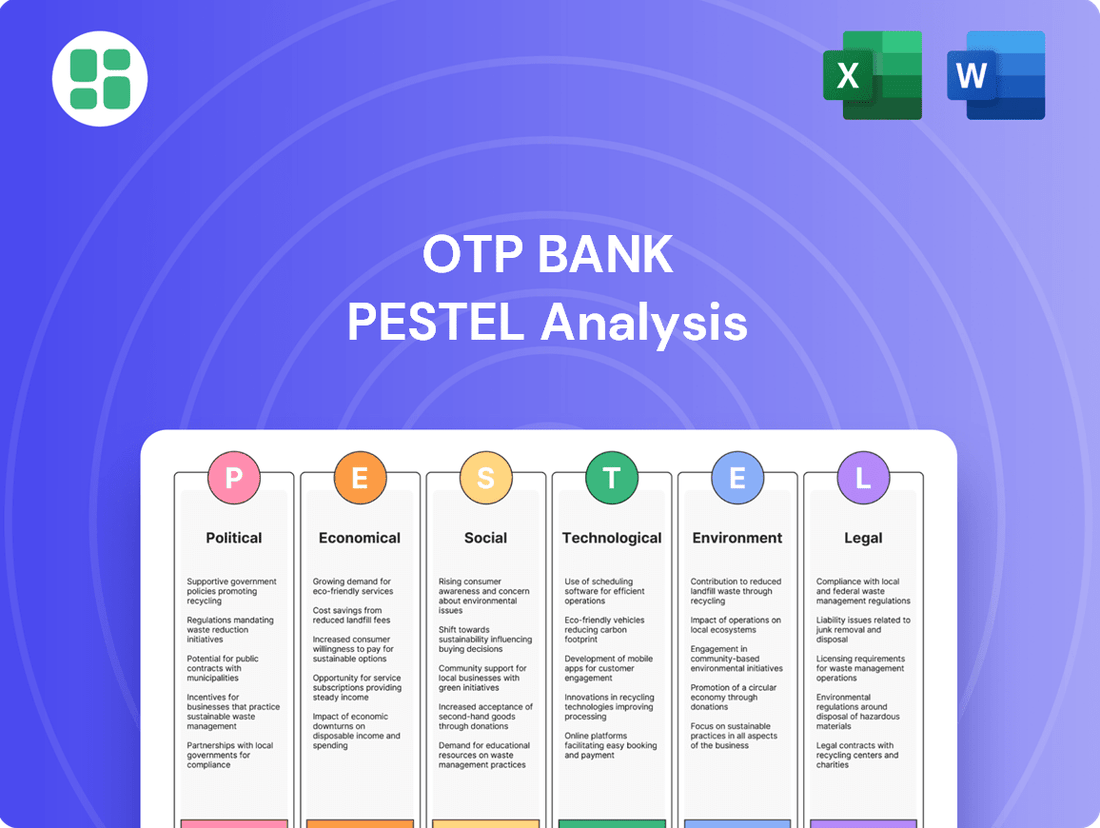

OTP Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OTP Bank Bundle

Gain a competitive edge with our comprehensive PESTLE analysis of OTP Bank. Understand the political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Download the full version to unlock actionable intelligence and refine your market strategy.

Political factors

OTP Bank's extensive operations across Central and Eastern Europe (CEE) expose it significantly to geopolitical instability. The ongoing conflict in Ukraine, for instance, creates a volatile operating landscape. This situation directly impacts economic stability, currency values, and the flow of trade and investment within the region, all of which are critical for a banking institution.

The repercussions of regional conflicts can be substantial for banks like OTP. Increased economic uncertainty can lead to higher non-performing loans and reduced lending activity. For example, in 2023, several CEE economies experienced slower growth partly due to the spillover effects of the conflict, impacting consumer and business confidence, and consequently, banking sector performance.

In response to these challenges, financial institutions in the CEE region are actively enhancing their risk management frameworks. This involves a more proactive integration of geopolitical risk assessments into core business strategies and operational planning. By adopting agile approaches, banks aim to better anticipate and mitigate the potential negative impacts of regional tensions on their financial health and strategic objectives.

Governments in Central and Eastern European (CEE) countries, including those where OTP Bank operates, may introduce policies like windfall taxes on bank profits or interest rate caps. For instance, Hungary, a key market for OTP Bank, has previously implemented significant banking taxes. Such interventions can directly affect profitability and necessitate strategic adjustments, impacting the bank's financial performance and long-term planning.

