Organigram Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

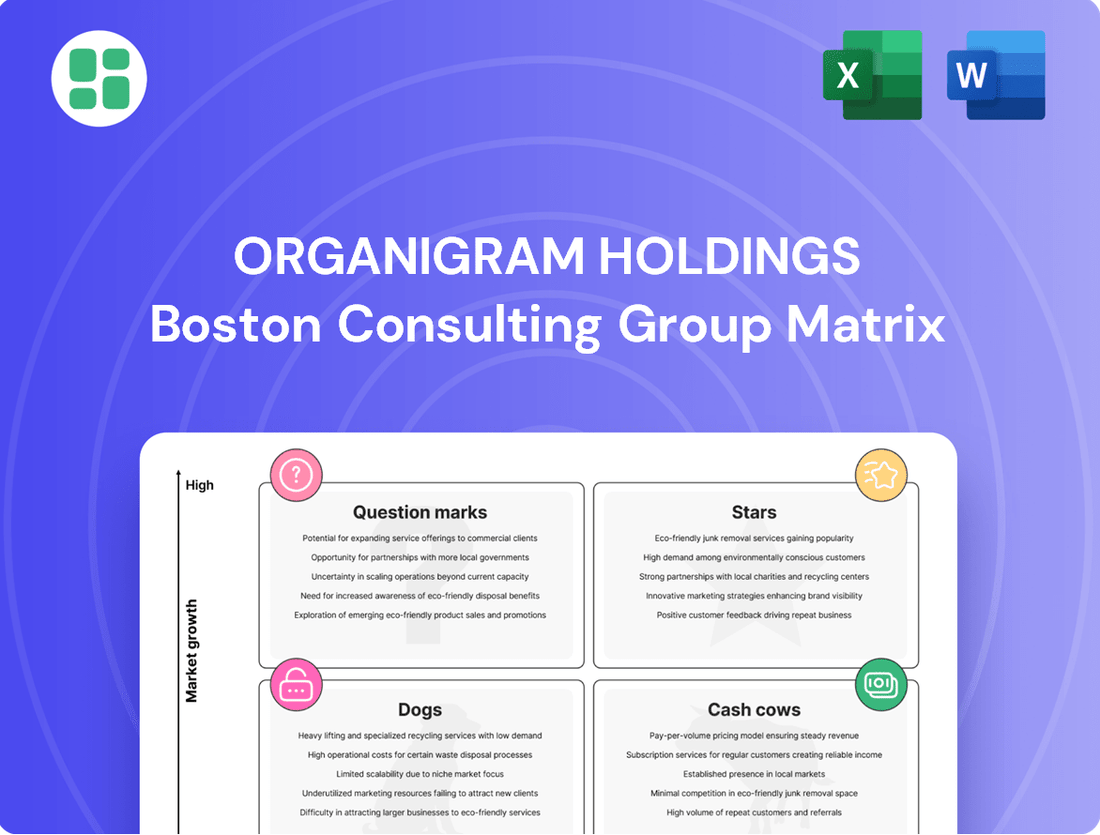

Organigram Holdings' BCG Matrix offers a strategic snapshot of its product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications is crucial for informed decision-making and resource allocation.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain detailed quadrant placements and actionable insights to optimize your investment strategy and drive future growth.

Stars

Organigram's strategic investment in Germany's Sanity Group is a key move to tap into a burgeoning international medical cannabis market. This German venture offers Organigram a significant growth avenue, contrasting with the more developed Canadian market, and positions the company for potential future entry into the recreational sector.

The German medical cannabis market is showing robust expansion, presenting a high-potential segment for Organigram. This international focus is designed to drive future revenue streams and diversify the company's geographic exposure beyond its established Canadian operations.

With Organigram's Moncton facility anticipating EU-GMP certification in spring 2025, the company is poised to enhance its export capabilities. This certification is crucial for accessing and serving the lucrative German and broader European cannabis markets, potentially improving profit margins.

