Pets at Home Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pets at Home Group Bundle

Discover the core strategies that make Pets at Home Group a leader in the pet care industry. This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their success. Unlock the full blueprint to understand their competitive edge.

Partnerships

Pets at Home Group’s veterinary segment thrives through a distinctive joint venture partnership model. This structure empowers individual veterinary professionals to own and operate their Vets for Pets and Companion Care clinics, fostering deep commitment and entrepreneurial drive.

This unique approach has been a significant engine for growth, enabling rapid expansion across the UK. By aligning the interests of the operating veterinarians with the overall success of the group, Pets at Home ensures a high standard of dedicated patient care and has seen its vet group achieve market outperformance.

Pets at Home Group maintains strong relationships with a wide array of pet food and product suppliers, ensuring a broad selection for customers. This includes exclusive collaborations, such as their partnership with Butternut Box to offer fresh dog food, a segment experiencing significant growth.

The company also prioritizes sustainable sourcing, exemplified by its work with Project Blu for eco-friendly pet accessories. These strategic alliances are vital for staying competitive, adapting to evolving consumer preferences for sustainability, and maintaining a diverse and appealing product catalog.

Pets at Home Group actively collaborates with prominent pet adoption and welfare charities, including the Blue Cross. These partnerships are crucial for facilitating pet adoptions and bolstering animal welfare efforts across the UK.

Through these collaborations, Pets at Home supports initiatives like feeding pets for a day via food bank partnerships, demonstrating a tangible commitment to animal well-being. In 2023, their efforts with the RSPCA, for example, saw over 2,000 animals rehomed.

These strategic alliances significantly enhance Pets at Home's brand reputation, reinforcing their core purpose of creating a better world for pets. Such community engagement builds customer loyalty and strengthens their position as a responsible leader in the pet care industry.

Technology and Digital Platform Partners

Pets at Home Group actively cultivates strategic alliances with leading technology providers, notably Microsoft. These collaborations are instrumental in the continuous development and enhancement of their digital platform, mobile application, and e-commerce functionalities. The focus is on leveraging advanced technologies like Artificial Intelligence to streamline operations and elevate the online customer journey, particularly for subscription services.

These digital investments are foundational for the company's future expansion. By integrating all aspects of pet care, from veterinary services to retail products, onto a robust digital infrastructure, Pets at Home aims to create a seamless and comprehensive experience for its customers. This digital-first approach is a critical enabler for evolving customer expectations and maintaining a competitive edge in the market.

- Microsoft Partnership: Enhancing digital platform, app, and e-commerce capabilities.

- AI Integration: Driving operational efficiency and improving online shopping and subscription experiences.

- Digital Infrastructure Investment: Building a foundation for future growth and integrated pet care services.

Logistics and Distribution Partners

Pets at Home Group leverages a network of logistics and distribution partners to ensure its extensive product range reaches customers efficiently. This includes crucial relationships for managing its supply chain and the operation of its recently opened, state-of-the-art distribution centre (DC).

The company's commitment to efficient logistics is paramount, directly impacting product availability across its vast store footprint and for the growing volume of online orders. This focus on operational capability is underscored by a significant investment in consolidating operations into a single, modern DC, designed to enhance service levels and product availability throughout 2024 and beyond.

Key aspects of these partnerships include:

- Supply Chain Management: Partners are integral to managing inventory flow from suppliers to the DC and then to stores and customers.

- Distribution Centre Operations: The group relies on its logistics partners for the day-to-day running of its primary distribution hub, ensuring seamless order fulfillment.

- Last-Mile Delivery: Collaborations with delivery providers are essential for timely and reliable customer deliveries, both for online purchases and potentially for store replenishment.

- Network Optimization: Logistics partners contribute to optimizing the distribution network, aiming to reduce costs and improve delivery times, a critical factor in maintaining competitive advantage.

Pets at Home Group’s veterinary segment thrives through a distinctive joint venture partnership model with individual veterinary professionals who own and operate their clinics. This fosters deep commitment and has driven rapid expansion across the UK, with the vet group achieving market outperformance.

The company maintains strong supplier relationships, including exclusive collaborations like the one with Butternut Box for fresh dog food, a rapidly growing segment. They also partner with welfare charities such as the Blue Cross, facilitating adoptions and supporting animal welfare initiatives; in 2023, their efforts with the RSPCA alone led to over 2,000 animals being rehomed.

Strategic alliances with technology providers like Microsoft are crucial for enhancing their digital platform, mobile app, and e-commerce, with a particular focus on AI integration to improve operations and customer experiences for subscription services.

Furthermore, the group relies on logistics and distribution partners to manage its supply chain and distribution centre operations, ensuring efficient product availability across its stores and for online orders. This network is vital for their operational capability, especially with the consolidation of operations into a new, state-of-the-art distribution centre in 2024.

What is included in the product

Pets at Home Group operates a vertically integrated model, offering a wide range of pet products and services through its retail stores and online channels, supported by veterinary practices and grooming salons.

This business model focuses on building customer loyalty through a strong brand, convenient omni-channel access, and a comprehensive "one-stop-shop" approach for pet owners' needs.

The Pets at Home Group Business Model Canvas acts as a pain point reliver by offering a structured, visual representation of their operations, enabling quick identification of customer needs and potential service gaps.

This allows for efficient problem-solving and strategic adjustments, ultimately enhancing the pet owner experience and addressing common frustrations within the pet care industry.

Activities

Pets at Home's retail sales and merchandising are central to its operations, encompassing the sale of a vast selection of pet food, accessories, and supplies. This includes managing stock efficiently and presenting products attractively in their physical stores and on their digital channels.

The company focuses on enhancing its product offerings, notably expanding into innovative areas like frozen and freeze-dried pet foods. This strategic merchandising is crucial for driving customer engagement and sales within the retail segment, which forms the backbone of their revenue generation.

In the fiscal year ending March 2024, Pets at Home reported retail sales growth, with their merchandise division playing a significant role. For instance, their own-brand products often see strong performance, contributing to overall sales volumes.

