OTP Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OTP Bank Bundle

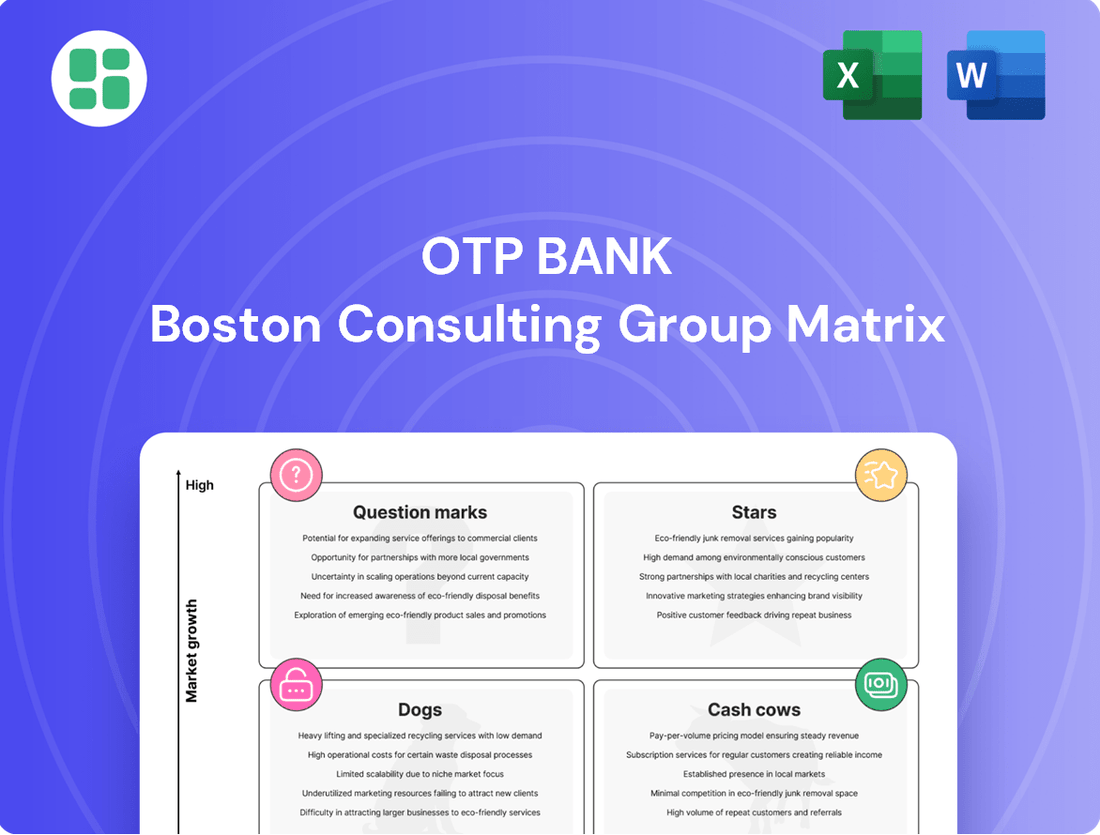

Unlock the strategic potential of OTP Bank's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are driving growth and which may require a strategic pivot. This preview offers a glimpse into the core of their market positioning.

Dive deeper into OTP Bank's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

OTP Bank's digital banking solutions, including its mobile apps and online platforms, are positioned as stars in the BCG matrix. The Central and Eastern European (CEE) region is seeing a boom in digital banking adoption, with projections indicating continued strong growth. OTP Bank is actively investing to maintain its competitive edge in this high-growth, high-share segment.

Green and Sustainable Finance Products are a key growth area for OTP Bank, driven by rising global demand for ESG-aligned investments. These products, such as green bonds and loans for renewable energy projects, are experiencing significant market expansion. For instance, the global green bond market reached an estimated $1 trillion in issuance by early 2024, highlighting the strong investor appetite.

OTP Bank is strategically investing in this sector, aiming to become a leader in sustainable finance. By offering specialized products like financing for energy-efficient building upgrades and loans for companies with strong environmental track records, OTP Bank is tapping into a market segment projected to grow substantially in the coming years. This focus aligns with broader European Union sustainability goals and increasing regulatory requirements for financial institutions.

