Pets at Home Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pets at Home Group Bundle

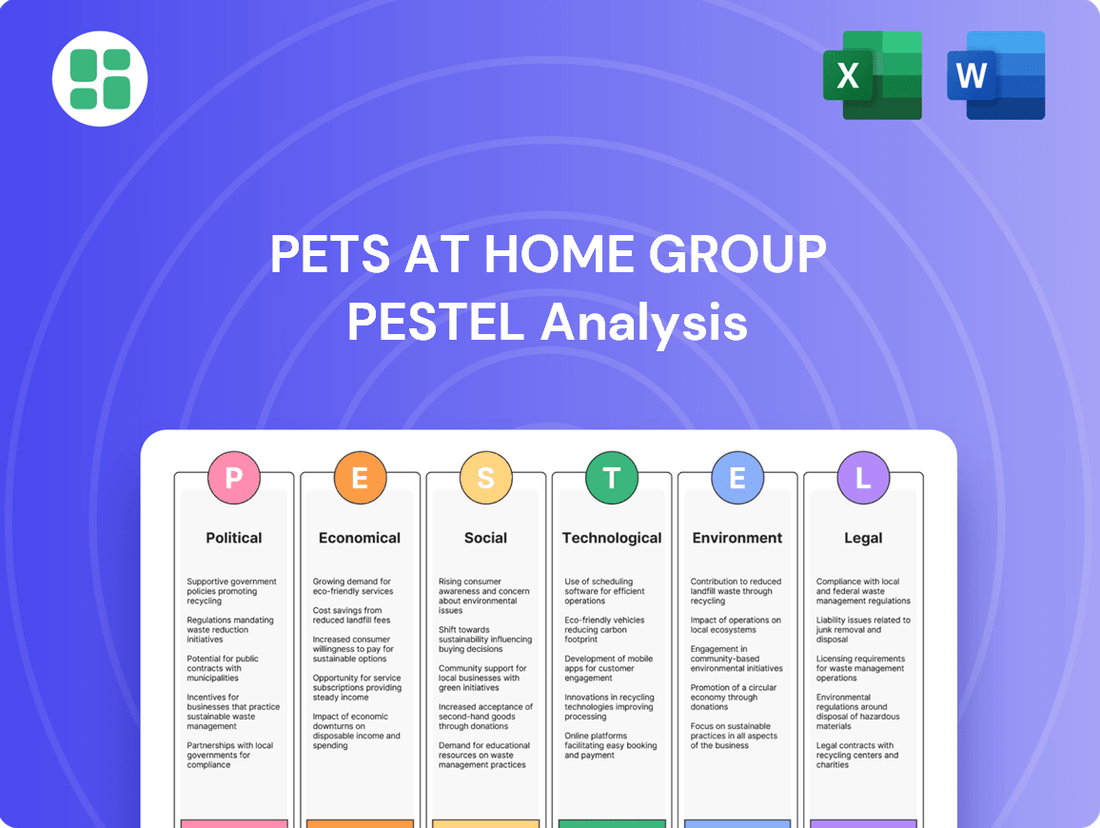

Pets at Home Group operates within a dynamic external environment, influenced by shifting consumer attitudes towards pet welfare, evolving economic conditions impacting disposable income, and technological advancements in veterinary care and online retail. Understanding these Political, Economic, Social, Technological, Legal, and Environmental (PESTLE) factors is crucial for strategic planning and identifying potential opportunities and threats. Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Pets at Home Group. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government pet welfare legislation significantly shapes Pets at Home's operational landscape, particularly concerning their retail and veterinary services. Stricter regulations on animal sourcing, breeding, and care standards directly influence the company’s supply chain and the quality of animals available, impacting their retail segment. For instance, the proposed Animal Welfare (Import of Dogs, Cats and Ferrets) Bill 2024-25, which seeks to increase the minimum age for imported pets and prohibit the import of pregnant or mutilated animals, could necessitate adjustments in how Pets at Home sources or handles live animals, potentially affecting availability and costs.

Furthermore, the increasing power of local authorities to issue penalty notices for animal welfare offenses heightens regulatory scrutiny. This means Pets at Home must maintain rigorous compliance across all its operations, from its retail stores to its grooming salons and veterinary practices, to avoid fines and reputational damage. The company's commitment to animal welfare, as demonstrated by its 'Pets Promise' initiative, is crucial in navigating this evolving regulatory environment and maintaining consumer trust.

