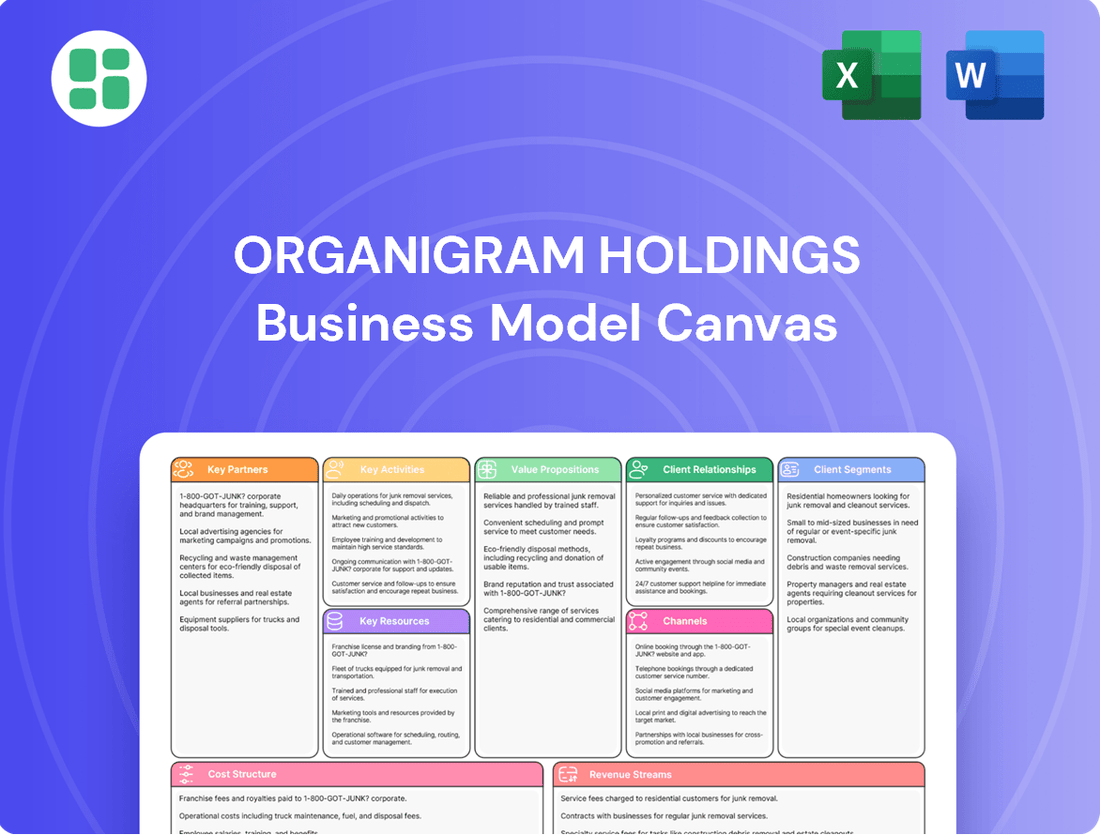

Organigram Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Unlock the strategic blueprint behind Organigram Holdings's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with their target markets, build key partnerships, and generate revenue in the dynamic cannabis industry. Gain actionable insights into their value proposition and operational structure.

Partnerships

Organigram Holdings actively collaborates with provincial cannabis boards across Canada. These boards function as the principal distributors for recreational cannabis in the majority of provinces, making them indispensable partners for Organigram.

These strategic alliances are vital for Organigram's market penetration and adherence to provincial regulatory frameworks. By working with these official bodies, Organigram ensures its products reach a wide consumer audience through established and compliant distribution networks.

In 2024, Organigram's recreational wholesale revenue in Canada is predominantly generated through sales to these provincial boards, alongside direct sales to major retail chains. This highlights the critical role these government-appointed entities play in Organigram's Canadian sales strategy.

Organigram's relationship with British American Tobacco (BAT) is a cornerstone of its business model, particularly through a significant strategic investment and Product Development Collaboration (PDC). This partnership includes a substantial follow-on investment and the establishment of a 'Jupiter' strategic investment pool, underscoring a deep commitment.

This collaboration is designed to harness BAT's extensive experience in product development, notably in areas like the innovative FAST™ nanoemulsion technology. The capital infusion from BAT is crucial for Organigram's international expansion efforts and for capitalizing on emerging growth opportunities in the global cannabis market.

The final tranche of BAT's follow-on investment was anticipated to finalize in February 2025. This closing is expected to significantly bolster Organigram's financial standing, providing the necessary resources to aggressively pursue its international market penetration and strategic growth initiatives.

Organigram Holdings cultivates vital relationships with international supply partners, crucial for its global market penetration. These collaborations extend to key territories such as Germany, the United Kingdom, Australia, and Israel, facilitating Organigram's expansion and bolstering international sales, which demonstrated robust growth in the first half of fiscal 2025.

A prime example is Organigram's strategic investment in Sanity Group, which has already yielded an enhanced supply agreement. Future growth is anticipated, particularly upon the attainment of EU-Good Manufacturing Practice (EU-GMP) certification for Organigram's Moncton facility, further solidifying these international ties and market access.

Technology and Genetics Providers (e.g., Phylos Bioscience)

Organigram Holdings' strategic alliances with technology and genetics providers are foundational to its innovation pipeline and operational efficiency. A prime example is its collaboration with Phylos Bioscience, a company specializing in seed-based cannabis genetics. This partnership is designed to enhance Organigram's product development and cultivation strategies.

Organigram's investment in Phylos grants it access to proprietary seed-based technology and a broader portfolio of genetics licenses. This includes access to novel cannabinoids like THCV, CBG, CBC, and CBDV. The long-term objective is to transition towards lower-cost cultivation methods that utilize seeds, a significant shift from traditional vegetative propagation.

- Strategic Investment: Organigram's investment in Phylos Bioscience provides crucial access to advanced seed-based genetics and cultivation technologies.

- Genetics Expansion: The partnership unlocks licenses for a wider array of cannabinoids, including THCV, CBG, CBC, and CBDV, diversifying Organigram's product offerings.

- Cost Optimization: The focus on seed-based cultivation aims to reduce production costs over time, enhancing Organigram's competitive edge.

