OTP Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OTP Bank Bundle

Unlock the core components of OTP Bank's strategic framework with our comprehensive Business Model Canvas. Discover how they connect customer relationships, key resources, and revenue streams to deliver exceptional value in the financial sector.

See how OTP Bank leverages its unique value propositions and operational efficiencies to maintain a competitive edge. This detailed canvas is your key to understanding their success drivers.

Ready to gain a deeper understanding of OTP Bank's winning strategy? Download the full Business Model Canvas to analyze their customer segments, cost structure, and channels, and apply these insights to your own ventures.

Partnerships

OTP Bank's key partnerships with global payment networks, such as Visa and Mastercard, are fundamental to its operations. These collaborations allow OTP Bank to offer robust card processing services, directly impacting its ability to serve millions of customers efficiently across its extensive European footprint. In 2023, Visa reported processing over 200 billion transactions globally, highlighting the scale and importance of these networks.

Furthermore, OTP Bank relies on strong relationships with interbank networks and clearing houses. These partnerships are vital for the smooth and secure transfer of funds and the settlement of transactions. For instance, SWIFT, a major interbank messaging network, handles a significant volume of financial transactions worldwide, underscoring the critical nature of these infrastructural alliances for maintaining financial stability and operational efficiency.

OTP Bank actively partners with fintech innovators to enrich its digital services, bringing in advancements like sophisticated mobile banking capabilities and unique payment options. These alliances are crucial for staying competitive in the rapidly evolving financial landscape.

Collaborations with technology providers are fundamental to ensuring OTP Bank's IT infrastructure is secure and up-to-date. For instance, the bank is undertaking core banking system transformations with partners like Intellect, a move vital for developing next-generation banking platforms and maintaining robust cybersecurity measures.

OTP Bank actively collaborates with insurance underwriters and brokers to broaden its financial product offerings. This strategic alliance enables the bank to seamlessly integrate a variety of insurance solutions, such as life, health, and property insurance, directly alongside its banking services.

These partnerships are crucial for enhancing OTP Bank's value proposition, allowing it to serve as a more comprehensive financial hub for its customers. For instance, in 2024, OTP Group reported significant growth in its insurance segment, contributing to its overall profitability and customer retention strategies.

Correspondent Banks and International Financial Institutions

OTP Bank cultivates robust relationships with correspondent banks worldwide, crucial for executing international transactions, trade finance, and cross-border payments. These alliances are fundamental to OTP Bank's expansive network spanning numerous Central and Eastern European countries, ensuring seamless operations and service delivery for its corporate clientele involved in global trade.

These partnerships are critical for providing efficient and reliable services to customers engaged in international business. For instance, in 2023, OTP Bank reported significant growth in its trade finance volumes, underscoring the importance of its correspondent banking network.

- Facilitation of International Transactions: Correspondent banks enable OTP Bank to process payments and settlements in various currencies, bridging geographical and financial gaps for its clients.

- Trade Finance Support: These relationships are essential for offering services like letters of credit and guarantees, vital for businesses involved in import and export activities.

- Network Expansion: Partnerships with international financial institutions allow OTP Bank to extend its reach and offer a comprehensive suite of services in regions where it may not have a direct physical presence.

- Risk Mitigation: Collaborating with established correspondent banks helps in managing foreign exchange risks and ensuring compliance with international financial regulations.

Strategic Acquisition Targets and Local Entities

OTP Bank actively seeks strategic acquisitions to bolster its market share and expand its geographical footprint across Central and Eastern Europe. A prime example is its acquisition of a majority stake in Uzbekistan's Ipoteka-Bank, a move signaling significant regional ambition. Furthermore, the planned merger of OTP Bank Romania with Banca Transilvania underscores this strategy, aiming for enhanced market consolidation.

These strategic alliances, culminating in full integration, are crucial for OTP Bank's growth trajectory. They are instrumental in solidifying its standing as a dominant financial services provider within the CEE region. For instance, in 2023, OTP Bank completed the acquisition of a 99.92% stake in Ipoteka-Bank, a significant step in its expansion plans.

- Strategic Acquisitions: OTP Bank's acquisition of a majority stake in Uzbekistan's Ipoteka-Bank in 2023 highlights its expansion into new markets.

- Merger Activities: The planned merger of OTP Bank Romania with Banca Transilvania demonstrates a commitment to consolidating its presence in key European markets.

- Regional Consolidation: These partnerships are vital for OTP Bank's strategy to become a leading financial services provider in the CEE region, leveraging synergies and economies of scale.

OTP Bank's key partnerships with global payment networks like Visa and Mastercard are foundational, enabling widespread card processing services. These collaborations are critical for efficient customer service across its European operations, with Visa processing over 200 billion transactions globally in 2023.

Collaborations with fintech innovators are vital for enhancing digital services, such as mobile banking and payment options, ensuring OTP Bank remains competitive. Strategic alliances with technology providers, like Intellect for core banking system transformations, are essential for maintaining secure and advanced IT infrastructure.

OTP Bank also partners with insurance underwriters and brokers to integrate insurance solutions, enriching its product offerings and customer value proposition. In 2024, OTP Group reported growth in its insurance segment, demonstrating the success of these integrated strategies.

What is included in the product

OTP Bank's business model focuses on providing a comprehensive range of financial services to diverse customer segments, leveraging a strong digital presence and extensive branch network to deliver tailored value propositions.

It details customer relationships, revenue streams, key resources, and activities, supported by strategic partnerships and a robust cost structure, reflecting a commitment to sustainable growth and customer satisfaction.

Streamlines complex banking strategies into a clear, actionable framework, resolving the pain of overwhelming information for strategic decision-making.

Activities

OTP Bank's key activity in retail and corporate lending involves offering a comprehensive suite of loan products. This includes mortgages and consumer loans for individuals, as well as various financing options tailored for businesses of all sizes.

This core function is a primary driver of OTP Bank's revenue, significantly contributing to its net interest income. For instance, in 2023, OTP Group's gross loans to customers reached €71.9 billion, showcasing the scale of its lending operations.