Government policies like increases to the National Living Wage and National Insurance Contributions directly impact Pets at Home's labor costs. For instance, the National Living Wage is set to rise to £11.44 per hour for those aged 21 and over from April 2024, a significant increase that will affect retailers with large workforces.

These rising operational expenses can put pressure on profit margins. Retailers like Pets at Home often respond by focusing on efficiency, potentially through investments in productivity initiatives or automation, to offset higher wage bills and maintain profitability.

Furthermore, broader government fiscal policies and the overall economic climate influence consumer disposable income. Changes in taxation or government spending can affect how much consumers have available to spend on discretionary items, including pet supplies and services, thereby impacting Pets at Home's sales performance.

The veterinary sector, a crucial component of Pets at Home's operations via Vets for Pets and Companion Care, operates under stringent regulations. The Veterinary Medicines Regulations (VMRs) 2024, for instance, dictate the entire lifecycle of veterinary medicines, from their creation and sale to their use. Ensuring adherence to these dynamic rules is paramount for Pets at Home to maintain legal standing and high service standards across its veterinary practices.

Brexit and Trade Policies

While specific 2024-2025 policy shifts directly impacting Pets at Home aren't extensively detailed, the ongoing adaptation to Brexit continues to shape the UK's trade landscape. This includes potential adjustments to import duties and customs procedures for pet food and accessories, which could influence Pets at Home's sourcing costs and product availability. For instance, the UK's continued negotiation of new trade deals post-Brexit might introduce preferential tariffs for certain goods or, conversely, create new barriers for others, directly affecting the company's supply chain efficiency and pricing flexibility.

The broader regulatory environment stemming from Brexit also plays a role. Changes in veterinary medicine import regulations or pet product safety standards could necessitate compliance updates for Pets at Home. The company's ability to navigate these evolving trade policies and maintain competitive pricing for its product range, particularly for imported items, remains a key consideration. For context, in 2023, the UK imported approximately £7.5 billion worth of pet food, highlighting the significance of frictionless trade for the sector.

- Ongoing Brexit Adjustments: Continued evolution of UK trade policies post-Brexit influences import/export dynamics for pet products.

- Supply Chain Impact: Potential changes in tariffs and customs procedures can affect the cost and availability of imported pet food and accessories.

- Regulatory Compliance: Evolving standards for pet products and veterinary medicines require ongoing adaptation by retailers like Pets at Home.

- Market Competitiveness: Navigating these trade complexities is crucial for maintaining competitive pricing and product assortment.

Competition Policy and Market Investigations

Government competition bodies, like the UK's Competition and Markets Authority (CMA), actively scrutinize sectors to ensure fair markets and protect consumers. These investigations can significantly impact how companies operate.

Pets at Home's veterinary services have recently been a focus of such scrutiny. For example, the CMA launched a market investigation into veterinary services for companion animals in the UK in September 2023, with its provisional findings expected in mid-2024 and its final report by July 2025. This investigation examines areas like pricing transparency, potential conflicts of interest in integrated services, and the availability of information for pet owners.

- CMA Investigation: The CMA's market study into veterinary services for pets, initiated in late 2023, is a key factor.

- Potential Remedies: Outcomes could include mandated changes to pricing structures, information disclosure, or even structural remedies if significant competition concerns are identified.

- Impact on Practices: These investigations can force businesses to adapt their practices to comply with new regulations or recommendations, potentially affecting profitability and strategic direction.

Government policies on animal welfare, such as the proposed Animal Welfare (Import of Dogs, Cats and Ferrets) Bill 2024-25, directly influence Pets at Home's sourcing and operational standards. Rising labor costs, exemplified by the National Living Wage increase to £11.44 per hour from April 2024, impact the company's profitability. Furthermore, the CMA's ongoing investigation into veterinary services, with provisional findings due mid-2024 and a final report by July 2025, could lead to significant operational adjustments.

What is included in the product

This PESTLE analysis of Pets at Home Group examines how political, economic, social, technological, environmental, and legal factors shape the company's operating landscape.

It provides a comprehensive understanding of the external forces impacting the pet care industry, offering insights for strategic decision-making.

This PESTLE analysis for Pets at Home Group acts as a pain point reliever by offering a clean, summarized version of complex external factors, making it easy to reference during meetings and presentations.

It provides a concise, easily shareable summary format ideal for quick alignment across teams or departments, helping to alleviate the pain of information overload.