- Product Innovation: Collaborations in advanced plant science research, like the Product Development Collaboration with Phylos, are key to developing next-generation cannabis products.

Acquired Entities and Subsidiaries (e.g., Motif Labs, Collective Project)

Organigram's strategic acquisitions of Motif Labs and Collective Project are pivotal to its business model, acting as crucial partnerships that bolster its market position and product offerings.

The December 2024 acquisition of Motif Labs integrated their expertise in vapes and infused pre-rolls, significantly boosting Organigram's presence in the recreational cannabis market and unlocking substantial cost synergies.

In March 2025, Organigram further expanded its reach by acquiring Collective Project, a move that allowed entry into the burgeoning U.S. hemp-derived THC beverage market and strengthened its Canadian cannabis beverage portfolio.

- Motif Labs Acquisition (December 2024): Enhanced Organigram's recreational market share with expertise in vapes and infused pre-rolls, driving significant cost synergies.

- Collective Project Acquisition (March 2025): Enabled entry into the U.S. hemp-derived THC beverage market and expanded Organigram's Canadian cannabis beverage category.

Organigram's key partnerships are multifaceted, encompassing provincial cannabis boards for distribution, British American Tobacco (BAT) for strategic investment and product development, and international supply partners in key markets. These alliances are critical for market access, innovation, and global expansion.

The company also leverages partnerships with technology and genetics providers, such as Phylos Bioscience, to enhance its product pipeline and cultivation efficiency. Furthermore, strategic acquisitions, like those of Motif Labs and Collective Project, integrate specialized capabilities and expand market reach, particularly in the beverage sector.

| Partner Type | Key Partners | Strategic Importance | 2024/2025 Impact |

|---|---|---|---|

| Distribution | Provincial Cannabis Boards | Market penetration in Canada | Primary channel for recreational sales in 2024 |

| Strategic Investment & R&D | British American Tobacco (BAT) | Capital infusion, product development (FAST™) | Follow-on investment closing Feb 2025, supports international growth |

| International Supply | Sanity Group, others | Global market access, product development | Enhanced supply agreement with Sanity Group; EU-GMP certification pending for Moncton facility |

| Technology & Genetics | Phylos Bioscience | Seed-based genetics, novel cannabinoids | Access to THCV, CBG, CBC, CBDV; aims for lower-cost cultivation |

| Acquisitions | Motif Labs (Dec 2024) | Vape & infused pre-roll expertise, cost synergies | Strengthened recreational market presence |

| Acquisitions | Collective Project (Mar 2025) | U.S. hemp-derived THC beverages, Canadian beverages | Entry into U.S. market, expanded beverage portfolio |

What is included in the product

Organigram Holdings' Business Model Canvas outlines its strategy for the Canadian cannabis market, focusing on premium product development and direct-to-consumer sales channels to reach its target customer segments.

This model emphasizes Organigram's commitment to innovation and quality, detailing key partnerships and revenue streams within the evolving legal cannabis industry.

Organigram Holdings' Business Model Canvas acts as a pain point reliever by clearly mapping out their value proposition for cannabis consumers and streamlining their supply chain for efficient production and distribution.

Activities

Organigram Holdings' key activity of cannabis cultivation and harvesting centers on its indoor facilities, notably in Moncton and Lac-Supérieur, with a strong emphasis on producing premium quality flower. This meticulous process is the bedrock of their product offering, ensuring a consistent and desirable end-product for consumers.

To meet growing demand and enhance efficiency, Organigram is actively expanding its cultivation capacity and transitioning towards higher-efficiency seed-based cultivation methods. This strategic shift is designed to optimize yields and reduce costs associated with traditional propagation techniques.

The company's commitment to this strategy is evident in its Q1 Fiscal 2025 performance, where it reported a significant 21% increase in harvests derived from seed-based cultivation. This boost directly contributes to improved operational efficiencies and strengthens their ability to scale production effectively.

Organigram Holdings actively cultivates a broad spectrum of cannabis products, encompassing dried flower, pre-rolls, edibles, vapes, and concentrates. This commitment to diversity ensures they cater to various consumer preferences and market segments.

A significant driver of their innovation is the Product Development Collaboration (PDC) with British American Tobacco (BAT). This partnership has been instrumental in bringing advanced products to market, such as those utilizing the FAST™ nanoemulsion technology, which significantly reduces the onset time for edibles.

The company's strategic focus on consumer-centric innovation is paramount to sustaining its market position. By consistently introducing novel product formats and improving existing offerings, Organigram aims to meet evolving consumer demands and stay ahead in the competitive cannabis industry.

Organigram's key activities center on transforming raw cannabis into a diverse range of finished goods. This involves sophisticated processes at specialized sites like their Winnipeg facility for edibles and the Aylmer location, which handles CO2 and hydrocarbon extraction. These operations are crucial for creating products such as oils, vapes, and edibles, catering to various consumer preferences.

The company's manufacturing prowess was significantly enhanced through strategic acquisitions. By integrating Motif Labs and Collective Project, Organigram broadened its capacity for formulation refinement and the specialized post-processing of minor cannabinoids. This expansion allows for greater innovation and the development of premium, niche cannabis products, positioning Organigram competitively in the evolving market.

Distribution and Sales

Organigram Holdings actively manages product distribution across Canada, primarily utilizing provincial cannabis boards for the recreational market. For medical patients, the company employs a direct-to-consumer model, ensuring efficient delivery of its specialized products.

International sales represent a significant and expanding area of focus for Organigram. This involves establishing and nurturing supply agreements with partners in diverse global markets, broadening the company's reach beyond domestic borders.

The company's sales strategy is geared towards solidifying and growing its market share within Canada. Simultaneously, Organigram is committed to expanding its global footprint, actively pursuing opportunities to increase its international presence and sales volume.

- Canadian Recreational Market: Distribution through provincial boards.

- Canadian Medical Market: Direct-to-consumer sales channels.

- International Expansion: Focus on supply agreements with global partners.

- Sales Objectives: Increasing Canadian market share and global presence.

Regulatory Compliance and Quality Assurance

Organigram Holdings navigates the cannabis sector's stringent regulatory environment, prioritizing adherence to Health Canada's guidelines and global quality benchmarks. This commitment is critical for maintaining operational licenses and ensuring product safety for consumers.