A core activity for Pets at Home Group is delivering veterinary services via its Vets for Pets and Companion Care brands. This encompasses routine check-ups, specialized treatments, and managing preventative care plans for pets.

The company actively works to expand its clinical capacity, ensuring a high standard of care and accessibility for pet owners. This focus on service delivery is crucial to their customer retention and overall business health.

In 2024, the veterinary division continued its robust growth trajectory, significantly contributing to the group's underlying profit. This segment represents a key pillar of the Pets at Home strategy, demonstrating the financial importance of their veterinary offerings.

The Groom Room salons are a cornerstone of Pets at Home Group's business model, providing essential pet grooming services. These salons are strategically located within the retail stores, offering customers a convenient, one-stop shop for their pet's needs, from food and accessories to expert grooming. This integration significantly enhances the in-store customer experience and drives foot traffic.

In 2024, Pets at Home Group continued to emphasize the value of its grooming services as a key differentiator. The company reported that its Groom Room services are a significant driver of customer loyalty and repeat business, with many customers utilizing both retail and grooming offerings during a single visit. This synergy strengthens the overall ecosystem and contributes to a higher customer lifetime value.

Developing and Managing Digital Platforms

Pets at Home Group's digital platform development is a core activity, focusing on its app and website to improve the online customer experience. This includes refining subscription services and utilizing customer data to create personalized promotions and offers, thereby driving engagement and loyalty.

The company's digital transformation strategy is designed to create a unified ecosystem where all pet-related products, services, and expert advice are easily accessible. This integration aims to provide a seamless and comprehensive solution for pet owners, reinforcing the brand's position as a trusted partner.

- Digital Platform Enhancement: Ongoing investment in the app and website to improve user interface and functionality.

- Subscription Services: Expanding and optimizing subscription models for recurring revenue and customer retention.

- Data Leverage: Utilizing customer data for personalized marketing and service offerings.

- Omnichannel Integration: Connecting online and in-store experiences for a seamless customer journey.

Pet Welfare and Community Engagement

Pets at Home actively engages in pet welfare by facilitating pet adoptions and offering expert pet care advice, reinforcing their brand purpose. In 2023, their Vet Group saw a 9.4% revenue growth, partly driven by increased customer engagement with their services, which includes welfare advice.

Community initiatives are also a cornerstone, with partnerships like pet food banks and significant colleague volunteering hours. For instance, in the financial year ending March 2024, Pets at Home colleagues contributed over 14,000 volunteering hours to various community causes, including those supporting animal welfare.

- Pet Adoption: Facilitating the rehoming of pets through partnerships with rescue centers.

- Expert Advice: Providing customers with guidance on responsible pet ownership and care.

- Community Partnerships: Collaborating with pet food banks and local charities.

- Colleague Volunteering: Encouraging staff to dedicate time to welfare and community projects.

Pets at Home Group's key activities revolve around its extensive retail operations, offering a wide array of pet food and accessories. They also provide crucial veterinary services through their Vets for Pets and Companion Care brands, focusing on both routine and specialized care. Furthermore, the company operates Groom Room salons, offering professional grooming services conveniently located within their retail stores.

Digital platform enhancement is a significant focus, aiming to create a seamless omnichannel experience for customers. This includes improving their app and website, optimizing subscription services, and leveraging customer data for personalized engagement. Community engagement and pet welfare are also core activities, demonstrated through facilitating pet adoptions and extensive colleague volunteering.

| Key Activity | Description | 2024 Financial Impact/Data |

|---|---|---|

| Retail Sales & Merchandising | Selling pet food, accessories, and supplies, with an emphasis on own-brand products and innovative offerings like frozen foods. | Retail sales growth reported for FY ending March 2024; own-brand products contribute significantly to volume. |

| Veterinary Services | Providing comprehensive pet healthcare, including check-ups, treatments, and preventative care plans. | Veterinary division showed robust growth in 2024, a key contributor to underlying profit. |

| Grooming Services (The Groom Room) | Offering professional pet grooming, integrated within retail stores for customer convenience. | Drives customer loyalty and repeat business; enhances in-store customer experience and foot traffic. |

| Digital Platform Development | Enhancing the app and website for improved customer experience, subscription services, and data-driven personalization. | Aims for a unified ecosystem, connecting online and in-store experiences for seamless customer journeys. |

| Pet Welfare & Community Engagement | Facilitating pet adoptions, providing expert advice, and engaging in community initiatives like pet food banks. | Colleagues contributed over 14,000 volunteering hours in FY ending March 2024 to community causes. |

