Pets at Home Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pets at Home Group Bundle

Pets at Home Group faces moderate bargaining power from suppliers, particularly for specialized pet products, while intense rivalry among existing pet retailers shapes the competitive landscape. The threat of new entrants is relatively low due to established brand loyalty and capital requirements, but the availability of substitutes, like online pet supply retailers and DIY pet care, presents a significant challenge.

The complete report reveals the real forces shaping Pets at Home Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Pets at Home's reliance on key suppliers for products like premium pet food and veterinary medicines significantly influences supplier bargaining power. If Pets at Home constitutes a substantial portion of a supplier's revenue, that supplier might have less leverage to dictate terms. For instance, in 2023, Pets at Home reported a revenue of £1.4 billion, indicating a considerable purchasing volume that could reduce the bargaining power of suppliers heavily dependent on this single channel.

The bargaining power of suppliers for Pets at Home Group is significantly influenced by the uniqueness and differentiation of their inputs. If suppliers offer proprietary pet food formulas or specialized veterinary equipment, they gain considerable leverage. For example, in 2024, the pet care industry saw continued innovation in specialized diets, meaning suppliers of these unique formulations could command higher prices.

Conversely, when inputs are commoditized and readily available from multiple sources, Pets at Home's ability to negotiate favorable terms increases. The group's extensive retail network and direct sourcing capabilities in 2024 likely allowed them to mitigate the impact of any single supplier's unique offerings by diversifying their supply chain for more standard pet supplies.

Switching costs for Pets at Home Group's suppliers are a key factor in supplier bargaining power. If it's difficult or expensive for Pets at Home to change suppliers, those suppliers gain leverage. This could involve costs like retooling manufacturing processes for new product specifications or the time and effort needed to vet and onboard new partners.

For instance, if a supplier provides highly specialized pet food ingredients or unique veterinary equipment that requires significant integration into Pets at Home's operations, switching would be costly. Imagine the expense of re-certifying veterinary products or redesigning store layouts to accommodate different product ranges. These types of barriers directly strengthen a supplier's position.

Conversely, if Pets at Home can easily source comparable products or services from multiple vendors without incurring substantial costs, supplier power diminishes. This is often the case for more commoditized goods, where many suppliers can meet the required standards. In 2024, Pets at Home's focus on efficient supply chain management likely aims to minimize these switching costs where possible, thereby maintaining better control over its supplier relationships.

Concentration of Suppliers

The concentration of suppliers significantly impacts Pets at Home Group's bargaining power. If only a few key suppliers provide essential products, such as specific premium pet food brands or specialized veterinary equipment, their ability to dictate terms to Pets at Home increases. For instance, if a limited number of manufacturers produce high-demand, proprietary pet food lines, Pets at Home has less leverage to negotiate pricing or favorable supply agreements. This concentration allows these dominant suppliers to wield considerable influence.

Conversely, a fragmented supplier base, where numerous companies can provide similar goods or services, generally dilutes supplier power. Pets at Home benefits when it can source items like basic pet supplies or common veterinary consumables from a wide array of providers. This broad availability allows the company to switch suppliers easily if pricing becomes unfavorable or if quality standards are not met, thereby strengthening its negotiating position.

- Supplier Concentration: A limited number of dominant suppliers for critical products like premium pet food or specialized veterinary services can significantly enhance their bargaining power over Pets at Home Group.

- Fragmented Supplier Base: A wide selection of suppliers for general pet supplies or common veterinary consumables reduces supplier power, giving Pets at Home greater negotiation leverage.

- Impact on Costs: High supplier concentration can lead to increased input costs for Pets at Home, potentially affecting profit margins if these costs cannot be passed on to consumers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Pets at Home Group. This occurs when suppliers, such as major pet food manufacturers or veterinary pharmaceutical companies, decide to enter the retail or service market directly, effectively cutting out Pets at Home as an intermediary. For instance, a large pet food brand could launch its own e-commerce platform or even establish branded physical stores, directly competing with Pets at Home’s core offerings.

This strategic move by suppliers would not only diversify their revenue streams but also grant them greater control over customer relationships and pricing. Such a development would inevitably increase their bargaining power, as they would no longer be solely reliant on Pets at Home for market access. This could lead to more stringent terms for Pets at Home, including higher product costs or reduced product availability.

