Organigram Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Organigram Holdings is navigating a dynamic cannabis market, showcasing strong brand recognition and innovative product development as key strengths. However, understanding their potential vulnerabilities and the competitive landscape requires a deeper dive.

Want the full story behind Organigram's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Organigram Holdings commands a dominant position in the Canadian cannabis market, consistently ranking as the largest recreational cannabis company by market share. This leadership is particularly evident in key product categories, where they hold the number one spot in vapes, pre-rolls, milled flower, and hash, demonstrating broad consumer appeal and strong product development.

This robust domestic market presence translates into a stable and predictable revenue stream, a significant advantage in a dynamic industry. Furthermore, their top-tier market share fosters substantial brand recognition across Canada, building consumer trust and loyalty.

Organigram Holdings possesses a robust and varied product lineup, encompassing dried flower, pre-rolls, edibles, vapes, and concentrates. This broad offering effectively serves both the medical and recreational cannabis sectors, ensuring wide market appeal.

The company's dedication to innovation is evident in recent developments like Edison Sonics, which features FAST™ nanoemulsion technology. This advancement specifically targets the ingestible market, positioning Organigram with a distinct competitive advantage and a forward-thinking approach to product development.

Organigram Holdings boasts a robust financial position, underscored by a pro-forma cash balance of roughly $113 million as of early 2024, coupled with minimal outstanding debt. This solid financial foundation provides significant operational flexibility and resilience.

Strategic capital infusion from British American Tobacco (BAT), notably through the dedicated 'Jupiter' investment pool, injects substantial funds. This capital is earmarked for critical growth initiatives, including international market penetration and the pursuit of value-enhancing strategic acquisitions, positioning Organigram for accelerated expansion.

Expanding International Footprint

Organigram is strategically broadening its global reach, with a keen focus on European markets, the United Kingdom, Australia, and the United States. This expansion is already yielding results, as evidenced by substantial growth in its international sales figures. For instance, international revenue saw a notable uptick in recent reporting periods, demonstrating the effectiveness of its global strategy.

The anticipated EU-GMP certification for Organigram's Moncton facility, expected in 2025, is a pivotal development. This certification will unlock significant opportunities within the European Union, allowing Organigram to tap into new markets. It also serves as a testament to the company's commitment to high-quality production standards, which can be leveraged to build trust and gain market share worldwide.

- International Sales Growth: Organigram reported a significant percentage increase in international revenue for the fiscal year ending September 30, 2024, driven by expanding distribution networks in key overseas markets.

- EU Market Entry: The projected EU-GMP certification for the Moncton facility in early 2025 is expected to facilitate direct market access to Germany, France, and other regulated European countries, potentially adding millions in new revenue streams.

- Diversification Strategy: Organigram's international expansion is a key component of its diversification strategy, reducing reliance on any single market and creating multiple avenues for future growth.

Operational Synergies from Acquisitions

Organigram's acquisition and integration of Motif Labs Ltd. have been a game-changer, significantly enhancing its market share and processing capabilities. This strategic move is projected to yield annual cost synergies exceeding $15 million, demonstrating a clear path to improved operational efficiency. The consolidation strengthens Organigram's competitive position within the industry.

These operational synergies are a direct result of combining resources and streamlining processes post-acquisition. The integration allows for greater economies of scale and a more robust supply chain.

- Enhanced Processing Power: Motif Labs brought advanced extraction and processing technologies, boosting Organigram's output capacity.

- Market Share Expansion: The acquisition solidified Organigram's presence in key markets, increasing its overall customer base.

- Cost Efficiencies: Anticipated annual cost synergies of over $15 million highlight the financial benefits of integration.

Organigram Holdings leverages its leading position in the Canadian recreational cannabis market, particularly strong in vapes, pre-rolls, and milled flower, to drive consistent revenue. Their diverse product portfolio, including innovative ingestibles with nanoemulsion technology, caters to a broad consumer base. A solid financial footing, with approximately $113 million in pro-forma cash and low debt as of early 2024, provides significant operational flexibility.

The strategic partnership with British American Tobacco (BAT), including a dedicated investment pool, fuels expansion into international markets and potential acquisitions. Organigram's international sales are already showing substantial growth, with a focus on Europe and the UK. The anticipated EU-GMP certification for their Moncton facility in 2025 is a critical step to unlock the lucrative European Union market, expected to significantly boost revenue streams.

