ending March 2024, provides a solid foundation for such strategic investments.

- Expand Service Offerings: Target partnerships with companies specializing in pet insurance comparison, advanced diagnostic tools, or personalized pet nutrition plans.

- Enter New Niches: Acquire businesses focused on sustainable pet products, premium pet food brands, or innovative pet training solutions.

- Gain Market Share: Bolt-on acquisitions in underserved geographic regions or specific pet care segments can solidify competitive advantage.

- Leverage Technology: Invest in or acquire companies developing AI-driven pet health monitoring systems or subscription-based pet wellness platforms.

Optimizing Store Formats and Locations

Pets at Home is strategically expanding its reach by opening smaller, more accessible city stores, a move that has seen them target areas like London which were previously less covered. This focus on urban convenience, alongside refitting existing locations, aims to capture new customer bases. For instance, by early 2024, the company had a significant presence in London, with plans to further optimize its store network.

This adaptation of store formats is a key opportunity. By tailoring the size and offerings to specific demographics and urban settings, Pets at Home can improve customer access and create a more seamless blend of retail shopping and pet services. This approach is crucial for maximizing engagement in diverse market segments.

The company's store optimization strategy is reflected in its ongoing investment in its physical footprint. As of their fiscal year ending March 2024, Pets at Home continued to invest in store refurbishments and strategic openings, demonstrating a commitment to enhancing customer experience and market penetration through format and location refinement.

- Targeted Urban Expansion: Opening smaller city stores to tap into previously underserved urban markets, particularly in London, as part of their growth strategy.

- Format Adaptation: Refitting existing stores and developing new formats to better suit diverse customer demographics and urban environments, enhancing accessibility.

- Integrated Offerings: Optimizing store layouts to more effectively combine retail sales with a full suite of pet services, creating a one-stop destination for pet owners.

- Strategic Network Growth: Continued investment in store refurbishments and new openings throughout fiscal year 2024 to strengthen market presence and customer convenience.

Pets at Home can capitalize on the growing pet humanization trend by expanding premium food and advanced veterinary services, aligning with owners' view of pets as family. Strategic partnerships or acquisitions of innovative pet tech or wellness businesses, such as a telehealth platform, could rapidly boost market share and introduce new service areas. The company's strong financial performance, with reported revenue of £1.4 billion for FY24, provides a solid base for such strategic moves.

| Opportunity Area | Key Actions | Potential Impact |

|---|---|---|

| Service Expansion & Partnerships | Collaborate with pet insurance comparison sites, diagnostic tool providers, or personalized nutrition services. | Increased revenue streams and enhanced customer value proposition. |

| Niche Market Entry | Acquire businesses focused on sustainable products, premium food, or innovative training. | Diversification of offerings and access to new customer segments. |

| Digital & Subscription Growth | Leverage digital platform and Pets Club for personalized offers and subscription services. | Enhanced customer loyalty and predictable recurring revenue. |

| Urban Store Strategy | Open smaller, accessible city stores and optimize existing locations. | Improved customer convenience and penetration in underserved urban areas. |

Threats

The UK pet care market is intensely competitive, facing pressure from major supermarkets, expansive online retailers, and niche independent pet shops. This crowded landscape means Pets at Home must constantly innovate to stand out.

Emerging business models, particularly direct-to-consumer subscription services for pet food and the ongoing shift towards online purchasing, pose a significant disruption risk. If Pets at Home can't adapt and maintain its competitive advantage in this evolving retail environment, its profit margins could face considerable strain.

The ongoing economic uncertainty, marked by persistent inflation and a generally subdued consumer backdrop, presents a significant threat to Pets at Home Group. This economic climate directly impacts discretionary spending, meaning consumers might cut back on non-essential pet products and services.

Consumers are likely to shift towards more budget-friendly alternatives for pet food and supplies. Furthermore, they may postpone or reduce spending on services like non-essential veterinary visits or grooming appointments. This trend could directly affect both the retail and service revenue streams for the company.