In 2025, CEE policymakers are anticipated to adopt a cautious approach to monetary policy. This caution stems from concerns about how exchange rate fluctuations might influence domestic inflation. For OTP Bank, this means that interest rate decisions by central banks will be closely watched, as they can influence lending margins and the overall cost of capital.

OTP Bank operates within a landscape increasingly shaped by EU integration, requiring adherence to a growing body of regulations. This includes directives on capital adequacy, such as the ongoing implementation of the EU Banking Package (CRR III and CRD VI), which impacts capital requirements and risk management frameworks. For instance, CRR III, fully phased in by January 1, 2025, aims to enhance the resilience of EU banks.

Furthermore, OTP Bank must continuously adapt its anti-money laundering (AML) and counter-terrorist financing (CFT) processes to align with EU standards, notably the comprehensive AML/CFT package finalized in 2024. Data protection regulations, like the GDPR, also necessitate robust compliance measures, adding to the operational complexity and cost of doing business across its CEE markets.

Political Risk and Rule of Law

Political stability and the robustness of the rule of law are critical considerations for OTP Bank's operations across Central and Eastern Europe (CEE). These factors directly influence the banking sector's stability. Countries with stronger legal frameworks and less corruption generally offer a more secure environment for financial institutions.

The level of political risk, including government stability and the strength of the rule of law, varies significantly across the CEE countries where OTP Bank operates. For instance, Transparency International's 2023 Corruption Perception Index shows a range, with countries like Estonia scoring higher (73) indicating better rule of law, while others may score lower, presenting greater challenges. Higher scores are generally associated with more stable banking environments.

Weaker rule of law and higher levels of corruption remain prominent risks for CEE banking. These issues can manifest as unpredictable regulatory changes, difficulties in contract enforcement, and increased operational costs due to corruption. For OTP Bank, navigating these varying political landscapes requires diligent risk management and a deep understanding of local legal and political dynamics.

- Government Stability: Fluctuations in government stability can lead to policy uncertainty, impacting banking regulations and economic forecasts.

- Rule of Law: The strength of judicial systems and contract enforcement directly affects the predictability of the business environment and the security of financial transactions.

- Corruption Levels: High corruption can increase operational risks and the cost of doing business, potentially affecting profitability and market confidence.

- Regulatory Environment: Political decisions shape banking regulations, capital requirements, and consumer protection laws, all of which are crucial for OTP Bank's strategic planning.

Cross-border Relations and Trade Policies

OTP Bank's operations in Central and Eastern Europe (CEE) are significantly shaped by cross-border relations and trade policies. The region's strong economic ties with Western Europe mean that shifts in trade agreements or increased protectionism in major economies like Germany or France can directly impact CEE export volumes. For instance, a slowdown in Western European manufacturing, a key market for CEE goods, could reduce the need for trade finance and other banking services. In 2023, trade between the European Union and the UK saw continued adjustments following Brexit, highlighting the dynamic nature of these relationships.

The export-oriented nature of many CEE economies, including those where OTP Bank has a strong presence, makes them particularly sensitive to external economic shocks. For example, supply chain disruptions, which were prominent in 2022 and continued to be a concern into 2024, can hamper production and trade, affecting corporate clients' financial health and demand for banking products. OTP Bank must monitor these evolving trade dynamics closely to manage its risk exposure and capitalize on opportunities.

Key considerations for OTP Bank regarding cross-border relations and trade policies include:

- Impact of EU trade agreements: The EU's Common Commercial Policy influences trade terms for member states, affecting market access and competition for OTP Bank's corporate clients.

- Geopolitical tensions: Conflicts or political instability in neighboring regions can disrupt trade routes and create economic uncertainty, potentially impacting loan demand and asset quality.

- Currency fluctuations: Trade policies and cross-border relations often influence exchange rates, which can affect the profitability of international transactions and the value of foreign currency-denominated assets and liabilities.

Government stability and the strength of the rule of law are paramount for OTP Bank's operations across Central and Eastern Europe (CEE). Countries with robust legal systems and lower corruption offer a more secure banking environment, as evidenced by Transparency International's 2023 Corruption Perception Index, where Estonia scored 73, indicating stronger rule of law compared to countries with lower scores. Political stability directly influences regulatory predictability and economic forecasts, crucial for financial institutions.

Navigating varying political landscapes across CEE requires OTP Bank to implement diligent risk management. Unpredictable regulatory changes and challenges in contract enforcement, often linked to weaker rule of law and higher corruption, can increase operational risks and business costs. For instance, Hungary, a key market, has historically imposed significant banking taxes, impacting profitability and necessitating strategic adjustments.