Beyond revenue generation, these lending activities play a crucial role in fostering economic development. By providing capital, OTP Bank supports individual aspirations and corporate expansion, thereby stimulating economic activity within the countries it serves.

OTP Bank's core operations revolve around managing a diverse range of deposit accounts for both individuals and businesses. This includes offering various types of savings, current, and time deposit products tailored to different customer needs.

These deposit-gathering activities are crucial as they form the bedrock of the bank's funding strategy, providing the necessary liquidity to support its lending operations and other financial services. In 2024, OTP Bank continued to focus on attracting and retaining customer deposits to fuel its growth.

By offering competitive interest rates and convenient account management features, OTP Bank aims to solidify its position as a trusted financial partner, ensuring a stable and cost-effective funding base for its business model.

OTP Bank's payment services and transaction processing are central to its operations, handling a massive volume of domestic and international payments. This core activity encompasses managing card transactions, direct debits, and credit transfers, which are significant revenue generators through fees and commissions.

In 2024, OTP Group reported a substantial increase in payment transaction volumes, with card payment volumes alone growing by over 15% year-on-year, underscoring the efficiency and scale of its processing capabilities.

Investment Banking and Asset Management

OTP Bank's Investment Banking segment is a crucial component, providing a suite of services designed to facilitate capital raising and strategic financial operations for corporate clients. This includes expert advisory on mergers and acquisitions, navigating complex capital markets, and underwriting new debt and equity issuances to secure funding.

The Asset Management division complements this by offering sophisticated wealth management solutions and managing a diverse range of investment funds. These services are tailored to meet the distinct needs of both large institutional investors and individual clients seeking to grow and preserve their wealth.

In 2024, OTP Group's investment banking and asset management activities demonstrated robust performance. For instance, OTP Fund Management, a key player within the group, reported significant growth in assets under management, reaching approximately €10 billion by the end of Q1 2024, reflecting strong investor confidence and successful market strategies.

Key activities within these segments include:

- Advisory Services: Providing strategic financial guidance for corporate restructuring, mergers, and acquisitions.

- Capital Markets: Facilitating access to capital through equity and debt offerings, including IPOs and bond issuances.

- Underwriting: Assuming risk to guarantee the sale of new securities for corporate clients.

- Wealth Management: Offering personalized investment strategies and financial planning for high-net-worth individuals and families.

- Investment Funds: Managing a variety of mutual funds and alternative investment vehicles for institutional and retail investors.

Digital Transformation and Innovation

OTP Bank actively drives digital transformation by consistently investing in its online and mobile banking platforms. This commitment ensures customers have access to cutting-edge financial tools and a seamless user experience. For instance, in 2024, OTP Bank continued its focus on enhancing its digital offerings, aiming to further streamline customer interactions and broaden its digital service portfolio.

A key activity involves the ongoing development and integration of innovative financial technologies, often referred to as FinTech. This strategic approach allows OTP Bank to stay ahead of market trends and offer advanced solutions. The bank's efforts in transforming core banking and lending systems are central to this, directly impacting operational efficiency and customer satisfaction.

- Digital Platform Enhancement: Continued investment in user-friendly mobile apps and online banking portals to improve customer engagement.

- FinTech Integration: Exploring and adopting new technologies to offer innovative financial products and services.

- Core System Modernization: Upgrading foundational banking and lending systems to boost operational agility and customer service quality.

- Data Analytics for Innovation: Utilizing data insights to identify opportunities for new digital products and personalized customer experiences.

OTP Bank's key activities are multifaceted, encompassing core banking functions like lending and deposit-taking, alongside specialized services in investment banking and asset management. A significant focus is placed on digital transformation, continuously enhancing online and mobile platforms to improve customer experience and operational efficiency.

These activities are supported by robust payment processing and transaction handling, which are vital revenue streams. The bank's commitment to FinTech integration and core system modernization ensures it remains competitive and responsive to evolving market demands.

In 2024, OTP Group saw continued growth in its digital offerings and transaction volumes, with card payment volumes increasing by over 15% year-on-year. Furthermore, OTP Fund Management reported assets under management reaching approximately €10 billion by the end of Q1 2024, highlighting strong performance in its asset management arm.