Consumer lending in emerging CEE markets presents a compelling growth opportunity for OTP Bank. In countries like Albania and North Macedonia, where OTP has expanded, consumer credit portfolios are showing robust expansion, driven by rising disposable incomes and a growing appetite for financing. For instance, OTP Albania saw its consumer loan portfolio grow by over 15% in 2023, reflecting this trend.

Advanced Payment Systems

Advanced Payment Systems, encompassing solutions like instant payments, QR code transactions, and digital wallet integrations, represent a significant growth area for OTP Bank. The market is experiencing rapid evolution, driven by consumer and business demand for speed and convenience. This necessitates ongoing investment from OTP to maintain and expand its market share in this dynamic sector.

The global digital payments market was projected to reach over $2.5 trillion by the end of 2024, highlighting the substantial opportunity. For instance, instant payment systems in Europe, like SEPA Instant Credit Transfer, have seen significant adoption. OTP Bank's strategic focus on these innovative payment methods positions it to capitalize on this trend.

- Market Growth: The digital payments sector is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond.

- Consumer Demand: Consumers increasingly prefer faster, more seamless payment experiences, driving adoption of instant and mobile payment solutions.

- Technological Advancement: Innovations in QR code technology and digital wallet integration offer new avenues for transaction efficiency and customer engagement.

- Competitive Landscape: Continuous investment is crucial for OTP Bank to remain competitive and capture market share against evolving payment providers.

Integrated SME Digital Platforms

Integrated SME Digital Platforms represent a strategic move for OTP Bank into a high-growth market. By offering comprehensive digital solutions that seamlessly connect with SME operations, OTP Bank aims to capture substantial market share.

These platforms are designed to cover essential banking needs for small and medium-sized businesses, including lending, payment processing, and valuable advisory services. This holistic approach addresses the growing demand for digitized business processes among SMEs.

- Market Growth: The SME sector is experiencing significant digital transformation, with a projected compound annual growth rate (CAGR) of 15% for digital banking solutions in emerging markets by 2025.

- Platform Integration: OTP Bank's digital platforms are built to integrate with existing accounting software and ERP systems, simplifying financial management for SMEs.

- Service Expansion: Beyond core banking, these platforms offer features like digital onboarding, automated loan applications, and personalized financial insights, enhancing customer value.

- Competitive Advantage: By focusing on user experience and comprehensive functionality, OTP Bank seeks to differentiate itself in a competitive landscape where digital offerings are key differentiators.

Stars in OTP Bank's portfolio represent high-growth, high-share business areas. These are segments where the bank has a strong competitive position and the market itself is expanding rapidly, demanding continued investment to maintain leadership. Digital banking solutions, green finance, consumer lending in emerging CEE markets, advanced payment systems, and integrated SME digital platforms all fit this description.

These "star" segments are characterized by strong market demand and OTP Bank's ability to capture a significant portion of that demand. For instance, the global digital payments market was projected to exceed $2.5 trillion by the end of 2024. OTP Bank's strategic focus on these areas ensures it is well-positioned to benefit from these expanding opportunities.

The bank's investment in these areas is critical for future revenue growth and market dominance. By staying ahead in digital innovation, sustainable finance, and catering to growing consumer and SME needs in its core regions, OTP Bank aims to solidify its position as a market leader.

| Star Segment | Market Growth Driver | OTP Bank's Position | Key Investment Focus |

|---|---|---|---|

| Digital Banking Solutions | Increased CEE digital adoption | Leading provider in CEE | Mobile app enhancement, online platform innovation |

| Green and Sustainable Finance | Global ESG investment demand | Growing market share | Green bonds, renewable energy financing |

| Consumer Lending (Emerging CEE) | Rising disposable incomes, credit appetite | Strong expansion in markets like Albania | Portfolio growth, tailored credit products |

| Advanced Payment Systems | Demand for speed and convenience | Capturing share in digital payments | Instant payments, QR codes, digital wallets |

| Integrated SME Digital Platforms | SME digital transformation | Targeting high-growth SME segment | Comprehensive digital tools, advisory services |

What is included in the product

This OTP Bank BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

The OTP Bank BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis and relieving the pain of information overload.