Preview Before You Purchase

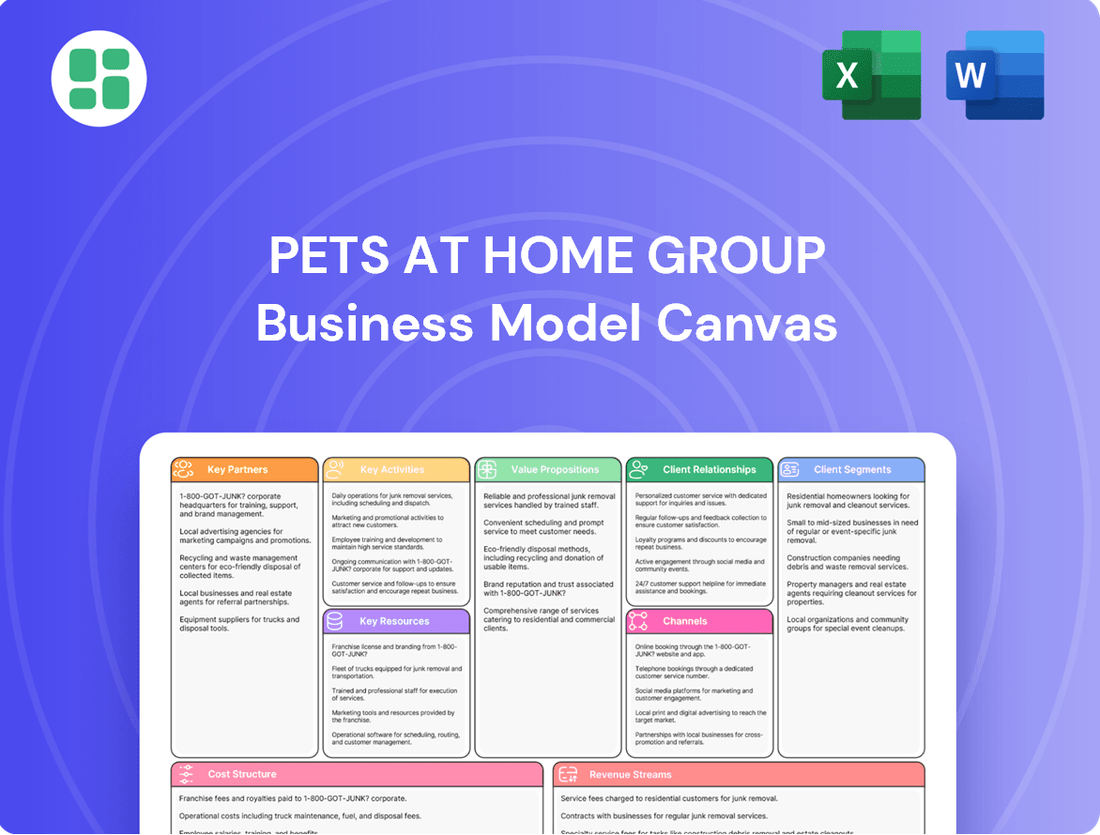

Business Model Canvas

The Business Model Canvas for Pets at Home Group that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the professional layout and content you see here are precisely what will be delivered, ready for your analysis and application.

Resources

Pets at Home Group's extensive retail store and service network is a cornerstone of its business model. With over 450 pet care centres strategically located across the UK, the company offers unparalleled convenience. Many of these locations are designed as integrated hubs, combining retail offerings with veterinary practices and grooming salons, creating a comprehensive one-stop shop for pet owners.

This physical footprint is not static; Pets at Home actively invests in expanding and modernizing its network. In 2024, the company continued its program of store openings and refurbishments, ensuring its facilities remain state-of-the-art and cater to evolving customer needs. This commitment to its physical presence directly supports customer accessibility and reinforces its market position.

Pets at Home Group leverages a powerful, unified brand portfolio, primarily under the 'Pets' master brand. This includes its retail arm, veterinary services (Vets for Pets/Companion Care), and grooming services (The Groom Room). This cohesive branding significantly enhances customer trust and recognition within the pet care market.

The company's strong brand equity is a crucial asset, simplifying the customer experience and solidifying its image as a comprehensive, one-stop shop for all pet needs. This unified approach reinforces their market position and customer loyalty.

In 2024, Pets at Home Group continued to benefit from this brand strength. For the fiscal year ending March 28, 2024, the company reported total revenue of £1,464.5 million, a testament to the enduring appeal and trust associated with its consolidated brand presence.

Skilled Veterinary and Grooming Professionals are a cornerstone of the Pets at Home Group's value proposition. This highly trained workforce, encompassing veterinarians, vet nurses, and groomers, directly delivers the high-quality services that differentiate the company. Their expertise is crucial for building customer trust and loyalty.

The company's commitment to its people is evident in its ongoing investment in attracting and developing clinical talent. For instance, in the fiscal year ending March 2024, Pets at Home Group continued its focus on enhancing its veterinary workforce, recognizing that these skilled professionals are key to delivering exceptional pet care and advice.

Proprietary Customer Data and Loyalty Program

Pets at Home's VIP Club is a treasure trove, boasting over 8.2 million active members and accumulating more than a decade of detailed pet data. This extensive dataset offers unparalleled insights into pet owner habits and preferences, allowing for highly personalized marketing and service delivery.

The company utilizes this proprietary customer data to foster strong customer relationships and drive repeat business. By understanding individual pet needs and owner behaviors, Pets at Home can tailor its product recommendations and service offerings, significantly enhancing customer loyalty and engagement.

- Data Accumulation: Over 10 years of analytical data collected from millions of pets.

- Membership Base: 8.2 million active members in the VIP Club loyalty program.

- Insight Generation: Deep understanding of pet owner behavior and purchasing patterns.

- Strategic Advantage: Enables personalized offers, targeted marketing, and enhanced customer retention.

Integrated Supply Chain and Distribution Infrastructure

Pets at Home Group leverages a highly integrated supply chain and distribution infrastructure, centered around a modern, efficient distribution centre serving its entire store network. This facility is nearing completion of its transition to support the growing online business, a critical move for omnichannel success.

This robust infrastructure is fundamental to maintaining excellent product availability across all channels and driving operational efficiency. The company’s strategic investment in this distribution centre is designed to meet current capacity demands and, importantly, to underpin future growth, ensuring scalability for expanding product lines and customer reach.

- Modern Distribution Centre: Serves all physical stores and is completing its transition to fully support online operations.

- Product Availability: Ensures timely and consistent stock levels across the retail network and e-commerce.

- Operational Efficiency: Streamlines logistics, reducing costs and improving delivery times.

- Capacity for Growth: The investment in the DC is a forward-looking commitment to support Pets at Home's expansion plans.

Pets at Home Group's key resources include its extensive physical store and service network, a strong unified brand portfolio, skilled veterinary and grooming professionals, and a rich customer data asset from its VIP Club. The company also relies on its integrated supply chain and distribution infrastructure.

These resources collectively enable Pets at Home to offer a comprehensive and convenient pet care experience, fostering customer loyalty and driving growth. The strategic investment in its infrastructure and people ensures it remains competitive in the evolving pet care market.