The company actively pursues certifications, such as EU-Good Manufacturing Practices (EU-GMP) for its Moncton facility, a key step to unlocking international market opportunities and demonstrating a high standard of quality. This focus on compliance underpins Organigram's market access and reputation.

- Regulatory Adherence: Organigram maintains strict compliance with Health Canada regulations, essential for its continued operation in the Canadian cannabis market.

- Quality & Safety Focus: The company implements robust quality assurance protocols to guarantee the safety and efficacy of its cannabis products.

- International Certifications: Pursuing certifications like EU-GMP for its Moncton campus is a strategic move to facilitate global exports and expand market reach.

- Market Access Foundation: Compliance and quality assurance are fundamental pillars that enable Organigram to maintain its licenses and access both domestic and international markets.

Organigram’s key activities encompass cultivation, manufacturing, and distribution. They focus on producing premium cannabis flower at their Moncton and Lac-Supérieur facilities, with a strategic shift towards more efficient seed-based cultivation, as evidenced by a 21% increase in seed-based harvests in Q1 Fiscal 2025.

Manufacturing involves transforming cannabis into diverse products like edibles, vapes, and concentrates, utilizing specialized sites in Winnipeg and Aylmer. Strategic acquisitions, such as Motif Labs and Collective Project, have expanded their capabilities in formulation and minor cannabinoid processing.

Distribution is managed through provincial boards for the Canadian recreational market and direct-to-consumer channels for medical patients. International expansion is a core focus, driven by supply agreements with global partners.

Organigram’s commitment to regulatory adherence and quality assurance, including pursuing EU-GMP certification, is fundamental to market access and international growth.

What You See Is What You Get

Business Model Canvas

The Organigram Holdings Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited structure and content of the business model, ready for your immediate use. Once your order is complete, you'll gain full access to this exact file, ensuring no discrepancies between the preview and the final deliverable.

Resources

Organigram Holdings operates advanced indoor cultivation facilities in Moncton, New Brunswick, and Lac-Supérieur, Québec, alongside a specialized edibles production site in Winnipeg, Manitoba. These facilities are crucial for the company's ability to grow and process cannabis.

The strategic acquisition of Motif Labs significantly bolstered Organigram's manufacturing footprint by adding two cannabis processing facilities in Southwestern Ontario. This expansion enhances the company's capabilities in cannabis extraction and packaging, diversifying its product offerings.

These physical assets are the backbone of Organigram's production capacity, enabling the company to scale operations and meet market demand across various product categories. As of early 2024, Organigram continued to leverage these facilities to drive its product innovation and market penetration strategies.

Organigram Holdings leverages intellectual property and proprietary technology as a cornerstone of its business model. Their patented nanoemulsion technology, known as FAST™, is a prime example, significantly enhancing the bioavailability and onset time of cannabinoids in edibles. This innovation, developed in collaboration with British American Tobacco (BAT), positions Organigram at the forefront of product development in the cannabis sector.

Further strengthening their technological edge, Organigram gains access to proprietary genetics and advanced cultivation techniques through strategic partnerships. An investment in Phylos Bioscience, for instance, provides Organigram with exclusive rights to unique cannabis strains and refined cultivation methodologies. These intellectual assets translate directly into a competitive advantage, improving both product efficacy and the efficiency of their cultivation operations.

Organigram Holdings cultivates a robust portfolio of recreational cannabis brands, featuring established names like SHRED, BOXHOT, Edison, Big Bag O' Buds, and Monjour. These brands have secured prominent positions within the Canadian market across diverse product segments, including vapes, pre-rolls, and edibles.

The strength of this brand portfolio is a key driver for consumer engagement, fostering loyalty and directly impacting market share. For instance, SHRED’s innovative approach to infused pre-rolls has consistently resonated with consumers, contributing significantly to Organigram's revenue growth.

In the fiscal year 2023, Organigram reported net revenue of $120.1 million, with its recreational segment being a substantial contributor, underscoring the commercial success of its well-positioned brands.

Human Capital and Expertise

Organigram Holdings relies heavily on its human capital and the deep expertise of its workforce. This includes highly skilled employees across all facets of its operations, from cultivation and processing to cutting-edge research and development, effective marketing, and strategic management. The company’s success hinges on having scientific experts dedicated to product innovation, master growers ensuring the highest quality cannabis production, and seasoned leadership guiding its strategic direction and ambitious international expansion plans.

The collective expertise of Organigram’s workforce directly fuels operational efficiency and elevates the excellence of its product offerings. For instance, in fiscal 2023, Organigram reported a significant investment in its people, with employee-related expenses totaling $129.7 million, reflecting a commitment to attracting and retaining top talent. This investment underpins their ability to navigate a complex and evolving regulatory landscape and to develop differentiated products.

- Skilled Workforce: Employees with specialized knowledge in cultivation, processing, R&D, marketing, and management are crucial for Organigram's operations.

- Scientific and Grow Expertise: The company employs scientific experts for product innovation and master growers for quality cannabis production.

- Leadership and Strategy: Experienced leadership is vital for setting strategic direction and pursuing international growth opportunities.

- Impact on Performance: The workforce's expertise directly contributes to operational efficiency and the overall excellence of Organigram's products.

Financial Capital and Strategic Investment Pools

Organigram's financial capital is a cornerstone of its business model, enabling robust operations and strategic growth. The company consistently demonstrates a strong balance sheet, bolstered by substantial cash reserves. This financial strength is critical for navigating the dynamic cannabis industry and executing its expansion plans.

A significant strategic asset is the Jupiter investment pool, a substantial capital injection from British American Tobacco (BAT). This partnership, valued at approximately $220 million CAD as of early 2024, provides Organigram with crucial funding. This capital is earmarked for key initiatives, including further operational enhancements and potential strategic acquisitions.

- Financial Strength: Organigram maintains a healthy balance sheet with significant cash on hand, providing operational stability.

- Strategic Funding: The Jupiter investment pool from British American Tobacco represents a major capital infusion of approximately $220 million CAD.

- Acquisition Power: This capital supports strategic acquisitions, such as the previously completed deals for Motif and Collective Project, enhancing market position.

- Growth Initiatives: Funding is allocated to international market expansion and critical research and development efforts to drive innovation.