Organigram's strategic acquisition of Collective Project and its subsequent launch of hemp-derived THC beverages across 25 U.S. states positions it firmly within a rapidly expanding market. This move allows Organigram direct access to the world's largest cannabis consumer base through an e-commerce platform.

The U.S. hemp-derived THC beverage market is anticipated to reach $4 billion by 2028, highlighting significant growth opportunities. Early indicators of success, including placement in major retail chains and product awards, underscore strong consumer reception and Organigram's potential for substantial market penetration.

Edison Sonics gummies, powered by Organigram's FAST™ nanoemulsion technology, represent a significant innovation in the cannabis edibles market. This proprietary technology is designed to accelerate cannabinoid absorption, offering consumers a faster onset of effects compared to traditional edibles.

The clinical validation of FAST™ technology confirms its efficacy in improving cannabinoid delivery, directly addressing a major consumer desire for more predictable and rapid results. This technological edge is crucial for Organigram as it seeks to capture market share in the rapidly expanding premium edibles segment.

In 2024, the Canadian cannabis edibles market continued its growth trajectory, with innovation in delivery systems like nanoemulsions being a key differentiator. Organigram's investment in and rollout of Edison Sonics with FAST™ positions them to capitalize on this trend, potentially leading to increased sales and brand loyalty within this high-value category.

Vapes (Post-Motif Acquisition)

Following its December 2024 acquisition of Motif Labs, Organigram Holdings has cemented its dominance in the Canadian vape market, capturing over 22% of the market share. This strategic move not only propelled Organigram to the number one position in this category but also significantly bolstered its overall Canadian cannabis market presence, unlocking substantial cost synergies.

The vape segment remains a robust and expanding category within the Canadian cannabis landscape, contributing significantly to Organigram's growth trajectory.

- Market Leadership: Organigram is the leading player in the Canadian vape category with over 22% market share post-Motif acquisition.

- Strategic Acquisition: The acquisition of Motif Labs in December 2024 was a key driver for this market leadership.

- Market Strength: The Canadian vape market continues to show strong performance and growth.

- Synergies: The acquisition is expected to deliver significant cost synergies for Organigram.

Pre-Rolls (Post-Motif Acquisition)

Organigram Holdings solidified its leadership in the pre-roll market, achieving the number one national position following its acquisition of Motif. This strategic move has propelled its flagship brands, SHRED and BOXHOT, to the forefront of retail sales in this rapidly expanding product category, making pre-rolls a clear star in Organigram's portfolio.

The company's dominance is underscored by its significant market share in pre-rolls, a segment experiencing robust consumer demand. This strong performance is a direct result of Organigram's commitment to innovation and the consistent strength of its brands within this popular format, ensuring high market share and promising growth potential.

- Number One Market Position: Organigram now leads the national pre-roll market.

- Key Brands: SHRED and BOXHOT are major contributors to this success.

- Category Growth: Pre-rolls represent a popular and expanding product segment.

- Innovation and Brand Strength: Continued product development and brand appeal drive market share and future growth.

Organigram's pre-roll and vape categories are clear Stars in its BCG matrix, demonstrating high market share in rapidly growing segments. The acquisition of Motif Labs in December 2024 propelled Organigram to over 22% market share in Canadian vapes, making it the category leader. Similarly, SHRED and BOXHOT brands now hold the number one national position in pre-rolls, a segment benefiting from strong consumer demand and Organigram's innovative product development.

| Category | Market Share (Canada) | Growth Trajectory | Key Brands |

|---|---|---|---|

| Vapes | > 22% (as of Dec 2024) | Strong & Expanding | Motif Labs portfolio |

| Pre-rolls | #1 National Position | Robust Consumer Demand | SHRED, BOXHOT |

What is included in the product

Highlights which Organigram Holdings units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes Organigram's portfolio, easing strategic decisions by highlighting cash cows and question marks.

Cash Cows

The SHRED brand, with its popular milled flower products, is a standout performer for Organigram Holdings. It consistently ranks as the top-selling milled flower in Canada, a testament to its strong market presence and consumer appeal. This brand is a significant contributor to Organigram's overall revenue, highlighting its role as a reliable cash generator.

