OTP Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OTP Bank Bundle

OTP Bank navigates a dynamic financial landscape where customer loyalty, intense competition, and the looming threat of digital disruption significantly shape its market position. Understanding these forces is crucial for any stakeholder looking to grasp OTP Bank's strategic outlook.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore OTP Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Technology and IT infrastructure providers hold significant bargaining power over OTP Bank. This is due to the bank's deep reliance on specialized software for core banking operations, robust cybersecurity measures, and advanced digital customer-facing platforms. For instance, in 2024, the global IT services market was valued at over $1.3 trillion, with a significant portion dedicated to financial sector solutions, indicating a concentrated demand for specialized expertise.

The leverage these suppliers possess is directly tied to the uniqueness of their technological solutions and the substantial switching costs involved for OTP Bank. Implementing new core banking systems, for example, can cost millions and disrupt operations for months. A 2023 report indicated that the average cost for a bank to switch its core banking system can range from $200 million to $500 million, underscoring the high barriers to entry for new providers and the established power of incumbents.

For OTP Bank, access to capital is paramount, as it fuels lending and operational activities. Suppliers of this crucial capital include a diverse range of entities: individual depositors, other financial institutions providing interbank loans, and large institutional investors such as pension funds and asset managers.

The bargaining power of these capital suppliers is significantly shaped by prevailing interest rates and the overall liquidity within financial markets. For instance, in a high-interest-rate environment, depositors may demand higher returns, increasing the bank's cost of funds. Similarly, during periods of market stress, interbank lenders might charge premium rates or reduce lending altogether, tightening liquidity for institutions like OTP Bank.

OTP Bank's own creditworthiness and reputation play a vital role in mitigating the bargaining power of its capital suppliers. A strong credit rating and a solid reputation for financial stability can lead to more favorable terms and a more consistent availability of funds, even in challenging market conditions. In 2024, European banks generally faced increased funding costs due to persistent inflation and central bank policy adjustments, making robust capital management even more critical.

OTP Bank, like many financial institutions, relies heavily on specialized talent. Think about areas like cybersecurity, data analytics, and digital transformation – these aren't just buzzwords; they're critical for staying competitive and secure. The availability of professionals in these fields is a key factor.

In the Central and Eastern European (CEE) region, where OTP Bank operates, there's a noticeable scarcity of highly skilled individuals in these specialized areas. This shortage directly translates to increased bargaining power for employees. For instance, in 2024, the demand for cybersecurity professionals in CEE outstripped supply, leading to salary increases of up to 15-20% for experienced individuals in certain markets.

This dynamic can significantly impact OTP Bank's recruitment costs and retention efforts. When skilled employees are in high demand and short supply, they can negotiate for higher salaries, better benefits, and more flexible working arrangements. This forces OTP Bank to be strategic in its compensation and development programs to attract and keep the best talent.

Regulatory and Compliance Service Providers

OTP Bank, like many financial institutions, navigates a complex regulatory landscape across its Central and Eastern European (CEE) markets. This necessitates reliance on specialized external providers for legal counsel, auditing, and compliance services. The intricate nature of financial regulations and the need for highly skilled professionals in these fields can grant these suppliers a notable degree of bargaining power.

The bargaining power of regulatory and compliance service providers for OTP Bank is influenced by several factors:

- Specialized Expertise: Firms offering niche regulatory advice or compliance solutions possess unique knowledge that is difficult for banks to replicate in-house, increasing their leverage.

- Concentration of Suppliers: In certain CEE markets, the number of highly reputable and experienced regulatory service providers may be limited, concentrating power among a few key players.

- Switching Costs: The effort and expense involved in changing legal or auditing firms, particularly given the sensitive nature of financial data and regulatory adherence, can deter banks from frequent supplier changes, thus reinforcing supplier power.

Payment Network Operators

Payment network operators like Visa and Mastercard hold substantial bargaining power over banks such as OTP Bank. Their extensive global reach and the critical role they play in facilitating card transactions mean that banks are heavily reliant on these networks. In 2024, the continued dominance of these established players means that switching costs for a bank are prohibitively high, encompassing not only financial outlay but also potential operational disruptions and customer inconvenience.