The acquisition of Motif Labs Ltd. has bolstered Organigram's market share and processing capabilities, projected to generate over $15 million in annual cost synergies. This integration enhances operational efficiency through economies of scale and a stronger supply chain, solidifying their competitive standing.

| Metric | Value | Period | Source |

|---|---|---|---|

| Canadian Market Share (Recreational) | Largest | FY 2024 | Company Reports |

| Key Product Category Leadership | #1 in Vapes, Pre-rolls, Milled Flower, Hash | FY 2024 | Company Reports |

| Pro-Forma Cash Balance | ~$113 Million | Early 2024 | Company Reports |

| Projected Annual Cost Synergies (Motif Acquisition) | >$15 Million | Post-Acquisition | Company Reports |

| International Revenue Growth | Significant % Increase | FY 2024 | Company Reports |

What is included in the product

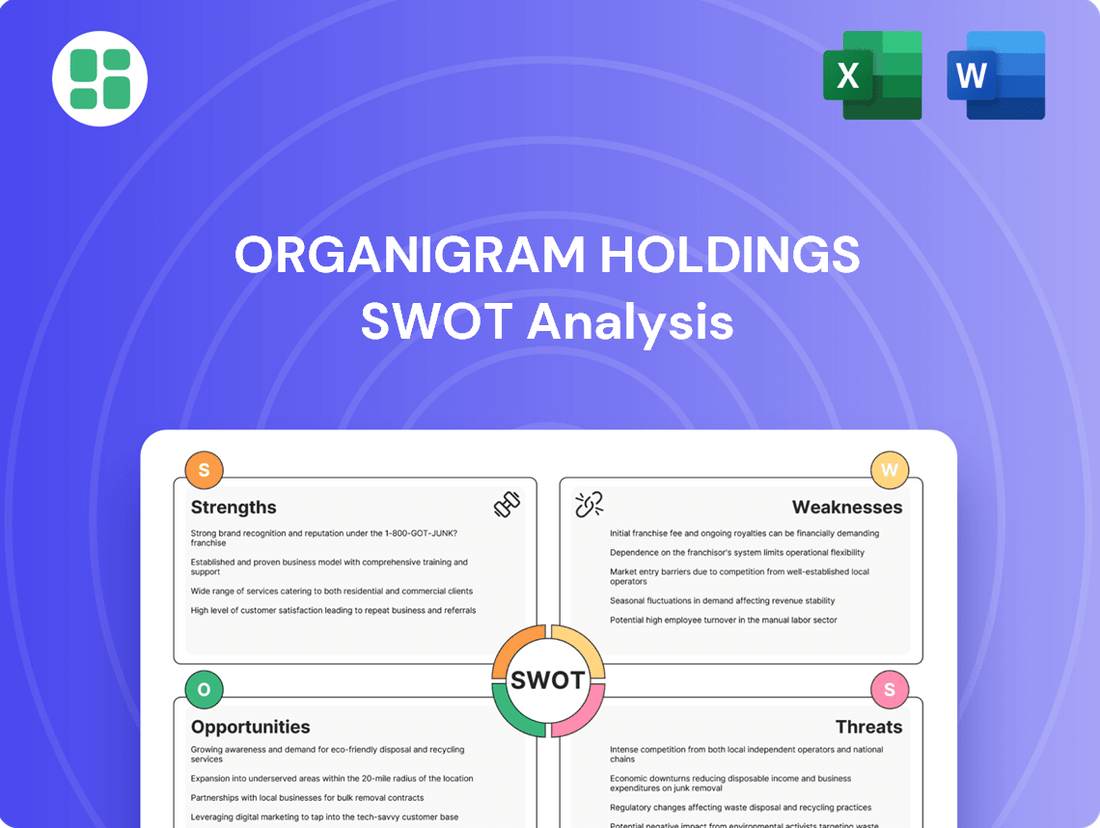

Organigram Holdings' SWOT analysis highlights its strong brand recognition and product innovation (Strengths), while also identifying potential challenges in market saturation and regulatory changes (Threats). It also points to opportunities in international expansion and new product development (Opportunities), alongside weaknesses in production capacity and cost management (Weaknesses).

Organigram Holdings' SWOT analysis offers a clear roadmap to navigate industry challenges and capitalize on emerging opportunities.

Weaknesses

Organigram Holdings has struggled with profitability, a significant weakness. The company reported a net loss of $23.0 million for the first quarter of fiscal 2025, and a $27.1 million net loss in the second quarter of fiscal 2024. This recurring pattern of net losses, despite revenue increases, highlights ongoing challenges in translating sales into sustainable profits.