While specific instances of major pet food suppliers integrating forward into UK retail in 2024 are not widely publicized, the broader trend of brands exploring direct-to-consumer (DTC) channels continues across many sectors. For example, in the broader consumer goods market, numerous brands have invested heavily in DTC operations, demonstrating the viability and attractiveness of this strategy. This ongoing shift underscores the potential risk for retailers like Pets at Home.

The potential impact on Pets at Home could include:

- Increased competition: Suppliers entering the retail space directly would create new competitive pressures.

- Margin erosion: Direct sales by suppliers could force Pets at Home to lower prices, impacting profitability.

- Reduced supplier loyalty: Suppliers might prioritize their own channels, potentially limiting product variety or availability for Pets at Home.

Suppliers of specialized products, like premium pet food or unique veterinary medicines, hold significant bargaining power over Pets at Home. This power is amplified when these inputs are differentiated, as seen with innovative pet food formulations gaining traction in 2024. Conversely, the availability of commoditized goods from multiple sources in 2024 allows Pets at Home to negotiate more effectively, leveraging its extensive network to source widely available items.

The bargaining power of suppliers is also shaped by the concentration of the supplier market. A few dominant suppliers for critical items can dictate terms, whereas a fragmented base for basic supplies empowers Pets at Home's negotiations. For example, if only a handful of companies produce a highly sought-after proprietary pet food, their leverage increases substantially.

Switching costs for Pets at Home also play a crucial role; high costs associated with changing suppliers, such as retooling for new product specifications, bolster supplier leverage. Forward integration by suppliers, where they enter the retail market directly, also poses a threat, potentially increasing competition and eroding margins for Pets at Home.

| Factor | Impact on Pets at Home | Example/Data Point |

|---|---|---|

| Supplier Differentiation | Increases supplier bargaining power | Continued innovation in specialized pet diets in 2024 |

| Supplier Concentration | Increases supplier bargaining power | Limited manufacturers for proprietary pet food lines |

| Switching Costs | Increases supplier bargaining power | Costs of re-certifying veterinary products |

| Forward Integration Threat | Increases competition and erodes margins | Brands exploring direct-to-consumer (DTC) channels |