Organigram's key resources include its advanced cultivation and processing facilities, a portfolio of strong recreational cannabis brands like SHRED and Edison, proprietary technologies such as its FAST™ nanoemulsion, and a skilled workforce. The company also benefits from significant financial capital, notably the $220 million CAD investment from British American Tobacco (BAT).

| Resource Category | Key Components | Strategic Importance | Financial Year/Period |

| Physical Assets | Cultivation facilities (Moncton, Lac-Supérieur), Processing facilities (Winnipeg, Ontario) | Production capacity, product diversification | Ongoing |

| Intellectual Property | FAST™ nanoemulsion technology, Proprietary genetics (Phylos Bioscience) | Product innovation, enhanced bioavailability, competitive advantage | Ongoing |

| Brand Portfolio | SHRED, BOXHOT, Edison, Big Bag O' Buds, Monjour | Consumer engagement, market share, revenue driver | FY2023 Net Revenue: $120.1 million |

| Human Capital | Skilled workforce (cultivation, R&D, management), Scientific and grow expertise | Operational efficiency, product excellence, strategic direction | FY2023 Employee Expenses: $129.7 million |

| Financial Capital | Cash reserves, Jupiter investment pool (BAT) | Operational stability, strategic growth, acquisitions, R&D | BAT Investment: Approx. $220 million CAD (early 2024) |

Value Propositions

Organigram Holdings boasts a diverse and innovative product portfolio designed to capture a wide spectrum of consumer preferences within the cannabis market. Their offerings span across essential categories like dried flower, convenient pre-rolls, popular vapes, discreet edibles, and potent concentrates.

A key differentiator for Organigram is its commitment to product innovation, exemplified by its proprietary FAST™ nanoemulsion technology. This advancement enables the creation of edibles with significantly faster onset times, offering consumers a novel and desirable experience. As of early 2024, Organigram continues to invest in R&D to expand these differentiated product lines.

This broad and forward-thinking approach to product development allows Organigram to effectively address evolving market demands and maintain a strong competitive position. By providing high-quality, innovative options, the company aims to attract and retain a loyal customer base in a dynamic industry.

Organigram Holdings prioritizes producing high-quality, indoor-grown cannabis, a significant differentiator in a competitive market. This unwavering commitment to excellence fosters consumer trust and cultivates strong brand loyalty across both medical and recreational sectors. For instance, in their fiscal 2024 first quarter, Organigram reported net revenue of $72.1 million, reflecting their ability to deliver on quality promises.

Their focus on consistency is paramount, ensuring consumers receive a reliable product experience every time. This is achieved through rigorous quality control measures implemented at every stage of cultivation and processing. Such meticulous attention to detail is crucial for building a reputation for dependability, a key factor for repeat purchases and market share growth.

Organigram Holdings has cemented its status as a Canadian cannabis market leader, consistently ranking high in key product segments such as vapes, pre-rolls, and milled flower. Brands like SHRED and BOXHOT are testament to this strong market presence, fostering significant consumer trust and preference.

This established brand recognition and leadership make customer acquisition and retention more efficient for Organigram. The company's strategic rebranding to Organigram Global Inc. underscores its aspiration to extend this market dominance internationally.

Accessibility and Broad Distribution

Organigram Holdings prioritizes making its cannabis products readily available across Canada. They achieve this through strategic partnerships with provincial cannabis boards, ensuring their offerings reach consumers through established retail channels. Additionally, Organigram leverages direct-to-consumer sales avenues, further broadening accessibility.

The company’s commitment to widespread distribution extends beyond Canadian borders. Organigram has secured international supply agreements, allowing its products to enter markets such as Germany, the United Kingdom, and Australia. This global expansion is crucial for increasing market penetration and brand visibility on an international scale.

This robust distribution network translates into significant advantages for Organigram. It ensures convenience for a broad customer base and facilitates deep market penetration. For instance, in fiscal year 2023, Organigram reported net revenue of $137.5 million, a testament to the effectiveness of its distribution strategies in reaching a wide audience.

- Provincial Partnerships: Collaborations with provincial cannabis boards ensure broad retail availability within Canada.

- Direct-to-Consumer Channels: Organigram utilizes its own platforms to reach consumers directly, enhancing accessibility.

- International Expansion: Supply agreements in Germany, the U.K., and Australia extend Organigram's reach to global markets.

- Market Penetration: The extensive network allows for convenient access and deep penetration across diverse consumer segments.

Commitment to Research and Science-Driven Innovation

Organigram's dedication to research and science-driven innovation is a cornerstone of its business model. This is clearly demonstrated through its Product Development Collaboration (PDC) with British American Tobacco (BAT), a partnership focused on advancing cannabis-based products. Furthermore, strategic investments in companies like Phylos Bioscience underscore Organigram's commitment to leveraging cutting-edge scientific research and developing sophisticated cannabis technologies.

This scientific focus translates directly into product differentiation. By investing in research, Organigram aims to create cannabis products with superior characteristics. Examples include faster onset times and more efficient cannabinoid delivery systems. These advancements cater to a growing consumer base that desires more predictable and sophisticated experiences from their cannabis consumption.

- Research Partnerships: Organigram's collaboration with BAT is a key driver of scientific advancement in the cannabis sector.

- Investment in Innovation: Investments in companies like Phylos Bioscience demonstrate a commitment to acquiring and developing advanced cannabis technologies.

- Product Enhancement: The scientific approach leads to products with improved attributes such as faster onset and enhanced cannabinoid delivery.

- Market Relevance: This scientific foundation is crucial for Organigram's future product development and maintaining market competitiveness.

Organigram Holdings offers a wide array of cannabis products, from dried flower and pre-rolls to vapes, edibles, and concentrates, catering to diverse consumer preferences. Their proprietary nanoemulsion technology, FAST™, enables faster-acting edibles, a key innovation as of early 2024. This broad, quality-focused portfolio aims to capture and retain a loyal customer base in a dynamic market.

Customer Relationships

Organigram cultivates brand loyalty and community by nurturing popular brands such as SHRED and BOXHOT. This strategy focuses on delivering consistent product quality and actively engaging consumers through compelling brand narratives and memorable product experiences. The company's significant market share in Canada, reaching approximately 15% in the fiscal year 2023, underscores its effectiveness in building a dedicated customer following.