Economic factors

The UK's economic climate, particularly inflation and real household disposable incomes, directly impacts how much consumers spend on their pets. Despite high pet ownership, persistent cost-of-living pressures are causing some owners to re-evaluate non-essential pet expenditures.

For instance, while the pet care market showed resilience, with spending growing significantly, the Office for Budget Responsibility forecasts that real household disposable income will see a modest increase of 0.6% in 2024, after a decline in previous years. This suggests a cautious consumer environment where discretionary spending, including on premium pet products or services, might be moderated.

The UK pet care market is on a significant growth trajectory, with projections indicating it will reach USD 13,755.4 million by 2033. This expansion is largely fueled by an increasing number of households owning pets and a growing trend of pet humanization, where pets are increasingly viewed as family members.

This heightened focus on pets as family members directly translates into a demand for premium products and services. Consumers are willing to spend more on high-quality pet food, specialized grooming treatments, and advanced veterinary care, creating a lucrative opportunity for companies like Pets at Home to tap into this upscale market segment.

While overall inflation has started to cool, retailers like Pets at Home are still grappling with persistent price pressures. This sticky inflation, coupled with rising operating expenses, particularly labor costs driven by increases in the National Living Wage, is putting pressure on profit margins.

For instance, the UK's National Living Wage increased by 9.7% to £11.44 per hour in April 2024, directly impacting businesses with significant workforces. Successfully navigating these cost headwinds while keeping prices attractive to consumers remains a critical economic hurdle for the company.

E-commerce Growth and Digital Sales

The pet care market is experiencing a substantial shift towards online channels, with e-commerce sales showing robust growth. This trend is expected to continue, driven by increasing consumer preference for digital convenience and wider product selection. Pets at Home Group is actively participating in this evolution by investing in its digital infrastructure and mobile application to better serve online shoppers.

In the UK, online retail sales as a percentage of total retail sales reached approximately 27.7% in early 2024, a figure that has steadily climbed over recent years. This broad trend is mirrored in the pet sector, where consumers increasingly opt for the ease of home delivery for pet food, accessories, and even veterinary prescriptions. Pets at Home reported that its digital channels contributed significantly to its revenue in the fiscal year ending March 2024, highlighting the importance of this segment.

- Digital Sales Growth: E-commerce in the pet industry is a key growth driver, with projections indicating continued expansion through 2025.

- Pets at Home Digital Investment: The company's focus on its app and online platform aims to capture a larger share of this growing digital market.

- Consumer Convenience: The shift to online shopping is largely fueled by the demand for convenient access to pet supplies and services.

- Market Share: By enhancing its digital offerings, Pets at Home seeks to solidify its position and increase its market share in the increasingly online pet care landscape.

Veterinary Sector Performance

The veterinary segment, encompassing Vets for Pets, is a standout performer for Pets at Home, consistently delivering robust revenue and profit growth. This division is outperforming the retail side, even in a challenging economic climate.

Key drivers for this success include a rise in customer visits, increased spending per visit, and a growing base of loyal customers enrolled in care plans. These care plans are particularly valuable as they create a predictable and resilient income stream for the business.

For the fiscal year 2024, Pets at Home reported that its veterinary division saw a 10.2% increase in revenue, reaching £507 million. Operating profit for the segment also grew by 10.8% to £144 million. This growth highlights the increasing demand for veterinary services and the effectiveness of the company's strategy in this area.

- Veterinary Revenue Growth: The veterinary division reported a 10.2% revenue increase in FY24, reaching £507 million.

- Profitability: Operating profit in the veterinary segment rose by 10.8% to £144 million in FY24.

- Key Performance Drivers: Growth is fueled by higher customer visit frequency, increased average transaction values, and expanding care plan membership.

- Market Resilience: The veterinary segment demonstrates strong performance, outshining the retail division in a subdued market.

The UK's economic landscape, marked by fluctuating inflation and modest growth in real household disposable income, directly influences consumer spending on pets. While the pet care market has shown resilience, the Office for Budget Responsibility projected a 0.6% increase in real household disposable income for 2024, indicating a cautious consumer environment that may temper discretionary spending on premium pet products.

Persistent inflation, despite recent cooling, continues to pressure retailers like Pets at Home. Rising operating costs, particularly labor expenses due to the National Living Wage increase to £11.44 per hour in April 2024, are squeezing profit margins, creating a challenge to maintain attractive pricing for consumers.