What is included in the product

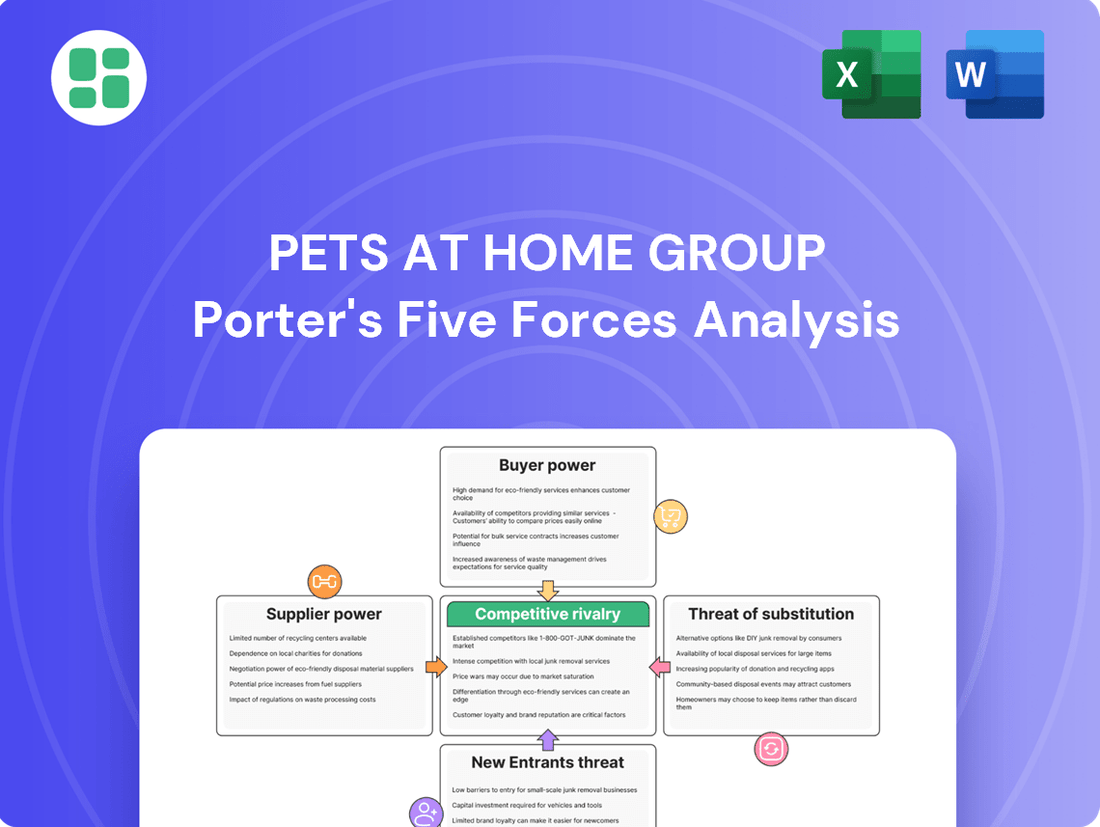

This analysis dissects the competitive forces impacting Pets at Home Group, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the pet care market.

Simplify competitive analysis with a visual breakdown of each force, making it easy to identify and address threats to Pets at Home Group's market position.

Customers Bargaining Power

Pets at Home's customers exhibit varying degrees of price sensitivity. For essential pet supplies like food and basic medications, customers may be more inclined to seek out competitive pricing, especially during periods of economic strain. For instance, in 2024, the UK experienced persistent inflation impacting household budgets, which likely amplified price consciousness among a broader segment of pet owners.

Customers can easily buy pet supplies from a variety of places, including large supermarkets, online giants like Amazon, and smaller independent pet stores. This wide selection of purchasing options directly strengthens their ability to negotiate better prices or switch providers if they are not satisfied. For instance, in the UK, the online retail sector for pet products saw significant growth, with many consumers shifting towards the convenience and competitive pricing offered by e-commerce platforms.

Switching costs for customers at Pets at Home are generally low for their retail products. However, for their veterinary and grooming services, established relationships and loyalty programs can create some friction when a customer considers moving to a competitor, slightly mitigating their bargaining power.

Customer Information and Transparency

Customers of Pets at Home Group benefit from increased transparency due to readily available information online. Price comparison websites and product reviews empower them to easily assess pricing, quality, and competitor offerings, significantly enhancing their bargaining power.

This heightened transparency means customers can make more informed purchasing decisions, often seeking the best value. For instance, in the UK pet supplies market, online retailers and comparison tools allow consumers to quickly identify competitive prices for food, accessories, and veterinary services, putting pressure on established players like Pets at Home to maintain attractive pricing and service levels.

- Informed Choices: Customers can readily compare prices and product features across various retailers, including online-only competitors.

- Price Sensitivity: Increased transparency often leads to greater price sensitivity among consumers, who can easily switch to more affordable options.

- Access to Reviews: Online reviews and forums provide insights into product quality and customer service experiences, influencing purchasing behavior.

Volume of Individual Purchases

The volume of individual purchases significantly dilutes the bargaining power of customers for Pets at Home Group. The company serves millions of pet owners across the UK, meaning no single customer represents a substantial portion of its revenue. This widespread customer base inherently limits the ability of any one individual to influence pricing or terms.

For instance, in the financial year ending March 2024, Pets at Home reported revenue of £1.36 billion. This substantial figure, derived from a vast number of transactions, underscores the fragmented nature of its customer demand. This fragmentation is a key factor in maintaining the company's pricing power.

- Fragmented Demand: Pets at Home's customer base is highly diversified, with millions of individual pet owners making purchases.

- Low Individual Contribution: No single customer's purchase volume is large enough to exert significant leverage over the company.

- Reduced Price Sensitivity: The inability of individual customers to collectively impact sales limits their power to negotiate lower prices.

- Scale of Operations: The sheer volume of individual transactions supports the company's overall revenue stability and pricing strategy.

The bargaining power of customers for Pets at Home is generally moderate, influenced by factors like price sensitivity and the availability of alternatives. While individual customers hold little sway due to the company's vast customer base, collective purchasing behavior and increased market transparency do exert pressure.