The necessity for banks to offer services compatible with these major payment networks grants these operators significant leverage. This dependence allows them to dictate terms, including fees and service level agreements, which banks must often accept to remain competitive in the payment card market. For instance, the ongoing investment required to integrate and maintain compliance with evolving network standards further entrenches the power of these operators.

- Visa and Mastercard's global transaction volume in 2023 reached trillions of dollars, underscoring their market dominance.

- The cost of migrating from one payment network to another can run into millions of dollars for financial institutions.

- Banks' reliance on these networks is a key factor in the operators' ability to set interchange fees and other charges.

Suppliers of physical infrastructure, such as data centers and office space, exert moderate bargaining power over OTP Bank. While essential, these are generally commoditized services with multiple providers available across OTP's operating regions. However, the specialized needs of a bank, particularly regarding security and uptime for data centers, can increase the leverage of providers meeting these stringent requirements.

The bargaining power of these infrastructure suppliers is influenced by the availability of alternatives and the specificity of OTP Bank's requirements. For instance, while many data center providers exist, those offering highly secure, compliant facilities with robust connectivity options in key financial hubs may command stronger terms. In 2024, the demand for secure and reliable data center space remained high, particularly for financial institutions needing to meet strict regulatory standards.

What is included in the product

This analysis delves into the competitive forces impacting OTP Bank, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the banking sector.

Instantly pinpoint competitive pressures and identify strategic vulnerabilities within the banking sector, empowering OTP Bank to proactively address market challenges.

Customers Bargaining Power

Retail customers, especially for everyday banking needs like savings accounts and basic loans, generally face minimal hurdles to switch providers and are quite attuned to interest rate differences and service charges. This price sensitivity is a key driver of their bargaining power.

The increasing availability of online comparison tools and the proliferation of fintech alternatives make it simpler than ever for consumers to shop around for the best deals. In 2024, for instance, the average interest rate on a standard savings account across major European banks hovered around 1-2%, but competitive fintechs were offering upwards of 3.5%, highlighting this price sensitivity.

This ease of comparison significantly amplifies customer bargaining power, particularly in densely populated urban areas where competition among banks and financial technology firms is most intense, forcing institutions like OTP Bank to remain competitive on pricing.

Large corporate clients at OTP Bank often demand highly specialized financial products. These can include complex syndicated loans, intricate investment banking services, and advanced treasury management systems tailored to their unique operational needs.

The sheer scale of their transactions and their very specific requirements grant these corporate customers considerable leverage. This power translates into pressure for more competitive pricing and a consistent demand for customized service offerings from OTP Bank.

For instance, in 2024, the corporate banking segment of OTP Group saw a significant portion of its revenue derived from these larger, more demanding clients who actively negotiate terms for bespoke solutions, reflecting their substantial bargaining power in the market.

The widespread availability of digital banking platforms and user-friendly mobile apps significantly reduces the effort customers need to compare financial institutions and switch providers. This enhanced accessibility and transparency give customers greater leverage, as they can readily explore alternative offerings and migrate if they find more attractive terms or a superior digital experience.

Availability of Diverse Financial Products

Customers can choose from a vast range of financial products offered by traditional banks, alongside an increasing number of non-bank financial institutions and burgeoning fintech companies. This extensive choice means customers are less dependent on any single bank like OTP Bank, giving them more leverage to negotiate favorable terms and superior service. For instance, by mid-2024, the global fintech market was projected to reach over $300 billion, highlighting the competitive landscape OTP Bank operates within.

The sheer volume of alternatives available empowers customers to shop around, compare offerings, and switch providers if their expectations aren't met. This dynamic forces OTP Bank to continually innovate and offer competitive pricing and enhanced customer experiences to retain its client base. In 2023, the digital banking sector saw a significant surge, with customer acquisition costs for online-only banks often being lower, allowing them to offer more aggressive pricing.

- Increased Competition: The proliferation of fintechs and neobanks provides customers with readily available alternatives, intensifying pressure on established players like OTP Bank.

- Price Sensitivity: With numerous comparable products, customers are more likely to base decisions on price, forcing OTP Bank to maintain competitive interest rates and fees.

- Demand for Better Service: Customers expect seamless digital experiences and personalized services, pushing OTP Bank to invest in technology and customer relationship management.

Impact of Financial Literacy and Information Access

Customers are increasingly empowered due to greater financial literacy and access to online information. This allows them to compare offerings from various institutions, including OTP Bank, and choose the most competitive products and services. For instance, in 2024, a significant portion of banking customers actively utilized online comparison platforms before making decisions on loans or savings accounts.