Cash Cows

Traditional retail deposit accounts are a bedrock for OTP Bank, especially in established markets like Hungary and Croatia. These accounts provide a stable, low-cost funding source, contributing significantly to consistent profitability with minimal marketing spend.

While deposit growth in this segment may be modest, OTP Bank’s substantial market share ensures a reliable and cost-effective base for its operations. This stability allows for predictable earnings generation.

In 2024, OTP Bank continued to leverage its strong retail deposit base, which historically represents a significant portion of its total funding. For instance, in Hungary, a key market, retail deposits have consistently shown resilience, forming a vital component of the bank's liquidity and funding strategy.

Established mortgage portfolios within OTP Bank's mature Central and Eastern European markets are significant cash cows. These seasoned loan books consistently deliver substantial interest income, reflecting OTP's long-standing presence and deep market penetration.

The stability and low-growth nature of these mortgage markets allow OTP to generate reliable cash flows from these established assets. This means the bank can effectively 'milk' these portfolios for profits without needing to inject significant new capital for expansion.

For instance, in 2024, OTP Group's mortgage lending continued to be a cornerstone of its operations, contributing significantly to its net interest income. While specific portfolio figures vary by country, the overall trend in CEE mortgage markets indicates a steady, albeit moderate, contribution to the bank's earnings, underscoring their cash cow status.

OTP Bank's core corporate banking services, encompassing working capital loans, trade finance, and treasury services, are a prime example of its Cash Cows. These offerings cater to large, established clients within OTP's key operational regions, fostering long-term, high-volume relationships.

These established client relationships translate into a consistent and predictable stream of fee and interest income for OTP Bank. This stability is a hallmark of a Cash Cow, reflecting the bank's entrenched market position and its ability to generate reliable cash flow from mature, low-growth segments.

For instance, OTP Group reported a net interest income of €2,586 million in 2023, with corporate banking playing a significant role in this robust performance. The consistent demand for these foundational services underscores their 'cash cow' status within the bank's portfolio.

Payment Card Issuance and Acquiring

OTP Bank's payment card issuance and acquiring operations function as a classic Cash Cow within its BCG Matrix. The bank commands a substantial market share in this segment across numerous Central and Eastern European nations. This dominant position, even with potentially moderate overall growth in card usage, translates into a steady stream of interchange fees and processing revenues. These consistent earnings are a vital contributor to OTP Bank's operational cash flow, bolstered by its well-established and mature infrastructure.

The robustness of OTP Bank's card business is evident in its financial performance. For instance, in 2023, OTP Group reported a significant increase in its payment and card segment income, driven by higher transaction volumes and expanded card portfolios. This segment consistently demonstrates strong profitability due to the low marginal cost of processing additional transactions on existing infrastructure.

- Dominant Market Position: OTP Bank holds a leading share in card issuance and acquiring across key CEE markets.

- Stable Revenue Generation: Consistent interchange fees and processing revenues from high transaction volumes provide reliable cash flow.

- Mature Infrastructure Advantage: Existing, efficient infrastructure minimizes incremental costs, maximizing profitability.

- Significant Contribution to Cash Flow: The segment is a primary driver of OTP Bank's operational cash generation.

Traditional Asset Management Products

Traditional asset management products, encompassing established mutual funds and portfolio management services, represent a significant portion of OTP Bank's offerings. These products cater to a wide array of retail and institutional clients, leveraging OTP's strong brand recognition and existing customer relationships.

While the market for these traditional products is mature, OTP Bank maintains a robust market share. This dominance translates into a consistent stream of management fees, a key driver of profitability for the bank. For instance, in 2023, OTP Group's asset management segment reported a net fee and commission income of €345 million, with traditional products forming a substantial base of this revenue.

- Steady Revenue Generation: Consistent management fees from a large, established client base.

- High Market Share: Benefiting from OTP Bank's strong brand and deep market penetration.