BOXHOT, a key brand for Organigram Holdings, is performing exceptionally well, nearing $100 million in combined retail sales alongside SHRED. While precise market share data across all its product categories isn't as detailed as SHRED's milled flower, its consistently high sales volume points to a mature product with a solid market position.

This strong sales performance suggests BOXHOT is a significant cash generator for Organigram, benefiting from established production processes and distribution networks.

Organigram's established dried flower products, particularly their large-format value offerings, are a cornerstone of their recreational wholesale revenue in Canada. These products cater to a segment of the market that prioritizes affordability and volume, contributing significantly to the company's overall sales figures.

While the Canadian dried flower market is experiencing a slowdown in growth as it matures, Organigram's strategic focus on operational efficiency and its established market position allow these value-oriented products to consistently generate substantial revenue. This efficiency is crucial for maintaining profitability in a competitive landscape.

These offerings represent a high market share within a stable, albeit slower-growing, segment of the cannabis market. Consequently, they are classified as cash cows within Organigram's business portfolio, providing a reliable stream of income that can fund other strategic initiatives.

Pure CBD Gummies

Organigram Holdings' pure CBD gummies represent a classic Cash Cow within its BCG Matrix portfolio. The company commands the leading market share in pure CBD gummies across Canada, indicating a strong and established presence in a segment with consistent consumer demand.

This dominant position allows Organigram to generate substantial and predictable cash flows. The CBD market, while dynamic, has a core base of consumers seeking pure CBD products, and Organigram's #1 ranking suggests it effectively taps into this steady demand. This translates to reliable revenue generation without the need for significant reinvestment in marketing or product innovation, freeing up capital for other strategic initiatives.

Key indicators supporting this classification include:

- Market Leadership: Organigram holds the #1 market position in pure CBD gummies in Canada.

- Consistent Demand Segment: The pure CBD gummy segment exhibits steady consumer demand, contributing to predictable sales.

- Cash Flow Generation: The high market share in a stable segment allows for strong, reliable cash flow generation.

International Medical Cannabis Exports (Existing Agreements)

Organigram's international medical cannabis exports, particularly through existing agreements, function as a significant cash cow. The company has secured supply deals with key markets including Germany, the U.K., Australia, and Israel. These established relationships have driven a notable surge in international sales for Organigram.

These existing agreements provide a consistent, high-margin revenue stream, effectively utilizing Organigram's production capacity. As these international markets continue to develop and demand from current partners expands, these export sales are poised to become dependable cash generators for the company.

- Germany: Organigram secured a multi-year supply agreement with a German medical cannabis distributor, aiming to supply high-quality dried cannabis flower.

- United Kingdom: The company has established partnerships to supply medical cannabis products to the U.K. market, a region showing growing patient access.

- Australia: Organigram has agreements in place to export medical cannabis to Australia, contributing to its international revenue diversification.

- Israel: With a long-standing medical cannabis program, Israel represents another key export market for Organigram's products.

Organigram's established dried flower products, particularly their large-format value offerings, are a cornerstone of their recreational wholesale revenue in Canada. These products cater to a segment of the market that prioritizes affordability and volume, contributing significantly to the company's overall sales figures.

While the Canadian dried flower market is experiencing a slowdown in growth as it matures, Organigram's strategic focus on operational efficiency and its established market position allow these value-oriented products to consistently generate substantial revenue. This efficiency is crucial for maintaining profitability in a competitive landscape.

These offerings represent a high market share within a stable, albeit slower-growing, segment of the cannabis market. Consequently, they are classified as cash cows within Organigram's business portfolio, providing a reliable stream of income that can fund other strategic initiatives.

Organigram Holdings' pure CBD gummies represent a classic Cash Cow within its BCG Matrix portfolio. The company commands the leading market share in pure CBD gummies across Canada, indicating a strong and established presence in a segment with consistent consumer demand.