This trend directly impacts OTP Bank by intensifying competitive pressures. Customers can easily identify and switch to providers offering better interest rates, lower fees, or superior digital banking features. This heightened awareness means banks must constantly innovate and offer compelling value propositions to retain their customer base.

- Informed Decisions: Increased financial literacy means customers understand product terms and conditions better, leading to more discerning choices.

- Price Sensitivity: Easy access to competitor pricing makes customers more sensitive to interest rates and fees.

- Digital Comparison Tools: Online platforms and comparison websites are widely used, facilitating quick evaluations of banking services.

- Switching Behavior: Customers are more willing to switch banks if they find a demonstrably better deal elsewhere.

The bargaining power of customers for OTP Bank is significantly influenced by the ease of switching and the availability of alternatives. With numerous fintechs and traditional banks offering similar products, customers can readily compare prices and services. This forces OTP Bank to remain competitive, particularly in retail banking where switching costs are low. For example, by mid-2024, the average interest rate difference between a standard savings account at a major European bank and a competitive fintech offering was around 1.5-2.5%, a gap customers actively leverage.

| Factor | Impact on OTP Bank | 2024 Data Point |

|---|---|---|

| Ease of Switching | High | Digital platforms reduce switching time and effort. |

| Availability of Alternatives | High | Proliferation of fintechs and neobanks offers diverse choices. |

| Price Sensitivity | Significant | Customers actively compare interest rates and fees, driving down margins. |

| Demand for Digital Services | High | Customers expect seamless mobile and online experiences. |

Preview Before You Purchase

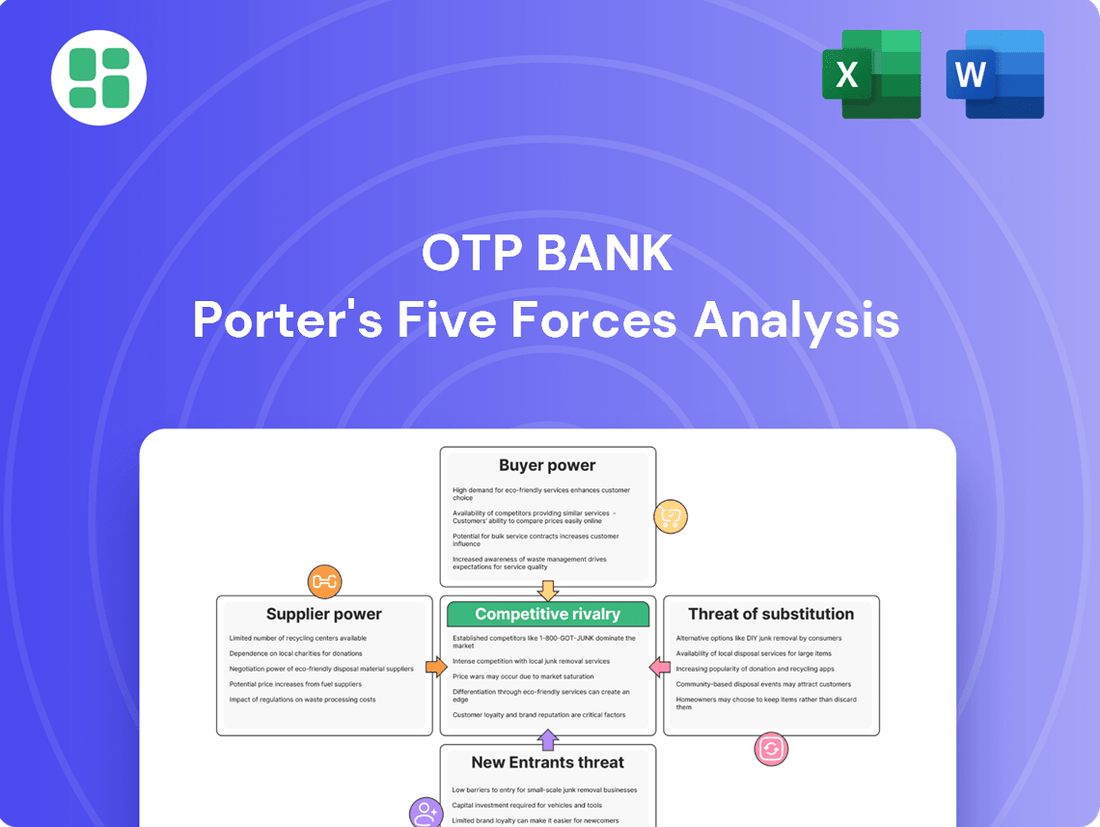

OTP Bank Porter's Five Forces Analysis

This preview displays the complete OTP Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the bank. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