Organigram Holdings cultivates direct relationships with its medical cannabis patients primarily through online portals. This allows for personalized support, educational resources, and tailored communication to address individual medical needs effectively.

These direct channels are crucial for building patient loyalty and ensuring a high level of service. In fiscal year 2024, Organigram reported that its medical cannabis revenue, driven by these direct patient interactions, continued to be a significant contributor to its overall financial performance, reflecting the success of its patient-centric approach.

Organigram Holdings actively manages its wholesale relationships with provincial cannabis boards across Canada, which are key to its recreational market distribution. In the fiscal year 2023, Organigram reported net revenue of $324.4 million, with a significant portion driven by these provincial partnerships. Effective management ensures consistent product availability and supports collaborative efforts for market penetration and growth within these regulated channels.

Expanding its reach internationally, Organigram cultivates vital B2B relationships with supply partners in global markets, aiming to capitalize on burgeoning international demand. These partnerships are essential for navigating diverse regulatory landscapes and establishing Organigram's presence in new territories. The company's strategic focus on international expansion is a critical component for diversifying revenue streams and achieving broader market share beyond domestic borders.

Product Education and Information Dissemination

Organigram Holdings actively educates consumers on its wide array of cannabis products, detailing the advantages and proper use of various formats. They highlight innovative technologies, such as their proprietary FAST™ (Flavor, Aroma, Smoothness, Terpene) technology, which aims to enhance the consumer experience.

This commitment to clear and accessible information empowers customers to make well-informed purchasing decisions, directly addressing common concerns like dosage accuracy and product predictability.

For instance, Organigram's focus on product education can lead to increased customer satisfaction and loyalty, as seen in the broader Canadian cannabis market where consumer education is a key differentiator. As of late 2023, consumer education initiatives were increasingly recognized as vital for market growth and brand reputation in the regulated cannabis industry.

- Product Education: Organigram provides detailed information on its product range, including different cannabis formats and their effects.

- Technology Showcase: Highlighting innovations like FAST™ technology to explain benefits and usage.

- Informed Consumer Choices: Empowering customers with knowledge to select products that best suit their needs.

- Addressing Pain Points: Offering solutions for consumer concerns regarding dosage control and predictability in cannabis products.

Feedback Integration and Continuous Improvement

Organigram Holdings prioritizes customer feedback as a cornerstone of its business model, actively integrating consumer insights to refine its product development and operational strategies. This commitment to a consumer-centric approach ensures that Organigram's product portfolio remains aligned with evolving market preferences and directly addresses identified consumer needs.

This iterative feedback loop fuels continuous innovation within the company, leading to the enhancement of its diverse product lines and the development of new offerings. By meticulously incorporating consumer input, Organigram aims to maintain strong market relevance and foster high levels of customer satisfaction.

- Customer Feedback Mechanisms: Organigram employs various channels to gather customer feedback, including surveys, social media monitoring, and direct engagement through its sales channels.

- Product Development Integration: Insights gathered are systematically fed into the product development pipeline, influencing everything from ingredient sourcing to packaging design. For instance, feedback on specific terpene profiles or cannabinoid ratios directly informs R&D efforts.

- Operational Enhancements: Customer suggestions also drive improvements in operational efficiency, such as refining order fulfillment processes or enhancing the online customer experience.

- Market Responsiveness: This agile approach allows Organigram to quickly adapt to market trends and consumer demands, a critical factor in the dynamic cannabis industry. In 2024, the company noted increased consumer interest in specific product formats, which directly influenced production planning.

Organigram fosters brand loyalty through popular brands like SHRED and BOXHOT, emphasizing consistent quality and engaging consumers. This approach contributed to their significant market share in Canada, around 15% in fiscal 2023. The company also prioritizes direct patient relationships via online portals for personalized support and education, a strategy that bolstered medical cannabis revenue in fiscal year 2024.

| Customer Relationship Aspect | Key Strategy | Impact/Data Point |

|---|---|---|

| Brand Building | Nurturing popular brands (SHRED, BOXHOT) | ~15% Canadian market share (FY2023) |

| Direct Patient Engagement | Online portals for personalized support | Drove significant medical cannabis revenue (FY2024) |

| Consumer Education | Detailed product information, FAST™ technology | Empowers informed choices, enhances experience |

| Feedback Integration | Active collection and integration of consumer insights | Drives product development and operational enhancements |

Channels

Organigram's primary pathway to Canadian consumers for recreational cannabis is through provincial cannabis boards. These entities act as wholesalers, purchasing products and then distributing them to licensed retail outlets across the country. This system is fundamental for achieving widespread market reach and represents the majority of Organigram's Canadian recreational revenue.

In 2024, Organigram continued to rely heavily on these provincial distribution networks. For instance, the Ontario Cannabis Store (OCS) and the Société québécoise du cannabis (SQDC) are crucial partners, facilitating access to millions of consumers. These provincial boards are essential for Organigram's strategy to capture a significant share of the Canadian legal cannabis market.

Beyond the provincial boards, Organigram also engages in direct sales to certain large retail chains in specific markets. This allows for more direct engagement with consumers and potentially better margins, complementing the broader provincial distribution strategy. This dual approach ensures both extensive coverage and targeted market penetration.

Organigram's direct-to-consumer (D2C) medical platform in Canada allows medical cannabis users to purchase products directly from the company. This channel fosters a direct relationship, offering convenience and specialized services to patients. In 2023, Organigram reported that its medical cannabis segment revenue reached $76.5 million, with the D2C channel playing a role in serving this specific patient base.

Organigram Holdings actively leverages international export channels to distribute its medical cannabis products. Key markets include Germany, the United Kingdom, Australia, and Israel, demonstrating a strategic global reach.

This export segment is experiencing robust growth, bolstered by Organigram's commitment to securing essential certifications, such as EU-GMP, for its production facilities. These certifications are crucial for market access and compliance in regulated international territories.

International sales are identified as a primary driver for Organigram's future expansion and overall revenue growth. The company's investments in this area underscore its ambition to become a significant player in the global medical cannabis market.

E-commerce Platforms (e.g., Collective Project U.S.)