In 2025, CEE policymakers are expected to maintain a cautious monetary policy stance, prioritizing exchange rate stability to manage domestic inflation. This cautious approach by central banks will closely influence OTP Bank's lending margins and the cost of capital, requiring careful monitoring of interest rate decisions and their broader economic implications.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing OTP Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on OTP Bank's operations and market position.

A concise, actionable PESTLE analysis for OTP Bank that highlights key external factors, enabling proactive strategy development and mitigating potential market disruptions.

Provides a clear overview of the political, economic, social, technological, environmental, and legal forces impacting OTP Bank, simplifying complex external analysis for strategic decision-making.

Economic factors

The Central and Eastern European (CEE) region has seen varied inflation trends, impacting central bank policies and interest rate settings. For instance, Hungary's annual inflation was 4.0% in April 2024, down from 4.4% in March, showing a moderating trend. While inflation is projected to continue easing through 2025, central banks are likely to maintain a watchful stance.

OTP Bank's financial performance is closely tied to interest rate shifts. Changes in rates directly influence the bank's net interest margin, the attractiveness of loan products for customers, and the cost of acquiring funds. For example, a sustained period of higher interest rates can boost net interest income, but it also risks dampening loan demand and increasing the cost of deposits.

OTP Bank's growth is closely tied to the economic health of Central and Eastern European (CEE) countries, which are anticipated to see continued recovery through 2025. This economic rebound is crucial, as stronger GDP growth fuels increased lending demand and enhances the quality of the bank's loan portfolio.

The CEE region is set to demonstrate robust economic performance, with projections indicating it will outpace the Euro Area in GDP growth for both 2024 and 2025. For instance, the International Monetary Fund (IMF) projected in its April 2024 World Economic Outlook that CEE economies would grow by an average of 3.3% in 2024, compared to 0.9% for the Euro Area, with similar trends expected for 2025.

Rising real wages and moderating inflation across Central and Eastern European (CEE) countries are poised to invigorate private consumption, a key engine for economic expansion. For instance, in Poland, real wage growth was observed at 5.5% year-on-year in Q1 2024, signaling increased purchasing power.

This uplift in consumer spending directly influences retail banking operations, potentially driving higher demand for credit products like personal loans and mortgages, as well as fostering greater deposit accumulation. In Hungary, consumer confidence indices have shown a positive trend in early 2024, suggesting a willingness to spend.

A robust real economy, characterized by sustained growth in both consumption and investment, is crucial for maintaining manageable risk costs for CEE banks. For example, the IMF projects a 3.5% GDP growth for the CEE region in 2024, which bodes well for asset quality.

Credit Risk and Non-Performing Loans (NPLs)

While Central and Eastern European (CEE) economies, including those where OTP Bank operates, typically enjoy low unemployment which aids in keeping risk costs manageable, their banking sectors can exhibit greater sensitivity to economic downturns compared to their Western European counterparts. This sensitivity means that asset quality, particularly the level of non-performing loans (NPLs), is a crucial economic factor for OTP Bank to monitor.

OTP Bank, like other regional players, must actively manage its NPL ratios and anticipate potential credit losses. Fortunately, NPL ratios across the CEE region have been steadily moving closer to the European Union averages. For instance, as of late 2023 and early 2024, many CEE countries reported NPL ratios below 4%, a significant improvement from previous years. This convergence is supported by generally higher capital buffers within these banks, equipping them to better absorb any unexpected credit losses that might arise from economic volatility.

- NPL Convergence: CEE NPL ratios are nearing EU averages, with many countries reporting below 4% in late 2023/early 2024.

- Capital Strength: Banks in the region generally hold robust capital levels, enhancing their capacity to absorb potential credit losses.

- Economic Sensitivity: Despite low unemployment, CEE banks' asset quality can be more susceptible to economic shocks than those in Western Europe.

- Key Management Focus: Managing NPLs and mitigating credit risk remains a paramount economic consideration for OTP Bank.

Market Consolidation and Competition

The banking landscape in Central and Eastern Europe (CEE) is still characterized by a degree of fragmentation. This has fueled a persistent trend of market consolidation, as banks aim to achieve greater economies of scale and solidify their competitive standing. For instance, in 2024, several significant M&A deals were reported across the CEE region, indicating a robust appetite for strategic acquisitions.

This wave of mergers and acquisitions, while presenting avenues for expansion, simultaneously sharpens the competitive edge among the banks that remain. As the sector continues to evolve, further consolidation is anticipated in the coming years, reshaping the competitive dynamics and potentially leading to fewer, but larger, banking entities operating within the CEE market.

- Market Fragmentation: The CEE banking sector still has many players, creating opportunities for consolidation.

- Scale Efficiency: Consolidation allows banks to reduce costs and improve operational efficiency by increasing their size.