OTP Bank faces significant competitive rivalry in the Central and Eastern European (CEE) banking sector. This market is populated by substantial domestic institutions and major international banks, including prominent players like Erste Group, Raiffeisen Bank International, UniCredit, and KBC Group subsidiaries. These established entities, alongside a multitude of smaller local banks, fiercely contend for market share, customer deposits, and lending opportunities across all banking segments.

The intensity of this rivalry is evident in the aggressive strategies employed by competitors. Banks frequently engage in price wars, particularly on loan and deposit rates, to attract and retain customers. Furthermore, a continuous drive for product innovation and impactful marketing campaigns are key battlegrounds, as institutions strive to differentiate themselves and capture a larger slice of the market. For instance, by the end of 2023, major CEE banks reported strong growth in lending volumes, highlighting the active pursuit of new business in a competitive environment.

The Central and Eastern European (CEE) banking sector is far from uniform, presenting a complex competitive landscape for OTP Bank. Each country within the CEE region boasts its own distinct regulatory framework and economic trajectory. For instance, while some markets might see a handful of large players dominating, others are characterized by a greater number of smaller, regional banks, influencing the intensity of rivalry.

This fragmentation means OTP Bank cannot adopt a one-size-fits-all approach. Adapting strategies to the specific nuances of, say, Hungary versus Romania, is crucial. In 2024, the banking sector in countries like Poland, a significant CEE market, continued to experience consolidation, but many smaller cooperative banks and specialized lenders still operate, contributing to a diverse competitive environment.

OTP Bank faces intense competition in the digital realm, as banks globally are pouring resources into mobile banking, online platforms, and AI. For instance, in 2024, many European banks, including those in OTP's operating regions, reported substantial increases in IT spending, often exceeding 10% of their operating expenses, to bolster their digital offerings and customer experience.

The surge of agile fintech startups further fuels this rivalry. While some fintechs collaborate with traditional banks, their innovative approaches and rapid development cycles pressure institutions like OTP to accelerate their own digital transformation, pushing for more intuitive and integrated digital banking solutions to retain and attract customers.

M&A Activity and Market Consolidation

The banking sector in Central and Eastern Europe (CEE) has experienced significant consolidation. Larger banks have actively acquired smaller institutions to expand their market share and benefit from economies of scale. This trend directly impacts the competitive intensity for players like OTP Bank.

This M&A activity reshapes the competitive landscape, often resulting in a market dominated by fewer, larger, and more powerful entities. Such consolidation can intensify pressure on existing banks to maintain competitiveness through innovation and efficiency.

For instance, in 2023, several notable M&A deals occurred across the CEE region, signaling continued interest in market consolidation. These transactions often involve banks seeking to strengthen their positions in key markets or enter new ones.

- Increased Market Concentration: Consolidation leads to fewer, larger competitors, intensifying rivalry.

- Economies of Scale: Acquired banks aim for cost efficiencies and broader service offerings.

- Reshaped Competitive Landscape: M&A activity can create formidable new market players.

- Strategic Acquisitions: Banks acquire others to gain market share and operational synergies.

Product Homogenization and Price Competition

Product homogenization is a significant challenge in the banking sector, particularly for core offerings like current accounts and basic loans. These products often become commodities, making it hard for institutions like OTP Bank to stand out based on features alone. This lack of differentiation fuels intense price competition.

Banks frequently engage in price wars, competing by offering more attractive interest rates on savings and loans or lower fees for services. This strategy, while aimed at customer acquisition, directly impacts profitability by squeezing profit margins. For instance, in 2024, the average interest rate on new mortgage loans in several European markets saw a slight decrease compared to late 2023, reflecting this competitive pressure.

- Commoditization of Core Products: Standard banking services like checking accounts and personal loans offer minimal unique selling propositions, leading to customer perception of similarity.