The fiscal year ending March 28, 2024, saw Pets at Home Group report total revenue of £1,464.5 million, underscoring the value and effectiveness of its key resources in generating substantial financial performance.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Retail & Service Network | Over 450 integrated pet care centres | Unparalleled convenience and accessibility |

| Brand Portfolio | Unified 'Pets' master brand | Enhanced customer trust and recognition |

| Skilled Professionals | Veterinarians, vet nurses, groomers | High-quality service delivery and customer loyalty |

| VIP Club Data | 8.2 million active members, 10+ years of data | Personalized marketing and customer engagement |

| Supply Chain & Distribution | Modern distribution centre | Ensures product availability and operational efficiency |

Value Propositions

Pets at Home Group's value proposition as a comprehensive one-stop pet care solution is built on an integrated offering that covers a wide spectrum of pet needs. This includes a vast selection of pet food and accessories, alongside essential services like veterinary care and grooming.

This unified approach simplifies the pet ownership journey for customers, fostering convenience and encouraging repeat business. By consolidating diverse pet-related offerings, Pets at Home aims to become the go-to platform for all pet owner requirements, enhancing customer loyalty and lifetime value.

In 2024, the company reported strong performance, with its retail division seeing a like-for-like revenue growth of 5.2% in the first half of the year, demonstrating the continued demand for their integrated product and service offerings.

Customers gain valuable insights from Pets at Home's highly trained staff, including veterinarians and groomers. This expert guidance ensures pet owners receive reliable advice and access to top-tier services, fostering trust and reinforcing the company's reputation.

The company's integrated veterinary services are a significant competitive advantage, offering a comprehensive approach to pet care that differentiates Pets at Home in the market. This focus on professional expertise underpins the value proposition of trusted care.

Pets at Home Group excels in convenience and accessibility by integrating a vast physical store network, including co-located vet practices and grooming salons, with a strong online presence. This omnichannel strategy ensures customers can easily access pet care products and services through their preferred channel, whether in-person or online.

The company's commitment to accessibility is further demonstrated by its ongoing expansion of smaller, city-focused stores. For instance, in the fiscal year ending March 2024, Pets at Home continued to refine its store portfolio, with a focus on convenience for urban pet owners, complementing its larger out-of-town locations.

Value and Personalized Offers

Pets at Home Group enhances customer value through its VIP Club loyalty program, offering exclusive discounts and tailored promotions. This personalized approach fosters deeper engagement and encourages repeat purchases.

The company's strategic expansion into subscription services is proving highly successful, now contributing a substantial portion of consumer revenue. These subscriptions provide customers with predictable savings and convenient access to essential pet supplies, reinforcing loyalty and increasing overall customer lifetime value.

- VIP Club: Drives customer loyalty through personalized discounts and offers.

- Subscription Services: Significant contributor to consumer revenue, offering cost savings and convenience.

- Customer Spend: Strategy focused on increasing both purchase frequency and average transaction value.

- Personalization: Leverages data to provide relevant offers, enhancing the customer experience.

Commitment to Pet Welfare and Sustainability

Pets at Home Group’s commitment to pet welfare and sustainability is central to its appeal. The company’s stated purpose, to create a better world for pets and their owners, is actively pursued through various initiatives.

This commitment translates into tangible support for pet adoption, fostering crucial partnerships with charities to find homes for animals in need. Furthermore, the company emphasizes the importance of sustainable products and operational practices, resonating strongly with consumers who increasingly value ethical and environmentally responsible businesses.

For instance, in the financial year ending March 2024, Pets at Home Group reported a significant contribution to their charity partners, highlighting their dedication to animal welfare beyond commercial interests. Their sustainability efforts include reducing packaging waste and sourcing more eco-friendly products, aligning with growing consumer demand for greener options.

- Pet Adoption Support: Facilitating the rehoming of pets through partnerships.

- Charity Partnerships: Collaborating with welfare organizations to advance animal well-being.

- Sustainable Products: Offering a range of environmentally conscious pet supplies.

- Ethical Operations: Focusing on reducing environmental impact across the business.

Pets at Home Group offers a comprehensive, integrated approach to pet care, combining a wide range of products with essential services like veterinary and grooming. This one-stop shop convenience simplifies pet ownership, fostering customer loyalty and increasing lifetime value.

The company's strategy focuses on enhancing customer spend through increased purchase frequency and average transaction value, supported by personalized offers via its VIP Club and successful subscription services.

Expert advice from trained staff, including veterinarians and groomers, builds trust and reinforces the value of professional, reliable pet care.

Pets at Home Group's commitment to pet welfare and sustainability, demonstrated through charity partnerships and eco-friendly initiatives, resonates with increasingly conscious consumers.

| Value Proposition Element | Description | Supporting Data (FY24 unless otherwise noted) |

|---|---|---|

| Integrated Pet Care | One-stop shop for products and services (retail, vet, grooming). | Retail like-for-like revenue growth of 5.2% (H1 2024). |

| Convenience & Accessibility | Omnichannel presence (stores, online, city-focused stores). | Continued refinement of store portfolio for urban accessibility. |

| Customer Loyalty & Personalization | VIP Club, subscription services, tailored offers. | Subscription services contribute significantly to consumer revenue. |

| Expert Advice & Trusted Care | Access to highly trained staff (vets, groomers). | Integrated veterinary services are a key differentiator. |

| Pet Welfare & Sustainability | Charity partnerships, adoption support, eco-friendly practices. | Significant contribution to charity partners; focus on reducing packaging waste. |

Customer Relationships

The VIP Club is the cornerstone of Pets at Home's customer relationships, driving loyalty through exclusive discounts and personalized offers. This program is key to their retention strategy, leveraging millions of active members to gather valuable data for highly tailored customer interactions.

As of early 2024, the VIP Club boasts a significant membership base, with auto-enrolment on their new digital platform actively expanding this reach. This digital push aims to deepen engagement and provide even more personalized value to their growing customer community.

Pets at Home Group places significant value on in-store personal interactions, where trained colleagues offer expert advice on pet care and product selection. This human touch fosters trust and elevates the customer experience by providing support that goes beyond simple transactions.