- Profitability Contribution: Acting as a reliable source of income, supporting overall bank performance.

- Mature Market Stability: Predictable cash flows despite slower growth potential.

OTP Bank's established retail deposit accounts are a prime example of a Cash Cow. These accounts provide a stable, low-cost funding source, contributing significantly to consistent profitability with minimal marketing spend.

While deposit growth in this segment may be modest, OTP Bank’s substantial market share ensures a reliable and cost-effective base for its operations, allowing for predictable earnings generation. In 2024, OTP Bank continued to leverage its strong retail deposit base, which historically represents a significant portion of its total funding, particularly in Hungary.

Established mortgage portfolios within OTP Bank's mature Central and Eastern European markets are significant cash cows, consistently delivering substantial interest income. The stability and low-growth nature of these markets allow OTP to generate reliable cash flows from these established assets, with mortgage lending continuing to be a cornerstone of operations contributing significantly to net interest income in 2024.

OTP Bank's core corporate banking services, encompassing working capital loans, trade finance, and treasury services, are a prime example of its Cash Cows. These offerings cater to large, established clients, fostering long-term, high-volume relationships that translate into a consistent and predictable stream of fee and interest income, underscoring their cash cow status within the bank's portfolio.

| Business Unit | BCG Category | Key Characteristics | 2023 Financial Contribution (Illustrative) |

| Retail Deposits | Cash Cow | Stable, low-cost funding; high market share in mature markets; predictable earnings. | Significant contributor to Net Interest Income. |

| Mortgage Portfolios (CEE) | Cash Cow | Seasoned loan books; substantial interest income; low growth, high stability. | Cornerstone of operations, contributing to Net Interest Income. |

| Corporate Banking Services | Cash Cow | Established client relationships; high-volume services (loans, trade finance); consistent fee and interest income. | Played a significant role in €2,586 million Net Interest Income. |

| Payment Card Issuance & Acquiring | Cash Cow | Dominant market share; steady interchange fees and processing revenues; efficient infrastructure. | Drove significant increase in payment and card segment income. |

| Traditional Asset Management | Cash Cow | Robust market share; consistent management fees; strong brand recognition. | Substantial base of €345 million Net Fee and Commission Income. |

What You’re Viewing Is Included

OTP Bank BCG Matrix

The OTP Bank BCG Matrix preview you are viewing is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, will be delivered without any watermarks or demo content, allowing for direct application in your business planning. You can confidently expect the same professional quality and actionable insights as presented here, ready for immediate use in your decision-making processes.

Dogs

Some of OTP Bank's physical branches are located in areas experiencing economic decline, leading to reduced customer activity. These branches often face high operating expenses compared to the income they generate. For instance, in 2024, rural bank branch closures accelerated, with some estimates suggesting over 500 branches closed across the US alone, highlighting a broader industry trend impacting profitability in less populated regions.

Niche, paper-based financial products, often remnants of past banking eras, are increasingly becoming liabilities for institutions like OTP Bank. These products, characterized by their reliance on physical documentation and lack of digital integration, are experiencing a significant downturn in customer interest. For instance, the global market for physical checks, a prime example of paper-based finance, has seen a dramatic decline, with the US processing fewer than 15 billion checks annually in 2023, a stark contrast to the over 40 billion processed in 2000. This trend directly impacts OTP Bank's offerings in this category.

These products typically occupy the Dogs quadrant of the BCG Matrix due to their minimal market share and stagnant or declining growth prospects. The high operational costs associated with manual processing, printing, and physical storage further exacerbate their inefficiency. Banks are finding that the resources allocated to maintaining these legacy products could be far better utilized in developing innovative digital solutions that cater to evolving customer preferences and offer higher potential returns.

Following its strategic acquisitions, OTP Bank may identify certain smaller, non-core subsidiaries or specific business lines that demonstrate low market share and limited growth prospects. These units, often absorbed through expansion, might consistently underperform, consuming valuable resources without generating substantial returns. For instance, if a recently acquired regional insurance unit, representing less than 1% of OTP's total revenue in 2024 and showing a negative growth rate, fails to show improvement, it could be classified as a dog.