This dominant position allows Organigram to generate substantial and predictable cash flows. The CBD market, while dynamic, has a core base of consumers seeking pure CBD products, and Organigram's #1 ranking suggests it effectively taps into this steady demand. This translates to reliable revenue generation without the need for significant reinvestment in marketing or product innovation, freeing up capital for other strategic initiatives.

Key indicators supporting this classification include:

- Market Leadership: Organigram holds the #1 market position in pure CBD gummies in Canada.

- Consistent Demand Segment: The pure CBD gummy segment exhibits steady consumer demand, contributing to predictable sales.

- Cash Flow Generation: The high market share in a stable segment allows for strong, reliable cash flow generation.

Organigram's international medical cannabis exports, particularly through existing agreements, function as a significant cash cow. The company has secured supply deals with key markets including Germany, the U.K., Australia, and Israel. These established relationships have driven a notable surge in international sales for Organigram.

These existing agreements provide a consistent, high-margin revenue stream, effectively utilizing Organigram's production capacity. As these international markets continue to develop and demand from current partners expands, these export sales are poised to become dependable cash generators for the company.

In fiscal year 2023, Organigram reported international revenue of $32.8 million, a substantial increase from $9.7 million in fiscal year 2022, largely driven by these medical cannabis exports.

- Germany: Organigram secured a multi-year supply agreement with a German medical cannabis distributor, aiming to supply high-quality dried cannabis flower.

- United Kingdom: The company has established partnerships to supply medical cannabis products to the U.K. market, a region showing growing patient access.

- Australia: Organigram has agreements in place to export medical cannabis to Australia, contributing to its international revenue diversification.

- Israel: With a long-standing medical cannabis program, Israel represents another key export market for Organigram's products.

Full Transparency, Always

Organigram Holdings BCG Matrix

The Organigram Holdings BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, just a comprehensive strategic analysis ready for immediate application in your business planning.

Dogs

Organigram's Canadian B2B sales experienced a downturn in the first quarter of fiscal 2025 when compared to the same period in 2024. This segment, which focuses on selling to other businesses domestically, seems to be characterized by sluggish growth and possibly a diminished market position.

The data indicates that this B2B channel is not currently a major driver of revenue for Organigram. If this underperformance persists, it signals that this specific sales avenue might warrant a strategic review, potentially leading to a reduction in focus or a complete re-evaluation of its role within the company's overall strategy.

Organigram's older or less popular edible lines, outside of their successful pure CBD gummies and Edison Sonics, likely fall into the 'dog' category of the BCG matrix. These products face significant headwinds in a market increasingly dominated by low-cost, single-count gummies, leading to price compression.

Without a distinct competitive advantage or substantial market share, these less popular edibles are characterized by low growth and low profitability. For instance, while Organigram reported total net revenue of $135.5 million for the fiscal year ended September 30, 2023, a portion of this revenue from older edible lines may be declining or stagnant, contributing to their dog status.

Organigram Holdings, like many in the cannabis industry, likely has certain niche or discontinued product lines that could be classified as Dogs in a BCG Matrix. These are typically products in low-growth market segments with a small market share. For instance, if Organigram had a specific line of CBD-infused edibles that didn't gain traction in the rapidly evolving edibles market, it might be a candidate for the Dog quadrant.

While specific discontinued product data isn't publicly detailed for Organigram, the company has navigated shifts in consumer preferences and regulatory changes since its inception. Products that required significant investment but yielded minimal returns, or those that were phased out due to market saturation or a strategic pivot, would fit this classification. For example, if Organigram's early ventures into specific terpene profiles for recreational markets did not capture significant market share and were subsequently deprioritized, they would represent Dog products.

The challenge with these Dog products is that they can tie up resources, including manufacturing capacity and marketing efforts, without generating substantial profit. Organigram's focus on innovation and expanding its premium offerings, such as its Edison and Trailblazer brands, suggests a strategic effort to move away from underperforming segments. The company's reported revenue growth in fiscal year 2024, reaching $130.7 million, indicates a successful reallocation of resources towards more promising product categories.