- Intensified Price Wars: Banks actively compete on price, offering lower interest rates on deposits and loans, and reduced fees for transactions and account maintenance.

- Margin Compression: The focus on price competition directly erodes net interest margins and fee income, putting pressure on overall profitability for banks like OTP.

- 2024 Market Trends: Data from early 2024 indicated that customer acquisition costs in retail banking remained high due to aggressive pricing strategies employed by competitors across the region.

OTP Bank operates in a highly competitive banking landscape across Central and Eastern Europe, facing rivalry from large international banks like Erste Group and Raiffeisen Bank International, as well as numerous strong domestic players. This intense rivalry is characterized by aggressive pricing strategies, particularly on loan and deposit rates, and a constant push for product innovation and digital enhancement.

The digital transformation race is a key battleground, with banks investing heavily in mobile platforms and AI. For example, in 2024, many European banks reported IT spending increases exceeding 10% of operating expenses to improve digital services, a trend OTP Bank must navigate. The rise of agile fintechs further intensifies this, compelling traditional banks to accelerate their digital strategies.

Consolidation within the CEE banking sector, marked by significant M&A activity in 2023, has led to fewer, larger competitors, increasing the pressure on remaining players to achieve economies of scale and maintain competitiveness through innovation. This reshaping of the market creates formidable new entities that OTP Bank must contend with.

Core banking products like current accounts and basic loans have become largely commoditized, forcing banks into price wars that compress margins. In 2024, average new mortgage rates in several European markets saw a slight dip, reflecting this pressure. Customer acquisition costs remain high due to these aggressive pricing tactics.

| Key Competitors | Market Presence (CEE) | Key Competitive Strategies |

| Erste Group | Significant in Czech Republic, Romania, Serbia, Austria | Digitalization, expanding retail and corporate banking services |

| Raiffeisen Bank International | Strong in Austria, Central Europe, Eastern Europe | Focus on digitalization, customer experience, and sustainable finance |

| UniCredit | Presence in Italy, Germany, Austria, Central and Eastern Europe | Digital transformation, cost optimization, strategic partnerships |

| KBC Group | Dominant in Belgium, significant in Central Europe (Czech Republic, Slovakia, Hungary) | Integrated banking, insurance, and asset management; digital innovation |

SSubstitutes Threaten

Fintech lending platforms, including peer-to-peer (P2P) and online direct lenders, present a significant threat of substitutes for traditional banking services like those offered by OTP Bank. These platforms cater to individuals and small to medium-sized enterprises (SMEs) seeking quicker and more adaptable loan options compared to conventional bank processes.

While not yet a complete replacement, the growth of these fintech lenders is notable. For instance, the global P2P lending market was projected to reach over $140 billion by 2023, indicating a substantial alternative funding channel. This disintermediation challenges traditional banks by offering a streamlined, often digital-first, experience that appeals to a growing customer segment.

Non-bank digital payment providers like PayPal, Revolut, Google Pay, and Apple Pay present a significant threat of substitution for OTP Bank. These platforms offer seamless and often lower-cost alternatives for everyday transactions, bypassing traditional banking channels entirely. For instance, in 2024, the global digital payments market was projected to reach over $10 trillion, with e-wallets holding a substantial share, indicating a strong consumer preference for these convenient substitutes.

Cryptocurrencies and Decentralized Finance (DeFi) present a growing threat by offering alternative financial channels. While still developing, these platforms allow for value storage, fund transfers, and financial services bypassing traditional banks. For instance, the total value locked in DeFi protocols reached over $100 billion in early 2024, indicating significant user engagement and a potential shift away from conventional banking for certain services.

Non-Bank Investment Platforms

Non-bank investment platforms present a significant threat of substitutes for OTP Bank's wealth management and investment advisory services. These platforms, including online brokerage firms, robo-advisors, and direct investment portals, empower individuals to manage their portfolios independently, bypassing traditional banking channels.

The accessibility and often lower fees associated with these platforms make them attractive alternatives. For instance, the global robo-advisor market size was valued at approximately USD 2.5 billion in 2023 and is projected to experience substantial growth, indicating a clear shift in consumer preference towards digital investment solutions.

- Increased Accessibility: Online platforms democratize investment, allowing individuals with smaller capital amounts to access sophisticated tools and diverse investment options.