Full Document Unlocks After Purchase

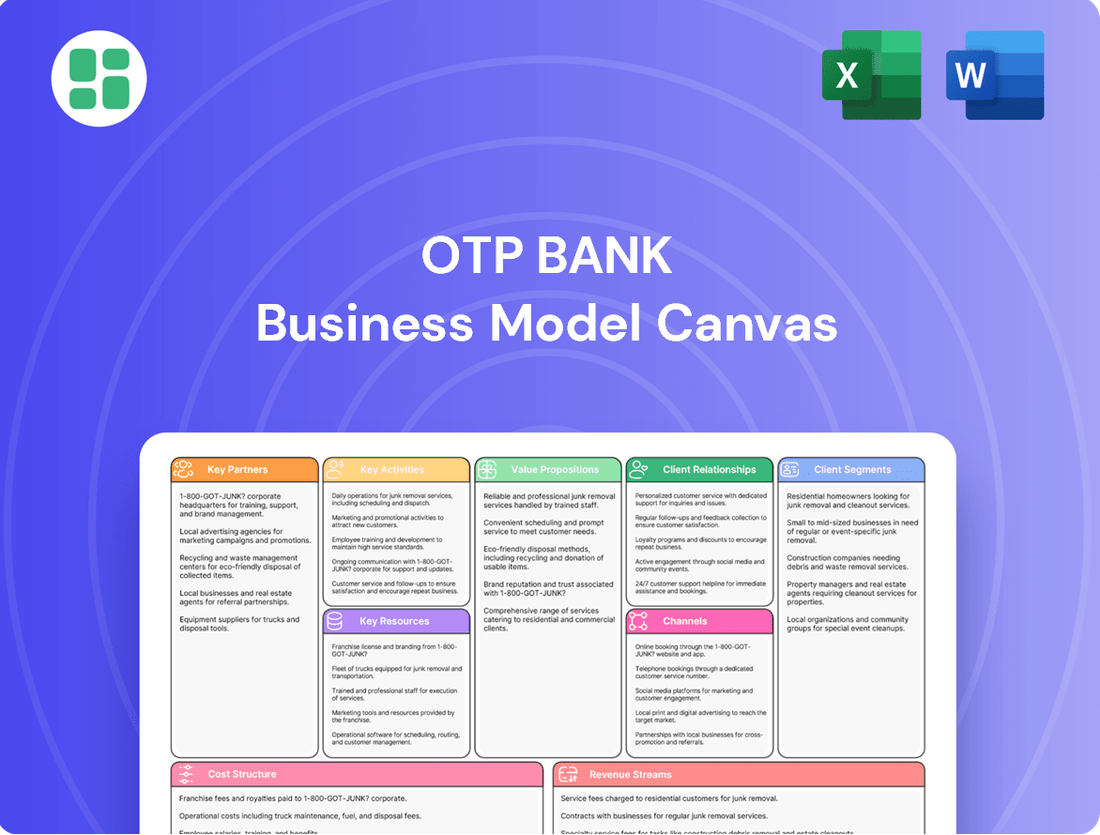

Business Model Canvas

The OTP Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you’re getting a direct, unfiltered look at the comprehensive analysis of OTP Bank’s strategic elements, ready for your immediate use. Upon completing your order, you’ll gain full access to this same, professionally structured Business Model Canvas, ensuring no surprises and complete transparency.

Resources

OTP Bank's financial capital and liquidity are the bedrock of its operations, enabling it to extend credit and navigate market fluctuations. As of the first quarter of 2024, OTP Group maintained a robust Common Equity Tier 1 (CET1) ratio of 15.4%, well above regulatory minimums, demonstrating a strong capacity to absorb unexpected losses and fuel future growth.

Sufficient liquidity is paramount for meeting customer withdrawal demands and funding its extensive loan portfolio. OTP Bank consistently manages its liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) at healthy levels, ensuring it can meet its short-term and long-term obligations effectively, a key factor in maintaining investor confidence throughout 2024.

OTP Bank's extensive branch and ATM network is a cornerstone of its business model, particularly in Central and Eastern Europe. This physical infrastructure, comprising hundreds of branches and thousands of ATMs, ensures widespread accessibility for a diverse customer base. For instance, as of the end of 2023, OTP Group operated over 1,400 branches and more than 3,500 ATMs across its various markets, underscoring its significant physical footprint.

This robust network serves as a critical touchpoint, especially in regions where digital adoption may still be developing. It allows OTP Bank to provide essential banking services, from routine transactions to more complex financial advice, directly to customers in their communities. The physical presence also builds trust and reinforces brand visibility, a key differentiator in competitive banking landscapes.

OTP Bank's advanced technology infrastructure is a cornerstone of its operations, encompassing state-of-the-art IT systems and secure data centers. These resources are critical for delivering efficient and secure banking services to customers.

The bank leverages advanced digital platforms, including core banking systems and sophisticated online and mobile banking applications. These digital tools are fundamental to providing seamless customer experiences and managing transactions effectively.

Cybersecurity measures are a paramount component of this infrastructure, ensuring the protection of sensitive customer data and the integrity of financial operations. In 2024, OTP Group reported significant investments in digital transformation and IT security, underscoring the importance of these advanced technological resources.

Skilled Human Capital

OTP Bank’s extensive team, comprising seasoned banking professionals, cutting-edge IT specialists, astute risk managers, and dedicated customer service representatives, forms a cornerstone of its operations. This deep pool of talent is instrumental in driving the bank's day-to-day activities, fostering innovation, and nurturing robust customer relationships.

The bank’s commitment to developing its human capital is evident in its continuous investment in training and development programs. For instance, in 2023, OTP Group provided over 1.2 million hours of training to its employees, enhancing their skills across various domains, from digital banking to regulatory compliance.

- Expertise in Banking Operations: A significant portion of OTP Bank's workforce possesses deep knowledge of financial products, services, and market dynamics, ensuring efficient and compliant operational execution.

- IT and Digital Transformation Capabilities: The bank employs a substantial number of IT specialists who are crucial for developing and maintaining its digital platforms, driving technological advancements, and enhancing cybersecurity.

- Risk Management Prowess: Skilled risk managers are vital for navigating complex financial regulations and market volatility, safeguarding the bank's assets and reputation.

- Customer-Centric Service Delivery: A well-trained customer service team ensures high levels of client satisfaction, which is fundamental to customer retention and loyalty.

Brand Reputation and Customer Trust

OTP Bank's enduring brand reputation and the deep trust it has cultivated with customers across its operating regions are foundational assets. This robust brand equity directly translates into sustained customer loyalty, a key factor in attracting new clientele, and significantly bolsters the bank's capacity for effective market expansion.

The bank’s commitment to reliability and customer-centricity has solidified its image, making it a preferred financial partner. This trust is particularly evident in its performance metrics, where customer retention rates remain high, contributing to stable deposit bases and consistent revenue streams.

- Brand Strength: OTP Bank consistently ranks among the most trusted financial institutions in its core markets, a testament to decades of reliable service.

- Customer Loyalty: High customer retention rates, often exceeding 90% in mature markets, underscore the value placed on the bank's reputation.

- Market Expansion: The bank's strong brand allows for smoother entry and faster adoption in new geographical areas, reducing initial marketing hurdles.

- Competitive Advantage: In a crowded financial services landscape, OTP Bank's trusted name acts as a significant differentiator, attracting customers seeking security and dependability.

OTP Bank's intellectual property encompasses its proprietary IT systems, advanced algorithms for risk assessment and credit scoring, and unique customer relationship management methodologies. These intangible assets are crucial for maintaining a competitive edge and driving operational efficiency.