The veterinary segment of Pets at Home is a strong performer, with revenue up 10.2% to £507 million and operating profit up 10.8% to £144 million in FY24. This growth is driven by increased customer visits, higher spending per visit, and a growing base of loyal customers in care plans, demonstrating the resilience and demand for veterinary services.

| Metric | FY24 Value | Change vs. Previous Year |

|---|---|---|

| Veterinary Revenue | £507 million | +10.2% |

| Veterinary Operating Profit | £144 million | +10.8% |

| Real Household Disposable Income (Projected 2024) | +0.6% | N/A |

| National Living Wage (April 2024) | £11.44 per hour | +9.7% |

What You See Is What You Get

Pets at Home Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Pets at Home Group details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. It provides actionable insights for strategic planning.

Sociological factors

The growing trend of pet humanisation sees owners increasingly viewing their pets as family members, driving demand for higher-quality products and services. This sociological shift means people are more inclined to invest in premium pet food, advanced veterinary treatments, and specialized grooming, reflecting a deeper emotional bond.

This humanisation directly impacts spending habits, with owners willing to allocate significant budgets to their pets' happiness and well-being. For instance, the UK pet care market was valued at approximately £13.5 billion in 2023, with a substantial portion attributed to premiumisation and discretionary spending on services like pet hotels and specialized training.

Pet ownership in the UK remains robust, with approximately 60% of households owning at least one pet in 2024, according to recent surveys. This sustained high level of pet ownership directly benefits companies like Pets at Home Group, as it signifies a consistent demand for pet-related products and services.

Demographic shifts are notably impacting the pet industry. Gen Z, a growing segment of pet owners, exhibits a strong preference for ethically sourced and sustainable pet products, alongside a keen interest in technology-driven pet care solutions, such as smart feeders and activity trackers. This trend is reshaping product development and marketing strategies within the sector.

The surge in pet adoption experienced during the COVID-19 pandemic has largely persisted, contributing to continued market expansion. Data from 2024 indicates that many new pet owners have maintained their commitment, leading to sustained growth in spending on pet food, veterinary care, and accessories, which is a positive indicator for Pets at Home.

The increasing focus on pet health and wellness is a significant sociological trend driving demand for specialized products and services. Pet owners are actively seeking out natural and organic food options, preventative veterinary care, and even advanced health monitoring devices. This aligns perfectly with Pets at Home's strategy, as evidenced by their expanding range of premium pet foods and their veterinary services, which saw revenue growth in their latest reporting periods.

Convenience and Lifestyle Changes

Modern lifestyles, characterized by increasing urbanization and a rise in dual-income households, significantly boost the demand for convenient pet care. This trend fuels the need for services like online pet supply ordering, mobile grooming, and easily accessible veterinary clinics. Pets at Home Group's strategic advantage lies in its integrated model, combining retail, veterinary, and grooming services, which directly addresses this consumer desire for a comprehensive and hassle-free pet care solution.

The company's commitment to convenience is evident in its digital offerings. For instance, in the fiscal year ending March 2024, Pets at Home reported a substantial increase in online sales, reflecting customer preference for home delivery and click-and-collect options. This focus on omnichannel accessibility is crucial for engaging busy pet owners.

- Urbanization: More people living in cities means a higher concentration of pet owners seeking convenient local services.

- Dual-Income Households: With both partners working, time becomes a premium, increasing the appeal of one-stop-shop pet care providers.

- Digital Adoption: A growing percentage of consumers, including pet owners, expect seamless online purchasing and service booking.

- Integrated Services: Pets at Home's ability to offer retail, vet, and grooming under one roof simplifies pet ownership for time-pressed individuals.

Ethical Consumerism and Pet Welfare

Consumers are increasingly scrutinizing the ethical implications of their purchases, with a significant focus on animal welfare and responsible sourcing. This trend directly impacts the pet industry, where customers are actively seeking brands that demonstrate a commitment to these values.

Pets at Home Group’s initiatives, such as facilitating pet adoptions and providing expert advice on pet welfare, resonate strongly with this growing segment of ethically-minded consumers. For instance, in the financial year ending March 2024, Pets at Home reported a significant number of adoptions through their partner charities, underscoring their dedication to responsible pet ownership.

This alignment with consumer values translates into tangible market appeal and brand loyalty. Key aspects include:

- Ethical Sourcing: Growing demand for transparency in the sourcing of pet food and accessories, ensuring no exploitation.