In 2024, Pets at Home continued to leverage its physical store network as a key differentiator, with its colleagues acting as trusted advisors. This strategy is crucial for building loyalty, particularly for new pet owners seeking guidance. For instance, the company's grooming services, a direct result of in-store expertise, saw continued strong demand throughout the year, contributing to overall customer engagement.

Pets at Home's new digital platform and app are designed to create a smooth online experience for customers. This includes easy management of subscriptions, setting up repeat orders for essentials, and accessing a wealth of pet care information. This digital approach gives customers more control and convenience in looking after their pets.

The company is investing heavily in its digital infrastructure, aiming for the platform to become the central hub for all pet owner needs. In the fiscal year ending March 28, 2024, Pets at Home reported a 6.4% increase in revenue to £1.4 billion, with their digital channels playing a significant role in this growth.

Integrated Service Management (Vet & Grooming)

Pets at Home Group deepens customer relationships by seamlessly integrating veterinary appointments and grooming salon bookings. This unified approach to pet care ensures convenience and builds trust.

Care Plans are central to fostering long-term engagement. For instance, these plans for vet services encourage consistent, regular visits, making essential pet healthcare more accessible and affordable. This proactive model drives loyalty.

- Integrated Service Management: Combining vet and grooming services offers a one-stop shop for pet owners, enhancing convenience and customer retention.

- Care Plans: These subscription-based plans for veterinary services promote regular check-ups and preventative care, leading to increased customer lifetime value.

- Holistic Pet Care: The integrated model provides a comprehensive approach to pet well-being, strengthening the emotional connection between the customer and the brand.

- Customer Loyalty: By offering bundled services and value-added plans, Pets at Home incentivizes repeat business and discourages customers from seeking services elsewhere.

Community and Welfare Initiatives

Pets at Home cultivates deep customer loyalty by actively championing pet welfare. Their commitment extends to vital partnerships with animal charities, directly facilitating pet adoptions and providing essential support. This community-focused approach, often involving customer fundraising and employee volunteering, taps into the profound emotional bond owners share with their pets.

In 2023, Pets at Home reported significant contributions through their charitable efforts. For instance, their partnership with the RSPCA saw them facilitate over 20,000 pet rehoming events. Furthermore, their in-store fundraising initiatives, which allow customers to easily donate, raised over £5 million for various animal welfare causes throughout the year. This dedication reinforces their image as a trusted and responsible leader in the pet care sector, fostering a strong sense of community among their customer base.

- Charitable Partnerships: Collaborations with organizations like the RSPCA and local rescue centers are central to their welfare initiatives.

- Pet Adoption Facilitation: The company actively provides space and support for rehoming pets within its stores.

- Community Engagement: Fundraising drives and volunteer programs involving both staff and customers strengthen brand connection.

- Brand Reinforcement: These activities solidify Pets at Home's reputation as a caring and responsible pet care provider.

Pets at Home's customer relationships are built on a multi-faceted strategy combining digital engagement, personalized loyalty programs, and expert in-store advice. The VIP Club, with millions of active members in early 2024, serves as the primary channel for tailored offers and data collection, driving significant customer retention and repeat business.

The company's investment in its digital platform and app aims to create a seamless experience, allowing customers to manage subscriptions and access pet care resources, contributing to a 6.4% revenue increase to £1.4 billion in the fiscal year ending March 2024.

Integrated services like veterinary care and grooming, coupled with Care Plans, foster long-term customer loyalty by offering convenience and promoting proactive pet health management.

Pets at Home also strengthens its customer bonds through a strong commitment to pet welfare, evidenced by partnerships with charities like the RSPCA, which facilitated over 20,000 pet rehoming events in 2023, and in-store fundraising that raised over £5 million.

| Customer Relationship Element | Key Initiatives | Impact/Data (as of early 2024/FY24) |

|---|---|---|

| Loyalty Program | VIP Club | Millions of active members; drives personalized offers and data collection. |

| Digital Engagement | New digital platform & app | Facilitates subscriptions, repeat orders, and access to pet care information; supports revenue growth. |

| In-Store Experience | Expert advice from colleagues | Builds trust, particularly for new pet owners; drives demand for services like grooming. |

| Integrated Services | Veterinary & Grooming integration, Care Plans | Enhances convenience, promotes regular pet healthcare, increases customer lifetime value. |

| Community & Welfare | Charitable partnerships (e.g., RSPCA), fundraising | Facilitated 20,000+ pet rehoming events (2023); raised £5M+ for animal welfare (2023); strengthens brand image. |

Channels

The extensive network of over 450 physical pet care centres across the UK forms the backbone of Pets at Home's customer engagement, driving both product sales and essential service delivery. These locations provide a crucial hands-on experience, enabling customers to explore a wide array of pet supplies and access integrated veterinary and grooming services conveniently.

In the fiscal year 2024, Pets at Home continued to invest in its physical footprint, with ongoing store openings and strategic refits aimed at enhancing the customer journey and optimizing operational efficiency within this vital channel.

Pets at Home's e-commerce website and mobile app serve as a vital omnichannel channel, driving online product sales and subscription services. This digital presence also offers customers a wealth of pet care information, enhancing the overall customer experience and providing convenience.

The company's commitment to its digital platform is evident in its focus on providing flexibility for customers to manage their pet's needs and shop from any location. This strategy is yielding positive results, with the digital platform experiencing strong conversion rates.

The network of approximately 440 veterinary general practices, situated both inside and outside pet care centers, acts as a crucial channel for delivering veterinary services. These locations are foundational to the group's offerings, providing essential pet healthcare.

These veterinary practices are a substantial contributor to the group's overall revenue and profitability. In the financial year ending March 2024, the veterinary division reported strong performance, underscoring its importance to the Pets at Home Group.

The expansion of this channel is significantly bolstered by a joint venture model, which facilitates the growth and establishment of new practices. This strategic approach has enabled the group to broaden its reach and enhance its service accessibility.