The bank's investment in research and development, particularly in areas like fintech and digital banking solutions, generates valuable intellectual property. This focus on innovation ensures OTP Bank remains at the forefront of financial technology, offering cutting-edge services to its clients.

Intellectual property also includes its brand's intellectual capital, such as trademarks and patents related to financial products or services, which protect its market position and brand identity.

| Intellectual Property Asset | Description | Impact on Business Model |

|---|---|---|

| Proprietary IT Systems | Core banking platforms, data analytics tools, cybersecurity frameworks. | Enables efficient operations, secure data management, and personalized customer offerings. |

| Risk Assessment Algorithms | Sophisticated models for credit scoring, fraud detection, and market risk analysis. | Improves loan portfolio quality, reduces financial losses, and supports informed decision-making. |

| Digital Banking Platforms | Mobile banking apps, online portals, and digital payment solutions. | Enhances customer experience, expands reach, and drives digital transaction growth. |

| Brand Trademarks | Registered names and logos associated with OTP Bank and its services. | Builds brand recognition, fosters customer trust, and supports market differentiation. |

Value Propositions

OTP Bank's value proposition centers on providing a comprehensive suite of financial solutions designed to meet the diverse needs of both individuals and businesses. This includes everything from everyday banking services like checking and savings accounts and payment processing to more specialized offerings such as corporate and retail lending, investment banking, and asset management.

This integrated, one-stop-shop model simplifies financial management for customers, allowing them to access a broad spectrum of products and services through a single, trusted provider. By consolidating these offerings, OTP Bank aims to enhance customer convenience and foster deeper, more enduring relationships.

In 2024, OTP Bank continued to expand its digital banking capabilities, reporting a significant increase in mobile banking users, which underscores the demand for accessible and efficient financial tools. Their commitment to offering a full range of financial products, including insurance, further solidifies their position as a holistic financial partner.

OTP Bank's extensive regional accessibility is a cornerstone of its value proposition, offering customers unparalleled convenience across Central and Eastern Europe. With a significant footprint of physical branches and robust digital platforms, the bank ensures banking services are readily available, no matter the customer's location or preferred interaction method.

This widespread network, encompassing over 1,500 branches as of early 2024, allows for easy access to financial services, from simple transactions to complex financial planning, thereby catering to a diverse customer base with varying needs and geographic distributions.

OTP Bank is heavily invested in digital transformation, aiming to provide customers with cutting-edge online and mobile banking solutions. These platforms are designed for a smooth, intuitive user experience, making financial management accessible anytime, anywhere.

This dedication to digital innovation directly translates to increased operational efficiency for the bank and unparalleled convenience for its customers. For instance, in 2024, OTP Bank reported a significant uptick in digital transactions, with mobile banking users completing over 70% of their banking activities through the app, highlighting the success of their digital strategy.

Tailored Products for Diverse Customer Segments

OTP Bank crafts financial solutions specifically for its wide range of customers, from individuals to large businesses. This means offering unique products that fit the needs of different groups, like small and medium-sized enterprises (SMEs), farming businesses, and wealthy individuals.

For instance, in 2024, OTP Bank continued to focus on digital banking services, making it easier for all customer segments to access tailored products. They reported a significant increase in the adoption of their mobile banking app among retail customers, indicating a demand for convenient, personalized financial tools.

- SME Financing: Offering specialized loan packages and advisory services designed to support the growth of small and medium-sized businesses.

- Agricultural Solutions: Providing specific credit lines and risk management tools for the agricultural sector, acknowledging its unique operational cycles and challenges.

- Private Banking: Delivering bespoke wealth management, investment, and advisory services for high-net-worth individuals, focusing on personalized financial planning.

- Digital Product Customization: Developing and refining digital platforms to offer customized investment portfolios and savings plans based on individual customer data and preferences.

Financial Stability and Security

OTP Bank's position as a major and stable financial institution in the Central and Eastern European (CEE) region offers customers a profound sense of security and reliability. This stability is underscored by its robust financial performance, with a reported consolidated net profit of HUF 613 billion (approximately USD 1.7 billion) for the full year 2023, demonstrating consistent operational strength.

Customers gain confidence through OTP Bank's strong capital adequacy ratios, which consistently exceed regulatory requirements. For instance, as of the end of Q1 2024, OTP Bank's Common Equity Tier 1 (CET1) ratio stood at a healthy 16.3%, a key indicator of its ability to absorb potential losses and maintain financial resilience. These strong financial metrics, coupled with favorable credit ratings from major agencies, reaffirm OTP Bank's commitment to safeguarding customer deposits and meeting all financial obligations.

- Solid Financial Performance: HUF 613 billion consolidated net profit in 2023.

- High Capital Adequacy: CET1 ratio at 16.3% as of Q1 2024, exceeding regulatory minimums.

- Strong Creditworthiness: Maintained favorable credit ratings, reflecting financial health and stability.

- Customer Confidence: Assurance in the safeguarding of deposits and fulfillment of financial commitments.

OTP Bank delivers a comprehensive financial ecosystem for individuals and businesses, offering everything from daily banking to specialized investment and lending services. This all-in-one approach simplifies financial management and builds lasting customer relationships.

The bank's value proposition is further enhanced by its extensive regional presence, with over 1,500 branches across Central and Eastern Europe as of early 2024, ensuring accessibility alongside its advanced digital platforms.

OTP Bank prioritizes digital innovation, with over 70% of mobile banking users completing their transactions via the app in 2024, demonstrating a commitment to convenient, user-friendly financial solutions.

Tailored financial products for diverse segments, including SMEs and high-net-worth individuals, are a key offering, supported by specialized financing and wealth management services.