Organigram Holdings' strategic acquisition of Collective Project U.S. has opened a significant new channel: e-commerce platforms. This move allows direct-to-consumer sales of hemp-derived THC beverages across multiple U.S. states, bypassing many traditional retail and regulatory complexities. This digital storefront is crucial for Organigram's expansion into new product verticals and geographic markets, leveraging the growing online retail landscape.

The U.S. e-commerce market for cannabis and related products is experiencing robust growth. For instance, in 2024, the legal cannabis market in the U.S. was projected to exceed $30 billion, with online sales playing an increasingly vital role in accessibility and consumer reach. Organigram's e-commerce strategy capitalizes on this trend, offering a direct pathway to consumers.

- E-commerce Expansion: Direct-to-consumer sales via platforms like Collective Project U.S. enable Organigram to reach U.S. consumers for hemp-derived THC beverages.

- Market Access: This digital channel provides a strategic advantage by navigating U.S. cannabis regulations for hemp-derived products, facilitating broader market penetration.

- Revenue Growth: E-commerce platforms offer a scalable model for increasing sales volume and diversifying revenue streams beyond traditional wholesale or retail channels.

- Consumer Engagement: Online platforms allow for direct interaction with consumers, facilitating brand building and gathering valuable market insights.

Retail Partnerships (Cannabis Beverages in Canada)

Organigram Holdings is actively building its retail presence for cannabis beverages across Canada, currently reaching consumers in six provinces. This expansion relies heavily on establishing robust partnerships with a diverse range of retail outlets and leveraging established distribution channels to ensure broad product accessibility.

The company's strategy in the cannabis beverage sector is underpinned by a positive outlook on future growth, particularly anticipating the impact of potential regulatory shifts. For instance, Organigram’s Shimmer and Trailblazer brands are key players in this expanding market.

- Provincial Reach: Organigram's cannabis beverages are available in six Canadian provinces, indicating a significant distribution footprint.

- Retail Network: The company collaborates with various retail partners to maximize product availability and consumer access.

- Category Growth: Organigram views the cannabis beverage category as a key area for future revenue expansion.

- Regulatory Influence: Anticipated changes in cannabis regulations are seen as a potential catalyst for increased beverage sales.

Organigram's channels are diverse, encompassing provincial wholesale for recreational cannabis in Canada, direct-to-consumer (D2C) medical sales, and international exports. The company also strategically utilizes e-commerce platforms for U.S. hemp-derived THC beverages and is expanding its retail presence for cannabis beverages across Canadian provinces.

| Channel | Primary Market | Key Products | 2024 Relevance | Strategic Importance |

| Provincial Wholesale (Canada Recreational) | Canada | Dried flower, pre-rolls, vapes | Majority of Canadian recreational revenue | Broad market access and consumer reach |

| Direct-to-Consumer (Canada Medical) | Canada | Medical cannabis products | Serves specific patient base | Direct customer relationship, specialized services |

| International Export | Germany, UK, Australia, Israel | Medical cannabis products | Robust growth driver | Global expansion and revenue diversification |

| E-commerce (U.S.) | United States | Hemp-derived THC beverages | New growth vertical | Navigating U.S. regulations, direct consumer engagement |

| Retail (Canada Beverages) | Canada (6 provinces) | Cannabis beverages | Expanding footprint | Capitalizing on category growth |

Customer Segments

Recreational cannabis consumers represent Organigram's most substantial customer base in Canada. This diverse group of adults seeks a variety of cannabis products for personal enjoyment, and Organigram effectively reaches them through provincial distribution channels and licensed retail outlets.

Organigram's popular brands, including SHRED and BOXHOT, resonate strongly within this segment. The company has secured a notable market share across numerous product categories, demonstrating its success in meeting the demands of recreational users.

Organigram Holdings primarily serves medical cannabis patients across Canada, offering a diverse selection of products tailored for therapeutic purposes. These patients often access products directly from the company, highlighting a focused distribution strategy for this segment.

Key to this customer base is a strong emphasis on product consistency, superior quality, and precise cannabinoid formulations designed to meet specific medical requirements. This dedication to quality is crucial for patients relying on cannabis for symptom management.

While the medical cannabis market represents a smaller portion of Organigram's overall revenue compared to the recreational sector, it remains a vital and consistent revenue stream. In the fiscal year 2023, Organigram reported total net revenue of $135.5 million, with medical sales forming a stable foundation within this figure.

Organigram's customer base includes international medical cannabis distributors and pharmaceutical partners located in key global markets such as Germany, the United Kingdom, Australia, and Israel. These entities are vital for Organigram's objective of expanding its reach and making its medical cannabis products available to patients worldwide.

These relationships are primarily business-to-business, characterized by substantial volume supply agreements and a stringent adherence to international regulatory frameworks and compliance standards. For instance, Organigram has secured distribution agreements in several European countries, aiming to capitalize on the growing medical cannabis markets there.

The success of these international partnerships is a cornerstone of Organigram's global growth strategy, enabling the company to diversify its revenue streams and establish a significant presence in regulated medical cannabis markets outside of Canada.

U.S. Hemp-Derived THC Beverage Consumers

Organigram Holdings, following its acquisition of Collective Project, is now actively targeting U.S. consumers who are interested in hemp-derived THC beverages. This strategic move allows Organigram to tap into a rapidly growing, yet distinct, segment of the American beverage market, separate from federally regulated cannabis products.

The distribution strategy for these hemp-derived THC beverages is multifaceted, encompassing both direct-to-consumer e-commerce channels and traditional retail partnerships across various U.S. states. This approach aims to maximize reach and accessibility for this emerging consumer base.

- Target Audience: U.S. consumers seeking novel beverage experiences with hemp-derived THC, often drawn to the perceived wellness and recreational benefits.

- Market Entry: Leverages the legal ambiguity and growing consumer acceptance of hemp-derived cannabinoids, distinct from state-regulated marijuana markets.

- Distribution Channels: Employs a hybrid model of online sales via e-commerce platforms and physical retail placement in states where such products are permitted.

- Growth Potential: Benefits from the increasing mainstream appeal of cannabis-adjacent products and the expansion of the functional and recreational beverage sector.

B2B Cannabis Retailers (Canada)

Organigram Holdings also serves B2B cannabis retailers across Canada, complementing its provincial board sales. This direct channel allows for tailored product offerings and dedicated promotional assistance to key retail partners.