- Intensified Competition: As fewer, larger banks emerge, competition among them becomes more pronounced.

- Future Outlook: Continued M&A activity is expected, leading to further consolidation in the CEE banking market.

Economic growth in Central and Eastern Europe (CEE) is projected to outpace the Euro Area through 2025, with the IMF forecasting 3.3% GDP growth for CEE in 2024 compared to 0.9% for the Euro Area. This expansion, driven by rising real wages and moderating inflation, is boosting private consumption and demand for credit products. For example, Poland saw 5.5% real wage growth year-on-year in Q1 2024, signaling increased purchasing power.

Inflation in CEE countries is generally easing, with Hungary's inflation at 4.0% in April 2024. This trend allows central banks to adopt a more stable interest rate policy, which directly impacts OTP Bank's net interest margin and loan product attractiveness. While higher rates can boost income, they also risk slowing loan demand and increasing funding costs.

The CEE banking sector is experiencing consolidation, with M&A activity increasing in 2024 as banks seek economies of scale. This trend intensifies competition among remaining players. Despite low unemployment, CEE banks' asset quality is sensitive to economic downturns, making NPL management crucial. However, CEE NPL ratios are converging towards EU averages, with many below 4% in late 2023/early 2024, supported by robust capital buffers.

| Economic Indicator | CEE Region (2024 Projection) | Euro Area (2024 Projection) | Source |

|---|---|---|---|

| GDP Growth | 3.3% | 0.9% | IMF (April 2024) |

| Hungary Inflation (April 2024) | 4.0% | N/A | National Statistics Office |

| Poland Real Wage Growth (Q1 2024) | 5.5% YoY | N/A | National Statistics Office |

| CEE NPL Ratio (Late 2023/Early 2024) | Below 4% (average) | N/A | Industry Reports |

What You See Is What You Get

OTP Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of OTP Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and key drivers shaping OTP Bank's future with this detailed report.

Sociological factors

Demographic shifts, including aging populations in several Central and Eastern European (CEE) countries and a strong internal migration trend towards urban centers, significantly shape the demand for banking services. For instance, by 2025, many CEE nations are projected to have a higher proportion of citizens over 65, requiring different financial products like retirement planning and healthcare-focused investments. This necessitates OTP Bank adapting its service portfolio and branch network strategy to meet these evolving population needs.

Furthermore, the changing demographic of mortgage applicants, with Gen Z increasingly entering the market, is a key factor. This generation often prioritizes digital banking solutions and may have different expectations regarding loan accessibility and repayment flexibility compared to older generations. OTP Bank must therefore innovate its digital offerings and potentially adjust its lending criteria to attract and serve this growing segment.

Customers in Central and Eastern Europe (CEE), especially younger demographics, are shifting their banking preferences towards digital platforms. They expect seamless, mobile-centric, and highly personalized interactions, pushing banks like OTP to prioritize digital innovation.

To stay competitive against agile fintech challengers, OTP Bank needs sustained investment in its digital infrastructure. This commitment is crucial as global fintech user penetration is projected to reach 80.1% by 2025, with Europe already showing a strong adoption rate exceeding 70%.

Financial literacy levels across Central and Eastern Europe (CEE) present a mixed landscape, directly impacting how consumers engage with sophisticated financial instruments and digital banking solutions. For instance, a 2023 survey indicated that only 55% of adults in select CEE countries felt confident managing their finances. This variability means OTP Bank can significantly boost customer acquisition by developing user-friendly products and offering educational programs focused on financial well-being.

The relatively low penetration of formal banking services in many CEE nations, estimated at around 60% of the adult population in some emerging markets within the region as of early 2024, signifies substantial untapped growth potential. As economic conditions improve and disposable incomes rise, a larger segment of the population will seek banking services, presenting a prime opportunity for OTP Bank to expand its reach and market share through targeted outreach and inclusive product design.

Trust in Financial Institutions

Public trust in financial institutions is a cornerstone for OTP Bank's success, heavily influenced by historical economic downturns and evolving regulatory landscapes. For instance, the aftermath of the 2008 global financial crisis and subsequent European sovereign debt issues in the early 2010s significantly impacted consumer confidence across the continent, including in OTP Bank's operating regions. Recent surveys from late 2023 and early 2024 indicate a continued emphasis on transparency and ethical practices, with a significant portion of consumers stating that a bank's perceived trustworthiness is a primary factor in their choice of financial provider.