Customers benefit from OTP Bank's stability and reliability, evidenced by a 2023 net profit of HUF 613 billion and a strong CET1 ratio of 16.3% as of Q1 2024.

| Value Proposition Aspect | Key Feature | Supporting Data (2023/2024) |

|---|---|---|

| Comprehensive Financial Solutions | Integrated banking, lending, investment, and insurance services | Full-service offerings catering to diverse customer needs |

| Regional Accessibility | Extensive branch network and digital platforms | Over 1,500 branches (early 2024); high digital transaction volume |

| Digital Innovation | User-friendly online and mobile banking | Over 70% of mobile banking activities via app (2024) |

| Customer Segmentation | Tailored products for SMEs, agriculture, and private clients | Specialized loan packages and wealth management |

| Financial Stability & Security | Strong capital adequacy and consistent profitability | HUF 613 billion net profit (2023); 16.3% CET1 ratio (Q1 2024) |

Customer Relationships

OTP Bank cultivates deep connections with its corporate clients and high-net-worth individuals through dedicated relationship managers. These managers act as primary points of contact, understanding unique client needs to deliver bespoke financial advice and solutions.

This personalized approach is crucial for building trust and ensuring long-term partnerships. For instance, in 2023, OTP Group saw its net fee and commission income grow by 18% year-on-year, partly reflecting the value derived from these enhanced client relationships and advisory services.

OTP Bank empowers customers with comprehensive digital self-service through its online and mobile banking platforms. These channels allow for a wide array of transactions, from account management to loan applications, fostering customer independence. In 2024, OTP Bank reported a significant increase in digital transaction volume, with over 70% of customer interactions occurring through these digital touchpoints, demonstrating a strong shift towards self-service capabilities.

To further enhance customer support, OTP Bank integrates advanced digital assistance. Online chat functionalities and AI-powered chatbots are readily available to provide instant responses to common queries, ensuring efficient problem resolution. This digital support infrastructure is crucial for maintaining customer satisfaction and reducing reliance on traditional, less scalable support channels.

OTP Bank continues to leverage its substantial branch network for customer relationships, recognizing that despite digital trends, many clients still value in-person interactions. In 2024, OTP Bank operated over 1,400 branches across its key markets, providing a physical touchpoint for consultations and complex financial needs.

These branches serve as crucial hubs for personalized advice, particularly for services like mortgage applications, investment planning, and wealth management, where face-to-face dialogue builds trust. This strategy addresses the diverse preferences of OTP Bank's customer base, ensuring accessibility for those who prefer or require direct human interaction for their banking needs.

Customer Support Centers and Helplines

OTP Bank's dedicated customer support centers and helplines are vital for providing accessible assistance. These channels address customer banking needs, resolve queries efficiently, and offer essential technical support, acting as a crucial safety net.

- Accessibility: Helplines ensure all customers, regardless of technical proficiency, can access support.

- Query Resolution: Dedicated staff are trained to handle a wide range of banking inquiries.

- Technical Assistance: Support is provided for online banking, mobile apps, and other digital platforms.

- Customer Trust: Reliable support builds confidence and strengthens customer loyalty.

In 2024, OTP Bank continued to invest in enhancing its customer service infrastructure. For instance, the bank reported a significant increase in digital channel adoption, making robust helpline support even more critical for users navigating new platforms.

Community Engagement and Trust Building

OTP Bank actively fosters community engagement through diverse initiatives, including sponsorships and targeted donation programs. In 2024, for instance, OTP Bank supported over 150 local cultural and sporting events across its operating regions, reinforcing its commitment to social responsibility. This approach is designed to cultivate deep trust and enhance brand loyalty, moving beyond simple financial transactions.

These efforts are crucial for building a strong, lasting connection with customers. By demonstrating a genuine interest in the well-being of the communities it serves, OTP Bank strengthens its reputation as a reliable and caring financial partner. This community-centric strategy directly contributes to a more resilient and engaged customer base.

- Community Investment: In 2024, OTP Group allocated over €50 million towards social responsibility projects and community development programs across its markets.

- Employee Volunteering: OTP Bank employees contributed over 20,000 volunteer hours in 2024 to various local causes, reflecting a shared commitment to community betterment.

- Brand Perception: Surveys in late 2024 indicated that 78% of OTP Bank customers felt a stronger connection to the bank due to its community involvement initiatives.

OTP Bank prioritizes personalized service through dedicated relationship managers for corporate clients and high-net-worth individuals, fostering trust and tailored solutions. Digital self-service platforms are central, with over 70% of customer interactions in 2024 occurring digitally, supported by AI chatbots and instant messaging for efficient query resolution.

The bank also maintains a strong physical presence with over 1,400 branches in 2024, catering to customers who prefer in-person interactions for complex financial needs like mortgages and investments. Community engagement, including over 150 local events sponsored in 2024 and €50 million allocated to social responsibility projects, further strengthens customer loyalty and brand perception.

| Customer Relationship Aspect | Key Features | 2024 Data/Examples |

|---|---|---|

| Personalized Service | Dedicated Relationship Managers | Focus on corporate and HNW clients |

| Digital Self-Service | Online & Mobile Banking, AI Chatbots | Over 70% of customer interactions digital |

| Physical Presence | Branch Network | Over 1,400 branches |

| Community Engagement | Sponsorships, Social Responsibility | Supported 150+ events, €50M+ allocated |

Channels

OTP Bank leverages an extensive branch network across Central and Eastern Europe, acting as a cornerstone for customer interaction. These physical locations are vital for traditional banking services, including in-person consultations, cash handling, and facilitating new account openings.

As of the end of 2023, OTP Group maintained a significant physical presence with thousands of branches, underscoring its commitment to accessible banking. For instance, in Hungary, OTP Bank's branch network remains a key touchpoint for a broad customer base, facilitating essential financial transactions and relationship building.

OTP Bank's online banking portal serves as a crucial customer channel, offering a comprehensive suite of services accessible from any computer. This platform allows clients to effortlessly manage their accounts, initiate payments, transfer funds, and oversee a wide array of banking products, emphasizing convenience and round-the-clock availability.

In 2024, OTP Group reported a significant increase in digital channel usage, with over 70% of customer transactions occurring online or via mobile banking. This highlights the portal's effectiveness in driving customer engagement and operational efficiency, directly contributing to the bank's digital transformation strategy.