- Animal Welfare Standards: Consumer preference for retailers that uphold high standards in their own operations and advocate for better welfare across the industry.

- Responsible Pet Ownership: Increased interest in educational resources and support services that promote the health, happiness, and longevity of pets.

- Brand Reputation: Companies demonstrating strong ethical credentials often build stronger customer relationships and a more positive public image.

The increasing humanisation of pets continues to drive demand for premium products and services, with owners treating their animals as family members. This sociological shift is reflected in the UK pet care market, valued at approximately £13.5 billion in 2023, with a significant portion driven by discretionary spending on higher-quality items and specialized care.

Demographic trends, particularly among younger generations like Gen Z, show a preference for ethically sourced and sustainable pet products, alongside an interest in tech-enabled pet care solutions. This is supported by sustained high pet ownership rates, with around 60% of UK households owning pets in 2024, ensuring a consistent customer base.

Modern lifestyles, characterized by urbanization and dual-income households, increase the need for convenient, integrated pet care solutions. Pets at Home Group's omnichannel strategy, including a rise in online sales in FY24, directly addresses this demand for accessible retail, veterinary, and grooming services.

Consumer focus on animal welfare and ethical sourcing is growing, influencing purchasing decisions. Pets at Home’s commitment to facilitating adoptions, as seen with significant numbers reported in FY24, aligns with these values, fostering brand loyalty among ethically-minded consumers.

| Sociological Factor | Impact on Pets at Home Group | Supporting Data/Trend |

|---|---|---|

| Pet Humanisation | Increased demand for premium products and services, higher customer spending. | UK pet care market valued at £13.5 billion in 2023; owners invest more in health and well-being. |

| Demographic Shifts (Gen Z) | Demand for ethical, sustainable, and tech-integrated pet products. | Growing preference for transparency in sourcing and interest in smart pet devices. |

| Lifestyle Changes (Urbanisation, Dual-Income) | Need for convenient, integrated pet care solutions and accessible services. | Rise in online sales for Pets at Home in FY24; appeal of one-stop-shop models. |

| Ethical Consumerism | Preference for brands with strong animal welfare and ethical sourcing commitments. | Pets at Home's adoption facilitation initiatives resonate with ethically-minded consumers. |

Technological factors

Technological advancements are fueling the growth of online pet retail, with consumers increasingly favoring e-commerce for pet supplies and services. This shift presents a significant opportunity for companies to expand their reach and customer base.

Pets at Home has actively embraced this trend, launching a new digital platform and a dedicated app. These initiatives have demonstrably boosted online sales and subscription numbers, improving customer interaction and offering greater convenience. For instance, their digital sales represented a substantial portion of their revenue in the fiscal year ending March 2024, reflecting the success of these investments.

This digital transformation is vital for Pets at Home to maintain and grow its market share in an increasingly competitive environment. By offering a seamless online experience, they can better cater to evolving consumer habits and preferences, solidifying their position in the market.

Smart devices like GPS trackers and automated feeders are transforming pet ownership, giving owners unprecedented insight into their pets' well-being. These gadgets provide real-time data on activity, location, and even eating patterns, allowing for more proactive and personalized pet care.

The wearable pet technology market is experiencing significant growth, with projections indicating a substantial increase in adoption. For instance, the global pet wearable market was valued at an estimated USD 2.5 billion in 2023 and is expected to reach over USD 7.5 billion by 2028, demonstrating a strong consumer interest in leveraging technology for pet health and safety.

The rise of telemedicine in veterinary services, including virtual consultations, is a significant technological shift. This allows for remote diagnosis and advice for less severe pet health issues, reducing the necessity for physical clinic visits. For instance, a survey by the American Veterinary Medical Association (AVMA) in late 2023 indicated that over 60% of veterinary practices had adopted some form of telemedicine, a substantial increase from pre-pandemic levels.

This trend enhances accessibility to veterinary care, proving particularly advantageous for pet owners in rural or underserved regions. It also caters to the growing demand for convenience among pet owners, allowing them to seek professional advice without the logistical challenges of travel. The global veterinary telemedicine market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, according to market research reports from early 2024.

Data Analytics and Personalisation

Pets at Home is increasingly using data analytics to offer highly personalized services. This includes creating bespoke meal plans and curated subscription boxes for pet food and accessories, directly addressing individual pet needs and owner preferences.