In 2024, heightened inflation in the UK meant many pet owners became more price-conscious, actively seeking value for essential items like pet food. This trend amplified the impact of readily available price comparison tools and online retailers, empowering consumers to switch providers more easily if dissatisfied with pricing or service.

Despite low switching costs for retail products, the loyalty built around Pets at Home's veterinary services and membership programs can offer some retention. However, the sheer volume of individual transactions, contributing to Pets at Home's £1.36 billion revenue in the year ending March 2024, means no single customer can significantly impact the company's operations or pricing strategies.

| Factor | Impact on Bargaining Power | Evidence/Data (2024 Context) |

|---|---|---|

| Price Sensitivity | Moderate to High | Persistent UK inflation in 2024 likely increased price consciousness for essential pet supplies. |

| Availability of Alternatives | High | Growth in online retail and supermarket offerings provides numerous purchasing options. |

| Switching Costs (Retail) | Low | Easy to switch between retailers for food, toys, and accessories. |

| Switching Costs (Services) | Moderate | Loyalty programs and established vet relationships can create some friction for service switches. |

| Information Transparency | High | Online comparison sites and reviews empower informed purchasing decisions. |

| Customer Volume | Low (for individual customers) | Millions of customers; no single entity has significant leverage. |

Preview the Actual Deliverable

Pets at Home Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for Pets at Home Group through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the pet care industry.

Rivalry Among Competitors

The UK pet care market is remarkably diverse, featuring a wide array of competitors. This includes major supermarket chains like Tesco and Sainsbury's offering pet food and accessories, online giants such as Amazon and Zooplus, and a significant number of independent pet stores. Furthermore, other veterinary chains and specialized service providers add to the competitive intensity.

This broad spectrum of players means Pets at Home faces rivalry not just from direct competitors in the pet retail and veterinary sectors, but also from businesses that offer pet-related products as part of a larger retail offering. For instance, in 2023, the UK grocery market alone was valued at over £200 billion, with a substantial portion dedicated to pet food and supplies, highlighting the scale of competition from unexpected sources.

The UK pet care market is experiencing robust growth, which generally tempers intense competitive rivalry. For instance, in 2023, the UK pet food market alone was valued at over £3 billion, demonstrating a healthy expansion. This upward trend allows companies like Pets at Home to expand their customer base without solely relying on taking market share from competitors.

Pets at Home Group faces significant competitive rivalry, particularly concerning product and service differentiation. Competitors like Jollyes and independent pet stores often differentiate through specialized product ranges, such as niche dietary foods or unique pet accessories, and by offering highly personalized customer service, which can be harder for larger chains to replicate.

The group's own efforts to differentiate include its integrated veterinary services and grooming salons, offering a one-stop shop experience. However, the market also includes online retailers like Amazon and Zooplus, which compete heavily on price and convenience, making it challenging for Pets at Home to maintain a strong differentiation advantage solely on product variety.

Exit Barriers for Competitors

Exit barriers in the pet care market can significantly influence competitive rivalry. For Pets at Home, these barriers might include substantial investments in its extensive network of physical stores and veterinary clinics, which represent considerable fixed assets. Leaving such an infrastructure would involve significant write-offs and disposal costs, making a complete exit financially punitive.

Competitors facing high exit barriers are often compelled to continue operating even when unprofitable, leading to intensified competition as they fight for market share. This can manifest as aggressive pricing strategies or increased marketing spend. For instance, the specialized nature of veterinary services requires highly skilled professionals, and retraining or redeploying these individuals can be a costly and complex undertaking for a departing firm.

The presence of long-term leases on prime retail locations or supply chain contracts can also trap competitors in the market. As of early 2024, the UK pet care market continues to see growth, with companies investing in new formats and services, suggesting ongoing commitment and thus higher potential exit costs for established players. A competitor like Pets at Home, with its integrated model, likely faces substantial costs if it were to divest its retail, grooming, and veterinary segments separately.

- High Capital Investment: Significant upfront costs in physical infrastructure like stores and veterinary practices create a substantial financial hurdle for exiting competitors.

- Specialized Workforce: The need for skilled veterinary staff and pet groomers means that exiting firms may face difficulties in reallocating or redeploying this specialized talent, increasing exit costs.