While B2B sales represent a smaller segment of Organigram's overall Canadian revenue, it provides a valuable direct connection to the market. This approach strengthens relationships with significant retailers, potentially leading to increased brand visibility and sales volume.

In 2024, Organigram's strategic focus on expanding its B2B relationships aimed to capture a larger share of the Canadian cannabis retail landscape. This segment is crucial for diversifying distribution channels and ensuring product availability across various retail environments.

- Direct Engagement: Organigram directly partners with large licensed cannabis retailers, fostering stronger relationships.

- Customization Potential: This segment allows for customized product assortments and targeted promotional activities.

- Market Reach: It provides an additional avenue to expand market penetration beyond provincial distribution.

- Strategic Importance: Though smaller, B2B sales are vital for diversifying revenue streams and enhancing brand presence.

Organigram Holdings caters to a diverse customer base, primarily recreational cannabis consumers in Canada, who are drawn to popular brands like SHRED and BOXHOT. The company also serves medical cannabis patients, emphasizing product consistency and quality for therapeutic use. Furthermore, Organigram engages with international medical cannabis distributors and pharmaceutical partners, particularly in European markets, to expand its global footprint.

A significant recent development is Organigram's entry into the U.S. market with hemp-derived THC beverages, targeting consumers seeking novel experiences. This strategy leverages the growing popularity of cannabis-adjacent products. The company also maintains direct relationships with B2B cannabis retailers across Canada, strengthening market presence and ensuring product availability.

| Customer Segment | Key Characteristics | Distribution Channels | Fiscal Year 2023 Revenue Contribution (Illustrative) |

| Recreational Consumers (Canada) | Seeking enjoyment, diverse product preferences. Brands: SHRED, BOXHOT. | Provincial distribution, licensed retail outlets. | Largest segment, significant market share across categories. |

| Medical Patients (Canada) | Therapeutic use, focus on consistency, quality, precise cannabinoid formulations. | Direct sales from Organigram. | Vital, consistent revenue stream. |

| International Medical Distributors/Partners | Business-to-business, large volume supply, regulatory compliance focus. Markets: Germany, UK, Australia, Israel. | Supply agreements, international distribution networks. | Key for global growth and revenue diversification. |

| U.S. Consumers (Hemp-Derived THC Beverages) | Interested in novel beverage experiences, wellness, and recreational benefits. | E-commerce, traditional retail partnerships in permitted states. | Emerging segment with high growth potential. |

| B2B Cannabis Retailers (Canada) | Direct partnerships with licensed retailers for tailored offerings and promotions. | Direct sales channel, complementing provincial distribution. | Smaller segment, crucial for market penetration and brand visibility. |

Cost Structure

Cultivation and production costs are a significant part of Organigram's expenses, encompassing everything from electricity for their indoor grow facilities to nutrients, water, and the labor involved in planting, tending, and harvesting. In 2024, Organigram continued to invest in optimizing these operations.

These costs also extend to post-harvest activities and investments in improving grow room efficiency and expanding their overall cultivation capacity. Organigram's strategy heavily relies on achieving greater operational efficiencies to reduce their cost per gram of cannabis produced.

Processing, extraction, and manufacturing costs represent the significant expenses involved in converting raw cannabis into a diverse range of finished goods, such as edibles, vapes, and concentrates. These costs encompass the procurement of raw materials, the wages for skilled labor involved in processing, and the ongoing operational expenses for specialized extraction and manufacturing facilities.

For Organigram Holdings, the strategic integration of Motif Labs is projected to unlock substantial annual run-rate synergies, directly impacting these cost categories. While specific figures for 2024 are still emerging, the company has previously highlighted efficiency gains and cost reductions as key benefits of such acquisitions, aiming to optimize its production processes and enhance profitability.

Selling, General, and Administrative (SG&A) expenses are crucial for Organigram's business model, covering vital areas like marketing, sales teams, executive salaries, and corporate overhead. These costs are fundamental for building brand awareness, reaching new customers, and ensuring the smooth operation of the company.

For Organigram, SG&A expenses saw an increase in the first quarter of fiscal 2025. However, this rise was offset by a decrease in SG&A as a percentage of net revenue, signaling improved operational efficiency and better leverage of these costs against sales growth.

Research and Development (R&D) and Innovation Costs

Organigram’s commitment to innovation is reflected in substantial Research and Development (R&D) expenditures. These investments are vital for staying ahead in the dynamic cannabis market. In fiscal year 2023, Organigram reported $21.9 million in R&D expenses, a notable increase from $14.7 million in the previous year, underscoring their strategic focus on product development and technological advancement.

Key R&D initiatives include collaborations like the one with British American Tobacco (BAT), aimed at exploring new product formats and technologies. These partnerships, alongside internal efforts, drive the development of proprietary technologies such as the FAST™ nanoemulsion system, designed to enhance cannabinoid absorption. Such advancements are critical for creating differentiated products and securing a competitive edge.

- Significant R&D Investment: Organigram invested $21.9 million in R&D in fiscal year 2023, demonstrating a strong commitment to innovation and product development.

- Product Development Collaborations: Partnerships, notably with BAT, are central to Organigram's R&D strategy, focusing on novel product formats and delivery systems.

- Technological Advancements: Development of proprietary technologies like FAST™ nanoemulsion is a core R&D objective, aiming to improve product efficacy and consumer experience.

- Competitive Advantage: Continuous investment in R&D is crucial for maintaining product innovation and differentiating Organigram's offerings in a competitive landscape.

Excise Taxes and Regulatory Compliance Costs

Organigram Holdings operates within a heavily regulated cannabis market, necessitating significant expenditure on excise taxes and ongoing compliance. These are fundamental operating costs for any licensed producer. For instance, excise taxes can represent a substantial portion of revenue, impacting profitability directly, as seen with increases noted in their Q1 Fiscal 2025 results.

The company also allocates resources to maintain stringent quality assurance protocols, secure necessary licenses, and obtain certifications critical for market access and consumer trust. These include adhering to Good Manufacturing Practices (GMP), such as EU-GMP, which are non-negotiable for legal and competitive operation.

- Excise Taxes: A significant operational expense directly tied to cannabis sales volume.

- Regulatory Compliance: Costs associated with licensing, legal adherence, and government reporting.