- Cost Efficiency: Many non-bank platforms offer lower management fees and commission structures compared to traditional bank offerings, directly impacting the cost-competitiveness of OTP Bank's services.

- Technological Advancement: Robo-advisors, powered by algorithms, provide automated portfolio management and personalized advice, directly competing with OTP Bank's human-led advisory services.

In-house Corporate Financing Alternatives

Large corporations often have access to a wider array of financing options beyond traditional bank loans, which can serve as substitutes for OTP Bank's corporate lending services. These alternatives include issuing corporate bonds and commercial paper, or leveraging retained earnings. For instance, in 2024, the global corporate bond market saw significant activity, with companies raising substantial capital through debt issuance, directly impacting the demand for bank financing.

This diversification of funding sources diminishes the bargaining power of banks like OTP. Companies can choose the most cost-effective and flexible option available, potentially bypassing bank intermediation altogether. In 2023, many large European firms successfully refinanced existing debt through bond markets, often at lower interest rates than they might have secured from banks, highlighting the competitive pressure from these substitutes.

- Corporate Bonds: In 2024, investment-grade corporate bond yields offered attractive alternatives to bank loans for many established companies.

- Commercial Paper: Short-term financing through commercial paper provided liquidity for working capital needs, reducing reliance on bank credit lines.

- Retained Earnings: Companies with strong profitability in 2023 and early 2024 utilized internally generated funds, lessening the need for external borrowing.

The threat of substitutes for OTP Bank is significant, encompassing fintech lending, digital payments, cryptocurrencies, and non-bank investment platforms. These alternatives offer greater speed, lower costs, and enhanced convenience, appealing to a broad customer base. For example, the global digital payments market exceeded $10 trillion in 2024, with e-wallets playing a major role, demonstrating a clear consumer shift towards these substitutes.

Corporate clients also have access to alternative financing, such as corporate bonds and commercial paper, which can bypass traditional bank lending. In 2023, many European firms successfully refinanced debt through bond markets at lower rates than bank loans, underscoring the competitive pressure.

| Substitute Category | Example Platforms/Methods | Key Advantages | Market Trend/Data (2023-2024) |

|---|---|---|---|

| Fintech Lending | P2P platforms, Online Lenders | Speed, Adaptability, Streamlined Process | Global P2P lending market projected over $140 billion by 2023 |

| Digital Payments | PayPal, Revolut, Apple Pay | Convenience, Lower Transaction Costs | Global digital payments market exceeded $10 trillion in 2024 |

| Alternative Finance | Corporate Bonds, Commercial Paper | Cost-effectiveness, Flexibility | European firms secured lower rates via bond markets in 2023 |

Entrants Threaten

The banking sector, including institutions like OTP Bank, faces substantial regulatory hurdles. For instance, Basel III requirements, which are being further refined by Basel IV, mandate significant capital adequacy ratios, liquidity coverage ratios, and net stable funding ratios. These regulations, coupled with stringent licensing processes and ongoing compliance with anti-money laundering (AML) and know-your-customer (KYC) protocols, create a formidable barrier for new entrants. In 2024, the global banking industry continues to navigate these complex frameworks, making it exceptionally costly and time-consuming for new, traditional banks to enter the market and compete effectively.

Established brand loyalty and trust represent a significant barrier for new entrants aiming to compete with incumbents like OTP Bank. For decades, banks like OTP have cultivated strong relationships with their customer base, fostering a sense of reliability and security that is paramount in financial services. In 2024, this translates to a substantial advantage, as new digital-only banks or fintech firms must invest heavily in marketing and customer acquisition to even begin to erode this deeply ingrained trust. Building this level of credibility from the ground up is a lengthy and costly endeavor, especially in a sector where customers often prioritize stability and proven track records over novelty.

Incumbent banks like OTP Bank benefit significantly from economies of scale. For instance, in 2024, major European banks reported operating costs per transaction that were substantially lower than what a new entrant would likely incur due to their massive transaction volumes and established infrastructure. This allows them to offer more competitive pricing on services, making it challenging for newcomers to match their cost efficiency.

Furthermore, OTP Bank, like other established financial institutions, benefits from strong network effects. Their extensive branch networks and large, loyal customer bases create a powerful advantage. In 2023, customer retention rates for established banks often exceeded 90%, a testament to the stickiness of these networks. New entrants struggle to build comparable trust and reach, requiring substantial investment to overcome this barrier.