- Long-Term Commitments: Leases on retail spaces and ongoing supply agreements can lock competitors into the market, making a swift departure impractical and expensive.

Strategic Commitments and Market Dominance

Pets at Home Group faces significant competitive rivalry stemming from its substantial strategic commitments and established market presence. Competitors like the RSPCA, local independent pet shops, and online retailers such as Amazon and Zooplus have also made long-term investments, creating an intensely competitive landscape.

The company’s integrated model, combining retail, veterinary services, and grooming, represents a considerable strategic commitment that rivals must counter. This comprehensive offering, a key differentiator for Pets at Home, requires substantial capital investment and operational expertise to replicate, intensifying the rivalry as players vie for customer loyalty across multiple service categories.

- Brand Recognition and Network: Pets at Home boasts strong brand recognition and an extensive store network, a strategic advantage built over years. For instance, as of their fiscal year ending March 2024, they operated over 450 stores across the UK.

- Integrated Service Offering: The unique combination of retail, veterinary, and grooming services creates high switching costs for customers, representing a significant strategic commitment.

- Online and Discount Competitors: The rise of online-only retailers and discounters puts pressure on pricing and convenience, forcing established players to continually innovate and invest in their digital strategies.

- Veterinary Sector Competition: In the veterinary sector, competition comes from corporate consolidators like IVC Evidensia and CVS Group, as well as independent practices, all of which have made strategic investments in acquiring and upgrading facilities.

Pets at Home Group faces intense rivalry from a diverse set of competitors, including supermarkets, online retailers like Amazon and Zooplus, and independent stores. This broad competitive landscape means they compete not only on price but also on product range and service quality.

The UK pet care market, valued at over £13 billion in 2023, is growing, which helps to temper some of the rivalry. However, differentiation remains key, with rivals often focusing on niche products or personalized service, while Pets at Home leverages its integrated retail, veterinary, and grooming model.

High exit barriers, such as significant investments in physical infrastructure and specialized staff, mean competitors are often committed to the market, leading to sustained rivalry. For instance, the veterinary sector alone saw significant investment in facility upgrades and acquisitions throughout 2023 and early 2024.

Pets at Home's strategic commitments, including its extensive store network (over 450 locations as of March 2024) and integrated service offering, create a strong competitive position but also necessitate continuous investment to counter rivals in both the online and veterinary spaces.

| Competitor Type | Key Differentiators | Market Share Impact |

| Supermarkets (e.g., Tesco) | Convenience, Price | Significant for consumables (food, litter) |

| Online Retailers (e.g., Amazon, Zooplus) | Price, Convenience, Wide Selection | Growing, especially for non-specialized items |

| Independent Pet Stores | Niche Products, Personalized Service | Loyal customer base for specialized needs |

| Veterinary Chains (e.g., IVC Evidensia) | Specialized Care, Network of Clinics | Direct competition for veterinary services |

SSubstitutes Threaten

The threat of substitutes for Pets at Home Group's offerings is moderate. While commercial pet food and professional grooming services are convenient, customers can opt for homemade food or DIY grooming, which can be cost-effective. The perceived quality and convenience of Pets at Home's products and services, such as their Vet Group and grooming salons, are key differentiators against these alternatives.

The threat of substitutes for Pets at Home is influenced by how their price and performance stack up against alternatives. If other options provide similar quality or convenience at a lower cost, customers might switch. For example, online pet supply retailers often compete on price, offering discounts on food and accessories that can be attractive to budget-conscious pet owners.

In 2024, the competitive landscape continues to be shaped by the accessibility and affordability of online channels. Many consumers are increasingly comparing prices across various platforms, including direct-to-consumer brands and large e-commerce marketplaces. This price sensitivity means that if Pets at Home's pricing is perceived as higher for comparable products, the threat from these substitutes intensifies.

Customer propensity to substitute for Pets at Home Group is influenced by several factors, including brand loyalty and awareness of alternatives. For instance, while many pet owners develop strong loyalty to their local vet, the availability of online pet pharmacies and independent veterinary practices can present viable alternatives, especially for routine prescriptions or less complex treatments. In 2023, the UK online pharmacy market continued its growth, with many consumers appreciating the convenience and potential cost savings for repeat medications.