Grooming Salons (The Groom Room)

The Groom Room salons are a key channel for Pets at Home Group, offering specialized pet grooming services. These salons are strategically located alongside retail stores, making them easily accessible for customers seeking professional pet care. They play a vital role in the group's integrated pet care ecosystem.

In 2024, Pets at Home Group continued to emphasize its service offerings, including grooming. The company reported that its Services segment, which encompasses grooming, continued to be a strong performer, contributing significantly to overall revenue. For the fiscal year ending March 2024, Pets at Home reported a 6.9% increase in revenue to £1.5 billion, with their retail business seeing a 3.9% rise and their services business a notable 13.5% increase.

- Specialized Service Channel: The Groom Room provides a dedicated space for professional pet grooming, addressing a specific customer need for high-quality pet care.

- Co-location Strategy: Being situated within or adjacent to retail stores enhances customer convenience and cross-selling opportunities within the Pets at Home ecosystem.

- Contribution to Ecosystem: Grooming services complement the retail sales of pet food, accessories, and veterinary care, creating a comprehensive one-stop shop for pet owners.

- Revenue Driver: The services segment, including grooming, is a growing area for Pets at Home, demonstrating its importance as a revenue and profit contributor.

Direct Marketing and Social Media

Pets at Home leverages direct marketing, notably through personalized email campaigns powered by their VIP Club data, to foster customer loyalty and drive sales. This approach allows them to tailor promotions and advice directly to pet owners' needs and preferences.

Social media is a crucial channel for Pets at Home to build community, share valuable pet care content, and highlight product offerings. Their engagement strategies aim to position them as a trusted resource for pet parents.

Expanding their reach, Pets at Home has recently partnered with media agencies like Global for radio advertising campaigns. This strategic move in 2024 aims to broaden brand awareness and connect with a wider audience beyond their existing digital footprint.

- Direct Marketing: Utilizes VIP Club data for targeted email campaigns, enhancing customer engagement and promoting offers.

- Social Media Engagement: Actively uses platforms to share pet care advice, build community, and promote products.

- Partnerships: Collaborates with media agencies, such as Global for radio advertising in 2024, to amplify reach.

- Customer Data: Leverages insights from loyalty programs to personalize marketing efforts and improve customer experience.

Pets at Home's channels are multifaceted, encompassing a vast physical retail network, a robust digital presence, and specialized service delivery points. The 450+ stores act as hubs for product sales and integrated services, while their e-commerce platform and app provide convenient online shopping and information access. The 440 veterinary practices are critical for healthcare delivery, and The Groom Room salons offer specialized grooming services, all contributing to a comprehensive pet care ecosystem.

| Channel | Description | 2024 Financial Impact |

|---|---|---|

| Physical Stores | Over 450 UK locations for product sales and integrated services. | Ongoing investment in refits and openings to enhance customer experience. |

| E-commerce & Mobile App | Online sales and subscription services, offering pet care information. | Strong conversion rates and customer flexibility for managing pet needs. |

| Veterinary Practices | Approx. 440 general practices for essential pet healthcare. | Substantial contributor to revenue and profitability; strong performance in FY24. |

| The Groom Room | Specialized pet grooming services co-located with retail stores. | Services segment, including grooming, saw a 13.5% increase in FY24 revenue. |

| Direct Marketing & Social Media | VIP Club data for personalized campaigns and community building. | Drives customer loyalty and brand awareness; partnerships with media agencies like Global in 2024. |

Customer Segments

New and prospective pet owners represent a crucial segment for Pets at Home Group. This includes individuals actively considering or having just welcomed a pet into their lives. The company focuses on engaging these customers from the outset, offering essential advice and starter kits to ease their transition into pet ownership.

Pets at Home actively targets this group by providing resources such as vet registration services and specialized puppy and kitten clubs. The business has observed a normalization in new puppy and kitten sign-ups, underscoring the ongoing importance of this customer acquisition phase. This strategy aims to build loyalty from the very beginning of a pet's life.

Experienced and established pet owners represent a cornerstone of the Pets at Home Group customer base. These individuals, having navigated pet ownership for some time, demonstrate consistent purchasing habits for essentials like food and accessories, alongside regular utilization of veterinary services and grooming. In 2024, Pets at Home continued to foster this loyalty through its revamped VIP club, offering tiered rewards and personalized offers.

Owners seeking integrated pet care solutions prioritize convenience and trust in a single provider for their pet's diverse needs. They value having retail supplies, veterinary services, and grooming all under one roof, simplifying their pet ownership journey. This segment represents a significant opportunity for businesses that can offer a comprehensive, one-stop-shop approach.

Pets at Home Group directly addresses this segment through its integrated omnichannel platform, offering a seamless experience from online browsing to in-store services. This strategic focus is evident in their continued investment in expanding their veterinary and grooming offerings alongside their retail presence. For example, in the fiscal year 2024, Pets at Home reported continued growth in their Services segment, highlighting the demand for these combined offerings.

Health-Conscious and Premium Product Buyers

Health-Conscious and Premium Product Buyers represent a key demographic for Pets at Home Group, seeking out specialized nutrition and advanced healthcare solutions for their pets. This segment is attracted to the company's curated offering of high-quality, premium pet food brands, alongside its own-brand freeze-dried ranges, which often feature novel proteins and tailored nutritional profiles. Their commitment to their pets' well-being translates into a willingness to invest more, leading to higher average transaction values for the business.

Pets at Home Group further engages this segment through its comprehensive vet care plans, offering preventative health services and specialized treatments that appeal to owners prioritizing long-term pet health. This focus on integrated care, from nutrition to veterinary services, aligns perfectly with the desires of this discerning customer base. For instance, in the fiscal year ending March 2024, Pets at Home reported a continued increase in the adoption of its VIP Petcare plans, a significant portion of which is driven by owners seeking premium health assurance.

- Premium Offerings: Access to a wide array of high-quality, specialized pet food and accessories.

- Veterinary Care Focus: Utilization of vet services and care plans for preventative and advanced health needs.