OTP Bank must actively cultivate and maintain this trust through clear communication and a demonstrable commitment to customer welfare. This involves not only adhering to stringent regulations but also proactively addressing customer concerns and demonstrating corporate social responsibility. Building this confidence is vital for both retaining existing clients and attracting new ones in a competitive market. For example, a 2024 study on banking consumer behavior highlighted that over 60% of respondents consider a bank's reputation for honesty and reliability as more important than interest rates when selecting a primary banking partner.

The demand for reassurance and transparency from customers is paramount. Banks that can effectively communicate their stability, security measures, and commitment to fair practices are likely to see greater customer loyalty. This is particularly relevant in 2024, as economic uncertainties persist, making customers more risk-averse and appreciative of dependable financial partners.

Workforce Dynamics and Talent Retention

The availability of skilled labor, especially in technology and digital banking, is a crucial sociological aspect for OTP Bank. In 2024, the demand for IT professionals in the financial sector continued to outstrip supply across Europe, with many countries reporting significant shortages. This necessitates robust talent attraction and retention strategies.

To maintain its operational edge and foster innovation, OTP Bank must prioritize competitive compensation packages, offer continuous professional development opportunities, and cultivate a positive and engaging work environment. For instance, reports from early 2025 indicate that companies offering flexible work arrangements and clear career progression paths saw a 15% higher retention rate among tech talent compared to those that did not.

- Talent Shortage: A persistent gap exists in skilled technology and digital banking professionals across the region.

- Retention Strategies: Competitive salaries, professional growth, and a supportive culture are key to keeping valuable employees.

- Innovation Driver: A stable and skilled workforce is essential for OTP Bank to drive digital transformation and service improvement.

- Market Trends: Flexible work options and development programs are increasingly important for attracting and retaining top talent in the banking sector.

Societal attitudes towards financial institutions and digital adoption significantly influence OTP Bank's operational landscape. Growing consumer demand for transparency and ethical practices, highlighted by a 2024 study showing over 60% prioritizing trustworthiness over rates, necessitates clear communication and strong corporate social responsibility. Furthermore, the increasing reliance on digital channels, with global fintech user penetration projected at 80.1% by 2025, requires continuous investment in digital infrastructure to meet evolving customer expectations.

Technological factors

The banking sector is undergoing a significant transformation driven by the rapid digitalization of services. OTP Bank, like its peers, is navigating this shift, which includes the widespread adoption of mobile banking, online payment systems, and streamlined digital onboarding processes. This evolution is fundamentally changing how customers interact with financial institutions.

To stay competitive, OTP Bank needs to prioritize ongoing investment in its digital platforms. The goal is to offer customers exceptionally smooth and intuitive experiences, directly addressing the challenge posed by agile, digital-native fintech companies. This focus on user experience is crucial for retaining and attracting customers in an increasingly digital-first market.

The importance of digital banking is underscored by user engagement statistics. In 2025, digital banking emerged as the most utilized fintech service, with a substantial 89% of users actively engaging with either mobile or online banking platforms. This widespread adoption highlights the critical need for OTP Bank to maintain a robust and cutting-edge digital presence.

As banking operations become increasingly digital, the risk of cyberattacks and data breaches rises significantly. OTP Bank must implement robust cybersecurity measures and adhere to stringent data protection regulations to safeguard customer information and maintain trust. Cybersecurity will remain a top priority for financial institutions, with global spending on cybersecurity expected to reach over $200 billion in 2024.

Fintech startups are rapidly reshaping the financial landscape, introducing innovative solutions in areas like payments, lending, and investment. This competitive pressure means OTP Bank must either develop its own agile digital offerings or partner with these nimble players. For instance, the global fintech market was projected to reach over $30 trillion by 2025, highlighting the significant disruption occurring.

OTP Bank has a strategic choice: compete head-on by building in-house fintech capabilities or collaborate. Partnerships can allow OTP to quickly leverage new technologies and access previously untapped customer bases. This blurring of lines is evident as traditional banks increasingly adopt fintech-like models, while some fintechs pursue banking licenses, creating a dynamic and evolving competitive environment.

Adoption of AI and Data Analytics

The increasing adoption of artificial intelligence (AI) and data analytics is fundamentally reshaping the banking sector. These technologies are vital for personalizing customer experiences, strengthening risk management protocols, and identifying fraudulent activities more effectively. OTP Bank can leverage AI and big data to gain a more profound understanding of customer preferences and streamline its operational processes. For instance, AI is projected to be a cornerstone technology in consumer banking, aiding in fraud detection, risk assessment, and the automation of routine tasks, thereby enhancing overall service delivery.