The Competition and Markets Authority (CMA) investigation into the UK veterinary market poses a significant regulatory threat to Pets at Home. The outcome could force alterations to pricing, ownership, or operational methods, potentially affecting the profitability of its Vet Group, which is a key growth driver.

Any mandated changes to the joint venture model, which has been instrumental in the Vet Group's success, could disrupt its established operations and financial performance. For instance, if the CMA mandates divestments or changes to partnership structures, it could directly impact the revenue streams and strategic flexibility of Pets at Home's veterinary arm.

Rising Operating Costs

Pets at Home is contending with a notable escalation in its operating expenses. These pressures stem from external factors such as adjustments in National Insurance contributions and new packaging regulations. Additionally, the company is addressing the cost associated with rebuilding its variable pay structures.

These combined cost increases are projected to represent a substantial burden in the upcoming financial year. For instance, the company has previously highlighted the impact of inflation on its cost base. Without successful mitigation strategies, such as driving sales or achieving greater operational efficiencies, these rising costs could negatively impact profit margins.

- National Insurance Contribution Changes: These government-imposed shifts directly add to labor costs.

- New Packaging Regulations: Compliance with evolving environmental standards for packaging materials often necessitates more expensive alternatives.

- Variable Pay Rebuild: Adjustments to employee compensation, particularly performance-related pay, can increase overall wage bills.

- Inflationary Pressures: Broader economic inflation affects the cost of goods, services, and utilities essential for operations.

Changes in Pet Ownership Trends or Pet Health Concerns

Shifts in how people own pets, such as fewer households owning multiple pets or a move towards smaller, less demanding animals, could affect the demand for Pets at Home's extensive product and service offerings. For instance, while the UK saw a significant surge in pet acquisition during the pandemic, with estimates suggesting millions of new pets entered households, there are indications that this growth may be normalizing. This normalization could mean slower revenue expansion compared to the peak pandemic years.

Furthermore, the emergence of widespread animal health crises or new, costly pet-related diseases presents a significant threat. Such events could not only increase operational costs for the company through higher veterinary supply demands or specialized services but also alter consumer spending habits, potentially leading them to prioritize essential care over discretionary purchases. For example, if a novel, expensive-to-treat illness became prevalent, customers might cut back on premium food or grooming services.

The pet population's demographic changes are also a factor. A potential aging pet population, for instance, might require different types of products and veterinary care, demanding adaptability in the company's inventory and service provision. This could necessitate investment in specialized health products or geriatric care services.

- Normalization of Pet Ownership Growth: Post-pandemic pet acquisition rates are expected to stabilize, potentially slowing the rapid growth seen in 2020-2021.

- Impact of Animal Health Crises: Widespread diseases could increase operational costs and shift consumer spending towards essential veterinary services, impacting sales of other product categories.

- Demographic Shifts in Pet Population: An aging pet demographic may require a pivot towards specialized health products and services, necessitating strategic adjustments in product sourcing and service development.

Intense competition from supermarkets, online retailers, and independent shops pressures Pets at Home to continually innovate. Evolving business models like direct-to-consumer subscriptions and the ongoing shift to online purchasing pose disruption risks, potentially straining profit margins if the company fails to adapt.

Economic uncertainty, including inflation, impacts discretionary spending, leading consumers to seek budget-friendly alternatives for pet food and supplies, and potentially delaying non-essential services like grooming. The CMA's investigation into the veterinary market is a significant regulatory threat, with potential outcomes impacting pricing, ownership, and operations of its Vet Group.

Rising operating expenses, driven by changes in National Insurance contributions, new packaging regulations, and variable pay structure adjustments, are projected to be a substantial burden. For instance, these combined cost increases could significantly impact profit margins without effective mitigation strategies, as highlighted by previous inflationary pressures on the company's cost base.

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary to ensure a robust and accurate SWOT assessment for Pets at Home Group.