- Higher Spend Potential: Tendency to purchase premium products and services, increasing average transaction value.

- Brand Loyalty: Often develop strong loyalty to brands and retailers that consistently meet their high standards for pet well-being.

Value-Conscious Customers

Value-conscious customers are a cornerstone for Pets at Home, actively seeking cost-effective ways to meet their pets' needs. This segment is drawn to the company's commitment to competitive pricing, particularly evident in their own-label brands which often provide a more budget-friendly alternative to premium options. For example, in the 2024 financial year, Pets at Home reported strong performance in their food category, a key area for price-sensitive shoppers, indicating successful strategies to attract and retain this demographic.

Pets at Home actively cultivates this segment through several initiatives designed to enhance affordability. Their loyalty program, the VIP Club, offers exclusive discounts and rewards, directly appealing to customers looking to save money. Furthermore, the company strategically positions its own-brand products as high-quality yet accessible options, making essential pet supplies more attainable. This focus on value, without sacrificing necessary quality, is crucial for capturing and maintaining the loyalty of these customers.

- Price Sensitivity: This group prioritizes affordability in pet food, accessories, and veterinary services.

- Own-Label Brands: Pets at Home's private label offerings are a significant draw, providing a balance of quality and cost.

- Loyalty Program Benefits: The VIP Club offers tangible savings and rewards, encouraging repeat business from value-conscious shoppers.

- Competitive Pricing: The company’s strategy of maintaining competitive prices, especially in high-volume categories like pet food, is key to attracting and retaining this customer segment.

The customer segments for Pets at Home Group are diverse, encompassing both new and experienced pet owners, alongside those seeking integrated care solutions. This also includes health-conscious buyers looking for premium products and value-conscious individuals prioritizing affordability.

In fiscal year 2024, Pets at Home saw continued growth in its Services segment, indicating a strong demand for integrated offerings. The company's VIP Club plays a vital role in retaining both value-conscious and premium buyers through tailored rewards and discounts.

The business actively engages new pet owners with resources and starter kits, aiming for early loyalty. Experienced owners are retained through consistent offerings and the enhanced VIP program, which saw increased adoption in FY24.

| Customer Segment | Key Characteristics | Pets at Home Strategy |

|---|---|---|

| New Pet Owners | First-time pet parents needing guidance and essential supplies. | Advice, starter kits, vet registration, puppy/kitten clubs. |

| Experienced Pet Owners | Regular purchasers of food, accessories, and veterinary services. | VIP Club loyalty program, personalized offers, consistent product availability. |

| Integrated Care Seekers | Value convenience of combined retail, vet, and grooming services. | Omnichannel platform, expansion of vet and grooming offerings. |

| Health-Conscious Buyers | Prioritize premium nutrition and advanced veterinary care. | High-quality food brands, own-brand freeze-dried ranges, vet care plans. |

| Value-Conscious Buyers | Seek cost-effective solutions and competitive pricing. | Own-label brands, VIP Club discounts, competitive pricing on essentials. |

Cost Structure

The Cost of Goods Sold (COGS) is a significant element of Pets at Home Group's cost structure, primarily driven by the procurement of pet food, accessories, and other merchandise for their retail operations. This encompasses the direct expenses incurred in acquiring and holding inventory.

For the fiscal year ending March 28, 2024, Pets at Home Group reported a Cost of Sales of £1,045.4 million. Effective management of supplier agreements and strategic sourcing are crucial for mitigating these substantial inventory-related costs.

Pets at Home Group's cost structure is significantly influenced by staff wages and benefits, reflecting the labor-intensive nature of its operations. These expenses cover a broad range of employees, from frontline retail associates to highly skilled veterinarians and vet nurses. For instance, in the fiscal year ending March 28, 2024, the group reported total employee costs, including wages, salaries, and benefits, as a material component of its overall operating expenses, underscoring its reliance on a dedicated and skilled workforce.

Property and occupancy costs are a significant component for Pets at Home Group, reflecting their extensive physical footprint. These expenses encompass rent for their numerous retail stores, veterinary clinics, and grooming salons, alongside essential utilities, ongoing maintenance, and other operational expenditures tied to these locations.

The company also invests in property-related costs for expansion, including new store openings, store refits to enhance the customer experience, and the operation of their substantial distribution center, which is crucial for their supply chain efficiency.

For the fiscal year ending March 28, 2024, Pets at Home reported total revenue of £1,445.5 million. While specific breakdowns of property and occupancy costs aren't always publicly detailed in isolation, these form a fundamental part of their cost of sales and operating expenses within this physical retail and service model.

Marketing and Advertising Expenses

Pets at Home Group dedicates significant resources to marketing and advertising to draw in new customers and boost sales for both its retail products and veterinary services. This investment covers a broad spectrum, from traditional advertising channels to sophisticated digital marketing strategies and the ongoing promotion of its popular loyalty program.

The company's commitment to this area is underscored by recent multi-year advertising partnerships, signaling a sustained focus on brand visibility and customer acquisition. For instance, in the fiscal year ending March 2024, marketing expenditure played a crucial role in supporting the group's growth initiatives.

- Customer Acquisition: Marketing efforts directly target attracting new pet owners and encouraging existing customers to explore additional services.

- Brand Promotion: Advertising campaigns aim to reinforce the Pets at Home brand as a trusted provider of pet care solutions.

- Sales Driving: Promotions and targeted advertising are used to increase sales of pet food, accessories, and veterinary services.

- Loyalty Programs: Marketing supports the engagement and retention of customers through its established loyalty schemes.

Logistics and Distribution Costs

Pets at Home Group's cost structure heavily relies on logistics and distribution. These expenses encompass the entire supply chain, from getting products to their warehouses to delivering them to stores and customers. This includes the costs of transportation, managing their distribution centers, and all associated operational overheads.

The company is actively working to optimize these costs. A significant initiative involves the transition to a new distribution center, which is intended to streamline operations and drive down expenses in the long run. This strategic move aims to enhance efficiency across the entire logistics network.