This data-driven strategy significantly boosts customer satisfaction and fosters loyalty. By understanding specific pet requirements, the company can proactively offer relevant products and services, making customers feel valued and understood.

For instance, in the fiscal year ending March 2024, Pets at Home reported a 6.1% increase in revenue, partly attributed to the success of its subscription services, which benefit from this personalization approach. The company's digital investments continue to focus on enhancing these data capabilities to further refine customer experiences.

- Data-driven personalization enhances customer engagement and retention.

- Subscription services, powered by data analytics, are a key growth driver.

- Targeted marketing campaigns based on pet profiles improve conversion rates.

- Investment in technology is crucial for maintaining a competitive edge in the pet care market.

Automation and Operational Efficiency

Pets at Home is actively investing in automation to boost efficiency, especially within its distribution centers and retail stores. This strategic move is designed to combat increasing labor expenses and enhance overall productivity.

These technological advancements, such as automated warehousing systems and in-store self-checkout options, are crucial for streamlining operations. For instance, the company's ongoing investment in its distribution network, including a new automated distribution center in Stoke-on-Trent, aims to significantly improve stock availability and delivery times. This focus on automation directly supports their ability to respond swiftly to evolving customer demands and protect profit margins in a competitive market.

The benefits of this technological push are evident in their financial performance. In the fiscal year ending March 2024, Pets at Home reported a revenue of £1.5 billion, and continued investment in automation is expected to further optimize their cost base and enhance service delivery, contributing to future growth.

- Investment in automated distribution: Enhancing supply chain speed and accuracy.

- In-store automation: Improving customer experience and operational flow.

- Mitigating labor costs: Automation provides a buffer against rising wage pressures.

- Optimizing logistics: Ensuring efficient product availability and responsiveness to demand.

Technological factors are significantly reshaping the pet care industry, driving innovation in how pets are cared for and how consumers interact with pet-related businesses. Pets at Home is strategically leveraging these advancements to enhance its offerings and operational efficiency.

The company's commitment to a digital-first approach is evident in its robust online platform and mobile app, which saw continued growth in fiscal year 2024, contributing significantly to overall revenue. This digital infrastructure allows for personalized customer experiences and seamless access to products and services.

Furthermore, the increasing adoption of smart pet devices and the rise of veterinary telemedicine are creating new avenues for engagement and service delivery. Pets at Home is exploring these areas to provide comprehensive solutions that cater to the evolving needs of modern pet owners.

Investment in automation, particularly within logistics and customer service, is a key technological focus for Pets at Home. This aims to streamline operations, reduce costs, and improve the speed and accuracy of service delivery, as seen in their ongoing distribution network upgrades.

Legal factors

Pets at Home Group navigates a robust legal landscape in the UK, particularly concerning animal welfare. The company must adhere to regulations that dictate standards for pet care, breeding, and sales. Failure to comply can result in significant penalties, impacting operational continuity.

Recent legislative developments underscore the increasing stringency of animal welfare laws. For instance, the introduction of new penalty notices for animal welfare offenses in 2024 signifies a tougher enforcement approach. Furthermore, the Animal Welfare (Import of Dogs, Cats and Ferrets) Bill, progressing through Parliament in the 2024-25 session, aims to implement more rigorous controls on the importation of pets, potentially affecting supply chains and sourcing practices.

Maintaining compliance is paramount for Pets at Home to retain its operating licenses and safeguard its brand reputation. The company's commitment to animal welfare is not just a matter of ethical responsibility but a critical legal and business imperative. In 2023, the RSPCA reported a 12% increase in animal cruelty investigations, highlighting the societal and regulatory focus on this area.

Pets at Home Group's veterinary operations must comply with the Veterinary Medicines Regulations (VMRs) 2024. These regulations govern the control of veterinary medicines and medicated feed, impacting how the company prescribes, dispenses, and handles these products. Adherence to strict standards for record-keeping and overall veterinary practice is mandatory.

Pets at Home Group operates under stringent UK consumer protection laws, mandating fair trading practices and transparent pricing. This legal framework ensures customers receive accurate product information, particularly crucial for pet health and safety products. For instance, the Consumer Rights Act 2015 guarantees goods are of satisfactory quality, fit for purpose, and as described, directly impacting how Pets at Home markets and sells its extensive product range.

Regulations concerning online sales, such as the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013, are vital for Pets at Home's e-commerce operations. These rules dictate clear information disclosure before purchase and establish cancellation rights, affecting customer trust and return policies. Ensuring product safety, governed by legislation like the General Product Safety Regulations 2005, is paramount, especially with pet food, medications, and accessories.