Legacy IT Systems Supporting Limited Customer Segments

Legacy IT systems that cater to limited customer segments often represent the Dogs in a BCG matrix analysis for a bank like OTP. These systems, while functional, typically support niche products or customer groups with low growth potential. Maintaining these older, specialized IT infrastructures can be a significant drain on resources, especially when they offer little strategic advantage.

For instance, a system supporting a legacy foreign currency account type with a dwindling customer base would fall into this category. Such systems are characterized by high maintenance costs relative to their revenue generation and limited scalability. In 2024, many financial institutions are actively reviewing these systems, with a focus on reducing IT operational expenses.

- High Maintenance Costs: Older IT systems often incur substantial costs for upkeep, specialized personnel, and software licensing, especially when they are not widely used.

- Low Market Share & Growth: These systems typically serve a small, often declining, customer segment, resulting in a low market share within the overall business.

- Decommissioning Potential: Given their inefficiency and lack of strategic value, these legacy systems are prime candidates for decommissioning or replacement with more modern, integrated solutions.

Highly Specialized, Low-Volume Advisory Services

Certain highly specialized advisory services, like bespoke wealth management for ultra-high-net-worth individuals or niche legal consulting, often fall into the 'dog' category within a BCG matrix analysis. These offerings typically serve a very small, select clientele, making them inherently low-volume. For instance, a 2024 report indicated that specialized financial advisory services targeting families with over $50 million in assets managed, while highly profitable per client, represented less than 0.5% of the total financial advisory market by client count.

The high cost associated with delivering such personalized expertise, often requiring significant one-on-one time from senior professionals, means these services may not contribute substantially to overall revenue growth, especially if scaling is limited. In 2023, the average cost of delivering bespoke advisory services for a single client could exceed $25,000 annually, a figure that makes broad market penetration challenging.

- Low Market Penetration: Services reaching only a fraction of a percent of potential clients.

- High Cost Per Client: Significant investment in personalized delivery.

- Limited Scalability: Difficulty in expanding reach without proportional cost increases.

- Stagnant Growth Prospects: Unlikely to capture substantial new market share.

Dogs represent business units or products with low market share and low growth prospects, often draining resources. For OTP Bank, this could include underperforming branches in declining areas or niche, paper-based financial products with dwindling customer interest. These segments typically have high operational costs relative to their revenue generation, making them inefficient.

| Category | Description | Example for OTP Bank | Key Challenges | 2024 Data/Trend |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Rural branches, legacy IT systems, niche paper products | High operating costs, low revenue, lack of scalability | Continued branch consolidation, digital migration impacting paper products |

Question Marks

OTP Bank is actively investigating blockchain technology for applications such as trade finance and cross-border payments. This sector represents a burgeoning area of innovation, offering substantial future growth prospects.

While the market for blockchain solutions is still in its early stages, OTP Bank's current market share in this segment is likely minimal. Significant investment will be necessary for the bank to build a substantial presence and achieve a leading position in this evolving technological landscape.

AI-powered personal financial management tools are rapidly transforming how individuals handle their money. These sophisticated platforms offer tailored budgeting, personalized investment advice, and even automated financial planning, catering to a growing demand for convenience and expert guidance. The market for these solutions is experiencing significant growth, with projections indicating continued expansion as AI capabilities become more sophisticated and accessible.

For OTP Bank, the development and deployment of such advanced AI-driven tools represent a significant opportunity within the high-growth segment of the market. While OTP's initial market share in this nascent area might be modest, particularly when contending with established fintech players, the potential for future gains is substantial. This necessitates considerable investment to build robust platforms, acquire users, and clearly demonstrate the unique value proposition offered by these AI-driven financial management solutions.

Entering highly competitive regions like Western Europe or emerging Asian markets presents a classic "question mark" scenario for OTP Bank. These markets offer significant growth potential, as evidenced by the projected 8.3% compound annual growth rate for the European banking sector through 2027. However, OTP's market share would initially be negligible, requiring substantial upfront investment to establish brand recognition and a competitive footing.