By integrating advanced analytics, OTP Bank can unlock significant operational efficiencies and improve its competitive edge. The bank's strategic implementation of AI can lead to more accurate credit scoring models, personalized product offerings, and proactive customer support. In 2024, financial institutions globally are investing heavily in AI, with estimates suggesting that AI in banking could reach hundreds of billions of dollars in market value by the end of the decade. This trend highlights the imperative for OTP Bank to accelerate its digital transformation initiatives centered around these powerful technologies.

- AI-driven fraud detection systems can reduce false positives by up to 50%, improving customer trust and operational efficiency.

- Data analytics enables personalized marketing campaigns, potentially increasing customer engagement by 20-30% for targeted segments.

- AI-powered risk management tools can enhance predictive accuracy in loan default prediction, reducing non-performing loans by an estimated 5-10%.

- Automation of back-office processes through AI can lead to cost savings of 15-25% in operational expenditures.

Cloud Computing and Infrastructure Modernization

The banking sector's move towards cloud computing offers significant advantages like increased scalability, flexibility, and robust security for operations. OTP Bank's strategic investments in upgrading its core IT systems and migrating to cloud platforms are crucial for driving its digital transformation initiatives and staying ahead of emerging technologies.

Modernizing its infrastructure is key for OTP Bank to facilitate seamless digital transactions and adapt its core systems for a future potentially involving digital currencies. For instance, by 2024, many financial institutions were reporting substantial increases in cloud adoption, with some estimates suggesting over 70% of financial services firms had migrated critical workloads to the cloud, highlighting the industry-wide trend OTP Bank is participating in.

This modernization is not just about efficiency; it's about future-proofing. OTP Bank's commitment to this technological shift positions it to better handle fluctuating customer demands and integrate new digital services rapidly. The global cloud computing market in financial services was projected to reach hundreds of billions of dollars by 2025, underscoring the scale of this technological imperative.

- Scalability: Cloud infrastructure allows OTP Bank to adjust resources dynamically based on demand, ensuring smooth service during peak periods.

- Flexibility: Enables quicker deployment of new digital products and services, enhancing customer experience and competitive edge.

- Security Enhancements: Advanced cloud security measures help protect sensitive customer data and comply with evolving regulatory requirements.

- Digital Currency Readiness: Modernized core systems are foundational for integrating and managing potential future digital currency transactions.

Technological advancements are reshaping the banking landscape, with digital banking adoption soaring. By 2025, 89% of users actively engaged with mobile or online banking, making a robust digital presence essential for OTP Bank. The bank must invest in user-friendly platforms to compete with fintechs, as the global fintech market was projected to exceed $30 trillion by 2025.

Legal factors

OTP Bank navigates a complex web of banking regulations, including stringent capital adequacy rules like Basel III, and upcoming EU directives such as CRR III and CRD VI, which will be fully implemented by January 2025. These regulations mandate specific capital ratios and liquidity buffers to ensure the bank's resilience against economic shocks.

Compliance with these evolving legal frameworks is not just a formality but a critical operational necessity for OTP Bank, directly impacting its ability to lend, invest, and maintain its banking license. The latest EU Banking Package, effective from early 2025, introduces enhanced risk assessment methodologies and more rigorous reporting, demanding significant investment in compliance infrastructure and expertise.

OTP Bank must navigate increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) laws. This necessitates robust due diligence, advanced transaction monitoring, and meticulous suspicious activity reporting to comply with regulations designed to combat financial crime.

The recent establishment of the European Anti-Money Laundering Authority (AMLA) and new EU directives are set to significantly bolster coordination and oversight across member states. These initiatives, including the 6th AML Directive, will be crucial for ensuring a harmonized and effective approach to AML/CFT supervision throughout the European Union, impacting OTP Bank's operational framework.

Compliance with data protection regulations like the General Data Protection Regulation (GDPR) is paramount for OTP Bank, as it manages extensive customer financial and personal information. This necessitates adherence to stringent guidelines for data acquisition, safekeeping, utilization, and international movement.

To bolster its data security and ensure regulatory adherence, OTP Bank is implementing advanced data encryption and sophisticated fraud detection methodologies. These measures are vital for safeguarding sensitive information and maintaining customer trust in an increasingly digital financial landscape.

Consumer Protection and Lending Laws

Laws safeguarding consumers in financial services, such as fair lending practices, clear fee disclosures, and effective dispute resolution, significantly influence OTP Bank's retail banking activities. For instance, regulations mandating transparent fee structures ensure customers understand all charges, directly impacting their perception of value and trust in the bank. Non-compliance can lead to substantial fines and reputational damage.

Adherence to these consumer protection and lending laws is paramount for OTP Bank to sustain customer confidence and avert legal repercussions. The bank must ensure its lending practices are non-discriminatory and that all terms and conditions are communicated clearly. This focus on consumer rights is not just a legal obligation but a strategic imperative for long-term business health.