These losses are partly attributed to factors like fair value adjustments on derivative liabilities and substantial operating expenses. Such financial performance can deter investors and limit the company's ability to self-fund future growth initiatives or acquisitions.

Organigram Holdings grapples with significant excise tax burdens in Canada. In the first quarter of fiscal 2025, these obligations surged to approximately $24.1 million, a substantial figure equating to roughly 36% of the company's gross revenue.

These high excise taxes directly compress gross margins and negatively affect overall profitability. Consequently, Organigram faces the challenge of retaining a larger share of its sales revenue, impacting its ability to reinvest or distribute profits.

Acquisitions, while strategic, present integration hurdles that can temporarily impact financial metrics. For instance, Organigram's acquisition of Motif Labs, though aimed at synergy, initially led to a dilution of adjusted gross margins. In Q2 Fiscal 2025, Motif's lower margins compared to Organigram's core business directly contributed to this effect.

The full realization of synergies from acquisitions is a gradual process, meaning that immediate financial performance can be affected. This integration period requires careful management to ensure that the long-term benefits of the acquisition outweigh the short-term financial adjustments.

Dependence on Volatile Canadian Market

Organigram's significant reliance on the Canadian recreational cannabis market presents a notable weakness. This market, while a primary focus, is characterized by fierce competition and downward pressure on pricing, impacting profitability. For instance, in Organigram's fiscal second quarter of 2024, the company reported net revenue of $72.8 million, a slight increase from the previous year, but the competitive landscape continues to be a challenge.

The immaturity of the overall Canadian cannabis market, coupled with ongoing supply-demand imbalances, further exacerbates this dependence. These factors can create an unpredictable operating environment, making it difficult to forecast sales and maintain stable margins. Organigram's performance is therefore closely tied to the evolving dynamics within Canada, highlighting a vulnerability to domestic market fluctuations.

- Market Concentration: Over-reliance on the Canadian recreational sector.

- Price Compression: Intense competition leads to lower product prices.

- Market Volatility: Canadian market immaturity and supply-demand issues create uncertainty.

Increased Selling, General & Administrative (SG&A) Expenses

Organigram Holdings experienced a rise in Selling, General & Administrative (SG&A) expenses during the first two quarters of fiscal year 2025. This increase was primarily driven by the integration of Motif's operational costs and a greater allocation towards trade investments aimed at market expansion.

While SG&A as a percentage of net revenue saw a reduction, the absolute increase in these costs presents a potential challenge to overall profitability. Effective management of these expenses, ensuring they are outpaced by revenue growth, will be crucial for maintaining healthy margins.

- SG&A Increase: Q1 and Q2 FY2025 saw higher SG&A due to Motif's inclusion and increased trade investments.

- Proportional Decrease: Despite the absolute rise, SG&A as a proportion of net revenue declined.

- Profitability Pressure: The absolute increase in costs could strain profitability if revenue growth doesn't keep pace.

Organigram's persistent net losses, including $23.0 million in Q1 FY2025, indicate challenges in converting revenue into profit, a significant weakness. These losses, exacerbated by fair value adjustments and high operating costs, can hinder future investment and growth.

The company faces substantial excise tax burdens in Canada, with Q1 FY2025 obligations reaching approximately $24.1 million, impacting gross margins. This tax structure directly limits Organigram's ability to retain revenue and reinvest in its operations.

Acquisition integration, such as with Motif Labs, has led to short-term financial adjustments, including diluted adjusted gross margins in Q2 FY2025. Realizing acquisition synergies is a gradual process that can temporarily affect financial performance.

Organigram's heavy reliance on the competitive Canadian recreational cannabis market, facing price compression and market volatility, presents a vulnerability. The immaturity of this market and supply-demand imbalances create an unpredictable operating environment.

| Financial Metric | Q1 FY2025 | Q2 FY2024 |

|---|---|---|

| Net Loss | $23.0 million | $27.1 million |

| Canadian Excise Tax | ~$24.1 million | N/A |

| SG&A Expenses | Increased (absolute terms) | N/A |

Preview the Actual Deliverable

Organigram Holdings SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Organigram Holdings' Strengths, Weaknesses, Opportunities, and Threats. This comprehensive analysis provides actionable insights for strategic planning.

Opportunities

Organigram's strategic agreements in key international medical cannabis markets like Germany, the U.K., Australia, and Israel, coupled with the anticipated EU-GMP certification for its Moncton facility, create a significant opportunity to boost global medical cannabis sales. This expansion is particularly attractive as the worldwide medical cannabis market is experiencing robust growth, often presenting higher profit margins than the recreational sector.