Advancements in Substitute Technologies or Solutions

The threat of substitutes for Pets at Home Group is amplified by emerging technologies that offer alternative ways to care for pets. For instance, advanced veterinary telemedicine platforms could reduce the necessity for physical clinic visits, a core service for Pets at Home. Similarly, sophisticated smart pet devices, such as automated feeders and self-cleaning litter boxes, can lessen the demand for traditional pet supplies and services.

These innovations are rapidly increasing the potential for substitution. Consider the growth in the pet tech market; by 2028, it's projected to reach over $30 billion globally, indicating a strong consumer interest in tech-driven pet care solutions. This trend directly challenges traditional pet retail and service models.

- Telemedicine: Virtual vet consultations can address minor ailments, reducing the need for in-person appointments.

- Smart Devices: Automated grooming tools or interactive toys can substitute for some human-led pet care activities.

- DIY Pet Care: Increased availability of online resources and products for at-home pet grooming and training can also divert customers.

Regulatory or Lifestyle Shifts Enabling Substitutes

Changes in how people live and work can open doors for substitute products or services for Pets at Home Group. For instance, the ongoing trend of increased remote work might lead more pet owners to consider do-it-yourself grooming or basic health checks at home, reducing reliance on professional grooming salons or vet visits for routine care. This shift could be amplified if new regulations make certain home-care products or simple veterinary procedures more accessible to the public.

For example, in 2024, continued adoption of flexible working arrangements means more owners are present to manage their pets' needs directly. This could foster a market for advanced at-home pet care kits and digital health monitoring devices that offer alternatives to traditional in-store services. The convenience factor of managing pet care alongside a home-based work schedule becomes a significant driver.

- Regulatory Impact: New veterinary guidelines or relaxed rules on over-the-counter pet medications could empower consumers to handle more tasks themselves, bypassing specialized pet service providers.

- Lifestyle Adaptations: The rise of the gig economy and flexible work schedules in 2024 means more pet owners have the time and inclination to engage in home-based pet maintenance and training.

- Technological Enablement: Advancements in pet tech, such as smart grooming tools or AI-powered diagnostic apps, are making DIY pet care more feasible and effective, presenting a growing threat to established service models.

The threat of substitutes for Pets at Home Group remains a significant consideration, particularly with the rise of digital alternatives and evolving consumer behaviors. While the company offers a comprehensive suite of products and services, customers can increasingly find comparable or alternative solutions outside of traditional pet retail and veterinary clinics. This dynamic is further influenced by economic factors and technological advancements that make DIY pet care more accessible.

In 2024, the competitive pressure from substitutes is evident in the growing online pet pharmacy market and the increasing availability of direct-to-consumer pet food brands. Many consumers are actively seeking cost savings and convenience, making price-sensitive decisions when purchasing essentials like pet food and medication. This trend highlights the importance of Pets at Home maintaining competitive pricing and demonstrating clear value propositions against these alternatives.

The accessibility of online resources for pet care and training also presents a substitute threat. Pet owners can find a wealth of information and products for at-home grooming, nutrition advice, and behavioral training, potentially reducing their reliance on professional services. For instance, the global pet care market is projected to see continued growth, with a significant portion attributed to e-commerce sales, indicating a strong shift in consumer purchasing habits.

| Substitute Category | Examples | Impact on Pets at Home |

|---|---|---|

| Online Pet Retailers | Amazon, Chewy, Zooplus | Price competition on food, accessories, and medications. Convenience of home delivery. |

| DIY Pet Care Resources | Online grooming tutorials, homemade food recipes, pet training apps | Reduced demand for professional grooming and veterinary advice for routine issues. |

| Telemedicine/Online Vet Services | Virtual consultations for minor ailments, online prescription refills | Potential displacement of in-person vet visits for non-urgent care. |

| Independent Veterinary Clinics | Local, non-chain veterinary practices | Competition for veterinary services, potentially offering more personalized care or specialized treatments. |

Entrants Threaten

The capital requirements for entering the UK pet care market are substantial, acting as a significant barrier for potential new competitors. Establishing a physical presence, whether it's a retail store, veterinary practice, or grooming salon, demands considerable upfront investment. This includes costs for acquiring or leasing prime retail space, stocking a diverse range of products, purchasing specialized veterinary equipment, and hiring qualified staff.