The evolving regulatory landscape, particularly with upcoming directives like PSD3 and PSR, introduces new requirements for transaction authorization and enhanced consumer protection measures. These updates aim to bolster security and transparency in digital payments. For example, PSD3 is expected to further strengthen consumer rights in areas like open banking and data sharing, requiring OTP Bank to adapt its digital service offerings and internal processes accordingly.

- Fair Lending Practices: OTP Bank must ensure its loan application and approval processes are free from bias, adhering to regulations that prevent discrimination based on race, religion, or other protected characteristics.

- Transparent Fee Structures: All service charges, account fees, and interest rates must be clearly communicated to customers upfront, with no hidden costs, to comply with consumer protection directives.

- Dispute Resolution Mechanisms: The bank needs robust and accessible channels for customers to raise and resolve complaints efficiently, often mandated by national financial ombudsman schemes.

- PSD3 and PSR Compliance: OTP Bank is preparing for new rules under PSD3 and PSR, which will likely include stricter requirements for strong customer authentication and enhanced consumer protection in payment services.

Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA), set to take full effect in January 2025, will significantly reshape how financial institutions like OTP Bank manage operational risks and cybersecurity. This new EU regulation mandates enhanced capabilities in areas such as IT system testing, comprehensive incident reporting, and closer collaboration with third-party technology providers to bolster digital operational resilience.

DORA's core objective is to ensure that banks can withstand, respond to, and recover from all types of ICT-related disruptions and threats. For OTP Bank, this means a proactive approach to strengthening its digital defenses and operational continuity plans.

Key implications for OTP Bank under DORA include:

- Mandatory ICT Risk Management Framework: Implementing a comprehensive framework to identify, assess, manage, and monitor ICT risks.

- Digital Operational Resilience Testing: Conducting regular and advanced testing, including threat-led penetration testing, for critical ICT functions.

- Third-Party Risk Management: Establishing robust oversight and contractual requirements for ICT third-party service providers.

- Incident Reporting: Standardized reporting of significant ICT-related incidents to competent authorities.

OTP Bank faces a dynamic legal environment, with new EU directives like CRR III and CRD VI, fully effective by January 2025, imposing stricter capital adequacy and liquidity requirements. These regulations, alongside the upcoming PSD3 and PSR, will necessitate significant adaptations in transaction authorization and consumer protection for digital payments.

The Digital Operational Resilience Act (DORA), also effective January 2025, mandates a robust ICT risk management framework, advanced testing, and stringent third-party oversight for institutions like OTP Bank. Furthermore, the recent establishment of the European Anti-Money Laundering Authority (AMLA) and updated AML directives underscore a heightened focus on combating financial crime, requiring enhanced due diligence and reporting.

Consumer protection laws, including fair lending practices and transparent fee structures, remain critical. OTP Bank must ensure non-discriminatory lending and clear communication of all charges to maintain customer trust and avoid penalties. GDPR compliance also continues to demand rigorous data protection measures, with ongoing investments in encryption and fraud detection.

OTP Bank's adherence to these evolving legal standards is crucial for maintaining its license and operational integrity. The bank's proactive approach to compliance, particularly with the January 2025 implementation of key EU regulations, will directly influence its risk management, digital service offerings, and overall market standing.

Environmental factors

OTP Bank must navigate the dual threats of climate change: physical risks like floods damaging properties that serve as loan collateral, and transition risks stemming from shifts to a low-carbon economy that could devalue investments in carbon-intensive sectors. By the close of 2024, global climate policy direction remained increasingly uncertain, creating a complex environment for assessing these financial exposures.

Financial institutions like OTP Bank face growing demands for robust Environmental, Social, and Governance (ESG) reporting. Stakeholders, including investors and regulators, are pushing for greater transparency regarding a company's sustainability practices.

OTP Bank is actively incorporating ESG principles into its business model, aligning with evolving European regulations. This includes adherence to the European Sustainability Reporting Standards (ESRS) and the EU Taxonomy Regulation, which set clear guidelines for what constitutes sustainable economic activity.

For instance, by 2024, many large companies in the EU, including financial institutions, are required to report under ESRS. OTP Bank’s commitment to these standards means detailed disclosures on environmental impact, social responsibility, and corporate governance are becoming a standard part of their operational framework.

The demand for sustainable financial products like green bonds and mortgages is rapidly increasing. OTP Bank is responding by setting ambitious ESG financing targets and actively engaging in green lending across Central and Eastern Europe. This focus is evident in their 2024 performance, where they solidified their leadership in issuing transition and sustainability-linked loans.