Cannabis 1.0 Products with High Competition

In the Canadian cannabis market, Organigram's basic Cannabis 1.0 products, like generic dried flower, are likely facing significant headwinds. This segment is characterized by high competition and diminishing pricing power, especially for offerings that don't stand out. If Organigram holds a modest market share in these undifferentiated categories, they could indeed be classified as dogs within their product portfolio.

These "dog" products, if they exist, would represent offerings that are not generating substantial revenue or profit growth. Their low market share in a competitive environment means they are unlikely to benefit from economies of scale or strong brand loyalty. For instance, in 2023, the average price per gram for dried cannabis in Canada saw a decline, highlighting the intense price pressure on basic products.

- High Competition: The Canadian cannabis market, particularly for dried flower, is saturated with numerous brands and producers.

- Price Sensitivity: Basic, undifferentiated products are highly susceptible to price wars, eroding profit margins.

- Low Market Share: Products that do not capture a significant portion of the market are less likely to achieve profitability.

- Declining Margins: As competition intensifies, margins on these types of products tend to shrink, making them less attractive.

Non-Strategic Domestic B2B Partnerships

Non-strategic domestic B2B partnerships for Organigram Holdings, particularly those within Canada, could be classified as Dogs in a BCG Matrix if they don't directly support the company's aim for market leadership in core cannabis categories. These might include collaborations that offer minimal revenue growth or lack synergistic benefits, potentially draining valuable resources.

For instance, a partnership with a small, local distributor of ancillary cannabis products that doesn't scale or offer unique market access might fall into this category. Such ventures could represent low-return activities that distract from Organigram's primary objectives, such as expanding its premium flower or vape product lines. In 2024, Organigram's focus remained on strengthening its position in the Canadian adult-use market, with significant investments in product innovation and brand building.

- Low Market Share: Partnerships that have not captured significant market share within their niche.

- Low Growth Potential: Ventures with limited prospects for future expansion or increased revenue.

- Resource Drain: Collaborations that consume management attention and capital without commensurate returns.

- Strategic Misalignment: Alliances that do not contribute to Organigram's core competencies or market leadership ambitions.

Organigram's less popular edible lines, excluding their successful pure CBD gummies and Edison Sonics, likely reside in the Dog quadrant of the BCG matrix. These products face intense competition from low-cost, single-count gummies, leading to significant price compression and reduced profitability. For example, while Organigram reported net revenues of $130.7 million for the fiscal year ended September 30, 2024, a portion of this from older edibles may be stagnant or declining.

These "dog" products, characterized by low market share and low growth, can hinder overall performance by consuming resources without generating substantial returns. Organigram's strategic focus on innovation and premium offerings, such as Edison and Trailblazer brands, indicates a deliberate effort to shift away from these underperforming segments. This strategic reallocation is crucial for optimizing resource allocation and driving future growth in the dynamic Canadian cannabis market.

Question Marks

Organigram's new hemp-derived THC beverage lines, such as Fetch, are positioned as Question Marks in the BCG Matrix. These products target the burgeoning U.S. market, which saw hemp-derived cannabinoid sales reach an estimated $5 billion in 2023, a figure projected to grow significantly.

While the market shows strong potential, Organigram's presence is new, meaning market share is still being established. This requires substantial investment in branding and distribution to compete effectively and potentially transition these offerings into Stars.

Organigram Holdings is strategically exploring expansion into new international markets, viewing these as potential question marks within its BCG matrix. While existing markets like Germany, the UK, Australia, and Israel demonstrate established sales, venturing into unproven territories requires significant investment to gauge market receptiveness and growth prospects. For instance, Organigram's international revenue for the fiscal year ended September 30, 2023, was $33.7 million, a substantial increase from the prior year, highlighting the potential of global reach.

The company's commitment to evaluating additional global partnership opportunities underscores its ambition to replicate success in nascent markets. However, entering these new ventures, where Organigram currently holds minimal to no market share, necessitates considerable capital outlay for research, regulatory navigation, and initial market penetration efforts. This investment is crucial to determine if these question marks can evolve into stars, thereby contributing to Organigram's overall portfolio growth and market diversification.