The substantial economies of scale enjoyed by incumbents like Pets at Home Group present a significant barrier to new entrants. For instance, their extensive network of stores and distribution centers allows for considerable cost savings through bulk purchasing of pet food, accessories, and veterinary supplies. In 2024, Pets at Home reported a revenue of £1.3 billion, indicating a scale that new, smaller competitors would find difficult to replicate quickly, thus hindering their ability to compete on price.

Pets at Home Group benefits from significant brand loyalty, a key factor in deterring new entrants. Their established reputation and extensive customer base mean newcomers face a substantial challenge in winning over existing clientele. For instance, Pets at Home's VIP (Very Important Pet) club boasts millions of members, fostering repeat business and creating a sticky customer relationship.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in securing prime retail locations and establishing robust supply chain networks. Established players like Pets at Home often have long-standing relationships with key pet product manufacturers and preferential lease agreements for high-traffic areas, making it difficult for newcomers to gain comparable access.

These established partnerships can translate into better pricing and product availability for incumbent firms. For instance, in 2024, the UK pet care market continued to see consolidation, with larger chains solidifying their supplier contracts, further limiting the bargaining power of new entrants seeking to establish their supply chains.

- Distribution Channel Barriers: Securing desirable retail space in the UK pet market is competitive, with prime locations often already occupied by established brands.

- Supply Chain Relationships: Major pet food and accessory manufacturers prioritize existing, high-volume clients, creating exclusivity and preferential terms that new entrants struggle to match.

- Economies of Scale: Established companies benefit from bulk purchasing power, which allows them to negotiate lower prices from suppliers, a cost advantage difficult for new entrants to overcome.

Regulatory Hurdles and Government Policy

The pet care industry, particularly its veterinary services segment, is heavily influenced by regulatory hurdles and government policies. These requirements can significantly increase the cost and complexity for new entrants. For instance, establishing veterinary practices necessitates adherence to stringent licensing, professional certification, and health and safety standards, creating substantial barriers to entry. In the UK, the Royal College of Veterinary Surgeons (RCVS) sets the standards for veterinary education and practice, requiring veterinarians to be registered and follow a strict code of conduct.

These compliance demands translate into considerable upfront investment for new businesses. Navigating these legal and regulatory landscapes requires specialized knowledge and resources, often making it difficult for smaller or less capitalized firms to compete. For example, the process of obtaining and maintaining veterinary practice premises approval from the RCVS involves meeting specific facility and equipment requirements, adding to the financial burden. This complexity acts as a deterrent, effectively limiting the number of new players entering the market, especially in specialized areas like advanced veterinary diagnostics or surgical procedures.

- Regulatory Compliance Costs: New veterinary clinics face significant expenses related to licensing, permits, and adherence to animal welfare regulations.

- Professional Certification Barriers: The mandatory registration and ongoing professional development for veterinary staff act as a skill-based entry barrier.

- Health and Safety Standards: Meeting rigorous health and safety protocols, including those for handling pharmaceuticals and infectious agents, requires substantial investment in infrastructure and training.

The threat of new entrants in the UK pet care market, specifically impacting a company like Pets at Home Group, is moderately low. High capital requirements for physical stores and veterinary clinics, coupled with established economies of scale that allow for cost efficiencies, present significant initial hurdles.

Brand loyalty, exemplified by Pets at Home's millions of VIP club members, creates customer stickiness that new entrants struggle to overcome. Furthermore, regulatory compliance, particularly for veterinary services, adds substantial costs and complexity, demanding specialized knowledge and investment in infrastructure and staff certification.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for retail space, inventory, and veterinary equipment | Significant financial barrier |

| Economies of Scale | Cost advantages from bulk purchasing and extensive networks | Difficulty competing on price |

| Brand Loyalty | Established customer base and loyalty programs | Challenge in customer acquisition |

| Regulatory Hurdles | Licensing, certification, and compliance for veterinary services | Increased complexity and cost |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Pets at Home Group is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Mintel and Statista, and competitor analysis derived from their investor relations websites and press releases.