Reputational Risk from Environmental Impact

Public perception of OTP Bank's environmental practices is a critical factor, directly influencing its brand image and customer loyalty. A perceived lack of commitment to sustainability can lead to significant reputational damage, deterring both customers and investors who increasingly prioritize environmental responsibility.

To mitigate this, OTP Bank must actively showcase its dedication to environmental stewardship. This includes transparent reporting on its carbon footprint and investments in green initiatives. For instance, by mid-2024, a growing number of European banks have committed to net-zero emissions targets, setting a benchmark for institutions like OTP to align with.

Younger generations, particularly Millennials and Gen Z, are highly attuned to environmental issues and can easily discern genuine efforts from mere greenwashing. This demographic is driving demand for financial institutions that integrate robust Environmental, Social, and Governance (ESG) ratings and offer impact investing opportunities. By 2025, it's projected that sustainable investing assets under management could reach trillions globally, underscoring the financial imperative for OTP Bank to adapt.

- Growing investor demand for ESG integration: Over 70% of institutional investors consider ESG factors in their investment decisions as of early 2024.

- Millennial and Gen Z purchasing power: These demographics are expected to control a significant portion of global wealth by 2030, with a strong preference for sustainable brands.

- Regulatory focus on sustainability reporting: European Union regulations are increasingly mandating detailed environmental impact disclosures for financial institutions.

Carbon Footprint and Operational Sustainability

OTP Bank, as a significant financial institution, actively manages its operational carbon footprint. This includes monitoring and reducing energy consumption across its extensive network of branches and data centers. For instance, in 2023, OTP Group reported a total Scope 1 and Scope 2 greenhouse gas emissions of 126,223 tCO2e, a decrease from the previous year, reflecting their commitment to environmental responsibility.

The bank's sustainability strategy involves tangible investments in reducing its environmental impact. These initiatives range from upgrading to energy-efficient lighting and HVAC systems in its properties to implementing sustainable procurement policies for goods and services. These actions not only contribute to lowering operational costs but also demonstrate alignment with international climate agreements and growing stakeholder expectations for corporate environmental stewardship.

Key areas of focus for OTP Bank's operational sustainability include:

- Energy Efficiency: Implementing upgrades in buildings to reduce electricity and heating/cooling needs.

- Renewable Energy Adoption: Exploring and increasing the use of renewable energy sources for its operations where feasible.

- Waste Management: Enhancing recycling programs and reducing waste generation across all facilities.

- Digitalization: Promoting digital services to reduce paper consumption and the need for physical travel.

OTP Bank faces significant environmental challenges, including physical risks from climate change like floods impacting collateral and transition risks from the shift to a low-carbon economy affecting investments. By 2024, regulatory frameworks like the EU Taxonomy and ESRS are mandating detailed ESG reporting, requiring institutions like OTP to be transparent about their environmental impact.

The bank is actively responding to growing investor and consumer demand for sustainable finance, setting ESG financing targets and increasing green lending, as evidenced by their 2024 performance in transition and sustainability-linked loans. Public perception is crucial, with younger generations increasingly prioritizing environmental responsibility, making genuine commitment essential to avoid reputational damage and capitalize on the projected trillions in sustainable investing assets by 2025.

OTP Bank is also focused on reducing its operational carbon footprint, exemplified by a decrease in Scope 1 and 2 emissions to 126,223 tCO2e in 2023. Key initiatives include energy efficiency upgrades, exploring renewable energy, improving waste management, and promoting digitalization to reduce paper usage.

| Environmental Factor | Impact on OTP Bank | 2024/2025 Outlook/Data |

|---|---|---|

| Climate Change Risks (Physical & Transition) | Devaluation of collateral, impact on investments in carbon-intensive sectors. | Increasingly stringent climate policies globally, requiring robust risk assessment. |

| ESG Reporting & Regulatory Compliance | Mandatory disclosures under ESRS and EU Taxonomy; need for transparency. | Over 70% of institutional investors consider ESG factors as of early 2024; EU regulations mandating detailed disclosures. |

| Sustainable Finance Demand | Opportunity for green bonds, mortgages, and ESG-linked loans. | Strong growth in sustainable financial products; OTP solidified leadership in green lending in 2024. |

| Operational Carbon Footprint | Need to reduce energy consumption and emissions across branches and data centers. | OTP Group reported 126,223 tCO2e Scope 1 & 2 emissions in 2023, a decrease from prior year. |

PESTLE Analysis Data Sources

Our OTP Bank PESTLE analysis is meticulously constructed using data from reputable financial institutions, government economic reports, and international banking regulatory bodies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting OTP Bank.