Access to Funding and Liquidity

New entrants into the banking sector, like OTP Bank, often grapple with establishing robust and varied funding streams. Securing stable deposit bases, which are the lifeblood of lending operations, presents a significant hurdle compared to incumbent institutions. For instance, in 2024, many emerging fintech banks found it challenging to attract and retain substantial retail deposits without offering premium interest rates, impacting their cost of funds.

Established players benefit from deeply entrenched customer relationships and sophisticated liquidity management frameworks. This allows them greater and more cost-effective access to interbank markets for short-term funding needs. By 2024, major banks consistently maintained lower average borrowing costs in wholesale markets due to their perceived stability and creditworthiness, a clear advantage over newcomers.

The threat of new entrants is therefore tempered by the difficulty in replicating the funding advantages of established banks. Consider the following points:

- Funding Diversification Challenges: New banks struggle to build diverse deposit portfolios, essential for stable, low-cost funding.

- Interbank Market Access: Established banks possess superior access and terms in interbank lending markets due to their size and reputation.

- Liquidity Management Expertise: Incumbents have honed sophisticated strategies for managing liquidity, a difficult capability for new entrants to replicate quickly.

- Cost of Capital Disadvantage: New entrants often face a higher cost of capital, impacting their ability to compete on pricing for loans and deposits.

Fintech-led Niche Entrants and Challenger Banks

While establishing a traditional, full-service bank like OTP requires immense capital and navigating complex regulatory landscapes, the threat from new entrants, particularly fintech-led niche players and challenger banks, is evolving. These agile companies can enter specific segments of the financial services market, such as digital payments or specialized lending, with significantly lower overheads due to their digital-only models and innovative technology. For instance, in 2024, the global fintech market continued its robust growth, with investments pouring into companies focused on streamlining payments and offering targeted credit solutions.

However, the path for these new entrants to become comprehensive universal banks, mirroring OTP's broad service offering, remains challenging. The hurdles of regulatory compliance, capital requirements, and building trust among a wide customer base are substantial. Despite the rapid adoption of digital banking services, with many European countries reporting over 70% of banking transactions conducted digitally by early 2025, replicating the scale and scope of established institutions is a different proposition.

- Fintechs can target lucrative niches with lower barriers to entry.

- Challenger banks leverage technology to offer competitive digital-only services.

- Scaling to a universal banking model presents significant regulatory and capital challenges for new entrants.

- While digital adoption is high, replicating the breadth of services of established banks like OTP remains difficult for newcomers.

The threat of new entrants for OTP Bank is moderate, primarily due to high regulatory barriers and substantial capital requirements for establishing a full-service bank. However, agile fintech firms can target specific, less regulated niches, posing a challenge. For example, by mid-2024, many neobanks were successfully capturing market share in digital payments and consumer lending.

Newcomers face significant hurdles in replicating OTP Bank's economies of scale and established brand trust. In 2024, the cost to acquire a new retail banking customer for a traditional bank remained upwards of $300, a figure most startups find prohibitive. This makes it difficult for new entrants to compete on price and service breadth.

While digital banking adoption is high, with over 75% of transactions in many European markets being digital by early 2025, this doesn't automatically translate to easy market entry for new players. The complexity of universal banking services, including risk management and capital adequacy, remains a substantial barrier.

New entrants often struggle with funding diversification and access to interbank markets, unlike established institutions. In 2024, the average cost of wholesale funding for Tier 1 banks was consistently lower than for emerging fintechs, impacting their lending competitiveness.

| Barrier | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Regulatory Compliance & Licensing | High; significant upfront costs and time | Average time for banking license approval: 18-24 months |

| Capital Requirements | High; substantial investment needed | Minimum capital for new banks in EU: €5 million |

| Brand Trust & Loyalty | High; difficult to build quickly | Customer retention rate for established banks: ~90% |

| Economies of Scale | High; incumbents have lower cost per transaction | Operating cost per transaction for large banks: <$0.10 |

| Access to Funding | Moderate to High; interbank markets and deposit base | Wholesale funding cost for established banks: ~4-5% |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for OTP Bank is built upon a robust foundation of data, including the bank's official annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific research from reputable financial news outlets and market analysis firms to capture the broader economic and competitive landscape.