Strategic Fintech Partnership Ventures

Strategic fintech partnership ventures for OTP Bank often fall into the question mark category. These involve significant investment in startups with high growth potential but also considerable risk. For instance, in 2024, OTP Bank continued its exploration of partnerships with innovative digital payment providers and blockchain-based financial solutions, areas known for rapid evolution and market uncertainty.

These ventures are characterized by low current market share but the promise of substantial future growth if they gain traction. OTP's involvement signifies a calculated risk, aiming to secure a competitive edge in the rapidly changing financial landscape. The success of these partnerships hinges on OTP's ability to provide strategic guidance and capital, alongside the fintech's innovative technology and market fit.

- High Growth Potential: Fintech partnerships offer access to new markets and technologies, driving future revenue streams.

- Market Uncertainty: The success of emerging fintechs is not guaranteed, with potential for low adoption or scalability issues.

- Strategic Investment: OTP's capital and expertise are crucial for nurturing these ventures from question marks to potential stars.

- Competitive Landscape: Investing in fintech is essential for maintaining relevance and competing with digitally native financial institutions.

Specialized Cybersecurity Consulting for Corporates

Specialized cybersecurity consulting for corporates represents a significant growth opportunity, driven by the increasing sophistication and frequency of cyber threats. In 2024, the global cybersecurity market was valued at an estimated $215 billion, with consulting services forming a substantial portion of this. While OTP Bank possesses strong financial sector knowledge, its current market share in dedicated, external cybersecurity consulting for a broad corporate base is likely nascent.

This segment of the market, while attractive due to high demand, requires substantial investment to establish credibility and a competitive edge against established cybersecurity firms. OTP Bank would need to strategically allocate resources towards building specialized expertise, developing tailored service offerings, and marketing these capabilities to a wider corporate audience beyond its existing banking clients.

- Market Growth: The global cybersecurity market is projected to reach $345 billion by 2026, indicating robust demand for specialized services.

- OTP Bank's Position: As a banking institution, OTP Bank's initial market share in broad corporate cybersecurity consulting is expected to be low.

- Investment Needs: Significant investment in talent acquisition, technology, and brand building is crucial for OTP Bank to gain traction in this specialized market.

- Competitive Landscape: The market is populated by established cybersecurity firms, necessitating a clear differentiation strategy for OTP Bank.

OTP Bank's exploration into new geographic markets, such as expanding its presence into emerging economies or highly competitive developed nations, fits the question mark profile. These ventures offer substantial growth potential, with some regions like Central and Eastern Europe showing average GDP growth rates of 3.5% in 2024. However, OTP Bank's current market share in these new territories is minimal, demanding significant investment to build brand awareness and establish a competitive position against entrenched local and international players.

Strategic alliances with innovative fintech companies, particularly those focused on niche but rapidly expanding areas like embedded finance or digital asset management, also represent question marks for OTP Bank. The global fintech market is projected to grow significantly, with some segments experiencing double-digit annual growth. While these partnerships offer access to cutting-edge technology and new customer bases, they carry inherent risks due to the evolving regulatory landscape and the unproven scalability of some startups. OTP Bank's investment in these areas is a calculated bet on future market leadership.

Developing and launching novel digital banking platforms tailored for specific underserved demographics, such as gig economy workers or small business owners, are also question marks for OTP Bank. The demand for specialized financial services is rising, with the digital banking market expected to see continued expansion. While these initiatives have the potential to capture significant market share in their target segments, they require substantial upfront investment in technology, marketing, and customer acquisition, and their success is not guaranteed given the competitive environment.

| Initiative | Market Potential | OTP Bank's Current Share | Investment Required | Risk Level |

|---|---|---|---|---|

| Geographic Expansion (Emerging Markets) | High | Low | High | Medium |

| Fintech Partnerships (Embedded Finance) | High | Low | Medium | High |

| Niche Digital Banking Platforms | Medium to High | Low | High | Medium |

BCG Matrix Data Sources

Our OTP Bank BCG Matrix is built on comprehensive financial disclosures, including annual reports and performance metrics. This is supplemented by robust market analytics and expert evaluations of the banking sector's growth and competitive landscape.