Employment Law and Minimum Wage

Changes in employment laws, including potential increases to the National Living Wage, directly affect Pets at Home's operational costs. For instance, the National Living Wage in the UK increased to £11.44 per hour for those aged 21 and over from April 2024. This rise necessitates adjustments to the company's wage structures to ensure compliance and maintain a competitive edge in attracting and retaining staff.

Furthermore, shifts in National Insurance contributions also impact the overall cost of employment. These legislative changes require Pets at Home to continually review and adapt its compensation and benefits packages. The company must balance these increased labor costs with maintaining profitability and service quality.

- National Living Wage Impact: The April 2024 increase to £11.44 per hour for workers aged 21+ directly raises the wage bill for hourly employees.

- National Insurance Contributions: Changes in these employer-paid contributions add to the total cost of employing staff.

- Compensation Strategy: Pets at Home must adapt its pay and benefits to remain compliant and competitive in the labor market.

- Cost Management: Balancing increased labor expenses with business profitability is a key challenge.

Data Protection and Privacy Laws (GDPR)

Pets at Home Group, like any business with an online presence and customer data, must navigate a complex web of data protection and privacy laws. The General Data Protection Regulation (GDPR) is a prime example, setting strict standards for how personal information is collected, processed, and stored. Failure to comply can lead to significant penalties, impacting both financial performance and brand reputation.

Adhering to these regulations is not just a legal necessity but also a cornerstone of building and maintaining consumer trust. In 2023, fines under GDPR continued to be substantial, with significant penalties levied against companies for data breaches and non-compliance. For Pets at Home, this means investing in robust data security measures and transparent data handling practices.

- GDPR Fines: Companies can face penalties up to €20 million or 4% of their annual global turnover, whichever is higher.

- Data Breach Impact: A significant data breach could result in reputational damage and a loss of customer loyalty, affecting sales.

- Compliance Costs: Investing in cybersecurity and data privacy training represents an ongoing operational cost.

- Consumer Trust: Demonstrating strong data protection practices can be a competitive differentiator, enhancing customer confidence.

Legal frameworks significantly influence Pets at Home Group's operations, particularly regarding animal welfare and consumer rights. Stricter enforcement of animal cruelty laws, exemplified by the 2024 introduction of new penalty notices, demands robust compliance. The company must also navigate evolving regulations like the Animal Welfare (Import of Dogs, Cats and Ferrets) Bill, impacting its supply chain and ethical sourcing practices.

Compliance with veterinary medicine regulations is critical for Pets at Home's veterinary services, ensuring proper handling and dispensing of products. Consumer protection laws, such as the Consumer Rights Act 2015, mandate transparency and quality in product sales, directly affecting marketing and customer relations. Furthermore, data protection laws like GDPR necessitate significant investment in cybersecurity and privacy, with substantial fines for non-compliance, as evidenced by continued significant penalties in 2023.

Environmental factors

Pets at Home Group is actively pursuing ambitious environmental goals, aiming to achieve net-zero status by 2040. This commitment extends to reducing emissions across Scope 1, 2, and 3 categories, demonstrating a comprehensive approach to sustainability.

A key strategy involves close collaboration with suppliers to lower emissions stemming from purchased goods and services, as well as transportation networks. This focus on the value chain is crucial for meeting their 2040 target.

Consumers are increasingly seeking out pet products with a minimal environmental footprint, driving demand for items like organic pet food and accessories crafted from biodegradable or recyclable materials. This trend highlights a significant shift in purchasing behavior within the pet care market.

Pets at Home is actively responding to this by prioritizing sustainable sourcing for its own-brand product lines. A key objective is to achieve a substantial reduction in plastic packaging by the year 2025, demonstrating a commitment to environmental responsibility.

Pets at Home Group recognizes the importance of effective waste management and recycling to minimize its environmental footprint. The company actively promotes circular economy principles within its retail operations, aiming to reduce waste generation. This includes initiatives like encouraging the reuse of packaging materials, contributing to a more sustainable approach to their business model.

In 2023, Pets at Home reported a reduction in waste sent to landfill, with a significant portion now being recycled or recovered. They are committed to further improving their recycling rates, focusing on customer engagement to foster participation in recycling schemes, such as bringing back old pet food pouches for specialized recycling.