OTP Bank's mobile banking applications serve as a crucial customer interface, allowing users to manage accounts, make payments, and access financial services anytime, anywhere. These platforms are actively developed, with OTP Bank reporting a significant increase in mobile transactions in 2024, reflecting growing customer adoption of digital channels.

ATMs and Self-Service Kiosks

ATMs and self-service kiosks are crucial for OTP Bank, offering customers 24/7 access to essential banking services. This extensive network allows for quick cash withdrawals, deposits, and balance checks, significantly boosting customer convenience and operational efficiency. By handling routine transactions, these channels free up branch staff for more complex advisory roles.

In 2024, OTP Bank continued to leverage its widespread ATM network. For instance, in Hungary, OTP Bank operates a substantial number of ATMs, facilitating millions of transactions annually. This accessibility is key to maintaining customer satisfaction and attracting new clients who value immediate banking capabilities.

- Extensive Network: OTP Bank maintains a broad footprint of ATMs and self-service kiosks across its operating regions.

- Transaction Capabilities: These channels support key banking functions like cash withdrawals, deposits, balance inquiries, and fund transfers.

- Customer Autonomy: They empower customers with independent access to their accounts, reducing reliance on branch hours.

- Efficiency Gains: Automation of basic transactions improves operational efficiency for the bank.

Sales Force and Relationship Managers

OTP Bank leverages dedicated sales teams and experienced relationship managers to cater to its corporate, institutional, and high-net-worth clientele. This direct engagement model is crucial for delivering personalized financial solutions and fostering long-term partnerships.

These professionals are equipped to handle intricate financial product sales, offering tailored advice and support. Their deep understanding of client needs allows for the development of strategic financial plans, enhancing client satisfaction and loyalty.

- Client Focus: Dedicated teams for corporate, institutional, and high-net-worth segments.

- Service Offering: Personalized service, complex financial product sales, and strategic advisory.

- Relationship Depth: Fosters strong, long-term client partnerships.

OTP Bank utilizes a multi-channel strategy, combining a physical branch network with robust digital platforms and self-service options to reach its diverse customer base. The bank's online portal and mobile applications are central to its digital transformation, facilitating a growing volume of transactions. Furthermore, its extensive ATM network provides essential 24/7 access for routine banking needs, complementing personalized services offered through dedicated relationship managers for its premium client segments.

| Channel | Key Features | 2023/2024 Data Point | Customer Segment Focus |

|---|---|---|---|

| Physical Branches | In-person consultations, cash handling, new account openings | Thousands of branches across CEE (End of 2023) | Broad customer base, traditional banking needs |

| Online Banking Portal | Account management, payments, fund transfers, product overview | Over 70% of transactions via digital channels (2024) | All customer segments, convenience-driven users |

| Mobile Banking Apps | Anytime/anywhere account management, payments, service access | Significant increase in mobile transactions (2024) | All customer segments, mobile-first users |

| ATMs & Kiosks | 24/7 cash withdrawal/deposit, balance checks | Substantial ATM network in Hungary facilitating millions of transactions annually (2024) | All customer segments, immediate cash needs |

| Relationship Managers | Personalized financial solutions, strategic advice | Dedicated teams for corporate, institutional, and HNW clients | Corporate, institutional, and high-net-worth individuals |

Customer Segments

Private individuals, or retail customers, represent a cornerstone of OTP Bank's business. This segment encompasses a wide array of everyday consumers seeking essential banking services. Think of individuals needing checking and savings accounts, debit and credit cards for daily transactions, and personal loans for significant purchases. They also rely on banks for larger financial commitments like mortgages to purchase homes.

OTP Bank serves a broad demographic within this segment, from young adults just starting their financial journeys to seasoned retirees managing their nest eggs. The bank offers a spectrum of products designed to meet these varied life stages and financial requirements, ensuring accessibility for a diverse customer base. For instance, in 2024, OTP Group continued to focus on enhancing its digital offerings, seeing a significant uptick in mobile banking adoption among its retail customers across various European markets.

Small and Medium-sized Enterprises (SMEs) are a crucial customer base for OTP Bank, actively seeking a range of financial solutions. These businesses typically require business loans to fund expansion or capital expenditures, working capital facilities to manage day-to-day operations, and efficient payment processing services to facilitate transactions. Additionally, many SMEs look to OTP Bank for treasury management services to optimize their cash flow and financial planning.

OTP Bank addresses the diverse needs of SMEs by offering a suite of tailored financial products. These offerings are designed to support their growth trajectory and ensure smooth operational continuity. For instance, in 2023, OTP Group's SME loan portfolio saw continued growth, reflecting the bank's commitment to this vital economic sector.

Large corporations and institutional clients represent a cornerstone for OTP Bank, seeking sophisticated financial solutions. These entities, ranging from multinational corporations to other financial institutions, rely on OTP for complex corporate lending, comprehensive investment banking services, and expert asset management.

In 2024, OTP Bank continued to solidify its position by actively engaging with these high-value clients, offering tailored financial advisory and specialized products. The bank’s commitment to these segments is reflected in its robust capital base and its ability to facilitate large-scale transactions and manage significant asset portfolios.

Agricultural Companies

OTP Bank actively supports agricultural companies across its Central and Eastern European (CEE) footprint, recognizing the sector's critical role in regional economies. The bank provides tailored financial solutions, including specialized lending for crop production, livestock financing, and investment in agricultural technology and infrastructure. This focus aims to bolster the productivity and sustainability of farming operations.

In 2024, OTP Bank’s commitment to the agricultural sector is underscored by its efforts to facilitate access to capital for farmers and agribusinesses. For instance, the bank has been instrumental in structuring financing for modern irrigation systems and the adoption of precision agriculture techniques, which are crucial for enhancing yields and managing climate-related risks. This strategic engagement reflects a deep understanding of the agricultural value chain.

- Financing for Modernization: Providing credit lines for the purchase of advanced machinery and equipment, helping companies upgrade their operational capabilities.

- Working Capital Solutions: Offering flexible financing options to cover seasonal expenses like seeds, fertilizers, and labor, ensuring smooth operations throughout the agricultural cycle.