Organigram's Product Development Collaboration (PDC) with BAT is actively exploring advanced cannabis products, the "Cannabis 3.0" pipeline. These R&D efforts are designed to create next-generation offerings, potentially tapping into high-growth areas like specialized wellness products or unique cannabinoid formulations.

Currently, these innovative products exist solely within the research and development phase, meaning they hold zero market share. This positions them as question marks within the BCG matrix, requiring significant investment in further R&D and successful commercialization strategies to determine their future market viability and growth potential.

Expansion of Cultivation Capacity for International Demand

Organigram Holdings is strategically expanding its cultivation capacity to meet anticipated international demand, planning to boost flower output by roughly 12,000 kilograms annually across fiscal years 2025 and 2026. This substantial investment targets a high-growth international market, positioning the company for potential gains if it successfully captures market share with its increased supply. The success of this expansion is crucial, as it represents a calculated risk that could elevate its products to Star status within the BCG matrix if demand is effectively met and sustained.

This move reflects Organigram's proactive approach to a burgeoning global cannabis market. For instance, the global legal cannabis market was valued at approximately USD 20.5 billion in 2023 and is projected to grow significantly. Organigram's expansion aligns with this trend, aiming to secure a larger piece of this expanding pie.

- Capacity Increase: Targeting an additional 12,000 kg of flower output annually by fiscal 2026.

- Market Focus: Primarily aimed at capturing share in high-growth international markets.

- Strategic Risk: Investment success hinges on converting increased supply into realized market demand.

- BCG Matrix Potential: This initiative could transition Organigram's international segment into a Star if market penetration is achieved.

Cannabis 2.0 Product Categories with Emerging Demand

Organigram's focus on product innovation positions it to explore emerging Cannabis 2.0 categories. These include unique concentrate formats and novel topical applications. Such segments represent growing markets with less established competition, offering potential for Organigram to capture early market share.

These products currently reside in Organigram's "question mark" quadrant of the BCG matrix. They are in high-growth market segments, but their success hinges on strategic investment and successful market adoption. If these initiatives gain traction and achieve significant market share, they could transition into "stars."

- Emerging Concentrate Formats: Exploring advanced extraction techniques for unique dab rigs, vape cartridges, or edible concentrates that offer distinct consumer experiences.

- Novel Topical Applications: Developing specialized creams, balms, or patches for targeted relief or cosmetic benefits, tapping into the wellness sector.

- Market Potential: The global legal cannabis market was valued at USD 20.5 billion in 2023 and is projected to grow significantly, with innovation in product categories being a key driver.

- Investment Strategy: Successful transition from question marks to stars requires significant R&D investment, effective marketing, and consumer education to build brand loyalty in these nascent categories.

Organigram's new hemp-derived THC beverage lines, like Fetch, are classified as Question Marks in the BCG Matrix. These products are targeting the expanding U.S. market, where hemp-derived cannabinoid sales reached an estimated $5 billion in 2023 and are expected to grow substantially.

Despite the market's strong potential, Organigram's position is relatively new, meaning market share is still being established. This necessitates considerable investment in branding and distribution to compete effectively and potentially elevate these offerings to Star status.

Organigram's exploration of new international markets also places them in the Question Mark category. While established markets like Germany and the UK show sales growth, with international revenue at $33.7 million for fiscal year ended September 30, 2023, venturing into unproven territories requires significant investment to gauge market reception and growth prospects.

The company's R&D efforts, particularly the "Cannabis 3.0" pipeline in collaboration with BAT, represent further Question Marks. These advanced product concepts are currently in the research phase with zero market share, requiring substantial investment to determine their future market viability and growth potential.

BCG Matrix Data Sources

Our Organigram Holdings BCG Matrix is constructed using comprehensive data, including financial reports, market share analysis, industry growth rates, and expert industry forecasts.