Climate Change Impact on Operations

Climate change presents a significant environmental factor for Pets at Home Group, potentially disrupting operations through supply chain vulnerabilities and shifts in consumer preferences towards eco-conscious choices. For instance, extreme weather events in sourcing regions could impact the availability and cost of pet food ingredients or accessories. Pets at Home's commitment to sustainability, as outlined in their 2024 annual report, focuses on mitigating these risks by diversifying suppliers and promoting sustainable product lines.

The company is actively integrating climate resilience into its operational framework. This includes exploring more localized sourcing options and investing in energy-efficient retail and distribution centers to reduce their carbon footprint. Their 2025 sustainability targets emphasize a 20% reduction in Scope 1 and 2 emissions compared to a 2022 baseline, directly addressing operational environmental impacts.

- Supply Chain Resilience: Diversifying sourcing to mitigate risks from climate-related disruptions to agriculture and manufacturing.

- Consumer Behavior Shifts: Adapting product offerings and marketing to align with growing consumer demand for sustainable pet products.

- Operational Efficiency: Implementing energy-saving measures in stores and distribution centers to lower environmental impact and costs.

- Emissions Reduction Targets: Working towards a 20% reduction in Scope 1 and 2 emissions by 2025, demonstrating a commitment to climate action.

Ethical and Environmental Consumer Preferences

Consumers, especially younger demographics like Gen Z, are increasingly scrutinizing the ethical and environmental footprint of the brands they support. This growing awareness translates into a preference for businesses that actively demonstrate sustainable practices and a commitment to social responsibility. For Pets at Home, aligning with these values is becoming a significant differentiator.

Pets at Home Group has been actively integrating sustainability into its operations. For instance, their commitment to reducing plastic waste is evident in initiatives aimed at minimizing single-use plastics in their product packaging. This focus on environmental responsibility not only appeals to eco-conscious consumers but also contributes to long-term operational efficiency and regulatory compliance.

The company's efforts to promote responsible pet ownership and sourcing also resonate with ethical consumer preferences. By providing clear information on product origins and promoting animal welfare, Pets at Home can build trust and foster deeper customer loyalty. This aligns with a market trend where consumers are willing to pay a premium for products and services that reflect their personal values.

Key areas of focus for Pets at Home in 2024 and 2025 include:

- Sustainable Sourcing: Enhancing transparency and ethical standards in the sourcing of pet food and accessories.

- Waste Reduction: Implementing further strategies to minimize waste across retail stores, veterinary practices, and online operations, with a target to reduce packaging waste by 15% by the end of 2025.

- Energy Efficiency: Investing in energy-efficient technologies for their facilities to lower their carbon emissions.

- Community Engagement: Supporting animal welfare charities and local environmental initiatives to demonstrate corporate citizenship.

Pets at Home Group is committed to environmental stewardship, aiming for net-zero emissions by 2040 across all scopes. This includes a 20% reduction in Scope 1 and 2 emissions by 2025 against a 2022 baseline, with a particular focus on reducing plastic packaging by 15% by the end of 2025.

Consumer demand for sustainable pet products is rising, influencing purchasing decisions towards eco-friendly options. The company is responding by prioritizing sustainable sourcing for its own-brand lines and enhancing transparency in ethical sourcing practices for pet food and accessories.

Climate change poses risks to supply chains and operational efficiency, prompting Pets at Home to explore localized sourcing and invest in energy-efficient retail and distribution centers. Waste management is also a key focus, with initiatives to increase recycling rates and promote circular economy principles.

| Environmental Focus Area | 2025 Target | 2024 Progress/Initiatives |

|---|---|---|

| Net-Zero Emissions | Net-zero by 2040 | Progress on Scope 1, 2, and 3 emission reductions |

| Scope 1 & 2 Emissions | 20% reduction (vs. 2022) | Ongoing energy efficiency measures in stores and distribution centers |

| Plastic Packaging Reduction | 15% reduction | Active strategies to minimize single-use plastics in product packaging |

| Waste Management | Improved recycling rates | Promoting circular economy principles; encouraging customer participation in recycling schemes |

| Sustainable Sourcing | Enhanced transparency and ethical standards | Prioritizing sustainable sourcing for own-brand product lines |

PESTLE Analysis Data Sources

Our PESTLE analysis for Pets at Home Group is informed by a comprehensive review of official government publications, reputable market research firms, and industry-specific reports. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable data.