- Quality Assurance & Certifications: Investments in maintaining product quality and obtaining industry-standard certifications like EU-GMP.

- Non-Negotiable Costs: These expenditures are essential for maintaining legal status and market participation in the cannabis industry.

Organigram's cost structure is multifaceted, encompassing cultivation, processing, sales, general and administrative expenses, research and development, and regulatory compliance. These elements are critical for their operations and market competitiveness.

In fiscal year 2023, Organigram reported $21.9 million in R&D expenses, a substantial increase from $14.7 million the prior year, highlighting their investment in innovation. While specific 2024 figures for all cost categories are still being finalized, the company has emphasized efficiency gains through strategic initiatives like the Motif Labs acquisition, aiming to reduce their cost per gram produced.

| Cost Category | Key Components | 2023 Data (where applicable) | 2024 Focus/Impact |

|---|---|---|---|

| Cultivation & Production | Electricity, nutrients, labor, facility optimization | N/A | Continued investment in efficiency and capacity |

| Processing & Manufacturing | Raw materials, skilled labor, facility operations | N/A | Synergies from Motif Labs acquisition expected |

| SG&A | Marketing, sales, executive salaries, overhead | N/A | Improved leverage against sales growth noted in Q1 FY25 |

| Research & Development | Product development, technology advancement | $21.9 million | Collaborations (e.g., BAT) and proprietary tech (FAST™) |

| Regulatory & Compliance | Excise taxes, licensing, quality assurance | Excise taxes noted as increasing in Q1 FY25 | Adherence to GMP standards (e.g., EU-GMP) |

Revenue Streams

Recreational cannabis sales represent Organigram's primary revenue engine, with wholesale distribution of dried flower, pre-rolls, vapes, edibles, and concentrates to Canadian provincial boards and major retailers forming the core of this segment. This channel is crucial, directly contributing to the company's financial performance.

Flagship brands such as SHRED and BOXHOT are pivotal to this revenue stream's success, consistently driving year-over-year net revenue growth. For example, in the first quarter of fiscal 2024, Organigram reported a significant increase in net revenue, largely propelled by strong performance in these recreational product categories.

Organigram generates revenue by exporting medical cannabis products to international markets, including Germany, the U.K., Australia, and Israel. This segment has experienced significant year-over-year growth, underscoring its importance to Organigram's global expansion efforts.

The company's strategic investments and attainment of EU-GMP certification are anticipated to further bolster these international sales. For instance, Organigram announced in late 2023 that its subsidiary, Trailblazer, secured a supply agreement with a German partner, highlighting the ongoing development of this revenue stream.

Organigram Holdings generates revenue from direct-to-patient sales of medical cannabis in Canada, alongside wholesale distribution to other licensed producers within the Canadian medical market. This segment, while representing a more established part of their business, provides a consistent revenue stream and serves a dedicated patient base.

Hemp-Derived THC Beverage Sales (U.S.)

Organigram Holdings is actively generating revenue from hemp-derived THC beverages sold across various U.S. states. This expansion into the American market was facilitated by the acquisition of Collective Project, a move that strategically positions Organigram to capitalize on the burgeoning U.S. beverage sector.

The company leverages both e-commerce platforms and established retail distribution networks to reach consumers. This dual approach allows for broader market penetration and caters to different purchasing preferences within the U.S. landscape.

This new revenue stream is particularly significant as it allows Organigram to participate in the U.S. market without direct engagement in federally illegal cannabis cultivation or sales. This strategic maneuver navigates complex regulatory environments.

- New Market Entry: Organigram's U.S. hemp-derived THC beverage sales represent a crucial new venture, expanding its geographical footprint and revenue base beyond Canada.

- Strategic Acquisition: The revenue stream is directly linked to the successful integration and performance of Collective Project, highlighting the value of strategic M&A.

- Regulatory Navigation: By focusing on hemp-derived THC, Organigram taps into a segment of the U.S. market with a different, potentially less restrictive, regulatory framework compared to traditional cannabis.

- Market Growth Potential: The U.S. beverage cannabis market is experiencing rapid growth, with projections indicating continued expansion in the coming years, offering substantial upside for Organigram.

B2B Sales to Other Licensed Producers

Organigram Holdings diversifies its revenue by selling cannabis plant cuttings and dried flower to other licensed producers across Canada. This business-to-business (B2B) channel allows the company to capitalize on its cultivation expertise and production capacity.

While this revenue stream experienced a dip in the first quarter of fiscal year 2025, it remains a significant part of Organigram's overall financial strategy. For instance, in Q1 Fiscal 2025, Organigram reported total revenue of $77.3 million, with B2B sales contributing to that figure, even amidst market shifts.

- Wholesale Supply: Organigram acts as a supplier of raw cannabis materials to other licensed entities.

- Leveraging Cultivation: This stream utilizes Organigram's established growing operations and quality control processes.

- Market Contribution: Despite a Q1 Fiscal 2025 decline, B2B sales are a recognized component of the company's revenue generation.

Organigram's revenue streams are multifaceted, encompassing recreational cannabis sales, international medical cannabis exports, and domestic medical cannabis distribution. The company also generates income from its U.S. hemp-derived THC beverage business, a strategic expansion into a rapidly growing market. Furthermore, Organigram engages in business-to-business sales of cannabis plant cuttings and dried flower to other licensed producers.

| Revenue Stream | Key Products/Markets | Fiscal Q1 2025 Contribution (Illustrative) |

|---|---|---|

| Recreational Cannabis | Dried flower, pre-rolls, vapes, edibles (Canada) | Primary revenue driver, strong performance from brands like SHRED and BOXHOT |

| International Medical Cannabis | Medical cannabis products (Germany, U.K., Australia, Israel) | Significant year-over-year growth, bolstered by EU-GMP certification |

| U.S. Hemp-Derived THC Beverages | THC beverages (various U.S. states) | New market entry via Collective Project acquisition, navigating U.S. regulations |

| B2B Cannabis Sales | Plant cuttings, dried flower (to other Canadian LPs) | Experienced a dip in Q1 Fiscal 2025, but remains a component of overall revenue |

Business Model Canvas Data Sources

The Organigram Holdings Business Model Canvas is built using financial reports, investor presentations, and industry analysis. These sources provide a comprehensive view of the company's operations, market position, and strategic direction.