Organigram Holdings' acquisition of Collective Project Limited, a Canadian beverage company, signifies a strategic move into the burgeoning U.S. hemp-derived beverage market. This entry into the world's largest cannabis market positions Organigram to capitalize on the significant growth potential within this segment.

The U.S. hemp-derived cannabinoid market, particularly for beverages, has seen substantial expansion. For instance, the U.S. CBD beverage market alone was valued at approximately $1.3 billion in 2023 and is projected to grow significantly in the coming years, driven by increasing consumer acceptance and product innovation.

Organigram's proprietary FAST™ nanoemulsion technology is a key differentiator, enabling faster onset of effects which is highly desirable in the beverage category. This technological advantage, combined with a foothold in the U.S. market, presents a strong opportunity for Organigram to capture market share and drive revenue growth.

The Jupiter strategic investment pool, bolstered by British American Tobacco's (BAT) significant follow-on investment, injects substantial capital into Organigram. This financial firepower is crucial for Organigram to aggressively pursue international expansion via strategic acquisitions and collaborations. For instance, BAT's commitment in 2023 provided Organigram with access to capital that can fuel market entry into new territories, potentially mirroring successful strategies seen in other markets where consolidation is occurring.

Product Diversification into Cannabis 2.0 and 3.0

Organigram's expansion into Cannabis 2.0 and 3.0 products, such as edibles, beverages, and wellness-focused items, capitalizes on increasing consumer interest in these categories. This strategic move allows the company to tap into a broader market segment beyond traditional flower. The company's investment in advanced technologies, including nanoemulsion, is crucial for developing high-quality, differentiated products that meet evolving consumer preferences.

The company's existing strength in high-margin product segments like vapes and infused pre-rolls provides a solid foundation for further diversification. For instance, Organigram's Q1 2024 results showed continued growth in their value-added product segments, indicating a positive market reception to their innovation efforts. This positions them well to capture market share as the demand for sophisticated cannabis consumables grows.

Key opportunities include:

- Capitalizing on the expanding edibles and beverage market: Consumer adoption of these product types continues to rise, offering significant revenue potential.

- Leveraging nanoemulsion technology: This allows for faster onset and improved bioavailability in ingestible products, creating a competitive advantage.

- Developing innovative wellness and topical products: The growing interest in CBD and other cannabinoids for health and personal care opens new avenues for product development.

- Expanding international market reach: As global regulations evolve, Organigram can explore exporting its diversified product portfolio.

Regulatory Streamlining in Canada

Recent updates to Canadian cannabis regulations in 2025, such as simplified licensing and relaxed packaging rules, are expected to significantly lower administrative hurdles for companies like Organigram. This streamlining aims to create a more efficient and competitive legal market, potentially reducing compliance costs and enhancing operational flexibility.

These regulatory changes could directly benefit Organigram by allowing for increased production thresholds for micro-cultivators, fostering growth and market participation. The anticipated reduction in compliance burdens is a key opportunity for Organigram to reallocate resources towards innovation and expansion.

- Reduced Compliance Costs: Anticipated savings from simplified licensing and packaging.

- Increased Operational Flexibility: Greater freedom in production and market strategies.

- Enhanced Competitiveness: A more level playing field with fewer administrative barriers.

Organigram's strategic international expansion, particularly into key medical cannabis markets like Germany and the UK, presents a significant growth opportunity. The company's acquisition of Collective Project Limited also positions it to capitalize on the rapidly expanding U.S. hemp-derived beverage market, a sector projected for substantial growth. Furthermore, Organigram's proprietary nanoemulsion technology offers a competitive edge in developing differentiated products like beverages with faster onset times, a highly sought-after attribute by consumers.

Threats

The Canadian cannabis sector is incredibly crowded, driving down prices, especially for edibles and budget-friendly options. This means Organigram faces significant pressure on its profitability and its ability to hold onto market share or dictate prices.

In the first quarter of fiscal 2024, Organigram reported a net revenue of $77.7 million, a notable increase from the previous year, but the competitive landscape continues to challenge average selling prices across the industry.

This price compression is a direct consequence of the high number of licensed producers and the ongoing efforts to capture consumer demand, forcing companies like Organigram to innovate and optimize costs to remain competitive.