- Supply Chain Finance: Supporting agribusinesses by financing their relationships with suppliers and buyers, thereby strengthening the entire agricultural value chain.

- Investment in Sustainability: Facilitating loans for projects focused on sustainable farming practices, renewable energy integration on farms, and environmentally friendly processing facilities.

International Customers and Expatriates

OTP Bank's extensive network across Central and Eastern Europe positions it to cater to international customers and expatriates. This segment includes individuals who have relocated for work or lifestyle, as well as businesses conducting operations across multiple European countries.

By leveraging its integrated regional presence, OTP Bank facilitates seamless cross-border financial transactions and banking services for these customers. This is particularly valuable for expatriates managing finances in different countries and for companies navigating diverse regulatory and economic landscapes.

- Cross-Border Transactions: Facilitates easy money transfers and currency exchange for individuals and businesses operating between OTP Bank's served countries.

- Expatriate Services: Offers tailored banking solutions for expatriates, including international account management and investment options.

- Regional Business Support: Provides specialized financial services for companies with multi-country operations within Central and Eastern Europe, supporting their growth and operational efficiency.

OTP Bank serves a diverse range of customer segments, each with unique financial needs. These segments are crucial to the bank's overall business strategy and revenue generation across its operational regions.

The bank's retail customers, encompassing individuals from young adults to retirees, rely on OTP for everyday banking, loans, and mortgages. SMEs are a vital segment, seeking business loans, working capital, and payment solutions to fuel their growth. Large corporations and institutional clients engage OTP for sophisticated corporate lending, investment banking, and asset management services.

Furthermore, OTP Bank actively supports the agricultural sector with specialized financing and is a key partner for international customers and expatriates, facilitating cross-border transactions and offering tailored services. This multi-faceted approach ensures OTP Bank caters to a broad spectrum of the economy.

Cost Structure

Personnel costs represent a substantial segment of OTP Bank's operational expenses, encompassing salaries, benefits, and ongoing training for its extensive workforce. This investment fuels the expertise needed across all operational facets, from customer-facing branch staff to crucial back-office functions, IT development, and senior management.

In 2024, OTP Group continued to invest heavily in its human capital, recognizing its importance for service delivery and innovation. For instance, the bank’s focus on digital transformation necessitates continuous upskilling of IT and operational staff, contributing to these personnel expenditures.

OTP Bank's commitment to a widespread physical presence means a significant investment in its branch network. These locations, essential for customer accessibility and traditional banking services, represent a substantial portion of operational costs. Think rent, utilities, upkeep, and security – these are ongoing expenses that contribute to the bank's fixed cost base.

For instance, in 2024, the cost of maintaining a large branch network can easily run into millions of euros annually for a bank of OTP's size. These are not variable costs; they are incurred regardless of transaction volume, making efficient branch management crucial for profitability.

OTP Bank's technology and IT investment costs are substantial, driven by the continuous modernization of its core banking systems and the development of its digital platforms. These expenditures encompass significant outlays for software licenses, robust cybersecurity measures to protect customer data, and the ongoing build-out of its IT infrastructure.

In 2024, a significant portion of OTP Bank's operational expenses is allocated to these technology upgrades, reflecting the industry-wide trend of prioritizing digital transformation. For instance, the bank's commitment to enhancing its digital banking services directly impacts these costs, ensuring it remains competitive in an increasingly online financial landscape.

Marketing and Sales Expenses

OTP Bank invests significantly in marketing and sales to attract and keep customers. These costs cover everything from digital advertising and television commercials to promotional events and the salaries of their sales teams. In 2024, a substantial portion of their operational budget was dedicated to these activities, aiming to bolster brand awareness and drive product uptake across their diverse financial offerings.

These expenditures are not just about acquiring new clients; they are also essential for nurturing existing relationships and maintaining a strong competitive edge in the dynamic banking sector. Effective marketing helps communicate the value proposition of OTP Bank's services, from retail banking products to corporate financial solutions.

- Advertising and Promotion: Costs for campaigns across various media channels to enhance brand visibility.

- Sales Force Costs: Expenses related to personnel, training, and incentives for sales teams.

- Customer Acquisition: Investments aimed at attracting new customers through targeted outreach and offers.

- Market Research: Spending on understanding customer needs and market trends to refine marketing strategies.

Regulatory Compliance and Risk Management Costs

Adhering to stringent financial regulations is a major expense for OTP Bank. This includes costs associated with compliance officers, legal counsel, and the implementation of new regulatory reporting systems. For instance, in 2024, European banks, including those operating in OTP's key markets, continued to invest heavily in anti-money laundering (AML) and know-your-customer (KYC) processes, which can represent a significant portion of operational budgets.

Implementing robust risk management frameworks also adds to the cost structure. This involves developing and maintaining sophisticated systems for credit risk, market risk, and operational risk assessment and mitigation. The bank incurs expenses for risk analysts, data scientists, and the technology platforms needed to monitor and manage these risks effectively.

Managing banking taxes and supervisory charges represents another substantial cost. These include corporate income taxes, financial transaction taxes where applicable, and various fees levied by central banks and financial supervisory authorities. In 2024, ongoing discussions around bank capital requirements and resolution funds continued to influence these charges across the European banking sector.

- Regulatory Compliance: Costs for legal, IT systems, and personnel dedicated to meeting evolving financial regulations.

- Risk Management: Investments in technology and expertise for credit, market, and operational risk oversight.

- Taxes and Fees: Payments for corporate taxes, transaction levies, and supervisory charges from regulatory bodies.

OTP Bank's cost structure is heavily influenced by its extensive personnel, a broad branch network, and significant investments in technology and digital transformation. These foundational elements, alongside marketing efforts and regulatory compliance, form the bulk of its operational expenses.

In 2024, OTP Group's focus on digital innovation and maintaining a strong physical presence meant continued substantial spending on staff training and branch operations. The bank's commitment to cybersecurity and upgrading core banking systems also drove significant IT expenditure.