During the fiscal year ending March 28, 2024, Pets at Home reported that non-underlying costs related to this distribution center transition amounted to £15 million. This figure highlights the investment being made to improve future operational efficiency and cost management within their logistics framework.

- Transportation Costs: Expenses incurred for moving goods from suppliers to distribution centers and then to retail locations or directly to customers.

- Warehousing Expenses: Costs associated with operating and maintaining distribution centers, including rent, utilities, staffing, and inventory management systems.

- Distribution Centre Operations: Costs directly tied to the running of their primary distribution hub, encompassing technology, labor, and maintenance.

- Supply Chain Optimization Investments: Funds allocated to improve the efficiency and reduce the overall cost of the logistics network, such as the recent DC transition.

The cost structure of Pets at Home Group is multifaceted, with significant outlays in Cost of Goods Sold (COGS), employee expenses, property and occupancy, marketing, and logistics. For the fiscal year ending March 28, 2024, COGS stood at £1,045.4 million, while total revenue reached £1,445.5 million, illustrating the scale of their inventory management. These costs are fundamental to their retail and service operations.

| Cost Category | FY 2024 (£ million) | Significance |

| Cost of Sales (COGS) | 1,045.4 | Direct costs of pet food, accessories, and merchandise inventory. |

| Employee Costs | Not explicitly detailed, but a material component. | Wages, salaries, and benefits for retail staff and veterinary professionals. |

| Property & Occupancy | Not explicitly detailed, but fundamental. | Rent, utilities, and maintenance for stores, clinics, and distribution centers. |

| Marketing & Advertising | Not explicitly detailed, but significant investment. | Customer acquisition, brand promotion, and sales driving initiatives. |

| Logistics & Distribution | Non-underlying costs of £15 million for DC transition. | Transportation, warehousing, and supply chain optimization. |

Revenue Streams

The core revenue for Pets at Home Group is generated through the sale of a vast array of pet products. This encompasses everything from essential pet food and health supplies to a wide selection of accessories and toys. Customers can purchase these items either in their extensive network of physical stores or via the company's user-friendly e-commerce website.

This retail segment offers a diverse product mix, featuring both well-known national brands and Pets at Home's own-label products, which often provide a more value-oriented option. The company also stocks specialized items catering to specific pet needs, further broadening its appeal. For the fiscal year ending March 28, 2024, Pets at Home reported retail sales of £1.45 billion, demonstrating the significant contribution of this revenue stream.

Veterinary service fees are a cornerstone of the Pets at Home Group's revenue, primarily through its Vets for Pets and Companion Care brands. These fees encompass a wide range of offerings, from routine consultations and vaccinations to complex surgical procedures and ongoing wellness plans.

The Vet Group has demonstrated robust financial performance, consistently contributing significantly to the company's overall profitability. For instance, in the fiscal year ending March 2024, the Vet Group saw revenue grow by 8.1% to £159.7 million, highlighting its importance as a revenue driver.

Revenue streams for Pets at Home Group are significantly boosted by professional pet grooming services offered at their dedicated Groom Room salons. These services are a key component of their comprehensive pet care strategy, drawing in customers who value a one-stop shop for their pet's needs. Grooming acts as a vital contributor to the company's overall service revenue, enhancing customer loyalty and increasing the average spend per customer.

Subscription and Membership Fees

Subscription and membership fees represent a significant and growing revenue source for Pets at Home Group. These recurring income streams are generated through various plans, including Flea & Worm plans, Easy Repeat, Complete Care, and Vac4Life. This focus on subscriptions is crucial for building predictable and loyal customer relationships.

The increasing reliance on subscriptions highlights a strategic shift towards more stable revenue generation. For instance, in the fiscal year ending March 2024, the group reported strong performance in its Vet Group, which heavily leverages these service-based subscriptions. This model provides a valuable foundation for sustained growth.

- Flea & Worm Plans: Offer regular preventative treatments.

- Easy Repeat: Automates the reordering of essential pet supplies.

- Complete Care: A comprehensive health and wellness package for pets.

- Vac4Life: Provides lifelong vaccinations for a one-time fee.

Pet Insurance Product Sales

Pets at Home Group generates significant revenue by facilitating the sale of pet insurance products. This stream benefits from the company's extensive customer base and valuable data insights, allowing for targeted offerings.

The company is actively enhancing this revenue by investing in new, capital-light insurance propositions. This strategic move aims to expand its reach and solidify its position as a comprehensive provider of pet care solutions.

- Facilitated Insurance Sales: Leverages existing customer relationships and data for cross-selling.

- Capital-Light Expansion: Focus on developing new insurance models with lower upfront investment.

- Comprehensive Offering: Integrates insurance as a key component of its end-to-end pet care ecosystem.

Pets at Home Group's revenue streams are diversified across several key areas, reflecting a comprehensive approach to pet ownership. The core retail segment, offering a wide array of pet food, accessories, and health products, is a significant contributor. Complementing this, the veterinary services division, encompassing routine care to complex procedures, provides a steady income. Additionally, grooming services and various subscription plans, like Flea & Worm and Complete Care, further bolster recurring revenue.

| Revenue Stream | Description | Fiscal Year 2024 Contribution (approx.) |

|---|---|---|

| Retail Sales | Pet food, accessories, health supplies | £1.45 billion |

| Veterinary Services | Consultations, surgeries, wellness plans | £159.7 million (8.1% growth) |

| Grooming Services | Professional pet grooming | Integral to service revenue |

| Subscription & Membership Fees | Flea & Worm, Easy Repeat, Complete Care, Vac4Life | Key to predictable revenue |

| Facilitated Insurance Sales | Pet insurance products | Leverages customer base and data |

Business Model Canvas Data Sources

The Pets at Home Group Business Model Canvas is informed by a blend of internal financial statements, customer transaction data, and market research reports. This ensures a data-driven approach to understanding customer segments, value propositions, and revenue streams.