Organigram's international growth hinges on navigating a complex web of global regulations. For instance, while Germany's recent cannabis legalization in April 2024 opens doors, the specifics of import and export rules remain subject to evolving interpretations, potentially causing delays. Similarly, the ongoing federal discussions around cannabis reform in the U.S. present both opportunity and uncertainty, with any shifts in federal policy potentially altering Organigram's market access and operational strategies.

Despite the significant expansion of the legal cannabis market, the persistent illicit market remains a considerable threat to Organigram. This underground sector operates without the regulatory burdens and costs associated with legal operations, allowing it to offer products at substantially lower price points.

This price disparity directly impacts Organigram by diverting consumers who prioritize cost savings away from legal, regulated channels. Consequently, this illicit competition can suppress sales volumes and limit revenue growth opportunities for the company, particularly in markets where the illegal supply chain is well-established.

Fluctuations in Gross Margins

Organigram's gross margins can be quite volatile, influenced by factors like seasonal demand, shifts in the types of products they sell, and the costs associated with bringing new acquisitions into the fold. For instance, during fiscal Q2 2024, Organigram reported a gross margin of 23.5%, a dip from the previous year's 28.1%, highlighting this sensitivity. While the company anticipates these margins will strengthen over time, this inconsistency can create uncertainty regarding their financial health and how investors perceive the company's performance.

These fluctuations pose a significant threat because they directly affect profitability. When gross margins shrink, less money is available to cover operating expenses, debt, and reinvestment, potentially hindering growth initiatives. Organigram's Q2 2024 results, showing a net loss despite revenue growth, underscore how margin pressure can impact the bottom line. Maintaining stable and improving gross margins is crucial for building investor confidence and ensuring long-term financial stability.

- Seasonal Impact: Sales volumes and pricing can vary seasonally, affecting the cost of goods sold and, consequently, gross margins.

- Product Mix: Changes in the proportion of higher-margin versus lower-margin products sold can lead to unpredictable gross margin performance.

- Acquisition Integration: Initial costs and operational adjustments related to acquired businesses can temporarily depress gross margins until efficiencies are realized.

- Competitive Pricing: Intense market competition may force Organigram to adjust pricing, impacting its ability to maintain strong gross margins.

Macroeconomic Headwinds and Consumer Spending Shifts

Broader economic turbulence, including persistent inflation and potential recessions, presents a significant threat to Organigram. Higher living costs can reduce consumers' disposable income, potentially leading to decreased spending on non-essential items like cannabis. For instance, in early 2024, inflation rates in key markets remained a concern, impacting consumer purchasing power.

Shifts in consumer discretionary spending habits, driven by economic uncertainty, could also negatively affect demand. Consumers might trade down to lower-priced cannabis products or reduce overall consumption. This is particularly relevant as the legal cannabis market matures and competition intensifies, making price a more significant factor for many buyers.

- Inflationary Pressures: Continued high inflation throughout 2024 could erode consumer budgets, impacting discretionary spending on premium cannabis products.

- Economic Downturns: A broader economic slowdown or recession would likely dampen overall consumer demand for cannabis, affecting sales volumes.

- Shifting Consumer Preferences: Economic hardship may cause consumers to opt for value-oriented brands over premium offerings, impacting Organigram's product mix and margins.

- Reduced Disposable Income: As essential goods become more expensive, consumers have less income available for purchases like legal cannabis.

Organigram faces intense competition in a crowded Canadian cannabis market, leading to price compression that pressures profitability and market share. The persistent illicit market further siphons consumers seeking lower prices, directly impacting Organigram's sales volumes and revenue growth potential.

Economic turbulence, including inflation and potential recessions, threatens to reduce consumer disposable income, potentially decreasing demand for cannabis or shifting preferences towards value brands. This economic uncertainty makes forecasting sales and maintaining healthy gross margins, which were 23.5% in Q2 fiscal 2024, increasingly challenging.

| Threat | Impact | Data Point (FY2024) |

|---|---|---|

| Intense Market Competition | Price compression, reduced market share | Average selling prices across the industry challenged |

| Illicit Market Competition | Diversion of consumers, suppressed sales | Competes on price with unregulated products |

| Economic Uncertainty (Inflation/Recession) | Reduced disposable income, lower demand | Inflation concerns impacting consumer purchasing power in early 2024 |

| Gross Margin Volatility | Impacts profitability and reinvestment | Q2 FY2024 gross margin of 23.5% (down from 28.1% prior year) |

SWOT Analysis Data Sources

This Organigram Holdings SWOT analysis is built upon a foundation of verifiable financial statements, comprehensive market research reports, and expert industry commentary. These sources ensure a robust and accurate assessment of the company's strategic position.