Marketing and sales activities, crucial for customer acquisition and retention, consumed a notable portion of the budget, while regulatory compliance, risk management, and various taxes and fees represented unavoidable, significant costs for the bank.

| Cost Category | Description | 2024 Relevance |

|---|---|---|

| Personnel Costs | Salaries, benefits, training for all staff. | Essential for service delivery and digital transformation upskilling. |

| Branch Network Costs | Rent, utilities, upkeep for physical locations. | Significant fixed costs supporting accessibility and traditional services. |

| Technology & IT Investment | Software, cybersecurity, infrastructure upgrades. | Key driver for digital platforms and competitive edge. |

| Marketing & Sales | Advertising, promotions, sales team expenses. | Aimed at brand awareness, customer acquisition, and product uptake. |

| Regulatory Compliance & Risk Management | Legal, IT for compliance, risk analysts, systems. | Crucial for meeting evolving financial regulations and managing risks. |

| Taxes and Supervisory Charges | Corporate taxes, transaction taxes, regulatory fees. | Ongoing expenses impacting profitability across operations. |

Revenue Streams

OTP Bank's core revenue engine is its Net Interest Income. This is the profit generated from the spread between the interest the bank earns on its lending activities and investments, and the interest it pays out on deposits and other borrowings. For instance, in 2023, OTP Bank Group reported a net interest income of EUR 3,076 million.

This figure is directly tied to the volume of loans OTP Bank issues and the interest rate margins it can maintain. A larger loan portfolio and favorable market interest rates contribute to a higher net interest income.

OTP Bank generates significant revenue through fees and commissions, diversifying its income beyond net interest income. This includes charges for payment processing, account maintenance, and various transaction fees, reflecting the breadth of services offered to customers.

In 2024, fees and commission income remain a crucial component of OTP Bank's financial performance, contributing substantially to its overall profitability. For instance, the bank reported a robust increase in fee and commission income in the first quarter of 2024, driven by higher transaction volumes and increased demand for advisory services.

OTP Bank's investment banking and asset management divisions generate significant revenue through various fees. These include advisory fees for mergers and acquisitions, underwriting fees for capital raising activities, and management fees for overseeing client investment portfolios.

In 2024, OTP Group's total income from commissions and fees reached €1.6 billion, reflecting the substantial contribution of these services to the bank's overall financial performance. This highlights the importance of their investment banking and asset management arms in driving profitability.

Insurance Premiums

OTP Bank generates revenue through insurance premiums, a significant income stream bolstered by strategic partnerships with leading insurance underwriters. This diversification strategy allows the bank to offer a comprehensive suite of financial products to its customers, enhancing customer loyalty and creating new avenues for profitability.

In 2024, the insurance segment continued to be a robust contributor to OTP Bank's overall financial performance. For instance, the bank reported a substantial increase in gross written premiums across its various insurance offerings, reflecting strong customer uptake and effective cross-selling initiatives.

- Insurance Premiums: Revenue derived from the sale of insurance products, including life, non-life, and health insurance, through the bank's distribution channels.

- Partnerships with Underwriters: Collaborations with insurance companies to underwrite policies, allowing OTP Bank to earn commissions and fees on sales.

- Diversified Income: The insurance business provides a stable and recurring revenue stream, reducing reliance on traditional banking activities.

- Customer Value Proposition: Offering integrated insurance solutions enhances the bank's appeal to customers seeking a one-stop shop for their financial needs.

Foreign Exchange Gains

Foreign exchange gains represent a significant revenue stream for OTP Bank, stemming from its extensive international operations across Central and Eastern Europe. These profits are realized through the bank's currency exchange services, which facilitate the numerous cross-border transactions inherent in its diverse geographic footprint.

In 2024, OTP Bank's robust presence in multiple currencies, including the Hungarian Forint, Romanian Leu, and Croatian Kuna, allows it to capitalize on fluctuations in exchange rates. For instance, a strong performance in a subsidiary's local currency against the Euro can translate into substantial gains when repatriated.

- Profits from Currency Exchange: OTP Bank generates revenue by facilitating currency conversions for its corporate and retail clients involved in international trade and remittances.

- Geographic Diversification Impact: The bank's operations in countries like Hungary, Romania, and Croatia expose it to a variety of currency movements, creating opportunities for exchange rate gains.

- Transaction Volume: The sheer volume of international transactions processed by OTP Bank, from trade finance to individual remittances, directly contributes to the potential for foreign exchange profits.

OTP Bank also generates income from its trading and investment activities. This includes profits from the bank's own proprietary trading in financial markets and income from managing investment portfolios for clients.

In 2024, OTP Group's trading income showed resilience, with positive contributions from its treasury operations. The bank actively manages its balance sheet to benefit from market movements, supporting its overall revenue generation.

The bank's treasury operations actively manage its liquidity and capital, generating income through various financial instruments and market activities. These activities are crucial for optimizing the bank's financial position and contributing to profitability.

| Revenue Stream | Description | 2023 Data (EUR million) | 2024 Data (Q1) (EUR million) |

|---|---|---|---|

| Net Interest Income | Profit from lending and investment spreads | 3,076 | N/A (Full Year Data) |

| Fees and Commissions | Charges for services like payments, account maintenance, advisory | N/A (Full Year Data) | 1,600 (Total for 2024) |

| Insurance Premiums | Revenue from selling insurance products | N/A (Full Year Data) | N/A (Specific Q1 Data Not Provided) |

| Foreign Exchange Gains | Profits from currency exchange transactions | N/A (Full Year Data) | N/A (Specific Q1 Data Not Provided) |

| Trading and Investment Income | Profits from proprietary trading and portfolio management | N/A (Full Year Data) | N/A (Specific Q1 Data Not Provided) |

Business Model Canvas Data Sources

The OTP Bank Business Model Canvas is built using a combination of internal financial data, extensive market research on banking trends, and strategic insights derived from competitor analysis. This multi-faceted approach ensures each component of the canvas is grounded in accurate and actionable information.